a-2368-12t4 kerry licciardi vs. marc licciardi

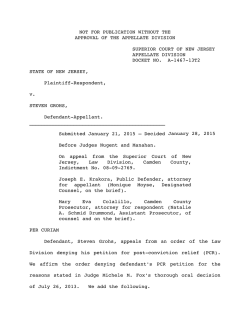

NOT FOR PUBLICATION WITHOUT THE

APPROVAL OF THE APPELLATE DIVISION

SUPERIOR COURT OF NEW JERSEY

APPELLATE DIVISION

DOCKET NO. A-2368-12T4

KERRY LICCIARDI,

Plaintiff-Appellant,

v.

MARC LICCIARDI,

Defendant-Respondent.

_____________________________________

Submitted January 15, 2014 – Decided January 29, 2015

Before Judges Waugh and Nugent.

On appeal from Superior Court of New Jersey,

Chancery

Division,

Family

Part,

Morris

County, Docket No. FM-14-552-06.

Kerry A. Licciardi, appellant pro se.

Respondent has not filed a brief.

The opinion of the court was delivered by

NUGENT, J.A.D.

Plaintiff Kerry Licciardi appeals from parts of a postdivorce

Family

Part

order

that

reduced

defendant

Marc

Licciardi's child support payments, increased his responsibility

to

pay

for

the

parties'

children's

extracurricular

and

extraordinary expenses, and denied plaintiff's motion to compel

defendant to produce documents.

affirm.

For the reasons that follow, we

After ten years of marriage during which two children were

born, the parties were divorced by a judgment that incorporated

their Property Settlement Agreement (PSA).

Defendant agreed in

the PSA to pay monthly child support of $3300 based on his gross

income of $175,000.

Plaintiff was unemployed but intended to

obtain a teaching certification.

The parties acknowledged in

the PSA that defendant was paying child support in excess of the

Child Support Guidelines found in Rule 5:6A (the guidelines).

Defendant

also

agreed

not

to

seek

a

reduction

in

his

child

support obligation "for three years regardless of any change of

circumstance . . . ."

The PSA provided that "child support may

be reviewed at the expiration of three years . . . and every two

years thereafter until both children are emancipated."

In March 2010, defendant filed a motion to reduce his child

support, which the court granted, decreasing his monthly child

support payments from $3300 to $2107.43.

That amount again

exceeded the amount provided for in the guidelines.

The court

explained its reasons for making the upward adjustment from the

guideline

amount,

including

the

disparity

in

the

parties'

standard of living, income, and respective earning abilities.

The court's finding that defendant's salary had decreased was

based on its averaging the parties' salaries over a three-year

period

from

2007

through

2009.

Defendant's

$148,713.33 and plaintiff's average was $32,340.66.

2

average

was

Under that

A-2368-12T4

analysis,

defendant's

average

income

had

decreased

by

approximately $26,000 from what he was earning when the parties

entered into the PSA.

In one of the years included in the

average, 2008, defendant had earned $245,496.

When defendant applied for and received his first child

support reduction, he had remarried and he and his second wife

had a two-year-old child.

in

its

statement

of

The court did not refer to that child

reasons

for

reducing

defendant's

child

support.

In September 2012, two and one-half years after receiving

his first support reduction, defendant filed a motion seeking a

further reduction.

certification

in

In support of his motion, defendant filed a

which

he

averred

that

since

the

previous

reduction he, and his second wife had divorced and he was now

paying $500 in monthly child support for their child.

certified

that

since

the

last

order

had

been

He also

entered,

his

employer "was legally able to deduct from [his paycheck] . . .

less than the Ordered amount[,]" and in order for him to stay

current with his obligations, he had to take a loan against his

401K.

He claimed he had no further ability to borrow money

because he had maximized his loan against his 401K, and his

credit rating was very low because his house had "slip[ped]

[into] foreclosure due to the very small amount of money [he]

actually take[s] home from [his] paycheck."

3

Because he had

A-2368-12T4

previously

averaged

his

income

over

three

years,

defendant

supported his motion with his income tax returns and W2's for

2009, 2010 and 2011, and he included a year-to-date statement of

his income for 2012.

Plaintiff filed an opposing certification and cross-motion

seeking

an

upward

directing

adjustment

defendant

extracurricular

compelling

to

and

in

pay

child

100%

extraordinary

defendant

to

produce

support;

of

the

expenses;

various

and

financial

records for the years 2010 through present.

an

order

children's

an

order

and

other

In support of her

motion, plaintiff certified that her own circumstances had taken

a downward turn.

the

added

coverage.

