Morning Coffee with GEPL Capital

Equity | F&O | DP | Commodities | Mutual Funds | Insurance | Bonds | IPOs | WMS | LAS | Currency Derivatives | NRI Services

Morning Coffee with GEPL Capital

Date: February 2, 2015

Market Update

Indices

Bulk Deals

Prev. Close

Abs. Change

Change(%)

29,182.95

(498.82)

(1.7)%

8,808.90

(143.45)

(1.6)%

Indian Markets

Sensex

Nifty

BSE

17,164.95

(251.90)

(1.4)%

Nasdaq

4,635.24

(48.17)

(1.0)%

FTSE

6,749.40

(61.20)

(0.9)%

Emerging Markets ( as of 08:30 am)

HangSeng

24,346.05

(161.00)

(0.7)%

Nikkei

17,579.78

(94.61)

(0.5)%

8833.00

(46.00)

(0.52)%

SGX Nifty

BSE Sectoral

Indices

Prev. Close

Abs. Change

Change(%)

19985.9

(245.19)

(1.2)%

Banks

22715.52

(737.58)

(3.1)%

Capital Goods

17095.72

(122.41)

(0.7)%

Comm & Teck

6136.48

(10.53)

(0.2)%

Con. Durables

10655.36

(200.93)

(1.9)%

8275.45

(45.95)

(0.6)%

Healthcare

15666.51

(83.30)

(0.5)%

IT

11178.71

22.27

0.2%

Metals

10190.2

(85.85)

(0.8)%

Oil & Gas

10143.2

(65.26)

(0.6)%

Power

2224.52

19.33

0.9%

Realty

1811.36

38.55

2.2%

Prev. Close

Abs. Change

Midcap

10738.59

Smallcap

11329.26

Auto

FMCG

By

Capitalisation

BM Purpose

BHARATFORG

Quarterly Results

CERA

Quarterly Results

CUMMINSIND

Quarterly Results

GICHSGFIN

Quarterly Results

UPL

Quarterly Results

REPCOHOME

Quarterly Results

Price

BHAGERIA TRADE

INVEST PRIVATE

LIMITED

Buy

196,000

125.93

BHAGYAREKHA

CAPITAL MARKET

PVT LTD

Sell

22,436

94.38

Client Name

30-Jan-15

BHAGERIA

30-Jan-15

ALFAVIO

For more Bulk Deals Click Here

NSE

Date

Scrip Name

Client Name

Buy/

Sell

Quantity

Price

30-Jan-15

Housing Development and I

ILLUMINATI TRADING

PRIVATE LIMITED

Buy

3712121

107.05

30-Jan-15

Unitech Ltd

ADROIT SHARE &

STOCK BROKER PVT.

LTD.

Sell

13243972

18.54

For more Bulk Deals Click Here

Event Update

Release Date

Event

Bloomberg

Consensus

3-Feb-15

RBI cash reserve ratio

-

4.00%

Change(%)

3-Feb-15

RBI Repurchase &

Reverse Repo ratio

-

7.75%/6.75%

(32.49)

(0.3)%

9-Feb-15

GDP

-

5.30%

(49.49)

(0.4)%

9-Feb-15

GDP Annual estimate

YoY

-

-

Board Meetings

Script Name

Quantity

Scrip Name

Developed Markets

DJIA

Buy /

Sell

Date

Corporate Actions

Ex Date

Purpose

TORNTPHARM

2-Feb –15

Interium Dividend

Rs 5.00

03-Feb-15

GANDHITUBE

2-Feb –15

Interium Dividend

Rs 7.50

03-Feb-15

POLYMED

2-Feb –15

Interium Dividend

Rs 5.00

03-Feb-15

For more Corporate Actions Click Here

Fund Flows

Latest

MTD

YTD

Flls

(771.55)

10606.30

111013.10

MFs

(37.60)

(7881.80)

15250.50

GEPL Capital Pvt Ltd

Record

Date

Script Name

For more Board Meetings Click Here

( Rs in crore)

