Saudi Market Daily

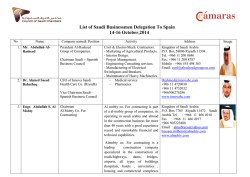

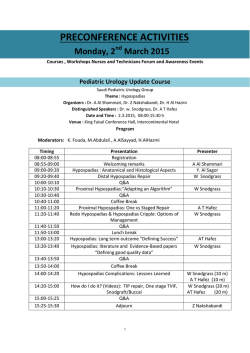

Saudi Stock Market Daily Snapshot As of 5-Feb-2015 DAILY MARKET PERFORMANCE Contents Market Snapshots Market Summary Market Trends & Stocks Consistently Gaining/Losing Daily Market Performance Tracking High & low Market Value Indicators Volume Performance (Times last 30 day volume) Saudi Market Movers Daily Snapshot Market Snapshot As of 5-Feb-2015 Saudi Indices Tadawul All Share Index Cement Agriculture & Food Ind. Multi-Investment Real Estate Hotel & Toursim Market Summary Banks & Financial Retail Telecom. & Info. Tech. Industrial Investment Transport Petrochemical Industries Energy & Utilities Insurance Building & Construction Media & Publishing Current Previous Day 9,180.11 9,169.20 0.12% -0.63% High 9,196.39 9,298.85 Low 9,073.02 9,144.27 TASI Percent Change 1.47% 1.11% Market P / E 0.26% 0.44% 0.16% 0.12% 0.06% -0.66% 0.15% 0.17% 0.15% -0.37% -0.14% -0.46% 16.26 16.27 Market P / BV 2.14 2.14 Dividend Yield 3.11% 3.10% Adv. / Decl. ratio -1.12% 0.9857 0.4216 1,985,762 1,988,161 8,592,750,306.70 9,293,877,505.20 321,454,350 360,047,813 142,742 152,324 Market Capilization (SAR million) Value (SAR) Volume -4.92% 8,592,750,306.70 Turnover by Sector - Volume Turnover by Sector - Value (SAR) Banks & Financial Svcs 18.3% Insurance 14.8% Petrochemical Industries 12.8% Real Estate Dev. 11.8% Industrial Investment 8.6% Building & Construction 7.7% Agriculture & Food Ind. 5.6% Telecom. & Info. Tech. 4.7% Retail 4.2% Multi-Investment 3.8% Cement 2.9% Hotel and Tourism Transport Energy & Utilities Media and Publishing 2.7% 1.3% 0.6% 0.3% # of Transactions Real Estate Dev. Banks & Financial Svcs Insurance Petrochemical Industries Telecom. & Info. Tech. Building & Construction Industrial Investment Multi-Investment Agriculture & Food Ind. Cement Retail Transport Energy & Utilities Hotel and Tourism Media and Publishing 321,454,350 26.8% 14.2% 12.2% 10.9% 9.3% 6.0% 5.5% 4.3% 4.0% 2.3% 1.5% 0.9% 0.9% 0.9% 0.2% Page 3 of 17 Saudi Market Summary INDEX CLOSING Sector Name Tadawul All Share Index Current 1Year Low 1Year High 05-Feb-15 1 Day %chg 1 Day Points 1 Week %chg 1 Week Points YTD2015 %chg YTD2015 Points 9,180.11 7,225.83 11,159.50 0.12% 11 3.40% 302 10.16% 847 20,380.16 16,402.04 24,747.60 1.11% 225 3.51% 691 11.28% 2,066 Petrochemical Industries 6,500.67 4,977.79 9,148.24 -1.12% -73 5.81% 357 10.99% 643 Cement 7,265.54 6,158.01 8,774.77 0.26% 19 0.36% 26 6.02% 413 17,050.92 12,609.35 17,924.18 0.44% 75 7.92% 1,252 9.87% 1,532 Banks & Financial Services Retail Energy & Utilities 6,004.83 5,127.91 6,798.83 0.16% 9 2.39% 140 6.31% 357 Agriculture & Food Industries 12,242.01 9,127.37 13,313.41 -0.66% -82 -0.20% -25 4.90% 572 Telecom. & Information Tech. 1,858.80 1,646.54 3,208.53 -0.37% -7 1.75% 32 -4.29% -83 Insurance 1,495.01 1,034.30 1,702.89 -0.14% -2 1.94% 28 17.17% 219 Multi-Investment 4,243.86 3,173.98 5,395.69 0.06% 2 4.97% 201 15.35% 565 Industrial Investment 8,064.86 5,220.98 9,381.12 1.47% 117 5.17% 396 22.33% 1,472 Building & Construction 3,845.98 2,832.03 4,972.96 0.15% 6 5.04% 184 16.45% 543 Real Estate Development 6,731.21 5,063.56 7,390.77 0.17% 12 2.62% 172 13.78% 815 Transport 8,098.90 5,659.31 9,434.51 0.15% 12 1.12% 89 11.82% 856 Media and Publishing Hotel and Tourism 2,386.08 1,945.50 6,392.55 -0.46% -11 4.36% 100 8.43% 185 22,654.31 14,535.31 25,488.28 -4.92% -1,172 -1.58% -363 14.59% 2,884 VALUE (SAR Thousand) Sector Name Current Previous Changes Tadawul All Share Index 8,592,750 9,293,878 -7.54% Banks & Financial Services 1,568,441 1,474,489 6.4% Petrochemical Industries -10.1% VOLUME (Thousand) TRADES Current Previous Changes 321,454 360,048 45,702 48,453 -5.7% -10.7% Current Previous Changes 142,742 152,324 -6.3% 14,729 11,389 29.3% 1,099,833 1,223,589 35,057 48,315 -27.4% 14,165 16,931 -16.3% Cement 246,188 246,583 -0.2% 7,337 8,830 -16.9% 4,847 5,515 -12.1% Retail 363,087 393,092 -7.6% 4,900 5,375 -8.8% 7,200 7,514 -4.2% Energy & Utilities Agriculture & Food Industries Telecom. & Information Tech. 47,958 30,400 57.8% 2,867 1,821 57.5% 618 449 37.6% 480,842 646,525 -25.6% 12,870 13,589 -5.3% 10,692 14,152 -24.4% -9.3% 29,801 27,103 10.0% 7,489 6,748 11.0% -17.4% 39,373 44,164 -10.8% 32,710 37,194 -12.1% 406,528 448,233 1,271,289 1,538,547 Multi-Investment 323,303 236,803 36.5% 13,908 10,410 33.6% 6,505 5,198 25.1% Industrial Investment 742,009 872,322 -14.9% 17,750 21,371 -16.9% 11,696 14,581 -19.8% Building & Construction 658,323 590,516 11.5% 19,181 18,218 5.3% 14,725 14,000 5.2% 1,013,398 1,236,344 -18.0% 86,136 105,328 -18.2% 9,832 10,946 -10.2% 111,983 106,418 2,990 2,866 4.3% 2,138 2,520 -15.2% 29,561 54,176 -45.4% 800 1,256 -36.3% 1,099 1,471 -25.3% 230,007 195,841 17.4% 2,782 2,949 -5.7% 4,297 3,716 15.6% Insurance Real Estate Development Transport Media and Publishing Hotel and Tourism 5.2% Page 4 of 17 Market Trends over the last 10 days 05-Feb-15 TASI movement and market turnover 16.00 Total Turnover - bln Market Volume and number of trades TASI 14.00 12.00 9,400 600,000 9,200 500,000 9,000 Total Volume 250,000 No. of Trades 200,000 400,000 8,800 8.00 8,600 150,000 (In '000) 6.00 300,000 100,000 200,000 8,400 50,000 100,000 5-Feb 4-Feb 3-Feb 2-Feb 1-Feb 29-Jan 28-Jan 22-Jan - 5-Feb 4-Feb 3-Feb 2-Feb 1-Feb 29-Jan 28-Jan 27-Jan 8,000 26-Jan 22-Jan 2.00 8,200 27-Jan 4.00 26-Jan (SR bln) 10.00 Stocks Consistently gaining/losing over three consecutive tradings days Total of 4 stocks rising for 3 consecutive days Company Company 2-Feb 3-Feb 4-Feb 5-Feb Almarai 84.50 83.50 81.50 81.25 67.50 SHB 46.70 46.40 45.70 45.10 39.10 39.50 National Petrochem. 25.80 25.70 25.40 25.20 42.40 42.80 MEDGULF 55.75 54.75 54.50 53.75 #N/A #N/A City Cement 23.60 23.40 23.05 22.85 #N/A #N/A #N/A eXtra 103.00 102.25 101.00 97.75 #N/A #N/A #N/A BAWAN 58.50 58.25 57.75 56.75 #N/A #N/A #N/A #N/A Al Alamiya 95.25 85.75 77.25 69.75 #N/A #N/A #N/A #N/A #N/A Hail Cement 26.50 25.80 25.10 25.00 #N/A #N/A #N/A #N/A #N/A Tabuk Cement 25.90 25.70 25.60 25.40 #N/A #N/A #N/A #N/A #N/A CHEMANOL 13.85 13.70 13.55 13.50 #N/A #N/A #N/A #N/A #N/A Saudi Fisheries 31.00 30.50 30.20 30.10 Dallah Health 2-Feb 3-Feb 4-Feb Total of 16 stocks losing for 3 consecutive days 5-Feb 137.50 139.50 140.00 141.00 Saudi Chemical 61.50 61.75 64.00 AL-BABTAIN 37.80 39.00 Buruj 41.70 41.80 #N/A #N/A #N/A #N/A #N/A #N/A #N/A #N/A Note: if number of companies consistently rising/losing for 3 consecutive days is greater than 12, only the twelve top (by market cap) are shown in the list. Page 5 of 17 DAILY MARKET PERFORMANCE Closing of : 5-Feb-2015 TOP GAINERS TOP LOSERS Companies 1Day Companies 1Day Companies 1Week Companies 2015YTD Saudi Chemical 5.5% AlHokair 22.0% Tawuniya 54.0% Al Alamiya -9.7% Al Alamiya -40.5% Etihad Etisalat -13.1% GACO 5.4% Saudi Export 17.0% Saudi Export 47.9% AlTayyar -6.0% SHB -4.0% SABB -5.6% Saudi Export 5.1% Nama Chemicals 16.7% Al-Babtain 45.8% eXtra -3.2% AlMarai -3.3% Aljazira Takaful Taawuni -3.5% Takween 4.9% Atheeb Telecom 15.0% Tokio Marine 41.9% SABIC -2.6% AlTayyar -3.3% Southern Cement -3.2% National Commercial Bank 3.7% SHAMS 13.5% Alujain 41.0% Alujain -2.4% Yanbu Cement -2.1% Bupa Arabia -1.8% Electrical Industries Co 3.1% Al-Babtain 12.5% SARCO 38.2% Budget Saudi -2.2% Aljazira Takaful Taawuni -2.0% GASCO -0.3% Astra Indust 2.7% Tawuniya 12.4% ACIG 33.2% Saudi Re -2.0% AlRajhi Takaful -1.9% TAPRCO -0.3% Tawuniya 2.7% Saudi Chemical 12.0% SHAMS 33.0% Nama Chemicals -1.8% Emaar EC -1.7% STC 0.0% Care 2.5% ACIG 11.5% Al Hokair Group 31.8% Taiba -1.8% Budget Saudi -1.6% Al-Baha 0.0% Herfy Foods 2.4% TADCO 11.3% Buruj 28.9% Farm Superstores -1.8% Arabian Cement -1.6% Weqaya Takaful 0.0% Market Cap. (SR million.) 1Week Companies 2015YTD Companies Market Trading Performance 169 Trading Turnover Current 1,985,762 Companies UP 69 Value Previous Day 1,988,161 Companies Down 70 Volume Difference (2,400) Top 10 Most Active by Value Companies Unchanged 40.8% 30 Top 10 Most Active by Volume 1 Day %chg. Value / Trans. 106,486.61 SAR 8,592,750,307 -7.54% Banks & Financial Services 321,454,350 -10.72% Petrochemical Industries 77,644.38 -6.29% Cement 50,791.92 Retail 50,428.79 Energy & Utilities 77,601.54 142,742 # of Trans. 