presentation - Ascri

Sponsor: About ASCRI and the PE&VC sector in Spain Voice of the Spanish PE&VC GPs GP Members 95 Founded in 1986 Team based in Madrid 4 Committees – – – – Public Affairs Investor Relations, Events and Communication Venture Capital Statistics and Training Scope The full range of PE&VC activities from early stage to the largest private equity firms ASCRI is the sector reference in Spain with the mission to create a more favorable environment for equity investment & entrepreneurship 2014 First Half Highlights: Number of portfolio companies 2,350 Number of Entities with activity in the spanish market • • • 104 Domestic private entities 80 International private entities 17 Public entities Volume invested: €1.1bn Fundraising: €2.1bn Exits: €1.1bn Number of investments: 231 Number of exits: 70 2 Introduction • 2014 – the year of the sector recovery. • In the second half of 2013 there was a change in trend, supported by a gradual improvement in the key macro-economic indicators and the change of perception by foreign investors regarding Spain. • This new cycle is reflected by the year-on-year growth in key variables, back to 2010 levels. • The international investors’ commitment to Spanish companies and Venture Capital/Private Equity funds is key for the sector growth. 3 Summary – Main Variables 1H 2013 € MN Seed / Start up Replacement Growth LBO Investment (# Deals) 43.3 (103) 82.5 (1) 271.2 (158) 120.9 (6) 1H 2014 € MN (# Deals) 31.4 241 484.5 417 (77) (4) (145) (7) 1H 2013/ 1H 2014 - 28% + 191% + 79% + 246% €517.2MN €1,173.7MN + 127% 268 231 - 14% New Funds Raised(*) €514MN €1,936MN + 276% Divestment €655MN €1,769MN + 170% Number of Deals *Includes funds raised by private Spanish entities (€980MN), investments made by international investors (€880MN) and public resources (€76MN). Source: ASCRI / Webcapitalriesgo 4 Investment • H1 2014 is characterized by the large investment appetite sparked by the many opportunities offered by the Spanish market, at risk adjusted prices and some improvement in availability of bank financing. • Total amount invested stands at 1,174 million Euros (+127% from H1 2013), spread out over a total of 231 transactions (-14% from H1 2013). • Growth capital investment stands out (41% of total volume invested). • Progressive reopening of bank-supported financing. Buyout volume increased to €417MN from €120MN in the first half of 2013. However, the number of buyouts closed remained steady (5 in H1 2014). • 90% of the investment transactions were directed towards SME financing at initial and growth stages. • 4 transactions exceeding €100MN, as compared to 1 in H1 2013, explain the H1 2014 YoY growth. • Slight recovery of the Middle Market (€10 – 100MN). 11 transactions during the year as compared to 5 in the first half of 2013. Of those 11 transactions, 8 were led by private domestic funds. 5 Investment 354 316 232 1,500 1,142 1,136 675 289 307 889 241 1,399 270 300 287 231 1,174 1,102 250 200 150 517 500 100 Volume (€MN) H2 2012 H1 2012 H2 2011 H1 2011 H2 2010 H1 2010 H2 2009 50 H1 2009 0 350 1,858 H1 2014 1,000 327 # Transactions 293 400 2,092 H2 2013 2,000 2,299 H1 2013 Volume (€MN) 2,500 0 # Transactions The investment volume reached 1,174 million Euros (+127% from H1 2013), similar to 2010 levels. 