Previous Value

-

Equity | F&O | DP | Commodities | Mutual Funds | Insurance | Bonds | IPOs | WMS | LAS | Currency Derivatives | NRI Services

Morning Coffee with GEPL Capital

Date: February 2, 2015

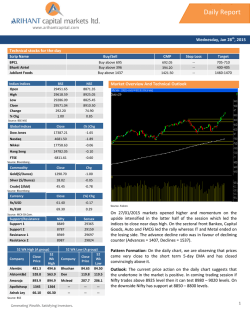

Market Summary

Indian market closed in the red on Friday with Sensex shredding 499 points to close at 29183 and Nifty losing 143 point to close at

8809. The market beat on Friday led by a drag in financial stocks like Bank of Baroda, ICICI Bank, oriental Bank of Commerce, after

reporting disappointing set of Q3FY15 earnings. Bank Nifty was down by 3.34%. CNX auto was down by 1.31%. CNX energy was down

by 0.40%. CNX finance was down by 3.16%. CNX FMCG was down by 0.60%. CNX PSU bank was down by 5.88%. CNX media were

down by 1.45%. CNX metal down by 1.07%. CNX pharma was down by 0.50%. CNX IT was up by 0.01%. HCL tech announces 1:1

bonus issues and also Tech Mahindra announces 1:1 bonus & stock split of equity share of the existing face value of Rs. 10 per share to

Rs. 5 per share.

Corporate News

PVR net profit jumps 127% in Q3 FY15. Successful performance of Bang Bang, Haider, Happy New Year and PK at box office push

up the profit.

Indoco Remedies Q3 net up 53% at Rs 22 crore. Company's net revenues in the December quarter grew by 13%

Berger Paints' Q3 profit decline marginally to Rs 82 crore. Company had posted consolidated net profit of Rs 82.28 crore during the

October-December quarter of last fiscal

Shoppers Stop Q3 net soars 2.8 times to Rs 14 cr. The company's turnover grew 10 per cent.. IFCI net profit slips 6% to Rs 134 cr in

Q3.

Economic News

Economic growth of FY14 revised to 6.9% by base year change. The government also revised its GDP for FY13 to 5.1% from 4.5%

earlier

Govt revises 2013-14 GDP growth to 6.9%. New measurement of GDP includes under-represented economic sectors as well as

items such as smartphones and LED TV sets.

Govt's fiscal bonanza from crude price slump estimated at Rs 45,000 cr this fiscal. This includes Rs 30,000 crore from the dip in petroleum subsidy and Rs 15,000 crore gain from four excise duty hikes.

Global News

European air safety body asks 'extreme caution' in Pakistan airspace. The European Aviation Safety Agency (EASA) "recommends all

operators to exercise extreme caution" when flying over the country.

Russian central bank makes surprise interest rate cut. Following the decision, the rouble extended losses to trade as much as 4 percent on the day against the dollar

Fundamental Call Summary

Release Date

Stock Name

Reco. Price

Target Price

Potential Upside

Rating

27-Nov-14

VIP Industries Ltd

123

136

10%

BUY

23-Jan-14

Transportation Corp.

of India Ltd

284

341

20%

BUY

For entire fundamental list please click here

GEPL Capital Pvt Ltd

Equity | F&O | DP | Commodities | Mutual Funds | Insurance | Bonds | IPOs | WMS | LAS | Currency Derivatives | NRI Services

Morning Coffee with GEPL Capital

Date: February 02, 2015

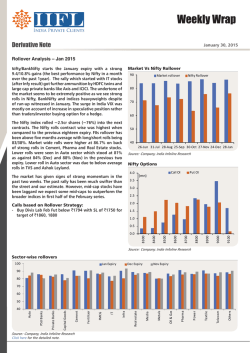

Technical Snapshot

Market Activity

30-January

Close

Points

%

BSE

29182

(498)

(1.68)

NSE

8808

(143)

(1.60)

8887

(98)

(1.10)

20000

(667)

(3.23)

Nifty Futures

Bank Nifty Futures

Nifty Trend

Support Nifty

Resistance Nifty

8000 (Up)

8825

8910

7900 (DOWN)

8800

8950

Sensex

Support

Resistance

29182

28800

29400

Key Highlights:

Nifty Futures breaches the support of 8900. The next support for the index is placed at 8810.