51.6% Sector Movers Top 10 Most Active by # of Trades 27.8% Value Traded (SAR) 814,448,930 % to total Companies Volume Traded % to total Companies Trades % to total Agriculture & Food Industries 44,972.14 9.5% Dar Al Arkan 77,893,359 24.2% Dar Al Arkan 5,887 4.1% Telecom. & Information Tech. 54,283.40 Alinma 582,741,224 6.8% Alinma 25,503,338 7.9% Alinma 4,980 3.5% Insurance 38,865.45 SABIC 497,760,106 5.8% ZAIN KSA 13,818,744 4.3% National Commercial Bank 4,778 3.3% Multi-Investment 49,700.69 National Commercial Bank 448,001,964 5.2% Atheeb Telecom 10,946,221 3.4% Electrical Industries Co 4,776 3.3% Industrial Investment 63,441.29 Al Rajhi 249,239,202 2.9% Saudi Kayan 8,444,544 2.6% SABIC 3,894 2.7% Building & Construction 44,707.82 Electrical Industries Co 208,102,009 2.4% National Commercial Bank 7,195,823 2.2% Sharqiya Dev Co 3,601 2.5% Real Estate Development 103,071.37 MA'ADEN 186,690,532 2.2% Al-Ahsa 6,333,720 2.0% Malath Insurance 3,369 2.4% Transport 52,377.48 Sharqiya Dev Co 180,309,663 2.1% Saudi Re 5,571,529 1.7% Trade Union 3,300 2.3% Media and Publishing 26,898.23 Trade Union 177,266,406 2.1% SABIC 5,272,075 1.6% Atheeb Telecom 2,595 1.8% Hotel and Tourism 53,527.28 Etihad Etisalat 161,971,603 1.9% MA'ADEN 5,006,317 1.6% Astra Indust 2,543 1.8% Tadawul All Share Index 60,197.77 Companies Dar Al Arkan Page 6 of 17 TRACKING OF HIGHEST & LOWEST SYMBOL & TRADING NAME 1010 1020 1030 1040 1050 1060 1080 1090 1120 1140 1150 1180 TBFSI 2001 2002 2010 2020 2060 2170 2210 2250 2260 2290 2310 2330 2350 2380 TPISI 3001 3002 3003 3004 3005 3010 3020 3030 3040 3050 3060 3080 3090 3091 TCESI 4001 4002 4003 4004 Riyad Bank Bank AlJazira The Saudi Investment Bank Saudi Hollandi Bank Banque Saudi Fransi The Saudi British Bank Arab National Bank Samba Financial Group Al Rajhi Bank Bank AlBilad Alinma Bank National Commercial Bank Banks & Financial Services Methanol Chemicals Co National Petrochemical Co Saudi Basic Industries Corp Saudi Arabia Fertilizers Co. National Industrialization Co Alujain Corporation Nama Chemicals Co. Saudi Industrial Investment Group Sahara Petrochemical Co. Yanbu National Petrochemical Co Saudi International Petrochemical Co Advanced Petrochemical Company Saudi Kayan Petrochemical Co Rabigh Refining and Petrochemical Co Petrochemical & Industries Hail Cement Company Najran Cement Company City Cement Company Northern Region Cement Co Umm Al-Qura Cement Co Arabian Cement Co Yamamah Saudi Cement Co. Ltd. Saudi Cement Company. The Qassim Cement Co Southern Province Cement Co. Yanbu Cement Co. Eastern Province Cement Co. Tabuk Cement Co. Al Jouf Cement Co Cement Abdullah Al Othaim Markets Co Mouwasat Medical Services Co United Electronics Co. (eXtra) Dallah Healthcare Holding Co Volume 5-Feb-15 1,083,483 4,247,431 200,128 181,366 283,782 200,853 731,056 1,344,662 4,198,647 531,092 25,503,338 7,195,823 38,505,838 1,880,200 288,995 5,272,075 92,520 1,822,434 1,654,553 3,081,366 1,032,007 4,125,477 1,268,600 1,167,780 779,974 8,444,544 4,146,948 35,057,473 528,685 289,043 1,688,071 455,810 97,791 509,441 515,907 117,037 135,192 32,372 391,504 188,969 60,729 2,326,052 7,336,603 156,110 129,802 260,552 27,431 Volume Avg. 30days 1,469,945 4,524,359 569,791 112,076 456,372 279,417 401,640 1,164,144 5,027,355 862,299 39,598,725 2,541,106 54,466,122 2,089,460 401,214 5,178,422 169,957 2,054,933 1,603,466 3,498,827 812,740 4,231,567 1,489,989 736,418 1,404,175 13,991,910 4,519,105 42,182,182 614,044 365,632 1,304,450 784,052 146,278 398,933 206,605 137,411 57,013 80,272 158,239 145,628 107,085 4,699,616 9,205,257 162,482 74,692 211,286 84,166 Vol. 30days Today / Avg excl. today 30 excl today 1,494,593 0.72 4,509,954 0.94 576,516 0.35 108,735 1.67 464,643 0.61 296,146 0.68 415,062 1.76 1,185,062 1.13 5,133,360 0.82 866,101 0.61 40,430,438 0.63 2,506,881 2.87 55,480,611 0.69 2,145,477 0.88 403,761 0.72 5,180,268 1.02 173,790 0.53 2,129,639 0.86 1,576,916 1.05 3,532,545 0.87 812,079 1.27 4,336,341 0.95 1,469,492 0.86 729,083 1.60 1,408,012 0.55 14,358,508 0.59 4,559,111 0.91 42,815,022 0.82 631,031 0.84 367,361 0.79 1,275,623 1.32 831,583 0.55 151,997 0.64 397,587 1.28 204,077 2.53 139,973 0.84 55,805 2.42 80,407 0.40 153,908 2.54 147,119 1.28 110,467 0.55 4,765,230 0.49 9,312,166 0.79 163,245 0.96 73,155 1.77 205,948 1.27 88,919 0.31 Today Prices 5-Feb-15 17.80 28.90 28.00 45.10 35.00 54.75 33.50 46.50 60.00 48.10 22.95 63.25 20,380.16 13.50 25.20 94.00 153.00 27.40 22.85 13.30 27.40 17.65 49.40 30.50 50.50 12.50 20.35 6,500.67 25.00 30.70 22.85 23.15 41.60 78.00 51.00 99.50 94.50 105.75 69.25 62.00 25.40 16.00 7,265.54 114.50 128.00 97.75 141.00 Open 17.60 28.60 27.80 45.50 34.40 54.50 33.30 46.00 58.00 48.10 22.60 60.25 20,155.49 13.55 25.00 94.50 154.00 27.30 23.05 13.30 26.70 17.30 48.70 30.20 49.30 12.45 20.00 6,574.16 24.80 30.70 22.85 23.10 41.90 77.25 50.25 99.00 94.00 105.00 69.00 61.25 25.50 15.90 7,246.41 116.25 127.50 100.00 139.00 Low 17.60 28.40 27.70 45.10 34.40 54.00 33.00 45.80 58.00 48.00 22.50 60.00 19,938.79 13.45 25.00 92.75 151.75 27.10 22.70 13.25 26.60 17.25 48.70 29.90 48.80 12.30 19.95 6,419.18 24.70 30.70 22.85 22.85 41.50 77.25 49.90 99.00 93.50 105.00 68.75 61.25 25.40 15.75 7,216.28 114.25 127.00 97.50 139.00 One Year Prices High 17.90 29.30 28.00 45.50 35.40 54.75 33.70 46.70 60.00 48.90 23.00 63.75 20,414.82 13.65 25.50 96.25 154.00 27.80 23.30 13.60 27.40 17.70 49.80 30.50 50.50 12.60 20.40 6,574.16 25.20 31.40 23.05 23.15 42.00 78.75 51.00 99.50 96.00 106.00 69.50 62.00 25.60 16.10 7,281.79 118.00 128.00 100.00 141.25 Low 14.75 25.00 23.10 37.25 25.43 45.70 26.10 34.80 48.40 34.00 15.50 49.50 16,402.04 10.00 17.65 70.25 126.00 21.00 14.05 8.00 21.85 12.55 38.50 22.30 35.70 8.70 14.65 4,977.79 17.80 24.25 18.60 17.25 10.00 54.40 42.00 89.00 85.00 90.50 54.50 49.00 21.80 11.50 6,158.01 75.00 79.50 73.00 76.00 High 24.30 39.30 33.50 56.00 42.50 67.00 36.90 52.00 79.50 60.00 27.80 66.50 24,747.60 18.75 36.40 136.50 173.00 41.10 29.90 18.70 42.70 27.70 77.75 44.40 61.75 19.05 36.10 9,148.24 30.50 38.10 32.30 29.10 50.75 89.25 74.00 127.00 107.00 126.00 82.50 65.50 33.60 25.10 8,774.77 118.75 137.50 133.50 156.75 Remarks (17 من7) الصفحة TRACKING OF HIGHEST & LOWEST SYMBOL & TRADING NAME 4005 4006 4007 4050 4160 4180 4190 4200 4240 4290 TRESI 2080 5110 TEUSI 2050 2100 2270 2280 4061 6001 6002 6004 6010 6020 6040 6050 6060 6070 6090 TAFSI 7010 7020 7030 7040 7050 TTISI 8010 8011 8012 8020 8030 8040 8050 8060 8070 8080 Today One Year Prices Volume Volume Vol. 30days Today / Avg Prices 5-Feb-15 Avg. 30days excl. today 30 excl today 5-Feb-15 Open Low High Low High 1.05 1.05 0.50 0.46 0.89 1.96 1.50 0.42 1.54 0.55 0.92 1.16 1.01 1.02 0.82 0.38 0.48 1.38 0.59 0.22 0.22 1.52 1.19 2.61 0.55 0.62 1.51 0.52 1.38 1.15 0.84 0.53 0.50 1.63 0.00 0.69 0.69 0.36 1.41 0.54 0.73 0.49 0.27 0.50 0.68 0.76 62.00 83.00 94.50 27.90 82.00 24.05 203.50 56.75 111.00 68.00 17,050.92 32.70 16.10 6,004.83 79.50 41.90 121.50 81.25 32.70 91.00 118.00 196.00 38.90 14.60 20.20 30.10 92.25 45.90 16.70 12,242.01 65.75 38.40 7.30 8.05 0.00 1,858.80 77.00 57.00 62.75 34.40 53.75 44.30 31.40 25.70 43.30 36.20 59.50 83.50 93.50 27.80 81.25 24.05 202.00 55.75 109.00 67.00 16,975.80 32.80 16.05 5,995.43 80.25 41.70 120.50 81.25 32.20 90.50 117.50 194.75 38.90 13.80 20.20 30.30 91.25 46.00 16.50 12,323.88 65.75 38.30 7.30 7.90 0.00 1,865.62 74.50 57.00 61.75 34.10 54.50 44.20 30.90 25.30 43.50 35.50 59.25 82.50 93.25 27.50 80.75 23.90 202.00 55.75 108.00 66.75 16,861.82 32.50 15.95 5,953.60 78.25 41.60 120.50 80.00 32.20 90.00 116.00 192.25 38.60 13.70 20.05 29.90 91.00 45.80 16.45 12,138.09 65.25 38.10 7.25 7.90 0.00 1,852.07 74.25 56.75 61.75 34.10 53.50 44.00 30.90 25.10 43.20 35.40 62.25 84.50 94.50 28.10 83.25 24.65 205.00 57.25 117.00 68.25 17,284.07 33.00 16.10 6,011.74 80.75 42.10 122.00 82.00 33.10 91.00 118.00 196.25 39.30 14.90 20.45 30.50 95.00 46.20 16.90 12,367.72 66.25 38.70 7.45 8.35 0.00 1,874.79 77.00 58.00 63.75 35.30 55.50 44.70 31.50 26.00 44.30 37.10 43.50 39.60 30.80 19.80 56.25 15.90 165.00 36.98 72.63 47.10 12,609.35 25.90 13.80 5,127.91 56.50 25.70 78.25 61.25 25.00 57.75 80.36 142.00 24.20 9.70 15.13 23.30 52.75 39.10 11.55 9,127.37 55.00 34.90 5.45 5.50 24.30 1,646.54 29.00 40.30 47.00 20.10 25.80 28.10 19.90 18.50 31.50 23.10 82.50 147.00 101.50 33.60 135.50 27.10 215.00 62.75 129.50 79.00 17,924.18 35.80 18.40 6,798.83 90.50 74.50 136.00 88.00 49.50 95.75 119.25 208.50 53.00 19.70 31.60 49.70 137.75 59.00 23.75 13,313.41 76.50 98.50 11.70 19.00 24.30 3,208.53 79.25 80.25 103.25 41.50 79.00 79.75 47.90 37.60 61.50 54.00 475,024 National Medical Care Company 185,844 Saudi Marketing Company 277,916 Al Hammadi Co For Dev and Inv 506,204 Saudi Automotive Services Co. 226,125 National Agriculture Marketing Co. 1,106,369 Fitaihi Holding Group 188,201 Jarir Marketing Co 293,456 Aldrees Petroleum & Transport Svcs Co. 916,209 Fawaz Abdulaziz AlHokair Co 150,857 Alkhaleej Training and Education Co 4,900,100 Retail 122,590 National Gas & Industrialization Co. 2,744,758 Saudi