6 Source: ASCRI /webcapitalriesgo Investment by Type of Investor Investment Volume by Type of Investor # Transactions by Type of Investor 2,500 400 350 Number of Deals 1,500 1,000 500 250 200 150 100 International Entity Domestic Private Entity Domestic Public Entity International Entity Domestic Private Entity Domestic Public Entity The activity of international investors in 20 transactions accounted for 75% of investment volume in H1 2014. 7 Source: ASCRI /webcapitalriesgo H1 2014 H2 2013 H1 2013 H2 2012 H1 2012 H2 2011 H1 2011 H2 2010 H1 2010 0 H2 2009 H1 2014 H2 2013 H1 2013 H2 2012 H1 2012 H2 2011 H1 2011 H2 2010 H1 2010 H2 2009 50 H1 2009 0 300 H1 2009 €MN 2,000 Investment by stage (Volume) 3,000 €MN 2,000 1,000 H1 2009 H2 2009 H1 2010 H2 2010 H1 2011 H2 2011 H1 2012 H2 2012 H1 2013 H2 2013 H1 2014 Seed and Start Up Growth Replacement LBO By investment volume, growth capital stands out (41% of total invested volume). 8 Source: ASCRI /webcapitalriesgo Investment by Stage (# Transactions) # Transactions 500 400 300 200 100 H1 2009 H2 2009 H1 2010 H2 2010 H1 2011 Seed and Start Up H2 2011 H1 2012 H2 2012 H1 2013 H2 2013 H1 2014 Growth Replacement LBO Financing of companies at seed, start up and growth phases remains predominant. 9 Source: ASCRI /webcapitalriesgo Investment by Size of Transaction (# Transactions) # Transactions 400 294 300 254 254 217 209 200 100 11 0 6 5 H1 2012 3 13 10 10 6 4 H2 2012 0 - 5 (€MN) 5-10 (€MN) 15 2 3 H1 2013 10 - 25 (€MN) 1 11 3 4 H2 2013 25 - 100 (€MN) 7 9 2 4 H1 2014 +100 (€MN) Investments in SMEs remain predominant (90% of transactions were lower than €5MN). 10 Source: ASCRI /webcapitalriesgo Investment by Sector – H1 2014 Volume 40% 19% 16% 8% 4% 4% 3% 2% Healthcare 4.8% Biotecnolo Biotechnology 6,1% 6.1% Otro Other Services 6.1% IT 41.6% C Communications 6.5% # Transactions Prod Consumer Goods 10.0% Fuente: ASCRI /webcapitalriesgo Industrial Products and Services 10.4% 11 Source: ASCRI /webcapitalriesgo Technology Investment Venture Capital/Private Equity Transactions H1 2014 Venture Capital/Private Equity Investment Volume H1 2014 Total VC&PE Sector Technology NON-Technology Total VC&PE Sector VC Only (seed + start up + other initial phases) Technology NON-Technology Total Venture Capital 2013 Volume (MN) % 1,002 43% 1,355 57.50% 2,357 100% 2013 Volume (MN) 170 38.5 208.5 H1 2014 Volume (MN) % 169 14.40% 1004.9 86% 1,173.9 100% 2013 # Deals 388 155 543 H1 2014 % 82% 18.50% 100% Volume (MN) 94 5.1 99.1 % 95% 5% 100% % 72% 29% 100% 2013 #Deals 323 54 377 H1 2014 # Deals % 162 70% 69 30% 231 100% H1 2014 % 86% 14% 100% # Deals 141 21 162 % 87% 13% 100% 12 Source: ASCRI /webcapitalriesgo Investment by Region – H1 2014 Volume €5.8 €13.7 MN €0 €217 MN €2.5 MN 0 €1.9 MN €517 MN €5 MN €214 MN €0.5MN €3MN 0 €1.1 MN €1.2 MN €132.6 MN The regions with the highest investment volume were Catalonia (46%), Madrid (19%), and the Basque Country (19%). By number of transactions Catalonia (56), Madrid (55), and Galicia (16) led the rankings. 