Newsletter - Des Moines Metro Credit Union

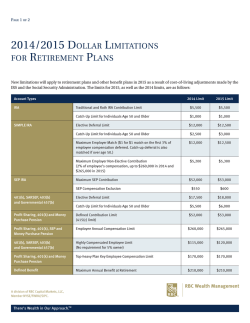

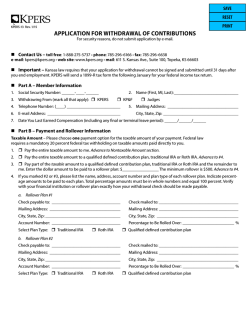

Metro Matters A Quarterly Newsletter Published For The Members Of Des Moines Metro Credit Union • Winter 2015 New/Used Car Loans Mortgage rates are still low. Model years 2013 and newer Call your loan officer at 283-4195 or apply online @ www.dmmcu.org. *Annual percentage rate is with qualifying credit and subject to change without notice; some restrictions apply. Payment example: $17.53 per month for every $1,000 borrowed at 1.99%APR for a 60-month term Free Mobile Money Access Sign up today through Home Banking • Mobile Web Access • Text For Balances • Text Alerts Use A Branch On Saturdays Or While Traveling 3.50 3.569 % apr % rates as low as 1.99%* rates as low as* DMMCU can help you refinance or purchase your next home. 15-year loan *Rates are with qualifying credit and subject to change without notice; some restrictions apply. 3.569% annual percentage rate is for a fixed-rate mortgage for 15 years. Payment example: 180 payments of $714.88 include principal and interest and is based on a $100,000 balance and 15-year term. Estimated closing costs of $1200 apply. Scholarship Opportunities Scholarship opportunities for higher education are available through the Iowa Credit Union Foundation. For more details or to apply, go to iowacreditunionfoundation.org, click on grants and scholarships, then select Warren A. Morrow Memorial Scholarship. Scholarship amounts range from $500 - $1500. Applicants must be a member of an Iowa credit union to be eligible. Deadline is February 6, 2015. Use Our Car-Buying Resource Are you or your family in the market for a vehicle? Don’t forget we have a great partnership with Enterprise Car Sales! They are located at 2551 100th St, Urbandale, IA. That’s right, Enterprise not only rents cars; they sell them, too! At Enterprise, you’re guaranteed hagglefree buying and worry-free ownership! Here are some benefits of purchasing with Enterprise: • No Haggle Pricing • 12 Month/12,000 mile powertrain warranty • Vehicle Certification • Trade-Ins Welcome • Free CAR FAX Reports • 7-Day Repurchase Agreement • 12-Month Roadside Assistance As a member of Des Moines Metro Credit Union you also receive: KBB Trade-In Value + $500 year-round! For more information about this partnership, ask your DMMCU staff or contact Enterprise Car Sales at 515-251-5200 today! Need to find a credit union shared branch across town or in another state? Want to make a deposit or withdrawal on a Saturday? Find a shared branch near you at: www.co-opcreditunions.org. Stay Connected Go Green With E-Statements • • • • Save paper! Protect against mail fraud Receive your statement faster Six months' worth of statements for recordkeeping To enroll: Log on to Home Banking. Select Self Service, select E-Statements, and follow the enrollment instructions. Lower Your Monthly Auto Payment, And We’ll Give You $150 CASH! If your car loan of $5000 or more is financed with another lender, now is the perfect opportunity to refinance, receive a lower interest rate, and walk out with $150 in your pocket.* Who couldn’t use an extra $150? Rates are at an all-time low, so your payment will probably be less, which means even more money in your pocket! Our interest rates on new and used vehicles are competitive, maybe better than the rate you have now. Call for more information or apply today! This offer is available for a limited time only. Please mention this offer when you apply or speak with a loan officer. *Must provide proof of current interest rate. Some restrictions apply. Loans already financed at DMMCU do no qualify. Tax Information 1098, 1099, and 1099R Your 1098 and 1099 forms will be sent in a separate mailing later this month. If you do not receive one by January 31, 2015, contact the credit union. You will not receive these forms unless