Valuation Analysis

ÍNDICE

Invitación

2

Edicto de Convocatoria

3

Manual de cómo votar a través del sistema online

Petición Pública de Poder

5

7

Deliberación de las siguientes cuestiones en la Asamblea General Extraordinaria(AGE)

I. Venta para la Companhia Ultragaz S.A., sociedad absorbida de la Ultrapar

Participações S.A., de 100% (cien por ciento) de la participación accionaria de

Petróleo Brasileiro S.A. - PETROBRAS en la Liquigás Distribuidora S.A.

8

Anexo I – Fairness Opinion – Itaú

14

Anexo II – Fairness Opinion - Crédit Agricole

19

Anexo III – Valuation – Crédit Agricole

22

II. Venta para el GRUPO PETROTEMEX, S.A. DE C.V. (“GRUPO PETROTEMEX”) y para

DAK AMERICAS EXTERIOR, S.L (“DAK”), sociedad absorbidas de Alpek, S.A.B. de

C.V. (“Alpek”), de 100% (cien por ciento) de la participación accionaria de Petróleo

Brasileiro S.A. – PETROBRAS en las sociedades Companhia Petroquímica de

Pernambuco (“PetroquímicaSuape”) y en la Companhia Integrada Têxtil de

Pernambuco (“CITEPE”)

66

Anexo I – Fairness Opinion - Crédit Agricole

72

Anexo II – Fairness Opinion - Evercore

75

Anexo III – Valuation – Evercore

79

1

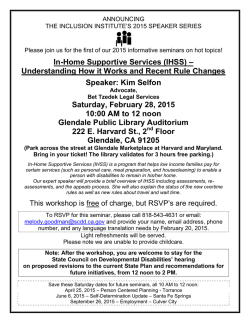

CONVITE

Fecha: 31 de enero de 2017

Horário: 15hs

Local: Auditorio de la sede de la Compañía, Avenida República do Chile 65, 1º

andar, en la ciudad de Río de Janeiro (RJ)

Asamblea General Extraordinaria

Cuestiones:

I.

Propuesta de aprobación de la venta de 100% (cien por ciento) de la

participación accionaria de Petróleo Brasileiro S.A. - PETROBRAS en la

Liquigás Distribuidora S.A. à Companhia Ultragaz S.A., sociedad absorbida

de la Ultrapar Participações S.A; y

II.

Propuesta de aprobación de la venta de 100% (cien por ciento) de la

participación accionaria de Petróleo Brasileiro S.A. – PETROBRAS en la

Petroquímica Suape y en la CITEPE, para el GRUPO PETROTEMEX, S.A. DE

C.V. (“GRUPO PETROTEMEX”) y la DAK AMERICAS EXTERIOR, S.L (“DAK”),

sociedad absorbidas de la Alpek, S.A.B. de C.V. (“Alpek”),

2

ASAMBLEA GENERAL EXTRAORDINARIA

EDICTO DE CONVOCATORIA

El Consejo de Administración de Petróleo Brasileiro S.A. – Petrobras convoca a los accionistas

de la Compañía a reunirse en Asamblea General Extraordinaria, el 31 de enero de 2017, a las

15:00, en el auditorio del Edificio Sede, en la Avenida República do Chile 65, 1º andar (piso),

en la ciudad de Río de Janeiro (RJ), con el fin de deliberar sobre lo siguiente:

I.

Propuesta de aprobación de la venta de 100% (cien por ciento) de la participación

accionaria de Petróleo Brasileiro S.A. - PETROBRAS en la Liquigás Distribuidora

S.A. à Companhia Ultragaz S.A., sociedad absorbida de la Ultrapar Participações

S.A., por el valor de R$ 2.665.569.000,00 (dos mil milliones, seiscientos sesenta y

cinco millones quinientos sesenta y nueve mil reales), y;

II.

Propuesta de aprobación de la venta de 100% (cien por ciento) de la participación

accionaria de Petróleo Brasileiro S.A. – PETROBRAS en la Petroquímica Suape y en

la CITEPE, para el GRUPO PETROTEMEX, S.A. DE C.V. (“GRUPO PETROTEMEX”) y la

DAK AMERICAS EXTERIOR, S.L (“DAK”), sociedad absorbidas de la Alpek, S.A.B. de

C.V. (“Alpek”), por el valor, en reales, equivalente a US$ 385,000,000.00 (tres ciento

ochenta y cinco millones de dólares), corregidas por la variación acumulada

positiva de la tasa de inflación de Estados Unidos para el período comprendido

entre la fecha (31/12/2015) y la fecha de cierre de la transacción, utilizando el tipo

de cambio de 3 días hábiles antes de la fecha de cierre de la transacción .

Quien esté presente en la Asamblea deberá probar su condición de accionista, según los

términos del artículo 126 de la Ley 6.404, del 15/12/1976. Si el accionista desea ser

representado, deberá cumplir los preceptos del párrafo 1º del artículo 126 de la mencionada

Ley y del artículo 13 del Estatuto Social de Petrobras, exhibiendo los siguientes documentos:

i) Documento de identidad del representante;

ii) Poder con facultades especiales del representado con firma reconocida en notaría (original

o copia compulsada);

iii) Copia del contrato/estatuto social del representado o del reglamento del fondo, si

aplicable;

iv) Copia del término de posesión o de documento equivalente que compruebe las facultades

del otorgante del poder, si aplicable.

3

Se solicita que los accionistas representados por poderes depositen, con antelación mínima

de tres días hábiles, los documentos antes enumerados en la sala 1002 (Atención al

Accionista) del Edificio Sede. Para aquellos que presentarán la documentación el día de la

Asamblea, la Compañía informa que estará apta a recibirla desde las 11 a.m., en el lugar

donde las reuniones serán realizadas.

El ejercicio del derecho a voto en el caso de préstamo de acciones quedará a cargo del

prestatario, excepto si el contrato firmado entre las partes lo disponga de manera diferente.

Además, los accionistas también pueden optar por votar en las materias constantes en este

Edicto mediante la utilización del pedido público de poder, conforme a la Instrucción CVM

481, del 17 de diciembre de 2009

La recepción de los poderes electrónicos se dará por medio de la dirección electrónica de la

Compañía (http://www.petrobras.com.br/ri) a partir de principios de enero de 2017.

La Compañía informa que no adoptó el boletín de voto a distancia de que trata la Instrucción

CVM 561 del 7 de abril de 2015, teniendo en cuenta su no-obligatoriedad para el asunto que

será deliberado en esta AGE, de conformidad con el artículo 21-A §2 de dicha Instrucción.

Se encuentra a disposición de los accionistas, en la sala 1002 (Atención al Accionista) del

Edificio Sede de la Compañía, y en las direcciones electrónicas de la Compañía

(http://www.petrobras.com.br/ri) y de la

Comissão de Valores Mobiliários – CVM

(http://www.cvm.gov.br), toda la documentación pertinente a las materias que serán

deliberadas en estas Asambleas Generales Extraordinaria y Ordinaria, según los términos de

la Instrucción CVM 481, del 17 de diciembre de 2009.

Rio de Janeiro, 29 de diciembre de 2016.

Durval José Soledade Santos

Presidente del Consejo de Administración en ejercicio

4

MANUAL DE CÓMO VOTAR POR EL SISTEMA EN LÍNEA

Paso 1 – Solicitar contraseña para validación del accionista

a) Ingrese a la dirección https://petrobras.infoinvest.com.br/assembleias/31-01-2017, haga

clic en "Haga clic aquí para solicitar el envío de la contraseña" y llene los datos del formulario

para recibir por correo la contraseña de validación del voto a distancia.

b) Se envía un correo electrónico para el solicitante de la contraseña con el identificador de

cada fondo.

c) El accionista recibirá en la dirección que consta en el registro el documento informando la

contraseña para la votación a distancia. Asegúrese de que su registro se actualice.

Paso 2 – Enviar documentos de identificación del accionista

Todos los documentos se deben presentar en un único sobre y deben ser recibidos hasta el día

23 de enero de 2017 en la dirección indicada abajo:

Donnelley Financial Solutions

Rua Dom Gerardo 46, 4º andar

CEP [código postal] 20090-030

Rio de Janeiro, RJ

Los documentos para identificación del accionista son los siguientes:

a) Persona física

• copia legalizada del CPF;

• copia legalizada de la identidad (RG, CNH [Licencia Nacional de Conducir] o pasaporte);

• copia legalizada del comprobante de residencia;

• poder con firma reconocida en notaría para la entrega de los poderes de voto a los

procuradores presentes en la asamblea.

b) Persona jurídica

• copia legalizada de la tarjeta del CNPJ;

• copia legalizada del estatuto social o reglamento;

• documentos de identificación de la persona física que posee poderes de representación del

CNPJ (de acuerdo con la lista de documentos para Persona Física mencionados

anteriormente);

• copia legalizada de los documentos que comprueban poderes de representación de la

persona física en cuestión (estatuto social o poder de otorga emitido por el representante

legal del CNPJ).