Nifty Futures opened weak and remained in the firm grip of bears for the entire session to conclude at 8887, losing 98 points.

The level of 8900 has now been breached marginally but now the index has support placed at 8810.

The index can still scale higher till the time it trades above 8810. On the higher side 8930 — 8950 range may be tested.

In case of extreme bullishness a retest of 9029 is also a possibility if 8810 is not breached in coming sessions.

Only a breach of 8810 would imply weakness, below which the index can swiftly decline till 8700 to 8670 range in coming days.

The intraday support levels for Nifty Futures are placed at 8825 and 8800 whereas the resistance levels are placed at 8910 and 8950.

Amongst the sectoral indices the BSE Power and Realty indices were the outperformers whereas BSE Bankex index was the laggard.

Stocks view for the day:

Stock

View

Segment

Lot Size Duration

CMP

Support

Resistance

NTPC

Bullish

Canara Bank

Bearish

Futures

2000 One Day

144

141

148

Futures

1000 One Day

445

436

452

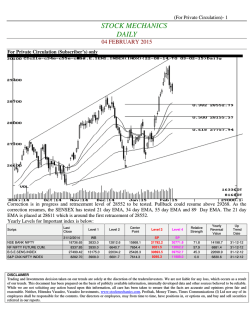

Current Calls:

Sr.

No

Date

Action

Company

Product

Reco. Price

Stop Loss

1

30-Jan–15

Buy

R Com

2

28-Jan–15

Buy

Bombay Dyeing

3

24-Dec–14

Buy

4

11-Dec–14

Buy

Target

CMP Time Frame Remarks

Short Term

81.60

78

87

79.6 1 Week

Short Term

78.75

66

103

81.1 4 Weeks

Opto Circuit

Short Term

26.10

21.90

34

24.1 4 Weeks

SREINFRA

Short Term

50.1

44.4

62

46.0 4 Weeks

Reco. Price

Stop Loss

Target 1

Target 2

19

10

32

40

Options Recommendations:

Sr.

No

1

Date

Action

Company

27-Jan–15

Buy

LT 1750 CE

GEPL Capital Pvt Ltd

CMP Remarks

14 Stop loss triggered at 10

Equity | F&O | DP | Commodities | Mutual Funds | Insurance | Bonds | IPOs | WMS | LAS | Currency Derivatives | NRI Services

Morning Coffee with GEPL Capital

Date: February 02, 2015

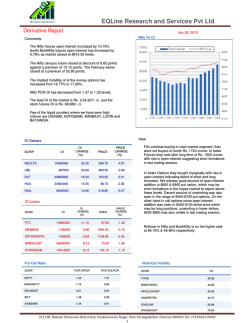

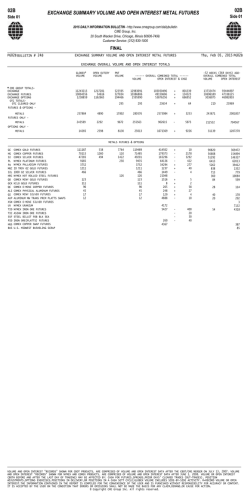

Derivatives Snapshot

Current

Nifty Spot

Nifty

Futures

Nifty Futures

Prem. / Disc

Nifty Futures

Basis

Nifty Futures

OI

Nifty Futures

Change in OI

Nifty Futures

Volume ( in cr.)

