ADT Q1 FY15 Earnings Call Slides - Finalx

Q1 2015 Review

EARNINGS CONFERENCE CALL

JANUARY 28, 2015

© 2014 ADT LLC dba ADT Security Services. All rights reserved.

Forward Looking Statements/Safe Harbor

Our reports, filings, and other public announcements may include “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. These forward-looking statements relate to anticipated financial performance, management’s plans and objectives for future operations, business prospects,

outcome of regulatory proceedings, market conditions and other matters. We make these forward-looking statements in reliance on the safe harbor protections provided under the Private Securities

Litigation Reform Act of 1995. All statements, other than statements of historical facts, included in this presentation that address activities, events or developments that we expect, believe or anticipate will

exist or may occur in the future, are forward-looking statements. Forward-looking statements can be identified by various words such as “expects,” “intends,” “will,” “anticipates,” “believes,” “confident,”

“continue,” “propose,” “seeks,” “could,” “may,” “should,” “estimates,” “forecasts,” “might,” “goals,” “objectives,” “targets,” “planned,” “projects,” and similar expressions. These forward-looking statements

are based on management’s current beliefs and assumptions and on information currently available to management that are subject to risks and uncertainties, many of which are outside of our control,

and could cause future events or results to be materially different from those stated or implied in this presentation. Specific factors that could cause actual results to differ from results contemplated by

forward-looking statements include, among others, the following:

•competition in the markets we serve, including new entrants in these markets, and our ability to continue to execute a competitive, profitable pricing structure;

•our ability to compete with new and existing competitors by developing or acquiring new technologies that achieve market acceptance and acceptable margins;

•entry of potential competitors upon the expiration of non-competition agreements;

•an increase in the rate of customer attrition;

•changes in the housing market and consumer discretionary income;

•shifts in consumers' choice of, or telecommunication providers' support for, telecommunication services and equipment;

•failure to maintain the security of our information and technology networks, including personally identifiable information;

•interruption to our monitoring facilities;

•volatility in the market price of our stock;

•current and potential securities litigation;

•failure to realize expected benefits from acquisitions and investments;

•risks associated with pursuing business opportunities that diverge from our current business model;

•potential loss of authorized dealers and affinity marketing relationships;

•risks associated with acquiring and integrating customer accounts;

•failure of our authorized dealers to mitigate certain risks;

•increase in government regulation of telemarketing, e-mail marketing and other marketing upon cost and growth of our business;

•unauthorized use of our brand name;

•risks associated with ownership of the ADT® brand name outside of the United States and Canada by Tyco International Ltd., our former parent company ("Tyco") and other third parties;

•failure to enforce our intellectual property rights;

•allegations that we have infringed the intellectual property rights of third parties;

•changes in U.S. and non-U.S. governmental laws and regulations;

•our dependence on certain software technology that we license from third parties, and failure or interruption in products or services of third-party providers;

•our greater exposure to liability for employee acts or omissions or system failures;

•interference with our customers' access to some of our products and services through the Internet by broadband service providers;

•potential impairment of our deferred tax assets;

•inability to hire and retain key personnel, including an effective sales force;

•adverse developments in our relationship with our employees;

•capital market conditions, including availability of funding sources;

•changes in our credit ratings;

•risks related to our increased indebtedness;

•exposure to counterparty risk in our hedging agreements;

•potential liabilities for legacy obligations relating to the separation from Tyco; and

•failure to fully realize expected benefits from the separation from Tyco.

Given the risk factors and uncertainties that could cause our actual results to differ materially from those contained in any forward-looking statement, we caution investors not to unduly rely on our forwardlooking statements. These risk factors should not be construed as exhaustive. We disclaim any obligations to and do not intend to update the above list or to announce publicly the result of any revisions

to any of the forward-looking statements to reflect future events or developments. If one or more of these risks or uncertainties materialize or if our underlying assumptions prove to be incorrect, actual

results may vary materially from what we projected. Consequently, actual events and results may vary significantly from those included in or contemplated or implied by our forward-looking

statements. More detailed information about these and other factors is set forth in ADT's most recent annual report on Form 10-K, our quarterly reports on Form 10-Q and in other subsequent filings with

the U.S. Securities and Exchange Commission.

2

Leveraging our market leading position while

continuing to invest in our future

Gross Additions

Net Revenue Attrition

262

14.2%

231

13.0%

Q1 FY14

Q1 FY15

New & Resale RPU

$47.28

Q1 FY14

Direct SAC Creation Multiple1

34.0x

31.9x

$44.91

Q1 FY14

Notes: 1. Excludes impact of upgrades.