5

Paso 3 – Votar en la asamblea por la plataforma

Para

ejercer

su

derecho

de

voto,

ingrese

a

https://petrobras.infoinvest.com.br/assembleias/31-01-2017 y haga clic en la opción "Haga

clic para votar". Para cada uno de los fondos, será necesario informar en la pantalla de inicio de

sesión el CPF/CNPJ (se necesita puntuación), el identificador del fondo (informado por correo

electrónico) y la contraseña (enviada por carta).

La votación podrá ser efectuada entre los días 13 y 30 de enero de 2017. El accionista recibirá el

comprobante de su voto por correo electrónico.

6

PEDIDO PÚBLICO DE PODERES

Rio de Janeiro, 29 de diciembre de 2016, Petróleo Brasileiro S.A. – Petrobras invita a sus

accionistas a participar en la Asamblea General Extraordinaria, que se realizará el 31 de

diciembre de 2016, a las 15 horas, a fin de deliberar acerca de la materia que consta en el

Edicto de Convocatoria.

Con el objetivo de facilitar e incentivar la participación de los accionistas con derecho a voto,

la Compañía pone a disposición a través de la red mundial de computadoras la posibilidad de

que los accionistas voten las materias constantes en el Edicto de Convocatoria, por

intermedio de la utilización del pedido público de poder, según la Instrucción CVM nº 481

establecida el 17 de diciembre de 2009.

El voto electrónico se dará por medio de plataforma para votación En línea, a través de la

dirección https://petrobras.infoinvest.com.br/assembleias/31-01-2017. Para ello, es

necesario que los accionistas soliciten tan pronto como les sea posible la contraseña de

validación del voto a distancia. La intención de voto por parte del accionista deberá enviarse

a través del sistema entre los días 13 y 30 de enero de 2017.

La participación electrónica en la Asamblea General Extraordinaria no está disponible para

nuestros poseedores de ADR.

Consulte el ítem “Manual de cómo votar por el Sistema En línea”, conforme consta en este

Manual para la Participación de Accionistas.

Con esta alternativa, Petrobras busca fortalecer su compromiso de adoptar las mejores

prácticas de Gobierno Corporativo y de transparencia.

7

ASAMBLEA GENERAL EXTRAORDINARIA

EXPOSICIÓN A LOS ACCIONISTAS

ÍTEM I

Venta, para la Companhia Ultragaz S.A., sociedad absorbida de la

Ultrapar Participações S.A., de 100% (cien por ciento) de la

participación accionaria de Petróleo Brasileiro S.A. – PETROBRAS en

Liquigás Distribuidora S.A.

En conformidad con comunicado por la Compañía el 17 de noviembre de 2016, el

Consejo de Administración ("CA"), en reunión realizada en aquella fecha, aprobó

la convocatoria de Asamblea General Extraordinaria de PETROBRAS para

deliberar sobre la venta de 100% (cien por ciento) de la participación accionaria de

Petróleo Brasileiro S.A. – PETROBRAS en la Liquigás Distribuidora S.A. para la

Companhia Ultragaz S.A. (“Ultragaz”) por el monto de R $ 2,666 mil millones de

dólares.

Liquigás es una sociedad absorbida de PETROBRAS y actúa en el

embotellamiento, distribución y comercialización de gas licuado de petróleo

("GLP"). La compañía está presente en casi todos los estados brasileños y cuenta

con 23 centros operativos, 19 almacenes, una base de almacenamiento y carga

por carretera y ferrocarril y una red de aproximadamente 4800 distribuidores

autorizados.

El Plan de Negocios y Gestión (“PNG”) 2015-2019, aprobado por el CA el 26 de

junio de 2015 tenía como objetivos fundamentales el desapalancamiento de la

Compañía y la generación de valor para los accionistas, previendo un importe de

desinversiones para el periodo entre 2015 y 2016 de US$ 15,1 mil millones. El Plan

Estratégico y PNG 2017-2021, aprobado el 19 de septiembre de 2016 por el CA

prevé una meta de desinversiones de US$ 19,5 mil millones para el bienio 20172018. Este importe es complementario a la meta del bienio 2015-2016.

Además, el Plan Estratégico y el PNG 2017-2021 han definido como una de sus

estrategias de optimización de portafolio de negocios la salida integral de la

distribución de GLP.

8

La venta de la participación integral de PETROBRAS en Liquigás, por lo tanto,

posee adherencia estratégica con el Plan Estratégico y el PNG 2017-2021.

Proceso de venta

PETROBRAS estructuró un procedimiento de venta que contó con la participación

de inversores estratégicos del segmento de GLP, inversores estratégicos del

segmento de Gas Natural e inversores financieros.

De las 46 empresas que recibieron el teaser, 19 firmaron el acuerdo de

confidencialidad para proseguir en el proceso y recepción del memorándum con

informaciones detalladas del activo en venta (Information Memorandum), lo cual

contiene aspectos como proyecciones financieras y análisis sectorial.

Después de la recepción de las ofertas no vinculantes, 6 (seis) empresas se

clasificaron para la siguiente etapa y se las invitó a realizar due diligence, y ofrecer

las ofertas vinculantes junto con las alteraciones propuestas en la minuta

estándar del Contrato de Compra y Venta de Acciones (“CCVA”).

Al final del proceso de due diligence, se recibieron 3 (tres) ofertas vinculantes, con

diferentes condiciones comerciales, donde la de Ultragaz, de mejor precio y

mejores condiciones contractuales, fue considerada más ventajosa para

Petrobras.

Firma del CCVA

Una vez finalizado el proceso de negociación con Ultragaz, y luego del proceso

interno de aprobación de la operación por la Dirección Ejecutiva y el Consejo de

Administración de PETROBRAS, PETROBRAS y Ultragaz, firmaron el 17 de

noviembre de 2016, el Contrato de Compraventa de Acciones y otros Convenios

("CCVA"), en la calidad de Vendedora y Compradora; y Liquigás y Ultrapar, en la

calidad de intervinientes, con cláusula de condiciones suspensivas imponiendo,

entre otras, la condición suspensiva de posterior aprobación por las autoridades

societarias competentes de ambas partes ("Asamblea General Extraordinaria" o

"AGE") y la aprobación de la Operación por el Consejo Administrativo de Defensa

Económica ("CADE").

Precio de Adquisición .

El precio de adquisición es de R$ 2.665.569.000,00 (dos mil millones seiscientos y

sesenta y cinco millones, quinientos y sesenta y nueve mil reales) ("Precio de

Adquisición Base"), el cual se ajustará por la variación de la tasa diaria promedio

ofrecida para depósitos interbancarios de 1 (un) día calculada y divulgada

9

diariamente por la Central de Custodia y Liquidación de Valores Financieros CETIP y expresada como un porcentaje por año (para un año de 252 días útiles)

("CDI") entre la fecha de la firma del CCVA y la fecha de cierre de Operación

("Fecha de Cierre" y "Precio de Compra"). Dicho Precio de Adquisición Base

corresponde a un enterprise value (valor de la empresa) de R$ 2.800.000.000,00

(dos mil millones ochocientos millones de reales), más el valor referente al

Terreno de Osasco (que podrá ser excluido del negocio hasta la Fecha de Cierre) y

deducida la deuda líquida de Liquigás en el 31 de diciembre de 2015, por un monto

de R$ 196.031.000,00 (ciento noventa y seis millones y treinta y un mil reales).

Ajustes al Precio de Adquisición

El Precio de Adquisición está sujeto a ajustes, para más o para menos, debido a

los cambios de capital circulante y de posición neta de deuda de Liquigás entre el

31 de diciembre de 2015 y la Fecha de Cierre, que se calculará después de dicha

Fecha de Cierre.

Condiciones suspensivas y resolutorias.

La consumación de la Operación está sujeta a ciertas condiciones suspensivas

usuales en negocios de esa naturaleza, de entre las cuales se destacan (i) la

aprobación del CADE: (ii) la aprobación por la AGE de accionistas de Ultrapar, bajo

los términos del art. 256 de la Ley N.° 6.404/76; y (iii) la aprobación por la AGE de

accionistas de PETROBRAS bajo los términos de su Estatuto Social.