your mortgage interest is $600 or more and/or your savings interest is $10 or more. The 1099R is for members with an IRA. TAX FILING RESOURCE If you are looking for an independent, trusted tax preparer in the Des Moines area, Mote CPA is an excellent choice. Contact Dave Mote at 271-8183 for more details. FAIR MARKET VALUES Your 2014 year-end Fair Market Value on your IRA at DMMCU can be determined by taking the total of your IRA certificates and your IRA share savings (account types 08,13,14, and 19) from your 2014 year-end statement. Contact Sharon, Kelly, or Scott at (515) 283-4195 with any questions. Prepaid Reloadable Visa® Card • • • • • • • Less fees, less hassle, less risk! If you or someone you know may need the spending power and convenience of a checking account but is not ready to handle the details, a reloadable card may be the best option. Reloadable cards are also great for students who are away at college or for traveling. Card details: Save money on check cashing and money orders Use like cash, in person and online. Pay bills, make purchases, withdraw cash Avoid overspending, overdraft fees, and interest fees No credit history required Load money at the credit union, through direct deposit, or ReadyLink merchants Insured against loss or theft Used where Visa is accepted internationally Order your card today for $4.95. (Mention this article and receive your card for $3.) Call for more details or go to: www.cooperacard.com DMMCU Information Address: 100 University • Des Moines, Iowa 50314 Phone (515) 283-4195 • Fax (515) 284-1652 Lobby Hours: Monday through Thursday 9:00am to 5:30pm Friday 8:00am to 5:30pm Drive Up Hours: Monday through Friday 7:30am to 6:00pm Web Site/Account Access: www.dmmcu.org E-mail: [email protected] Metro Matters is written and edited by Traci Stiles. Current Loan Rates Annual percentage rates are with qualifying credit and subject to change without notice. Contact the credit union for current rates and terms. VEHICLE New/Used (2015-2013) 1.99% up to 63 months 2.24%* 69 months 2.74%** 75 months All auto rates reflect a .25% discount for members with a DMMCU checking account. *2011 and newer models only; $15,000 minimum loan balance; 10% down.**2011 and newer models only, $25,000 minimum loan balance, 10% down or 90% NADA retail.. Used (2012-2009) 3.99% up to 63 months Used (2008 & older) 5.75% 27 months 5.95% 39 months 6.15% 51 months HOME EQUITY Fixed 4.24% (balloon) 64 months 4.49% 36-60 months Variable 4.50% The home equity rate, calculated every Jan. 1 and July 1, is based on the previous 6-month average of the 6-month Federal T-Bill Auction Rate, plus an additional 3 percentage points with a minimum rate of 4.50% and maximum rate of 13%. MORTGAGE Mortgage rates change daily. Contact Sharon Foust at 283-4195 for more information. SIGNATURE 10.99% 11.99% 12.99% 13.99% 12 months 24 months 36 months 48 months MASTERCARD 9.90% 11.50% 13.50% 13.50% Platinum Gold Regular Youth There is a 25-day interest-free grace period on purchases. There is no annual fee for any of our credit cards. Save With An IRA Saving for retirement is important, and we can help you with this goal. Many employers offer retirement plans, such as a 401K, but you can supplement these retirement plans with an individual retirement account (IRA). We offer several types of IRAs, including traditional, Roth, and Coverdell (formerly educational). All IRAs offer tax-deductible or taxdeferment benefits. You should consult your tax advisor before opening an IRA to learn what tax benefits are available and what type of IRA is best for you. If you currently have an IRA, please be sure the beneficiaries you’ve chosen are up-to-date. Also, if you are nearing retirement or changing jobs, we may be able to help you roll over your 401K or other retirement plans into an IRA. Please contact us with questions. January Newsletter, CU19341

© Copyright 2026