Q1 FY15

Q1 FY15

Q1 FY14

Q1 FY15

3

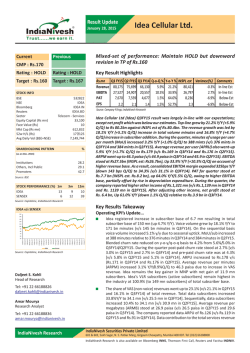

Q1 FY 2015 Overview1

Delivering improvement in operational metrics

Increased gross additions in both channels to 262,000, a 13.4% increase

Lowered revenue attrition by 120 basis points to 13.0%; unit attrition down 70 basis points to 12.9%

Net customer losses reduced to 8k units from 48k units in Q1’14, a reduction of 83.3%

Grew new subscriber RPU to $47.28, up 5.3%

Reduced both Total Company Net SAC creation multiple3 by 0.7x to 31.7x and Direct channel Net SAC

creation multiple3 by 2.1x to 31.9x

Strong financial performance

Grew recurring revenue to $825 million, an increase of 6.5% or 7.1% in constant currency2

Increased EBITDA before special items by 6.3% to $453 million2

Improved EBITDA margins before special items to 51.1%2, a 30 basis point improvement

Diluted earnings per share before special items of $0.512, an 18.6% increase

Steady-State Free Cash Flow before special items grows 13.5% to $8932 million

Repurchased 2.9 million shares at an average price of $32.35

Announced a 5% increase in the quarterly dividend subsequent to the close of the quarter

Notes: 1. All variances are year-over-year unless otherwise noted.

2. Reconciliations from GAAP to non-GAAP financial measures can be found in the appendix.

3. Excludes impact of upgrade units.

4

Investing in ADT’s Future

Enhancing Customer Experience

Total Security Panel and E-Contract roll out

Expanding Commercial Business

Sales force & service capabilities

Building Health Platform

Launching new products and distribution channels

Growing Customer Base & Driving Pulse and higher ARPU

Adds up over 13%; Pulse customers exceed 1.1M

New subscriber RPU up 5.3%

Strengthening Senior Team

Appointed new Canada leader and Board member

5

ADT Pulse Penetration Rates

New/Resale Pulse Installs as % of Total Gross Additions1

60%

60%

50%

50%

53.4%

40%

40%

30%

30%

36.5%

20%

20%

18.8%

10%

10%

7.2%

0%

0%

Q1'12

Q1'13

Total ADT

Q1'14

Residential Direct

PULSE - NEW/RESALE UNIT%

Residential Direct

Small Business

Dealer

Total ADT

Protectron

Q1'15

Small Business

Q1'12

14.4%

5.7%

0.7%

7.2%

Q1'13

29.8%

20.9%

4.5%

18.8%

Q1'14

42.0%

35.9%

28.9%

36.5%

Dealer

Q1'15

56.8%

49.5%

49.9%

53.4%

45.9%

Approximately 71% of new ADT residential customers taking Pulse, with take rates at its highest levels

Total ADT Pulse customers exceeded 1.1M, increasing our Pulse customer base to 18%2 of existing ADT customer base

Upgraded 31K existing customers to Pulse

Notes: 1. Home Health units and bulk account purchases excluded from gross additions in this calculation.

2. Percentage of ADT Pulse customer base excludes Protectron customers.

6

ADT at 2015 International CES

ADT Booth at CES

Named one of Time Magazine’s “6 Coolest Smart

Home Innovations at CES”

ADT Pulse technology featured during key note speech

demonstrating the future of home security

ADT showcased its products in the Sands Expo and

Convention center

ADT Pulse ensures consumers that their “smart

homes” can also be “safe homes”

ADT Business Security Services

ADT Total Security (TS)

Next generation ADT Pulse keypad and panel

No drilling or wiring required

Faster installation time

Services upgraded remotely

Panel sends signal even if keypad by door is broken or

tampered with during break-in

Premier automation capabilities and fully expandable

to support up to 250 sensors or devices through a

single system

Health Security Services

7

Q1 FY 2015 Key Income Statement Item Comparison

F or the

Quarte rs Ended

Recurring revenue

Decem be r 26 ,

De ce m be r 2 7 ,

2014

2013

$

Installation revenue recognition

Net outright sales

T&M and other revenue

Non-recurring revenue

Revenue

$

825

$

C hange

775

6.5%

40

37

8.1%

7

15

-53.3%

15

12

25.0%

62

64

-3.1%

8 39

5.7 %

6.1%

887

$

Cost to serve expenses before special items

277

261

Gross SAC expenses

112

113

-0.9%

D&A

Other

309

281

10.0%

F or the

5

5

0.0%

Quarters Ende d

6 60

6.5 %

De ce m ber 2 6 , De ce m be r 2 7 ,

To tal o pe rating e x pense s (befo re spe cial ite m s)