Electricity Co 2,867,348 Energy & Utilities 283,019 SAVOLA Group 512,509 Food Products Co. 36,199 Saudia Dairy & Foodstuff .Co 433,818 Almarai Company 543,366 Anaam International Holding Group Co 11,015 Halwani Bros 23,943 Herfy Food Services Co 125,968 Saudi Airlines Catering Co. 772,551 National Agriculture Development Co. 4,859,735 Qassim Agriculture Co. 990,561 Tabuk Agriculture Development Co. 572,416 Saudi Fisheries Co. 1,926,514 Ash-Sharqiyah Development Co 122,361 Al-Jouf Agriculture Development Co. 1,656,206 Jazan Development Co. 12,870,181 Agriculture & Food Industries 820,706 Saudi Telecom 4,215,700 Etihad Etisalat Co 13,818,744 Mobile Telecom. Co. Saudi Arabia 10,946,221 Etihad Atheeb Telecommunication Co 0 Saudi Integrated Telecom Company 29,801,371 TeleCom. & Info. Technology 807,813 The Co. for Cooperative Insurance 264,823 MetLife AIG ANB Coop Ins Co 1,781,513 Aljazira Takaful Taawuni Co. Malath Coop Insurance and Reinsurance Co 4,478,509 1,449,542 The Mediterranean & Gulf Insurance & Reinsurance Co Allianz Saudi Fransi Cooperative Insurance Co 339,029 187,783 Saudi IAIC Cooperative Insurance Co. 641,807 Saudi United Cooperative Insurance Co 560,976 Arabian Shield Cooperative Insurance Co 1,123,736 SABB Takaful 455,623 177,088 547,204 1,060,648 238,121 577,309 128,573 689,800 612,649 255,897 5,275,537 104,504 2,693,272 2,797,776 336,557 1,291,242 74,896 310,630 902,623 46,777 106,705 84,197 646,481 1,938,531 1,737,580 892,227 1,290,289 210,693 1,184,075 11,053,504 979,892 7,748,064 26,744,461 6,862,023 0 42,334,440 1,137,875 706,582 1,298,417 8,276,885 2,025,154 681,436 672,504 1,210,200 815,084 1,488,312 453,233 176,774 553,993 1,089,206 253,450 563,362 125,127 702,113 593,577 274,121 5,316,222 105,871 2,716,953 2,822,824 345,185 1,357,313 75,906 315,437 918,323 49,620 109,532 82,845 649,101 1,862,876 1,787,501 920,754 1,279,337 233,608 1,204,509 11,191,848 980,737 7,951,893 27,441,258 6,705,337 0 43,079,225 1,176,508 743,857 1,262,612 8,238,814 1,983,504 685,632 686,559 1,280,988 829,098 1,480,405 Remarks (17 من8) الصفحة TRACKING OF HIGHEST & LOWEST SYMBOL & TRADING NAME 8090 8100 8110 8120 8130 8140 8150 8160 8170 8180 8190 8200 8210 8220 8230 8240 8250 8260 8270 8280 8290 8300 8310 8311 8312 TINSI 2030 2120 2140 2190 4080 4130 4280 TMISI 1201 1210 1211 1212 1213 1214 2070 2150 2180 2220 2230 2300 Today One Year Prices Volume Volume Vol. 30days Today / Avg Prices 5-Feb-15 Avg. 30days excl. today 30 excl today 5-Feb-15 Open Low High Low High 0.00 0.30 0.79 1.30 0.85 0.60 0.00 0.71 3.06 0.57 0.35 1.38 0.32 0.00 0.55 0.68 0.65 0.38 0.75 0.34 0.48 0.35 1.25 0.52 0.50 0.76 1.45 0.58 1.38 1.32 0.78 0.00 0.52 1.11 1.65 0.38 0.34 2.29 0.69 0.30 0.55 0.30 0.97 0.64 2.21 0.90 0.00 44.10 34.90 20.60 53.25 15.60 27.10 20.20 41.00 31.70 22.35 10.00 168.00 0.00 45.40 63.75 38.10 31.20 42.80 69.75 22.10 74.50 16.15 30.30 52.50 1,495.01 68.25 22.45 16.85 18.15 28.70 0.00 19.00 4,243.86 54.00 37.80 37.70 37.40 17.85 75.50 43.30 40.00 55.50 37.00 67.50 28.70 0.00 44.10 34.10 20.15 52.75 #N/A 27.30 19.95 40.70 31.20 22.20 10.15 167.50 0.00 44.40 64.50 38.50 30.60 42.00 69.75 21.80 75.00 15.80 30.10 52.25 1,497.13 68.00 22.05 16.70 17.50 28.50 0.00 18.70 4,241.39 50.50 37.00 36.80 36.00 17.45 75.00 42.80 39.70 55.25 36.80 63.25 28.30 0.00 43.30 34.10 20.15 52.75 #N/A 26.90 19.90 40.60 31.20 22.15 9.85 167.00 0.00 44.00 63.25 38.00 30.60 42.00 69.75 21.75 74.25 15.80 30.00 51.50 1,479.34 68.00 22.00 16.65 17.50 28.50 0.00 18.60 4,172.82 50.50 37.00 36.70 36.00 17.45 75.00 42.60 39.20 55.25 36.60 63.25 28.20 0.00 44.50 35.60 20.85 54.00 #N/A 27.70 20.35 42.60 32.10 22.40 10.15 171.50 0.00 45.40 64.50 38.90 31.50 43.50 69.75 22.30 76.25 16.70 30.80 52.75 1,502.80 70.00 22.50 17.05 18.60 29.30 0.00 19.15 4,271.95 55.50 38.10 37.70 37.80 17.95 77.50 43.30 40.20 56.75 37.30 68.75 29.10 10.80 25.50 21.45 15.55 33.00 11.00 17.60 14.30 24.25 23.85 17.70 7.55 48.50 19.15 30.90 42.50 25.10 21.50 26.20 26.07 15.85 46.40 8.75 23.10 29.60 1,034.30 41.30 16.15 13.90 12.50 19.70 13.45 14.55 3,173.98 32.10 23.00 23.20 28.40 13.35 53.25 27.60 24.80 36.80 23.80 44.70 20.00 22.55 59.50 140.00 37.80 73.00 35.06 32.20 26.80 47.00 52.75 32.90 14.15 194.00 31.90 57.75 88.00 72.25 52.25 61.50 122.00 28.40 108.50 41.30 51.25 74.00 1,702.89 93.00 30.30 22.95 21.20 36.50 13.60 28.50 5,395.69 59.75 48.30 40.41 67.50 28.40 92.25 55.25 48.00 75.00 59.00 78.00 56.46 0 Sanad Insurance & Reinsurance Cooperative Co 215,348 Saudi Arabian Cooperative Insurance Co 804,865 Saudi Indian Company for Co-operative Insurance 1,372,325 Gulf Union Cooperative Insurance Co 730,051 Al Ahli Takaful Co. 1,054,707 Al-Ahlia Insurance Co 521,426 Allied Cooperative Insurance Group 684,125 Arabia Insurance Cooperative Co 4,271,207 Trade Union Cooperative Insurance Co 1,299,706 Al Sagr Co-operative Insurance Co 564,183 United Cooperative Assurance Co 5,571,529 Saudi Re for Cooperative Reinsurance Co 114,104 Bupa Arabia for Cooperative Insurance 0 Weqaya Takaful Insurance and Reinsurance Co 365,834 Al-Rajhi Company for Cooperative Insurance 276,803 Ace Arabia Cooperative Insurance Co. 696,142 AXA Cooperative Insurance Co 503,200 Gulf General Cooperative Insurance Co 429,640 Buruj Cooperative Insurance Co. 121,859 Al Alamiya for Cooperative Insurance Co 3,079,659 Solidarity Saudi Takaful Co 184,329 Wataniya Insurance Co 3,680,138 Amana Cooperative Insurance Co 862,809 Saudi Enaya Cooperative Insurance Co 333,337 Alinma Tokio Marine Co 39,372,857 Insurance 1,284,747 Saudi Arabia Refineries Co. 1,003,905 Saudi Advanced Industries Co. 6,333,720 Al-Ahsa Development Co. 3,704,982 Saudi Industrial Services Co. 821,530 Aseer Trading, Tourism & Manufacturing Co. 0 Al-Baha Investment & Development co 759,390 Kingdom Holding Co 13,908,274 Multi-Investment 1,330,495 Takween Advanced Industries 119,220 Basic Chemical Industries Co 5,006,317 Saudi Arabian Mining Co 4,077,620 Astra Industrial Group 592,316 Al Sorayai Trading & Industrial Group Co 92,188 Al Hassan Ghazi Ibrahim Shaker 394,318 Saudi Pharma.Indust.& Med. Aplcs Corp. 222,201 The National Co. for Glass Industries Filing & Packing Materials Manufacturing Co. 950,249 National Metal Manufacturing and Casting Co. 1,106,585 1,107,328 Saudi Chemical Co 1,069,634 Saudi Paper Manufacturing Co. 35,161 712,460 1,016,932 1,061,371 864,032 1,739,150 1,057,912 950,592 1,476,255 2,265,266 1,553,577 3,996,141 351,553 2,133 651,464 407,944 1,068,155 1,284,256 570,031 356,590 6,171,520 519,444 3,017,799 1,599,798 649,235 51,691,220 885,255 1,684,815 4,729,758 2,763,512 1,014,188 0 1,358,815 12,436,343 829,320 303,755 14,630,649 1,854,228 824,298 305,275 672,310 726,209 956,341 1,664,925 528,783 1,183,420 35,161 722,759 1,022,237 1,057,913 862,760 1,754,237 1,060,711 962,833 1,396,405 2,260,559 1,621,964 4,042,379 353,606 2,133 661,760 408,058 1,075,727 1,309,110 571,411 361,067 6,409,218 520,490 2,946,639 1,666,359 666,488 52,119,964 883,317 1,740,273 4,600,398 2,799,957 1,057,397 0 1,457,911 12,539,254 808,665 314,747 14,832,650 1,780,889 863,802 308,434 717,505 751,720 980,641 1,734,495 500,926 1,194,358 Remarks (17 من9) الصفحة TRACKING OF HIGHEST & LOWEST SYMBOL & TRADING NAME 2340 AlAbdullatif Industrial Investment Co 4140 Saudi Industrial Export Co TIVSI Industrial Investment 1301 United Wire Factories Co. 1302 Bawan Company 1303 Electrical Industries Co 1310 Mohammad Al Mojil Group Co 1320 Saudi Steel Pipe Co 1330 Abdullah A. M. Al-Khodari Sons Co 2040 Saudi Ceramic Co. 2090 National Gypsum Co 2110 Saudi Cable Co 2130 Saudi Industrial Development Co. 2160 Saudi Arabian Amiantit Co. 2200 Arabian Pipes Co 2240 Zamil Industrial Investment Co 2320 Al-Babtain Power & Telecommunication Co 2360 Saudi vitrified clay pipes co. 2370 Middle East Specialized Cables Co 4230 Red Sea Housing TBCSI Building & Construction 4020 Saudi Real Estate Co. 4090 Taiba Holding Co. 4100 Makkah Construction & Development Co. 4150 Arriyadh Development Co. 4220 Emaar The Economic City 4250 Jabal Omar Development Co 4300 Dar Alarkan Real Estate Development Co 4310 Knowledge Economic City TRDSI Real Estate Development 4030 The National Shipping Co. of Saudi Arabia 4040 Saudi Public Transport Co. 4110 Saudi Transport and Investment Co 4260 United International Transportation Co Ltd. TTRSI Transport 4070 Tihama Advertising & Public Relations Co. 4210 Saudi Research and Marketing Group 4270 Saudi Printing & Packaging Co TMPSI Media and Publishing 1810 ALTAYYAR TRAVEL GROUP 1820 Abdulmohsen Alhokair group 4010 Saudi Hotels & Resort Areas Co. 4170 Tourism Enterprise Co. THTSI Hotel & Tourism TASI Tadawul All Share Index Today One Year Prices Volume Volume