2015 Annual Conference

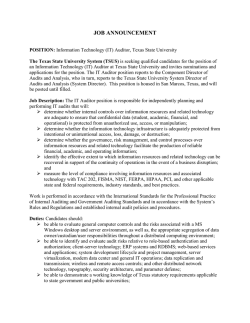

2015 Annual Conference March 2nd through March 5th Courtyard River Village New Braunfels, TX www.tacua.org THE go-to continued educational resource for audit professionals in higher education. 2014/2015 TACUA OFFICERS & DIRECTORS TACUA cordially invites you to New Braunfels, Texas! Eloy Alaniz, President University of Texas‐Pan American [email protected] Andrew Groover, President-Elect Texas Woman’s University [email protected] Angela McCarter, Treasurer University of Texas‐Austin [email protected] Emily Knopp, Secretary Angelo State University/ [email protected] Steve Kieff, Past President Baylor University steve_kieff@baylor.edu Charlie Hrncir Texas A&M University System [email protected] Charla Parker-Thompson Texas Southern University [email protected] TABLE OF CONTENTS President’s Invitation ................................................ 2 Location Information ............................................... 3 Schedule of Events .................................................. 4 Conference Fees ....................................................... 7 Course Descriptions ................................................. 8 Speaker Biographies ............................................... 11 Registration Form ................................................... 18 TACUA2015Conference Page1 President’sInvitation As the current Texas Association of College and University Auditors (TACUA) President, I want to personally extend an invitation to you to attend our 2015 TACUA Conference in New Braunfels. As most of you know, TACUA has been an invaluable resource to all internal auditors across the State of Texas. For about 30 years, TACUA has provided cost-effective and timely professional development focusing on higher education topics for auditors. The first conference I attended was the 16th Annual TACUA Conference in 2001. Besides the quality training, one of the most important benefits I received was the opportunity to network with other auditors, resulting in friendships. The Courtyard New Braunfels River Village on the Guadalupe River will be a scenic setting for our conference. New Braunfels, established by a German immigrant, means new brown rock in German and has many attractions. We will provide you with some time to enjoy the charm of this German town. One of the best things to see is the historic district of Gruene, featuring the ruins of the original gristmill and live music at Gruene Hall. Gruene Hall, established in 1878, is the oldest operating dance hall in Texas. Other attractions include tubing on the Guadalupe and Comal Rivers, Texas Ski Ranch, Natural Bridge Caverns, Schlitterbahn Waterpark, Bandit Golf Club and for you shoppers, the San Marcos Prime and Tanger Outlet Malls are only 15 minutes away. So join us again in New Braunfels for great speakers and networking opportunities. But don’t take my word for it, read what some of the auditors had to say about last year’s conference… “Very good conference.” “Enjoyed the central location; Good facilities and prices; Great speakers.” “Excellent venue; All topics were very interesting.” “Great conference w/relevant information; Location was easy to get to.” “Great conference venue; Great hotel.” “Great balance of cost/benefit.” It is you who makes us a great organization and makes these conferences fun. I hope to see you there! Sincerely, Eloy Alaniz President of TACUA TACUA2015Conference Page2 LocationInformation Courtyard New Braunfels River Village http://cwp.marriott.com/satnb/tacua2015 750 IH 35 North New Braunfels, TX 78130 1-830-626-4700 1-800-321-2211 TACUA attendees receive the discounted rate of $83, plus 13% tax, a night (single room). Use the URL above and/or the group code TAC when making your reservation. Discounted rate is subject to availability. Rooms must be booked prior to Monday, February 9, 2015. Courtyard New Braunfels River Village also features the following: High-speed Internet Access o Guest rooms: Complimentary Wireless, Wired Fitness Activities o Exercise Room o Lobby and Public areas: Complimentary Wireless, Wired o Outdoor Pool o Meeting rooms: Wireless, Wired o Nearby Golf Course Complimentary on-site parking o Bike trails Convenient access to airports o Whirlpool o 27 miles from the San Antonio Airport (SAT) o 50 miles from Austin-Bergstrom Airport (AUS) TACUA2015Conference Page3 ScheduleofEvents Monday, March 2nd 12:00 – 1:00 Registration 1:00 — 1:15 Welcome and Opening Remarks Eloy Alaniz, University of Texas-Pan American 2015 TACUA President 1:15 — 2:30 The Next Generation of Internal Auditors–The fight for talent! Mark Salamasick, University of Texas-Dallas 2:30 – 3:00 Break 3:00 – 4:30 Roundtable Discussions [Separate roundtables for Directors and Staff] 5:30 — 8:00 Opening Reception Tuesday, March 3rd 7:00 — 8:00 Breakfast 8:00 — 9:10 How Controlled Are Your Controlled Substances? Brett Swett and Rendi Owens, Texas Tech University System 9:15 — 10:30 Data Analytics and Student Financial Aid Tracey Sadler, Texas