$

703

$

2 0 14

* EBITDA be fo re spe cial item s

$

* EBITDA margin % before special items

* EBITDA be fo re spe cial item s (pre-SAC )

453

51.1%

$

* EBITDA margin % before special items (pre-SAC)

558

4 26

6.3 %

50.8%

30 bps

$

5 24

6.5 %

66.6%

-20 bps

$

66.4%

Restructuring and other, net (1)

$

17

$

9

Net interest expense

$

50

$

47

Effective tax rate

N e t inco m e

33.3%

$

72

35.8%

$

77

1

23

3

Non-recurring separation costs

Separation related other income (2)

-

5

(1)

Within cost to serve when presented after special items.

(2)

Within other income when presented after special items.

-

1

(9)

17

(6)

$

9

-6 .5 %

$

0 .4 1

$

0 .39

5.1 %

$

0 .5 1

$

0 .43

1 8.6 %

* Dilute d EPS using cash tax rate (be fo re spe cial item s)

$

0 .7 3

$

0 .66

1 0.6 %

* Reconciliations from GAAP to non-GAAP financial measures can be found in the appendix.

5

1

-250 bps

* Dilute d EPS (be fore special item s)

Dilute d EPS (GAAP)

$

Radio conversion costs (1)

Im pact o f special ite m s on ne t inco m e $

6.4%

2

Acquisition and integration costs (1)

Tax effect of taxable special items

Impact of special items on net income

2013

$

8

Key Levers Performance Trends

Customer Additions

Average Revenue per Customer1

(Gross Adds in 000’s)

$47.28

262

$44.91

231

100

84

$41.76

$40.98

147

162

Q1 FY14

Q1 FY15

Direct

Q1 FY14

Dealer

Q1 FY15

New

Direct YOY % = 10.2%, 7.9% excl. Protectron

Dealer YOY % = 19.0%, 12.4% excl. Protectron

Total YOY % = 13.4%, 9.6% excl. Protectron

Average

New/Resale YOY % = 5.3% , 6.4% excl. Protectron

Average YOY % = 1.9%, 4.0% excl. Protectron

Direct channel:

ARPU:

Direct gross adds grew 10% year-over-year despite credit

screening

New/Resale ARPU grew 5.3% YOY and Average ARPU increased

by 1.9% YOY

Growth in Residential and Business channels

RPU growth in all channels driven by increased Pulse adoption

and sales of add-on services such as hosted video in the

Business channel

Strong lead generation, increased self-generated business and

improved close rates

Dealer Channel:

Pulse RPU continues to be approximately 25% higher than nonPulse accounts

Dealer adds grew 16k units, or 19%, to 100k units

Dealer channel nearly doubled Pulse penetration versus Q1’14

Continued to strengthen the quality of the dealer program

Notes: 1. “New” represents ARPU for both new and resale gross additions during the period; “Average” represents ARPU for existing customers, excluding contract monitoring, at the end of the period.

9

Key Levers Performance Trends (continued)

Tenure

Tenure

(T12M Net $ Attrition)

(T12M Net Unit Attrition)

14.2%

13.6%

13.0%

Q1 FY14

Q1 FY15

12.9%

Q1 FY14

Total Company

Q1 FY15

Residential & Small Business

Net revenue attrition improved by 120 basis points to 13.0%

Gross revenue attrition1 improved 80 basis points year-over-year

Strong year-over-year increase in resale units

Lowered net customer losses to 8k units, down from 48k units in Q1’14

Completed rollout of fully-automated credit screening process for the direct channel

Increased staffing, restructured collections, and improved loyalty & retention activities

Attrition remains a priority:

Focus on resales

Tenure screening

Pulse penetration

Notes: 1. Net of Dealer charge backs.

