ACTIMED AA/3HR T.VALOR EMISORA SERIE CALIF - Actinver

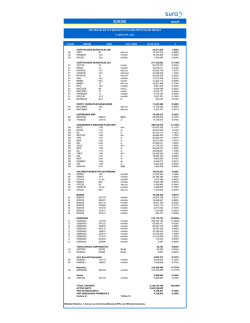

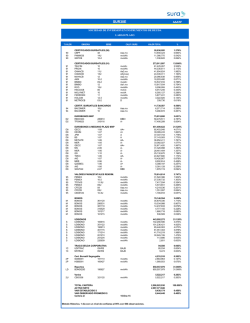

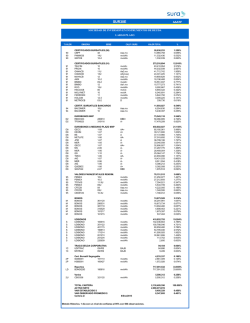

ACTIMED AA/3HR HR Ratings de México, S.A. De C.V. Deuda Sociedad de Mediano Plazo T.VALOR 90 EMISORA SERIE Cert.Bursatiles Municipales CBPF 48 AAA(mex) VALOR TOTAL 278,554,946 278,554,946 % 0.90% 0.90% 91 91 91 91 91 91 91 91 91 91 91 91 91 91 91 91 91 91 91 91 91 91 91 91 91 91 91 91 91 91 91 91 91 91 91 91 91 91 91 91 91 91 91 91 91 91 91 91 91 91 91 91 91 91 91 Cert.Bursatiles Corporativos FUNO 13 INCARSO 12 INCARSO 13 GCARSO 12 NRF 13 TLEVISA 14 NRF 12 ELEKTRA 14 ARCA 09-4 DINEXCB 12 VWLEASE 12 VWLEASE 13 ELEKTRA 13 KIMBER 07 DAIMLER 14 MFRISCO 13 AERMXCB 13 CULTIBA 13 IENOVA 13-2 NEMAK 07 BLADEX 14 DAIMLER 14-3 DAIMLER 12-2 TOYOTA 12 DAIMLER 14-2 ARCA 10-2 IDEAL 11-2 CATFIN 12 VTOSCB 13 KUO 12 KUO 10 BIMBO 12 KIMBER 13-2 HERDEZ 14 KIMBER 10 TELMEX 09-4 FIDEPCB 14 CATFIN 14 HERDEZ 11 VWLEASE 14 VWLEASE 13-2 AC 13 VWLEASE 14-2 LAB 13-2 CATFIN 11 AC 11 SCRECB 12 LIVEPOL 12 TOYOTA 14 TELMEX 08 GDINIZ 12 BIMBO 09-2 XIGNUX 07 LOMCB 12 AC 11-2 CALIF / BURS AAA(mex) AA(mex) AA(mex) AA+(mex) Aaa.mx AAA(mex) Aaa.mx A(mex) AAA(mex) AA-(mex) Aaa.mx Aaa.mx A(mex) AAA(mex) AAA(mex) AA-(mex) HRAA+ AA(mex) Aaa.mx AA-(mex) AAA(mex) AAA(mex) AAA(mex) AAA(mex) AAA(mex) AAA(mex) Aa2.mx Aaa.mx HRAAA A(mex) A(mex) AA+(mex) AAA(mex) AA(mex) AAA(mex) Aaa.mx AA(mex) Aaa.mx AA(mex) Aaa.mx Aaa.mx AAA(mex) Aaa.mx AA(mex) Aaa.mx AAA(mex) AAA(mex) AAA(mex) AAA(mex) Aaa.mx HRAAA+(mex) AA(mex) mxBAAA(mex) 11,091,411,166 885,134,572 672,814,020 601,796,502 522,378,025 512,391,737 435,806,352 403,952,066 382,465,186 366,767,678 359,659,858 340,560,514 329,880,230 330,192,336 298,491,171 295,850,557 288,034,920 285,523,597 280,784,361 259,702,737 236,372,181 235,583,475 200,427,928 197,344,742 198,906,665 154,034,978 147,010,767 149,650,623 143,362,347 143,069,404 129,762,757 108,172,485 108,032,168 100,311,663 100,135,957 85,906,508 70,862,973 71,714,535 70,116,416 60,250,559 62,412,168 60,310,780 50,067,532 50,086,027 50,395,536 41,638,651 40,143,029 40,230,963 36,751,166 21,913,614 21,950,827 15,910,042 12,637,863 11,061,828 6,823,191 5,862,399 35.93% 2.87% 2.18% 1.95% 1.69% 1.66% 1.41% 1.31% 1.24% 1.19% 1.17% 1.10% 1.07% 1.07% 0.97% 0.96% 0.93% 0.93% 0.91% 0.84% 0.77% 0.76% 0.65% 0.64% 0.64% 0.50% 0.48% 0.49% 0.46% 0.46% 0.42% 0.35% 0.35% 0.33% 0.32% 0.28% 0.23% 0.23% 0.23% 0.20% 0.20% 0.20% 0.16% 0.16% 0.16% 0.14% 0.13% 0.13% 0.12% 0.07% 0.07% 0.05% 0.04% 0.04% 0.02% 0.02% 93 93 93 93 93 93 93 Cert.Bursa.Ref.a Papel Comercial FACILSA 05313 FORD 01114 GMFIN 02914 FORD 01914 GMFIN 01714 FORD 03714 GMFIN 01614 F1+(mex) F1+(mex) F1+(mex) F1+(mex) F1+(mex) F1+(mex) F1+(mex) 