Corporate plan 2012 - 2015 (PDF, 456kb)

The

Corporate

plan

2012-2015

Contents

Foreword

page 3

Introduction

The Pensions Regulator

The Corporate plan

page 6

page 6

page 7

Regulatory approach

How The Pensions Regulator operates

The regulated community

page 8

page 8

page 10

Strategic plan 2012-2015

Strategic theme 1: Reducing risks to DB scheme members

Strategic theme 2: Reducing risks to DC scheme members

Strategic theme 3: Automatic enrolment

Strategic theme 4: Better Regulation

page 11

page 11

page 14

page 18

page 21

Business plan 2012-2013

DB deliverables 2012-2013

DC deliverables 2012-2013

Automatic enrolment deliverables 2012-2013

Better Regulation deliverables 2012-2013

page 24

page 25

page 27

page 29

page 30

Key performance indicators 2012-2013

How we measure performance

Strategic theme 1: Reducing risks to DB scheme members

Strategic theme 2: Reducing risks to DC scheme members

Strategic theme 3: Automatic enrolment

Strategic theme 4: Better Regulation

page 32

page 33

page 34

page 36

page 38

page 39

Resource summary

page 41

Financials

page 41

Workload assumptions

page 47

Appendix 1: The pensions landscape

page 49

2

Corporate plan 2012-2015

Foreword

As the pensions industry continues to deal with the ongoing economic

volatility, and prepares for automatic enrolment to become a reality, the pace

of change for all involved in workplace pensions will continue to increase.

With such a high level of industry activity, it is inevitable

that cases requiring our investigation or interventions

will increase. Our workload has steadily grown across

all areas of business over the past few years, and we

expect that trend to continue in 2012-2013.

The regulator has three main focus areas and our

operations are structured around these. The priorities

for each area are set out in this plan. In 2012-2013

we will:

• continue our work to improve the solvency,

governance and administration standards of

defined benefit (DB) pension schemes

• work with the industry to ensure that all defined

contribution (DC) schemes have the features

necessary to enable members to achieve a good

outcome from their savings

• support employers in understanding their new

duties under automatic enrolment and preparing

for them effectively.

In addition, we will continue to focus on achieving

economy, effectiveness and efficiency in line with

the Spending Review 2010 settlement and the Red

Tape Challenge.

With automatic enrolment, workplace pensions will be

an increasingly significant component of retirement

provision for many more people in the UK. We take

our responsibility for making this process work as

effectively as possible very seriously. However, the

majority of memberships, and pension scheme assets,

are still in DB schemes. These are difficult times for

schemes and sponsors and a significant portion of

our resources remain dedicated to protecting those

members and the Pension Protection Fund (PPF).

We are a risk-based regulator. We make choices

about where and how we engage with the industry

to achieve our goals based on the risk to members’

benefits. We seek to do this as transparently as

possible. In a world where outcomes do not often

become apparent until pensions are in payment

– usually many years hence – setting performance

indicators and evaluating our success is sometimes

not straightforward. Where possible, however,

we endeavour in this document to indicate what

we plan to do, and how we will monitor progress.

We welcome views, as always, on how our task

of protecting member benefits might be better

approached, monitored or evaluated.

continued over...

Corporate plan 2012-2015

3

Foreword

In each of our key focus areas, this document sets out

the main tasks we set ourselves for 2012-2013. The

key elements of these are as described below.

In protecting members of DB schemes, we will:

• help make trustees and employers facing valuation

dates of December 2011-March 2012 aware of

the key issues as we see them, and how we will

approach our regulatory duties for this tranche of

recovery plans (due in 2013)

• explain, later in the year, how we will use our

learning (from six years of operation and two

complete cycles of recovery plans) to target our

limited supervisory resources proactively at higher

risk schemes

• provide support and guidance to DB scheme

trustees on holistic risk management by looking

across investment, funding and covenant risk areas

to create a more comprehensive view of member

security in schemes. It is likely we will revise our

code of practice on scheme funding

• remain fully engaged in the discussions

currently underway in Europe on the reform of

the Institutions for Occupational Retirement

Provision (IORP) Directive and be fully involved in

the impact assessment being undertaken on the

funding proposals contained in the IORP review.

4

Corporate plan 2012-2015

In protecting members of DC schemes, we will:

• explain to the supply and demand sides of the

pensions industry how they might demonstrate

that our six key principles for delivery of DC

pensions are present in their arrangements

• work with trust-based schemes in particular

to ensure that schemes are sufficiently robust

and durable

• work to embed our six DC principles with

providers and advisers.

In maximising employer compliance with automatic

enrolment duties, we will:

• raise general levels of awareness and

understanding of the duties among employers

and advisers so that the requirements of

automatic enrolment are properly anticipated and

preparations start in good time

• send specific communications at 12 months and

3 months to employers subject to the duties and

work closely with these employers, their advisers

and suppliers in the first tranche of automatic

enrolment to anticipate and resolve issues

• start to build intelligence, investigation and

enforcement capabilities in preparation for small

and micro employers being brought into the

programme in later years.

Foreword

These are challenging ambitions. We set out these

plans and our resource budget in a period of spending

cuts, low public sector resources and constrained

public sector growth. We have planned accordingly,

with a focus on value for money and doing only

what is necessary to achieve our objectives. In all our

endeavours, our core asset is our people.

In 2012-2013, our challenge is to continue to

demonstrate the value of working at the regulator

to current and prospective employees. We do so

in a world of shrinking real public sector pay and

increased employee pension contributions. The

people who work at the regulator are committed and

capable. Management’s task is to maintain morale and

capability through what is likely to be a difficult year.

We have every confidence that the professionalism

and dedication of colleagues at the regulator will

continue to be the first and most enduring impression

for those we deal with in the industry, consistent with

the industry’s feedback to us over the last two years.

Our approach of educate, enable and enforce

will remain embedded in everything we do. We

will continue to work with trustees, employers,

pension specialists and business advisers, providing

guidance and education to make clear what is

expected of them and enabling them to achieve high

standards. Whilst supporting people in meeting their

responsibilities, we will be firm with those who do not

respect their obligations.

We look forward to working with you as we move

ahead together to reach the outcomes we all desire.

Michael O’ Higgins

Bill Galvin

Chair, The Pensions Regulator

Chief executive, The Pensions Regulator

With automatic enrolment,

workplace pensions will be an

increasingly significant component

of retirement provision for many

more people in the UK.

Corporate plan 2012-2015

5

Introduction

The Pensions Regulator

The Pensions Regulator is the regulator of workbased pensions, established under the Pensions Act

2004 as an executive non-departmental public body

of the Department for Work and Pensions (DWP).

Our objectives, as set out in the Pensions Act 2004

and Pensions Act 2008, are to:

• protect the benefits of members of

work-based pension schemes

• promote, and improve understanding of the good

administration of work-based pension schemes

• reduce the risk of situations arising which may

lead to compensation being payable from the

Pension Protection Fund (PPF)

• maximise employer compliance with employer

duties and the employment safeguards introduced

by the Pensions Act 2008.

