PDF (2.5MB) - ThyssenKrupp AG

ThyssenKrupp Equity Story Steel Europe & Steel Americas January 2015 ThyssenKrupp Equity Story Steel Europe & Steel Americas January 2015 1 Developing the future. Developing the future. ThyssenKrupp – Diversified Industrial Group FY 2013/14 ThyssenKrupp Group Sales: EBIT adj.*: Employees: €41.3 bn €1,314 m 160,745 Components Technology Elevator Technology Industrial Solutions Materials Services Steel Europe Steel Americas Sales: €6.2 bn EBIT adj.*: €268 m Empl.: 28,941 Sales: €6.4 bn EBIT adj.*: €674 m Empl.: 50,282 Sales: €6.3 bn EBIT adj.*: €420 m Empl.: 18,546 Sales: €13.7 bn EBIT adj.*: €212 m Empl.: 30,289 Sales: €8.9 bn EBIT adj.*: €206 m Empl.: 26,231 Sales: €2.1 bn EBIT adj.*:€(68) m Empl.: 3,466 * pro forma, based on new EBIT definition effective Oct 1st, 2014 ThyssenKrupp Equity Story Steel Europe & Steel Americas January 2015 2 Developing the future. Steel Europe: Strong Presence in More Resilient Markets and Industries Volume Steel Europe Competition Flat steel market and share Steel Europe Automotive Duisburg 31 % 15 % 54 % Special Vehicles Engineering 27 % 250 km Construction 17 % 56 % 500 km > 500 km ThyssenKrupp Equity Story Steel Europe & Steel Americas January 2015 3 Trucks Appliances Packaging Customers Flat Steel market 2013 in Europe, market share Steel Europe; Source: Eurofer/estimates TK SE Energy Developing the future. Premium Flat Carbon Steels Made by ThyssenKrupp Product Mix Steel Europe FY 2013/14 Ratio of load capacity to operating weight increased to 8:1 For extreme demands on deep drawing properties (0.07 mm) in % of net revenues Hot Strip MediumWide Strip 9 Heavy 7 Plate 16 16 6 7 Cold Strip Tinplate Tinplate Electrical Steel Heavy Plate 39 Coated Products (HDG, EG, Color) Thick hot strip 30 projects, >40 individual solutions Green, cost-competitive, lightweight ThyssenKrupp Equity Story Steel Europe & Steel Americas January 2015 4 In sour gas resistant grades for pipelines Developing the future. Challenging Flat Carbon Steel Market in Europe – Slow Recovery Expected HRC price, raw material basket and spread €/t * schematic model, i/o and hcc only, fob Source: Platts, CRU, own calculations million t Source: Eurofer/estimates BCG (BiCR) -23% 140 800 700 Flat carbon steel demand Europe ~2%/yr 120 HRC Germany 600 100 500 80 400 60 spread 300 40 200 100 raw material basket * 0 2000 ThyssenKrupp Equity Story Steel Europe & Steel Americas January 2015 5 2004 2008 2012 ’14 20 0 2004 2008 Developing the future. 2012 2020e Program Geared to Achieve +ve ∅TKVA Over the Cycle Comprehensive market & competition review Costs ~ €600 m/yr • structural adjustments • operational improvements • exit non-core activities gross EBIT effects by FY 2014/15 Mix ~ €100 m/yr • expand attractive niches • adjust Capex strategy gross EBIT effects by FY 2014/15 Differentiation • innovation initiative • time-to-market • delivery performance ThyssenKrupp Equity Story Steel Europe & Steel Americas January 2015 6 from Developing the future. to capacities customers Solutions for Automotive Efficiency Leveraging ThyssenKrupp Group Synergies • By some distance biggest R&D project pursued by ThyssenKrupp in recent years • 30 projects with more than 40 individual solutions • Green, cost-competitive, lightweight, high-performing ThyssenKrupp Equity Story Steel Europe & Steel Americas January 2015 7 Developing the future. Costs Mix Differentiation Driving Economic Weight Reduction Cold forming Further development of multi-phase steels Hot forming New manganese-boron steels (MBW® 