Resumen de las declaraciones y garantías prestadas por PETROBRAS

Las declaraciones y garantías prestadas por PETROBRAS son (i) constitución y

existencia de PETROBRAS y de Liquigás bajo los términos de la ley brasileña; (ii)

capacidad de PETROBRAS y de Liquigás para celebrar el CCVA, cumplir las

obligaciones asumidas en él y consumar la operación prevista en el mismo; (iii)

ausencia de violación de la ley, de los documentos societarios de PETROBRAS o de

Liquigás, debido a la celebración del CCVA: (iv) titularidad de las acciones objeto

de la Compra por PETROBRAS y ausencia de gravámenes; (v) conformidad y

adecuación de las demostraciones financieras de Liquigás en el 31 de diciembre

de 2015 y de sus libros de contabilidad y registros fiscales con los principios

contables brasileños y la ley aplicable; (vi) conducción de los negocios de Liquigás

en su curso normal desde el día 31 de diciembre de 2015 hasta la fecha de

celebración del CCVA; (vii) ausencia de procesos relevantes (según lo definido en

el CCVA) involucrando a Liquigás; (viii) propiedad o posesión, por Liquigás, de los

activos necesarios para la continuidad del curso normal de sus negocios, libre de

gravámenes: (ix) mantenimiento de pólizas de seguro en una cantidad apropiada

por Liquigás; (x) aspectos fiscales; (xi) aspectos laborales; (xii) aspectos

10

anticorrupción; (xiii) aspectos de competencia; (xiv) propiedad intelectual de

propiedad de Liquigás o que sea usada por ella; (xv) cumplimiento de las leyes por

Liquigás; (xvi) ausencia de terceros que tengan derecho a recibir el pago en

consecuencia de la Compra (Excepto por el asesor financiero de PETROBRAS, cuya

comisión será pagada por PETROBRAS); y (xvii) ausencia de pagos o

bonificaciones respecto a la compra (incluyendo empleados y administradores de

Liquigás).

Resumen de las declaraciones y garantías prestadas por Ultragaz

Las declaraciones y garantías prestadas por Ultragaz son (i) constitución y

existencia de la compradora bajo los términos de la ley brasileña; (ii) capacidad de

Ultragaz para celebrar el CCVA, cumplir las obligaciones asumidas en él y

consumar la operación prevista en el mismo; (iii) ausencia de violación de la ley, de

los documentos societarios de Ultragaz y de cualquier instrumento celebrado por

Ultragaz, debido a la celebración del CCVA; (iv) disponibilidad de recursos, propios

o mediante financiamiento por institución financiera de primer orden, para

cumplir las obligaciones bajo el CCVA; (v) ausencia de cualquier impuesto o

comisión de corretaje, intermediación u otro honorario o comisión similar

respecto a la operación, excepto por el Banco Bradesco BBI S.A.; (vi) Ultragaz tuvo

acceso a las informaciones sobre Liquigás durante la fase de negociación a través

de visitas técnicas, preguntas y respuestas ("Q&A") y consulta a la documentación

disponible en el Data Room.

Reglas sobre indemnización por PETROBRAS

PETROBRAS indemnizará a Ultragaz, a Liquigás (después de la fecha de cierre de

la operación), sus afiliadas y respectivos administradores por cualquier pérdida,

obligación, demanda o pasivo, al igual que multas, intereses, penalidades, costos

o gastos, incluyendo costos judiciales, honorarios razonables de abogados y de

otros expertos ("Pérdidas"), efectiva y directamente sufridas o incurridas por tales

personas como resultado: (i) de cualquier inexactitud, violación u omisión de

cualquier declaración o garantía prestada por PETROBRAS en el CCV: (ii) del

incumplimiento, parcial o total, de cualquier obligación, deber o acuerdo asumido

por PETROBRAS en el CCV; (iii) del incumplimiento de las leyes anticorrupción en

la conducción de la administración y/o negocios y actividades de Liquigás; y/o (iv)

del terreno de Osasco, en caso que este haya sido vendido por Liquigás a terceros

antes de la fecha de cierre de la operación.

Se aplican ciertas limitaciones a la obligación de pago de indemnización, las cuales

varían dependiendo de la naturaleza de la pérdida. Las pérdidas específicamente

relacionadas a fraude, dolo o mala fe de PETROBRAS, al incumplimiento de las

leyes anticorrupción en la condición de la administración y/o de los negocios y

11

actividades de Liquigás serán indemnizables si reivindicadas en un periodo de

hasta 5 años a contar desde la fecha de cierre de la operación, limitado al valor del

precio de compra.

Reglas sobre indemnización por Ultragaz

Ultragaz indemnizará a PETROBRAS y a Liquigás (antes de la fecha de cierre de la

operación), sus afiliadas y respectivos administradores por (i) pérdidas efectiva y

directamente sufridas o incurridas en consecuencia de cualquier violación u

omisión de cualquier declaración o garantía prestada; (ii) incumplimiento, parcial o

total, de cualquier obligación, deber o acuerdo asumido en el CCVA.

Aprobaciones gubernamentales necesarias

La Adquisición está sujeta a la aprobación por el CADE.

Teniendo en cuenta que Liquigás alquila determinadas áreas ubicadas en

terminales portuarios, la aprobación de ANTAQ también deberá ser obtenida por

PETROBRAS en el ámbito del cumplimiento de las condiciones precedentes al

cierre, de forma a evitar la rescisión de los respectivos contratos.

Garantías otorgadas

Ultragaz presentó Carta de Garantía N.° 2.076.299-3 emitida por el Banco

Bradesco S.A., válida hasta el 14 de febrero de 2018, la cual está destinada a

garantizar (i) el pago del Precio de Compra, (ii) el pago del ajuste al Precio de

Adquisición (caso este llegue a ser debido por Ultragaz bajo los términos del

CCVA) y (iii) el pago de la penalidad referida en el ítem 17 arriba (en caso llegue a

ser debido por Ultragaz bajo los términos del CCVA).

Inaplicabilidad del artículo 253 de la LSA

Cabe señalar también que con base en el Oficio Circular/CVM/SEP/N.°02/2016 y

en el art. 253 de la Ley N.° 6.404/76 es inaplicable en el presente caso,

considerando el posicionamiento actual de la Comisión de Valores Mobiliarios

("CVM") sobre el tema, en el sentido de que un dispositivo de este tipo sólo se

aplicaría en el caso que Liquigás se hubiera convertido en subsidiaria de

propiedad total por medio de operación de incorporación de acciones, lo cual no

fue el caso, ya que Liquigás pasó a integrar el Sistema PETROBRAS después de

una operación de compra y venta de acciones.

Acciones Judiciales y TCU

12

Por último, en relación a la decisión cautelar del Tribunal de Cuentas de la Unión

(TCU), de acuerdo a lo divulgado el 8 de diciembre de 2016 y a los procesos

judiciales en trámite en el Poder Judicial tratando de las operaciones de

desinversiones de PETROBRAS, en lo que se refiere a la venta de las acciones de

Liquigás, dicha venta, hasta la fecha, no ha sido suspendida por medidas liminares

judiciales requeridas en el ámbito de acciones populares y de acción civil pública,

no hay ningún impedimento para PETROBRAS proceder con el cumplimiento de

las condiciones suspensivas previstas en el CCVA.

Existe, asimismo, la decisión TC-013-056/2016-6 proferida por la Plenaria del TCU

la cual dio a PETROBRAS permiso para completar cinco negocios, además de la

venta de las acciones de Liquigás, cuyos instrumentos contractuales relativos a la

Operación ya habían sido firmados.

Evaluaciones económicas

Se realizaron evaluaciones económicas, en cumplimiento con la Sistemática para

Desinversiones de Activos y Empresas del Sistema PETROBRAS, internas (visión

vendedor) y externas (visión mercado). El monto final de la transacción superó los

escenarios corporativos de evaluación, y se consideró razonable según las

opiniones de equidad sobre las operaciones (fairness opinion) emitidas por el Itaú

BBA y por el Banco Crédit Agrícole Brasil S.A.

Con base en lo anterior, el Consejo de Administración de PETROBRAS somete a la

elevada apreciación y deliberación de la Asamblea General la propuesta de venta

de 100% (cien por ciento) de la participación accionaria de Petróleo Brasileiro S.A.

– PETROBRAS en Liquigás Distribuidora S.A. para la Companhia Ultragaz S.A. por

el monto de R $ 2,666 mil millones de reales.