13 Source: ASCRI /webcapitalriesgo Main Private Equity Investments (published) Eurazeo PORTFOLIO COMPANY Desigual Consumer Goods TYPE OF TRANSACTION Growth KKR Port Aventura Hospitality/Leisure Replacement Arclight Capital Bizkaia Energía Energy Buyout CVC Deoleo Consumer Goods Buyout Magnum Nace Services Buyout Springwater Aernova Replacement Springwater Adveo (Unipapel) Industrial Products and Services Consumer Goods Buyout Magnum Geriatros Healthcare Buyout Springwater Hospitality/Leisure Buyout Nazca PullmanturNautalia Gestair Transportation Growth Diana Capital Gocco Confec Consumer Goods Growth Proa Capital Rotor Componentes tecnologicos Forus PE FIRM BPEP SECTOR Consumer Goods Services Growth Buyout 14 Source: ASCRI /webcapitalriesgo Main Venture Capital Investments (published) VC FIRM PORTFOLIO COMPANY SECTOR Accel / Active Venture Partners TYPE OF TRANSACTION Packlink Internet VC Growth Inveready Bilua Internet VC Growth Seaya Maxi Mobility Spain (Cabify) Internet VC Growth Partech / Idinvest /Cabiedes Kantox Internet VC Growth Ysios Kala Farma Biotechnology VC Growth Axon Iyogi IT Start up Internet VC Growth Onza / Kibo /Qualitas Eshop Source: ASCRI /webcapitalriesgo Nauta Forcemanager (Tritium IT Software) VC Growth CR Biotech Mecwins Biotechnology VC Growth Adara Stratio Big Data IT Start up CR Biotech Nuubo (Smart Solutions Technologies) Healthcare: Instruments/ Equipment Start up Axon / Caixa CR Byhours Internet VC Growth Repsol New Ventures Scutum Logistic / Caixa CR Energy VC Growth Axon Akamon Internet Start up Iberdrola VenturesPerseo Qbotix Energy VC Growth Caixa Capital Riesgo Gigas Internet Start up Kibo Promofarma Internet Seed Riva y Garcia Nlife Biotechnology Start up Axon Pidefarma Internet Start up Active Percentil Internet Start up Caixa Capital Riesgo / Start Up Capital Getting Robotik Industrial Products and Services Start up 15 Fundraising • Total fundraising in Spain in the first half of 2013*: €1,9BN (+276% from H1 2013). • International investor interest together with the opening of the public fund of funds FOND ICO Global, holding €1.2BN**, has been the push that the sector needed to spark private national fundraising. • In the first half of 2014 the funds raised by private national firms were €980MN, which meant year-on-year growth of +666% from the €128MN raised in H1 2013; back to 2006-2008 levels, when all-time highs were reached. • A majority of the national private fundraising focused on Growth/ Buy-out Capital funds (Corpfin Capital, Portobello, Miura, Suma Capital and Sherpa). • …Although new Venture Capital funds are still being raised (Caixa Innvierte Biomed, Onza Capital, Axon ICT II, Inveready First Capital II...) • In total there are 201 active firms in the Spanish VC&PE market, 104 of which are national firms with a majority of private capital, 17 are national with a majority of public capital, and 80 are international, 18 of which have office in Spain. *Total funds raised by private Spanish entities (€980MN), total investments made during the year by international investors (€880MN), and public resources from Public National and Regional Budgets for public VCs&PEs entities (€76MN). ** In its two first allocations, Fond ICO Global contributed a total of €437MN to 14 Venture Capital & Private Equity firms. 16 Fundraising of domestic VC&PE entities €980MN - Funds raised by Private Spanish Venture Capital & Private Equity firms. Fundraising for financing companies in Growth and Consolidation stages has returned. 