ATI Mid-day Commentary

MID-DAY COMMENTS

www.advance-trading.com

January 29, 2015

HIGHLIGHTS: MACRO: U.S. indices are mixed this morning. The DOW is 73 higher but both the S&P (-.03) and the NAS (-12) are in varying

degrees of negative territory. Europe had the DAX and CAC 40 with ¼ to ½% gains; the FTSE loss ¼% point. Unemployment claims of 265 K

were a 15 year low, well under the 300 K consensus. But, pending home sales fell 3.7% in December in contrast for ideas of a .6% increase.

The trade continues to berate the $ for its impact on earnings; today the Index is up ½ point at 95.20; energy futures are working lower,

with CLH off 60 cents; gold is out of favor today, giving up $32 at the moment. T-Storm Weather: Decent overnight rains in South America

with ½ to 1” in Argentina and less than ½” for much of Brazil. Argentina is still forecast for average rains for the next ten days with above

average temperatures, the forecast is for average rains over the Brazilian bean areas for the next ten days with below average

temperatures. The moisture focus will be on the driest areas of Center-West, Northeast, and Southeast Brazil. There should also be

scattered t-storms in other areas of Brazil/Paraguay. A mix of weather continues in Argentina, but heavy rainfall is not foreseen in wettest

areas. Rain and snow affect some U.S. cattle and hog areas this weekend as the unusually-mild pattern further breaks in the Plains. The

potential for a winter storm exists in the Corn Belt Sunday-Monday. EUROPEAN GRAINS: May UK Feed Wheat, up 6 ½ to $4.83 ¼; Mar

French Maize: up 2 ¼ to $4.40; Mar French Milling Wheat, up 1 ½ to $5.78 ¾

Corn

Fund selling, dollar strength despite best month of export sales in 7 years; glass ½ full or ½ empty—calling the

50% sales drop from LW, “an ominous sign”: CH5: down 3; CK5: down 3; CZ5: down 2-3

Spreads: CH/CK: -8 ½, off ¼; CH/CN: -16, down ¼; CK/CN: -7 ¾, off ¼; CN/CU: -6 ¾, steady; CN/CZ: -15 ¼, steady;

CU15/CZ15: -8 ¼, up ¼; CZ15/CH16: -8 ½, steady

CIF: JAN, 54/59, down 2; FEB, 56/61, 2 higher; Brazil: AUG, steady at 50/60. Ethanol: Cedar Rapids, 0 CH,

steady; Blair, -2 CH, steady; Decatur, +3 CH, steady; Fort Dodge, -8 CH, steady; IN, 4 to -7 CH, steady. Hereford:

Jan +72 CH, off 1; Feb, down 1 to 73 CH. CIF Milo, 225 CH, steady

FHG Barge Freight: IL River, 440/460, off 10-15; STL, 325/350, steady; OH River, 350/375, steady; MemphisCairo, 240/250, steady

World FOB values ($/MT)—

Today

Change

Argentina

$181

-$10

Ukraine

$173

-$7

Ukraine Feed Wheat

$2155

-$10

Brazil (Cif)

$181

$0

Bordeaux (France)

$171

+$1

US Gulf

$181

-$1

CIF Milo

225 CH

NA

Export Sales—Another solid week of corn activity at 42.1 with the trade thinking 33-37; 16.6/wk needed. Good

list of buyers. Milo was a robust 9.1, mostly China; YTD at is at 270 mbu which IS the USDA forecast

Daily Sales Announcement: USDA says 116 K MT of milo sold to Unknown (1/2 TY, ½ NY)

Oct-Jan corn exports from the Ukraine total 8.7 MMT, down from 11.9 for the same period last year

Dalian May corn futures edged a ½ cent lower to $9.83 ¾ (rate: Yuan = .16002 $US

Soybeans

Supported early on strong export sales, optimism fades; good SBM # suggest continue decent crush; Argentina

biodiesel ruling pressures sbo again: SH: down 2; SK: down 2; SMH: +$1.70; SMK +$1.90; BOH: -0.97; BOK: -0.97

Spreads: SB: H/K: -6 ¾, up ¼; K/N: -5 ¼, up ½; N/X: +28, up 3 ¼. SBM: H/K: -$.10, $7.40. Board crush down 4 cents

to $1.01 1/2, oil much weaker again

CIF: JAN, 86/89, down 1; FHFEB, 79/84, also 1 lower; BRAZIL--FHFEB: 90/100, unch; LHFEB: 77/90, unch

World FOB values ($/MT):

Today

Change

U.S. Gulf

$393

-$2

PNW

$405

-$2

Brazil

$384 (Feb)

$0

Argentina

$373 (Mar)