En anexo: Copia de Fairness Opinions y Valuation Report

13

Project Laguna

Valuation Memorandum

November, 2016

Global Investment Banking

Disclaimer

The present document (the “Document”) has been prepared by Banco Crédit Agricole Brasil S.A. (“CA-CIB” or “Crédit Agricole CIB”) for the exclusive use of

Petrobras S.A. (the “Recipient”) in the context of opinion that CA-CIB will give to the Recipient with respect to the fairness from a financial point of view of the price to

be paid by Companhia Ultragaz S.A. for 100% of the shares of Liquigás Distribuidora S.A. (the “Project”). By receiving the Document from Crédit Agricole CIB, the

Recipient shall be deemed to have accepted all of the below mentioned provisions

This Document is confidential and its content may not be quoted, referred to, distributed or otherwise disclosed, in whole or in part to any third party, except with

Crédit Agricole CIB prior written consent and only for the sole purpose of the achievement of the Project. It is understood that, in such a case, by receiving the

Document from the Recipient, all of the provisions of the present disclaimer shall apply in the same terms and conditions to any of such third party. To that extent, the

Recipient undertakes to notify any of such third party of this disclaimer in providing it with the Document

The information contained in the Document is being delivered for information purposes. Although the information contained in the Document or on which the

Document is based has been obtained from sources which Crédit Agricole CIB believes to be reliable, it has not been independently verified. Crédit Agricole CIB

does not make any representation or warranty, express or implied, as to the accuracy or the completeness of such information. As a result, the Recipient has agreed

that no liability of any form is or will be accepted by Crédit Agricole CIB or any of its directors or employees which expressly disclaim any and all liabilities which may

be based on, or may derive from the Document or its content or for any errors, omissions or misstatements

Nothing contained in the Document is a promise or a representation of the future or should be relied upon as being so. In particular, no representation or warranty is

given by Crédit Agricole CIB as to the achievability achievement or reasonableness of any future projections, estimates, management targets or prospects, if any. It is

therefore advisable for the Recipient to make its own judgment and assessment of the information contained in the Document

In providing the Document, Crédit Agricole CIB does not undertake to provide the Recipient with access to any additional information or to update the information

contained in the Document or to correct any inaccuracies therein which may become apparent

Nothing in this Document shall be taken as constituting the provision of investment advice and this Document is not intended to provide, and must not be taken as,

the basis of any decision and should not be considered as a recommendation by CA-CIB. The Document does not constitute an offer or invitation to trade and is not

intended to provide as a basis of any agreement or a substitute for the Recipient’s analysis. Furthermore, the Recipient agrees that although this Document might

contain legal, tax, or accounting references as a way to clarify its contents, it does not constitute any legal, tax, or accounting advising

2

November, 2016

Confidential

Contents

I.

Executive Summary

II. Transaction Overview

III. Business Plan

IV. Valuation Analysis

A.

Methodology

B.

Summary

C.

WACC

D.

DCF – Discounted Cash Flow

E.

Multiples

Appendices

3

November, 2016

A.

Macroeconomic Assumptions

B.

Financial Statements

C.

WACC Parameters

Confidential

Section I

Executive Summary

4

November, 2016

Confidential

Executive Summary

Crédit Agricole CIB has been retained by Petróleo Brasileiro S.A. (“Petrobras” or “Seller”) to provide a fairness opinion regarding the disposal of

100% of Liquigás Distribuidora S.A. (“Liquigás” or the “Company”), a Brazilian Liquefied Petroleum Gas (“LPG”) distribution company:

Petrobras performed a competitive process for the sale of 100% of Liquigás Distribuidora S.A. and is currently negotiating with the winning bidder (“Proposed

Acquisition”), the oil & gas company Companhia Ultragaz S.A. (“Buyer”)

On October 21st, 2016, Petrobras made available to us the final version of the stock purchase agreement (“SPA”) and the Binding Offer (“BO”)

containing the final terms of the Proposed Acquisition, with an offer price of BRL 2,800,000,000.00 for 100% of Liquigás (the “Offer Price”)

The Offer Price is in a cash and debt free basis, includes three minority stakes that Liquigás holds in other companies but excludes a non-operational real

estate asset

The Offer Price will be adjusted by CDI interest rate between the signing of the SPA and the closing of the Proposed Acquisition

Liquigás operates in the bottling, distribution and sale of LPG and is a leading player in the LPG distribution sector in Brazil, with presence in 23 out

of 26 States and leading positions in all regions

The present document has been prepared by Crédit Agricole CIB in order to determine the fairness for Petrobras from a financial perspective of the

Offer Price

To carry out a comprehensive valuation for Liquigás (“Valuation”), four valuation references have been selected:

5

The Discounted Cash Flow (“DCF”) methodology based on Liquigás’ 2016-2030 business plan provided by Petrobras and its financial advisor

Precedent transactions multiples based on comparable transactions in the Brazilian LPG distribution industry

Comparable listed companies trading multiples of global LPG companies

The shareholders’ equity method

November, 2016

Confidential

Executive Summary

When applying the aforementioned methodologies for this specific case, it is important to notice the following:

The DCF methodology was based in managerial information and projections provided to us by Petrobras and its financial advisor. Should those information

and projections be not accurate the value of the Company could significantly change

Both trading multiple and transaction multiple valuation do not take into account specific business plans and projects of the companies, being less relevant for

our analysis

The shareholders’ equity method does not capture Company’s perspectives and projections, therefore is less relevant in this specific case as well

The base date of the Valuation is December 31st, 2015 as requested by Petrobras

The total enterprise values derived from the selected methodologies are the following, as of December 31st, 2015 :

DCF: BRL 2,156 – 2,350 MM, representing respectively 7.5x and 8.2x 2017E Liquigás EBITDA

Trading: BRL 2,082 – 2,301 MM, representing respectively 7.3x and 8.0x 2017E Liquigás EBITDA

Transaction: BRL 2,259 – 2,497 MM, representing respectively 7.9x and 8.7x 2017E Liquigás EBITDA

Shareholders’ Equity Method: BRL 1,057 MM, representing 4.0x 2017E Liquigás EBITDA

Our Valuation does not address the merits of the underlying decision by Petrobras to enter into any agreement regarding the Company, neither shall

be deemed to be an assurance or guarantee as to the expected results of the Proposed Acquisition, and does not constitute an opinion or

recommendation to any shareholders’ meetings to be held in connection with this Proposed Acquisition

6

November, 2016

Confidential

Section II

Transaction Overview

7

November, 2016

Confidential

Transaction Overview

Envisaged Transaction

Company Description

Geographic Footprint

Liquigás operates in the bottling, distribution and sale of LPG, operating in two

RR

business segments: bottled and bulk

Liquigás is a leading player in the LPG distribution sector in Brazil, with presence in

AP

AM

PA

23 of 26 States and leading positions in all regions

AC

#1 player in the bottled market (served through 13kg bottles), with 24% market

MA

TO

RO

CE RN

PB

PE

AL

SE

BA

PI

MT

share

GO DF

MG

The Company benefits from a network of more than 4,900 branded distributors,

MS

ES

SP

which serve over 35 million residential customers per month

Bottling Plants (26)

Storage Facilities (20)

RJ

PR

SC

RS

Transaction Description

Petrobras is negotiating the sale of 100% of Liquigás Distribuidora S.A. to the oil & gas company Companhia Ultragaz S.A.

Current Shareholders Structure

Post Acquisition Shareholders Structure

100%

100%

Proposed Acquisition

Proposed Acquisition Perimeter

Source: Company and Petrobras

8

November, 2016

Confidential

Transaction Overview

Brazilian LPG Industry Model

PRODUCERS

Petrobras Refineries1: 12

DISTRIBUTORS

SALES CHANNELS

END USERS

Total of 19 distributors

RESELLERS

Domestic User

(Bottled)

Leading Players Market Share4

Private Refineries2: 1

1st

23.1%

Plants3:

2nd

22.6%

3rd

20.4%

Petrochemical

3

END USERS

Large commercial

and residential

consumers

(Bulk)

Producers

Importers

Industry is structured in producers, distributors and sales channels to get to the end users

Liquigás has its own primary logistics infrastructure, with direct access to primary sourcing of LPG

Bottled LPG is transported from the bottling plants to the distributors’ premises

Bulk LPG is usually supplied directly from the bottling plants to end users

The client profile includes households, industrial clients, commercial facilities, industries and farms

Notes:

1. Replan, Rlam, Revap, Reduc, Repar, Refap, RPBC, Regap, RNEST, Recap, Reman and Lubnor

2. Riograndense

3. Braskem, Copesul and Quattor

4. As of 2015

9

November, 2016

Source: ANP (2015)

Confidential

Transaction Overview

Market Segments - LPG distribution operates under “Bottled” and “Bulk” market segments in Brazil

Product / Supply

Client Profile

Market Volume (mm tons) –

2015

Market Historical Growth

Bottled

Bulk

DOMESTIC

INDUSTRIAL AND COMMERCIAL

Cylinders of 5kg, 8kg, 13kg

and 45kg (typically 13kg)

Households

Cylinders of 20kg, 45kg

and 90kg

Industrial companies,

commercial areas and lifts

5.26 (72% of total)1

2.04 (28% of total)