Vol. 30days Today / Avg Prices 5-Feb-15 Avg. 30days excl. today 30 excl today 5-Feb-15 Open Low High Low High 0.74 1.40 0.68 0.98 0.89 1.26 0.00 1.19 0.66 0.85 0.67 0.58 0.65 0.94 0.83 0.98 0.63 0.36 0.40 0.81 0.71 0.68 0.84 0.49 1.15 0.61 0.42 1.37 0.95 1.26 0.60 0.29 0.37 0.97 0.41 1.01 0.52 0.33 0.50 2.45 0.64 0.56 1.26 1.13 0.85 38.60 56.50 8,064.86 39.20 56.75 65.75 0.00 27.60 34.00 115.75 29.00 10.40 16.95 14.55 21.30 57.25 39.50 101.00 24.95 42.50 3,845.98 40.50 43.90 84.00 23.00 14.60 57.75 10.45 20.60 6,731.21 38.10 26.60 40.70 76.25 8,098.90 90.25 19.45 21.25 2,386.08 133.50 77.75 33.70 51.75 22,654.31 9,180.11 38.40 53.00 7,947.71 39.00 57.50 63.00 0.00 27.70 33.00 114.50 28.70 10.30 16.95 14.35 21.05 57.00 38.50 100.75 24.35 41.80 3,840.11 39.90 44.30 83.50 23.20 14.75 57.00 10.40 20.25 6,719.47 37.50 26.00 40.00 77.50 8,087.12 90.00 19.25 21.35 2,397.14 141.00 77.75 33.90 50.50 23,826.35 9,169.20 38.30 52.75 7,831.67 38.70 56.50 62.75 0.00 27.50 32.90 113.75 28.70 10.25 16.80 14.25 21.00 56.75 38.40 100.50 24.35 41.50 3,796.54 39.70 43.90 83.00 22.95 14.60 57.00 10.35 20.10 6,677.78 37.30 25.70 39.80 76.00 7,978.37 90.00 19.20 21.10 2,372.95 130.00 77.25 33.70 50.25 22,180.01 9,073.02 39.00 56.50 8,090.86 39.70 58.00 67.00 0.00 28.00 34.50 115.75 29.30 10.40 17.20 14.65 21.50 57.75 39.80 102.00 25.20 42.80 3,853.60 40.60 45.00 84.00 23.20 14.95 58.25 10.60 20.90 6,776.35 38.30 26.80 40.90 78.00 8,116.41 90.50 19.95 21.50 2,414.14 141.00 79.00 34.40 52.00 23,826.35 9,196.39 29.30 32.00 5,220.98 29.50 40.10 48.80 12.55 21.15 27.20 88.00 19.60 8.15 12.30 11.10 16.20 39.80 21.75 72.25 13.85 29.30 2,832.03 26.70 29.00 59.50 15.90 9.75 32.30 6.80 12.70 5,063.56 26.20 18.75 23.80 58.25 5,659.31 82.00 12.80 15.75 1,945.50 81.75 50.00 23.55 36.00 14,535.31 7,225.83 51.50 84.00 9,381.12 57.25 85.00 75.75 12.55 41.30 77.75 154.75 44.00 15.15 24.95 20.50 34.80 70.00 49.70 115.25 26.90 67.25 4,972.96 55.50 48.70 93.50 27.15 19.35 59.75 16.15 27.80 7,390.77 41.50 41.40 55.25 86.75 9,434.51 441.50 22.50 29.60 6,392.55 148.50 102.75 43.80 86.25 25,488.28 11,159.50 304,311 1,377,268 17,750,050 514,298 628,920 3,170,849 0 334,397 2,675,806 340,074 510,665 683,678 2,059,488 2,410,661 1,749,396 258,509 605,415 24,967 2,884,132 329,415 19,180,670 168,957 289,720 33,842 1,287,132 2,721,222 799,111 77,893,359 2,942,631 86,135,974 1,069,059 1,052,823 630,119 237,533 2,989,534 191,466 380,732 228,198 800,396 917,897 540,081 209,271 1,114,609 2,781,858 314,258,527 410,142 973,459 25,863,112 517,370 689,646 2,382,524 0 275,136 3,762,200 398,917 760,728 1,116,477 3,080,236 2,526,559 2,057,943 253,767 938,886 65,037 7,103,072 405,632 26,334,129 244,443 342,935 68,839 1,071,192 4,406,344 1,856,543 58,382,051 3,072,605 69,444,952 1,704,173 3,492,974 1,645,309 242,943 7,085,399 191,788 722,396 669,282 1,583,465 385,472 796,081 355,469 895,255 2,432,277 364,185,716 413,695 984,774 26,187,301 523,780 708,826 2,521,562 0 281,696 4,075,526 400,745 766,795 1,184,162 3,191,105 2,554,633 2,098,729 262,455 967,674 69,341 7,132,803 408,420 27,148,250 250,000 346,644 69,388 1,114,594 4,491,558 1,924,785 57,051,205 3,108,474 68,356,648 1,776,469 3,650,617 1,681,157 244,564 7,352,806 189,583 728,043 685,291 1,602,916 373,975 841,538 374,626 882,300 2,472,439 367,797,496 Remarks (17 من10) الصفحة VOLUME PERFORMANCE (Times last 30 day average volume) TRADING NAME National Commercial Bank Arab National Bank Saudi Hollandi Bank Samba Financial Group Bank Al Jazira Al Rajhi Bank Riyad Bank The Saudi British Bank Al Inmaa Bank Bank Al Bilad Banque Saudi Fransi The Saudi Investment Bank Banks & Financial Services Saudi Int'l. Petrochemical Co. Saudi Industrial Inv. Group Alujain Corp. Saudi Basic Industries Corp. Sahara Petrochemical Co. Rabigh Refining & Petrochem. Co. Methanol Chemical Co. Nama Chemicals Co. Yanbu Nat'l. Petrochemical Co. National Industrialization Co. National Petrochemical Co. Saudi Kayan Petrochem. Co. Advanced Polypropylene Co. Saudi Arabia Fertilizers Co. Petrochemical Industries Yanbu Cement Co. Yamamah Saudi Cement Co. Ltd. The Qassim Cement Co. City Cement Co. Eastern Cement Co. Arabian Cement Co. Hail Cement Co. Saudi Cement Co. Najran Cement Co. Umm Al-Qura Cement Co Tabouk Cement Co. Northern Cement Al Jouf Cement Co. Southern Province Cement Co. Cement Ahmed H. Fitaihi Co. Mouwasat Medical Services Co. Fawaz Abdulaziz Al Hokair Co. Jarir Marketing Co. eXtra FARM Care Al Othaim Markets Nat'l. Agriculture Marketing Co. Al Khaleej Training & Educ. Co. AlHammadi Saudi Automotive Services Co. Today / Avg 30 excl today 2.87 1.76 1.67 1.13 0.94 0.82 0.72 0.68 0.63 0.61 0.61 0.35 0.69 1.60 1.27 1.05 1.02 0.95 0.91 0.88 0.87 0.86 0.86 0.72 0.59 0.55 0.53 0.82 2.54 2.53 2.42 1.32 1.28 1.28 0.84 0.84 0.79 0.64 0.55 0.55 0.49 0.40 0.79 1.96 1.77 1.54 1.50 1.27 1.05 1.05 0.96 0.89 0.55 0.50 0.46 TRADING NAME Al Drees Petr. & Trans. Servs. Co. Dallah Health Retail Nat'l. Gas & Industrialization Co. Saudi Electricity Co. Energy & Utilities Qassim Agriculture Co. Saudi Airlines Catering Co. Ashargiyah Agriculture Dev. Co. Al Marai Co. Jazan Development Co. Nat'l. Agriculture Dev. Co. SAVOLA Group Saudi Fisheries Co. Anaam Int'l. Holding Group Co. Tabouk Agriculture Dev. Co. Al Jouf Agriculture Dev. Co. Saudia Dairy & Foodstuff Co. Food Products Co. Halwani Bros Herfy Food Services Co. Agriculture & Food Industries Ethihad Atheeb Saudi Telecom Co. Etihad Etisalat Co. ZAIN KSA Telecom. & Information Tech. Trade Union Coop. Insurance Aljazira Takaful Taawuni Co. Saudi Re for Coop Reins Co Gulf Union Coop. Insurance Co. Amana Cooperative Insurance Co Al Ahli Takaful Co. Saudi Indian Company for Coop. Ins. SABB Takaful Buruj Coop Insurance Co. The Mediterranean & Gulf Ins. & Reins. Arabia Insurance Coop. Co. The Company for Coop. Ins. ACE Arabian Coop. Insurance Co. Arabian Shield Coop. Insurance Co. AXA Coop. Insurance Co. Al Ahlia Insurance Co. Al Sagr Company for Coop. Ins. Al Rajhi Co. for Coop. Insurance Malath Coop. Ins. And Reins. Co. Saudi Enaya Cooperative Insurance Co Saudi United Coop. Insurance Co. Alinma Tokio Marine Co Saudi Fransi Coop. Insurance Co. Allied Coop. Insurance Group Solidarity Saudi Takaful Co. Gulf General Coop Insurance Co. MetLife AIG ANB Coop Ins Co Wataniya Insurance Company Today / Avg 30 excl today 0.42 0.31 0.92 1.16 1.01 1.02 2.61 1.52 1.51 1.38 1.38 1.19 0.82 0.62 0.59 0.55 0.52 0.48 0.38 0.22 0.22 1.15 1.63 0.84 0.53 0.50 0.69 3.06 1.41 1.38 1.30 1.25 0.85 0.79 0.76 0.75 0.73 0.71 0.69 0.68 0.68 0.65 0.60 0.57 0.55 0.54 0.52 0.50 0.50 0.49 0.49 0.48 0.38 0.36 0.35 TRADING NAME United Cooperative Assurance Co. Al Alamiya for Coop Ins Co Bupa Arabia for Cooperative Insurance Saudi Arabian Coop. Insurance Co. Saudi IAIC Coop Insurance Co. weqaya and sanad Insurance Saudi Arabia Refineries Co. Al Ahsa Development Co. Saudi Industrial Services Co. Aseer Trading, Tourism & Mfg. Co. Saudi Advanced Industries Co. Kingdom Holding Co. Multi-Investment Astra Industrial Saudi Chemical Co. Takween Saudi Industrial Export Co. FIPCO Saudi Paper Manufacturing Co. Al Abdullatif Industrial Investment Co. Al-Sorayai Group Maadaniyah SPIMACO BCI MA'ADEN Al Hassan Ghazi Ibrahim Shaker ZOUJAJ Industrial Investment Electrical Industries Co Saudi Steel Pipe Co. Zamil Industrial Investment Co. United Wire Factories Co. Saudi Arabian Amiantit Co. Bawan Company Saudi Ceramic Co. Arabian Pipes Co. Red Sea Housing National Gypsum Co. Abdullah A. M. Al-Khodari Sons Co. Saudi Indistrial Development Co. Al Babtain Power & Telecom Co. Saudi Cable Co. Middle East Specialized Cables Co. Saudi Vitrified Clay Pipes Co. Building & Construction Dar Al Arkan Real Estate Dev. Co. Arriyadh Development Co. Knowledge Economic City Taiba Holding Co. Saudi Real Estate Co. Emaar, The Economic City Makkah Construction & Dev. Co. Jabal Omar Dev. Co. Real Estate Development Today / Avg 30 excl today 0.35 0.34 0.32 0.30 0.27 0.76 1.45 1.38 1.32 0.78 0.58 0.52 1.11 2.29 2.21 1.65 1.40 0.97 0.90 0.74 0.69 0.64 0.55 0.38 0.34 0.30 0.30 0.68 1.26 1.19 0.98 0.98 0.94 0.89 0.85 0.83 0.81 0.67 0.66 0.65 0.63 0.58 0.40 0.36 0.71 1.37 1.15 0.95 0.84 0.68 0.61 0.49 0.42 1.26 TRADING NAME United International Transport Co. Ltd. The Nat'l. Shipping Co. of Saudi Arabia Saudi Land Transport Co. Saudi Public Transport Co. Transport Tihama Advertising & Public Relations Saudi Research & Marketing Group Saudi Printing & Packaging Co. Media and Publishing AlTayyar Travel Group Tourism Enterprise Co. Al Hokair Group Saudi Hotels & Resort Areas Co. Hotel and Tourism TASI TOP SECTORS Real Estate Development Agriculture & Food Industries Multi-Investment