right c - WHAT does HAIL DAMAGE look like?

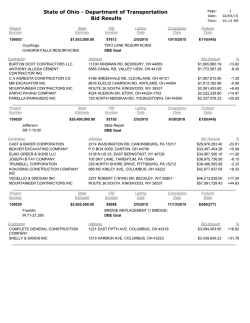

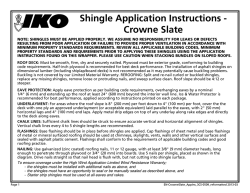

SO THE HAIL STORM DAMAGED YOUR HOME? A Complete Primer on Hail Damage and What to Do About It presented by the Colorado Homeowners Alliance Hailstorms are a way of life in many parts of the US, It’s not a question of whether a hailstorm will hit, but when damaging hail will hit. Many areas in the U.S. receive hail six or more times a year and many homes are damaged every year. By definition, hail damage is any damage resulting from hailstones and hailstorms. Hailstones that are 0.75 inches or greater are large enough to cause substantial damage to homes, automobiles & property. For comparison, 0.75 inches is the diameter of a penny. How to Identify Hail Damage You may think that just because you can't see any signs of damage, or because your roof isn't leaking, you don't have damage. Remember, hail damage can be particularly difficult to identify and many homeowners discover major roofing damage years down the road, after it's too late to file a storm damage claim with their insurance company. If you have any reason to suspect hail damage after a storm, you should have a full property damage inspection performed by a reputable contractor, right away. Roof Hail Damage When most people think of roofing shingles, they are actually thinking of asphalt shingles, the most common type of shingles in the country. Asphalt shingles are made from asphalt re-enforced with either organic material or fiberglass and they are coated with small metallic surface granules that protect the roof from UV-rays that speeds deterioration. Asphalt shingles come in a wide range of colors, sizes and styles. During severe storms asphalt shingles can be seriously damaged and require repair or replacement. On an asphalt roof, hail damage looks like a dark spot, or bruise, where the roofing granules have been knocked away. In some cases you may find holes, cracking, or missing shingles on roofs with hail or storm damage. After a tornado, you may notice split seams and torn or missing shingles. This can result in leaking and serious water damage, which can lead to mold formation and wood rot, which can compromise the structural integrity of your roof resulting in collapse. In severe wind storms, it is common for shingles or sections of the roof to be missing altogether. On other types of roofs, including shake (wood), metal, tile and slate, damage can include broken or cracked shingles, missing shingles, torn or split seams, and missing sections of the roof. If a tree limb or other debris has fallen onto your roof during the storm, you may have structural damage, and will want to exercise extreme caution. Common Signs of Roof Damage Missing shingles Bruises or dented asphalt shingles Cracked or broken tile, slate, or concrete shingles Granules collecting in gutters or downspouts Leaks in your roof or ceiling Window Damage In high wind areas, many homes have protective storm shutters to protect exposed glass. However, even with storm shutters, many windows can get cracked or damaged. If your home has been hit by hail, high winds, or a tornado, cracked or broken windows and damaged window casings are the most common signs of damage. Remember, a broken, shattered or missing window is dangerous. Watch out for shards of glass and make sure you board up any shattered windows until they can be repaired. Common Sing of Window Damage Shattered windows Cracks and holes Broken panes Damaged frame If you have or suspect you have damage to your home or commercial building, start with a free damage inspection from an NSDC certified contractor. 3-Tab Shingles 3-tab shingles are the most common type of shingle on the market. They are made of asphalt re-enforced with either organic material, or wood. The most common shape is rectangular, with a flat, two-dimensional appearance. The surface is coated with tiny metallic granules that provide protection from sun damage. 3-tab shingles are lightweight, easy to install, require no maintenance, come in many colors and are resistant to light weather. Typically 3-tab shingles carry the shortest warranty and under ideal conditions will last 15-20 years. But, they are highly susceptible to hail and wind damage. When hail strikes a 3-tab shingle, the impact causes protective granules to be knocked away, exposing the asphalt base to the sun and elements. This causes a number of problems including leaking, cracking, curling and shortened lifespan. A strong wind or tornado can tear off shingles, which renders your roof ineffective at repelling water. A 3-tab roof that has been damaged by hail, wind oses its ability to effectively protect the structure underneath. Long-term exposure to the elements on a damaged roof can lead to wood rot and structural compromise, and can lead to your roof caving in. If your home has been hit by a storm and you have 3-tab shingles, you'll want to have your roof inspected