here - Thomson Reuters

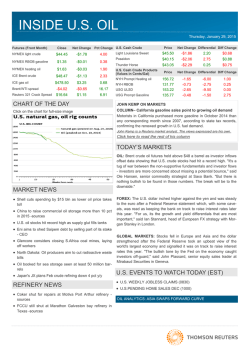

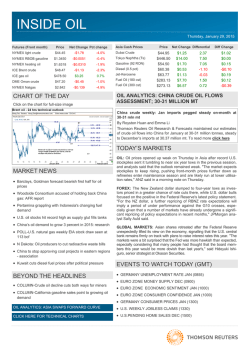

INSIDE COMMODITIES Monday, February 2, 2015 SHANGHAI COPPER- OUTLOOOK MARKETS SNAPSHOT Click on the chart for full-size image Crude prices fell after U.S. unions called a refinery strike. Copper jumped more than two percent, after an official report showed factory growth in China shrank while Gold steadied. European markets looked set to open low tracking Asian market. Wall Street closed negative on Friday. To read more, please click here Contract (AS OF 0714 GMT) Last Change YTD NYMEX light crude $47.14 -2.28% -9.44% NYMEX RBOB gasoline $1.46 -1.33% 3.03% $498.00 4.13% -6.64% $2.66 -1.23% -6.85% $1,278.80 -0.31% 8.39% LME Copper $5,518 0.41% -12.78% LME Aluminium $1,858 -0.32% 0.62% CBOT Corn $3.69 -0.41% -6.80% ICE gas oil NYMEX natural gas Spot Gold TOP NEWS CBOT Wheat $5.02 -0.20% -14.75% CBOT Soybeans $9.52 -0.3% -9.52% China factory sector jolts by shrinking in January Index (Total Return) Workers strike for new pact at 9 U.S. oil, chemical plants Saudi Aramco stops red sea deepwater exploration work -Sources Latest Close Change YTD Thomson Reuters/Jefferies CRB 219.3848 2.91% -4.83% S&P GSCI 2967.0249 3.89% -7.50% Rogers International 2529.95 0.00% -9.41% Crisis veteran Naimi stays to hold line on Saudi oil policy Cont Commod Indx 429.9106 1.28% -3.91% U.S. soyoil open interest suggests further falls ahead Index (Total Return) Latest Close Change YTD Wheat for Egypt stuck at Russian ports ahead of export US STOCKS (DJI) tax launch - Sources Sugar traders have informal talks about Euro-based contract Codelco aims to cut 2015 costs by $1 bln as copper price plummets Speculators hike bearish copper bets as mood darkens CFTC India's JSW steel calls for action against Chinese steel "dumping" BEYOND THE HEADLINES PREVIEW-Saudi Arabia expected to cut March crude prices for Asia CLICK HERE FOR TECHNICAL CHARTS 17164.95 -1.45% -3.69% US DOLLAR INDEX 94.85 0.02% 5.02% US BOND INDEX (DJ) 352.28 0.56% 2.99% ECONOMIC WATCH GMT 08:15 Indicators Unit Reuters Prior ES Manufacturing PMI ind 54 53.8 08:45 IT Markit/ADACI Mfg PMI ind 48.8 48.4 08:50 FR Markit Mfg PMI ind 49.5 49.5 08:55 DE Markit/BME Mfg PMI ind 51 51 09:00 EZ Markit Mfg Final PMI ind 51 51 09:30 GB Markit/CIPS Mfg PMI ind 52.6 52.5 13:30 US Consumption, Adjusted MM pct -0.2 0.6 13:30 US Personal Income MM pct 0.2 0.4 15:00 US Construction Spending MM pct 0.7 -0.3 15:00 US ISM Manufacturing PMI ind 54.5 55.1 INSIDE COMMODITIES February 2, 2015 MARKET MONITOR Crude oil prices fell after U.S. unions called a refinery strike and traders cashed in on strong price gains last week when the market soared on a sharp drop in U.S. drilling. Brent crude oil futures were trading at $51.70 a barrel, down 2.19 percent, while U.S. WTI futures were at $47.02, down 2.43 percent a barrel. Three-month copper on the London Metal Exchange traded up 0.4 percent at $5,516 a tonne. Gold steadied near $1,280 an ounce, after posting its biggest monthly gain in three years, as a shaky outlook for the global economy preserved bullion's safe-haven draw. Spot gold was off 0.3 percent at $1,279.18 an ounce. The yen briefly touched a two-week high versus the dollar, while commodity currencies were fragile as worries about the health of the Chinese economy added to unease following a selloff on Wall Street. The dollar slid to a two-week low of 116.64 yen in early trade. The euro also reached a one-week trough of 132.00 yen before bouncing back to 133.16, while the Australian dollar plumbed an 11-month low of 90.25. U.S. corn fell for a sixth consecutive session and wheat eased to trade near a four-month low, with grain markets starting February on a bearish note after a dismal performance last month under pressure from ample global supplies. Chicago Board of Trade March wheat had fallen 0.4 percent to $5.01 a bushel, after dropping to its lowest since Oct. 6. Shanghai copper jumped more than two percent, after an official report showed factory growth in China shrank for the first time in more than two years last month, fuelling hopes for increased stimulus from the world's second biggest economy. The most-traded April copper contract on the Shanghai Futures Exchange was up 2.4 percent at 40,140 yuan ($6,414) a tonne. European markets looked set to open lower tracking most of Asian stocks