Hotel and Tourism Energy & Utilities Retail Petrochemical Industries Cement Insurance Building & Construction Banks & Financial Services Telecom. & Information Tech. Industrial Investment Media and Publishing Transport TOP COMPANIES Trade Union Coop. Insurance National Commercial Bank Qassim Agriculture Co. Yanbu Cement Co. Yamamah Saudi Cement Co. Ltd. AlTayyar The Qassim Cement Co. Astra Industrial Saudi Chemical Co. Ahmed H. Fitaihi Co. Mouwasat Medical Services Co. Arab National Bank Saudi Hollandi Bank Takween Ethihad Atheeb Saudi Int'l. Petrochemical Co. Fawaz Abdulaziz Al Hokair Co. Catering Ashargiyah Agriculture Dev. Co. Jarir Marketing Co. 5-Feb-15 Today / Avg 30 excl today 0.97 0.60 0.37 0.29 0.41 1.01 0.52 0.33 0.50 2.45 1.26 0.64 0.56 1.05 0.85 Today / Avg 30 excl today 1.26 1.15 1.11 1.05 1.02 0.92 0.82 0.79 0.76 0.71 0.69 0.69 0.68 0.50 0.41 Today / Avg 30 excl today 3.06 2.87 2.61 2.54 2.53 2.45 2.42 2.29 2.21 1.96 1.77 1.76 1.67 1.65 1.63 1.60 1.54 1.52 1.51 1.50 Market Value Indicators 5-Feb-15 Code NAME OF COMPANY Current Price Daily Since Wk. Since 1M Since 3M Shares Latest Ratio BETA Shares Performance 5-Feb-15 Since 1Y FY2014 2015YTD 1Year Qrtr. P/E P/B Dvd. Yld. # of shares SAR % to SAR Free Float % to outstanding Capitalization Mkt. Cap. Capitalization Total Cap. Banks & Financial Services 1010 Riyad Bank 17.80 0.0% 1.4% 8.5% -5.8% -2.7% 16.4% 4.7% 0.97 4th 12.27 1.49 4.10% 3,000,000,000 53,400,000,000 2.69% 25,333,140,243 2.88% 1020 Bank Al Jazira 28.90 0.3% 4.3% 7.0% -5.2% 32.1% 30.5% 4.7% 1.07 4th 20.20 1.86 0.00% 400,000,000 11,560,000,000 0.58% 10,309,333,137 1.17% 1030 The Saudi Investment Bank 28.00 0.0% 3.7% 10.2% 0.0% -1.1% -1.6% 8.1% 0.71 4th 11.69 1.36 2.86% 600,000,000 16,800,000,000 0.85% 9,016,021,364 1.03% 1040 Saudi Hollandi Bank 45.10 -1.3% -4.0% 7.1% -6.0% 19.7% 28.6% 0.7% 0.82 4th 11.80 1.99 2.22% 476,280,000 21,480,228,000 1.08% 5,937,512,642 0.68% 2.58% 1050 Banque Saudi Fransi 35.00 1.2% 0.6% 16.7% -0.6% 36.5% 20.3% 11.1% 0.78 4th 12.00 1.62 2.71% 1,205,357,167 42,187,500,845 2.12% 22,681,197,140 1060 The Saudi British Bank 54.75 0.0% -1.4% -2.7% -1.8% 17.7% 31.8% -5.6% 0.81 4th 12.83 2.08 1.92% 1,000,000,000 54,750,000,000 2.76% 17,797,744,396 2.02% 1080 Arab National Bank 33.50 -0.3% -0.3% 13.2% 8.4% 22.8% 16.5% 9.8% 0.70 4th 11.65 1.56 2.99% 1,000,000,000 33,500,000,000 1.69% 16,275,169,895 1.85% 1090 Samba Financial Group 46.50 0.9% 1.5% 23.3% 4.5% 15.3% 2.9% 20.5% 0.99 4th 11.14 1.43 4.02% 1,200,000,000 55,800,000,000 2.81% 28,051,776,140 3.19% 1120 Al Rajhi Bank 60.00 1.7% 5.7% 17.1% -7.0% -9.1% -23.9% 17.1% 0.92 4th 14.26 2.33 2.92% 1,625,000,000 97,500,000,000 4.91% 71,180,572,980 8.10% 1140 Bank Al Bilad 48.10 -1.2% 3.9% 13.2% -10.1% 20.6% 27.4% 7.8% 1.18 4th 22.27 3.24 1.04% 400,000,000 19,240,000,000 0.97% 13,545,840,759 1.54% 1150 Al Inmaa Bank 22.95 0.7% 5.8% 16.8% 0.7% 32.7% 36.2% 13.1% 1.39 4th 27.24 1.90 2.16% 1,500,000,000 34,425,000,000 1.73% 23,783,085,000 2.71% 1180 National Commercial Bank 63.25 3.7% 7.2% 17.1% #DIV/0! - 22.2% 15.0% - 4th 14.62 2.72 1.02% 2,000,000,000 126,500,000,000 6.37% 45,111,917,802 5.13% 20,380.16 1.11% 3.5% 14.2% -2.4% 8.1% 2.5% 11.3% 0.95 13.68 1.95 2.41% 14,406,637,167 567,142,728,845 28.56% 289,023,311,496 32.88% 0.19% TBFSI Banks & Financial Services Petrochemical & Industries 2001 Methanol Chemical Co. 13.50 -0.4% 6.3% 15.4% -13.7% -9.7% -21.6% 13.0% 1.10 4th 50.56 1.06 4.44% 120,600,000 1,628,100,000 0.08% 1,628,100,000 2002 National Petrochemical Co.*** 25.20 -0.8% 1.8% 15.6% -18.7% -9.0% -14.5% 15.1% 1.32 4th 15.61 2.47 0.00% 480,000,000 12,096,000,000 0.61% 2,116,800,000 0.24% 2010 Saudi Basic Industries Corp. 94.00 -2.6% 9.0% 18.2% -8.5% -15.5% -24.7% 11.9% 1.25 4th 12.03 1.73 5.85% 3,000,000,000 282,000,000,000 14.20% 59,574,904,238 6.78% 2020 Saudi Arabia Fertilizers Co. 153.00 -0.2% 3.6% 10.1% -2.4% -5.6% -10.1% 8.7% 0.67 4th 16.07 6.49 4.58% 333,333,333 50,999,999,949 2.57% 18,020,236,266 2.05% 2060 National Industrialization Co. 27.40 -1.1% 2.6% 4.2% -6.8% -8.4% -20.0% 2.2% 1.24 4th 16.17 1.57 5.47% 668,914,166 18,328,248,148 0.92% 15,977,458,655 1.82% 2170 Alujain Corp.*** 22.85 -2.4% 0.2% 44.2% -3.8% -1.9% -35.7% 41.0% 1.37 4th 9.45 1.72 0.00% 69,200,000 1,581,220,000 0.08% 1,408,359,750 0.16% 2210 Nama Chemicals Co. 13.30 -1.8% 16.7% 30.4% -3.6% 0.4% -24.2% 24.9% 1.46 4th -15.20 1.39 0.00% 128,520,000 1,709,316,000 0.09% 1,709,316,000 0.19% 2250 Saudi Industrial Inv. Group 27.40 0.7% 7.9% 16.3% -19.2% -22.6% -21.3% 7.5% 1.22 4th 13.23 1.81 3.65% 450,000,000 12,330,000,000 0.62% 10,406,539,920 1.18% 2260 Sahara Petrochemical Co. 17.65 0.3% 3.5% 17.7% -8.1% -16.4% -23.5% 16.5% 1.31 4th 19.65 1.33 4.82% 438,795,000 7,744,731,750 0.39% 6,818,953,526 0.78% 2290 Yanbu Nat'l. Petrochemical Co. 49.40 -1.0% 3.8% 16.5% -16.6% -31.4% -34.9% 2.9% 1.23 4th 11.21 1.79 6.07% 562,500,000 27,787,500,000 1.40% 10,004,156,724 1.14% 2310 Saudi Int'l. Petrochemical Co. 30.50 0.3% 1.7% 19.6% -5.9% -3.8% -15.7% 13.8% 1.12 4th 18.45 1.87 4.10% 366,666,666 11,183,333,313 0.56% 10,110,511,795 1.15% 2330 Advanced Polypropylene Co. 50.50 1.6% 7.4% 22.6% -4.3% 14.0% -1.0% 25.0% 1.08 4th 11.03 3.43 5.94% 163,995,000 8,281,747,500 0.42% 7,753,979,121 0.88% 2350 Saudi Kayan Petrochem. Co.*** 12.50 -0.8% 2.5% 18.5% -11.0% -10.7% -30.3% 14.2% 1.30 4th -421.77 1.33 0.00% 1,500,000,000 18,750,000,000 0.94% 11,296,105,513 1.29% 2380 Rabigh Refining & Petrochem. Co.*** 4th 27.56 1.87 0.00% 876,000,000 17,826,600,000 0.90% 3,277,291,249 0.37% 13.09 1.92 5.17% 9,158,524,165 472,246,796,660 23.78% 160,102,712,755 18.21% TPISI Petrochemical & Industries 20.35 0.2% 4.4% 15.3% -22.3% -20.8% -25.4% 12.4% 1.49 6,500.67 -1.12% 5.8% 15.9% -9.3% -13.3% -22.4% 11.0% 1.19 Cement 3001 Hail Cement Co.*** 25.00 -0.4% 0.6% 10.9% -2.3% 13.4% 7.0% 9.6% 1.03 4th 16.64 2.31 4.40% 97,900,000 2,447,500,000 0.12% 2,447,500,000 0.28% 3002 Najran Cement Co. 30.70 -1.6% 5.9% 10.4% -2.8% 19.0% 8.3% 17.2% 0.94 4th 21.46 2.53 3.75% 170,000,000 5,219,000,000 0.26% 3,892,816,089 0.44% 3003 City Cement Co. 22.85 -0.9% 0.0% 3.9% -13.1% -3.8% -0.7% 0.2% 1.10 4th 19.50 2.18 4.38% 189,200,000 4,323,220,000 0.22% 2,161,610,000 0.25% 3004 Northern Region Cement Co. 23.15 0.0% 2.0% 10.8% -3.1% -4.7% -8.6% 9.5% 0.99 4th 17.79 2.00 8.64% 180,000,000 4,167,000,000 0.21% 3,662,805,061 0.42% 3005 Umm Al-Qura Cement Co 41.60 -1.4% 1.5% 14.6% -0.7% #DIV/0! 265.0% 14.0% 1.00 4th -81.72 4.38 0.00% 55,000,000 2,288,000,000 0.12% 1,144,000,000 0.13% 3010 Arabian Cement Co. 78.00 0.0% -1.6% -1.9% -5.7% 42.9% 51.3% 0.3% 0.68 4th 12.07 2.41 6.41% 100,000,000 7,800,000,000 0.39% 7,348,094,598 0.84% 3020 Yamamah Saudi Cement Co. Ltd. 51.00 1.0% 1.0% 7.4% -17.7% -13.6% -16.2% 6.3% 0.88 4th 15.39 2.77 5.88% 202,500,000 10,327,500,000 0.52% 8,837,275,512 1.01% 3030 Saudi Cement Co. 99.50 0.3% 0.5% 4.7% -9.1% -10.8% -5.4% 3.6% 0.63 4th 14.16 4.74 7.04% 153,000,000 15,223,500,000 0.77% 12,948,801,645 1.47% 3040 The Qassim Cement Co. 94.50 0.5% 2.4% 5.0% -1.6% 2.4% -0.3% 5.9% 0.52 4th 15.10 4.31 6.35% 90,000,000 8,505,000,000 0.43% 4,329,104,535 0.49% 3050 Southern Province Cement Co. 105.75 0.5% -1.4% 0.2% -3.6% -8.2% -0.9% -3.2% 0.69 4th 14.16 5.00 4.73% 140,000,000 14,805,000,000 0.75% 6,191,824,086 0.70% 3060 Yanbu Cement Co. 69.25 1.1% -2.1% 13.1% 0.7% 5.7% -8.2% 13.1% 0.81 4th 13.60 3.09 5.78% 157,500,000 10,906,875,000 0.55% 8,230,445,877 0.94% 3080 Eastern Cement Co. 62.00 1.2% 2.1% 14.3% 3.3% 2.5% -6.7% 11.7% 0.65 4th 14.29 2.36 5.65% 86,000,000 5,332,000,000 0.27% 3,629,108,124 0.41% 3090 Tabouk Cement Co. 25.40 -0.8% 0.0% 4.5% -8.3% -9.6% -12.4% 2.4% 0.86 4th 16.61 1.97 7.87% 90,000,000 2,286,000,000 0.12% 1,866,211,127 0.21% 3091 Al Jouf Cement Co. 4th 34.42 1.44 0.00% 130,000,000 2,080,000,000 0.10% 2,075,200,000 0.24% 15.02 3.19 5.76% 1,841,100,000 95,710,595,000 4.82% 68,764,796,654 7.82% 0.42% TCESI Cement 16.00 0.0% -0.6% 15.5% -25.1% -8.8% -19.9% 13.5% 1.35 7,265.54 0.26% 0.4% 6.5% -7.1% -0.7% -2.4% 6.0% 0.79 Retail 4001 Al Othaim Markets 114.50 -1.1% 3.9% 10.4% 8.3% 50.7% 68.7% 8.8% 0.76 4th 23.99 5.41 2.62% 45,000,000 5,152,500,000 0.26% 3,726,975,000 4002 Mouwasat Medical Services Co. 128.00 0.8% 1.6% 3.2% 2.0% 49.7% 34.8% 3.2% 0.64 4th 26.65 6.22 1.56% 50,000,000 6,400,000,000 0.32% 2,990,810,240 0.34% 4003 United Electronics Co. (eXtra) 97.75 -3.2% 2.9% 20.7% -9.5% -1.0% -18.7% 21.8% 0.93 4th 24.21 5.67 3.07% 30,000,000 2,932,500,000 0.15% 1,124,145,625 0.13% 4004 Dallah Healthcare Holding Co 141.00 0.7% 4.8% 12.4% 3.9% 76.3% 85.7% 8.9% 1.00 4th 45.24 5.22 1.06% 47,200,000 6,655,200,000 0.34% 3,211,980,000 0.37% Market Value Indicators 5-Feb-15 Code NAME OF COMPANY Current Price 5-Feb-15 Since Wk. Since 1M Since 3M Since 1Y Shares Latest Ratio BETA Shares Performance Daily FY2014 2015YTD 1Year Qrtr. P/E P/B Dvd. Yld. # of shares SAR % to SAR Free Float % to outstanding Capitalization Mkt. Cap. Capitalization Total Cap. 4005 National Medical Care Company 62.00 2.5% 9.7% 17.0% -12.1% 12.7% 0.9% 12.7% 1.22 4th 29.68 3.33 2.50% 44,850,000 2,780,700,000 0.14% 1,104,326,578 4006 Saudi Marketing Company 83.00 -1.8% 0.9% 5.1% -5.1% #DIV/0! 