CAGR 2007-15: 1%1

CAGR 2007-15: 2%

The most common way of promoting the product is through 13kg

bottles (popularly called cooking gas) targeting domestic use

LPG is the most versatile form of energy for cooking food and

Considerations

heating water, being the second most used energy source by the

country’s commercial sectors

Branded distributors are the most common distribution channel to

sell the product to end users

Tanks and pipelines

Industrial companies, households, commercial facilities,

industries, farms and transportation

The bulk market is characterized by the distribution of LPG

through tanker trucks and also customized to the needs of each

client

Unlike the distribution of gas for domestic use (bottled) in which

there is an exchange of the container, the distribution of the bulk

gas is performed on site, wherein the container can be stationary

(fixed) or transportable and receives the LPG in liquid form

Notes:

1. Considers P13kg and equivalents

10

November, 2016

Source: ANP

Confidential

Section III

Business Plan

11

November, 2016

Confidential

Business Plan

Main assumptions and methodology

Liquigás Business Plan provided by Petrobras for the period comprised between 2016 and 2030 including but not limited to the

following documents available in the virtual data room (“VDR”):

dados_itau.xlsx

Projeto Laguna_Relatório Final_Rev_DIP CONTROLADORIA_DN 7_2016.pdf

Audited Financial Statements (income statement and balance sheet) of Liquigás available in the VDR as of October 24th, 2016

for 2015, 2014 and 2013

Main Documents

and Assumptions

used in Valuation

Trial balances (income statement and balance sheet) of Liquigás available in the VDR as of October 24th, 2016

Information Memorandum available in the VDR as of October 24th, 2016

Management Presentation available in the VDR as of October 24th, 2016

Share Purchase Agreement available in the VDR as of October 24th, 2016, including Exhibit 4.1 for the price adjustment

mechanics

Q&A exchanged with Petrobras and Liquigás

Petrobras LPG supply contract and its amendments available in the VDR, as of October 24th, 2016

Market inflation assumptions based on Brazilian Central Bank Focus Report (“Focus Report”), as of October 14th, 2016

All the operational assumptions from 2016-2030 were based on information from Liquigás provided to us by Petrobras, including

the Company business plan and management main thoughts on Liquigás expectations.

Other Relevant

Information

Additionally, CA-CIB team had conference calls with Petrobras and Liquigás management to understand key points of the recent

developments and expectations of Liquigás performance

Our Valuation does not include the non-operational real estate asset of the Company

12

November, 2016

Confidential

Business Plan

Main assumptions and methodology

The company business plan has been provided by Petrobras for the 2016-2030 period

Projections were forecasted considering Liquigás Business Plan for 2016-2030 period

General

Projections of Liquigás are in real terms, we applied market consensus inflation projections (Focus Report) in order to convert it to nominal

terms

Projections don’t consider any synergies

Sales Volume was forecasted individually by each market segment: Bottled and Bulk

Sales

Volumes were forecasted according to Liquigás management expectations of market growth and market

share for each segment

Volume

Liquigás management expects a growth in the market share for the 2016-2030 period due to its brand

recognition. According to a survey made in 2014, Liquigás brand is “Top of Mind” in LPG segment

Sales

LPG Prices were estimated by Liquigás management for Bottled and Bulk market segments

LPG

13

November, 2016

Prices were estimated based on three factors:

Sale

Commodity Price: Price of LPG acquired by Liquigás from Petrobras

Prices

Freight Costs: Costs of the transportation of the LPG

Margin: Margin applied by Liquigás over its variable costs

Confidential

Business Plan

Main assumptions and methodology

Costs were estimated based on Liquigás business plan for 2016-2030 commodity prices and freight costs

Costs

LPG commodity prices are freely defined by Petrobras and were projected constant by Liquigás

Management

SG&A estimates were based on Liquigás business plan

Costs &

SG&A

Expenses

Liquigás Business Plan assumes a constant workforce in the projections with a real wage increase of around

1.0% annually

Taxes

Corporate taxes were forecasted according to Brazilian current corporate law and Liquigás Audited Financial

Statements, including the amortization of deferred fiscal assets and liabilities and interest on capital

Capex was projected according to Liquigás business plan for the 2016-2030 period

Capex

Most of the capex is related to the refurbishment of operating units and bottles replacement

Free Cash

Flow Items

Working Capital assumptions were based on historical levels, according to the main drivers below:

Working

Receivables: estimated as days of revenues

Inventory: estimated as days of cash COGS

Suppliers: estimated as days of cash COGS

Taxes: estimated as days of revenues

Capital

14

November, 2016

Confidential

Business Plan

Projections Summary: Volumes and Market Share

Gas Sale Volume was estimated by the management based on Bulk and Bottled expected market share

Bulk volume is expected to increase more than Bottled (CAGR of 2.2% vs 0.7%, respectively) within the 2016-2030 period due to a higher increase in market share and

market volumes

Gas Sale Volume (000 m3 / year)

3,503

3,537

3,230

3,465

3,184

3,431

3,139

3,396

3,095

3,355

3,021

3,057

3,320

3,006

3,273

3,001

791

813

834

861

947

1,002

769

976

749

925

721

735

903

717

879

724

2,277

2,289

2,300

2,322

2,346

2,370

2,393

2,417

2,439

2,459

2,477

2,493

2,506

2,518

2,527

2,535

2015A

2016E

2017E

2018E

2019E

2020E

2021E

2022E

2023E

2024E

2025E

2026E

2027E

2028E

2029E

2030E

Bottled

Bulk

Market Volumes and Liquigás’ Market Share (000 m3 / year)

23.8%

24.0%

24.1%

24.2%

24.3%

24.5%

24.6%

24.7%

24.8%

25.0%

25.1%

25.2%

25.3%

25.5%

25.6%

25.7%

20.6%

20.7%

19.3%

20.4%

21.5%

20.3%

21.3%

20.1%

21.2%

19.8%

19.9%

21.0%

19.7%

19.7%

20.9%

19.6%

3,759

3,655

3,667

3,721

3,780

3,860

3,940

4,013

4,084

4,185

4,242

4,328

4,403

4,478

4,578

4,666

9,556

9,530

9,541

9,586

9,634

9,683

9,733

9,781

9,820

9,851

9,872

9,887

9,889

9,886

9,875

9,856

2015A

2016E

2017E

2018E

2019E

2020E

2021E

2022E

2023E

2024E

2025E

2026E

2027E

2028E

2029E

2030E

Bottled Market Volume

15

November, 2016

Bulk Market Volume

Liquigás Bottled Mkt Share

Liquigás Bulk Mkt Share

Confidential

Business Plan

Projections Summary: Prices and Revenues

Bottled prices are expected to remain constant in real terms during the projected period and Bulk prices are expected to have a slightly real increase

Net Revenues are projected to increase above inflation mainly due to market share gains

Net prices (BRL / m3)

1,577

1,669

1,748

1,829

1,915

2,003

2,096

2,748

2,875

3,008

2,294

2,511

2,192

2,400

2,627

1,898

1,980

2,156

1,818

2,066

1,743

2025E

2026E

2027E

2028E

2029E

2030E

1,187

1,470

1,600

1,293

1,533

1,238

1,349

1,067

1,179

1,408

1,670

2015A

2016E

2017E

2018E

2019E

2020E

2021E

2022E

2023E

2024E

Bottled Prices

Bulk Prices

Net Revenues (BRL MM)

3,288

860

4,536

4,810

5,411

5,731

5,102

1,828

1,975

2,109

6,800

7,185

2,603

2,267

2,430

8,027

2,805

8,479

3,013

3,831

4,050

4,287

1,203

1,371

1,584

1,132

1,284

1,473

1,704

4,316

5,467

4,106

5,222

3,903

4,985

3,517

3,707

4,755

3,337

4,532

3,165

2019E

2020E

2021E

2022E

2023E

2024E

2025E

2026E

2027E

2028E

2029E

2030E

2,429

2,699

2,847

3,003

2015A

2016E

2017E

2018E

Bottled Revenues

16

6,081

6,424

7,588

November, 2016

Bulk Revenues

Confidential

Business Plan

Projections Summary: COGS

COGS per m³ of both segments are expected to remain constant in real terms over the 2016-2030 period

The growth in the total costs is caused by volume increase and inflation

COGS of Bottled LPG Segment (BRL MM)

1,597

2015A

2,057

2,168

2,669

2,805

2,946

3,090

2,285

2,409

2,536

141

148

155

163

171

3,241

180

3,395

188

3,554

197

1,723

1,850

1,951

114

127

97

103

108

120

134

1,625

1,748

1,843

1,942

2,048

2,158

2,275

2,396

2,521

2,649

2,783

2,919

3,061

3,207

3,357

2016E

2017E

2018E

2019E

2020E

2021E

2022E

2023E

2024E

2025E

2026E

2027E

2028E

2029E

2030E

Bottled Commodity Prices

Bottled Freight

COGS of Bulk LPG Segment (BRL MM)