10

Key Levers Performance Trends (continued)

Recurring Revenue Margin%

Subscriber Acquisition Cost (SAC)

(Recurring revenue – Cost to Serve1)

creation multiple

66.3%

66.4%

Q1 FY14

Q1 FY15

Total Company (Existing Customer Base)

Total Company Recurring Revenue Margin YOY % = 10bps

Total Company excluding Protectron2 Recurring Revenue Margin YOY % = 70bps

34.0x

32.4x

Q1 FY14

Direct Channel (excl. upgrades)

31.9x

31.7x

Q1 FY15

Total Company (excl. upgrades)

Direct Net SAC Creation Multiple (excl. upgrades) YOY % = -6.1%

Total Company Net SAC Creation Multiple (excl. upgrades) YOY % = -2.2%

Increased Pulse take rates and sales of add-on services

driving RMR and margin expansion

Direct channel Net SAC creation multiple (excl. upgrades) of

31.9x, an improvement of 2.1x versus Q1’14

Excluding Protectron2, recurring revenue gross margin was

67% and cost to serve expenses1 flat to last year

Total Company Net SAC creation multiple (excl. upgrades)

improved 0.7x over prior year to 31.7x

Executing on business process improvement programs,

including the restructuring of various functions

New Pulse RPU growth combined with cost reduction initiatives

lowering SAC creation multiples

Continuing to invest in customer experience and expanding

into Commercial market

Broad roll-out of electronic contracts and planned hardware

efficiencies expected in FY2015

Notes: 1. Before special items of $26 million in Q1 2015 and $9 million in Q1 2014.

2. Effect of Protectron in Q1 2015 on recurring revenue is $32 million and on cost to serve before special items is $15 million. There was no effect in Q1 2014.

11

Q1 FY 2015 Free Cash Flow

($ in millions, except per share amounts)

Results & YOY Comparison

FCF Drivers and Outlook

Q1

2015

Q1

2014

Change

$453

$426

$27

Cash Interest

($41)

($16)

($25)

Working Capital, Cash

Tax & Other

($22)

($68)

$46

$390

$342

$48

Direct capex

($177)

($157)

($20)

Dealer capex

($146)

($110)

($36)

Other capex2

($21)

($7)

($14)

($344)

($274)

($70)

EBITDA

(before special items)1

Operating cash flow

(before special items)1

Total capex

(before special items)2

Free cash flow

(before special items)1

SteadySteady-state free cash flow

(before special items)1

EBITDA before special items1 growth of 6.3% driven by

strong financial and operational performance

Increased long-term debt to finance share

buybacks, and to a lesser extent acquisitions,

resulting in increased YOY interest expense

Operational efficiencies and working capital

management drove significant YOY reduction

Operating cash flow before special items1 up 14.0%

versus the same period last year

Investing in ADT Pulse and building stronger revenue

profile and customer base

Subscriber capex increase due to 13.4% YOY

growth in gross additions

ADT Pulse take rates exceeded 53%, fueling

Q1’15 new RPU to $47.28, a 5.3% improvement

from Q1’14

Completed 31k Pulse upgrades in the quarter

$46

$893

$68

$787

($22)

Pulse Automation customers continue to

generate strong returns and demonstrate better

attrition characteristics than non-pulse accounts

13.5%

Investments in real estate, improvements in IT

platforms, and for development of new services

led to increase in other capex spend

Notes: 1. Reconciliations from GAAP to non-GAAP financial measures can be found in the appendix.

2. Before special items of $11 million in Q1 2015 and $5 million in Q1 2014 spend in other capex.

12

Capital Structure

($ in millions, except share amounts)

FY 2013

Actual

FY 2014

Actual

Q1 2015

Actual

Total Debt

$3,376

$5,100

$5,258

EBITDA

$1,690

$1,767

$1,8292

Debt / EBITDA1

2.0x

2.8x2

2.9x2

Diluted Average Shares

Diluted Ending Shares3

224

212

183

175

175

173

(% reduction from inception)

(9.8%)

(25.5%)

(26.5%)

before special items1

(trailing 12 month)

Balanced use of capital structure focused on growth and shareholder return

Raised $300 million of fixed debt swapped to variable rate

The Company's average cost of borrowing was below 4% for Q1’15

Dividend growth

Paid quarterly dividend of 20 cents in Q1’15, a 60% increase, compared to 12.5 cents in Q1’14

Announced a 5% increase in the quarterly dividend payable in Q2’15

Opportunistic share repurchases

Repurchases of 2.9 million shares at an average price of $32.35

$286 million remaining on the share buyback authorization

As of the end of Q1’15, reduced diluted ending share count by 26.5%

Notes: 1. Reconciliations from GAAP to non-GAAP financial measures can be found in the appendix.