343,023,392 100,144,627 49,536,573 45,083,604 39,091,761 40,056,044 40,030,156 29,080,627 1.11% 0.32% 0.16% 0.15% 0.13% 0.13% 0.13% 0.09% 94 94 94 94 94 94 94 94 94 94 94 94 94 94 94 Certif. Bursatiles Bancarios BANAMEX 10 BINBUR 13 BINBUR 12-3 BINBUR 14 BINBUR 13-3 VWBANK 12 BINBUR 13-4 COMPART 12 BINTER 14-4 VWBANK 11 BINBUR 12-4 BINBUR 14-3 COMPART 11 COMPART 10 BINBUR 14-5 AAA(mex) HRAAA HRAAA HRAAA HRAAA Aaa.mx HRAAA AA+(mex) A(mex) Aaa.mx HRAAA HRAAA AA+(mex) AA+(mex) HRAAA 2,505,302,246 484,659,562 306,980,660 293,986,900 264,105,202 251,025,638 195,992,248 194,137,477 147,655,664 100,685,625 80,158,199 70,566,016 40,003,211 30,325,977 24,984,255 20,035,612 8.12% 1.57% 0.99% 0.95% 0.86% 0.81% 0.64% 0.63% 0.48% 0.33% 0.26% 0.23% 0.13% 0.10% 0.08% 0.07% 95 95 95 95 95 95 95 95 95 95 95 95 95 95 95 95 95 95 95 95 95 95 Cer.Bur.Emit.Ent.o Ins.Gob.Fed FEFA 13 CFE 13 IFCOTCB 13 PEMEX 12 FEFA 12 FEFA 14 CFECB 06-2 CFEGCB 13 PEMEX 10-2 CFEHCB 07-2 CFECB 10 CFEHCB 07 CEDEVIS 06-4U CFECB 10-2 FEFA 12-2 CFEHCB 07-3 CFECB 07 TFOVIS 10-3U CFECB 05 CFECB 06 PEMEX 11 CFEHCB 08 AAA(mex) AAA(mex) AAA(mex) AAA(mex) AAA(mex) AAA(mex) AAA(mex) AAA(mex) Aaa.mx AAA(mex) AAA(mex) AAA(mex) Aaa.mx AAA(mex) AAA(mex) AAA(mex) AAA(mex) AAA(mex) AAA(mex) AAA(mex) Aaa.mx AAA(mex) 3,292,203,838 640,967,097 512,172,638 437,708,523 355,443,579 222,132,139 153,752,959 126,588,495 120,852,206 117,559,751 85,858,315 84,638,338 65,669,579 64,564,759 60,425,313 62,276,502 53,877,388 44,167,143 42,231,871 16,142,218 12,732,670 7,526,173 4,916,182 10.66% 2.08% 1.66% 1.42% 1.15% 0.72% 0.50% 0.41% 0.39% 0.38% 0.28% 0.27% 0.21% 0.21% 0.20% 0.20% 0.18% 0.14% 0.14% 0.05% 0.04% 0.02% 0.02% 480,000 480,000 0.00% 0.00% AAA(mex) AAA(mex) 313,540,896 307,559,016 5,981,880 1.02% 1.00% 0.02% 3,668,331 3,668,331 0.01% 0.01% 5500702 12,221 12,221 0.00% 0.00% D2 D2 Eurobonos Empresas Priv.(Fix) AMXL764 150116 TFON023 310116 A A 229,992,510 179,869,080 50,123,430 0.75% 0.58% 0.16% D8 Titulos Emisoras Extranje.SIC MLMXN 1-07 AAA(mex) 196,673,296 196,673,296 0.64% 0.64% FB FB Futuros sobre Tasas y Bonos M3 TE28 DC14 TE28 DC14 AIM Operaciones con Instrumentos Financieros Derivados ACTINVE Cetes con Impuesto CETES CETES 150723 150723 CHD Chequera Dolares 40-012 3705536 CHE Chequera Euros 40-012 BI BI FWD Forward de Divisas MXPEUR 141216 0 0 0 0.00% 0.00% 0.00% -324,055 -324,055 0.00% 0.00% I I Pagare de Rend.Liquidable Vto. BACTINV 14504 BACTINV 15014 F1(mex) F1(mex) 1,764,701,730 1,047,611,250 717,090,480 5.72% 3.39% 2.32% IM IM IM IM IM IM IM Bonos Prot.Ahorro (BPAG28) BPAG28 170223 BPAG28 161222 BPAG28 170518 BPAG28 151112 BPAG28 160204 BPAG28 160616 BPAG28 161020 AAA(mex) AAA(mex) AAA(mex) AAA(mex) AAA(mex) AAA(mex) AAA(mex) 1,047,064,589 