She had lost her teaching job, and she now had

expense

of

$345

per

month

for

reduced

medical

She had withdrawn money from her retirement account

and had substantially increased her credit card debt.

In opposing defendant's motion, plaintiff asserted, among

other things, that defendant had not complied with Rule 5:54(a);

had

provided

"incomplete,

inaccurate

and

internally

inconsistent" documentation; and had not "established a baseline

against

which

viewed."

deficiencies

case

his

She

in

information

current

gave,

financial

among

defendant's

statement

others,

motion:

(CIS)

situation

these

examples

defendant

listing

his

[could]

had

of

be

the

attached

previous

a

year's

gross income as $75,486, but his 2011 federal income tax return

4

A-2368-12T4

showed gross income of $155,242; defendant's projected yearly

income for 2012 was approximately $140,000, but that did not

take into account defendant's year-end bonuses or commissions;

and defendant reported $2000 in monthly rental income for his

two

rental

properties,

but

reported

$3000

in

monthly

rental

income on his 2011 federal tax return.

Plaintiff

also

asserted

that

defendant

was

sheltering

income by purchasing stock options offered by his employer.

certified

that

since

defendant's

March

2010

child

She

support

reduction, he had taken an eight-day trip to Mexico, an eightday trip to Disney World, a business trip to Orlando, another

trip to Orlando with the parties' children, and he had invited

their children to go with him to Cancun.

foregoing

and

other

defendant

should

pay

considerations,

all

of

their

Lastly, based on the

plaintiff

children's

claimed

that

extracurricular

expenses.

Defendant filed a reply certification in which he disputed

much

of

what

plaintiff

had

asserted.

He

explained

the

discrepancies between his CIS and his tax returns based upon his

interpretation

of

the

CIS

instructions

and

the

difference

between gross earned income and gross taxable income.

He also

explained that his year-to-date income included a 2011 year-end

bonus that was not paid until 2012.

He averred that any stock

he received from his employer as income reported on his paystub

5

A-2368-12T4

was

taxable,

and

immediately.

that

he

had

to

pay

taxes

on

that

stock

Defendant claimed he had a studio apartment above

his garage for which he received $3000 in rental income and he

once had a short-term renter in a previous marital property.

As previously noted, the court reduced defendant's child

support payments, denied without prejudice plaintiff's motion to

compel defendant to produce documents, and increased defendant's

obligation

to

pay

the

children's

extracurricular

and

extraordinary expenses.

The court found that the parties had

established

and

substantial

permanent

changed

circumstances

based on defendant paying monthly child support for his third

child

following

his

divorce

from

his

second

wife,

plaintiff

losing her job, and a new parenting time schedule created by the

parties

which

significantly

reduced

the

number

of

overnights

enjoyed by defendant.

The court further explained that plaintiff's adjusted gross

taxable income for child support purposes was calculated based

on

her

weekly

unemployment

compensation

of

$611

and

that

"[t]axable interest and dividends and taxable retirement plan

distributions

return."

were

taken

from

[p]laintiff's

2011

federal

tax

According to the court, defendant's adjusted gross

taxable income for child support purposes was calculated based

on his year-to-date earnings of $107,310.26, which calculated to

a weekly amount of $2683; in addition to which defendant had

6

A-2368-12T4

received $2000 in year-to-date rental income on his CIS.

The

court noted that "[i]nterest and dividend income and income tax

credits or rebates were averaged over three . . . years based on

his 2009-2011 federal tax returns."

Acknowledging that plaintiff objected to the accuracy of

defendant's CIS, the court ruled that "she [had] not provide[d]

persuasive proof that [d]efendant [had] committed tax fraud or

that his [] tax returns should be disregarded."

The court also

noted

stocks

that

the

guidelines

"expressly

exclude

from

a

party's gross income, 'unless the court finds that the intent of

the investment was to avoid the payment of child support.'"

The court concluded that "[s]ince [d]efendant's total earnings,

before any pre- or after-tax deductions were taken, were used in

determining [his] weekly income, it is not relevant what his

intent is with regard to the stocks."

Based

on

its

calculation

of

the

parties

gross

taxable

income for child support purposes, its rejection of plaintiff's

arguments

about

disregarded,

defendant's

and

why

its

intention

defendant's

ruling

with

tax

concerning

respect

to

return

the

his

should

irrelevancy

stocks,

modified his child support to $346 per week.

the

be

of

court

The court also

ordered that defendant pay $35 per week toward arrears.