1900) Further development of tailored tempering Optimized properties Improved corrosion resistance Better surface quality Steel-polymer sandwich material with high bend and oil canning resistance (cold forming) 3-layer steel sandwich material with high energy absorption capacity (hot forming) Hybrid materials – Composites ThyssenKrupp Equity Story Steel Europe & Steel Americas January 2015 8 Costs Mix Differentiation Developing the future. Costs Mix Differentiation Reducing the Blind Spot Status Quo A-Pillar Cost-Efficient Weight Reduction of up to 10% Reduces the A-pillar “blind spot” by an incredible 34% ! ThyssenKrupp Equity Story Steel Europe & Steel Americas January 2015 9 Developing the future. Comprehensive Cost & Differentiation Program Geared to Sustainable Improvement of Profit and Cash Flow Profile EBIT adj / EBITDA adj * Costs Mix Differentiation in € bn Business Cash-Flow** in € bn historically with manageable volatility sig +ve EBIT adj / BCF in upcycle ≠ -ve EBIT adj / BCF in downcycle +ve ∅TKVA over the cycle in € bn EBITDA adj. EBIT adj. TKVA “Best-in-Class Reloaded” program to meet Group requirements and tackle steel market challenges ThyssenKrupp Equity Story Steel Europe & Steel Americas January 2015 10 * EBIT(DA) as reported until 2005/06 ** FCF until 2010/11; excl. –ve FCF Steel Americas projects Developing the future. ThyssenKrupp – Diversified Industrial Group FY 2013/14 ThyssenKrupp Group Sales: EBIT adj.*: Employees: €41.3 bn €1,314 m 160,745 Components Technology Elevator Technology Industrial Solutions Materials Services Steel Europe Steel Americas Sales: €6.2 bn EBIT adj.*: €268 m Empl.: 28,941 Sales: €6.4 bn EBIT adj.*: €674 m Empl.: 50,282 Sales: €6.3 bn EBIT adj.*: €420 m Empl.: 18,546 Sales: €13.7 bn EBIT adj.*: €212 m Empl.: 30,289 Sales: €8.9 bn EBIT adj.*: €206 m Empl.: 26,231 Sales: €2.1 bn EBIT adj.*:€(68) m Empl.: 3,466 * pro forma, based on new EBIT definition effective Oct 1st, 2014 ThyssenKrupp Equity Story Steel Europe & Steel Americas January 2015 11 Developing the future. US Assets Divested And Forward Strategy TK CSA Defined Current focus on operating improvements in Brazil Exit TK Steel USA slab sales TK CSA in m t/yr Sale to MT/NSSMY Price: $1.55 bn 4.1 • stabilization & continuous ramp-up 3.5 3.3 TKS USA Alabama • efficiency imprvmts 2.8 Shift in market focus TK CSA Slab supply contract • 2 mt/yr until Sep 2019 • @ [HRC MidWest minus] • implement sales orga and develop customer base complementing TK CSA Brazil • 40% load from slab supply to Alabama 0.0 09/10 11/12 13/14 Mid-term solution outside of TK portfolio feasible ThyssenKrupp Equity Story Steel Europe & Steel Americas January 2015 12 Developing the future. Positive EBITDA Achieved in FY‘13/14, Cash Break-Even Targeted in FY’14/15 2010/11 2011/12 2012/13 (0.2) 0.05 (0.1) (0.7) (0.5) (0.2) in FY 2013/14 € bn ThyssenKrupp Equity Story Steel Europe & Steel Americas January 2015 13 2.5 2.0 1.5 1.0 assuming no major headwinds from F/X and raw material spreads (1.4) (2.8) during FY ‘14/15 Positive EBITDA adj (1.1) (0.5) BRL/USD 3.5 3.0 BCF ~ break-even (0.4) (0.6) 2014/15E 2013/14 2004 2006 2008 2010 2012 2014 seaborne raw material spread vs HRC US Source: Platts, CRU, own calculations Δ $600/t Business Cash Flow Capex EBITDA adj 2004 2006 2008 Developing the future. 