781

621

2015A

839

893

1,173

1,255

951

1,019

1,093

31

33

35

1,440

38

41

1,545

1,652

46

43

50

1,897

53

2,032

57

22

24

25

27

29

758

816

868

924

990

1,062

1,140

1,220

1,315

1,400

1,502

1,605

1,715

1,844

1,975

2016E

2017E

2018E

2019E

2020E

2021E

2022E

2023E

2024E

2025E

2026E

2027E

2028E

2029E

2030E

Bulk Commodity Prices

17

1,353

1,765

November, 2016

Bulk Freight

Confidential

Business Plan

Projections Summary: SG&A and EBITDA

Liquigás SG&A’s most significant items are personnel expenses and freight. Personnel expenses were projected considering a flat workforce and a real wage increase of

around 1%

Others expenses are formed by advertisement, water, electric energy, fuel, lubricants and tax expenses

Liquigás EBITDA margin is expected to increase throughout the projection period due to an increase in Bulk segment gross margins

SG&A (BRL MM)

1,124

1,669

1,747

1,834

1,921

282

2,048

303

2,156

317

1,327

1,404

1,477

1,569

259

219

233

249

271

686

782

657

741

628

1,188

1,248

197

208

1,016

1,074

166

176

467

561

415

497

391

435

523

603

152

357

160

377

184

736

816

1,057

663

698

1,004

597

629

953

566

905

537

860

507

775

428

2015A

2016E

2017E

2018E

2019E

2020E

2021E

2022E

2023E

2024E

2025E

2026E

2027E

2028E

2029E

2030E

8.3%

8.5%

8.7%

8.6%

8.7%

662

688

2028E

2029E

864

144

292

Personnel Expenses

Freight, Services and Rent

Others

8.1%

7.9%

EBITDA (BRL MM)

8.1%

7.1%

6.5%

7.4%

7.5%

312

287

319

341

2016E

2017E

2018E

2019E

7.8%

7.8%

7.9%

375

397

426

2020E

2021E

2022E

8.1%

462

491

510

2023E

2024E

2025E

562

609

737

214

2015A

EBITDA

18

November, 2016

2026E

2027E

EBITDA margin

Confidential

2030E

Business Plan

Projections Summary: CAPEX and Working Capital

Capex was projected by the management aligned with Company’s growth strategy. Most relevant investments for Liquigás are: refurbishment of operating units, replacement

of bottles and growth capex

Liquigás main working capital requirements are clients receivables and taxes receivables

CAPEX (BRL MM)

4.1%

2.6%

3.1%

2.6%

3.0%

2.9%

3.2%

3.3%

3.1%

3.1%

2.8%

2.8%

2.6%

2.5%

2.7%

1.7%

216

165

135

124

113

2017E

2018E

100

2015A

2016E

135

139

2019E

2020E

2021E

179

180

189

182

192

189

188

147

2022E

CAPEX

2023E

2024E

2025E

2026E

2027E

2028E

2029E

2030E

4.2%

4.2%

4.2%

4.2%

4.2%

4.2%

318

336

2028E

2029E

% of net revenues

Working Capital (BRL MM)

4.6%

4.2%

4.2%

4.2%

4.2%

4.2%

4.2%

4.2%

213

161

179

189

151

169

201

226

2015A

2016E

2017E

2018E

2019E

2020E

2021E

2022E

Working capital

19

November, 2016

4.2%

4.2%

254

285

240

269

301

2023E

2024E

2025E

2026E

2027E

% of net revenues

Confidential

355

2030E

Section IV

Valuation Analysis

A.

B.

C.

D.

E.

20

Methodology

Summary

WACC

DCF – Discounted Cash Flow

Multiples

November, 2016

Confidential

Valuation Analysis

Methodology

Methodology

1

Description / assumptions

Relevance

The DCF method, which reflects the intrinsic value of the company, was used to value Liquigás, as we

RETAINED

believe it to be the most relevant method

The DCF model was based on Liquigás business plan without synergies

Discounted Cash

Flows

Sensitivities run on WACC and perpetuity growth rate

WACC calculated at 12.55% in nominal terms (in BRL) and perpetual growth rate is estimated at 0.0%

(real terms) or 4.4% (nominal terms)

15 year discount period from 2016 to 2030

This method allows a direct comparison between the valuation of a company and its listed peers

2

Peers in LPG distribution business were selected

Trading multiples

Relevant metric: EBITDA

There is no listed Brazilian LPG pure player, most of the Companies are located in other markets and also

BENCHMARK

engages in other activities affecting its multiples, therefore we consider this parameter to be less relevant

in this case

3

Only transactions in the LPG Brazilian market were analyzed due to the specific characteristics of the

Transaction

multiples

market (high penetration, low competition of natural gas and Petrobras role as sole supplier)

Based on the limited number of transactions in Brazil and considering undisclosed expected synergies

from comparables, we consider this parameter to be less relevant

4

Based on the company’s shareholders’ equity

Book value

This method is usually employed for companies in sectors with strong asset bases such as utilities. It does

not capture profitability and future perspectives

21

November, 2016

Confidential

Section IV

Valuation Analysis

A.

B.

C.

D.

E.

22

Methodology

Summary

WACC

DCF – Discounted Cash Flow

Multiples

November, 2016

Confidential

Valuation Analysis

Summary – Enterprise Value (as of December 31st, 2015)

Liquigás Total Enterprise Value – BRL million

Comments

Offer Implied EV @ BRL 2,800 MM

BRL2,249MM

7.8x EBITDA 17E

1

Based on a WACC of 12.55%

BRL2,156MM

7.5x EBITDA 17E

Discounted cash flow

2

Range based on a -0.3%/+0.3%

WACC variation

BRL2,192MM

7.6x EBITDA 17E

Trading

Multiples

BRL2,350MM

8.2x EBITDA 17E

BRL2,082MM

7.3x EBITDA 17E

3

Median of Trading Comps EV/EBITDA

2017E multiples applied to EBITDA

2017E

BRL2,301MM

8.0x EBITDA 17E

Range based on a -5%/-+5%

BRL2,378MM

8.3x EBITDA 17E

Transaction

BRL2,259MM

7.9x EBITDA 17E

4

Median of Transaction Comps LTM

EV/EBITDA multiples applied to 2015

BRL2,497MM

8.7x EBITDA 17E

Range based on a -5%/+5%

BRL1,136MM

4.0x EBITDA 17E

Shareholders’ Equity Value plus BRL

Book Value

Implied EV/EBITDA 2015A

Implied EV/EBITDA 2016E

Implied EV/EBITDA 2017E

196.0 MM of Net Debt

November, 2016

BRL214MM

BRL312MM

BRL287MM

500

750

1000

1250

1500

1750

2000

2250

2500

2750

3000

EBITDA 16E:

2.3x

3.5x

4.7x

5.8x

7.0x

8.2x

9.4x

10.5x

11.7x

12.9x

14.0x

EBITDA 17E:

1.6x

2.4x

3.2x

4.0x

4.8x

5.6x

6.4x

7.2x

8.0x

8.8x

9.6x

1.7x

2.6x

3.5x

4.4x

5.2x

6.1x

7.0x

7.8x

8.7x

9.6x

10.5x

2

23

EBITDA 15A:

3

4

Confidential

We consider these valuation methodologies

to be less relevant to the analysis

Valuation Analysis

Summary – DCF Enterprise Value (as of December 31st, 2015)

DCF Enterprise Value Breakdown (BRL MM)

Central value of Enterprise Value obtained with Discounted

17.7

Cash Flow analysis: BRL 2,248.9 MM

Sum of discounted cash flows represents 55.4% of total

value

986.4

Terminal value represents approximately 43.9% of total

value

Associates¹ represents approximately 0.7% of total value

2,248.9

Implied multiples of the central enterprise value of DCF are:

1,244.8

2015A EV/EBITDA: 10.5x

2016E EV/EBITDA: 7.2x

2017E EV/EBITDA: 7.8x

( + ) NPV Cash flows

( + ) NPV Terminal Value

( + ) Associates

Total Enterprise value¹

Enterprise Value’s sensitivity based on DCF (BRL MM)

The impact of perpetuity rate variation on Firm Value, being WACC constant, is as

follow:

Perpetuity rate

("g")

WACC

13.1%

12.8%

12.5%

12.2%

11.9%

3.4%

1,975

2,051

2,133

2,221

2,316

3.9%

2,020

2,101

2,188

2,282

2,383

4.4%

2,069

2,156

2,249

2,350

2,459

4.9%

2,125

2,218

2,318

2,427

2,546

5.4%

2,188

2,288

2,397

2,516

2,647

A 0.5% change in the perpetuity rate contributes with a variation of around BRL 70 MM

on Firm Value

The impact of WACC variation on Firm Value, being perpetuity rate constant, is as

follow:

A 0.3% change in WACC contributes with a variation of approximately BRL 100 MM on

Firm Value

1 – Include associates in order to compare with Offer Price EV

24

November, 2016

Confidential

Section IV

Valuation Analysis

A.