A&M University System 10:30 — 10:50 Break 10:50 — 12:00 Navigating NCAA Rules for Successful Internal Audits Lori Hammond and Blake Barlow, University of Texas-Austin 12:00 — 1:00 Lunch TACUA2015Conference Page4 ScheduleofEvents,continued 1:00 — 2:15 Dealing with Difficult Auditees—Panel Discussion Andrew Groover, Texas Woman’s University (moderator) Toni Stephens, University of Texas-Dallas Charlie Hrncir, Texas A&M University System Russ Hoskens, University of Houston System Steve McGee, Texas State University 2:20 — 3:30 Minors on Campus Charlie Hrncir, Texas A&M University System 3:30 — 3:50 Break 3:50 — 5:00 TBD 5:30 — 8:00 Networking Reception Wednesday, March 4th 7:00 — 8:00 Breakfast 8:00 — 9:10 Follow the Yellow Brick Road…Not the Rabbit Trail…to an Effective Individual Audit Risk Assessment Toni Stephens, University of Texas-Dallas 9:15 — 10:30 HIPAA Auditing Update Mike Cullen, Baker Tilly Virchow Krause, LLP 10:30 — 10:50 Break 10:50 — 12:00 Social Media - How to Actively Engage your Audit Committee Randy Crawford and Richard Ochoa, University of Texas Medical Branch at Galveston 12:00 — 1:00 Lunch 1:00 — 2:15 Fundamentals of Construction Auditing, What You Need to Know—Bill Mansfield, Sirius Solutions LLLP TACUA2015Conference Page5 ScheduleofEvents,continued 2:20 — 3:30 Computer Forensics for Auditors Tod Maxwell, University of Texas-Austin 3:30 — 3:45 Break 3:45 — 5:00 Roundtable Discussions [Title IX Compliance or Information Technology] *Round up some of your new friends and head out to dinner* (Please plan to handle your own check as registration fees do not include dinner.) Thursday, March 5th 7:00 — 8:00 Breakfast 8:00 — 9:10 Understanding your BLACKBOARD LEARN™ Environment So That You Can Audit it Effectively Ali Subhani, University of Texas-Dallas 9:15 — 10:30 Hidden in Plain Sight: Investigating on the Internet Allan Bachman, Association of Certified Fraud Examiners 10:30 — 10:45 Break 10:45 — 12:00 Fraud and the Risk Assessment – What do Auditors Think? Emily Knopp & Christine Esqueda, Texas Tech University System 12:00 – 12:15 Closing Remarks/Conference Evaluations 12:15 Boxed lunches/Departures TACUA2015Conference Page6 ConferenceFee Secure the early registration rate of $350 by submitting registration and payment on or before February 20, 2015. After February 20th the rate increases to $400. The registration fee covers All conference sessions Breakfast, lunch, and evening receptions during the conference Please refer to the Registration Form (page 18) for details on how and where to remit payment. Please pay attention to the updated mailing address for TACUA. At this time, TACUA is not able to accept credit card payments. The conference brochure with registration form may also be downloaded at www.tacua.org. Tax Identification Numbers State Tax ID: 1 5213598079005 Federal Tax ID: 52-1359807 Conference Attire Conference dress is business casual. Attendees are encouraged to bring a jacket in the event of a chilly conference room and cold weather. Cancellations Cancellations made prior to February 27, 2015 will be refunded 50% of the registration fee. After February 27th no refunds will be issued. Replacement attendees can attend in lieu of a registered attendee upon proper notification. CPE Credit/Certification Attendees have the opportunity to receive 25 CPE hours. CPE certificates will be provided onsite at the end of the conference. TACUA is a TSBPA-approved CPE Sponsor (#1222). No sessions require advanced preparation and the knowledge level is basic to intermediate. Each course offers between 1.4 to 1.8 hours of CPE credit. Please refer to the following pages for additional course outlines and objectives, speaker biographies, and specific CPE credit. TACUA2015Conference Page7 CourseDescriptions Roundtable Discussions—Participants These sessions will provide a forum for internal audit directors and staff of colleges and universities to meet independently and exchange ideas, best practices, challenges and information. The annual meeting of TACUA members and election of Board members will also be held during the Directors Roundtable. [1.8 CPE] Title IX Compliance Roundtable Discussion—Participants This session will provide a forum for attendees to meet independently and exchange ideas, best practices, challenges and information specific to Title IX compliance. [1.8 CPE] Information Technology Roundtable Discussion—Participants This session will provide a forum for attendee to meet independently and exchange ideas, best practices, challenges and information related to information technology. [1.8 CPE] The Next Generation of Internal Auditors – The fight for talent!—Mark Salamasick The job market for internal auditors and risk control specialist is greater than ever. The supply of new auditors isn’t anywhere near the need for talented internal auditors, however at the College and University level there are many unique opportunities. Mark will provide perspective on overall demand along with what is happening on the supply side of potential candidates. He will address key factors and action steps on how you can win the war for top talent. He will also provide insight to a unique process to provide for a pipeline for future talent. [1.5 CPE] How Controlled Are Your Controlled Substances?