after soft data on China's factory sector activity raised concerns over the outlook for the world's second biggest economy. Wall Street closed negative on Friday. TOP NEWS China factory sector jolts by shrinking in January Workers strike for new pact at 9 U.S. oil, chemical plants China's factory sector unexpectedly shrank for the first time in nearly 2-1/2 years in January and firms see more gloom ahead, an official survey showed, raising expectations that policymakers will take more action to forestall a sharper slowdown. The official Purchasing Managers' Index (PMI) fell to 49.8 in January, the National Bureau of Statistics said on Sunday, a low last seen in September 2012 and a whisker below the 50-point level that separates growth from contraction on a monthly basis. The December level was 50.1, and a Reuters poll saw a better result, 50.2 for January. Only one of 11 economists in the poll predicted a January contraction. Most of the PMI indexes "showed a downward trend, indicating that current economic growth is still in a downtrend," said Zhang Liqun, an economist at the Development Research Centre, a state think-tank. Some economists said the January reading was especially downbeat as it suggested that factories did not enjoy a usual spike in business before China's annual Spring Festival holiday, which falls in mid-February this year. The poor January official PMI fueled bets that more monetary policy loosening was in store in the world's second-largest economy. "China still needs decent growth to add 100 million new jobs this year, plus China is entering a rapid disinflation process," ANZ economists said in a note to clients. "We (think) the People's Bank of China will cut the reserve requirement ratio by 50 basis points and cut the deposit rate by 25 basis points in the first quarter," they said. Marred by a housing slump, erratic growth in exports and a state-led slowdown in investment, China's economy has steadily lost steam in the last year as growth sunk to a 24-year low of 7.4 percent. Union workers took to picket lines on Sunday after strikes were called at nine U.S. refineries and chemical plants in a bid to pressure oil companies to agree to a new national contract covering workers at 63 plants. The walkouts, the first held in support of a nationwide pact since 1980, target plants that together account for about 10 percent of U.S. refining capacity. The discord comes as plunging crude prices force oil companies to slash spending. The United Steelworkers union (USW) said Royal Dutch Shell Plc, the lead industry negotiator, halted talks after the union rejected a fifth proposal from the company. "Shell refused to provide us with a counter-offer and left the bargaining table," USW International President Leo Gerard said. "We had no choice but to give notice of a work stoppage." Shell said it would like to restart talks. "We remain committed to resolving our differences with USW at the negotiating table and hope to resume negotiations as early as possible," Shell said. Shell activated a strike contingency plan at its sprawling joint venture refinery and chemical plant in Deer Park, Texas, to keep operating normally. Other companies have said they were calling on trained managers to use as replacement workers, so the strikes are not expected to cause gasoline prices to spike. Tesoro Corp said management was operating its refinery in Carson, California, and that managers would take over from union workers at its plant in Anacortes, Washington, in the next 24-48 hours. It said its Martinez, California, refinery, which was undergoing maintenance work, would be shut down. Besides Shell and Tesoro, the USW said strikes were called at three plants belonging to Marathon Petroleum in Texas and Kentucky, and LyondellBasell's plant near Houston. At least two of the plants on the list have a history of deadly accidents. 