B.

C.

D.

E.

25

Methodology

Summary

WACC

DCF – Discounted Cash Flow

Multiples

November, 2016

Confidential

Valuation Analysis

WACC

Cost of Debt After Taxes

Cost of Equity

D

WACC =

(USD, Nominal)

E

xx

D+E

[KD x (1 - t)]

+

x

[(Rf,USA) + (PM,BRL) + (b AL) x (PE)]

D+E

WACC

=

(USD, Nominal)

9.75%

WACC =

(USD, Nominal)

14.3%1

xx

8.8% x (1 – 34.0%) = 5.8%

+

85.7%1

x

[2.4% + 4.1% + 0.56 x 6.9%] = 10.4%

(+) INFBR

WACC

(BRL, Nominal)

12.55%

Legend:

Legend:

D

–

Net Debt (Target

E

–

Equity (Target Structure)1

KD

–

Marginal cost of debt in USD of Liquigás estimated based

on Petrobras’ bonds

t

–

Brazil Marginal Corporate Tax Rate (long term)

INFBR

–

Inflation differential BRA/USA of 2.6%

Structure)1

Rf, USA

–

Risk Free rate, calculated by the last 6 months average of the 30 year

USA Government Bond (Source: Bloomberg, as of October 20th , 2016)²

bAL

–

Monthly Adjusted Industry Unlevered Beta (3-year average) of 0.50,

releveraged to Target Capital Structure (Source: Thomson One, as of

December 31st, 2015)¹

PM, BRL

–

Country Risk Premium of Brazil based on last 6 months average of 30

years bond CDS (Source: Bloomberg, as of October 20th , 2016)²

PE

–

Equity Risk Premium of the US market (30 years), last 6 months

average (Source: Bloomberg, as of October 20th , 2016)²

Note 1. Please refer to pg. 30

Note 2. Please refer to appendix C for data details (pg. 44)

26

November, 2016

Confidential

Section IV

Valuation Analysis

A.

B.

C.

D.

E.

27

Methodology

Summary

WACC

DCF – Discounted Cash Flow

Multiples

November, 2016

Confidential

Valuation Analysis

DCF – Discounted Cash Flow

Discounted Cash Flow

Free Cash Flow (BRL MM)

EBITDA

EBITDA Margin

Depreciation & amortization

EBIT

EBIT Margin

Tax rate

( - ) Taxes

( + ) Equity Interest (JCP)

NOPLAT

NOPLAT Margin

Depreciation & amortization

∆ Working capital

Capex

Free cash flow to firm

( x ) Discount factor (WACC)

NPV of free cash flow s

2021E ...2022E ...2023E

...

2024E

...

2025E

...

2026E

...

2027E

...

2028E

...

2029E

...

2030E

462

8%

491

8%

510

8%

562

8%

609

8%

662

9%

688

9%

737

9%

(71)

(79)

(88)

(96)

(104)

(113)

(122)

(131)

(139)

334

7%

355

7%

383

7%

403

7%

415

6%

458

7%

496

7%

540

7%

557

7%

598

7%

34%

(100)

34

34%

(114)

36

34%

(121)

39

34%

(130)

42

34%

(137)

46

34%

(141)

49

34%

(156)

51

34%

(169)

54

34%

(184)

57

34%

(189)

59

34%

(203)

62

206

5%

228

5%

257

5%

274

5%

295

5%

312

5%

322

5%

354

5%

382

5%

413

5%

427

5%

457

5%

75

(10)

(113)

144

77

(11)

(135)

138

81

(11)

(139)

159

63

(12)

(165)

142

71

(13)

(179)

152

79

(13)

(180)

181

88

(15)

(189)

196

96

(14)

(182)

221

104

(16)

(192)

251

113

(16)

(189)

289

122

(17)

(188)

330

131

(19)

(216)

323

139

(19)

(147)

430

0.84

0.74

0.66

0.59

0.52

0.46

0.41

0.37

0.33

0.29

0.26

0.23

0.20

0.18

Sum of

FCFs

92

107

91

93

74

70

75

72

72

72

74

75

66

77

1,245

2016E

2017E

2018E

2019E

2020E

312

8%

287

7%

319

7%

341

8%

375

8%

397

8%

426

8%

(65)

(69)

(75)

(77)

(81)

(63)

247

6%

218

5%

244

6%

264

6%

294

6%

34%

(84)

24

34%

(74)

29

34%

(83)

31

34%

(90)

32

187

5%

172

4%

192

4%

65

(10)

(100)

142

69

(7)

(124)

110

0.94

134

Key Assumptions

...

Terminal Value Calculation

Valuation as of December 31st, 2015

We have applied a Weighted Average Cost of Capital (WACC) of 12.55%, in BRL

nominal terms, to discount the cash flows

Perpetuity

Cash Flow

WACC

Perpetuity

Growth

Discount

Factor

Terminal

Value

BRL448

MM

12.55%

4.4%

0.180

BRL 986

MM

We consider Liquigás business plan until 2030

Terminal value was calculated using a 0% perpetuity growth in real terms (4.4% in

nominal terms)

The 0% perpetuity growth assumption is based on Liquigás Management’s view

Book Value of the investments in subsidiaries of BRL 17.7 MM

28

November, 2016

Confidential

Section IV

Valuation Analysis

A.

B.

C.

D.

E.

29

Methodology

Summary

WACC

DCF – Discounted Cash Flow

Multiples

November, 2016

Confidential

Valuation Analysis

Multiples

Trading Comps (as of December 31st, 2015)

We selected global LPG peers for our analysis

We selected 2017E EV/EBITDA multiples and applied to Company’s 2017E EBITDA as it is the best representative of Company’s profitability going forward

Company

Country

Global

Mkt Cap

EV

EV/Sales

EV/EBITDA

EBITDA Margin

Net Debt /

EBITDA LTM

LTM

16E

17E

LTM

16E

17E

LTM

16E

17E

D / EV

Unlev.

Beta

USD MM

USD MM

United States of America

3,183

5,661

3.5x

2.4x

2.3x

2.1x

8.1x

8.9x

8.7x

29.8%

25.3%

24.3%

42.8%

0.50

Aygaz As

Turkey

1,038

449

0.2x

0.2x

0.2x

0.2x

3.1x

3.4x

3.2x

6.2%

5.6%

5.1%

7.3%

0.67

Rubis Sca

France

Korea; Republic

(S. Korea)

3,275

3,636

0.7x

1.1x

1.0x

1.0x

8.1x

7.9x

7.6x

13.5%

12.8%

12.8%

8.4%

0.79

553

1,730

5.9x

0.4x

0.4x

0.4x

9.2x

8.6x

8.0x

4.7%

4.8%

5.2%

64.5%

0.18

Thailand

266

491

2.8x

0.3x

0.3x

0.3x

6.3x

6.6x

6.1x

5.1%

5.2%

5.1%

44.8%

0.37

Amerigas Partners Lp

Sk Gas Ltd

Siamgas And Petrochemicals

Pcl

Total Nigeria Plc

Nigeria

251

186

n.m

0.1x

0.1x

0.1x

1.3x

2.1x

2.0x

8.7%

5.5%

5.9%

-69.2%

0.36

Brazil

8,502

10,267

1.4x

0.5x

0.5x

0.5x

9.9x

9.5x

9.1x

5.0%

5.2%

5.0%

14.3%

0.67

Median

2.8x

0.4x

0.4x

0.4x

8.1x

7.9x

7.6x

6.2%

5.5%

5.2%

14.3%

0.50

Average

2.6x

0.7x

0.7x

0.6x

6.6x

6.7x

6.4x

10.4%

9.2%

9.1%

16.1%

0.50

Ultrapar Participacoes Sa

Source: Thomson One

30

November, 2016

Confidential

Valuation Analysis

Multiples

Trading Comps Details

Company

Key Financials

(USD MM 2015)

Net Revenues

2,885

EBITDA Breakdown (2015)

Other

9%(1)

AmeriGas Partners, L.P. is a holding company that operates

EBITDA

572

Propane

91%(1)

Net Debt/EBITDA

4.1x

Net Revenues

2,358

Other

15%

operating in production, procurement, storage, filling and

production and sale of LPG-operated devices

Gas and

petroleum

products

85%

Net Debt/EBITDA

0.8x

Support and

Services

20%(1)

Storage

20%(1)

EBITDA

382

Net Debt/EBITDA

1.0x

as a retail propane distributor in the United States, serving

approximately two million residential, commercial, industrial,

agricultural, wholesale and motor fuel customers in all 50

states from approximately 2,000 propane distribution

locations.