2010 2012 2014 Performance Improvements and De-Risking at Steel Businesses with Significant Contribution to Value Upside of ThyssenKrupp Group Strategic Way Forward Change Management CT ET Performance Orientation return to previous margin levels (6-8%) • performance measures • ramp-up new plants in BIC Customer & Markets Financial Stability sales growth ∅ 5% to €8 bn • while maintain stable EBIT margin of 6-7% efficient corporate structure central projects and initiatives preparing next level of efficiency gains ThyssenKrupp Equity Story Steel Europe & Steel Americas January 2015 14 Strategic Push return to previous margin levels • performance measures • specialization & processing AST/VDM: perform./attract. concept MX close margin gap to peers • while leverage growth opportunities • target: 15% I €1 bn (EBIT adj) IS Corp People Success return to > wacc across the cycle • BiC Reloaded: efficiency & differentiation continuous EBIT improvement BCF ~break-even during FY 14/15 sustainable slab marketing concept SE AM Developing the future. Appendix ThyssenKrupp Equity Story Steel Europe & Steel Americas January 2015 15 Developing the future. Overview Business Area Steel Europe Key Figures Steel Europe 2009/10 2010/11 2011/12 2012/13 2013/14 8,857 €m 10,770 12,814 10,992 9,620 Sales Crude steel kt Shipments kt EBITDA €m EBIT €m €m EBIT adj. EBIT adj.* € m Empl. (Sep 30)# 13,296 13,247 11,860 11,646 12,249 12,009 1,301 13,022 1,670 12,009 659 11,519 512 11,393 592 731 731 1,133 1,133 188 247 62 143 34,711 28,843 27,761 26,961 192 216 206 26,231 * pro forma after definition change Product Mix Steel Europe FY 2013/14 Sales by Industry Steel Europe FY 2013/14 in % of net revenues Hot Strip Medium-wide Strip Tinplate Electrical Steel in % of net revenues Others Packaging Mechanical Engineering Heavy Plate Cold Strip ThyssenKrupp Equity Story Steel Europe & Steel Americas January 2015 16 Coated Products (HDG, EG, Color) Trade 13 Automotive industry (incl. suppliers) 5 28 6 22 Developing the future. 26 Steel and steelrelated processing Steel Europe – Q4 2013/14 Highlights Order intake in €m EBIT in €m; EBIT adj. margin in % Shipments in 1,000 t Ø rev/t indexed (Q1 2004/05=100) 123 2,274 121 117 119 118 EBIT adjusted EBIT 4.6 62 2,430 2,177 2,178 3,109 2,036 2,839 2,580 2,858 2,847 42 1.8 28 Q4 Q3 Q4 Q4 2012/13 2013/14 2012/13 Strengthening differentiation: Leveraging ThyssenKrupp Group synergies Status Quo Q3 2013/14 A-Pillar 1 of >40 solutions for sustainable automobile construction cost-efficient weight reduction potentials of up to 10% reduces the A-pillar “blind spot” by an incredible 34% ! ThyssenKrupp Equity Story Steel Europe & Steel Americas January 2015 17 Q4 Q4 2012/13 20 32 2.6 19 0.9 52 1.5 92 Q3 2013/14 28 Q4 Current trading conditions 103 Qoq lower EBIT adj. reflecting mainly lower production volumes, less fixed cost dilution, higher maintenance & repair costs related to BF#2 reline and further/complementary Capex/maintenance & repair projects Following delayed completion of modernization of continuous caster #1, BF#2 was relit mid October Expectation fiscal Q1 ’14/15: qoq higher EBIT adj. as relinerelated effects should largely fall away Against background of inadequate selling prices and earnings, focus remains on "Best-in-Class Reloaded“; reduced weekly working hours for pay-scale employees has become effective Oct 1st, 2014 Developing the future. Steel Europe: Output, Shipments and Revenues per Metric Ton Crude steel output (incl. share in HKM) 1,000 t/quarter Shipments*: Hot-rolled and cold-rolled products 1,000 t/quarter Cold-rolled Hot-rolled; incl. slabs HKM share 3,324 696 3,312 828 2,628 2,485 2,965 863 2,102 2009/10 2010/11 2011/12 3,418 3,119 2,986 3,097 2,941 3,146 863 2,622 822 2,567 833 857 859 786 611 843 2,555 2,296 