We are responsible for regulating work-based

pension schemes consisting of occupational DB

schemes, occupational DC schemes, work-based

personal pensions and stakeholder pensions. We

are organised around the three main areas of DB

regulation, DC regulation and automatic enrolment.

In the case of work-based personal pensions, the

provider is also subject to regulation by the Financial

Services Authority (FSA). We are mindful of the

regulatory reform resulting in the restructuring of the

UK’s financial regulatory framework and will continue to

work with the FSA and its successor bodies to ensure

the regulation of DC provision remains appropriate.

The regulator is a member of the European Insurance

and Occupational Pensions Authority (EIOPA).

EIOPA will play an influential part in the future UK

pensions landscape and has recently given advice

to the European Commission on the review of the

IORP1 directive. We work in this forum to support our

statutory objectives.

We are funded via a Grant-in-Aid from the DWP –

some of which is recovered from eligible schemes via

the general levy. The setup and operating costs of

the Employer Compliance Regime (ECR) established

under the Pensions Act 2008 are being met by the

DWP. The regulator is financially accountable to the

Secretary of State for Work and Pensions.

We are fully committed to delivering efficiency

savings in line with the Spending Review 2010

settlement. This includes seeking continuous

improvement in processes and technology.

1

6

Corporate plan 2012-2015

Institutions for occupational retirement provision

Introduction

The Corporate plan

This Corporate plan sets out our regulatory approach

and covers our Strategic plan for 2012-2015 and our

Business plan for 2012-2013.

The Strategic plan describes our strategic priorities

for 2012 to 2015. These are outlined in terms of the

following areas:

• reducing risks to DB scheme members

• reducing risks to DC scheme members

• automatic enrolment

• better regulation.

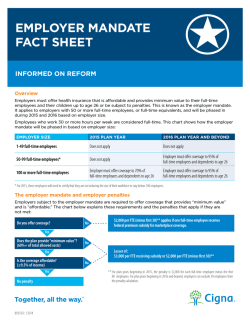

Figure 1

Our strategic themes and their link to our statutory objectives

Statutory themes

Statutory objectives

Reduce risks

to the PPF

Promote good

administration

Protect members’

benefits

Maximise employer

compliance

Reducing risks to DB scheme members

Reducing risks to DC scheme members

Automatic enrolment

Better Regulation

The annual Business plan covers the year ahead

and includes:

• our deliverables for 2012-2013

• our performance measures for

the period 2012-2013

• the resources we will need to deliver

our priorities for 2012-2015

• our workload assumptions for 2012-2013.

Finally, an Appendix provides some background

information on the pensions landscape.

Given the evolving nature of the policy and pensions

landscape, during the year we shall keep our priorities

under review in order to ensure that our resources are

allocated or re-allocated appropriately. We also retain

a contingency in our budget which allows some scope

to draw down funds for extra tasks if required.

This Corporate plan sets out our

regulatory approach and covers our

Strategic plan for 2012-2015 and

our Business plan for 2012-2013.

Corporate plan 2012-2015

7

Regulatory approach

How The Pensions Regulator operates – educate, enable and enforce

Our role is to ensure people responsible for providing access to and managing

work-based pensions fulfil their obligations. We work with trustees, employers,

pension specialists and business advisers, providing guidance and education

to make clear what is expected of them and enabling them to achieve high

standards. While supporting people in meeting their responsibilities, where

necessary, we use our enforcement powers against those that do not respect

their obligations.

8

Corporate plan 2012-2015

Regulatory approach

Our approach is to ‘Educate, Enable and Enforce’.

We seek to educate trustees in their duties via the

use of tools such as the Trustee toolkit and enable

the regulatory community via the publication

of regulatory guidance, codes of practice and

statements. We are determined to ensure that those

we regulate follow the rules and we are prepared

to use our powers where it is appropriate and

proportionate to do so. When we use our major

powers, decisions are taken by the Determinations

Panel, whose constitution ensures it is independent

of the case teams to enable it to make impartial

decisions, based on the evidence before it.

Our operational approach is based on risk

assessment. Risk assessment is used to prioritise and

determine the probability of identified risks occurring

and their potential impact on the achievement of

our statutory objectives. The aim at every level is to

ensure resources are focused on the most significant

risks and to manage these with a clear understanding

of who is accountable for the action being taken to

mitigate risks.

We are committed to the principle of reasonableness

and will ensure that all our actions consider the

probability and size of the potential impact on

members’ benefits and the impact on those within

our regulatory remit, including sponsoring employers.

In early 2012, we set out our high-level strategy for

achieving our new role while adapting our approach

to regulation to reflect the growing DC market and its

dynamics. This included the five strategic principles

which will guide our regulatory approach:

• to engage the market at the most

appropriate part of the value chain

• to adopt an evidence-based approach to

segment the market according to the risk

presented to member benefits

• to ensure our approach will be proportionate

to the risks presented to our objectives

• to ensure that there is clear

accountability for member outcomes

• to work closely with Government and

other regulators to maximise the overall

effectiveness of our approach.

In late 2012, we will set out our ongoing strategy for

the regulation of DB schemes.

continued over...

We continue to focus on operational efficiency to

minimise the burden on pension schemes of meeting

their legal duty to register and submit data to the

regulator. In doing so, we are committed to the

principles of good regulation – to be proportionate,

accountable, consistent, transparent and targeted.

Corporate plan 2012-2015

9

Regulatory approach

The regulated community

Trustees

Pensions, administration and payroll providers

There are over 100,000 pension scheme trustees and

they are instrumental in the delivery of good member

outcomes2. Many will be lay persons, effectively in a

position of running financial institutions. Although

this removes conflicts of interest created by the profit

motive, it introduces issues of capability and capacity.

We believe that, in the first instance, the most

appropriate regulatory tools are communications

and education. Our communications and education

programme to trustees encourages them to update

and increase their knowledge by use of our online

Trustee toolkit and further ‘bite-sized’ learning.

Pensions administration and payroll providers are

ssential to the delivery of products that enable members

to achieve a good outcome from their savings. We

will work with them to encourage the delivery of

products that provide good member outcomes.

Employers

Employers have a critical role in the maintenance

and stability of work-based pension provision. Under

their new duties they must select a pension scheme

that meets the qualifying criteria for automatic

enrolment. They will also wish to ensure that they

select a scheme that meets their needs and the needs

of those who will be automatically enrolled into it.

We believe an engaged employer can significantly

minimise the risks associated with poor governance

and administration. Aside from our role in promoting

understanding of the pension reforms, we continue

to work with employers (who already provide workbased pensions) by providing information tailored to

different segments of the employer population.

Members

We have limited direct contact with members (mainly

in a whistleblowing capacity) but our primary focus

is on providing good practice guidance for those

responsible for communicating with members. We

will monitor knowledge and understanding among

members to make judgements about our priorities

and continue to work closely with the Pensions

Advisory Service (TPAS) the DWP and other

organisations communicating directly to the member.