218.9% 1.2% 1.17 4th 27.73 5.85 0.00% 35,000,000 2,905,000,000 0.15% 871,500,000 0.13% 0.10% 4007 Al Hammadi Co For Dev and Inv 94.50 0.0% 2.2% 14.2% 8.6% #DIV/0! 200.9% 12.2% 0.94 4th 54.96 5.37 1.06% 75,000,000 7,087,500,000 0.36% 2,126,250,000 0.24% 0.11% 4050 Saudi Automotive Services Co. 27.90 -0.7% 2.2% 14.3% -1.4% 20.8% 3.8% 14.1% 1.08 4th 15.43 1.73 5.38% 45,000,000 1,255,500,000 0.06% 952,753,696 4160 Nat'l. Agriculture Marketing Co. 82.00 0.6% 1.9% 2.5% -9.8% 40.2% 90.0% 2.5% 0.36 4th 46.70 12.56 0.00% 10,000,000 820,000,000 0.04% 820,000,000 0.09% 4180 Ahmed H. Fitaihi Co.*** 24.05 -0.4% 2.1% 13.2% 6.4% 50.8% 25.7% 14.5% 0.99 4th 29.77 1.73 0.00% 55,000,000 1,322,750,000 0.07% 1,021,042,750 0.12% 4190 Jarir Marketing Co. 203.50 1.4% 5.7% 14.2% 8.5% 17.6% 16.4% 10.0% 0.67 4th 24.74 13.52 3.27% 90,000,000 18,315,000,000 0.92% 18,304,761,508 2.08% 4200 Al Drees Petr. & Trans. Servs. Co. 56.75 0.4% 3.2% 12.9% 7.1% 52.6% 51.1% 11.3% 0.86 4th 18.35 3.91 2.64% 40,000,000 2,270,000,000 0.11% 2,229,752,616 0.25% 4240 Fawaz Abdulaziz Al Hokair Co. 111.00 0.0% 22.0% 22.7% 2.8% 52.8% 43.2% 11.6% 1.16 3rd 29.43 9.41 2.03% 210,000,000 23,310,000,000 1.17% 11,888,100,000 1.35% 4290 Al Khaleej Training & Educ. Co. 4th 26.67 4.88 1.47% 35,000,000 2,380,000,000 0.12% 1,864,870,556 0.21% 28.44 7.20 2.04% 812,050,000 83,586,650,000 4.21% 52,237,268,570 5.94% TRESI Retail 68.00 0.0% 3.4% 15.3% 6.3% 39.8% 70.0% 4.6% 1.10 17,050.92 0.44% 7.9% 14.7% 4.6% 35.2% 32.7% 9.9% 0.86 Energy & Utilities 2080 Nat'l. Gas & Industrialization Co. 32.70 -0.9% -0.9% 4.1% -0.6% 25.3% 23.3% -0.3% 0.80 4th 16.11 2.42 5.50% 75,000,000 2,452,500,000 0.12% 1,652,709,143 0.19% 5110 Saudi Electricity Co. 16.10 0.3% 2.9% 9.2% -3.6% 9.2% 3.1% 7.3% 0.79 4th 18.58 1.13 4.35% 4,166,593,815 67,082,160,422 3.38% 11,524,452,917 1.31% 6,004.83 0.16% 2.4% 8.5% -3.2% 10.9% 5.4% 6.3% 0.80 18.48 1.15 4.39% 4,241,593,815 69,534,660,422 3.50% 13,177,162,060 1.50% 3.62% TEUSI Energy & Utilities Agriculture & Food Industries 2050 SAVOLA Group 79.50 -1.2% -1.5% 4.6% -1.9% 39.5% 26.3% 0.3% 1.00 4th 20.48 4.20 2.83% 533,980,684 42,451,464,378 2.14% 31,806,109,973 2100 Food Products Co. 41.90 -0.2% 4.5% 22.2% -14.7% 30.9% 5.3% 24.3% 1.40 4th 1,845.32 4.12 1.19% 20,000,000 838,000,000 0.04% 838,000,000 0.10% 2270 Saudia Dairy & Foodstuff Co. 121.50 0.4% 0.8% 3.0% 3.8% 50.5% 37.4% 2.5% 0.77 3rd 23.87 4.29 2.88% 32,500,000 3,948,750,000 0.20% 1,903,362,017 0.22% 1.88% 2280 Al Marai Co. 81.25 -0.3% -3.3% 8.7% 7.6% 30.5% 46.7% 5.5% 0.62 4th 29.12 4.48 1.23% 600,000,000 48,750,000,000 2.45% 16,494,402,519 4061 Anaam Int'l. Holding Group Co. 32.70 0.0% 6.5% 20.2% -5.2% 4.1% -16.7% 17.2% 1.08 4th -25.88 3.87 0.00% 19,600,000 640,920,000 0.03% 545,441,396 0.06% 6001 Halwani Bros 91.00 0.6% 9.3% 14.5% 19.0% 56.9% 38.5% 13.8% 0.93 4th 28.63 4.26 2.20% 28,571,430 2,600,000,130 0.13% 1,156,740,130 0.13% 6002 Herfy Food Services Co. 118.00 2.4% 5.1% 21.6% 14.6% 45.9% 24.9% 19.2% 0.80 4th 26.49 8.04 2.12% 46,200,000 5,451,600,000 0.27% 1,705,359,600 0.19% 6004 Saudi Airlines Caterging Co. 196.00 -1.0% 5.0% 12.0% 3.7% 35.6% 31.3% 5.5% 1.00 4th 24.58 13.11 2.81% 82,000,000 16,072,000,000 0.81% 4,821,600,000 0.55% 6010 Nat'l. Agriculture Dev. Co. 38.90 -0.5% 7.2% 26.7% 1.8% 36.4% 17.6% 26.7% 1.16 4th 25.40 2.16 1.10% 70,000,000 2,723,000,000 0.14% 2,178,338,733 0.25% 6020 Qassim Agriculture Co.*** 14.60 5.4% 10.6% 26.4% -3.6% -15.6% -34.9% 24.3% 1.12 4th -61.23 2.19 0.00% 50,000,000 730,000,000 0.04% 729,983,356 0.08% 6040 Tabouk Agriculture Dev. Co. 20.20 -0.7% 11.3% 17.0% -20.9% -9.3% -26.8% 19.3% 1.05 4th 125.33 2.56 0.00% 45,000,000 909,000,000 0.05% 658,917,738 0.07% 6050 Saudi Fisheries Co.*** 30.10 -0.3% 6.4% 19.9% -5.3% 2.7% -10.7% 9.1% 0.83 4th -34.70 6.31 0.00% 53,537,500 1,611,478,750 0.08% 620,366,990 0.07% 6060 Ashargiyah Agriculture Dev. Co.*** 92.25 -0.8% 8.5% 28.1% -11.3% 71.6% 31.2% 27.2% 1.29 4th -279.51 11.74 0.00% 7,500,000 691,875,000 0.03% 691,700,648 0.08% 6070 Al Jouf Agriculture Dev. Co. 45.90 -0.9% 1.5% 10.1% -7.3% 11.3% -1.6% 12.2% 0.83 4th 12.85 1.77 1.82% 30,000,000 1,377,000,000 0.07% 1,309,940,100 0.15% 6080 Bishah Agriculture Dev. Co.*** 69.75 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.00 4th -207.84 -173.08 0.00% 5,000,000 348,750,000 0.02% 348,750,000 0.04% 6090 Jazan Development Co.*** 16.70 0.3% 4.7% 20.1% -9.0% -3.2% -20.1% 19.7% 1.22 4th 99.96 1.39 0.00% 50,000,000 835,000,000 0.04% 824,915,872 0.09% 12,242.01 -0.66% -0.2% 8.5% 1.0% 33.9% 26.9% 4.9% 1.12 24.73 4.56 2.07% 1,673,889,614 129,978,838,258 6.55% 66,633,929,069 7.58% TAFSI Agriculture & Food Industries TeleCom. & Info. Technology 7010 Saudi Telecom Co. 65.75 -0.4% -0.8% -1.1% -7.4% 8.2% 22.9% 0.0% 0.87 4th 11.95 2.17 3.42% 2,000,000,000 131,500,000,000 6.62% 21,373,894,938 2.43% 7020 Etihad Etisalat Co. 38.40 -0.5% 4.3% -11.5% -40.9% -56.7% -48.3% -13.1% 0.97 4th 134.54 1.44 3.26% 770,000,000 29,568,000,000 1.49% 17,059,797,773 1.94% 7030 ZAIN KSA*** 7.30 0.0% 2.1% 13.2% -23.2% -20.2% -30.6% 13.2% 1.15 4th -6.21 1.44 0.00% 1,080,100,000 7,884,730,000 0.40% 4,087,634,058 0.47% 7040 Etihad Atheeb Telecom. Co.*** 8.05 1.3% 15.0% 15.0% -15.7% -45.1% -54.2% 22.0% 1.11 3rd -14.06 2 0.00% 157,500,000 1,267,875,000 0.06% 869,556,975 0.10% 7050 Saudi Integrated Telecom Co.*** 24.30 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.00 3rd -49.51 2.70 0.00% 100,000,000 2,430,000,000 0.12% 850,500,000 0.10% 1,858.80 -0.37% 1.7% -4.1% -25.6% -34.0% -26.9% -4.3% 0.91 14.34 1.99 3.39% 4,107,600,000 172,650,605,000 8.69% 44,241,383,744 5.03% TTISI TeleCom. & Info. Technology Insurance 8010 The Company for Coop. Ins. 77.00 2.7% 12.4% 49.5% 2.7% 165.5% 42.0% 54.0% 1.01 4th 12.79 3.51 0.00% 100,000,000 7,700,000,000 0.39% 4,109,521,339 0.47% 8011 MetLife AIG ANB Coop Ins Co 57.00 -0.4% -1.3% 10.1% -15.6% -14.9% -18.6% 6.0% 0.93 4th -38.43 8.26 0.00% 17,500,000 997,500,000 0.05% 299,250,000 0.03% 8012 Aljazira Takaful Taawuni Co. 62.75 0.4% -2.0% 4.4% -19.0% 32.4% 21.5% -3.5% 0.81 4th 317.10 6.23 0.00% 35,000,000 2,196,250,000 0.11% 658,875,000 0.07% 8020 Malath Coop. Ins. And Reins. Co.*** 34.40 0.0% 9.6% 20.3% 37.6% 65.0% 43.5% 12.1% 1.19 4th -166.13 3.51 0.00% 30,000,000 1,032,000,000 0.05% 1,032,000,000 0.12% 8030 The Mediterranean Gulf Ins. & Reins.*** 53.75 -1.4% 4.4% 5.9% -27.1% 97.6% 43.3% 7.5% 1.59 4th 27.78 4.54 0.00% 100,000,000 5,375,000,000 0.27% 1,961,875,000 0.22% 8040 Saudi Fransi Coop. Insurance Co.*** 44.30 -0.4% 2.5% 33.8% -17.6% -43.2% -56.4% 26.9% 1.37 4th 55.76 4.75 0.00% 20,000,000 886,000,000 0.04% 310,100,000 0.04% 8050 Saudi IAIC Coop Insurance Co.*** 31.40 0.3% 5.4% 28.2% -7.9% -6.5% -38.2% 12.9% 1.08 4th 139.31 10.78 0.00% 10,000,000 314,000,000 0.02% 219,800,000 0.03% 8060 Saudi United Coop. Insurance Co.*** 25.70 0.4% 6.2% 19.3% -18.7% 0.4% -17.9% 16.8% 1.33 4th 106.26 2.64 0.00% 20,000,000 514,000,000 0.03% 456,946,000 0.05% 8070 Arabian Shield Coop. Insurance Co.*** 43.30 -1.1% 2.4% 28.1% -8.8% 35.3% -2.6% 26.2% 0.96 4th 56.55 3.49 0.00% 20,000,000 866,000,000 0.04% 476,300,000 0.05% 8080 SABB Takaful*** 36.20 0.6% 0.0% 24.8% -12.8% 9.0% -8.1% 14.2% 1.20 4th 72.34 3.44 0.00% 34,000,000 1,230,800,000 0.06% 443,812,000 0.05% Market Value Indicators 5-Feb-15 Code NAME OF COMPANY Current Price 5-Feb-15 Since Wk. Since 1M Since 3M Since 1Y Shares Latest Ratio BETA Shares Performance Daily FY2014 2015YTD 1Year Qrtr. P/E P/B Dvd. Yld. # of shares SAR % to SAR Free Float % to outstanding Capitalization Mkt. Cap. Capitalization Total Cap. 8090 Sanad Ins. & Reins. Coop. Co.*** 15.23 0.0% 0.0% 0.0% 0.0% -16.5% -33.1% 0.0% -0.05 4th -11.55 6.98 0.00% 20,000,000 304,600,000 0.02% 215,656,800 0.02% 8100 Saudi Arabian Coop. Insurance Co.*** 44.10 -0.9% 3.8% 37.8% -22.3% -4.3% -30.7% 27.5% 1.23 4th 21.81 6.25 0.00% 10,000,000 441,000,000 0.02% 299,880,000 0.03% 8110 Saudi Indian Company for Coop. Ins.*** 34.90 0.3% 8.0% 28.3% 3.6% -49.1% -64.8% 22.5% 1.17 4th 500.00 11.99 0.00% 10,000,000 349,000,000 0.02% 240,810,000 0.03% 8120 Gulf Union Coop. Insurance Co.*** 20.60 1.2% 5.6% 22.3% -16.4% -10.0% -27.6% 19.1% 1.13 4th -70.81 3.89 0.00% 22,000,000 453,200,000 0.02% 309,716,880 0.04% 8130 Al Ahli Takaful Co.