2,241 2,082 2,360 2,010 2,153 1,725 Q1 Q2 Q3 Q4 Q1 Q2 Q4 2,046 2,126 1,977 957 3,058 3,093 2,529 1,130 1,026 1,684 845 2009/10 2010/11 2011/12 Q1 2013/14 2012/13 Fiscal year Q3 3,002 3,256 3,002 2,839 1,942 1,977 1,834 2,580 1,116 1,116 1,004 Q2 Q3 Q4 150 Q1 Q2 Q3 Q4 2007/08 156 153 139 120 Q1 Q2 Q3 Q4 2008/09 1,783 1,205 1,041 1,064 Q2 Q1 Q3 Q4 2013/14 Q1 2004/2005 = 100 122 116 120 Q1 Q2 129 Q3 Q4 2009/10 140 146 130 135 147 Q1 Q2 Q1 Q2 Q3 Q4 2010/11 136 138 136 Q3 Q4 135 126 127 123 Q1 Q2 Q3 2011/12 * shipments and average revenues per ton until FY 2007/08 relate to former Steel segment ThyssenKrupp Equity Story Steel Europe & Steel Americas January 2015 18 947 1,904 1,817 2012/13 Fiscal year Average revenues per ton*, indexed 133 136 138 1,633 3,109 2,858 2,847 Developing the future. 2012/13 Q4 121 117 119 118 Q1 Q2 2013/14 Q3 Q4 Steel Europe: Despite Adverse Market Environment with Positive EBIT and Cash-Flow Contribution Q1 Q2 2012/13 Q3 Q4 FY Q1 Q2 2013/14 Q3 Q4 FY Order intake €m 2,403 2,620 2,315 2,177 9,515 2,274 2,430 2,178 2,036 8,919 Sales €m 2,253 2,512 2,562 2,293 9,620 2,074 2,389 2,228 2,166 8,857 EBITDA €m 142 98 119 154 512 126 158 192 117 592 EBITDA adjusted €m 142 118 166 146 572 126 168 205 121 620 EBIT €m 29 (10) 14 28 62 20 52 92 28 192 EBIT adjusted €m €m 30 9 62 42 143 19 62 103 32 216 16 60 100 30 206 % % 1.3 0.9 2.6 4.6 1.5 2.4 0.8 2.5 4.5 1.4 2.3 EBIT adjusted* EBIT adj. margin EBIT adj. margin* 0.4 2.4 1.8 1.5 (432) (245) TK Value Added €m Ø Capital Employed €m 5,387 5,351 5,291 5,198 5,198 4,669 4,605 4,595 4,594 4,594 BCF €m 15 97 173 (5) 280 182 59 (41) 140 340 CF from divestm. €m 2 1 5 159 167 0 (3) (4) (20) (27) CF for investm. €m (94) (105) (74) (136) (408) (91) (63) (95) (155) (404) 27,629 27,773 27,609 26,961 26,961 26,658 26,397 26,047 26,231 26,231 Employees BCF (Business Cash Flow) = FCF before interest, tax and divestments = EBITDA +/- ∆ NWC – Capex +/- Other * pro forma after definition change However, significant improvements required to cover cost of capital ThyssenKrupp Equity Story Steel Europe & Steel Americas January 2015 19 Developing the future. Performance Program “BiC – reloaded” at Steel Europe to Meet Group Requirements and Tackle Steel Market Challenges Group Requirements Steel Market Challenges Market & Competition Review Strategic Way Forward Performance Benchmarking sustainable profitability & positive BCF positive ∅TKVA over the cycle leading position vs best in class peers ThyssenKrupp Equity Story Steel Europe & Steel Americas January 2015 20 CRM / EGL / HDGL Neuwied 1 HDGL Galmed, Spain 1 OrgCL Duisburg 1 EGL Dortmund Restructuring GO Electrical Steel ~ €600 m/yr gross EBIT effects by FY 2014/15 from efficiency improvements as contribution to impact 2015 Production & Process Review Structural & operating adjustments needed for viability of core upstream facilities Closure or divestment of: Costs Mix Differentiation incl. reduction of >2,000 FTEs ~ €100 m/yr gross EBIT effects by FY 2014/15 based on strategic mix development Reinforce & secure existing strong competitive position as premium flat carbon steel supplier CRM = cold-rolling mill EGL = electrolytic galvanizing line HDGL = hot dip galvanizing line OrgCL = organic coating line GO ES = grain-oriented electrical steel Developing the future. Increasingly difficult trading conditions high and volatile energy & raw material prices high economic uncertainties significantly reduced consumption levels & low growth esp. in South-West-Europe Significant Improvement of Cost Position Achievable