Highest Total OI

Call Strike

Highest Total

OI Put Strike

Nifty OI

PCR

NSE

VIX

8808.90

8872.65

63.75

58.60

25504975

758725

1.47

9000

8000

0.95

20.17

Previous

8952.35

8986.30

33.95

49.75

24746250

4320300

1.30

9000

8000

1.09

19.43

Change

(143.45)

(113.65)

29.80

-

-

-

-

-

-

-

0.74

% Chg

(1.60)

(1.26)

-

-

-

-

-

-

-

-

3.81

Snapshot:

Nifty February Futures ended @ 8872.65 down by 113.65 points with premium of 63.75 points.

Nifty 9000 call saw addition of 18.20 lakh shares in OI, and Nifty 9000 put saw addition of 6.70 lakh shares.

Nifty futures Open interest increased by 7.59 lakh shares with February series total open interest stands at 2.55 crore shares.

Nifty 9000 call has highest OI, whereas 8000 put holds the highest OI indicating 9150 to 8650 range for the week and Bank Nifty

21000 call has highest OI and 20000 put has highest OI indicating 19000 to 21000 range for the week.

India VIX ended at 20.17 up by 3.81% against the previous close of 19.43.

FII Derivatives Statistics:

Securities in Ban for Trade :

Buy (Rs. in Cr.)

Sell (Rs. in Cr.)

Net Buy / Sell (Rs. in Cr.)

INDEX FUTURES

2091.21

2019.13

72.09

1

-

5

-

INDEX OPTIONS

16203.52

14885.59

1317.93

2

-

6

-

STOCK FUTURES

3226.68

4835.14

(1608.46)

3

-

7

-

STOCK OPTIONS

2388.56

2249.57

138.98

4

-

8

-

Open Interest Summary:

Sr. No. Stock Name

Sr. No.

Y Axis

Long Build Up (+ +)

Short Build Up (- +)

Stock

Price %

OI %

Stock

Price %

OI %

BANKBARODA

(11.01)

23.76

ANDHRABANK

1.21

29.03

ALBK

(5.48)

17.18

IBREALEST

6.19

20.54

TCS

(2.33)

15.93

HCLTECH

8.77

14.20

SBIN

(5.28)

14.20

ADANIENT

7.40

13.29

UNIONBANK

(3.19)

13.96

JPASSOCIAT

9.11

10.93

X Axis

0

Long Unwinding (- -)

Stock

Short Covering (+ -)

Price %

OI %

Stock

Price %

OI %

ACC

(1.61)

(4.09)

BPCL

1.98

(9.41)

DIVISLAB

(2.33)

(3.45)

HINDPETRO

3.10

(4.70)

VOLTAS

(2.79)

(3.35)

SKSMICRO

2.20

(2.96)

SUNTV

(1.30)

(2.99)

BOSCHLTD

0.96

(2.77)

TITAN

(2.21)

(2.57)

LUPIN

1.76

(1.11)

Long Build Up: When price of a particular stock/Index future rises along with the rise in Open Interest.

Short Build Up: When Price of a particular stock/Index future falls with the rise in Open Interest.

Short Covering: When price of a particular stock/Index future rises with the fall in Open Interest.

Long Unwinding: When price of a particular stock/Index future falls along with the fall in Open Interest.

GEPL Capital Pvt Ltd

Stock Name

Equity | F&O | DP | Commodities | Mutual Funds | Insurance | Bonds | IPOs | WMS | LAS | Currency Derivatives | NRI Services

Morning Coffee with GEPL Capital

Date: February 2, 2015

Debt Market Snapshot

Forex Rates

Prev. Close

Abs. Change

Change(%)

USD/INR

61.40

0.47

0.76

EUR/INR

70.23

0.57

0.81

GBP/INR

93.43

0.08

0.09

JPY/INR

52.63

0.55

1.05

Government Security Market:

The Inter-bank call money rate traded in the range of 6.25% 8.05%on Friday ended at 7.95%.

Total Borrowings From RBI's Repo with banks taking Rs. 118510

mn on Friday Vs Rs. 159000 mn on Thursday.

The benchmark 8.40% GOI 2024 closed at 7.6910% on Friday Vs

7.7107% on Thursday .

