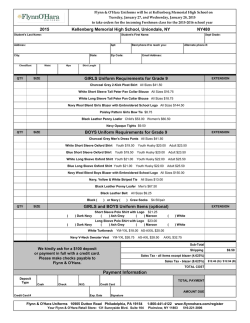

ACTS 4304 Instructor: Natalia A. Humphreys HOMEWORK 2 Lesson

ACTS 4304 Instructor: Natalia A. Humphreys HOMEWORK 2 Lesson 2: Parametric Distributions. Lesson 4: Mixtures and Splices. Due: January 29, 2015 (Thurs) Sufficient work must be shown to get credit for a correct answer. Partial credit may be given for incorrect answers which have some positive work. Problem 1 Claim sizes expressed in deutsche marks follow a lognormal distribution with parameters µ = 4 and σ = 2.5. A euro is worth 1.32 DM. Calculate the probability that a claim will be worth 75 euros or more. Problem 2 Claim sizes X initially follow a Weibull distribution with parameters τ = 2 and θ = 400. Claim sizes are inflated by 30% uniformly. Calculate the probability that a claim will be for 90 or less after inflation. Problem 3 For a oil transportation insurance • In 2010, loss sizes follow a two-parameter Pareto distribution with parameters α = 3 and θ. • In 2011, there is uniform inflation at rate i. • The 80th percentile of loss size in 2010 equals the mean loss size in 2011. Determine i. Problem 4 Y follows an exponential distribution with mean 30. Determine the mean of Y 5 . Problem 5 You are given: • In 2009, losses follow a Pareto distribution with parameters θ = 400 and α = 2. • Inflation of 3.5% impacts all losses uniformly from 2009 to 2010. What is the 75th percentile of the portion of the 2010 loss distribution above 500? (A) 639 (B) 641 (C) 1366 (D) 1400 (E) 1414 Problem 6 The severity distribution for losses on an auto collision coverage is: 3 5 1500 4500 − 0.45 , x≥0 F (x) = 1 − 0.55 1500 + x 4500 + x Calculate the mean and the variance of the loss size. (A) 1,877,344 (B) 1,912,148 (C) 1,919,531 (D) 1,954,336 (E) 2,293,850 Problem 7 The number of losses on a car insurance policies is binomially distributed with parameters m = 6 and Q. Q varies by policyholder exponentially with mean θ = 200. Calculate the variance of the number of losses for a randomly selected policyholder. ACTS 4304. SP 2015. HOMEWORK 1. Problem 8 You are given the following information about a portfolio of insurance risks: • There are three classes of risks: A, B, and C. • The number of risks in each class, and the mean and standard deviation of claim frequency for each class, are given in the following chart: Number Claim Frequency of Standard Class Risks Mean Deviation A 100 0.17 0.25 B 600 0.2 0.3 C 300 0.23 0.35 Determine the variance of claim frequency for a risk randomly selected from a portfolio. Problem 9 You are given the following: • Risks in a portfolio are liability risks with probability 1/3 and property risks with probability 2/3. • The risks have identical claim count distributions. • Loss sizes for liability risks follow an inverse gamma (Vinci) distribution with parameters θ = 200 and α = 5. • Loss sizes for property risks follow an inverse gamma distribution with parameters θ = 500 and α = 4. Determine the variance of the claim size distribution for this portfolio for a single claim. Problem 10 Loss sizes follow a spliced distribution. The probability density function of this distribution below 300 is a multiple of b of the probability density function of an inverse Pareto distribution with τ = 3 and θ = 100. The probability density function above 300 is the same as for an exponential distribution with θ = 500. Calculate the probability that a loss will be less than 150. Copyright ©Natalia A. Humphreys, 2015 Page 2 of 2

© Copyright 2026