—Brett Swett and Rendi Owens The objective of this presentation is to share one approach for assessing compliance with U.S. Department of Justice and the Texas Department of Public Safety controlled substances regulations. Specifically, we will the discuss common places where controlled substances may reside in higher education settings, gain an understanding of the complexities of controlled substance program compliance, and discuss methods for evaluating the effectiveness of your institution’s controlled substances program. [1.5 CPE] Data Analysis for Student Financial Aid—Tracey Sadler Texas A&M University System Internal Audit department has developed more than 45 data analytic scripts to detect possible non-compliance with federal student financial aid and Texas Grant programs. This presentation will discuss the road less taken with data analytics and how these scripts can help your student financial aid programs. The discussion will briefly touch on continuous auditing and how the TAMU System is implementing CA/CM. [1.5 CPE] Navigating NCAA Rules for Successful Internal Audits—Lori Hammond and Blake Barlow The NCAA has encountered some significant changes to its rules and governance structure in the last three years. This session will provide you an update on those key legislative changes. The presenters will also discuss best practices for staying updated on NCAA rules changes, as well as, share methods for enhancing internal audits related to NCAA rules on your campuses. [1.4 CPE] TACUA2015Conference Page8 CourseDescriptions Dealing with Difficult Auditees—Panel This panel discussion will provide insight into dealing with difficult auditees. As most auditors face this challenge during their career, this presentation will provide details about the characteristics of difficult auditees and why they do the things they do. The panel will provide real life situations and how these were handled. The presentation will also provide information on what we as auditors can do to mitigate the possibility of difficult auditees. [1.4 CPE] Minors on Campus—Charlie Hrncir Youth safety on our campuses has always been important but events over the last few years have indicated that our campuses may not be as well prepared for minors on our campuses as they should be. This session will discuss statutory requirements, control processes, and audit techniques that should help keep your campus safer for minors visiting your campus. [1.5 CPE] Follow the Yellow Brick Road…Not the Rabbit Trail…to an Effective Individual Audit Risk Assessment—Toni Stephens After attending this presentation, participants will be able to plan and perform an audit in the most effective and efficient manner by: 1. Identifying the professional standards relating to risk assessment. 2. Describing risks and different ways to gain an understanding. 3. Utilizing the tools developed to prepare a risk assessment for any type of audit assignment. 4. Develop an audit program based on risk assessment. 5. Conduct a case study using the tools discussed by conducting a risk assessment on your own internal audit department. [1.4 CPE] HIPAA Auditing Update—Mike Cullen In this session, we will provide an update on HIPAA auditing, including: • Highlighting the latest developments with HIPAA rulemaking and the OCR’s planned audits of covered entities (CE) and business associates (BA) • Discussing key areas of HIPAA compliance that institutions should review • How Internal Audit can assist with the HIPAA security risk assessment for their institutions, whether as a CE or BA [1.5 CPE] Social Media: How to Actively Engage Your Audit Committee—Randy Crawford & Richard Ochoa In this session we will discuss emerging trends shaping the future of online consumerism, how our customers and constituents are increasingly interacting with and through online social media communities, and how this method of disseminating information presents risks to the institution’s reputation, brand, message, and identity. Having had the recent pleasure of presenting “Social Media Risks and Opportunities” to our Institutional Audit Committee, we can attest that these issues will most likely engage your committee well beyond your expectations. Further, we can definitively speak to the questions your audit committee members may soon be asking you regarding your own organizational use of social media. [1.4 CPE] TACUA2015Conference Page9 CourseDescriptions Fundamentals of Construction Auditing, What You Need to Know—Bill Mansfield Generally, construction projects represent a major capital spend and a considerable risk to an organization. Understanding that risk and controlling the construction project empowers educational institutions to gain control over capital spend, limit overpayments, control change and maximize work towards a successful