2. On a pro forma basis, including an estimate of Protectron’s trailing 12 month EBITDA before special items.

3. Ending shares plus the effect of dilutive securities.

13

Progress Towards Achieving FY 2015 Outlook

Recurring revenue growth %2

EBITDA growth

before special items3

T12M Net Unit Attrition

Steady-state free cash flow

before special items3

Additional Q1 Operating Levers

•Gross adds

•SAC Creation Multiples5

•New & Resale RPU

FY 2015E

Outlook

Q1’15

Results1

5% - 6%

7.1%

$70M – $100M

+$27M

< 13%

12.9%

> $1 billion

+14%4

+13.4%

-0.7x

+5.3%

1. In exception of the attrition results, all other comparisons of Q1’15 are on a year-over-year basis.

2. In constant currency. For a reconciliation to the most comparable GAAP measures please see the Appendix.

3. Unless otherwise noted, all figures are before special items and are non-GAAP measures. For a reconciliation to the most comparable GAAP measures please see the Appendix.

4. Compared to Q1’14 SSFCF.

5. Excluding the impact of upgrades.

14

Appendix

15

Q1 FY 2015 SteadySteady -State Free Cash Flow

($ in millions, except per share amounts)

Results & YOY Comparison

SSFCF Drivers and Outlook

Q1

2015

Q1

2014

Change

LQ Annualized EBITDA preSAC (before special items)1

$2,232

$2,096

6.5%

SAC required to maintain

recurring revenue

(1,329)

(1,299)

2.3%

(10)

(10)

0.0%

SteadySteady-state free cash flow

(before special items)1

$893

$787

13.5%

Improvements in customer experience, nonpay initiatives and focus on resale efforts

driving attrition lower

LQ average RMR

$275

$258

6.6%

LTM disconnects, net of

price escalation

Ability to generate strong cash flow allows for

continued investment into creating more

customers

14.6%

14.9%

-30bps

LQ gross recurring revenue

creation multiple

33.1x

33.8x

-2.1%

$1,329

$1,299

2.3%

SSFCF

Maintenance capex

SAC required to maintain

recurring revenue

Notes: 1. Reconciliations from GAAP to non-GAAP financial measures can be found in the appendix.

Steady-State Free Cash Flow up 13.5% YOY

Growth in RPU and gross additions, combined

with lower attrition and cost reductions drove

improvement in Pre-SAC EBITDA

2% YOY reduction in creation multiples

despite increase in Pulse penetration, as

Pulse customers generate higher RPU to

offset higher SAC expense

Launch of new Total Security (TS) panel for

Pulse in Q1’15 and deployment of electronic

contract system throughout 2015 will

continue to drive efficiencies and reduce

creation multiples

16

NonNon-GAAP Financial Measures

Revenue in constant currency, recurring revenue in constant currency, leverage ratio, earnings before interest, taxes, depreciation and amortization

(EBITDA), EBITDA margin, EBITDA (pre-SAC), EBITDA margin (pre-SAC), free cash flow (FCF), steady-state free cash flow (SSFCF), diluted earnings per share

(EPS) and diluted EPS at cash tax rates, in each case "before special items," are non-GAAP measures that may be used from time to time and should not be

considered replacements for GAAP results.

Revenue and recurring revenue, each in constant currency, are useful measures because they provide transparency to the underlying performance in

markets outside the United States by excluding the effect that foreign currency exchange rate fluctuations have on comparability. Revenue and recurring

revenue in constant currency as presented herein may not be comparable to similarly titled measures reported by other companies. The difference between

revenue (the most comparable GAAP measure), revenue in constant currency (non-GAAP measure) and recurring revenue in constant currency (the nonGAAP measure) is the exclusion of the impact of foreign currency exchange fluctuations. This is also the primary limitation of this measure, which is best

addressed by using revenue and recurring revenue in constant currency in combination with GAAP revenue.

The leverage ratio is defined as the ratio of EBITDA before special items to total debt. The leverage ratio is a useful measure of the Company's credit position

and progress towards leverage targets. Refer to the discussion on EBITDA before special items for a description of the differences between the most

comparable GAAP measure. The calculation is limited in that the Company may not always be able to use cash to repay debt on a dollar-for-dollar basis.

EBITDA is a useful measure of the Company's success in acquiring, retaining and servicing our customer base and ability to generate and grow recurring

revenue while providing a high level of customer service in a cost-effective manner. The difference between Net Income (the most comparable GAAP

measure) and EBITDA (the non-GAAP measure) is the exclusion of interest expense, the provision for income taxes, depreciation and amortization expense.

Excluding these items eliminates the impact of expenses associated with our capitalization and tax structure as well as the impact of non-cash charges

related to capital investments.

