Cartera Semanal - SURA

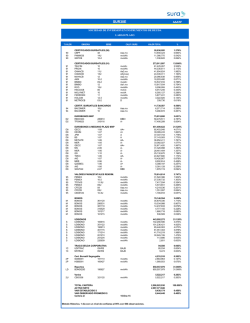

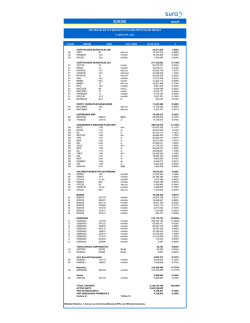

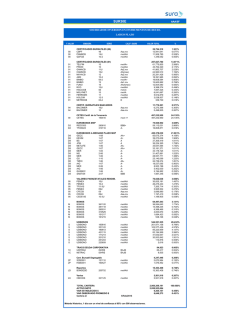

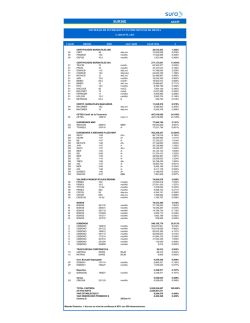

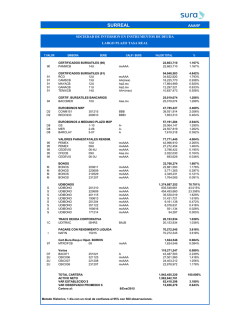

SUR30E AAA/5F SOCIEDAD DE INVERSION EN INSTRUMENTOS DE DEUDA LARGO PLAZO T.VALOR EMISORA SERIE CALIF / BURS VALOR TOTAL % 90 90 90 CERTIFICADOS BURSATILES (90) CBPF 48 PAMMCB 14U GDFCB 10-2 Aaa.mx mxAAA mxAAA 26,630,233 13,965,758 11,332,436 1,332,039 1.250% 0.656% 0.532% 0.063% 91 91 91 91 91 91 91 91 91 91 91 91 91 91 CERTIFICADOS BURSATILES (91) TELFIM 10 PROIN 10 GANACB 11U CAMSCB 13U MAYACB 12 AMX 10-2 BIMBO 09-2 BIMBO 12 RCO 12U HSCCICB 06 MOLYMET 10 FERROMX 11 HOLCIM 12-3 METROCB 03-2 mxAA+ mxAAA Aa2.mx AA(mex) Aa2.mx mxAAA mxAA+ Aa1.mx mxAAA mxCC mxAA mxAAA mxAAA D 275,218,894 63,410,954 44,032,939 41,712,742 24,301,225 19,859,629 18,196,468 16,551,937 15,777,273 9,282,867 6,855,422 6,045,691 5,842,792 3,009,225 339,730 12.918% 2.976% 2.067% 1.958% 1.141% 0.932% 0.854% 0.777% 0.741% 0.436% 0.322% 0.284% 0.274% 0.141% 0.016% 94 94 CERTIF. BURSATILES BANCARIOS BACOMER 10U BACOMER 10 Aaa.mx Aaa.mx 11,693,027 6,254,630 5,438,397 0.549% 0.294% 0.255% D2 D2 EUROBONOS MXP REDC933 TFON023 BBB+ A- 75,545,118 58,066,909 17,478,209 3.546% 2.726% 0.820% D8 D8 D8 D8 D8 D8 D8 D8 D8 D8 D8 D8 D8 D8 D8 D8 EUROBONOS A MEDIANO PLAZO MXP GECC 1-08 KEXIM 1-07 BS 1-07 METLIFE 1-06 JPM 1-07 MER 1-05 GECC 1-07 MS 2-06 MER 1-06 GS 1-10 TMCC 1-06 AIG 1-07 MER 2 06 2-06 AIG 1-06 QUEBEC 1-06 SANTAN 2-07 AA+ A+ A AAA AAA+ AAAAAAA AAA+ BBB 450,602,927 85,185,061 39,121,800 37,172,960 37,019,692 36,799,106 33,045,558 32,690,927 31,287,770 28,469,054 25,064,147 24,659,098 18,431,033 8 911 934 8,911,934 5,386,212 5,382,058 1,976,518 21.150% 3.998% 1.836% 1.745% 1.738% 1.727% 1.551% 1.534% 1.469% 1.336% 1.176% 1.157% 0.865% 0 418% 0.418% 0.253% 0.253% 0.093% 95 95 95 95 95 95 95 VALORES PARAESTATALES RENDIM. PEMEX 10U PEMEX 10-2 TFOVIS 11-3U PEMEX 09U CFECB 09 CFECB 09U CEDEVIS 10-3U mxAAA mxAAA mxAAA mxAAA Aaa.mx Aaa.mx mxAAA 78,151,512 31,250,977 27,212,693 7,394,521 5,534,709 4,222,005 1,348,595 1,188,012 3.668% 1.467% 1.277% 0.347% 0.260% 0.198% 0.063% 0.056% M M M M M M BONOS BONOS BONOS BONOS BONOS BONOS BONOS 361120 290531 381118 310529 151217 161215 mxAAA mxAAA mxAAA mxAAA mxAAA mxAAA 74,875,528 35,291,991 18,673,734 13,994,460 4,698,463 1,679,397 537,484 3.514% 1.657% 0.877% 0.657% 0.221% 0.079% 0.025% S S S S S S S S UDIBONOS UDIBONO UDIBONO UDIBONO UDIBONO UDIBONO UDIBONO UDIBONO UDIBONO 160616 351122 401115 190613 171214 201210 251204 220609 mxAAA mxAAA mxAAA mxAAA mxAAA mxAAA mxAAA mxAAA 410,852,793 102,036,663 100,788,546 80,658,460 54,795,040 41,595,925 30,861,806 113,752 2,600 19.284% 4.789% 4.731% 3.786% 2.572% 1.952% 1.449% 0.005% 0.000% 1C 1C TRACS DEUDA CORPORATIVA UDITRAC ISHRS M5TRAC ISHRS BAJB BAJB 94,184 84,686 9,499 0.004% 0.004% 0.000% 2P 2P Cert. Bursatil Segregable SCB0001 151110 HSB0001 160427 mxAAA mxAAA 4,233,337 2,661,309 1,572,028 0.199% 0.125% 0.074% LD Reportos BONDESD 180816 mxAAA 717,091,532 717,091,532 33.659% 33.659% 2U Varios CBIC006 321125 mxAAA 5,500,312 5,500,312 0.258% 0.258% 280610 310116 TOTAL CARTERA ACTIVO NETO VAR ESTABLECIDO $ VAR OBSERVADO PROMEDIO $ Cartera al: 2,130,489,396 2,090,073,019 9,405,329 8,347,885 8/Ene/2015 Metodo Historico, 1 dia con un nivel de confianza al 95% con 500 observaciones. 100.000% 0.450% 0.401%

© Copyright 2026