as soon as possible. Architectural Shingles For homeowners that value appearance and greater storm resistance, architectural shingles are becoming popular. They come in a wide range of shapes, sizes and color blends and give the roof a 3dimenisional or layered look. Architectural shingles are heavier and more substantial than 3-tab shingles and are less likely to sustain damage during a light storm. But, architectural shingles can be damaged during a moderate to severe hail, windstorm, or tornado. Architectural shingles are coated with protective metallic granules. When architectural shingles are hit by hail, loss of the protective granules is common. A strong hail hit, even on an impact resistant roof can cause cracking, tearing, split seams and compromise the overall integrity of the shingle, leading to water damage, leaking and staining on the walls and ceiling inside your home. Missing shingles break the water seal and expose your roof to damage from future storms. Even though architectural shingles typically carry a longer warranty, up to 40 years, storm damage is not covered by most warranties. With limited time to file an insurance damage claim, if you have architectural shingles and your home has been hit by a hailstorm, windstorm or tornado, you'll want to have your roof inspected by a qualified, insurance restoration contractor, as soon as possible. T-Lock Shingles These shingles were first introduced as a high-wind resistant alternative to 3-tab shingles. T-lock shingles are most commonly found on homes located in high wind areas and have been discontinued since 2005. T-lock shingles are shaped like a "T" and were designed to offer better performance in strong windstorms. T-lock shingles are made from asphalt covered by protective metallic granules. When hail hits a T-lock roof and granules are knocked away creating a "bruise", the shingle loses its ability to protect your home from sun, UV rays, moisture and leaks. Designer Shingles These are the top-of-the-line shingles offered by manufactures. Designer shingles can be made from a variety of composite materials, are unique in appearance and are designed to give the roof a specific, unique appearance. Most designer shingles are made from reinforced asphalt, and tend to be much heavier than basic shingles. Designer shingles outperform basic shingles and may offer features such as impact resistance, fungus resistance, and longer warranties. As with other reinforced asphalt shingles, loss of protective granules, cracking, split seams, and missing shingles are common after a severe hailstorm or tornado. If you have a designer shingle, it is important to remember that storm damage can seriously impact the life of your roof, and its ability to protect your home from damaging UV-rays, moisture and other elements. Shake Shingles Cedar shake shingles are an attractive, natural looking shingle popular in upscale neighborhoods. Shake shingles are highly durable, resist sun, insects and stand up well in heavy rainstorms and moderate hail and wind storms. Because moisture is the natural enemy of wood shingles, shake shingles require ongoing maintenance and tend to be installed in drier climates. In areas prone to fires, shake roofs should be treated with a fire retardant. While shake shingles outperform asphalt shingles in light to moderate weather, they can still be split, cracked and blown off. Severe wind, hail storms and tor- Tile Shingles Tile shingles are quickly becoming one of the most popular shingle choices in the country. They are beautiful, highly durable, energy efficient and highly fire resistant. Tile shingles are typically made from concrete or clay and come in a wide range of colors, shapes and styles. STORM DAMAGE INSURANCE FAQs Q: Am I required to have homeowners insurance? A: It is always smart to have a good homeowners insurance policy, even if you don't owe any money on your home. If you have a mortgage, home equity loan, or use your home as collateral, your lender will require you to maintain insurance. Q: Are all homeowners insurance policies the same? A: There are many different types of insurance policies. Levels of coverage, exclusions and limits of liability vary greatly. Some policies provide basic coverage, while others offer broad coverage and high levels of protection. Q: Does my homeowners insurance cover all types of storm damage? A: It depends on your policy. Most homeowners insurance policies cover storms including hail, tornado and wind damage. But, floods and earthquakes usually require additional coverage. It is always smart to check your policy to see exactly what is covered. Q: Is replacement cost the same as the sale price of my home? A: Not necessarily. The replacement cost is the actual cost to rebuild your home in the event it is completely destroyed, which may be more or less than the market value, or sale price. Q: What does a homeowners insurance policy cover? A: Homeowners insurance covers the repair or replacement