2 INSIDE COMMODITIES February 2, 2015 TOP NEWS (Continued) Saudi Aramco stops red sea deepwater exploration work Sources Crisis veteran Naimi stays to hold line on Saudi oil policy The new Saudi king's decision to keep Ali al-Naimi in his job as oil minister signalled to energy markets that the world's top crude exporter would not flinch from its policy of refusing to cut output as it fiercely guards market share. Naimi convinced fellow OPEC members to pursue such a strategy, regardless of how far oil prices might fall. He was determined not to cede ground to producers outside the group such as Russia and U.S. shale drillers. When reshuffling his cabinet on Thursday, King Salman - just days into his role as ruler - would have found it difficult to find more experienced hands to guide the kingdom's oil sector through these turbulent times. After all, 79-year-old Naimi has seen at least three price crashes during his two decades as oil minister. State oil giant Saudi Aramco has put on hold its deepwater oil and gas exploration and drilling activities in the Red Sea because of high costs as it economises in an environment of low crude prices, industry sources said on Sunday. The cost of operations in the Red Sea, a new area for Saudi Aramco, was around $1 million per day, said two sources, who declined to be identified because they were not authorised to speak to media. "It is related to budget cost reduction in the Red Sea offshore," said one of the sources. Saudi Aramco declined to comment. The company's chief executive Khalid al-Falih said last week that Saudi Aramco would renegotiate some contracts and postpone some projects because of the plunge in oil prices over recent months. The firm has suspended plans to build a $2 billion clean fuels plant at its largest oil refinery in Ras Tanura, sources told Reuters last month. Wheat for Egypt stuck at Russian ports ahead of export tax launch - Sources Several vessels loading tens of thousands of tonnes of wheat for the state buyer of Egypt, the world's largest wheat importer, are stuck in Russia's Black Sea ports ahead of the launch of an export tax in Moscow, trade sources said. After the rouble's slump against the dollar spurred grain exports, driving up domestic prices, the Russian government was forced to curb exports with informal limits and announced an export tax that will come into force on Feb. 1. Due to the informal curbs, these supplies for Egypt's state grain buyer, the General Authority for Supply Commodities (GASC), have already missed deadlines of previously agreed contracts, but traders cannot change the origin of supply. "There have been negotiations to try to change the origin even to Ukraine but GASC insisted that it remains Russian," one of sources said. U.S. soyoil open interest suggests further falls ahead U.S. soyoil futures are likely to test recent six-year lows next week after investors extended bearish bets in a surge of trading after a policy decision that could boost Argentina's exports to the United States. Open interest in soyoil on Thursday expanded to 401,410 contracts, the most since mid-November, as prices tumbled to 29.32 cents per lb, the lowest levels since February 2009, CME Group data showed on Friday. Trading volume on Wednesday of 178,984 soyoil contracts was the most in nearly a year, the CME Group said. Open interest can be an indicator that investors are making short bets, or buying with the expectation prices will fall. Codelco aims to cut 2015 costs by $1 bln as copper price plummets Sugar traders have informal talks about Euro-based contract World No.1 copper miner Codelco will look to slash costs by $1 billion in 2015, Chief Executive Nelson Pizarro said Friday, as the price of the base metal slumped to multi-year lows. It is seeking to cut direct cash costs by some $0.193 per pound of copper at its operations, Pizarro told journalists. In the January through September, Codelco's cash costs averaged $1.537 per pound. Still, none of the Chilean state-run copper miner's large investment projects will be at risk and no personnel will be laid off, Pizarro said. Instead, the company will look to implement efficiencies by such measures as the renegotiation of energy contracts, its task eased by slumping oil prices and a Chilean peso that has weakened around 25 percent versus the U.S. dollar over the last two years. Sugar traders have held several meetings to discuss the possible launch of a European euro-denominated futures contract following lobbying from both beet growers and industrial users. Prices for sugar within the European Union, which has import tariffs and production quotas, can differ significantly from global benchmarks set by ICE raw sugar and white sugar contracts. "The momentum (for the European contract) is frustration with the current opacity," one trade source involved in the process said. "It's very much at the probing stage. There has been a considerable amount of scepticism," the source added. 