Intermediaries

Intermediaries are third parties who offer advice and

information to employers and trustees in relation

to pension provision or their automatic enrolment

obligations. They have a strong level of influence over

employers’ and trustees’ behaviour and will play a

key role in supporting them with their new duties –

particularly in the selection of a suitable scheme. We

continue to develop our relationships with advisers

and intermediaries. Our aim is to maximise the use

of intermediaries as a conduit to employers, identify

and communicate good practice, and encourage

advisers to ensure that products used by employers

for automatic enrolment are consistent with the six

key principles for DC schemes (see page 15).

2 For more information, see our recently published strategy document ‘Delivering

successful automatice enrolment – The Pensions Regulator’s approach to the

regulation of employers and schemes’.

10

Corporate plan 2012-2015

Our role is to ensure people

responsible for providing access to

and managing work-based pensions

fulfil their obligations.

Strategic theme 1:

Reducing risks to

DB scheme members

Strategic objective

DB risks engage three of our statutory objectives: to protect the benefits of

members of work-based pension schemes, to reduce the risk of compensation

being payable by the PPF and to promote good administration of work-based

pensions schemes.

Corporate plan 2012-2015

11

Reducing risks to DB scheme members

Current issues

Regulatory strategic plan 2012-2015

The biggest challenge this year is the economy.

Continued economic volatility, uncertain investment

returns, low interest rates and low gilt yields have all

come together to deepen scheme deficits. This is

clearly a difficult time for everyone involved with DB

pension provision.

All schemes have now carried out two valuations

under the scheme specific funding regime and have

experience in how to apply the funding framework.

We will continue to work with schemes to ensure

appropriate funding targets are set within the

changing landscape, and with employers to set

reasonably affordable plans for achieving those

targets. To achieve this, we will ensure our approach

reflects the different risks in each segment of the

landscape, outlining our expectations of those facing

these challenges, and working with parties to ensure

good outcomes are achieved.

A rapidly changing landscape has brought with it new

and increased challenges for schemes, sponsoring

employers, their advisers and the wider pensions

industry (including the regulator). De-risking, and

particularly transfer exercises, have become a focus

for many schemes and challenges still remain to

ensure exercises are run with transparency and

fairness for all parties.

The DB pensions landscape continues to evolve as

schemes close, liabilities are legitimately removed

from the employers’ balance sheet, and new provision

moves away from DB. Only 16% of DB schemes are

open to new members (see Chart 1 below).

Chart 1

Distribution of DB schemes by status

Winding up

128 (2%)

Closed to

new members

3,739 (58%)

Closed to

future accrual

1,552 (24%)

Open

1,013 (16%)

This reduction in the DB landscape has been a

steady trend for several years and shows no sign of

abating especially in light of the very challenging

economic environment.

12

Corporate plan 2012-2015

We will use our experience of the last six years

to deliver on the principles of good regulation

ie to be proportionate, accountable, consistent,

transparent and targeted, and share our experience

and understanding with the pensions industry to

drive continued improvements in standards. Through

development of a more segmented approach (in

which we will take a greater interest in schemes that

fall into more risky segments eg those schemes with

a very weak employer covenant), we will be able to

drive good behaviour and be more transparent and

targeted in our expectations and intentions in specific

areas of risk.

DB schemes are faced with a challenging and changing

environment. Pressure to manage liabilities may

lead entities and individuals to consider actions they

would not otherwise do. We have seen continuing

innovation in the DB landscape including new derisking products, sophisticated funding solutions

as well as the continued use of more established

methods. We welcome innovative solutions that are

appropriate for specific circumstances.

Our challenge is to ensure actions do not

inadvertently, or in some cases intentionally, place

the burden of risk disproportionately on the security

of members’ benefits and the PPF. All trustees need

to be aware of moral hazard risk, and it will remain a

particular focus for the regulator.

Reducing risks to DB scheme members

Governance and administration

Our key focus will be on ensuring a fair distribution

of assets to pension schemes while recognising

the range of pressures, existing and emerging, that

employers face. In any economic climate, some

employers will struggle to meet their pension

liabilities. The regulator is committed to helping

employers and trustees work through these issues

and continues to believe that a strong and engaged

employer is the best support for a scheme. We expect

funding plans to continue to be based on affordability,

recovering deficits as quickly as is reasonably

affordable whilst ensuring over the medium and long

term, liabilities are appropriately managed.

We are keen to ensure the highest standards of

governance for DB pension schemes including robust

internal controls, clear accountabilities for decisionmaking and appropriate management of conflicts.

Where we believe poor funding outcomes arise from

poor governance, we have a variety of regulatory

options from educating and liaising with trustees and

industry to enforcement options such as improvement

notices and/or possibly the replacement of trustees to

fix the underlying causes.

A small minority of employers find themselves in

a position where their ability to meet the liabilities

they face is beyond their reach. We expect trustees

and employers to acknowledge this reality rather

than taking excessive risk in the hope liabilities may

be met. We are willing to work with trustees and

employers to find a solution that provides fair value

for the scheme and an acceptable outcome for the

employer. However, trustees and their advisers should

be mindful and vigilant to arrangements being made

that seek to remove the covenant from the scheme,

and guard against abandonment.

A rapidly changing landscape has

brought with it new and increased

challenges for schemes, sponsoring

employers, their advisers and the

wider pensions industry (including

the regulator).

Corporate plan 2012-2015

13

Strategic theme 2:

Reducing risks to

DC scheme members

Strategic objective

DC risks engage two of our statutory objectives, namely to protect the

benefits of members of work-based pension schemes and to promote good

administration of work-based pensions schemes.

14

Corporate plan 2012-2015

Reducing risks to DC scheme members

Current issues

Six key principles for DC schemes

DC provision continues to grow. The introduction of

automatic enrolment from October 2012 is certain to

change the work-based pensions landscape significantly.

The DWP estimates that as a result of these reforms

the number of individuals saving more or saving for

the first time will increase by 5-8 million. In addition, it

is likely that the ongoing trend for the closure of DB

schemes will result in an increase in DC membership.

In December 2011, we published ‘Six principles of

design and management of a good DC scheme’.

We would like to see all DC schemes, particularly

those used for automatic enrolment, follow them. In

keeping with the six principles:

Regulatory strategic plan 2012-2015

• a comprehensive scheme governance framework

is established at set-up, with clear accountabilities

and responsibilities agreed and made transparent

The introduction of automatic enrolment will result

in many more scheme members who are not actively

engaged with their pension savings, and many

employers offering a scheme for the first time.

Between 2012 and 2017, all employers will review

their pension arrangements for their staff. If sensible

decisions are made this will result in products being

selected which are durable, well governed and

of sufficient scale to deliver a good outcome for

members. We will support employers through this

process by engaging with them and with industry

by providing information to support their decisions.

Our aim is that members are placed in products with

characteristics that can help to deliver good member

outcomes. We will, therefore, be working with

the pensions industry in the five market segments

(outlined on page 16) with a view to assisting schemes

to deliver these.