completion of a project. The presentation will equip the auditor with the key (auditable) elements of major construction projects, such as key players, phases of construction, construction risk and common construction audit findings. We will also discuss the issues around managing a construction audit project, especially as it relates to timing and project interactions. [1.5 CPE] Computer Forensics for Auditors—Tod Maxwell After attending this presentation, participants will understand: What is computer forensics? Working with the investigators, Mechanics of digital forensics, Forensics defenses, and Takeaways [1.4 CPE] Understanding Your BLACKBOARD LEARN™ Environment So That You Can Audit It Effectively—Ali Subhani After attending this presentation, participants will: 1. Have a general understanding of the architecture that may be in place to support a Blackboard Learn environment. 2. Be able to identify how to perform key functions within the application. 3. Understand how integrations are setup. 4. Be introduced to Building Blocks, and the risks that come along with their implementation. 5. Know potential areas of concern that an audit team should be mindful of related to the Learn environment. 6. Know different controls that can be implemented to enhance the overall security of the environment. [1.4 CPE] Hidden in Plain Sight: Investigating on the Internet—Allan Bachman Auditors have to use every resource at their disposal when interviewing for, or researching a fraud case. One of the most useful tools is the internet where potential second party witnesses and suspects park personal information, information which might be useful. Learning where this information can be found is simple; finding it effectively and efficiently makes the process even more productive. In this session, learn how to get internet search tools to work both smarter and harder for you. Hear how social media has become a gold mine of information and how to utilize these tools to enhance you investigation and protect yourself and your family at the same time. [1.5 CPE] TACUA2015Conference Page10 CourseDescriptions Fraud Risk Assessment – What Do Auditors Think?—Emily Knopp and Christine Esqueda Fraud occurs across all industries. This session will define fraud and its four factors of fraud. Specific fraud schemes seen in higher education will be discuss through real-world application. Throughout the presentation, participants will also assess fraud risk, using four evaluation criteria, producing a fraud risk assessment for higher education. Finally, participants will be able to understand and identify controls for monitoring and preventing fraud. [1.5 CPE] TACUA2015Conference Page11 SpeakerBios Allan Bachman, CFE Allan Bachman has been Education Manager for the Association of Certified Fraud Examiners in Austin Texas since 2006. In his role he is responsible for seminar development and the educational content of conferences and online learning. Most recently Allan worked in Higher Education as director of an audit unit and was project manager on several IT implementations specializing in information and access security. His largest fraud investigation, for over $1.5 million, was conducted during this time. Previously Allan has worked in or has consulted for retail, real estate, manufacturing and has done extensive small to medium business consulting where he has actively worked a number of fraud cases going back to the mid 1970’s. Allan regularly conducts training sessions and speaks for national organizations and has taught college courses in accounting/auditing and information systems & security. Blake Barlow, CCEP Blake Barlow, a Certified Compliance and Ethics Professional, is in his eighth year with The University of Texas Athletics Department. His primary responsibilities include assisting in the oversight of the department’s compliance with NCAA, Big 12 Conference and University rules and assisting in the implementation of a comprehensive risk management program. He holds a M.Ed. in Sport Management from The University of Texas and a BBA from The University of Central Arkansas. Blake is a member of the Society for Corporate Compliance and Ethics and the National Association for Athletics Compliance, serving on the Legislation and Governance Committee. He also completed the Sports Management Institute (SMI) program in 2013. Randy Crawford, CIA, CISA, CISSP, CISM With over thirty years of IT experience, Randy was UTMB Health’s first Information Security Officer and currently the IT Audit Manager. He is a life-long learner who works collaboratively to create positive and practical organizational change. Randy is a Certified Internal Auditor, Certified Information Systems Auditor, Certified Information Systems Security Professional, Certified Information Security Manager, Certified HIPAA Security Professional, Certified in Risk and Information Systems Control, and Certified in the Governance of Enterprise IT. Committed to serving the information systems audit and assurance profession, Randy was an active