of your home and its contents up to defined limits. Your policy may also include a liability policy, which protects you in the event someone is injured on your property due to your negligence. Q: What are the various types of coverage included in a homeowners policy? A: To determine the types of coverage you have, check the declarations page of your insurance policy. Types of coverage are as follows: Coverage Coverage Coverage Coverage Coverage Coverage A - Damage to your home B - Damage to garage, deck or swimming pool C - Loss or damage to the contents of your home D - Loss of use in case your home is not inhabitable E - Personal liability to third parties F - Medical payments to third parties Q: Who pays for living expenses when my home is being repaired after a storm? A: Your insurance company will pay for loss of use, in the case that your home is uninhabitable after it has been damaged by a storm, up to applicable limits. Q: Does my policy cover tornado, wind and hail damage? A: Most standard homeowners insurance policies cover damage done by tornado, windstorms and hailstorms. Check your policy for limits and details. Q: What is not covered by homeowners insurance? A: Earthquakes, floods and other named exclusions and usually require separate coverage. Normal wear and tear and poor maintenance is not covered by insurance. Q: Will my insurance cover the cost of tree removal after a severe storm? A: Most policies cover the cost of tree removal after a storm, however, you should check your policy. Some insurance companies require a separate tree removal policy. Q: Will my homeowners insurance cover damage to cars on my property? A: No. Damage to your car is not covered by your homeowners policy, even if a tree on your property falls and damages your car. Damage to your car is covered by your comprehensive auto insurance policy. Q: If I file a storm damage claim, will my premiums go up? A: Most states prohibit insurance companies canceling your coverage or singling you out for a rate increase due to an Act of God damage claim. Q: Will my homeowners policy cover earthquake damage? A: Not unless your policy specifically includes coverage for earthquakes. In most cases you'll need a separate insurance policy to cover earthquake and flood damage. AVOIDING CONTRACTOR SCAMS Every year, many homes and commercial buildings are damaged by severe storms. Property owners become the victims of unlicensed, uninsured, inexperienced contractors and outright scammers who come to prey on uninformed people. Poor quality contractors and scammers can cause permanent damage, devalue your property, steal your money and put you at personal, legal and financial risk... not to mention all the headaches! Many scams begin with a knock at your door, or an unsolicited call on the phone, claiming to be a contractor. Unfortunately, many scam companies imitate legitimate contractors, so protect yourself by checking your contractor out, before agreeing to an inspection. Make sure any contractor you work with is properly licensed, insured, and provides 3 local references. For your protection, the CHO maintains a database of highly rated contractors experienced with storm restoration work. The following list represents the most common indicators that the person or company you are speaking with might be running a scam. Not properly licensed No insurance or under-insured No local office (beware of P.O. boxes and hotel addresses) Won't provide local references Demands up-front cash or deposit Shows up on convicted criminals and/or sex offenders list Out-of-State Contractors Many excellent storm restoration companies have multiple offices around the country, or travel to work in hard hit storm areas. Just because a contractor is from out of state, it is not necessarily a reason to worry. However, as with any contractor you hire, you'll want to do your homework and check the contractor out before signing a contingency agreement or contract to do any work on your property. If you decide to hire a contractor that is based out of state, make sure they have a local office, or reciprocal relationship with a local contractor, who will perform warranty repairs, if your contractor should leave the state. It is important to remember your workmanship warranty is worthless, if your out-of -state contractor leaves the state and does not have a local representative to honor the warranty. Storm Chaser Scam Warning Signs Storm chasers are like ambulance chasers. They flock to areas of the country that have been recently hit by damaging storms and attem pt to scam people that are in need ofserious help A temporary office or P.O. box Out-of-state phone numbers Out-of-state license plates Staying in a hotel, or motel No local references Don't know your area You can avoid scams by working with one of the highly rated and experienced storm restoration contractors listed in our free directory. HIRING THE RIGHT CONTRACTOR After a severe storm hits your area, it is