EBITDA (pre-SAC) is a useful measure of the Company’s success in retaining and servicing our customer base while providing a high level of customer service

in a cost-effective manner. The difference between Net Income (the most comparable GAAP measure) and EBITDA (pre-SAC) (the non-GAAP measure) is the

exclusion of interest expense, the provision for income taxes, depreciation expense, amortization expense, and subscriber acquisition related revenue and

expenses. Excluding these items eliminates the impact of expenses associated with our capitalization and tax structure, the impact of non-cash charges

related to capital investments and the impact of growing our subscriber base.

In addition, from time to time, the Company may present EBITDA and EBITDA (pre-SAC) before special items, which are the respective measures, adjusted to

exclude the impact of the special items highlighted below. These numbers provide information to investors regarding the impact of certain items

management believes are useful to identify, as described below.

17

NonNon-GAAP Financial Measures (continued)

There are material limitations to using EBITDA and EBITDA (pre-SAC). EBITDA and EBITDA (pre-SAC) may not be comparable to similarly titled measures

reported by other companies. Furthermore, EBITDA and EBITDA (pre-SAC) do not take into account certain significant items, including depreciation and

amortization, interest expense and tax expense, which directly affect our net income. Additionally, EBITDA (pre-SAC) does not take into account

expenses related to acquiring new customers. These limitations are best addressed by considering the economic effects of the excluded items

independently, and by considering EBITDA and EBITDA (pre-SAC) in conjunction with net income as calculated in accordance with GAAP. The EBITDA and

EBITDA (pre-SAC) discussion above is also applicable to the respective margin measures.

FCF is a useful measure of our ability to repay debt, make other investments and return capital to shareholders through dividends and share

repurchases. The difference between Cash Flows from Operating Activities (the most comparable GAAP measure) and FCF (the non-GAAP measure)

consists of the impact of capital expenditures, subscriber system assets, dealer generated customer accounts and bulk account purchases. Dealer

generated accounts are accounts that are generated through the network of authorized dealers. Bulk account purchases represent accounts acquired

from third parties outside of the authorized dealer network, such as other security service providers, on a selective basis. These items are subtracted

from cash flows from operating activities because they represent long-term investments that are required for normal business activities.

SSFCF is a useful measure of pre-levered cash that is generated by the Company after the cost of replacing recurring revenue lost to attrition, but before

the cost of new subscribers that drive recurring revenue growth. The difference between Net Income (the most comparable GAAP measure) and SSFCF

(the non-GAAP measure) consists of the factors discussed above regarding EBITDA (pre-SAC), on a quarter-to-date basis. EBITDA (pre-SAC) is then

annualized and adjusted for additional factors, described in the reconciliation below, required to maintain the steady-state. Certain components of these

inputs are determined using trailing twelve month information or information from the most recent quarter.

In addition, from time to time the Company may present FCF and SSFCF before special items, which is FCF or SSFCF, adjusted to exclude the impact of

the special items highlighted below. These numbers provide information to investors regarding the impact of certain items management believes are

useful to identify, as described below.

The limitation associated with using FCF and SSFCF is that they adjust for certain items that are ultimately within management's and the Board of

Directors' discretion to direct and therefore may imply that there is less or more cash that is available than the most comparable GAAP measure. FCF is

not intended to represent residual cash flow for discretionary expenditures since debt repayment requirements and other non-discretionary expenditures

are not reduced. This limitation is best addressed by using FCF and SSFCF in combination with other GAAP financial measures.

FCF and SSFCF as presented herein may not be comparable to similarly titled measures reported by other companies. These measures should be used

in conjunction with other GAAP financial measures. Investors are urged to read the Company's financial statements as filed with the Securities and

Exchange Commission, as well as the accompanying tables to this press release that show all the elements of the GAAP measure.

18

NonNon-GAAP Financial Measures (continued)

Diluted EPS at cash tax rates is a useful measure of the Company's diluted earnings per share after considering the difference between the effective tax

rate and cash tax rate. The difference between diluted EPS (the most comparable GAAP measure) and diluted EPS at cash tax rates (the non-GAAP

measure) is the exclusion of the impact of income tax expense and the inclusion of the impact of income taxes paid, net of refunds. Adjusting for these

items provides information on the impact of our net operating loss carryforwards on our diluted EPS.