member of the working group asked by the Texas Department of Information Resources to enhance the Texas Administrative Code Security Rule and is a founding member of The University of Texas System Security Council devoted to improving information security at all 15 UT institutions. Randy has also served as curriculum consultant to a local community college, an External Quality Assessment Peer Reviewer, and presently serves as a member of UTMB Health’s Information Security and Privacy Compliance Committee. Mike Cullen, CIA.CISSP, CIPP/US Mike Cullen is a Senior Manager with Baker Tilly, a national accounting and advisory firm. Mike leads the firm’s Higher Education and Research Institution’s IT risk and IT audit services team. For over 13 years, he has worked with a variety of higher education clients of various sizes, both public and private. He has led IT risk assessments and audits, developed information privacy and security programs, performed ethical hacking of IT systems, and conducted digital TACUA2015Conference Page12 SpeakerBios forensic investigations. Mike has presented to a variety of audiences, including Association of College and University Auditors (ACUA), National Council of University Research Administrators (NCURA), Society of Corporate Compliance and Ethics (SCCE), various Institute for Internal Auditors (IIA) chapters, regional, national conferences, and at multiple universities. Mike is also a Certified Information Systems Auditor (CISA), Certified Information Systems Security Professional (CISSP), and Certified Information Privacy Professional (CIPP/US). Christine Esqueda, CIA, CGAP, CFE Christine Esqueda is the Audit Manager at Texas Tech Health Sciences Center El Paso, member of the Texas Tech University System. Christine received her Bachelors of Business Administration in Accounting and Masters of Accountancy from the University of Texas at El Paso. She has 10 years of internal audit experience in local government and higher education. She is a Certified Internal Auditor, Certified Government Auditing Professional, and Certified Fraud Examiner. In addition, Christine is a former board member and president of the El Paso Chapter of the Institute of Internal Auditors, and is the president of the newly formed El Paso Chapter of the Association of Certified Fraud Examiners. Andrew Groover, M.Ed., CPA, CIA CICA, CISA, CFE Andrew S. Groover, M.Ed., CPA, CIA CICA, CISA, CFE, is the Director of Internal Audits at Texas Woman’s University where he has served in this capacity for the last eight years. Prior to joining Texas Woman’s University he served as the Audit Manager for the University of Texas at Dallas. Overall, he has over 20 years of auditing experience in varied capacities including public accounting, wholesale distribution, retail, healthcare, and higher education. Andrew holds a Bachelor of Science in Business Administration – Accounting from Oklahoma State University and a Master of Education – Educational Administration (Higher Education) from the University of Nebraska. Lori Hammond, CCEP Lori Hammond joined The University of Texas staff in July 2003 as the compliance coordinator. She was promoted to director of compliance in September 2005, assistant athletics director in November 2008 and associate athletics director in September 2012. Lori oversees a staff of seven in all facets of the risk and compliance operation. Prior to Texas, Lori began her tenure in compliance in August 1999 as an intern in the Compliance Office at Texas Tech University. In September 2000, Lori was promoted to graduate assistant. Upon completion of her masters in December 2001, Texas Tech created a compliance coordinator position for her to fill and she remained at Texas Tech through June 2003 when she left to pursue a position at Texas. Hammond is a Certified Compliance and Ethics Professional (CCEP) and a member of the Society of Corporate Compliance and Ethics (SCCE), National Association for Athletic Compliance (NAAC) and the National Association of Collegiate Women Athletics Administrators (NACWAA). She recently completed service on the NAAC Board of Directors in July 2014 and previously served as the chair of the NAAC Legislation and Governance TACUA2015Conference Page13 SpeakerBios Committee 2010-2012. Lori is a graduate of the 2005 NACWAA HERS Institute and the 2009 Sports Management Institute (SMI). Lori oversees the Collegiate Athletics Talent and Professional Leadership Training (CATAPLT) program for Texas Athletics, which is a collaborative effort between Texas Athletics and University Human Resources to provide personal and professional leadership development opportunities for the athletics program. Lori earned her bachelor's degree in exercise and sports sciences/health from Texas Tech in August 2000 and went on to earn her master's degree in sports administration from Texas Tech in December 2001. Charlie Hrncir, CPA C.R. "Charlie" Hrncir has over thirty years of management and supervisory experience as an internal and external auditor of government institutions