Particulars

Latest

Previous

Chg (bps)

5 Year GOI Bond

7.64%

7.67%

0.03

10 Year GOI Bond

7.69%

7.71%

0.02

15-Year GOI Bond

7.78%

7.80%

0-02

Call Money (WAR)

7.83%

7.72%

(0.11)

CBLO (WAR)

7.72%

7.60%

(0.12)

US 10 Year

1.75%

1.72%

(0.03)

Bonds in Secondary Market:

Crude Oil (in $/bl)

48.24

44..45

(3.79)

Bonds

Inflation (Monthly)

0.11%

0.11%

-

GEPL Capital Pvt Ltd

Global Debt Market:

U.S. Treasury 10-year notes are posting the biggest gain to start the

year in more than a quarter-century as investors snap up the highest

yields among Group of Seven nations as central banks worldwide seek

to avoid deflation .

10 Year Benchmark Technical View:

10 year (8.40% GOI 2024) yield likely to move in the range of 7.67% 7.71% level on Monday.

7.22 REC 2022 ( Tax Free)

Coupon

Maturity

Face Value

7.22

19/12/22

1000

Equity | F&O | DP | Commodities | Mutual Funds | Insurance | Bonds | IPOs | WMS | LAS | Currency Derivatives | NRI Services

Morning Coffee with GEPL Capital

Date: February 02, 2015

GEPL CAPITAL Pvt Ltd

Reg. Office: D-21/22 Dhanraj mahal, CSM Marg, Colaba, Mumbai 400001

Disclaimer:

This report has been prepared by GEPL Capital Private Limited ("GEPL Capital"). GEPL Capital is regulated by the Securities and Exchange Board of India. This report does

not constitute a prospectus, offering circular or offering memorandum and is not an offer or invitation to buy or sell any securities, nor shall part, or all, of this presentation form

the basis of, or be relied on in connection with, any contract or investment decision in relation to any securities. This report is for distribution only under such circumstances as

may be permitted by applicable law. Nothing in this report constitutes a representation that any investment strategy, recommendation or any other content contained herein is

suitable or appropriate to a recipient’s individual circumstances or otherwise constitutes a personal recommendation. All investments involve risks and investors should exercise prudence in making their investment decisions. The report should not be regarded by the recipients as a substitute for the exercise of their own judgment.

Any opinions expressed in this report are subject to change without notice and may differ or be contrary to opinions expressed by other business areas or groups of GEPL

Capital as a result of using different assumptions and criteria. GEPL Capital is under no obligation to update or keep current the information contained herein. The securities

described herein may not be eligible for sale in all jurisdictions or to certain categories of investors. Options, derivative products and futures are not suitable for all investors,

and trading in these instruments is considered risky. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect

the value, price or income of any security or related instrument mentioned in this report.

Any prices stated in this report are for information purposes only and do not represent valuations for individual securities or other instruments. There is no representation that

any transaction can or could have been effected at those prices and any prices do not necessarily reflect GEPL Capital’s internal books and records or theoretical modelbased valuations and may be based on certain assumptions. Different assumptions, by GEPL Capital or any other source may yield substantially different results. GEPL

Capital makes no representation or warranty, express or implied, as to, and does not accept any responsibility or liability with respect to, the fairness, accuracy, completeness

or correctness of any information or opinions contained herein. Further, GEPL Capital assumes no responsibility to publicly amend, modify or revise any forward-looking statements, on the basis of any subsequent development, information or events, or otherwise. Neither GEPL Capital nor any of its affiliates, directors, employees or agents accepts

any liability for any loss or damage arising out of the use of all or any part of this report. In no event shall GEPL capital be liable for any direct, special indirect or consequential

damages, or any other damages of any kind, including but not limited to loss of use, loss of profits, or loss of data, whether in an action in contract, tort (including but not

limited to negligence), or otherwise, arising out of or in any way connected with the use of this report or the materials contained in, or accessed through, this report.

GEPL Capital Pvt Ltd

© Copyright 2026