• schemes are designed to be durable, fair and

deliver good outcomes for members

• those who are accountable for scheme decisions

and activity understand their duties and, are fit and

proper to carry them out

• schemes benefit from effective governance and

monitoring through their full lifecycle

• schemes are well administered with

timely, accurate and comprehensive processes

and records

• communication to members is designed and

delivered to encourage member engagement,

so that they are able to make informed decisions

about their retirement savings.

continued over...

Corporate plan 2012-2015

15

Reducing risks to DC scheme members

DC landscape segments

We have segmented the existing market by scheme

size and type and have identified risks associated with

each segment (see Chart 2 below).

We are developing our approach to ensure we match

our regulatory activities to the risk posed in each of

the market segments, taking account of both current

and future risks in the market.

Chart 2

Segments of the existing DC market

• Micro schemes with fewer than 12 memberships

These typically, though not exclusively, are

composed of financially literate individuals with

a close trustee-member affinity. We will seek to

develop a low burden approach working closely

with Her Majesty’s Revenue & Customs (HMRC)

• Large employer-sponsored schemes

with over 1,000 members

Our focus will be around self regulation, possibly

through voluntary accreditation or self declaration

of compliance with the six key principles. In

addition, we will support trustees by providing

education material and guidance

Large

employersponsored

• Multi-employer schemes with

non-associated employers

Small and

medium

Multiemployer

DC

provision

Contract

Micro

These offer a DC trust based governance model,

but service more than one employer that is not

part of the same corporate structure. We will apply

our existing regulatory toolkit to encourage higher

standards and we will engage with the industry

and our Government partners to consider whether

the current regulatory regime is appropriate

• Small and medium sized schemes

Our approach to this segment will be to use our

existing regulatory toolkit to drive up standards of

governance and administration. We will address

any systemic issues that exist within these segments

and set out our views on good provision

• Contract-based work-based schemes such

as Group Personal Pensions (GPPs)

The regulator and the FSA both have regulatory

responsibilities in relation to this segment and we

will continue to work with the FSA to help ensure

that the benefits of members are protected and

high standards in administration are achieved.

16

Corporate plan 2012-2015

Reducing risks to DC scheme members

Governance and administration

The provision of good scheme governance and

administration is driven from both the demandside of the market (such as trustees and employers)

and supply-side institutions (such as providers,

administrators and intermediaries).

We will continue our focus on ensuring the demandside of the market puts in place robust governance

structures with clear lines of accountability and

responsibilities are agreed and made transparent. We

will continue the process begun in December 2011

on the six key principles for DC schemes and work

with both the demand and supply-side of the industry

to agree the criteria and standards for administration

and governance that underpin the principles.

In addition, we will focus on encouraging the

supply-side of the market to facilitate good member

outcomes and supporting trustees in becoming more

demanding clients of administrators. This will include

continuing to focus on ensuring the existence of

adequate internal controls and monitoring the uptake

of our record-keeping guidance.

We will engage the market at the most appropriate

part of the supply chain. This will involve working

both with our traditional audience of trustees and

employers and increasingly with providers and

advisers. We will also be working with other agencies

(particularly HM Treasury, the FSA and the DWP).

We are developing our approach

to ensure we match our regulatory

activities to the risk posed in each

of the market segments, taking

account of both current and future

risks in the market.

Corporate plan 2012-2015

17

Strategic theme 3:

Automatic enrolment

Strategic objective

The regulator is responsible for maximising compliance with the employer duties

and employment safeguards in the 2008 Act, as well as protecting the benefits

of members of work-based pension schemes once they have been enrolled.

18

Corporate plan 2012-2015

Automatic enrolment

Current issues

Automatic enrolment is the core employer duty of

the pensions reform which will commence in October

2012 for large employers. The new employer duties

will be phased in for all employers over a number of

years (see Table 1 below), starting with the largest

employers from October 2012. Eventually, this

requirement will apply to all UK employers.

These reforms mean that employers in Great Britain

and Northern Ireland will have to automatically place

their eligible jobholders into a qualifying pension

scheme and make minimum contributions on their

behalf (this contribution will be increased in phases).

The full extent of the duties is set out in the Pensions

Act 2008 and secondary legislation.

Table 1

The Automatic enrolment staging profile (Source: DWP)

Employer size (by PAYE scheme size)

or other description

Automatic enrolment

duty date

From

To

1 October 2012

1 February 2014

50 to 249 members

1 April 2014

1 April 2015

Test tranche for less than 30 members

1 June 2015

30 June 2015

30 to 49 members

1 August 2015

1 October 2015

Less than 30 members

1 January 2016

1 April 2017

Employers without PAYE schemes

1 April 2017

–

New employers April 2012 to March 2013

1 May 2017

–

New employers April 2013 to March2014

1 July 2017

–

New employers April 2014 to March 2015

1 August 2017

–

New employers April 2015 to December 2015

1 October 2017

–

1 November 2017

–

New employers October 2016 to June 2017

1 January 2018

–

New employers July 2017 to September 2017

1 February 2018

–

New employers October 2017

Immediate duty

–

250 or more members

New employers January 2016 to September 2016

continued over...

Corporate plan 2012-2015

19

Automatic enrolment

Regulatory strategic plan 2012-2015

Our strategy focuses on ensuring that all employers

are ready for automatic enrolment. Our initial focus

will be on large and medium employers, as the duties

will apply to them first, but we will eventually be

communicating with all employers. A key focus is also

to ensure that the advisers to whom employers will

turn are ready to offer support. This includes pension

providers, business software providers, administrators

and financial and business advisers.

Our employer audience is diverse, encompassing

large engaged corporations, and the owners of very

small businesses, who are not familiar with pension

provision. We will tailor our approaches for employers

of different sizes and business sectors utilising

different methods and language, communicating

over different timescales, and focusing on different

business advisers.

The educational products that we have already made

available include detailed guidance for large and/

or knowledgeable employers and advisers, business

software guidance, checklists for trustees, employers

and accountants, direct letters to employers as they

approach their staging date, and online interactive

tools to introduce small businesses to the new

requirements. We will continue to work to make sure

that employers have access to the information and

guidance that they need.

Our aim is to establish a pro-compliance culture

by supporting employers and making it as

straightforward as possible to comply, but also

making it clear that wilful or persistent noncompliance will result in regulatory action being

taken. Such action could include compliance notices,

fines, and escalating penalties, but we will not take

enforcement action unless we have previously given

the employer a chance to be compliant.

Our strategy focuses on ensuring

that all employers are ready for

automatic enrolment.

20

Corporate plan 2012-2015

Our enforcement approach is to:

• establish and maintain a pro-compliance

culture among employers

• maximise deterrence for those who are

considering committing a breach of the law

• prevent non-compliance by ensuring effective

controls are in place

• swiftly detect non-compliance by putting in place

effective systems to facilitate whistle blowing,

employer registration, and the analysis and sharing

of information and intelligence with other agencies

• investigate breaches of the law in a fair,

objective and professional manner to seek to

ensure that those responsible are held to account

for their actions

• fully examine the causes of breaches and ensure

that they inform our regulatory approach so as

to minimise the risk of such breaches occurring

again and

• effectively enforce against non-compliance by

applying appropriate civil and criminal sanctions.

