¡Visite nuestros locales gratuitamente, reciba su

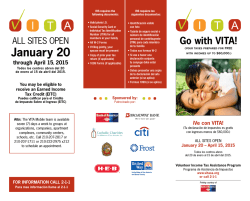

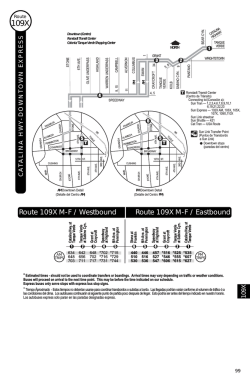

Free Tax Preparation & Resource Building Preparación de Impuestos Gratuita y Creación de Recursos ¡Visite nuestros locales gratuitamente, reciba su reembolso de impuestos preciso de manera rapida y gratis! Proporcionamos preparación de impuestos a las familias con ingresos de menos de $53,000 y a individuos con ingresos de menos de $20,000. Documentos que debe traer con usted al sitio de preparación: ✔ ¡Nuevo! Prueba de plan medico (Forma 1095-A, 1095-B o1095-C) ✔ Sus tarjetas de seguro social para usted y sus dependientes ✔ Documento de identidad con foto ✔ Documentos de ingresos incluyendo formularios W-2 y 1099 ✔ Cheque anulado para depósito directo ✔ Información del proveedor de cuidado de niños (incluyendo SS # o EIN) ✔ Formulario 1098-T (declaración del pago de matrícula) Visit one of our free tax sites! Receive an Accurate Refund Fast and Free. We provide tax preparation to families with incomes less than $53,000 and individuals with incomes less than $20,000. What to bring with you to tax site: ✔ NEW! Proof of health insurance (Form 1095-A, 1095-B or 1095-C) ✔ Your social security cards for you and dependents ✔ State-issued photo ID ✔ Income documents including W-2s and 1099s ✔ Voided check for direct deposit Obtenga su declaración de Impuestos por un profesional IRS certificado ✔ Childcare provider information (including SS # or EIN) ✔ Form 1098-T (tuition payment statement) All returns are completed by an IRS-certified preparer. Customers are seen on first-come, first-served basis. Se le atenderá y se le servirá en base al orden de llegada. Para más información llame al 2-1-1 o visita www.UnitedForImpact.org/VITA For more information call 2-1-1 or visit www.UnitedForImpact.org/VITA Para declarar sus impuestos gratuitamente encuéntrenos en www.cwfphilly.org English on reverse side. To file your own taxes for free, find link at www.cwfphilly.org Español al reverso United Way of Greater Philadelphia and Southern New Jersey 2015 FREE Community Tax Sites • Sites Open February 2-April 15, 2015 ATLANTIC COUNTY TAX SITES Carnegie Library Center E 34 S. MLK Jr Blvd., Atlantic City, NJ Wednesday: 1pm – 4pm Egg Harbor City Library E 134 Philadelphia Ave., Egg Harbor City, NJ Thursday: 5pm – 8pm Egg Harbor Township Family Success Center E 3050 Spruce Ave., Egg Harbor Township, NJ Tuesday 8:30am – 2pm Hammonton Family Success Center E 310 Bellevue Ave., Hammonton, NJ Thursday: 12:30pm – 3:30pm Richard Stockton College of New Jersey E 101 Vera King Farris Dr., Galloway, NJ Thursday: 2/19, 2/26, 3/19, 3/26 10am – 5pm Saturday: 3/28, 10am – 2pm United Way of Greater Philadelphia and Southern New Jersey E 4 E. Jimmie Leeds Rd., Suite 10, Galloway, NJ Friday: 9am – 12pm BURLINGTON COUNTY TAX SITE Burlington County Human Services Bldg. E 795 Woodlane Rd., Westampton, NJ Monday: 4:30pm – 8pm Wednesday: 1pm – 4pm Wednesday: 4:30pm – 8pm (Drop-off) CUMBERLAND COUNTY TAX SITES Bridgeton Alms Center E 28 MLK Way, Bridgeton, NJ Wednesday: 5pm – 8pm Thursday: 5pm – 8pm Inspira Family Success Center of Vineland E 1038 E. Chestnut Ave., Vineland, NJ Tuesday: 12pm – 7pm Sun National Bank E 226 Landis Ave., Vineland, NJ Friday: 10am – 7pm Saturday: 9am – 2pm E Tax sites are accessible. New Site Days and hours of operation may change. WHY VITA? The Volunteer Income Tax Assistance (VITA) program is a locally-run IRS-supported tax preparation service that is free for families making a total household income of less than $53,000 per year or individuals with less than $20,000 in annual income. It is supported by United Way of Greater Philadelphia and Southern New Jersey in partnership with Campaign for Working Families. For families and individuals throughout our region living paycheck-to-paycheck, a full tax refund can be a significant budget boost. Too often, tax payers are unaware of important credits they are eligible for, leaving valuable dollars on the table. WHAT IS THE EITC? EITC, the Earned Income Tax Credit, sometimes called EIC, is a tax credit to help you keep more of what you earned. To qualify, you must meet certain requirements and file a tax return, even if you do not owe any tax or are not required to file. WHO MAY QUALIFY? EITC is for working people who earn less than $52,427. This year, the credit can be from $2 up to $6,143. The credit amount changes based on: • if you are single or married • if you have no children or the number of children you have • the amount you earned WHAT OTHER CREDITS MAY BE AVAILABLE? A number of tax credits or deductions such as the Child and Dependent Care Credit or Education Credit, may be available to individuals and families filing a tax return. By working alongside a VITA preparer, more people in our region can take advantage of valuable tax credits and receive full refunds that can pay down debt or provide savings. FIND OUT MORE OR MAKE AN APPOINTMENT TODAY BY CALLING 2-1-1.

© Copyright 2026