3 INSIDE COMMODITIES February 2, 2015 TOP NEWS Speculators hike bearish copper bets as mood darkens CFTC India's JSW steel calls for action against Chinese steel "dumping" Hedge funds and money managers increased their bearish positions in copper futures and options to a four-month high and raised their bullish bets in gold to their highest in just over two years in the week to Jan. 27, U.S. Commodity Futures Trading Commission (CFTC) data showed on Friday. In silver, they increased their net long by 6,539 lots to 40,164, the highest since July last year. Hedge fund and other speculative investors increased their net long in bullion by 21,960 contracts to 167,693, the most since late November 2012, while in copper, they increased their net short by 4,970 to 12,976, the highest since early October last year. India's JSW Steel Ltd on Friday urged the government to address "dumping" of cheap steel by Chinese rivals and take steps to improve iron ore availability after lower steel prices led to a 30 percent drop in the company's third-quarter profit. Steel imports into India leapt by more than 60 percent in the April to December period, with 1 million tonnes imported in December alone, group Chief Financial Officer Seshagiri Rao told reporters in Mumbai. "We have been representing to the government that they should take steps, as is being done by various countries, in stopping the dumping and to stop injury to the domestic industry," Rao said. BEYOND THE HEADLINES Light and Heavy as naphtha and fuel oil cracks rebounded from last month, boosting demand for these grades in Asia. Arab Extra Light "should increase relative to Arab Light for March as naphtha is so strong", an analyst said. Saudi OSPs to Asia are set as premiums or discounts to the average of Platts Oman and Dubai prices. The extent of the price cuts depend on how Saudi Aramco will factor in the spread in its calculations, traders said. A sharp widening of the Oman/Dubai spread this week could lead to bigger price cuts, they said, although the spread was little changed if compared on an average monthly basis. Saudi crude OSPs, usually released by the fifth of each month, set the trend for Iranian, Kuwaiti and Iraqi prices, affecting more than 12 million barrels per day (bpd) of crude bound for Asia. PREVIEW-Saudi Arabia expected to cut march crude prices for Asia By Florence Tan Top oil exporter Saudi Arabia is expected to cut prices for most of the crude it sells to Asia in March in line with a weak Dubai market, trade sources said on Friday. Ample supply continued to weigh on the Middle East crude market, widening Dubai's prompt inter-month spread into a deeper contango. Prompt oil is cheaper than supply in future months in a contango market. Four of the six traders who took part in a Reuters survey expected Arab Light's OSP to fall by about $1 in March while the other two forecast price cuts of just over $2 a barrel. Traders are also expecting smaller price cuts for Arab Extra 4 INSIDE COMMODITIES February 2, 2015 3 month TECHNICAL CHARTS (12 and 50 days Exponential Moving Average) Click on the chart for full-size image NYMEX Crude ICE BRENT Crude Spot Gold Spot Silver CBOT Corn CBOT Wheat (Inside Commodities is compiled by Atiqul Habib in Bangalore) For more information: Learn more about our products and services for commodities professionals, click here Contact your local Thomson Reuters office, click here For questions and comments on Inside Commodities click here Your subscription: To find out more and register for our free commodities newsletters click here © 2015 Thomson Reuters. All rights reserved. This content is the intellectual property of Thomson Reuters and its affiliates. Any copying, distribution or redistribution of this content is expressly prohibited without the prior written consent of Thomson Reuters. Thomson Reuters shall not be liable for any errors or delays in content, or for any actions taken in reliance thereon. Thomson Reuters and its logo are registered trademarks or trademarks of the Thomson Reuters group of companies around the world. Privacy statement: To find out more about how we may collect, use and share your personal information please read our privacy statement here To unsubscribe to this newsletter click here 5

© Copyright 2026