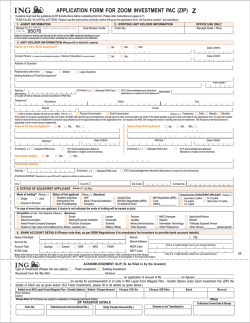

ALGEMENE INFORMATIE ING GLOBALE WONING- EN

Identity and particulars of the relevant parties Insurers: ING Non-Life Belgium SA/nv, an insurance company, licensed by the NBB under the code number 2551. Registered office: Cours Saint Michel 70, B-1040 Brussels - Brussels RPM/RPR - VAT BE 0890.270.750 - Phone + 32 2 738 56 66 - info- The contract The general terms and conditions as well as the special terms and conditions constitute the ING Family and Home Blanket insurance contract. The contract has a term of one year and is tacitly renewable each year. Cover [email protected] - www.ing.be - BIC: BBRUBEBB - The Family and Home Blanket insurance always co- IBAN: BE95 3200 0812 7458. vers one or both of the basic options: the building Insurance agent: ING Belgium SA/nv, an insurance broker, registered with the Banking, Finance and Insurance Commission under the code number 12381A. Registered office: avenue Marnix, 24 - B1000 Brussels – Brussels RPM/RPR – VAT BE 0403.200.393 – www.ing.be – BIC: BBRUBEBB – IBAN: BE45 3109 1560 2789. The product’s main features or home contents. The insurance also always includes the ‘Home Assistance’ option. This option provides, in the event of damage, immediate telephone assistance and fast home assistance (e.g. immediate repair of material damage, rescue and storage of insured goods, temporary accommodation for residents, screening off and/or ensuring the security of the home, relief for the insured, repatriation). ING Family and Home Blanket insurance is a com- In addition you can also choose from a raft of other prehensive insurance for home, contents andfamily options: through its broad basic covers and five supplementary options. It is intended for private individuals from the age of 18 or more whose residence is in Belgium. • consequences of burglary • of injury and/or damage caused to third parties and intended for private and/or (limited) profes• commercial or manufacturing activity is carried out (only office or liberal professions). Family third-party liability (family insurance) protection against the financial consequences The fire insurance covers homes located in Belgium sional use. Professional use is allowed provided no Theft and vandalism: protection against the Family and home legal aid: legal aid following an insured claim • Vehicles not in use: protection of your vehicles Subscription parked in your home or in the immediate vicin- Subscription is possible at any ING branch or via ING ity of your home against fire and lightning in Info by calling + 32 2 464 60 04. particular. The full description of the options is available in the general terms and conditions. Management of the contract Your policy can be amended immediately at any ING branch. Amendment of your contract is free of charge and you will always be notified of amendments by post. You can find more information about your contract or the product in general: • • members, as well as the home insurance and options you are interested in. 3. The premium simulation is based on the rates in force on the date on which it is made and is in no way binding on either you or the insurance company. 4. If you wish to take up our offer, please enter the online via Home’Bank (the policy details can data the insurer needs to assess the application and always be consulted there) compile a policy. by calling ING Info on+32 2 464 60 04 (week- 5. Before you finalise your application, you will al- days from 8 a.m. to 10 p.m. and on Saturdays ways receive a full overview of your details and our from 9 a.m. to 5 p.m.) • details about the policyholder and other family at any ING branch. Filing a claim or requesting assistance In such cases you must call ING Assist’Line: • in Belgium on 02 550 06 00 • abroad by dialling + 32 2 550 06 00. offer, to check everything. 6. If you take out ING Family and Home Blanket insurance, you declare to have read and accepted the insurance proposal, the product’s characteristics, advantages and limitations, this product info sheet as well as the general terms and conditions. The general terms and conditions are available on the ING website and from any ING branch. You will The ING Assist’Line is accessible 24 hours a day, 7 receive a copy together with the special terms and days a week. conditions. Cost of the service 7. In most cases ING will inform you immediately The cost is calculated on the basis of your individual cepted. If immediate acceptance is not possible, situation and the characteristics of your home. A list of the characteristics that determine your premium you will find in this product sheet under the heading “ What determines if you can be insured or stay insured, what the insurance covers and what whether your insurance application has been acyour application will be examined as quickly as possible. If we are unable to accept your application you will be notified in writing. you pay for it?” The premium offered in a premi- 8. If your application is approved, you will received um simulation includes costs, charges and tax. They the special and general terms and conditions of ING are indicated separately in the policy documents. Family and Home Blanket insurance at your ING You can pay your premiums by direct debit from branch. your ING current account. You can also choose the 9. If you cancel another insurance to take out ING payment frequency: monthly, quarterly, six- Family and Home Blanket insurance, we can help monthly and annually (the surcharge for non- you with the formalities if you wish. In that case annual payment is 6, 4 and 2% respectively). together with the policy you will receive a cancellation letter to be signed and returned to us. ING will then finalise the formalities for you. Subscription procedure All documents relating to the subscription and life- 1. You choose the channel through which you take time of your ING Family and Home Blanket insur- out your ING Family and Home Blanket insurance: ance will be archived for a period of at least 5 years ING Info or an ING branch. after the end of the contract. During this period 2. You complete the required information to obtain a premium simulation. Such information includes you can request this data from ING Belgium by sending a letter to its registered office at the ad- dress as indicated under “Identity and particulars of You are entitled to notify ING Non-Life Belgium the relevant parties”. SA/nv that you are terminating the ING Family and Languages used for your relationship with ING Home Blanket insurance agreement. You may exer- This product info sheet as well as the general and Michel 70, B-1040 Brussels. special terms and conditions of the ING Family and Home Blanket insurance are available in four languages: Dutch, French, German and English. You can also read this product info sheet as well as the general terms and conditions via www.ing.be in Dutch, French and English. After concluding the insurance contract, written communication will be in either Dutch or French, at the customer’s discretion. However, translation into English or German is possible upon request. You can always contact the branch in the language of the region (Dutch, French or German) in which the branch is located. Retraction right If you took out the policy via the ING Contact Centre (distance selling) you are entitled to notify ING Non-Life Belgium SA/nv that you wish to terminate the ING Family and Home Blanket insurance, without paying a penalty and without any justification within 30 calendar days. This period will start on the day you receive the contract. You may exercise cise that right by sending a registered letter to: ING Family and Home Blanket insurance, cours Saint The full terms and conditions for cancellation of the agreement are required by law and are determined in Article 5 ‘When and how can the parties terminate the contract?’ of chapter V “All about the contract” of the general terms and conditions of the ING Family and Home Blanket insurance. What determines if you can be insured or stay insured, what the insurance covers and what you pay for it? This information is important on subscribing the insurance, but also after the insurance is concluded. The following characteristics are decisive for the acceptance of the insurance of the building and contents and the optional guarantees theft and vandalism, family third-party liability and legal aid, the extent of the insurance and the price you pay. Not always all the characteristics are requested. We only ask the characteristics which are relevant for this right by sending a letter to: ING Family and your situation. Home Blanket insurance, Cours Saint Michel 70, B- The characteristics are: 1040 Brussels. • the type of building and the contiguity: a Retraction by the policyholder comes into force as house, flat or block of flats and detached, semi- soon as it is notified. If you cancel the agreement detached house or adjacent on both sides. The when it had already come into effect prior to can- type of building and the contiguity have an in- cellation, we charge the premiums for the period fluence on the value as new for which we in- cover was provided. Such amounts represent com- sure you; pensation for the services already provided by the insurer. • letter. The quality determines the extent of the If you exercise the right of retraction, the insurer will refund you all the premiums non used you paid within 30 calendar days at the latest. This period coverage; • example natural stone flooring, façades with traction by letter. natural stone, a swimming pool, a load bear- Termination right ing structure in wood…These determine also the value as new; After the 30-day retraction period, you can termisubject to the statutory 3 months’ period of notice. the division and the characteristics of the building: the number of rooms and the finishing for starts on the day the insurer receives notice of re- nate the contract on the next main maturity date, the quality: namely insured as owner, tenant or • the condition of the building: vacant, dilapidated buildings or buildings meant to be demolished we wish not to insure. If the building is under construction or will be totally renovat- site ([email protected]). The policyholder can contact any ed a premium reduction is accorded because ING branch for that purpose. not all basic covers are yet insured; • • • the construction date of the building: recent Blanket insurance agreement can also be sent in building are less susceptible to damage; writing to the following address: the location of the building: gives an indication • Michel 60, B-1040 Brussels ([email protected] – the occupation: a regularly occupied building Tel. + 32 2 547 61 01 - Fax + 32 2 547 83 20); • the prevention measures taken against burgla- [email protected] - Phone + 32 2 547 58 71 – are equipped with cylinder locks and/ or the Fax + 32 2 547 59 75). building is equipped with an alarm system approved by INCERT; the professional activity which is possibly carried out in the building: we insure only liberal professions (other than chemist) and office activities (without production or storage); • • Such complaint does not exclude the policyholder from taking legal action. Jurisdiction and competent courts Belgian law (in particular the law of 4 April 2014 concerning insurance apply to any dispute relating the value of the content: which determine the to the relationship between you and ING with re- maximum remuneration; gard to the conclusion, application, interpretation the claims record: this gives us information so and execution of the ING Family and Home Blanket that we can estimate correctly the risk. We take insurance agreement. into account whether you and or one of the The Belgian courts of the legal district where the persons living with you had a claim ( inter alia policyholder has his/her domicile are competent to damage by fire, flooding, earthquakes, theft or hear any dispute which may arise in relation to the damage to a third part in your private life ). insurance contract, unless stipulated otherwise in The number of claims and the amount of the Articles 4, 5, 8 to 14 of the European Council regu- damage play also a role. We take also into ac- lation n° 44/2001 of 22 December 2000 on the juris- count If ever an insurance company (including diction, recognition and enforcement of judge- ING Non-Life Belgium SA/nv) already has termi- ments in civil and commercial matters. nated or refused to cover one or several opages did you have after you had this insurance; Code of conduct and competent bodies for the insurance family third-party liability and As an insurance broker, ING Belgium SA/nv is super- legal aid : if the building is insured or not (ad- vised by supervised by the FSMA – rue du Congrès tions you want to insure and how many dam• or the Insurance Ombudsman, de Meeûssquare 35, - B-1000 Brussels (www.ombudsman.as - ry: namely if the outside doors of the building • either Complaint Management, Cours Saint- of the risk on burglary; is less susceptible to a break-in; • Complaints relating to the ING Family and Home vantageous rate) and if all the insured persons 12-14, B-1000 Brussels – Phone + 32 2 220 52 11 – are older than 65 year (premium reduction giv- Fax + 32 2 220 52 75), available at www.fsma.be. en we expect less damage); ING Belgium SA/nv has signed the following codes This information is important on subscribing the of conduct: insurance , but also after the insurance is conclud- • ed. Complaints and disputes Code of Conduct of the Belgian Banking Association, available at www.febelfin.be • Code of Conduct of the insurance agent of the You can send your comments, questions and com- Professional association of Insurance compa- plaints on-line to the message service on the web- nies, available at www.assuralia.be • Code of Conduct relating to electronic trading of the Association of Belgian Enterprises, available at www.vbo.be. The information, offers and charges indicated on the website are only valid on the date on which they are provided, unless another date is expressly indicated. January 2015

© Copyright 2026