-$6

Ukraine

$370

-$10

Export Sales—Surprisingly strong bean # at 32.6. Trade was looking for 7-15 with only 3.7/week needed. China

bought 62%; SBM was just shy of 300 K MT (150-350) with 99/wk needed. SBO at 10.6 K fell short of the trade

range. SBM exports were 276 K; 4-week average at 320 K/Wk ties LY for the all-time seasonal high

India contemplating reducing duty on imported soybeans from 30%, down to 5 to 10% to boost domestic

processing

Low January rainfall ceases barge operations on Brazil’s Tiete River, to delay start of peak export season;

possibly shift some demand back to the U.S. –Bloomberg

Disclaimer – This material is a solicitation to enter into a derivatives transaction. The information and data contained herein have been obtained from sources believed to be reliable but Advance Trading Inc. ("Advance") does not

warrant their accuracy or completeness. Recommendations and opinions contained herein reflect the judgment of Advance as of the date hereof, are subject to change, and are based on certain assumptions, only some of which

are noted herein. Different assumptions could yield substantially different results. You are cautioned that there is no universally accepted method for analyzing financial instruments. Advance does not guarantee any results and

there is no guarantee as to the liquidity of the instruments involved in our analysis. Advance, its affiliates, and its and their officers, directors, and employees may sell or purchase, for their own account or for customers, positions

in futures, options or other instruments which may be similar or different from the positions referred to herein. As a matter of policy, Advance does not give tax, accounting, regulatory or legal advice to clients. Clients therefore

should consult their own advisors regarding the tax, accounting and legal implications of the recommended strategies before transactions are affected. Trading commodity futures and options involves significant risk and is not

appropriate for all investors. Information relating to past performance is not necessarily indicative of future results. Reproduction in any form without Advance's express written consent is strictly forbidden.

MID-DAY COMMENTS

www.advance-trading.com

January 29, 2015

May Dalian SB futures plummeted 26 ½ cents overnight to $19.03 ½; May SBM was off $.60 to $389.78); South

American beans were penciling out to crush margins of $.21 to $.36 per bushel

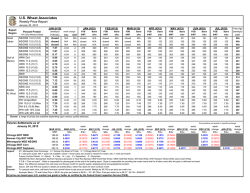

Wheat

Solid export sales, especially for HRW, Spring and white wheat said to give at least a temporary boost to futures:

WH: up 5; KWH: up 11-12; MWH: up 9-10

Spreads: WH/WK: -5, steady; KWH/KWK: -5 ½, up ½; MWH/MWK: -6 ¾, up 1

SRW FGH: 80/100, steady; GH: 90/100, steady. HRW F: 120/UNQ, no change; GH: 123/UNQ, steady

World FOB Values

Today

Change

FOB Rouen

10.5%

$215

+$1

FOB Russia

11.5%

$252

-$2

FOB India

11.5%

$284

$0

FOB Argentina

12%

$245

-$23

FOB Baltic

12%

$243

$0

S AUS

APW

NA

NA

US HRW

FOB

$250

-$11

US SRW

FOB

$238

-$7

Export Sales—better than expected (9-17) at 20 mbu. The Philippines bot 3.5 mbu. Sales by class included HRW

7.1 (4.7 LW); HRS, 5.9 (7.7); white, 5.7 (3.4); SRW, 1.3 (1.1)

The U.K. cuts wheat supply forecast by a modest 15 k MT from its November forecast, down to 19.864 MMT

Ukraine Ag Minister says wheat exports to-date now total 8.6 MMT since July 1, versus 7.0 a year ago

Disclaimer – This material is a solicitation to enter into a derivatives transaction. The information and data contained herein have been obtained from sources believed to be reliable but Advance Trading Inc. ("Advance") does not

warrant their accuracy or completeness. Recommendations and opinions contained herein reflect the judgment of Advance as of the date hereof, are subject to change, and are based on certain assumptions, only some of which

are noted herein. Different assumptions could yield substantially different results. You are cautioned that there is no universally accepted method for analyzing financial instruments. Advance does not guarantee any results and

there is no guarantee as to the liquidity of the instruments involved in our analysis. Advance, its affiliates, and its and their officers, directors, and employees may sell or purchase, for their own account or for customers, positions

in futures, options or other instruments which may be similar or different from the positions referred to herein. As a matter of policy, Advance does not give tax, accounting, regulatory or legal advice to clients. Clients therefore

should consult their own advisors regarding the tax, accounting and legal implications of the recommended strategies before transactions are affected. Trading commodity futures and options involves significant risk and is not

appropriate for all investors. Information relating to past performance is not necessarily indicative of future results. Reproduction in any form without Advance's express written consent is strictly forbidden.

© Copyright 2026