in Texas. Responsibilities include providing leadership in helping manage the internal audit department for The Texas A&M University System and managing audits with over 100 auditors in multiple locations across Texas while employed by the Texas State Auditor’s Office. Charlie possesses a Bachelor of Business Administration degree in Accounting from Texas A&M University. Charlie is a Certified Public Accountant and a graduate of the Governor's Executive Development Program. He has held leadership positions with the local chapters of CPAs in Austin, and Brazos County and chaired a conference committee for the Texas State Society of CPAs. He has also served on the Board of Governors for the Brazos Valley Chapter of the IIA and is a past president and member of the board of TACUA. Russ Hoskens, CPA, CIA, CFE, CISA Russ Hoskens is the Director of the Internal Auditing Department at the University of Houston System. He has over 30 years of experience in internal auditing, including 22 years of experience in higher education. He is a Certified Public Accountant, a Certified Internal Auditor, a Certified Fraud Examiner, and a Certified Information Systems Auditor. In addition, he received a MBA degree from Louisiana State University with a concentration in Internal Auditing in 1992 and is a Past-President of TACUA. Emily A Knopp, CPA, CISA Emily A. Knopp is the Audit Director at Angelo State University, member of the Texas Tech University System, and has 14-plus years of audit and corporate accounting experience. She has assisted the Office of Audit Services in developing and maturing its IT audit activities and education programs. Emily also serves as the Past President of the San Angelo chapter of the Texas Society of CPAs and is the current Secretary of the Texas Association of College and University Auditors. TACUA2015Conference Page14 SpeakerBios William (Bill) Mansfield, CPA, CIA Bill Mansfield, CPA, CIA, has over 25 years of experience in providing specialized services in financial accounting, financial planning, internal control and investment analysis to clients in the following industries: energy, manufacturing, oil and gas trading, oilfield services, exploration and production, gas transportation and via public accounting. Prior to joining Sirius, Bill served as Senior Director of Finance at Coral Energy, a wholly owned subsidiary of Shell Oil Company and General Auditor of Tejas Gas Corporation. Bill has project experience in directing discussions of business processes, risks, and controls with executive level management of companies to comply with the Sarbanes-Oxley legislation; and in leading a reporting & data warehousing project supporting the client’s data storage and reporting capabilities in ecommerce. Bill also has extensive operational, construction and financial auditing experience, founded and staffed auditing services function for an energy group; and directed internal and joint interest auditing initiatives. Bill received a BSBA in Accounting from Oklahoma State University. Tod Maxwell, CISA, CISSP Tod Maxwell serves as Senior IT Auditor for The University of Texas at Austin Office of Internal Audits where he has worked since 2009. He is a graduate of UT Dallas and holds numerous certifications including CISA, CISSP, including several from the SANS Institute. Tod is a member of IIA and ISACA. Steve McGee, CPA, CIA, CFE Steve McGee holds a BBA in Accounting from Southwest Texas State University and he is a CPA, CIA, and CFE. He has been auditing for over 33 years, including 10 years in the healthcare industry and 23+ years in Texas state government. Steve’s state experience includes working at the Texas State Auditor’s Office, Stephen F. Austin State University, and Texas State University. Steve is and has been a member of the Institute of Internal Auditors and the Association of Certified Fraud Examiners. He has previously served on the TACUA board, holding each officer position and was the President of TACUA in 2000. Richard Ochoa, CISA Richard holds the CISA certification. Richard has two years of experience in UTMB Information Services Operations and four years of Operational IT systems experience. Richard’s hands on experience with Information Systems operational, managerial, technical controls, and knowledge of industry best practices facilitates comprehensive reviews of IT systems. Rendi Owens, CIA, CGAP Rendi Owens is an Audit Manager for the Texas Tech University System and has more than ten years’ of audit experience. She is a Certified Internal Auditor and a Certified Government Auditing Professional. She holds a Bachelor of Science degree in Financial Planning from Texas Tech University. TACUA2015Conference Page15 SpeakerBios Tracey Sadler, CIA, CGAP Tracey Sadler, CIA, CGAP, Senior Internal Auditor has worked with the Texas A&M University System Internal Audit department for more than 16 years. She has used data analytics first with ACL since 1998 when reviewing payroll compliance throughout the A&M System. She has since used data analytics to assist