Through Structural Adjustments and Operational Measures Costs Mix Differentiation Improvement vs FY 2011/12 Structural adjustments Operational improvements Closure or divestment of: CRM / EGL / HDGL Neuwied 1 HDGL Galmed, Spain 1 OrgCL Duisburg 1 EGL Dortmund Restructuring GO Electrical Steel Raw materials Maintenance Production / material efficiency Energy efficiency Logistics Procurement G&A ~ €600 m/yr gross EBIT effects by FY 2014/15 ThyssenKrupp Equity Story Steel Europe & Steel Americas January 2015 21 Developing the future. Stringent Portfolio Adjustments and Strategic Mix Improvements Portfolio adjustments in % of sales FY 11/12 Tailored Blanks Construction Elements Hot Strip 15 7 2 Medium-wide Tinplate Strip 13 8 Heavy Plate 7 7 Cold Strip Strategic mix development targeted increase/reduction by detail segment vs FY 2011/12 7 Electrical Steel 34 expand attractive segments / grades Coated Products Adjust capex strategy: example medium-wide strip Upgrade of specialized mediumwide strip mill completed and successfully ramped up €30 m Capex to reinforce leading position with further improvmt of strip quality and ~25% capacity increase to ~1.3 m t/yr by 2015 ThyssenKrupp Equity Story Steel Europe & Steel Americas January 2015 22 Costs Mix Differentiation ~ €100 m/yr gross EBIT effects by FY 2014/15 TK medium-wide strip offers: • extraordinary tight tolerances similar to cold rolled strip • superior surface quality • uniform material properties • optimum shaping properties even in higher strength steels • customized batch sizes exit / reduce less profitable segments / grades Developing the future. Steadily Increasing and More Focused R&D Expenditures to Reinforce Differentiation Strategy Costs Mix Differentiation R&D expenditure in € m R&D ratio: R&D costs/Sales 0.5% 0.7% 0.8% 1.0% ~1.5% > 100 86 80 67 66 R&D expenditures FY 2010/11 ThyssenKrupp Equity Story Steel Europe & Steel Americas January 2015 23 11/12 12/13 13/14 Mid term Developing the future. A Clear Strategic Way Forward for Business Area Steel Europe Best-in-Class Portfolio optimization Closed Tailored Blanks Construction Asset closures Neuwied Galmed EBA 4 BBA 1 Change management Top management structure optimized Performance orientation Leaner and more efficient organization Structured performance program to achieve ~€600 m EBIT effect by FY 2014/15 started Financial stabilization Sustainable profitability & positive BCF Positive Ø TKVA over the cycle Agreement reached with unions and works council on working hours reduction – faster efficiency gains ThyssenKrupp Equity Story Steel Europe & Steel Americas January 2015 24 Developing the future. Strategic offensive Diversify productportfolio Reinforce position as large-scale, premiumniches player with strong customer focus Steel Americas 2012/13 Q1 Q2 Q3 2013/14 FY Q4 Q1 Q2 Q3 FY Q4 Order intake €m 560 509 496 491 2,056 609 574 412 620 2,215 Sales €m 488 501 473 406 1,867 538 535 441 546 2,060 EBITDA €m (87) (12) (162) (205) (467) 29 143 33 (16) 188 EBITDA adjusted €m (87) (12) (162) (106) (368) 10 1 40 (4) 48 EBIT €m (122) (44) (193) (821) (1,180) 1 117 8 (54) 72 EBIT adjusted €m (122) (44) (193) (136) (495) (17) (26) 16 (33) (60) (19) (28) 14 (35) (68) (3.2) (4.9) 3.6 (6.0) (2.9) (3.5) (5.2) 3.2 (6.4) (3.3) EBIT adjusted* €m EBIT adj. margin % EBIT adj. margin* n.a. n.a. n.a. n.a. n.a. % (1,500) (174) TK Value Added €m Ø Capital Employed €m 3,244 3,296 3,284 3,202 3,202 2,789 2,820 2,660 2,456 2,456 BCF €m (142) (71) (220) (100) (533) (178) (151) 84 64 (181) CF from divestm. €m 