17 Source: ASCRI /webcapitalriesgo Fundraising by type of investor- national VC&PE private entities Public sector, Corporate investors and pension funds were the main contributors of the resources. 53% of new funds raised by domestic private entities came from international LPs. 18 Divestment • Foreign investor appetite, both from industrial and financial players, opening up of debt and securities markets, and attractive company valuations for both sellers and buyers increased divestment activity. • Divestment in Spain throughout the first half of 2014 (at cost price) reached €1,769MN (+170% from H1 2013), spread out over 102 transactions. • Most divestments were made by international firms, totaling €1,114MN in 16 transactions. The mechanisms most frequently used by these entities were, in terms of volume, “Trade sale” (52%) and “IPO” (32.9%). • Private national investors divested a total of €621MN in 56 transactions, with “Trade sale” (48%) and “Post IPO sale of trade shares” (19.7%) standing out. Finally, public national investors divested a total of €34MN in 30 transactions. 19 Divestment Semi-Annual Divestment (Full & Partial) 2,500 1,989 1,167.2 H1 2014 655.1 H2 2013 H2 2012 H1 2012 H2 2011 H1 2011 569.9 H1 2013 706.6 938.2 H2 2010 0 H1 2010 500 1,034.93 408.8 282.8 H2 2009 1,000 1,769.85 583.3 1,500 H1 2009 €MN 2,000 The most commonly used divestment method (based on volume) was “Trade sale” (56%, e.g. Mivisa, Inaer, Everis, Cunext Copper Industries, El Tenedor, and MasMovil), followed by “Stock Market” (27.6%, e.g. eDreams, Applus), and “Sale to VC&PE entity” (8%, e.g. Port Aventura, Nace, Rotor). 20 Source: ASCRI /webcapitalriesgo Outlook • Fundraising will remain steady, driven by the upcoming calls of Fond ICO Global, international investors’ interest in Spain, and by good divestment figures. • The investment pace has been slow but surely recovering thanks to the increase in resources available for investment, progressive reopening of loans, and opportunities in the national market. • In June 2014, a Bill on the regulation of Venture Capital & Private Equity Entities was passed, giving the sector a renewed framework for action, which provides investors with greater security, new and more flexible legal forms and transposing the Community Directive on alternative investment fund managers (AIFMD), which will allow for use of the “European Passport” as well as for funds to be marketed and managed across the entire European Union. 21 Entities covered by statistics (1) DOMESTIC PRIVATE ENTITIES VC&PE Management Companies (S.G.E.C.R.) 52) AC Desarrollo, SGECR 53) Activa Ventures, SGECR, SA VC&PE Companies (S.C.R) Active Venture Partners, SGECR, SA 54) Adara Venture Partners 55) Addquity Growth Capital, S.A. 56) 1) Activos y Gestión Empresarial, SCR, SA Ahorro Corporación Infraestructuras 57) 2) ADE Gestión Sodical SCR SA Ambar Capital y Expansión SGECR S.A. 58) 3) Aldebarán Riesgo SCR de régimen simplificado Artá Capital SGECR, SA 59) 4) Arico 99 SCR Atitlan Capital, SGECR, SA 60) 5) Arnela Capital Privado SCR de Régimen Simplificado Atlas Capital Private Equity SGECR, SA 61) 6) BBVA Ventures AXIS Participaciones Empresariales, SGECR, SAU.62) 7) Cabiedes & Partners SCR, de régimen simplificado, S.A. Axón Capital e Inversiones SGECR, SA 63) 8) CMC XXI SA, SCR Sociedad de Régimen Simplificado Banesto SEPI Desarrollo