always a good idea to get a full property damage inspection and at least three qualified estimates from reputable contractors. Some states do not have a state licensing requirement for contractors and storm damage brings potentially unreliable contractors in from other states. To protect yourself, make sure all contractors you talk to are reputable, established companies with references in your area. Make sure your contractor has completed numerous local jobs, is fully trained to install all of the materials required to restore your home and has a permanent office in your area. Remember your workmanship warranty is worthless if your contractor leaves the state and does not have a reciprocal relationship with a local contractor who will take care of you, should you need warranty service down the road. Regardless of the contractor you choose to restore your home, protect yourself by making sure they meet the following criteria: Established company with a positive track record Fully insured; liability and workers comp Insurance claims experience Have passed a background check Can provide at least 3 local referenceS. Questions to Ask Your Contractor: How long has your company been in business? Look for a company with an established business history. Most successful storm restoration contractors are proud of their history in business and hard -earned reputations. Tell me about your experience working with insurance claims? If you are filing an insurance claim, it is critical that you work with a contractor who has the experience to advocate for you and make sure your insurance claim is settled for a fair amount that will cover the cost of your repairs. Do you have your own crews, or do you outsource your work? While many good contractors outsource the actual restoration work to subcontractors, you’ll want to make sure your contractor can provide adequate supervision to ensure a high quality finished job. Who will be assigned as my on-site project manager for the job? Ask for the contact information for this person, and whom you can contact if the project manager is not available. Get the names and phone numbers for the people who will be overseeing your job. What can I expect from you and your team? This question will give you a sense of how the contractor works and what you can expect during your project. Does your company specialize in storm repair? If you have damage to your roof, siding, windows, or structural damage, you’ll want to make sure your contractor specializes in those repairs. Storm restoration can be a complicated process and you want to make sure you are working with an expert with the experience to ensure a good result for you. Is your company fully insured? Do you carry liability and workers compensation? It is always smart to ask any contractor you are considering hiring for copies of their insurance policies to verify coverage, then confirm that the policy is in force with your contractor’s insurance company. If a worker is injured on your property and your contractor does not have adequate coverage, you can be held responsible. So, protect yourself by making sure your contractor is fully insured. Can you provide a list of references for local projects in the past 12 months? The contractor should be able to supply you with a minimum of three references, including names, telephone numbers and addresses. See the checking a contractor’s references section for tips on questions to ask. To determine if your contractor is running a sound business, ask for supplier references and make sure they are in good standing with local materials suppliers. What percentage of your business is by referral? This will give you a good sense of the contractor’s customer satisfaction rate. In an area hit by a storm, referrals to a good contractor are very common so ask to see if your contractor has a high rate of referral businesses. How many insurance claims have you handled in the past 12 months? This will help you determine the contractor's familiarity with storm damage repair and working through the insurance claims process. An active storm restoration contractor will have handled at least 50 claims in the past 12 months. What permits will be required for this project? This will give you a good sense of what permits will be required for your project. Since it is critical to obtain permits for most serious storm restoration projects and your inspection can be denied without a permit, it is critical to understand what your contractor is legally required to do before the work can begin. Do I feel comfortable hiring this person and do I trust this company to repair my property? Your home, or property is an important financial asset, so it is critical to have a high level of confidence in the person you hire to repair your property. To ensure a positive outcome, make sure and do your homework. Contractor Warning Signs To protect yourself and your family from inexperienced, uninsured contractors, and out-of-state contractors