In developing our employer compliance regime

to support automatic enrolment, we will work with

agencies already operating in the field of employer

compliance regimes including those responsible

for national minimum wage, health and safety and

gangmaster licensing. We aim to ensure effective

joint working in order to identify and address those

employers with a high risk of non-compliance, while

minimising the regulatory burden. Such collaboration

will necessitate our having a common or shared view of

risk with relevant agencies, and processes for sharing

and transferring risks. This will allow us to leverage

the most appropriate and proximate regulatory

regime to achieve our respective objectives.

Employers should have good systems of

administration in place to enable the timely payment

of contributions and exchange of information

between all parties involved in running the scheme

so that it is clear what contributions are due and paid

to schemes. This enables those running schemes to

meet their statutory duties to monitor contributions.

We will publish guidance on maintaining

contributions in 2012.

Strategic theme 4:

Better Regulation

Strategic objective

Since the launch of The Pensions Regulator in April 2005, we have been

committed to being risk-based and aligned with the principles of good

regulation ie to be proportionate, accountable, consistent, transparent and

targeted. Economy, effectiveness and efficiency are guiding principles in all

the regulator’s work and we are committed to the cross-government Smarter

Government initiative and efficiency priorities.

Corporate plan 2012-2015

21

Better Regulation

Current issues

Regulatory strategic plan 2012-2015

The difficult economic climate puts considerable

pressure on both employers and work-based pension

schemes. In light of these pressures, it is extremely

important that we fully apply the principles of

good regulation and be mindful of the burden on

employers and schemes. We are fully committed to

the Government’s Red Tape Challenge and its work to

reduce the overall burden of regulation.

The regulator will continue to further the good

regulation agenda by:

We will continue to work with other government

agencies to ensure that we deliver our objectives

while keeping the burden on business to a minimum.

This will also involve continuing to evaluate our

regulatory toolkit and the extent to which our powers

are effective and remain fit for purpose.

Accountability – As a public body, we continue to

be accountable for our conduct and operations to

Parliament, our stakeholders and the general public.

We have a complaints procedure in place.

All public bodies must operate within tight

expenditure constraints and we are committed

to economy, effectiveness and efficiency in all

our activities. Reducing our overall burden on the

environment also remains a priority.

In March 2011, the Work and Pensions Select

Committee adopted a report on automatic enrolment

and the National Employment Savings Trust (NEST)

and made a number of recommendations for the

Government to consider regarding the role that it and

the regulator might play in to ensure that the pensions

reforms are a success. These recommendations

included measures to ensure that the pension

schemes used to receive contributions from people

automatically enrolled into a pension of appropriate

standard and that measures to promote compliance

with the automatic enrolment duties are effective.

The regulator will consider the recommendations

made and, in conjunction with the DWP, take action

where appropriate. It will also play a full part in

providing evidence to the Work and Pensions Select

Committee’s next inquiry on pensions which is due to

take place over the summer of 2012.

At the time of writing this report, the National Audit

Office (NAO) was in the process of undertaking a

‘value for money’ review on the regulator. We expect

the NAO to produce its report shortly after this

document has been published. We will give careful

consideration to the recommendations it makes and if

appropriate amend our plans accordingly.

22

Corporate plan 2012-2015

Proportionality – In deciding whether to use our

powers, we ensure we consider the circumstances

surrounding the breach of the law including the risk

of harm to our objectives and the seriousness of any

breach, and apply the most appropriate remedy.

Consistency – We carry out our work in a fair and

reasonable manner by using a similar approach in

like cases to achieve similar ends. We ensure that we

assess our risks and use our enforcement options in a

consistent way where appropriate.

Transparency – We will remain committed to being

as transparent as we can within the constraints placed

upon us by legislation and the need to maintain

commercial confidentiality. We publicise and where

appropriate consult on our strategy, policies and

guidance, as well as our compliance activities and

enforcement outcomes. We will continue to publish

our key data and analysis publications on an annual

basis: these are the Purple Book (DB pensions

universe risk profile), Recovery plan analysis and An

analysis of the DC trust-based landscape.

Targeting – We direct our compliance activity at the

most serious risks. We engage with other regulators

to coordinate our action where we can do so thereby

avoiding duplication and burden on employers and

third parties.

Better Regulation

The regulator will continue to promote economy,

effectiveness and efficiency by:

Economy – Continuing our commitment to

the cross-government Smarter Government

initiatives and efficiency prioritisations targeted at

reducing back office costs. We acquire and maintain

human and capital resources in the most efficient

way possible.

• We continue to review and update our

procurement and IT processes to identify

opportunities for cross-organisation cost savings

and group negotiating of procurement contracts

to secure discounts. We seek to operate

economically by ensuring customers and suppliers

are fully aware of procurement processes and

commercial implications.

• Using our flexible resourcing model to draw on

high-calibre permanent staff with a small number

of secondments from the financial services and

professional sectors to bring up-to-date knowledge

and practices into the regulator.

Efficiency – Delivering maximum output for

our resources.

• We are fully committed to delivering our

operations in line with the Spending Review 2010

settlement including achieving efficiency savings.

This includes an ongoing focus on continuous

improvement in processes and technology.

• In line with the Government’s strategy of digital

by default, all of our reports and publications are

now available for downloading on our website,

and we have significantly reduced our production

of paper-based material. We continue to focus

our programme of regulatory communications on

our low cost e-channels and use of social media

communications channels where appropriate.

• We remain committed to maintaining a culture

that is fair and inclusive and promotes respect for

all, both as an employer and as a regulator.

• We continue to work with other public bodies

in order to provide joined up regulation. This

includes assisting the DWP in identifying and

implementing opportunities for reducing

avoidable burdens on schemes and employers

through the Red Tape Challenge and reducing the

overall regulatory burden on schemes.

Effectiveness – Ensuring the ongoing delivery of our

statutory objectives.

• Measure and reduce the environmental impact

of our actions.

• We continue to asses our performance through

a series of key performance indicators across our

four strategic themes.

• We monitor awareness of and attitudes towards

the regulator by means of an annual perceptions

tracker survey which gathers the opinions of a

wide audience ranging from scheme actuaries

to employers. We review areas where we are

perceived as effective and those where we are not.

• We continue to engage with external partners to

achieve exposure to a wide variety of perspectives,

keeping current with economic and regulatory

theories and approaches of other regulators.

In light of these pressures, it is

extremely important that we fully

apply the principles of good

regulation and be mindful of the

burden on employers and schemes.

Corporate plan 2012-2015

23

Business plan

2012-2013

Our business plan sets out our plans for the year ahead and the resources we

will need to deliver our priorities. It consists of:

• our deliverables for 2012-2013

• our performance measures for the period 2012-2013

• the resources we will need to deliver our priorities for 2012-2015

• our workload assumptions for 2012-2013.