Aygaz is the only Turkish fully integrated LPG company,

EBITDA

124

Net Revenues

3,233

Description

LPG Distribution

60%(1)

Aygaz provides its services in 81 cities and more than 100k

homes per day through 3,800 cylinder gas dealers and

autogas stations

Rubis SCA is a France-based international company

engaged in the storage and distribution of petroleum and

other liquid products. The Company is structured around two

operational divisions: Rubis Terminal, specialized in the bulk

storage of liquid industrial products; and Rubis Energie,

engaged in the logistics and distribution of petroleum

products, notably LPG, which are sold as bottled gas and

marketed under the Vitogaz brand name

(1) Based on Revenues

31

November, 2016

Source: Companies and Thomson

Confidential

Valuation Analysis

Multiples

Trading Comps Details

Company

Key Financials

(USD MM 2015)

EBITDA Breakdown (2015)

Services

(1)

>1%

Net Revenues

1,699

EBITDA

83

LPG Sales and

Distribution

100%(1)

Net Debt/EBITDA

2.1x

Net Revenues

1,699

Others

7%(1)

Net Debt/EBITDA

5.0x

Net Revenues

1,059

LPG Domestic

50%(1)

Net Debt/EBITDA

0.0x

Thailand-based company engaged in the trading business of

LPG and related petroleum products. Its products are

distributed under the brand names of Siam Gas and Unique

Gas. It operates LPG warehouses and gas containing

factories, as well as works with the dealers and gas service

stations throughout Thailand

Thailand-based company engaged in the trading business of

LPG and related petroleum products. Its products are

distributed under the brand names of Siam Gas and Unique

Gas. It operates LPG warehouses and gas containing

factories, as well as works with the dealers and gas service

stations throughout Thailand

Total Nigeria is a marketing and services subsidiary of Total

Lubricants and

others

12%

Total Nigeria is the leader in the downstream sector of the

Nigerian oil and gas industry, with its distribution network of

over 500 service stations nationwide and other energy

products and services

EBITDA

47

NIGERIA

Siamgas and Petrochemicals Public Company Limited is a

Siamgas and Petrochemicals Public Company Limited is a

LPG Exports

43% (1)

EBITDA

83

Description

Petroleum

products

88%

Total Nigeria has 5 LPG bottling plants distributed over the

country and also owns a coastal storage in Apapa

(1) Based on Revenues

32

November, 2016

Source: Companies and Thomson

Confidential

Valuation Analysis

Multiples

Trading Comps Details

Company

Key Financials

(USD MM 2015)

Net Revenues

22,712

Revenues Breakdown

(2015)

Others

Chemicals 1%

19%

LPG Distribution

9%

EBITDA

1,187

Net Debt/EBITDA

1.4x

Fuel Distribution

71%

Description

Ultrapar Participacoes S.A. (Ultrapar) is a Brazilian holding

company that engages in services, commercial and industrial

activities. It operates through five segments: gas distribution

(Ultragaz), which distributes LPG to residential, commercial

and industrial; fuel distribution (Ipiranga); chemicals

(Oxiteno); storage (Ultracargo), and drugstores (Extrafarma)

Source: Companies and Thomson

33

November, 2016

Confidential

Valuation Analysis

Multiples

Transaction Comps

We selected transactions involving LPG companies in the Brazilian Market

#

Date

Target Name

Target Nation

Acquirer Name

% of Shares

Acquired

Transac. Value

(BRL MM)

Implied EV

(BRL MM)

EV / EBITDA

1

Oct-11

Repsol Gas Brasil SA

Brazil

Ultragaz Participações Ltda

100%

50

47.85

10.19x

2

Aug-04

Agip Liquigás

Brazil

Petrobras

100%

1,424

2,071.23

12.06x

3

Jul-04

Supergasbras

Inds e Comercio

Brazil

SHV Holdings NV

51%

308

602.94

19.98x

4

Aug-03

Shell Gas (LPG) Brasil S.A.

Brazil

Ultrapar Participações S.A.

100%

171

170.57

10.03x

Median

11.12x

Average

13.06x

Source: Companies

34

November, 2016

Confidential

Valuation Analysis

Multiples

Transaction Comps Details

Target Company

Target Description

Transaction Description

Repsol Gás Brasil (Repsol) is a LPG

company that operates in the Brazilian In October 2011, Ultragaz Participacoes Ltda, a unit of Ultrapar Participacoes SA, acquired the entire

bottled LPG with 1% of market share in

share capital of Repsol Gas Brasil SA, a Rio de Janeiro-based bottled LPG company for BRL 50 MM

2011

(USD 28.5 MM)

Twelve months prior to the transaction, After the transaction Repsol Gás Brasil S.A. was renamed to Distribuidora de Gás LP Azul S.A.

Repsol sold a total of 22k ton of LPG

Agip do Brasil (Agip) is a company that In August 2004, in a transaction with ENI SpA, Petroleo Brasileiro SA (Petrobras) acquired AGIP do

operates in the marketing and distribution of

Brasil (Agip), a company engaged in the distribution of LPG, fuels and lubricants, for USD 450 MM

fuels, petroleum derivates and natural gas,

especially in the bottling, marketing and In the transaction, Petrobras acquired 28 envasing units, 28 deposits, the brands Liquigás, Tropigás

and Novogás and 21.4% of the LPG market share

distribution of LPG

In 2003, Agip had around 3% of market Petrobras also acquired fuel and lubricants contracts and assets, including distribution centers and

share in Brazil

gas stations

Founded in 1946, Supergasbras is a

company mainly engaged in the marketing In July 2004, SHV Holdings NV acquired the remaining 51% interest, or 14.86 Bn ordinary and

and distribution of bottled LPG

preferential shares, which it did not own yet, in Supergasbras Industria e Comercio SA

(Supergasbras), a wholesaler of liquefied gas and a holding company, from Sajutha Rio

Supergasbras works with bottled gas (P13),

Participacoes SA, for BRL 304.1 MM (USD 100 MM), in a privately negotiated transaction

gas cilinder (P45) and gas tanks (P1900,

P2000 and P500)

Shell Gas (LPG) Brasil S.A. (Shell Gas) is a

company engaged in purchase, bottling,

In August 2003, Ultrapar Participacoes SA acquired Shell Gas SA, a gas utility company, from Royal

distribution, transport and storage of gases

Dutch/Shell Group's Shell Brasil SA unit, for BRL 170.6 MM (USD 57.1 MM)

and other petroleum hydrocarbons

The acquisition included the liquefied petroleum gas operations of Shell Gas SA, with 6 bottling plants

Shell Gas had 4.5% share in the Brazilian

LPG distribution market in 2003

Source: Companies

35

November, 2016

Confidential

Appendices

A.

B.

C.

36

Macroeconomic Assumptions

Financial Statements

WACC Parameters

November, 2016

Confidential

Appendices

Macroeconomic Assumptions

Macroeconom ic assum ptions

2014A

2015A

2016E

2017E

2018E

2019E

2020E

2021E

2022E

2023E

2024E

2025E

2026E

2027E

2028E

2029E

2030E

Inflation

Brazil (IPCA)

USA (CPI)

%

%

6.4%

1.6%

10.7%

0.1%

7.0%

1.7%

4.9%

1.9%

4.4%

2.0%

4.4%

2.0%

4.4%

2.0%

4.4%

2.0%

4.4%

2.0%

4.4%

2.0%

4.4%

2.0%

4.4%

2.0%

4.4%

2.0%

4.4%

2.0%

4.4%

2.0%

4.4%

2.0%

4.4%

2.0%

Interest Rate

Selic - Average

TJLP Average

%

%

10.9%

5.0%

13.5%

6.0%

14.2%

7.5%

11.8%

7.5%

10.5%

7.5%

10.3%

7.5%

9.3%

7.5%

9.3%

7.5%

9.3%

7.5%

9.3%

7.5%

9.3%

7.5%

9.3%

7.5%

9.3%

7.5%

9.3%

7.5%

9.3%

7.5%

9.3%

7.5%

9.3%

7.5%

Source: Focus Survey as of October 20th 2016 and FED as of July 31st 2016

37

November, 2016

Confidential

Appendices

A.

B.

C.

38

Macroeconomic Assumptions

Financial Statements

WACC Parameters

November, 2016

Confidential

Appendices

Liquigás Financial Statements

Assets (BRL MM)

2014A

2015A

2016E

2017E

2018E

2019E

2020E

2021E

2022E

2023E

2024E

2025E

2026E

2027E

2028E

2029E

2030E

13

174

39

42

5

7

280

13

203

30

65

7

15

333

96

230

42

62

7

15

452

101

243

44

67

8