Investment Strategy

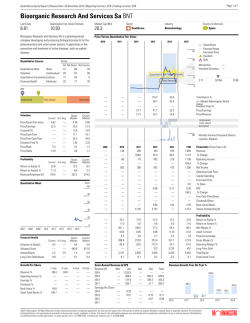

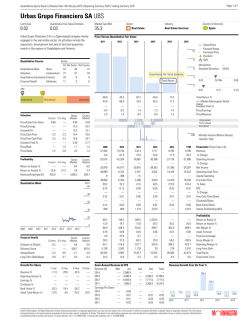

January 28, 2015 Investment Strategy Financial liquidity has improved as a result of worldwide easing monetary policies, having positive sentiment on stock markets. We recommend big-cap stocks like SCC(FV@B530) and KBANK(FV@B300). Top pick is SYNTEC([email protected]); we revise up its earnings and fair value forecasts to reflect stronger growth. We also recommend speculating on BLAND([email protected]), which has PBV below 1x. 1,589.81 1.50 62,859.26 Change in Currencies (YTD) % Change (YTD) Appre ciation 14.0 9.81 SET Index Change Market cap (Bm) 10.0 Japan Switzerland Myanmar China Singapore Indonesia H ong Kong Thailand South Korea Taiw an Philippines (6.59) Eurozone (2.68) UK De pre ciation -10.0 N ew Zealand (5.07) (2.59) Australia 1.31 -6.0 (3.12) (0.60) -2.0 (2.23) 0.03 (0.42) 0.83 0.64 1.63 2.0 India 3,360.77 347.02 -659.07 -3,048.72 1.67 2.70 6.0 Net buy and sell by investor type (Bm) Foreign Proprietary Trading Institution Retail Keep an eye on MPC meeting today The market could be keeping an eye on the MPC s decision about the policy interest rate at its meeting today, after the rate has been kept unchanged at 2% for 11 consecutive months (the latest cut of 0.25% was in March 2014). At the same time, there has been concern that strong THB, which resulted from QE measures launched by the EU and Japan, would affect the export sector. The export volume in December 2014 grew only 1.90%yoy, resulting in FY2014 export growth of -0.41%yoy, which was the second year with negative growth (versus our projection of +0.8%). On the other hand, the import growth in December 2014 was -8.74%yoy, resulting in FY2014 import growth of -8.97%yoy (versus our projection of -5.4%). Accordingly, there is a good chance that Thailand s GDP growth in FY2014 would be 0.8% lower than projection. Another concerning factor is the decreasing inflation rate. Earlier, Thailand used to be in a deflation state in January 2009, which caused the policy rate to be cut by 0.75% to 2% in the month and gradually slashed further by 0.75% until it touched 1.25% in September 2009, before it was increased again nine months later. If Thailand faces a deflation problem again, the policy rate may be lowered in order to stimulate the economy. However, we believe the policy rate cut is not necessary at present because the current rate of 2% is already low and deceleration of private investment in the present is a delay to wait Porranee Thongyen, CISA for the government s investment stimulus measures. In addition, amidst slower-than-expected economic growth worldwide, License No: 004146 especially in the Eurozone, weakening THB through the policy rate cut would have insignificant benefit in boosting the export. [email protected] Therdsak Thaveeteeratham Nevertheless, this factor can still be a positive factor for the market. License No: 004132 [email protected] Pobchai Phatrawit License No: 052647 [email protected] Assistant Analysts Kasidej Ratanasomboon Maraporn Kiwiriyakun For the Fed meeting, of which the outcome will be announced tomorrow according to Thailand s time, it is projected that the policy rate would be kept low and Fed chairperson Janet Yellen would reiterate to be patient about raising the policy rate; English research reports are a rough translation of our Thai-language research products. It is produced primarily with time efficiency in mind, so that English-reading clients can see what the main recommendations are from our Thai-language research team. Given that this is a rough-and-ready translation, Asia Plus Securities pcl cannot be held responsible for translation inaccuracies. The Thai language research reports and information contained therein are compiled from public data sources and our analysts' interviews with executives of listed companies. They are presented for informational purposes only and not to be deemed as solicitations to buy or sell any securities. Best attempts have been made to verify information from these vast sources, but we cannot guarantee their accuracy, adequacy, completeness and timeliness. The analyses and comments presented herein are opinions of our analysts and do not necessarily reflect the views of Asia Plus Securities. Yellen had promised at the previous meeting that the Fed would not increase the rate in the first two meetings of the year or until April. Although the economic figures have been fluctuating in the short term, they still could show improvement overall. Yesterday, consumer confidence index in January 2015 was reported at 102.9 (up 11% from the prior month and making a new high since August 2008), while durable goods orders in December 2014 stabilized from the same period last year. Positive factors encourage fund flow Yesterday, foreign investors possessed a net buy position in regional stock markets at the total of US$657m (seventh day, leaping over twofold). Taiwan was with the largest net buy of US$429m (seventh