The following sections set out our planned deliverables for the year ahead

(2012-2013) in each of our four strategic areas.

24

Corporate plan 2012-2015

Business plan 2012-2013

DB deliverables 2012-2013 This year, our overarching aim will be to help schemes navigate through the

challenging economic environment and to provide clarity to trustees and sponsors on our expectations

regarding valuations and recovery plans.

Scheme

valuations

and scheme

applications

Receive the outstanding scheme valuations from the second cycle of triennial funding

statements and focus on areas of risk this information presents.

Regulatory

guidance

Set out our strategic direction for the regulation of DB schemes.

Deal quickly and effectively with all applications and scheme submissions including

recovery plans.

Publish a spring 2012 statement that will set out our expectations of those trustees

going through the valuation process in the coming months. We plan to make this an

annual statement, helping trustees to understand our expectations within the prevailing

economic conditions.

Provide more clarity on our views on good outcomes and behaviours through the revision

of key funding documents such as our funding code of practice.

Publish where appropriate reports explaining the reasoning behind significant

regulatory decisions.

Revise the timing and production of our Recovery plan analysis statistics on the scheme

funding landscape to produce a richer annual data set.

Market

behaviours

Proactively monitor and engage the market on innovative solutions and ensure

the risks to scheme members and the PPF are adequately considered.

Continue to target those instances where moral hazard and avoidance activity

have placed members’ benefits at risk.

Scheme

segmentation

Segment the DB market and tailor our approach to risks in each segment to better

target our resources on risks to members and PPF levy payers.

Proactively engage with schemes whose valuations present particular risk, and work

with those schemes early in their funding process.

Focus on the longer term funding of schemes, specifically where they are rapidly maturing.

Partnership

working

Continue to work with our government partners and industry stakeholders to

raise standards of scheme governance and protect the security of pension scheme

members’ benefits.

Work with the European Insurance and Occupational Pensions Authority (EIOPA),

our UK government partners, and the pensions industry to ensure the UK position is

recognised in Europe and the right outcome is achieved for UK pension schemes. This will

include engaging fully in the review of the IORP Directive with a particular focus on the

development of a sound impact assessment.

continued over...

Corporate plan 2012-2015

25

Business plan 2012-2013

DB deliverables 2012-2013 continued...

Scheme

administration

Continue to measure the extent to which schemes have adopted the record-keeping

standards, on which we issued guidance in June 2010. This will include measuring the

percentage of large schemes which have a complete set of common data.

Examine the ease of switching administration provider for employers and trustees and

consider the extent to which the current system safeguards member benefits.

Scheme

governance

Monitor, using our annual Scheme governance survey, the way that pension schemes

are run, including the existence of robust systems of internal controls and clear

accountabilities for the decisions made in the scheme.

Undertake governance and administration cases including applications, financial

management, wind-ups, internal controls and record-keeping.

26

Corporate plan 2012-2015

Business plan 2012-2013

DC deliverables 2012-2013

Key principles

for DC

schemes

Build awareness of the six key principles for DC schemes. This will include delivering new

educational content to trustees via the Trustee toolkit to reflect the key

principles for DC schemes, and delivering content to help employers engage with

their advisers in understanding the features of schemes which can assist in leading to good

member outcomes.

Produce a suite of products, messages and tools that will raise the standards of pension

provision used for automatic enrolment, help employers select a suitable scheme for

automatic enrolment, and enable members and trustees to assess their scheme.

Agree the criteria and standards for administration and governance with the demand and

supply side of the industry that underpin the principles and communicate any next steps

we expect industry to take.

Engage in work taking place in the EIOPA to seek to ensure the right outcome is reached

for UK schemes.

Deliver an education and communications programme across all channels in line with the

DC strategy including a communications programme to support automatic enrolment.

Our ECR communications strategy includes helping employers who may be reviewing their

pension arrangements. As part of this help, we will ensure employers and their advisers are

aware of the six key principles for DC schemes. We will engage with employer stakeholder

bodies, intermediary stakeholder bodies and employers via a range of communications

channels ranging from digital to face-to-face engagement where appropriate.

DC landscape

segments

Continue to build our regulatory programme in the five work streams of the DC

programme consisting of micro schemes, small and medium schemes, large employersponsored schemes, multi-employer schemes with non-associated employers and

contract-based provisions (work-based personal pensions). We will:

• Focus on the trustee in small, medium and large employer sponsored

schemes and use our existing regulatory toolkit to drive up standards of

governance and administration

• Engage the industry and our Government partners to review whether the

regulator’s reach in regard to multi-employer schemes with non-associated

employers is sufficient and to understand how regulatory oversight can address

the risks identified

• Define a strategy, in collaboration with the FSA, for contract-based provision to

help ensure that members receive appropriate levels of protection.

Market

developments

Continue to review developments in the DC marketplace including those relating

to charges, investment decisions and annuities. This will include building on the

recommendations expected in 2012 by the Open market option (OMO) review group.

Continue to monitor the proportion of schemes which have default funds established to

reflect the profile of the scheme membership.

continued over...

Corporate plan 2012-2015

27

Business plan 2012-2013

DC deliverables 2012-2013 continued...

Trustee

Knowledge and

Understanding

Measure Trustee Knowledge and Understanding (TKU) among the regulated community

and continue to monitor the effectiveness of the trustee register. Indentify any gaps

within the current Trustee toolkit for DC trustees and publish new material to close

hose gaps.

Scheme

administration

Continue to measure the extent to which schemes have adopted the record-keeping

standards we issued guidance in June 2010. This will include measuring the percentage

of large schemes which have a complete set of common data.

Clarify the role and responsibilities of administrators, who play a key role in helping

industry to adopt good practice standards of administration.

Examine the ease of switching administration provider for employers and trustees

and consider the extent to which safeguards for member outcomes are achieved.

Review the quality of administration for deferred members and use our existing

regulatory toolkit to drive up standards.

Scheme

governance

Consider how the trustee model can best provide good member outcomes.

Monitor, using our annual Scheme governance survey, the way that pension schemes are

run and how key risks are evaluated, including the existence of robust systems of internal

controls and clear accountabilities for the decisions made in the scheme.

Review governance in contract-based arrangements at provider level.

Continue to review the governance of hybrid schemes and

take further action as necessary.

28

Corporate plan 2012-2015

Business plan 2012-2013

Automatic enrolment deliverables 2012-2013 In 2012-2013, the regulator will:

Employer

compliance

Write to employers to notify them of their duty date 12 months and 3 months before their

duty date. An additional 18 month letter will go to large employers.

We will provide:

• A variety of tools to raise awareness, including producing stakeholder guidance,

holding industry stakeholder events and providing online information and tools

• Customer support to all employers

• Information to intermediaries to ensure that employer advisers, know what employers

need to do, when and how they need to do it

• Information directly to employers to support them as they prepare

• Online interactive tools to introduce small businesses to the new requirements and

• Detailed guidance suitable for pensions professionals.