The Company has presented its diluted EPS, diluted EPS at cash tax rates, EBITDA, EBITDA margin, EBITDA (pre-SAC), EBITDA margin (pre-SAC), FCF,

SSFCF and other measures before special items. Special items include charges and gains related to acquisitions, restructurings, impairments, and other

income or charges that may mask the underlying operating results and/or business trends of the Company. The Company utilizes these measures to

assess overall operating performance, as well as to provide insight to management in evaluating overall operating plan execution and underlying market

conditions. The Company may also present its effective tax rate as adjusted for special items for consistency. One or more of these measures may be

used as components in the Company's incentive compensation plans. These measures are useful for investors because they may permit more

meaningful comparisons of the Company's underlying operating results and business trends between periods. The difference between net income and

diluted EPS before special items and net income and diluted EPS (the most comparable GAAP measures) consists of the impact of the special items

noted above on the applicable GAAP measure. EBITDA, EBITDA margin, EBITDA (pre-SAC) and EBITDA margin (pre-SAC) before special items do not

reflect any additional adjustments, other than taxes, that are not reflected in net income before special items. The limitation of these measures is that

they exclude the impact (which may be material) of items that increase or decrease the Company's reported operating income, operating margin, net

income and EPS. This limitation is best addressed by using the non-GAAP measures in combination with the most comparable GAAP measures in order

to better understand the amounts, character and impact of any increase or decrease on reported results.

19

THE ADT CORPORATION

GAAP to Non-GAAP Reconciliations

(Unaudited)

Net Income Before Special Items

December 26,

2014

($ in millions)

Net Income (GAAP)

$

Restructuring and other, net

$

82

2

Acquisition and integration costs

Conversion costs

72

(1)

For the

Quarters Ended

September 26,

2014

(1)

Non-recurring separation costs

Separation related other expense (income)

(2)

Pre-separation and other discrete tax items

Net Income before special items

$

77

3

2

15

(1)

$

1

-

(1)

December 27,

2013

-

12

2

-

4

3

-

3

1

89

(7)

97

86

$

$

(1)

Items have been presented net of tax of $9M for the quarter ended December 26, 2014, $11M for the quarter

ended September 26, 2014 and $6M

. for the quarter ended December 27, 2013.

(2)

Relates to the 2012 Tax Sharing Agreement between Tyco, ADT and Pentair.

Diluted EPS Before Special Items

December 26,

2014

Diluted EPS (GAAP)

$

0.41

$

0.10

0.51

(1)

Impact of special items

Diluted EPS before special items

(1)

For the

Quarters Ended

September 26,

2014

December 27,

2013

$

0.47

$

0.39

$

0.08

0.55

$

0.04

0.43

Items have been presented net of tax where applicable.

Diluted EPS Before Special Items at Cash Tax Rates

For the

Quarters Ended

Diluted EPS (GAAP)

December 26,

September 26,

December 27,

2014

2014

2013

$

0.41

$

0.47

$

0.39

Plus: Impact of income tax expense on diluted EPS

0.21

0.15

0.22

Less: Impact of income taxes paid, net of refunds

(0.03)

(0.01)

(0.02)

Diluted EPS at cash tax rates

$

0.59

$

0.14

0.73

(1)

Impact of special items

Diluted EPS before special items at cash tax rates

(1)

Items presented at cash tax rates where applicable.

$

0.61

$

0.59

$

0.18

0.79

$

0.07

0.66

20

THE ADT CORPORATION

GAAP to Non-GAAP Reconciliations (continued)

(Unaudited)

For the Twelve Months Ended

December 26,

September 26,

September 27,

2014

2014

2013

Leverage Ratio

($ in millions)

$

Net Income (GAAP)

Interest expense, net

Depreciation and intangible asset amortization

Amortization of deferred subscriber acquisition costs

Amortization of deferred subscriber acquisition revenue

EBITDA

$

Restructuring and other, net

Radio conversion costs

Non-recurring separation costs

(1)

Separation related other income

EBITDA before special items

EBITDA Margin before special items

$

$

$

421

117

121

128

221

1,066

1,040

942

133

131

123

(154)

(151)

(135)

1,660

$

1,644

$

1,689

17

(1)

7

7

64

44

12

17

23

37

1,794

38

1,767

(23)

1,690

$

51.9%

Protectron adjustment to EBITDA before special items

Pro-forma EBITDA before special items

304

192

14

Acquisition and integration costs

35

1,829

51.8%

$

2

-

$

51.1%

54

1,821

Relates to the 2012 Tax Sharing Agreement between Tyco, ADT and Pentair.

December 26,

2014

$

4

5,254

$

5,258

Current maturities of long-term debt

Long-term debt

Total Debt

Leverage Ratio

(2)

Leverage Ratio including pro-forma Protectron

(2)

$

195

Income tax expense

(1)

299

(2)

September 26,

2014

$

4

5,096

$

5,100

2.9

2.9

2.9

2.8

September 27,

2013

$

3

3,373

$

3,376

2.0

Leverage ratio is defined as the ratio of debt to trailing twelve month EBTIDA before special items or trailing twelve

month EBITDA before special items including pro-forma Protectron.