who may not be experienced repairing storm damage, or have your best interests in mind, watch out for the following warning signs: Out of state license plates No local office No insurance or under-insured Won’t provide local references Demands upfront cash or deposit Convicted criminals and sex offenders Poor BBB ratings or no local ratings Checking References When asking for references, it is a good idea to ask for the last three, local jobs the contractor performed. Do not hire a contractor who cannot provide local references or who is unwilling to let you drive by the site of a completed job in your area. Once you receive references, do your homework and give them a call. Explain that you are a homeowner in the area and are thinking of working with the contractor. The following questions will give you a good idea of how your contractor will treat your project and the level of professionalism you can expect. 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. Did your contractor clearly explain what needed to be done in advance? How did your contractor handle your insurance claims process? Did your contractor and crew show up on time? Was there always someone there to answer your questions? Did the contractor obtain necessary permits? Was the crew pleasant and professional? Were change orders made in writing? Did any issues arise? How were they handled? How did the contractor leave your site at the end of the day? Did your job finish on schedule? Did the work pass inspection? Did the finished job meet your expectations? Was your contractor fair, ethical and honest? Would you work with this contractor again? Would you hesitate to recommend this contractor to a family member? RESIDENTIAL STORM DAMAGE FAQ Q: I think my home has been damaged by the September 29th hail storm. What should I do? A: Contact the CHA for help and information. Whether you need a full property inspection, or repair estimates, we can connect you with a reputable, certified contractor who will work with your insurance company to ensure you are fairly represented. Q: What is the cost for having my property inspected for damage? A: CHA Contractors provide homeowners with no cost property damage inspections and no-obligation repair estimates. Q: Can I get multiple bids or inspections? A: It is always smart for homeowners to get three estimates from reputable contractors with insurance claims and storm damage repair experience. Q: My home is fairly new. Won't my homebuilder's warranty cover the repairs? A: No. Storm damage is almost always a named exclusion in manufacturer, homebuilder and contractor warranties, which are designed to cover problems with materials and workmanship, not storm damage, or factors beyond control. Q: How much will it cost to fix my home? A: The cost to repair your home can vary, depending on the extent of the damage, cost of materials and cost of quality installation by a reputable contractor. If you are filing an insurance claim, make sure to choose an experienced storm restoration contractor who is committed to quality workmanship and preserving your home's value. Q: Can you help me find a reputable contractor to fix my damage? A: Yes. The CHA maintains a database of reputable contractors, who are licensed, insured and commit to a strict Code of Ethics designed to protect homeowners. Q: How many inspections or estimates should I get? A: You should get at least three inspections or estimates from reputable contractors that specialize in repairing storm damage and dealing with insurance claims. Q: Why should I get my home inspected for storm damage? A: Peace of mind. If your home is damaged, you may have a short time to file an insurance claim. Since your insurance company limits the amount of time you have to file a claim it is important to get your claim approved and repairs STORM DAMAGE FAQ (continued) Q: Why should I get my home inspected for storm damage? A: Peace of mind. If your home is damaged, you may have a short time to file an insurance claim. Since your insurance company limits the amount of time you have to file a claim it is important to get your claim approved and repairs scheduled as soon as possible. Q: Can CHA Contractors help me file my insurance claim? A: Yes. CHA Contractors are insurance claims experts. They will help you file your claim and will work with your insurance company to ensure a fair outcome for you. Q: Will my insurance premiums go up if I file a claim? A: In most states, insurance companies are prohibited from singling out any one homeowner for a rate increase based on an “Act of God” damage claim, which includes hail, wind, tornado and hurricane storm damage claims. Q: Should I hire the cheapest contractor to fix my home? A: If your insurance company is paying for your repairs, it is in your best interest to hire a contractor who will provide quality service, workmanship, materials and a good warranty. Q: I've heard some contractors pay insurance deductibles? Is this