p23_Layout 1 - Kuwait Times

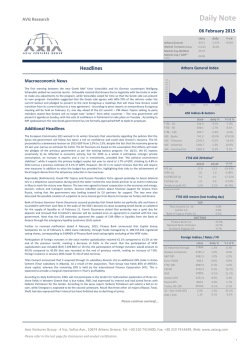

MONDAY, FEBRUARY 2, 2015 BUSINESS Aramco stops Red Sea deepwater exploration KHOBAR: State oil giant Saudi Aramco has put on hold its deepwater oil and gas exploration and drilling activities in the Red Sea because of high costs as it economizes in an environment of low crude prices, industry sources said yesterday. The cost of operations in the Red Sea, a new area for Saudi Aramco, was around $1 million per day, said two sources, who declined to be identified because they were not authorized to speak to media. “It is related to budget cost reduction in the Red Sea offshore,” said one of the sources. Saudi Aramco declined to comment. The company’s chief executive Khalid Al-Falih said last week that Saudi Aramco would renegotiate some contracts and postpone some projects because of the plunge in oil prices over recent months. The firm has suspended plans to build a $2 billion clean fuels plant at its largest oil refinery in Ras Tanura, sources told Reuters last month. However, Falih also said Saudi Aramco would continue investing in key projects, and had earmarked $7 billion to spend on unconventional gas in coming years after investing $3 billion in the past. A second source said deepwater exploration in the Red Sea had stopped because of several factors, including environmental issues, costs, and the need for further studies to minimize risks. “One of the most expensive offshore (areas) happens to be in the Red Sea the depth is different from the Gulf coast. They did discover a lot of oil and gas but they need to do lots of tests. Now with the current prices, they have put it on hold until further notice to collect more data,” said a third source. Saudi Aramco said in its 2013 annual review that it was continuing operations in the Red Sea’s deep waters and had made a new oilfield discovery at AlHaryd. “It would not be surprising if Saudi Aramco were to suspend exploration in the Red Sea because it is a very complex basin, and no significant discoveries have been announced since the Midyan field complex and the Um Luj condensate discoveries accomplished by the Aramco exploration team of the early 90s,” said Sadad Al-Husseini, a former top executive at Saudi Aramco and now an energy consultant. — Reuters Waha Capital to invest $870m cash bounty: CEO ABU DHABI: Abu Dhabi investment firm Waha Capital plans to invest 3.2 billion dirhams ($872 million) in the short-term to grow its energy, healthcare and infrastructure portfolio, its chief executive said yesterday. Salem Rashid Al-Noaimi spoke to Reuters after the firm posted an 88 percent increase in fourth-quarter net profit to 142.1 million dirhams and a more-than five-fold increase in annual profit to 1.73 billion dirhams, bolstered by deals around its investment in AerCap Holdings. AerCap Holdings, in which Waha was the largest shareholder, bought American International Group’s aircraft leasing business in a $5.4 billion cash and share deal that was completed in May. This diluted its stake in the firm by almost half but provided it with significant cash to deploy into new deals. Its cash position was bolstered further in December, when Waha hedged 12 million shares it owned in AerCap and sold a further 3 million shares in the aircraft leasing firm, giving it $532 million in funding. “We would like to deploy our firepower of 3.2 billion dirhams to grow our energy, infrastructure, healthcare and education projects,” Noaimi said, adding some deals are close to finalizing. He did not elaborate. Waha would like to increase its stake in Dubai’s National Petroleum Services (NPS), having bought a 20.15 percent stake last year for 274 million dirhams, he said. It was also interested in launching a second infrastructure fund. It is currently co-sponsor of the $300 million Mena Infrastructure Fund, which is fully invested. Currently Waha holds a 12.6 percent stake in AerCap and all its shares are fully hedged, Noaimi said, adding Waha plans to stick to its hedging plan until maturity over three years, after which it has the option to hand back shares or pay for them. Profit growth in 2015 may not be “phenomenal as in 2014”, Noaimi said, but in the next three to five years “our ambition is to continue in the same trajectory”. — Reuters Greece on European charm offensive for debt relief Athens seeks to renegotiate $270bn bailout PARIS: Greece’s new anti-austerity government was set to kick off its European charm offensive in Paris yesterday seeking to renegotiate its 240 billion euro ($270 billion) bailout, though Germany has already refused to consider any debt relief. Finance Minister Yanis Varoufakis, who is looking to write down half of Greece’s debt, was scheduled to meet with his French counterpart Michel Sapin and Economy Minister Emmanuel Macron in the afternoon, before heading on to London and Rome. Greece’s Prime Minister Alexis Tsipras has tried to calm