As to plaintiff's motion to compel documents, the court

ruled that "[a]lthough [p]laintiff establishe[d] inconsistencies

7

A-2368-12T4

in [d]efendant's current submissions and prior submissions, she

fail[ed]

to

establish

especially

as

reduce[d]

income."

the

[d]efendant's

For

relevance

tax

that

returns

reason,

of

these

indicate

the

documents

losses

court

that

denied

plaintiff's request.

Lastly, because the court had determined that the parties'

proportionate incomes had changed since they executed the PSA,

and because the proportions of their incomes were 74.47 percent

defendant

and

25.53

percent

plaintiff

according

to

the

guidelines, the court ordered that defendant be responsible for

seventy-five

percent

of

the

children's

extracurricular

and

extraordinary expenses.

Plaintiff appeals from the order implementing the court's

decision.

Defendant has not filed an opposing brief.

Courts are authorized by statute to "revise[] and alter[]"

child support orders "from time to time as circumstances may

require."

N.J.S.A.

2A:34-23.

"The

party

moving

for

the

modification bears the burden of making a prima facie showing of

changed circumstances."

Miller v. Miller, 160 N.J. 408, 420

(1999)

v.

(1980)).

of

(citing

Lepis

Lepis,

83

N.J.

139,

157-59

Changed circumstances "include an increase in the cost

living,

an

increase

or

decrease

in

the

income

of

the

supporting or supported spouse, cohabitation of the dependent

spouse, illness or disability arising after the entry of the

8

A-2368-12T4

judgment, and changes in federal tax law."

J.B. v. W.B., 215

N.J. 305, 327 (2013) (citing Lepis, supra, 83 N.J. at 151).

If the party seeking the modification of a support order

makes a prima facie showing of changed circumstances, "a court

may

order

discovery

and

hold

a

hearing

supporting spouse's ability to pay."

420

(citing

Lepis,

supra,

83

to

determine

the

Miller, supra, 160 N.J. at

N.J.

at

157-59).

"As

is

particularly the case in matters that arise in the Family Part,

a

plenary

hearing

is

only

required

if

material and legitimate factual dispute."

there

is

a

genuine,

Segal v. Lynch, 211

N.J. 230, 264-65 (2012); accord, Lepis, supra, 83 N.J. at 159

("a party must clearly demonstrate the existence of a genuine

issue as to a material fact before a hearing is necessary").

Whether a child support obligation should be modified based

on

changed

circumstances

is

a

decision

that

rests

within

a

Family Part judge's sound discretion.

See Larbig v. Larbig, 384

N.J. Super. 17, 21 (App. Div. 2006).

Each case "'rests upon its

own particular footing and the appellate court must give due

recognition to the wide discretion which our law rightly affords

to

the

trial

judges

who

deal

with

these

matters.'"

Ibid.

(quoting Martindell v. Martindell, 21 N.J. 341, 355 (1956)).

We

will

it

is

contrary

to

of

or

not

disturb

a

trial

manifestly

unreasonable,

reason

to

or

other

court's

arbitrary,

evidence,

9

or

decision

"'unless

or

clearly

the

result

whim

A-2368-12T4

caprice.'"

Jacoby v. Jacoby, 427 N.J. Super. 109, 116 (App.

Div. 2012) (quoting Foust v. Glaser, 340 N.J. Super. 312, 315-16

(App. Div. 2001)).

If

the

changed

court

determines

circumstances

that

that

a

warrants

party

a

has

demonstrated

modification

of

child

support, "[t]he guidelines set forth in Appendix IX of . . .

shall be applied . . . ."

R. 5:6A.

The guidelines "include a

mechanism to apportion a parent's income to all of his or her

legal dependents regardless of the timing of their birth or

family association (i.e., if a divorced parent remarries and has

children, that parent's income should be shared by all children

born to that parent)."

Child Support Guidelines, Pressler &

Verniero, Current N.J. Court Rules, Appendix IX-A on R. 5:6A at

2633 (2015).

good cause.

With

A court may modify or disregard the guidelines for

R. 5:6A.

those

principles

contentions on appeal.

argues

that

guidelines

the

and

trial

failed

in

mind,

we

address

plaintiff's

In her first two arguments, plaintiff

court

to

failed

make

to

proper

properly

utilize

findings

of

the

fact

or

conclusions of law in ordering a reduction of child support.