0 0 1 4 5 0 1,263 6 2 1,271 CF for investm. €m (52) (42) (28) (48) (170) (22) (33) (3) (31) (89) 3,990 4,068 4,100 4,112 4,112 5,491 4,037 3,446 3,466 3,466 Employees BCF (Business Cash Flow) = FCF before interest, tax and divestments = EBITDA +/- ∆ NWC – Capex +/- Other ThyssenKrupp Equity Story Steel Europe & Steel Americas January 2015 25 Developing the future. * pro forma after definition change Steel Americas – Q4 2013/14 Highlights Order intake in €m Production & shipments in 1,000 t EBIT in €m 986 998 987 1,071 1,054 609 620 16 Q4 2012/13 412 Q3 Q4 2013/14 1,130 936 923 1,034 1,046 Slab shipments CSA Q4 2012/13 Q3 2013/14 (26) 1 117 (33) 8 (54) Q3 2013/14 Q4 Q4 2012/13 Q3 2013/14 Q4 Current Currenttrading tradingconditions conditions Sig. depreciation of BRL vs. USD 3.0 3.0 2.5 2.5 2.0 2.0 1.5 1.5 1.0 1.0 (821) (17) (136) Q4 2012/13 Q4 BRL : USD 05/06 EBIT Slab production CSA 574 491 EBIT adjusted 07/08 09/10 11/12 13/14 Qoq EBIT adj. down reflecting esp. a reimbursement payment in Q3 (BF#2 damage in May 2013) and negative translation effects related to R$-based sales tax assets in Q4 which could not be compensated by higher shipments and efficiency gains Special items in Q3: €(12) m from updated valuation of a long-term freight contract and €(9) m impairment charge Similar to Q3 last FY, EBIT Q4’13/14 influenced by negative translation effects related to R$-based sales tax assets ThyssenKrupp Equity Story Steel Europe & Steel Americas January 2015 26 Developing the future. Disclaimer ThyssenKrupp AG “The information set forth and included in this presentation is not provided in connection with an offer or solicitation for the purchase or sale of a security and is intended for informational purposes only. This presentation contains forward-looking statements that are subject to risks and uncertainties. Statements contained herein that are not statements of historical fact may be deemed to be forward-looking information. When we use words such as “plan,” “believe,” “expect,” “anticipate,” “intend,” “estimate,” “may” or similar expressions, we are making forward-looking statements. You should not rely on forward-looking statements because they are subject to a number of assumptions concerning future events, and are subject to a number of uncertainties and other factors, many of which are outside of our control, that could cause actual results to differ materially from those indicated. These factors include, but are not limited to, the following: (i) market risks: principally economic price and volume developments, (ii) dependence on performance of major customers and industries, (iii) our level of debt, management of interest rate risk and hedging against commodity price risks; (iv) costs associated with, and regulation relating to, our pension liabilities and healthcare measures, (v) environmental protection and remediation of real estate and associated with rising standards for real estate environmental protection, (vi) volatility of steel prices and dependence on the automotive industry, (vii) availability of raw materials; (viii) inflation, interest rate levels and fluctuations in exchange rates; (ix) general economic, political and business conditions and existing and future governmental regulation; and (x) the effects of competition. Please note that we disclaim any intention or obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise.” ThyssenKrupp Equity Story Steel Europe & Steel Americas January 2015 27 Developing the future.

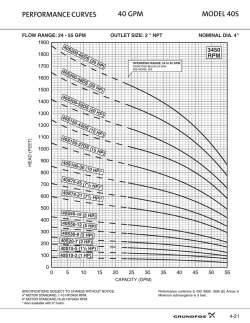

© Copyright 2026