nerves and markets spooked by his radical plans, saying he did not intend to renege on commitments to the European Union and International Monetary Fund. “It has never been our intention to act unilaterally on Greek debt,” Tsipras said in a statement to Bloomberg News. But he said Greece needed greater leeway to tackle root problems in its economy, such as tax evasion, corruption and policies that favor only a wealthy few. “We need time to breathe and create our own medium-term recovery program,” he said. Varoufakis is likely to get a sympathetic hearing in France, where Sapin has already said the EU should be open to reworking Greece’s bailout program, while emphasizing that it must still pay up eventually. “We can discuss, we can postpone, we can alleviate-but we will not cancel” Greek debt, Sapin told France’s CanalPlus television. The flurry of diplomacy has seen Tsipras phone European Central Bank chief Mario Draghi late Saturday and book meetings with Italian Prime Minister Matteo Renzi, French President Francois Hollande and European Commission President Jean-Claude Juncker this week. Neither he nor Varoufakis intend to visit Germany, which has shouldered the bulk of Greece’s loans and which strongly objects to Athens’ plans. Germany holds firm German Chancellor Angela Merkel on Saturday ruled out fresh debt relief, telling the Hamburger Abendblatt daily: “There has already been voluntary debt forgiveness by private creditors, banks have already slashed billions from Greece’s debt.” “I do not envisage fresh debt cancellation,” she said. Portugal and Finland also oppose debt relief. Despite a restructuring in 2012, Greece is still lumbered with debts of more than 315 billion euros, upwards of 175 percent of gross domestic product (GDP) — an EU record. But in its first week in power, the government scrapped the privatization of Greece’s two main ports and the state power company and announced a major increase in the minimum wage. Varoufakis says he no longer wishes to deal with the EU-IMF negotiating team based in Athens, saying they have no authority to renegotiate the bailout conditions. “I don’t want to waste their time,” he told the To Vima weekly. A renowned left-wing blogger, Varoufakis argues that the bailout merely throws good money after bad-piling more debt on Greece to pay off old borrowing, rather than fixing the economy. “We are calling (the bailout) into question not just because it is ATHENS: Tourists take a look of central Athens with the Acropolis hill (top) engulfed in African dust carried by strong southerly winds as they stand on Lycabettus hill yesterday. A day after Greece appeared on a collision course with its creditors, new radical left Prime Minister Alexis Tsipras has tamped down the rhetoric by vowing to pay off debts and not act unilaterally. — AP not good for Greece, but we consider that it is very bad for all of Europe,” he said. Greece has been promised another 7.2 billion euros in funds from the EU, IMF and European Central Bank (ECB), but this is dependent on a review of reforms at the end of February. Varoufakis has said his government does not want the loans, but there are concerns that Greece cannot survive without them, not least since its banks are being propped up by the ECB. The stunning success of Tsipras’ hard-left Syriza party in last Sunday’s polls sent shockwaves through the continent and has encouraged other anti-austerity parties. At least 100,000 people took to the streets of Madrid on Saturday in support of the Spanish party Podemos, which has surged in polls ahead of elections late this year. — AFP UAE’s Massar Solutions postpones flotation DUBAI: Abu Dhabi-based fleet manager Massar Solutions has postponed its initial share sale after the planned flotation failed to secure enough investor backing during the subscription period, a report by United Arab Emirates’ daily The National said yesterday. Significantly less than half of the shares in the 576 million dirham ($156.8 million) initial public offering (IPO) were taken up by local retail and institutional investors for whom they were reserved, the paper reported, citing an advisory source familiar with the matter. Massar’s listing is now being reviewed by the advisors and the markets regulator, the Securities and Commodities Authority (SCA), the report added. The company was selling a 40 percent stake provided by existing shareholders Invest AD, a local financial firm, and Abu Dhabi National Energy Co (TAQA) between Jan. 11 and 25. A spokesman for Massar declined to comment when contacted by Reuters. Should the postponement be confirmed, it will be a blow to the Abu Dhabi bourse and other companies in the UAE which were hoping to go public in the nearterm. Massar would have been the first listing in Abu Dhabi since 2011, as investor sentiment suffered in the wake of the financial crisis but was improving after rebounds in UAE markets since 2013. —Reuters

© Copyright 2026