F.C.R. 64) 9) Compas Private Equity Bankinter Capital Riesgo, SGECR (Intergestora) 65) 10) Corporación Empresarial de Extremadura, SA Baring Private Equity Partners España, SA 66) 11) Fides Capital, SCR, SA 16) BS Capital 67) 12) FIT Inversión en Talento SCR de Régimen SimplificadoL S 17) Bullnet Gestión, SGECR, SA 68) 13) Grupo Intercom de Capital, SCR, SA 18) Caixa Capital Risc SGECR, SA 69) 14) Grupo Perseo (Iberdrola) 19) Cajastur Capital 70) 15) Infu- capital SCR de Régimen Simplificado 20) Cantabria Capital SGECR, S.A 71) 16) Innova 31, SCR, SA 21) Capital Grupo Santander SGECR, SA 72) 17) Inversiones ProGranada, SA 22) Clave Mayor SGECR, SA 73) 18) INVERTEC (Societat Catalana d'Inversió en Empreses de Base Tecnològica, SA) 23) Cofides 74) 19) Investing Profit Wisely 24) Corpfin Capital Asesores, SA, SGECR 75) 20) Landon Investment 25) CRB Inverbío SGECR 76) 21) Madrigal Participaciones 26) Cross Check 22) Murcia Emprende Sociedad de Capital Riesgo, SA 23) Najeti Capital, SCR, SA 24) Navarra Iniciativas Empresariales, SA (Genera) 25) Repsol New Energy Ventures 26) Ricari, Desarrollo de Inversiones Riojanas S.A 27) Sadim Inversiones 28) SEPI Desarrollo Empresarial, SA (SEPIDES) 29) Sinensis Seed Capital SCR, S.A 30) Sociedad de Desarrollo de las Comarcas Mineras, S.A (SODECO) 31) Sociedad de Desarrollo Económico de Canarias, SA (SODECAN) 32) Sociedad de Desarrollo de Navarra, SA (SODENA) 33) Sociedad para el Desarroll o Industrial de Aragón, SA (SODIAR) 34) Sociedad para el Desarrollo Industrial de Castilla -La Mancha, SA (SODICAMAN) 35) Sociedad para el Desarrollo Industrial de Extremadura, SA (SODIEX) 36) Sociedad de Fomento Industrial de Extremadura, SA 37) Sociedad Regional de Promo ción del Pdo. de Asturias, SA (SRP) 38) Soria Futuro, SA 39) Telefónica Ventures 40) Torreal, SCR, SA 41) Unirisco Galicia SCR, SA 42) Univen Capital, SA, SCR de Régimen Común 43) Up Capital 44) Vigo Activo, S.C.R. de Régimen Simplificado, S.A. 45) VitaminaK Venture Capital SCR de régime n común, S.A. 1) 2) 3) 4) 5) 6) 7) 8) 9) 10) 11) 12) 13) 14) 15) 27) 28) 29) 30) 31) 32) 33) 34) 35) 36) 37) 38) 39) 40) 41) 42) 43) 44) 45) 46) 47) 48) 49) 50) 51) Diana Capital, SGECR, SA EBN Capital SGECR, SA Eland Private Equity SGECR SA Espiga Capital Gestión SGECR, SA Finaves GED Iberian Private Equity, SGECR, SA Gescaixa Galicia, SGECR, SA Gestión de Capital Riesgo del País Vasco, SGECR, SA Going Investment Gestión SGECR Highgrowth, SGECR, SA Hiperion Capital Management, S.G.E.C.R., S.A. Institut Català de Finances Capital SGECR (ICF) Invercaria Gestión Inveready Kibo Ventures Magnum Industrial Partners MCH Private Equity, SA Miura Private Equity Nauta Tech Invest Nazca Capital, S.G.E.C.R, SA Neotec Capital Riesgo Next Capital Partners, SGECR, S.A Nmás1 Capital Privado, SGECR, SA Nmas1 Eolia SGECR, SA Ona Capital Oquendo Capital PHI Industrial Acquisitions Portobello Capital Proa Capital de Inversiones SGECR, SA Qualitas Equity Partners Realza Capital SGECR, SA Riva y García Gestión, SA Seaya Ventures Santander Central Hispano Desarrollo, SGECR, SA Seed Capital de Bizkaia, SA SES Iberia Private Equity, SA Sherpa Capital Gestión SI Capital R&S I SA,SCR de Régimen Simplificado Suanfarma Biotech SGECR Suma Capital Private Equity Taiga Mistral de Inversiones Talde Gestión