day, rising 51%), followed by Thailand of US$103m (B3.4bn, fifth day, jumping 45%), South Korea of US$82m (buying and selling for three days), and Indonesia of US$52m (third day, down 17%). On the other hand, the Philippines faced a net sell of US$9m (second day, up 38%). Foreign net buy has continued in Asia. Foreigners have sold Thai stocks for five consecutive days at the total of B11bn, probably slowing down soon but not likely to reverse to massive net sell. These investors had previously sold Thai stocks since late 2014, resulting in a four-year low accumulated foreign net buy since 2009 of B28bn (currently at B39bn). In addition, the QE has positive sentiment on Asian stock markets. Uptrend cycle of contractors, golden year of SYNTEC The contractor sector is entering an uptrend cycle since 2015 onward; the government infrastructure investment plan will gradually become solider this year, thus boosting overall construction work, both from the government and the private sectors. Contractors, at the same time, are ready for the projects, reflected from their net gearing at end-3Q14 of only 0.86x; ITD and UNIQ have earlier increased their registered share capitals, SEAFCO has saved cash for paying dividend, CK and SYNTEC have sold some of their shares, while NWR has issued warrant at an exercised price of lower than the market price; all there are an attempt of contractors to get themselves ready in terms of capital for future investments. Although P/E ratio of many contractor stocks has been considerably high, we upgraded our recommendation for the sector from NEUTRAL to OVERWEIGHT since early January for the industry has a potential for solid growth in the future and many companies in the sector have high upside. We favor SYNTEC ([email protected]) and choose it as a top pick of the sector; our analyst yesterday revised up FY2015 profit forecast of the company by 14% to reflect the projection for increasing income from more construction projects other than condominiums and massive backlog this year. Furthermore, the company also has a benefit of more than B500m from a tax shield. As a result, 2015 fair value is B3.85, providing more than 20% upside (which has still not included additional upside from hidden assets that may be booked as extraordinary profit, i.e. BMCL shares and unused land). P/E ratio is low at only 11.3x. Positive sentiment from interest rate downtrend Yesterday, we analyzed four sectors benefiting from the policy interest rate downtrend: property, auto, commerce, and leasing; other sectors are likely to benefit from the downtrend as well: Media Top pick is BEC(FV@B57) The media sector is anticipated to benefit from the interest rate downtrend. Although the sector had previously been with net cash position since some had benefited from interest income, media companies have currently become net borrowers after bidding for digital TV channel licenses because they have recognized equipment cost and monthly network rental cost and invested more in contents to maintain their competitiveness amidst new rivals. Media companies have to recognize license expense throughout six-month term every February until 2019 (as regulated by the NBTC). Their funding cost is probably based on MLR, so its financial cost is likely to drop. However, their share prices have already rebounded as digital TV has 2 gained popularity and they have raised their advertisement rates. Only BEC (FV@B57) remains laggard, likely to rebound in 2015 thanks to programs reshuffle on Channel 3 Family and Channel 3 SD (from January on) and advertisement rate hike for some programs on analog Channel 3 and Channel 3 HD (from early 2015 on). Top pick is laggard BEC(FV@B57) which has the lowest P/E ratio and 11% upside. Air transportation Benefiting from low policy rate As a business with high-cost investment, the air transportation sector would benefit from the policy interest rate downtrend, especially THAI, which has D/E ratio over 4.02x (versus AAV's of 0.46x) and about a half of its of total loan debt from financial institutions and over 50% floating-rate interest expense (B90bn). If the policy rate is lowered by 0.25%, THAI's earnings are expected to rise by B180m or 8.2% from the FY2015 forecast. AAV's end-3Q14 floating-rate interest expense was B6.0bn; 100% of which are from Thai AirAsia (AAV holds 55% stake). If the policy rate is lowered by 0.25%, AAV's earnings are expected to rise by B7m or 0.5% from the FY2015 forecast. However, AOT is not likely to benefit significantly from the policy rate cut. All of AOT's long-term debt (B34bn at end 3Q14) has fixed-rate interest expense. The sector s top pick is AAV(FV@B6) for it will benefit from downtrends of the policy rate and oil price. ICT Only positive sentiment The policy interest rate downtrend has only positive sentiment on the ICT sector but no significant benefit on earnings. Although debt comes from investment in network expansion, most ICT companies have low D/E ratio: ADVANC (1.12x), DTAC (0.73x), TRUE (0.65x), THCOM (0.59x), and JAS (0.37x). THCOM, ADVANC, and DTAC are likely to benefit most from the interest rate downtrend because they have B4.0bn, B23bn, and B20bn debt at end 3Q14, with 50% 60%, and 80% floating-rate interest expense, respectively. If the policy rate is lowered by 0.25%, THCOM, ADVANC, and DTAC's earnings are expected to rise by B8m (0.4%), B46m (0.1%) and B40m (0.3%) from the FY2015 forecasts, respectively. TRUE and JAS are not likely to benefit remarkably from the downtrend. TRUE has already paid up all of its long-term debt after the previous capital increase, so its total end-3Q14 debt was B44bn, coming from bonds issuance. Although JAS has 70% floating-rate interest expense (B3.5bn), it has planned to raise fund through JASIF valued at least B55bn within February and probably pay up its debt with the fund. Our recommendation for the ICT sector is NEUTRAL. The sector s top picks are INTUCH(FV@B113) and AIT(FV@B53) for lower P/E ratio than peers and FY2015 dividend yields of 6.5% and 4.8%, respectively. Hotel Limited benefit from low policy rate Despite D/E ratio of 1x, 55% of the debt is with fixed interest rate. MINT is likely to benefit least because 66% of its debt is in THB (nearly 80% comes from bonds issuance with fixed interest rate while another 15% is with floating interest rate) and another 34% is in foreign currencies with floating interest rate. If the policy rate is lowered by 0.25%, MINT's earnings would not grow more than 0.5%. Similarly, CENTEL has 40% floating-rate interest expense (B4.1bn) in THB. If the policy rate is lowered by 0.25%, CENTEL's earnings would grow by less than 1%. ERW is projected to benefit most because it has 93% floating-rate interest expense (B7.8bn). If the policy rate is lowered by 0.25%, CENTEL's earnings would grow most by B15.6m or 7-8% from FY2015 forecast of B200m. 3 However, as 70% of the sector's earnings comes from MINT, the interest rate downtrend would have a limited benefit on the sector, raising overall earnings by less than 1% from FY2015 forecast of B7bn. The sector s top pick is ERW(FV@B6) for its potential turnaround and highest upside of 25%. Contractor, energy Limited benefit from low policy rate Big-cap contractors, especially ITD and CK, have high debt, and most debt comes from bond issuance with fixed interest rate. Meanwhile, many contractors have been with net cash position: STPI, SRICHA, BJCHI, STEC, SYNTEC. Their interest income would drop if the policy rate is lowered. Similarly, the energy sector would have a limited benefit because over 85% of its debt comes from bond issuance with fixed interest rate, which means the policy rate cut would have an insignificant effect on the sector's earnings. Steel Not enough benefit to negate loss Upstream steel (slab and billet) producers invest in large raw material stock and machinery (furnace), resulting in high debt and high working capital. SSI would benefit most from the interest rate downtrend because its D/E ratio is as high as 11.5x. However, although the cut would lower SSI's financial cost from B800m/quarter, SSI is not likely to revive and generate profit; we recommend staying away from investment in SSI. 4 Stocks Recommended in Market Talk 5 Start Stocks Date Price Fair Value Start Last Accumula ted Return 31.96 24.07 24.8 3.0% PER 2014F PBV 2014F Dividend Yield Strategist Comment 30-Min Chart Dividend play. SPALI 05-Jan-15 PTTGC 05-Jan-15 AIT 05-Jan-15 RCL 05-Jan-15 STPI 05-Jan-15 PTT 08-Jan-15 ROBINS 12-Jan-15 SCC 19-Jan-15 MCS 21-Jan-15 7.66 KBANK 23-Jan-15 300.00 7.77 1.50 5.21 Included in SET50 list. Sell to take profit. 68.00 52.10 56 7.5% 7.42 0.83 6.21 Switch to SYNTEC. Earnings rebounds, 53.00 37.31 41.75 11.9% 10.20 2.39 5.10 benefiting from digital economy policy. Benefit from lower oil cost, 11.80 8.66 9.5 9.7% 20.32 - 2.46 4Q14 profit to stay unchanged from 3Q14. Dividend play. 30.30 19.12 20.6 7.8% 11.51 2.71 4.85 Regular annual dividend payment. LPG price float benefits PTT, 394.00 345.32 350 1.4% 9.28 1.19 4.50 possibly boosting profit by 11.1%. Oil price plunge lowers cost, benefiting the sector. 64.00 47.01 44.75 -4.8% 17.22 3.11 2.92 Highest upside, lowest P/E ratio among peers. Revise up fair value to reflect petrochemical uptrend. 530.00 458.41 472 3.0% 12.12 2.48 3.60 High upside, over 3% dividend yield. Turnaround stock. 6.53 6.25 -4.4% 6.78 0.99 - 233.28 232 -0.6% 9.06 1.61 2.59 Expanding business in Japan for 2020 Olympic Games prepararion. Laggard stock with solid fundamental sector Low P/E ratio, high upside. Accumulated returns since our recommendation ROBINS MCS -4.8% -4.4% KBANK -0.6% PTT 1.4% SCC 3.0% SPALI 3.0% 7.5% PTTGC STPI 7.8% RCL 9.7% AIT -10% 11.9% -5% 0% 5% 10% 15% Note: In calculating returns from a stock we recommended, we use the average price on the day of our recommendation as cost and compare it with the recent closing price. This will result in accumulative returns until the day we recommend closing the position to take profit or cut loss. 6

© Copyright 2026