*** 53.25 0.0% 2.9% 23.0% -9.7% 9.8% -19.4% 28.3% 1.25 4th 29.34 5.32 0.00% 16,666,667 887,500,018 0.04% 394,937,518 0.04% 8140 Al Ahlia Insurance Co.*** 15.60 -0.3% 4.0% 11.4% -15.2% -31.3% -35.2% 10.6% 1.09 4th -9.39 2.21 0.00% 32,000,000 499,200,000 0.03% 471,120,000 0.05% 8150 Allied Coop. Insurance Group*** 27.10 -0.7% 11.5% 18.9% 8.4% 6.3% -24.9% 33.2% 1.11 4th 60.28 4.91 0.00% 20,000,000 542,000,000 0.03% 325,200,000 0.04% 8160 Arabia Insurance Coop. Co.*** 20.20 0.5% 6.0% 30.7% -9.0% 2.3% -36.7% 22.8% 0.96 4th 210.97 6.22 0.00% 20,000,000 404,000,000 0.02% 246,036,000 0.03% 8170 Trade Union Coop. Insurance*** 41.00 0.5% -0.2% 19.2% 9.9% 68.4% 37.6% 19.9% 0.20 4th -74.24 4.41 0.00% 27,500,000 1,127,500,000 0.06% 752,493,500 0.09% 8180 Al Sagr Company for Coop. Ins.*** 31.70 0.6% 2.6% 20.5% -21.1% 13.2% -1.5% 19.6% 1.01 4th 29.83 2.32 0.00% 25,000,000 792,500,000 0.04% 554,750,000 0.06% 8190 United Cooperative Assurance Co.*** 22.35 0.0% 1.4% 14.6% -25.7% 1.8% -19.3% 10.4% 1.13 4th -11.37 3.50 0.00% 28,000,000 625,800,000 0.03% 400,065,000 0.05% 8200 Saudi Re for Coop Reins Co*** 10.00 -2.0% 3.6% 18.3% -12.7% -14.5% -28.0% 16.3% 1.11 4th 101.56 1.22 0.00% 100,000,000 1,000,000,000 0.05% 898,000,000 0.10% 8210 Bupa Arabia for Cooperative Ins.*** 168.00 -0.4% 2.0% 6.0% 7.0% 247.1% 304.3% -1.8% 1.16 4th 22.31 6.56 0.30% 40,000,000 6,720,000,000 0.34% 3,544,800,000 0.40% 8220 Weqaya Takaful*** 19.39 0.0% 0.0% 0.0% 0.0% -29.2% -38.8% 0.0% 0.02 2nd -4.27 43.96 0.00% 20,000,000 387,800,000 0.02% 269,521,000 0.03% 8230 Al Rajhi Co. for Coop. Insurance*** 45.40 0.9% -1.9% 23.4% -13.9% 17.9% -18.2% 26.1% 1.20 4th 44.03 8.62 0.00% 20,000,000 908,000,000 0.05% 345,040,000 0.04% 8240 ACE Arabia Coop. Insurance Co.*** 63.75 -1.2% 2.8% 26.2% -4.9% 9.9% -17.1% 22.6% 1.09 4th 40.57 3.42 0.00% 10,000,000 637,500,000 0.03% 382,500,000 0.04% 8250 AXA Cooperative Insurance Co.*** 38.10 -1.3% -0.3% 12.7% -18.9% 10.4% -6.6% 7.9% 1.12 4th 42.80 3.68 0.00% 20,000,000 762,000,000 0.04% 342,900,000 0.04% 8260 Gulf General Coop Insurance Co.*** 31.20 -0.3% 2.3% 26.8% -23.2% -25.5% -40.7% 17.7% 1.24 4th 25.61 3.02 0.00% 20,000,000 624,000,000 0.03% 405,600,000 0.05% 8270 Buruj Coop Insurance Co.*** 42.80 0.9% 6.5% 33.3% -11.4% -0.9% -29.8% 28.9% 1.35 4th 27.70 6.16 0.00% 13,000,000 556,400,000 0.03% 258,726,000 0.03% 8280 Al Alamiya for Coop Ins Co.*** 69.75 -9.7% -40.5% 16.9% 9.8% 159.4% 124.9% 15.5% 0.91 4th -98.66 33.33 0.00% 40,000,000 2,790,000,000 0.14% 837,000,000 0.10% 8290 Solidarity Saudi Takaful Co.*** 22.10 0.2% 3.0% 13.9% -6.2% -2.4% -21.6% 8.9% 1.20 4th -21.50 4.38 0.00% 55,500,000 1,226,550,000 0.06% 882,618,750 0.10% 8300 Wataniya Insurance Company*** 74.50 -0.7% 3.5% 26.3% -9.1% -9.7% -30.4% 18.3% 1.20 4th 64.50 10.86 0.00% 10,000,000 745,000,000 0.04% 257,025,000 0.03% 8310 Amana Cooperative Insurance Co.*** 16.15 2.2% 2.5% 27.7% -34.2% -49.5% -64.7% 4.2% 1.23 4th -7.01 4.07 0.00% 32,000,000 516,800,000 0.03% 405,688,000 0.05% 8311 Saudi Enaya Coop. Insurance Co.*** 30.30 0.3% 3.8% 23.2% -17.2% -10.9% -35.5% 16.5% 1.17 4th -26.83 4.82 0.00% 40,000,000 1,212,000,000 0.06% 484,800,000 0.06% 8312 Alinma Tokio Marine Co 52.50 0.0% 6.5% 44.6% -9.5% -13.9% -43.7% 41.9% 1.10 4th -35.74 11.81 0.00% 20,000,000 1,050,000,000 0.05% 315,000,000 0.04% 1,495.01 -0.14% 1.9% 20.8% -7.6% 36.4% 5.7% 17.2% 0.95 25.19 3.51 0.00% 1,058,166,667 46,673,900,018 2.35% 23,808,363,787 2.71% TINSI Insurance Multi-Investment 2030 Saudi Arabia Refineries Co. 68.25 -0.4% 6.2% 41.6% -3.5% 16.7% -15.9% 38.2% 1.22 4th 38.92 2.12 0.88% 15,000,000 1,023,750,000 0.05% 1,023,750,000 0.12% 2120 Saudi Advanced Industries Co. 22.45 0.7% 3.0% 21.7% -8.7% 18.2% 0.0% 21.4% 1.19 4th 63.69 1.24 2.23% 43,200,000 969,840,000 0.05% 711,243,277 0.08% 2140 Al Ahsa Development Co.*** 16.85 0.0% 3.1% 20.8% -4.8% 14.6% -0.7% 15.0% 1.12 4th -27 1.65 0.00% 49,000,000 825,650,000 0.04% 825,650,000 0.09% 2190 Saudi Industrial Services Co. 18.15 2.3% 3.1% 24.3% -4.7% 13.1% -10.4% 20.2% 1.20 4th 15.81 1.35 2.75% 68,000,000 1,234,200,000 0.06% 1,052,807,012 0.12% 0.21% 4080 Aseer Trading, Tourism & Mfg. Co. 28.70 -1.0% 5.9% 20.1% -0.3% 27.8% 2.2% 20.8% 1.28 4th 19.48 1.39 3.48% 126,388,889 3,627,361,114 0.18% 1,816,578,726 4130 Al Baha Investment & Dev. Co.*** 13.50 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.00 4th -49.30 52.43 0.00% 15,000,000 202,500,000 0.01% 202,500,000 0.02% 4280 Kingdom Holding Co. 19.00 0.0% 5.6% 7.3% 0.4% -20.8% -26.5% 5.6% 0.73 4th 81.02 2.18 0.93% 3,705,882,300 70,411,763,700 3.55% 3,520,588,185 0.40% 4,243.86 0.06% 5.0% 17.3% -2.2% -0.5% -15.4% 15.4% 0.99 65.8 2.09 1.10% 4,022,471,189 78,295,064,814 3.94% 9,153,117,200 1.04% 0.08% TMISI Multi-Investment Industrial Investment 1201 Takween Advanced Industries 54.00 4.9% 7.5% 28.0% 3.8% 37.1% 21.7% 14.6% 1.05 4th 34.16 3.87 0.93% 35,000,000 1,890,000,000 0.10% 665,039,214 1210 BCI 37.80 0.0% 2.4% 20.4% -6.2% 16.7% -11.2% 28.6% 1.30 4th 43.91 2.25 2.65% 27,500,000 1,039,500,000 0.05% 810,198,207 0.09% 1211 MA'ADEN 37.70 1.1% 3.9% 24.0% 13.2% 31.1% 1.8% 23.6% 1.32 4th 32.45 1.65 0.00% 1,168,478,261 44,051,630,440 2.22% 14,513,308,680 1.65% 1212 Astra Industrial 37.40 2.7% 7.8% 23.4% -16.5% -35.5% -40.0% 17.6% 1.06 4th 25.25 1.56 4.68% 74,117,647 2,771,999,998 0.14% 1,557,503,627 0.18% 1213 Al-Sorayai Trading & Ind. Group Co. 17.85 1.4% 5.3% 15.2% -17.2% -14.8% -24.0% 9.2% 1.19 4th -22.68 1.48 2.80% 37,500,000 669,375,000 0.03% 669,375,000 0.08% 1214 Al Hassan Ghazi Ibrahim Shaker 75.50 0.0% 0.7% 24.3% -9.6% 6.0% -14.0% 25.8% 0.94 4th 5.80 2.59 3.31% 35,000,000 2,642,500,000 0.13% 1,732,725,000 0.20% 2070 SPIMACO 43.30 -0.2% 2.6% 26.6% -0.9% 6.8% -20.4% 28.1% 1.10 4th 16.40 1.49 2.31% 120,000,000 5,196,000,000 0.26% 3,353,175,555 0.38% 2150 ZOUJAJ 40.00 -0.2% 5.0% 22.0% -2.4% 36.1% 9.0% 22.3% 1.21 4th 19.51 1.95 4.25% 30,000,000 1,200,000,000 0.06% 855,600,000 0.10% 2180 FIPCO 55.50 -0.4% 2.3% 26.7% -6.7% 9.4% -11.8% 19.9% 1.25 4th 26.30 3.45 1.80% 11,500,000 638,250,000 0.03% 638,250,000 0.07% 2220 Maadaniyah 37.00 -0.5% 5.1% 23.7% -21.3% 22.1% -2.3% 22.1% 1.23 4th 50.14 2.67 1.35% 28,112,089 1,040,147,293 0.05% 671,261,955 0.08% 2230 Saudi Chemical Co. 67.50 5.5% 12.0% 27.4% 8.4% 19.5% 5.5% 16.4% 1.06 4th 15.05 2.76 5.93% 63,240,000 4,268,700,000 0.21% 4,140,450,000 0.47% 2300 Saudi Paper Manufacturing Co. 28.70 0.0% 5.1% 22.6% -14.1% 4.7% -14.9% 20.1% 1.28 4th 49.43 1.85 0.00% 45,000,000 1,291,500,000 0.07% 774,900,000 0.09% Market Value Indicators 5-Feb-15 Code NAME OF COMPANY Current Price Daily Since Wk. Since 1M Since 3M Shares Latest Ratio BETA Shares Performance 5-Feb-15 Since 1Y FY2014 2015YTD 1Year Qrtr. P/E P/B Dvd. Yld. # of shares SAR % to SAR Free Float % to outstanding Capitalization Mkt. Cap. Capitalization Total Cap. 2340 Al Abdullatif Industrial Investment Co. 38.60 0.0% 7.2% 18.4% -4.9% 0.8% -17.6% 14.2% 1.03 4th 15.65 2.30 6.48% 81,250,000 3,136,250,000 0.16% 936,213,432 4140 Saudi Industrial Export Co. 56.50 5.1% 17.0% 52.7% -3.0% 22.3% -16.8% 47.9% 1.21 4th 238.64 4.74 0.00% 10,800,000 610,200,000 0.03% 610,200,000 0.07% 8,064.86 1.47% 5.2% 24.7% 2.9% 15.4% -7.0% 22.3% 1.11 23.75 1.82 1.29% 1,767,497,997 70,446,052,731 3.55% 31,928,200,670 3.63% TIVSI Industrial Investment 0.11% Building & Construction 1301 United Wire Factories Co. 39.20 -0.3% 8.9% 17.0% -7.8% 11.9% -2.2% 13.0% 1.11 4th 18.37 3.41 2.83% 43,875,000 1,719,900,000 0.09% 1,719,900,000 0.20% 1302 Bawan Company 56.75 -1.7% 3.2% 26.1% -17.5% 3.2% -25.2% 19.5% 1.25 4th 16.08 3.74 2.64% 50,000,000 2,837,500,000 0.14% 1,516,643,750 0.17% 1303 Electrical Industries Co 65.75 3.1% 6.5% 22.3% #DIV/0! - 3.2% 17.9% - 4th 17.22 4.75 0.00% 45,000,000 2,958,750,000 0.15% 887,625,000 0.10% 1310 Mohammad Al Mojil Group Co.*** 12.55 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.00 4th -2.29 -0.89 0.00% 125,000,000 1,568,750,000 0.08% 784,375,000 0.09% 1320 Saudi Steel Pipe Co. 27.60 -1.4% 0.7% 12.2% -14.6% -23.3% -31.8% 14.0% 1.12 4th 44.73 1.74 5.43% 51,000,000 1,407,600,000 0.07% 613,997,190 0.07% 1330 Abdullah A. M. Al-Khodari Sons Co. 34.00 1.5% 8.6% 18.1% -51.9% 3.0% -7.0% 11.1% 1.01 4th 17.85 2.04 1.47% 53,125,000 1,806,250,000 0.09% 797,298,572 0.09% 2040 Saudi Ceramic Co. 115.75 -0.2% 5.2% 15.5% -13.3% -4.9% -4.9% 9.2% 0.98 4th 13.99 2.53 2.30% 37,500,000 4,340,625,000 0.22% 3,344,172,721 0.38% 2090 National Gypsum Co. 29.00 0.0% 3.9% 26.9% -14.5% -1.7% -24.0% 23.9% 1.24 4th 43.83 1.94 2.76% 31,666,667 918,333,334 0.05% 802,697,583 0.09% 2110 Saudi Cable Co. 10.40 0.5% 4.5% 14.9% -11.1% -13.0% -26.2% 11.8% 1.02 4th -3.89 1.73 0.00% 76,000,000 790,400,000 0.04% 642,229,318 0.07% 2130 Saudi Indistrial Development Co. 16.95 -0.6% 0.9% 19.4% -14.6% -8.6% -25.3% 14.5% 1.19 4th 95.06 1.65 0.00% 40,000,000 678,000,000 0.03% 677,994,915 0.08% 2160 Saudi Arabian Amiantit Co. 14.55 0.7% 3.9% 13.2% -7.3% -7.3% -14.7% 11.1% 1.07 4th 20.34 1.17 6.87% 115,500,000 1,680,525,000 0.08% 1,680,525,000 0.19% 2200 Arabian Pipes Co.