SGECR, SA Thesan Capital Torsa Capital, SGECR, S.A. Uninvest Fondo I+D Valanza Venturcap Vista Capital de Expansión, SA XesGalicia SGECR, SA Ysios Capital Partners 22 Entities covered by statistics(2) DOMESTIC PUBLIC ENTITIES 1. AXIS Participaciones Empresariales, SGECR, SAU. 2. Cofides 3. Gestión de Capital Riesgo del País Vasco, SGECR, SA 4. Invercaria Gestión 5. INVERTEC (Societat Catalana d'Inversió en Empreses de Base Tecnològica, SA) 6. Sadim Inversiones 7. Seed Capital de Bizkaia, SA 8. SEPI Desarrollo Empresarial, SA (SEPIDES) 9. Sociedad de Fomento Industrial de Extremadura, SA 10. Sociedad de Desarrollo de Navarra, SA (SODENA) 11. Sociedad de Desarrollo de las Comarcas Mineras, S.A (SODECO) 12. Sociedad de Desarrollo Económico de Canarias, SA (SODECAN) 13. Sociedad para el Desarrollo Industrial de Aragón, SA (SODIAR) 14. Sociedad para el Desarrollo Industrial de Castilla-La Mancha, SA (SODICAMAN) 15. Sociedad para el Desarrollo Industrial de Extremadura, SA (SODIEX) 16. Sociedad Regional de Promoción del Pdo. de Asturias, SA (SRP) 17. XesGalicia SGECR, SA 23 * Entidades internacionales con oficina abierta en España Entities covered by statistics (3) WITH OFFICE IN SPAIN 1) 2) 3) 4) 5) 6) 7) 8) 3i Europe plc (Sucursal en España) Advent International Advisory, SL Blackstone Bridgepoint CVC Capital Partners Limited Demeter Partners Doughty Hanson Ergon Capital 10) 11) 12) 13) 14) 15) 16) 17) 18) Investindustrial Advisors, S.A. Kohlberg Kravis Roberts (KKR) L Capital Oaktree Capital Management, L.P PAI Partners. Permira Asesores Riverside España Partners, S.L. Springwater Capital The Carlyle Group España, SL 9) Harvard Investment Group Capital (HIG) WITHOUT OFFICE IN SPAIN 1) 2) 3) 4) 5) 6) 7) 8) 9) 10) 11) 12) 13) 14) 15) 16) 17) 18) 19) 20) Accel Partners Apax Partners España, SA Argos Soditic Arle Capital Partners Atomico Avalon Ventures Bain Capital Balderton Capital Bertelsmann SE & Co Boehringer Ingelheim Boston Seed Capital Bruckmann, Rosser, Sherrill & Co CCMP Capital Advsors Coral Group Correlation Ventures Costanoa Venture Capital Crédit Agricole Private Equity Data Collective VC DLJ South American Partners Elaia Partners INTERNATIONAL ENTITIES 21) 22) 23) 24) 25) 26) 27) 28) 29) 30) 31) 32) 33) 34) 35) 36) 37) 38) 39) 40) 41) 42) 43) 44) 45) 46) 47) 48) 49) 50) 51) 52) 53) 54) 55) 56) 57) 58) 59) 60) 61) 62) First Reserve General Atlantic GGM Capital GGV Capital Goldman Sachs Greylock Partners G Square HG Capital Highland Capital Partners Horizon Ventures Hutton Collins Idinvest Partners Index Ventures Insight Venture Partners Intel Capital Javelin Venture Partners JZ International Kennet Partners Kleiner Perkins C&B Kurma Partners Magenta Partners Maveron Open Ocean Oxford Capital Partners Palamon Capital Partners Partners Group Providence Equity Partners QED Investors Quadrangle Group LLC Scope Capital Advisory Sequoia Capital Sigma Partners Smart Ventures Spark Capital Partners Sun Capital Thomas H. Lee Partners Tiger Global Management Top Tier Capital Trident Capital Trilantic Partners Triton Investment Advisers Warburg Pincus 24 Thanks to Corpfin Capital for sponsoring this presentation 25 Príncipe de Vergara, 55 – 4ºD 28006 Madrid Telf. 91 411 96 17 www.ascri.org 26

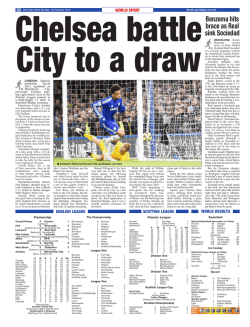

© Copyright 2026