audits in areas of procurement cards, voucher payments, vendor analysis, fixed assets, and research administration. TAMU SIAD currently uses Idea software for data analytics. Mark Salamasick, CIA, CISA, CRMA, CSP Mark Salamasick is Director of the Center for Internal Auditing Excellence at The University of Texas at Dallas (UTD). The program is the largest graduate internal audit program worldwide. The program is in the twelfth year and has an emphasis on integration of technology into internal audit practices. Mark currently teaches Internal Audit, Information Technology Audit and Risk Management and Advanced Auditing. He has spent most of his career recruiting, mentoring, managing and placing auditors in positions worldwide. He is also a risk management consultant with focus on quality assurance reviews and internal audit process improvement. Mark was previously with Bank of America for over twenty years. During the last two years at the bank he was Senior Vice President of Internet/Intranet Services. Prior to that he served as Senior Vice President and Director of Information Technology Audit. He worked within the Internal Audit Group of the bank for eighteen years with experience in technology, financial, and operational auditing. He had responsibility for partnering with management for significant improvement in technology, information security, and business continuity. Prior to joining Bank of America, Mark was a senior consultant with Accenture (Andersen Consulting). He is one of the co-authors of the all three editions of the IIA Published internal audit textbook, Internal Auditing: Assurance and Consulting Services along with other publications of the IIA Research Foundation. He is a member of the IIA, ISACA, NACD, and ACFE. He has served many years on the Dallas IIA Board and the IIA International Research Foundation Board. Toni Stephens, CPA, CIA, CRMA Toni Stephens is the UT Dallas Institutional Chief Audit Executive for UT System. She received her accounting degree from Texas A&M University. Toni has almost 30 years of both internal and external audit experience, including working for the Texas State Auditor’s Office. Toni’s professional activities include service as a board member for the Dallas Chapter of the IIA, holding several key committee leadership positions. She has also served as President of the Association of College and University Auditors (ACUA), on their board, and as head of their professional education committee. She also served as president of the Texas Association of College and University Auditors as well as on their board. Honors include receiving service awards from both ACUA and the Dallas IIA. Currently, Toni serves on the ACUA Faculty. She is an advisory board member for the UTD Center for Internal Auditing Excellence. She conducts presentations on risk assessment and audit planning for the internal audit students at UT Dallas and works with and mentors them on audits to provide them with actual audit experience. TACUA2015Conference Page16 SpeakerBios Brett Swett, CIA Brett Swett is a Senior Auditor for the Texas Tech University System and has more than four years of combined banking and audit experience. He is a Certified Internal Auditor and received both a Bachelor of Business Administration and Masters of Business Administration degrees from Wayland Baptist University. Ali Subhani, CISA Ali Subhani is the IT Audit Manager at The University of Texas at Dallas, and has 10 plus years of internal audit experience. He is a Certified Internal Auditor, a Certified Information Systems Auditor and also a GIAC Systems and Networks Auditor. Since joining UTD’s Internal Audit team in 2006, he has assisted in maturing the IT audit function. Ali received his Master’s degree in Accounting and Information Management from UTD. TACUA2015Conference Page17 TACUA texas association of college and university auditors 2015 TACUA Conference Registration Form Attendee Information Name: Title: Institution: Number: Email: Conference registration will begin at 12:00 p.m. on Monday, March 2nd with Welcome / Opening Remarks starting at 1:00 p.m. The conference will conclude at 12:00 p.m. on Thursday, March 5th. Participants will earn up to 25 hours of Continuing Professional Education (CPE) credits. Please indicate any special dietary and/or meeting accommodation needs: Please indicate which Roundtable sessions you plan to attend: Directors Staff selectone Title IX Compliance Information Technology selectone Payment Information Register prior to February 20, 2015 to get the discounted rate of $350. After February 20, 2015, the rate increases to $400. Registration fee covers all conference sessions, breakfast and lunch during the conference, and two evening receptions. Please make payments payable to TACUA and remit payment with the registration form to: UT Austin Internal Audit c/o Angela McCarter, TACUA Treasurer 1616 Guadalupe Street, Suite 2.302 Austin, TX 78701 THANK YOU! We look forward to seeing you in New Braunfels! TACUA2015Conference Page18

© Copyright 2026