249,230,748 199,575,364 199,299,506 149,366,346 99,881,853 99,876,044 49,834,728 3.39% 0.81% 0.65% 0.65% 0.48% 0.32% 0.32% 0.16% IQ IQ IQ Bonos Prot. Ahorro (BPAG91) BPAG91 170420 BPAG91 170629 BPAG91 151001 AAA(mex) AAA(mex) AAA(mex) 448,141,588 249,382,583 99,934,004 98,825,001 1.45% 0.81% 0.32% 0.32% IS IS Bonos Prot.al Ahorro Pago Sem. BPA182 160331 BPA182 171005 AAA(mex) AAA(mex) 184,529,751 134,204,776 50,324,975 0.60% 0.44% 0.16% JE Nota Estructurada sin Garantia AMX 0619 AAA(mex) 125,477,830 125,477,830 0.41% 0.41% JI JI JI Tit.Org.Financ.Multilaterales CABEI 1-13 CABEI 1-11 CABEI 1-12 Aaa.mx Aaa.mx Aaa.mx LD LD LD LD LD LD LD LD LD Bondes D BONDESD BONDESD BONDESD BONDESD BONDESD BONDESD BONDESD BONDESD BONDESD M M Q Q Q S S S SWP SWP SWP SWP SWP SWP SWP SWP SWP SWP SWP SWP SWP SWP SWP SWP SWP SWP SWP SWP SWP LD LD LD IQ 598,982,392 278,691,787 230,185,128 90,105,477 1.94% 0.90% 0.75% 0.29% AAA(mex) AAA(mex) AAA(mex) AAA(mex) AAA(mex) AAA(mex) AAA(mex) AAA(mex) AAA(mex) 3,674,261,659 748,899,803 674,522,219 550,024,152 531,617,821 423,147,918 295,331,256 199,471,402 151,815,096 99,431,992 11.90% 2.43% 2.19% 1.78% 1.72% 1.37% 0.96% 0.65% 0.49% 0.32% Bonos Gob. Fed. Tasa fija (20) BONOS 241205 BONOS 181213 AAA(mex) AAA(mex) 1,380,220,538 1,061,795,914 318,424,624 4.47% 3.44% 1.03% Obligaciones Subordinadas(FIX) BAZTECA 08 BANORTE 08 BANORTE 08-2 BBB(mex) Aa2.mx Aa1.mx 343,800,821 200,023,862 97,351,886 46,425,073 1.11% 0.65% 0.32% 0.15% Udibonos UDIBONO UDIBONO UDIBONO 141218 160616 190613 AAA(mex) AAA(mex) AAA(mex) 1,676,733,275 802,089,081 583,871,744 290,772,450 5.43% 2.60% 1.89% 0.94% Swaps Entregables 2TIEMXP 1MXPTIE 2TIEMXP 2TIEMXP 1MXPTIE 1MXPTIE 1MXPTIE 1MXPTIE 1MXPTIE 2TIEMXP 1MXPTIE 1MXPTIE 1MXPTIE 1MXPTIE 1MXPTIE 1MXPTIE 1MXPTIE 1MXPTIE 1MXPTIE 1MXPTIE 1MXPTIE 150129 180202 150305 150618 180912 180921 181015 241007 241008 161031 241028 190610 190610 241031 241031 241105 241105 241106 241106 241107 200127 -6,046,270 702,800 -1,273,200 198,100 266,400 -829,760 -746,050 -1,025,750 -307,600 -165,250 288,800 -335,900 -662,310 -184,050 -1,369,350 -1,252,650 -216,200 -157,900 277,600 519,400 221,600 5,000 -0.02% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% REPORTOS BONDESD BONDESD BONDESD BPAG91 161027 161229 170824 180816 1,378,088,009 716,569,012 284,869,513 277,671,238 98,978,246 4.46% 2.32% 0.92% 0.90% 0.32% 30,870,494,699 31,719,293,988 100.00% 160901 161027 170223 170427 170622 160505 161229 171221 171019 AAA(mex) AAA(mex) AAA(mex) AAA(mex) TOTAL CARTERA ACTIVO NETO Cartera al: Límite Máximo de VaR: PARÁMETROS: 20/11/2014 0.134% Var Promedio: 0.008% Modelo Histórico,1 día con un nivel de confianza al 95% con 252 observaciones. Límite autorizado por CNBV %

© Copyright 2026