In

her second argument, plaintiff asserts: "The lower court failed

to

apply

the

support

guidelines."

We

cannot

evaluate

that

argument without the child support worksheet prepared by the

court.

Because plaintiff has not provided the worksheet with

10

A-2368-12T4

the record on appeal, we reject her arguments that the judge

either did not use the guidelines or improperly calculated child

support under the guidelines.

Rule

5:6A

requires

that

a

"Child

Support

Guidelines

worksheet" be filed with any order or judgment that includes

child support.

Here, the order challenged by plaintiff states

explicitly that it is being entered "for the reasons set forth

in

the

attached

Statement

Guidelines worksheet[.]"

included

meaningful

in

the

Reasons

and

Child

Support

The worksheet has not, however, been

appellate

appellate

of

record.

review.

R.

It

is

necessary

2:6-1(a)(1).

for

Although

plaintiff is self-represented, she is held to the same standard

for compliance with our court rules as a litigant represented by

counsel.

Rubin v. Rubin, 188 N.J. Super. 155, 159 (App. Div.

1982).

Plaintiff argues that the court did not relate its finding

of fact to the guidelines.

But we cannot, for example, compare

the court's computation of the parties' incomes – as set forth

in its statements of reasons accompanying the order – with the

computations on the worksheet.

In short, we cannot analyze

plaintiff's arguments because she did not include in the record

the necessary documents.

Plaintiff cites as an example of the court's failure to

give adequate reasons for its opinion the court's decision to

11

A-2368-12T4

allocate

responsibility

expenses

seventy-five

percent to plaintiff.

for

the

percent

to

children's

defendant

extraordinary

and

twenty-five

But the court stated in its decision that

it was doing so based upon the parties' proportionate incomes.

As noted, without the Child Support Guidelines worksheet, we

cannot assess the accuracy of the court's computation of these

incomes.

Plaintiff next contends that defendant was not entitled to

a

reduction

incomplete

in

and

child

support

deceitful,

and

because

his

therefore

disclosures

the

court

could

were

not

properly determine whether or not there was a substantial and

permanent change in the parties' circumstances.

argument for two reasons.

We reject that

First, plaintiff's assertions about

defendant's fraudulent statements were simply bare assertions

buttressed

by

rhetorical

questions,

but

persuasive, competent, documentary evidence.

found.

unsupported

by

any

The trial court so

Its finding was amply supported by the record.

More importantly, plaintiff herself asserted that there had

been a change in circumstances requiring modification of child

support.

It is difficult to discern her argument that the judge

erred by determining that circumstances had changed when she

herself asserted precisely that position in her cross-motion.

Cf. Spring Creek Holding Co. v. Shinnihon U.S.A. Co., 399 N.J.

Super. 158, 177 (App. Div.) ("[t]he filing of a cross-motion for

12

A-2368-12T4

summary

judgment

generally

limits

the

ability

of

the

losing

party to argue that an issue raises questions of fact, because

the act of filing the cross-motion represents to the court the

ripeness of the party's right to prevail as a matter of law"),

certif. denied, 196 N.J. 85 (2008).

Plaintiff's

remaining

arguments

are

without

sufficient

merit to warrant extended discussion in a written opinion.

2:11-3(e)(1)(E).

We add only these comments.

R.

Plaintiff argues

the court should not have considered the birth of a third child

as a change in circumstance warranting a modification of child

support

because

defendant

the

court

previously

moved

had

for

considered

a

child

that

fact

support

when

reduction.

However, defendant and his second wife had not divorced at the

time

the

court

reduction.

granted

defendant

his

first

child

support

Here, the court properly considered that since the

previous order, defendant was paying $500 per month for his

third child.

Plaintiff

also

discovery

to

prove

income.

Because

argues,

that

her

in

essence,

defendant

assertion

had

that

she

fraudulently

concerning

fraud

needed

concealed

was

either

unsupported by evidence or based on rhetorical questions, we

conclude the trial court did not abuse its discretion when it

decided not to conduct a hearing.

13

A-2368-12T4

We note that the court denied without prejudice plaintiff's

cross-motion to compel defendant to produce documents.

In view

of the statement in the court's opinion that plaintiff had not

provided persuasive proof defendant had committed tax fraud or

that his federal tax return should be disregarded, we find no

abuse of discretion.

grant

plaintiff

We presume that the court will likely

discovery

in

the

event

of

a

subsequent

application for a modification of child support.

Affirmed.

14

A-2368-12T4

© Copyright 2026