*** 21.30 0.5% 5.2% 11.5% -19.6% -10.5% -20.4% 10.4% 1.14 4th -16.28 1.29 0.00% 40,000,000 852,000,000 0.04% 731,716,344 0.08% 2240 Zamil Industrial Investment Co. 57.25 -0.4% 3.6% 25.8% -3.8% 23.1% 8.3% 21.5% 1.28 4th 13.19 1.97 3.49% 60,000,000 3,435,000,000 0.17% 2,576,214,219 0.29% 2320 Al Babtain Power & Telecom Co. 39.50 1.0% 12.5% 46.3% -3.9% 23.1% -15.3% 45.8% 1.16 4th 15.83 2.28 2.53% 42,631,312 1,683,936,824 0.08% 1,683,936,824 0.19% 2360 Saudi Vitrified Clay Pipes Co. 101.00 0.0% 5.2% 18.1% -3.6% 40.3% 23.3% 12.2% 0.94 4th 15.06 6.01 4.95% 15,000,000 1,515,000,000 0.08% 932,028,000 0.11% 2370 Middle East Specialized Cables Co.*** 24.95 0.6% 0.0% 29.6% 22.3% 76.3% 59.3% 13.9% 0.91 4th -64.48 3.11 0.00% 60,000,000 1,497,000,000 0.08% 1,497,000,000 0.17% 4230 Red Sea Housing 4th 16.27 2.62 1.96% 60,000,000 2,550,000,000 0.13% 1,007,250,000 0.11% 17.00 2.43 2.74% 946,297,979 32,239,570,158 1.62% 21,895,604,435 2.49% TBCSI Building & Construction 42.50 1.2% 5.2% 23.5% -18.7% -4.9% -0.5% 17.1% 1.21 3,845.98 0.15% 5.0% 21.5% -11.4% 6.4% -5.7% 16.4% 1.02 Real Estate Development 4020 Saudi Real Estate Co. 40.50 0.7% 2.0% 21.3% -4.5% 27.4% -2.3% 19.8% 1.05 4th 17.42 1.40 2.47% 120,000,000 4,860,000,000 0.24% 1,489,260,492 0.17% 4090 Taiba Holding Co. 43.90 -1.8% 5.5% 7.6% 3.5% 0.5% 3.0% 8.1% 0.97 4th 5.42 1.65 6.83% 150,000,000 6,585,000,000 0.33% 3,929,183,895 0.45% 4100 Makkah Construction & Dev. Co. 84.00 0.6% 2.8% 10.2% 6.3% 24.4% 20.2% 8.4% 0.90 3rd 44.30 1.94 2.98% 164,816,240 13,844,564,160 0.70% 9,254,715,792 1.05% 4150 Arriyadh Development Co. 23.00 -1.1% 0.7% 19.8% 4.5% -3.3% -3.1% 12.2% 1.11 4th 16.19 1.79 4.35% 133,333,333 3,066,666,659 0.15% 3,065,724,878 0.35% 4220 Emaar, The Economic City 14.60 -1.7% -1.7% 20.7% -11.0% 3.5% -10.2% 22.2% 1.48 4th 32.68 1.51 0.00% 850,000,000 12,410,000,000 0.62% 4,976,345,629 0.57% 4250 Jabal Omar Dev. Co.*** 57.75 0.9% 3.1% 11.6% 13.2% 78.2% 79.8% 10.0% 0.80 4th 125.81 5.77 0.00% 929,400,000 53,672,850,000 2.70% 31,583,642,533 3.59% 4300 Dar Al Arkan Real Estate Dev. Co. 10.45 -0.5% 2.5% 35.7% -14.3% -1.4% -17.3% 28.2% 1.33 4th 19.64 0.64 0.00% 1,080,000,000 11,286,000,000 0.57% 10,933,401,774 1.24% 4310 Knowledge Economic City*** 20.60 1.0% 4.0% 27.2% 3.3% 18.1% -4.8% 22.3% 1.36 4th -240.51 2.22 0.00% 339,300,000 6,989,580,000 0.35% 2,101,200,000 0.24% 6,731.21 0.17% 2.6% 16.1% 3.1% 31.0% 24.2% 13.8% 0.55 31.32 2.06 1.05% 3,766,849,573 112,714,660,819 5.68% 67,333,474,993 7.66% TRDSI Real Estate Development Transport 4030 The Nat'l. Shipping Co. of Saudi Arabia 38.10 0.5% 0.8% 13.7% 19.1% 34.6% 20.6% 12.1% 1.02 4th 28.10 1.92 2.62% 393,750,000 15,001,875,000 0.76% 7,839,221,266 0.89% 4040 Saudi Public Transport Co. 26.60 0.8% 3.9% 26.7% -12.8% -9.8% -11.4% 10.8% 1.14 4th 32.58 2.23 2.82% 125,000,000 3,325,000,000 0.17% 2,780,635,336 0.32% 4110 Saudi Land Transport Co.*** 40.70 0.5% 2.0% 15.6% -7.9% 17.0% -3.4% 20.8% 1.30 4th 17 2.97 2.46% 18,000,000 732,600,000 0.04% 732,567,847 0.08% 4260 United International Transport Co. Ltd. 76.25 -2.2% -1.6% 12.1% 7.8% 18.6% 29.6% 9.3% 0.81 4th 18.13 3.93 2.21% 40,666,667 3,100,833,359 0.16% 2,013,957,929 0.23% 8,098.90 0.15% 1.1% 16.1% 7.5% 19.0% 11.8% 11.8% 1.17 26.04 2.14 2.59% 577,416,667 22,160,308,359 1.12% 13,366,382,377 1.52% TTRSI Transport Media and Publishing 4070 Tihama Advertising & Public Relations 90.25 0.0% -0.3% -0.8% -5.2% -34.7% -17.5% -0.3% 0.08 3rd -25.28 9.60 0.00% 15,000,000 1,353,750,000 0.07% 1,091,744,142 0.12% 4210 Saudi Research & Marketing Group 19.45 -0.3% 11.1% 35.6% 1.6% -6.7% -22.1% 16.5% 0.86 4th -40.00 1.39 0.00% 80,000,000 1,556,000,000 0.08% 1,022,309,505 0.12% 4270 Saudi Printing & Packaging Co. 4th 32.84 0.00 2.35% 60,000,000 1,275,000,000 0.06% 605,625,000 0.07% 32.84 1.41 2.35% 155,000,000 4,184,750,000 0.21% 2,719,678,647 0.31% TMPSI Media and Publishing 21.25 -1.6% 2.4% 16.2% -14.7% -11.8% -21.2% 13.0% 0.96 2,386.08 -0.46% 4.4% 14.8% -5.2% -21.1% -19.6% 8.4% 1.08 Hotel & Tourism 1810 AlTayyar Travel Group 133.50 -6.0% -3.3% 18.1% 0.4% 44.5% 39.0% 12.2% 1.18 4th 17.83 7.04 2.40% 150,000,000 20,025,000,000 1.01% 11,609,181,627 1.32% 1820 Abdulmohsen Alhokair group 77.75 -1.6% 5.1% 32.9% 3.3% #DIV/0! 18.0% 31.8% 1.19 4th 21.76 5.71 1.61% 55,000,000 4,276,250,000 0.22% 1,282,875,000 0.15% 4010 Saudi Hotels & Resort Areas Co. 33.70 -0.6% 2.7% 15.4% -4.3% 0.3% -15.1% 15.4% 1.15 4th 32.41 1.89 3.56% 100,000,000 3,370,000,000 0.17% 1,211,262,351 0.14% 4170 Tourism Enterprise Co. 51.75 2.0% 13.5% 35.5% -24.2% -38.9% -52.8% 33.0% 0.97 4th 106.34 5.61 0.00% 10,150,000 525,262,500 0.03% 525,262,500 0.06% THTSI Hotel & Tourism 22,654.31 -4.92% -1.6% 19.6% -0.9% 31.9% 22.2% 14.6% 1.21 19.74 15.05 0.43% 315,150,000 28,196,512,500 1.42% 14,628,581,478 1.66% TASI Tadawul All Share Index 9,180.11 0.12% 3.4% 13.2% -4.7% 4.4% -2.4% 10.2% 1.00 16.26 2.14 3.11% 48,850,244,833 1,985,761,693,584 100.0% 879,013,967,934 100.0% *** PE calculation; for all the sectors and TASI excluding companies reported Net Loss on TTM basis, and the companies that have not been fully operational, and new companies for which earning numbers are not available. Free Float based on Quarterly Data; this report based on the data from Tadawul. Saudi Market Movers (Top & Bottom 20) As of 5-Feb-2015 GAINERS 5.5% Saudi Chemical 5.4% GACO 5.1% 4.9% 3.7% 3.1% LOSERS Al Alamiya AlTayyar Saudi Export eXtra Takween SABIC National Commercial Bank Electrical Industries Co 2.7% Astra Indust 2.7% Tawuniya -9.7% -6.0% -3.2% -2.6% Alujain -2.4% Budget Saudi -2.2% Saudi Re -2.0% Nama Chemicals -1.8% Taiba -1.8% Farm Superstores -1.8% Bawan Company -1.7% Emaar EC -1.7% SHAMS Saudi Printing -1.6% 1.7% Al Rajhi Najran Cement -1.6% 1.6% APPC Al Hokair Group -1.6% 1.5% ALKHODARI 1.4% AlSorayai Group 1.4% Jarir 1.3% Atheeb Telecom 1.2% Gulf Union 2.5% Care 2.4% Herfy Foods 2.3% SISCO 2.2% AMANA Insurance 2.0% Saudi Steel -1.4% Umm Al-Qura Cement Co -1.4% MEDGULF -1.4% SHB -1.3% AXA-Cooperative -1.3% Page 16 of 17 Disclaimer: “All rights reserved. This research document is prepared for the use of clients of FALCOM Financial Services and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the express written consent of FALCOM Financial Services. Receipt and review of this research report constitutes your agreement not to redistribute, retransmit, or disclose to others the contents, opinions, conclusion, or information contained in this report (including any investment recommendations, estimates or price targets) prior to public disclosure of such information by FALCOM Financial Services. The information herein was obtained from various sources believed to be reliable but we do not guarantee its accuracy. FALCOM Financial Services makes no representations or warranties whatsoever as to the data and information provided and FALCOM Financial Services does not represent that the information content of this document is complete or free from any errors. This research report provides general information only. Neither the information nor any opinion expressed constitutes an offer or an invitation to make an offer, to buy or sell any securities or other investment products related to such securities or investments. It is not intended to provide personal investment advice and it does not take into account the specific investment objectives, financial situation and the particular needs of any specific person who may receive this report. Investors should seek financial advice regarding the appropriateness of investing in any securities, other investment or investment strategies discussed or recommended in this report and should understand that statements regarding future prospects may not be realized. Investors should note that income from such securities or other investments, if any, may fluctuate and that price or value of such securities and investments may rise or fall. Accordingly, investors may receive back less than originally invested. Any investment action based on the contents of this document is entirely the responsibility of the investor. FALCOM Financial Services or its officers or one or more of its affiliates (including research analysts) may have a financial interest in securities of the issuer(s) or in related investments. Our Research documents and reports are subject to change without notice.”

© Copyright 2026