Employer

registration

Put in place effective registration systems and supporting organisational systems by July

2012 to enable employers to register with us in compliance with their duties and to seek

to ensure non-compliance is held at an absolute minimum. This will be developed through

intensive stakeholder engagement and feedback.

Employer and

employee

contributions

Review the framework for maintaining contributions to identify the most efficient and

effective approach to achieving good member outcomes.

Consult on any changes to codes and regulatory guidance which may be necessary to

support the process of maintaining contributions.

Aim to ensure that employers and industry are aware of the regulators’ role in maintaining

contributions.

Work with providers to help ensure that their products comply with legislation and with

business software providers to help ensure that the payroll systems used by employers

support them in being able to comply with their duties.

Regulatory

processes

Develop processes to identify and manage systemic risks as they develop. This will

be supported through the use of intelligence including management information,

whistleblowing, working with other agencies and data analysis.

This will include building our internal organisation and people capacity and working with

external suppliers to manage any outsourced aspects of the compliance process.

Engage in the work taking place in the EIOPA to ensure they take account of the

requirements of automatic enrolment.

Measure stakeholder confidence in the regulator’s ability to deliver its compliance role.

continued over...

Corporate plan 2012-2015

29

Business plan 2012-2013

Better Regulation deliverables 2012-2013 In 2012-2013, the regulator will:

Economy,

effectiveness

and efficiency

Economy

Maintain tight controls, including those set by central government, on all

expenditure. Deliver all changes within a programme of change that measures

all impacts and costs centrally.

Continue to explore e-procurement and IT solutions to provide cost saving vehicles for

goods and services that deliver business benefits.

Carry out a survey of all staff working for us, and benchmark the results against those of a

wide variety of other employers, to help identify areas of strength and any concerns that

we may need to address.

Effectiveness

Continue to measure our operations against a series of key performance indicators as

outlined on pages 32 to 40. We will prioritise our work in accordance with a thorough

assessment of the risks posed to the achievement of our statutory objectives.

Fully consider the recommendations from the Work and Pensions Committee

reports on pensions and the NAO’s value for money review of the regulator and take

action as appropriate.

Continue to monitor awareness of and attitudes towards the regulator by means of a biannual Perceptions tracker survey which gathers the opinions of a wide audience ranging

from scheme actuaries to employers.

We will explore a new Customer Relationship Management (CRM) solution in order to

increase the targeting and effectiveness of our regulatory communications programme. In

addition we will continue to monitor customer quality of service including call pick up rate,

email, letter and fax response rates and proactive contacts.

30

Corporate plan 2012-2015

Business plan 2012-2013

Better Regulation deliverables 2012-2013 continued...

Economy,

effectiveness

and efficiency

continued...

Efficiency

Achieve the 2012-2013 target in line with the Spending Review 2010 settlement. Savings

will be monitored through an internal efficiency programme board whose aim is to achieve

process efficiencies across business with a particular focus on back office operations.

Automate our recovery plan submission process to deliver a more streamlined and

efficient internal and external process.

Undertake a scheme burden project to understand detailed cost drivers for schemes in

preparing scheme returns and develop cost efficiencies. Baseline scheme burden against a

new Key Performance Indicator (KPI) and measure future improvements against this.

Achieve greater efficiency and closer co-operation on a range of policy and transactional

processes. This will include working closely with HMRC to enable appropriate regulation of

micro schemes, shared procurement with other public

bodies and automation of processes.

Work with our government partners to reduce the overall burden of regulation in line with

the Red Tape Challenge.

Implement the 2012-2013 sustainability action plan across the regulator to continue to

work towards delivering a 25% reduction in carbon emissions base lined against 2009-2010

by the target date of 2014-2015. These reductions will be delivered within an overall focus

on cost efficiency.

Corporate plan 2012-2015

31

Key performance indicators

2012-2013

The following sections set our annual Business plan objectives and associated

corporate performance measures for the period 2012-2013.

32

Corporate plan 2012-2015

Key performance indicators 2012-2013

How we measure our performance

Our aim is to measure, as far as practicable, the

outcomes of our interventions in the market, both in

terms of what we have achieved and how effectively

we deliver these outcomes.

Measuring our effectiveness in protecting member

benefits, especially over a one year timeframe, is not

straightforward as:

• pensions are a long-term investment and it may

be decades before it becomes clear whether

members have received their full benefits

• other factors over which we have no or minimal

impact will strongly influence the outcome, such

as underlying market conditions.

Therefore we focus our attention on more

intermediate results that we believe will enable us to

meet our long-term ambitions. So, for example, we

aim our activity at:

As there is a time lag between our actions and these

outcomes becoming apparent, we also measure some

key enablers of our ability to deliver these outcomes.

In particular, we focus on the delivery of key outputs

and the credibility of the regulator. These measures

are principally secured through research and survey

results and we believe that these are good indirect

measures. These measures are reported quarterly

to our board and the DWP using a performance

dashboard specifically developed to present the

outcome measures agreed in the Business plan.

While our KPIs are aligned with our one year Business

Plan, for each of our three main business areas, we

have also set out our long term strategic objectives,

which given the longer timeframe, allow us to focus

more on the eventual pension outcomes for members.

continued over...

• ensuring that schemes and sponsors are aware

of our expectations of them and have the right

approach to managing risks in their schemes

• promoting better governance to reduce the

likelihood of schemes being underfunded or

of administrative failings that impact on

members’ benefits

• increasing the understanding of the risks to DC

schemes, and how to manage them, to reduce

the likelihood of such risks materialising

• increasing employer awareness and understanding

of their duties under the Pensions Act 2008 in

order to maximise compliance.

Corporate plan 2012-2015

33

Key performance indicators 2012-2013

Strategic theme 1: Reducing risks to DB scheme members

In addition to the ‘in-year’ measures below, we shall monitor over the longer-term the extent to which we

are achieving our two major strategic objectives in DB by monitoring:

1. the extent to which all members receive uncompromised pension provision.

And where it is not possible to ensure members receive their full entitlement from their scheme:

2. we will monitor the extent to which schemes where the sponsor becomes insolvent are funded

below the levels which the PPF believe are appropriate.

We aim to publish further details of these longer-term indicators in September 2012.

1.1

Objective

To ensure schemes and their advisers understand the regulator’s position on scheme funding for the

next round of valuations, taking account of the ongoing economic downturn.

Performance indicator

Effectiveness of the regulator’s activity to inform schemes submitting

a scheme valuation in the next cycle.

Measure: scheme funding expectations

We will target in a survey planned for the third quarter an appropriate increase in awareness and

understanding of the regulator’s expectations for the next round of valuations among schemes and

their advisers, against a baseline measure that we will obtain in a survey taking place in the first

quarter of the year.

1.2

Objective

To ensure the regulator is efficient at dealing with recovery plans.

Performance indicator

Reduction in the time the regulator takes to deal with recovery plans.

Measure: recovery plan response time

We will set a target of reducing the time that the regulator takes to close recovery plans, both for

those requiring further investigations and for those that do not.

1.3

Objective

To ensure that trustees and employers have an effective approach to scheme risk management.

