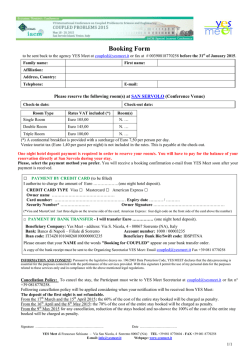

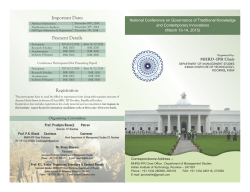

Societal Innovations for Global Growth