21

THE ADT CORPORATION

GAAP to Non-GAAP Reconciliations (continued)

(Unaudited)

Operating Cash Flow and FCF Before Special Items

For the

Quarters Ended

December 26,

December 27,

2014

2013

($ in millions)

Operating cash flow (GAAP)

$

369

Restructuring and other, net

Acquisition and integration costs

$

2

-

2

-

Radio conversion costs

17

1

Non-recurring separation costs

-

6

Operating cash flow before special items

$

390

$

342

Dealer generated customer accounts and bulk account

purchases

(146)

(110)

Subscriber system assets

(177)

(157)

(32)

(12)

Capital expenditures

Non-recurring separation costs for capital expenditures

FCF before special items

11

46

$

Revenue at Constant Currency

December 26,

December 27,

2014

Recurring revenue as reported

Recurring revenue at constant currency

Total revenue as reported

Total revenue at constant currency

5

68

$

For the

Quarters Ended

($ in millions)

(1)

335

(1)

(1)

2013

$

825

$

775

$

830

$

775

$

887

$

839

$

893

$

839

Constant currency revenue results are calculated by translating current period revenue in local

currency using the prior comparable period's currency conversion rate.

22

THE ADT CORPORATION

GAAP to Non-GAAP Reconciliations (continued)

(Unaudited)

SSFCF Before Special Items

For the

Quarters Ended

($ in millions)

Last quarter, annualized EBITDA before

special items (pre-SAC)

SAC required to maintain recurring revenue

September 26,

December 27,

2014

2014

2013

$

(1)

Maintenance capital expenditures

SSFCF before special items

(1)

December 26,

2,232

$

(1,329)

(10)

893

$

2,264

$

(1,288)

(10)

966

$

2,096

(1,299)

(10)

787

$

SAC required to maintain recurring revenue is calculated as follows:

For the

Quarters Ended

($ in millions)

Last quarter average recurring revenue under

contract for the period

Trailing twelve month disconnects net of price

December 26,

September 26,

December 27,

2014

2014

2013

$

(2)

escalation

Last quarter gross recurring revenue creation

$

14.6%

(3)

multiple

SAC required to maintain recurring revenue

275

$

33.1

1,329

273

$

14.7%

$

32.1

1,288

258

14.9%

$

33.8

1,299

(2)

Average trailing twelve month recurring revenue disconnected net of price escalations. Disconnects account for

dealer chargebacks.

(3)

Gross creation cost includes amount held back from dealers for chargebacks.

23

THE ADT CORPORATION

GAAP to Non-GAAP Reconciliations (continued)

(Unaudited)

EBITDA Before Special Items

For the

Quarters Ended

December 26,

September 26,

December 27,

2014

2014

2013

($ in millions)

$

Net Income (GAAP)

72

$

82

$

77

Interest expense, net

50

50

Income tax expense

36

27

43

275

273

249

Depreciation and intangible asset amortization

Amortization of deferred subscriber acquisition costs

Amortization of deferred subscriber acquisition revenue

$

EBITDA

47

34

33

32

(40)

(40)

(37)

427

$

425

$

411

48.1%

48.1%

49.0%

Restructuring and other, net

2

2

5

Acquisition and integration costs

1

4

1

23

17

3

7

5

EBITDA Margin

Radio conversion costs

-

Non-recurring separation costs

Separation related other expense

EBITDA before special items

(1)

$

EBITDA Margin before special items

Subscriber acquisition cost expenses, net of related revenue

EBITDA before special items (pre-SAC)

$

EBITDA Margin before special items (pre-SAC)

Revenue (GAAP)

453

$

3

458

$

1

426

51.1%

51.9%

50.8%

105

558

108

566

98

524

66.4%

67.8%

66.6%

$

887

$

883

$

839

Subscriber acquisition cost related revenue

Revenue (pre-SAC)

$

(47)

840

$

(48)

835

$

(52)

787

EBITDA before special items

$

453

$

458

$

426

Effect of Protectron on EBITDA before special items

EBITDA before special items excluding Protectron

$

(13)

440

$

(11)

447

$

426

Revenue (GAAP)

$

887

$

883

$

839

$

(36)

851

$

(33)

850

$

839

Effect of Protectron on revenue

Revenue excluding Protectron

EBITDA Margin before special items excluding Protectron

(1)

Relates to the 2012 Tax Sharing Agreement between Tyco, ADT and Pentair.

51.7%

52.6%

50.8%

24

© Copyright 2026