Performance indicator

Trustees with a DB scheme manage funding and investment risk with reference to covenant.

Measure: risk management

We will target in the Scheme governance survey planned for the fourth quarter, an appropriately

challenging improvement in a new baseline measure that we will obtain in the autumn Scheme

governance survey.

34

Corporate plan 2012-2015

Key performance indicators 2012-2013

Strategic theme 1: Reducing risks to DB scheme members continued...

1.4

Objective

To educate and enable those responsible for member record-keeping and those who administer

pension arrangements, to improve the standard of record-keeping across the industry.

Performance indicator

Among large DB schemes, an improvement in the proportion of member records with all the

common data items in place according to the regulator’s guidelines for common data.

Measure: record-keeping

We will target 95% for legacy data, to be achieved by December 2012, as measured in our annual

Record-keeping survey.

continued over...

Corporate plan 2012-2015

35

Key performance indicators 2012-2013

Strategic theme 2: Reducing risks to DC scheme members

In addition to the ‘in-year’ measures below, which are designed to encourage good design and governance

of new and existing DC schemes, we shall monitor over the longer-term the extent to which we are

achieving our two major strategic objectives in DC by monitoring:

1. the extent to which features of the DC principles are integrated into work-based DC schemes.

2. the extent to which beneficiaries from DC schemes achieve demonstrably better outcomes.

2.1

Objective

To manage the delivery of the DC programme (including project delivery

and its impact on the regulator’s other activities).

Performance indicator

Project delivery is to plan. The regulator achieves its planned business objectives without disruption.

Measure: delivery milestones

We will look to achieve all of our delivery milestones in 2012-2013 on time and within tolerance.

2.2

Objective

To build awareness of the six principles of design and management of a good DC scheme.

Performance indicator

Good levels of awareness of the principles among both the supply-side and demand-side.

Measure: principles of scheme design and management

We will target in surveys planned for the fourth quarter, an appropriate increase in awareness of the

principles, against baseline measures that we will obtain in the first and second quarters of the year.

2.3

Objective

To educate and enable those responsible for member record-keeping and those who administer

pension arrangements, to improve the standard of record-keeping across the industry.

Performance indicator

Among large DC schemes, an improvement in the proportion of member records with all the

common data items in place according to the regulator’s guidelines for common data.

Measure: record-keeping

We will target 95% for legacy data, to be achieved by December 2012, as measured in our annual

Record-keeping survey.

36

Corporate plan 2012-2015

Key performance indicators 2012-2013

Strategic theme 2: Reducing risks to DC scheme members continued...

2.4

Objective

To ensure that trustees have sufficient understanding of costs and charges incurred by members to

deliver better value for money for members.

Performance indicator

Trustee boards’ collective understanding of the charges incurred by the members in their scheme.

Measure: understanding of costs and charges

We will measure, through the biannual Scheme governance survey, trustee boards’ collective

understanding of the following in relation to the scheme’s funds:

• annual management charge

• total expense ratio

• portfolio turnover rate.

We will set an appropriately challenging target in the survey planned for the fourth quarter, against

the result achieved in the fourth quarter of 2011-2012.

continued over...

Corporate plan 2012-2015

37

Key performance indicators 2012-2013

Strategic theme 3: Automatic enrolment

In addition to the ‘in-year’ measures below, we shall monitor over the longer-term the extent to which we

are achieving our major strategic objectives of maximising employer compliance with employer duties

and the employment safeguards introduced by the Pensions Act 2008 by monitoring the extent to which

the process of automatic enrolment becomes an accepted part of an employer’s duties, akin to all other

established legal obligations.

3.1

Objective

To manage the delivery of the Employer Compliance Regime (ECR) programme (including project

delivery and its impact on the regulator’s other activities).

Performance indicator

Project delivery is to plan. The regulator achieves its planned business objectives without disruption.

Measure: delivery milestones

We will look to achieve all of our delivery milestones in 2012-2013 on time and within tolerance.

3.2

Objective

To maximise on-time compliance with the new employer duties.

Performance indicator

Employers register with the regulator.

Measure: principles of scheme design and management

Cumulative number of employers who have registered with the regulator.

3.3

Objective

To communicate effectively to employers about the pensions reform.

Performance indicator

High proportion of employers whose staging date falls in 2012-2014 are aware of and understand

their automatic enrolment duties, as measured in the Employer tracking survey.

Measure: communications effectiveness

For those employers whose staging date falls in 2012-2013, we will target 95% to be aware and 80%

to understand their duties 3 months before their staging date. For those employers whose staging

date falls in 2013-2014, we will target levels of awareness and understanding that show appropriate

progression towards the targets above.

38

Corporate plan 2012-2015

Key performance indicators 2012-2013

Strategic theme 4: Better Regulation

4.1

Objective

To continue to deliver risk-based regulation in line with the Hampton Principles and to be an

exemplar of best practice.

Performance indicator

The regulator continues to be authoritative and demonstrates improvements in the five principles of

good regulation, as evidenced by research. We will measure this through the biannual Perceptions

tracker survey.

Measure: Hampton Principles

We aim to maintain our strong ratings measured in our Perceptions tracker survey across the

collective results on the Hampton Principles. We will continue a target of 70% of stakeholders

agreeing that the regulator meets the six principles (on average across the principles).

4.2

Objective

External stakeholders have confidence in the regulator’s delivery of DB regulation,

DC regulation and the Employer Compliance Regime.

Performance indicator

Sustained performance in stakeholder confidence, as measured by the Stakeholder perceptions survey.

Measure: stakeholder satisfaction

We will measure the extent to which our stakeholders have confidence in the regulator’s delivery of

DB regulation, DC regulation and the Employer Compliance Regime.

Following the survey taking place in the fourth quarter of 2011-2012, we will set an appropriately

challenging target to achieve in the survey planned for the fourth quarter.

4.3

Objective

To ensure efficiency in our data collection processes.

Performance indicator

New schemes which have registered with HMRC are registered with the regulator or have told us why

they are exempt.

Measure: new schemes registration

We will target an appropriate improvement in the proportion of new schemes which have registered

with HMRC are registered with the regulator.

continued over...

Corporate plan 2012-2015

39

Key performance indicators 2012-2013

Strategic theme 4: Better Regulation continued...

4.4

Objective

To continue to develop appropriate education programmes to influence our core trustee audience (ie

the Trustee toolkit) and to explore the options for extending this approach to other audiences.

Performance indicator

Toolkit usage among lay trustees to match the 2011-2012 targets.

Measure: Trustee Knowledge and Understanding (TKU

We will continue to set quarterly targets for trustee completions of modules of the Trustee toolkit.

Targets are aligned with communications activity and seasonality and are follows:

• Q1: 5,000 completions

• Q2: 4,000 completions

• Q3: 4,000 completions

• Q4: 5,300 completions.

4.5

Objective

To provide a high-quality service to our customers.

Performance indicator

Maintenance of the high customer satisfaction as measured by our customer

and website satisfaction research.

Measure: Customer service