true? A: Many contractors offer special programs to help homeowners limit out of pocket expenses. Ask your contractor about the programs they offer to help cover the cost of your deductible. Q: Should I trust contractors that knock on my door? A: Be wary of door-to-door contractors. If you get an inspection from a door -to-door company, do your research and make sure they are credible, licensed, insured and properly trained. It is always a good idea to get at least 3 inspections from reputable companies. Q: My contractor asked me to sign a contingency agreement? What's this? A: A contingency agreement typically includes two parts, an inspection agreement, which gives the contractor permission to request an inspection from your insurance company and a work-order agreement, which obligates you to use that contractor to perform your repairs if damage is confirmed. If you just want an estimate, you should only sign the inspection agreement. STORM DAMAGE FAQ (continued) Q: How long can I file an insurance claim after the storm? A: The time you have to file an insurance claim varies by insurance company, but as a general rule, most insurance companies require you to file within 1224 months. It is a good idea to contact your insurance agent, or an NSDC certified contractor for details on your specific policy. Q: My insurance agent is the nicest person. Won't he take care of me? A: No matter how much you like your insurance agent personally, it is important to remember your insurance company is in business to make money. Get at least 3 estimates from reputable, independent contractors. Contractors recommended by insurance companies may have an incentive to save the insurance company money, at your expense. Q: My insurance company denied my claim. What can I do? A: You can request 3 separate inspections and re-file a claim that has been denied. Make sure your contractor is present during your next inspection. An experienced contractor can often help get your claim approved, even if it has been denied previously. Q: Several of my neighbors are getting their roof replaced, should I get my home inspected? A: Yes. If your neighbors have storm damage and are getting their roof repaired or replaced, chances are very good you have storm damage as well. Q: How can I tell if my home has sustained hail damage? A: You may notice small dents on rain gutters or air conditioning units, missing or bent shingles, washout (granules accumulating in gutters or downspouts), moist areas on your ceiling indicating leads, cracks or dents in windows or siding, shredded plants and flowers, leaves knocked off trees and dents in cars parked on the street. If any of your neighbors are having repairs done, chances are your property is damaged as well. Q: What does a hail hit look like on an asphalt roof? A: A hail hit on asphalt shingles looks like a dark spot, or bruise, where the roofing granules have been knocked away. In some cases you may find holes, cracking, or missing shingles on roofs that have been damaged by hail. Q: My home was hit by hail, but I don't see any damage. What should I do? A: It can be difficult to identify signs of hail damage. Rely on a trained professional to perform a full property inspection and look for leaks, flooding, structural damage and serious issues. STORM DAMAAGE FAQs (continued) Q: What are the risks of not fixing a hail damaged roof? A: The most common problems associated with hail damage are leaking water and flooding. Over time, water leaks through tiny holes in your roof and causes serious issues including water damage, mold and structural damage, including roof collapse. Q: My roof has sustained storm damage. Can I just fix it myself? A: If your home has been damaged by a storm and you are filing an insurance claim to pay for the repairs, there is no advantage to doing the work yourself. Hire a reputable contractor, with insurance claims experience that is committed to quality workmanship. Q: Can storm damage impact the value of my home? A: Yes. If you plan to sell your home in the future, it is critical to address storm damage issues immediately. Many homeowners are shocked to learn they have costly storm damage to fix, years after the time to file an insurance claim has expired. Q: Do I need to get my roof replaced right away? A: The devastating nature of hail damage is you might not start experiencing problems, such as leaking, mold, or structural damage right away. But, because most insurance companies limit the time you can file a claim, it is important to get your roof fixed immediately, before your time to file a claim expires. Q: Why would my insurance company pay to fix my home? A: The purpose of your homeowners insurance is to protect your home against losses that affect the value, functionality and safety of your home. If your home has sustained storm damage, your insurance company will provide compensation to have your property restored to its original condition before the storm.

© Copyright 2026