Feb 02, 2015 - Moneycontrol

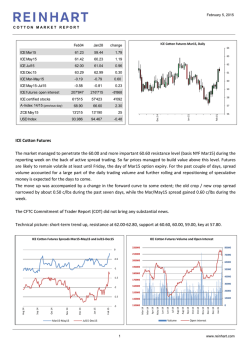

Commodities & Currencies Weekly Tracker Commodities Weekly Tracker Monday | February 2, 2015 Contents Returns • Non Agri Commodities • Currencies • Agri Commodities Non-Agri Commodities • Gold • Silver • Copper • Crude Oil Currencies – DX, Euro, INR Agri Commodities • Chana • Turmeric • Jeera • Soybean • Refine Soy Oil & CPO • Cotton Commodities Weekly Tracker Monday | February 2, 2015 Global Equities Performance (%) 1.0 0.9 0.7 0.4 0.0 (0.3) (1.0) (0.3) (0.8) (1.2) (1.4) (2.0) (3.0) (2.8) (2.9) Commodities Weekly Tracker Monday | February 2, 2015 Currencies Weekly Performance (%) 2.0 1.7 1.5 1.0 1.5 1.2 0.9 0.7 0.5 0.5 0.0 (0.1) (0.5) (1.0) (0.3) Commodities Weekly Tracker Monday | February 2, 2015 Non-Agri Commodities Weekly Performance (%) 6.5 6.0 2.0 (2.0) (6.0) (10.0) 5.8 1.5 1.3 1.2 (0.5) (0.9) (5.6) (9.9) Commodities Weekly Tracker Monday | February 2, 2015 Agri-Commodity Weekly Performance (%) 8 6.6 6 4 2 2.6 2.1 1.4 1.2 0.6 0 (2) (0.9) (4) (6) (8) Source: Reuters, Angel Commodity Research (1.5) (1.7) (2.3) (2.8) (3.6) (4.4) (6.0) (6.8) Commodities Weekly Tracker Monday | February 2, 2015 Gold Weekly Price Performance • Spot gold prices traded volatile last week with prices touching an high of $1298.76 and low of $1251.86 ranging almost around $50 band • The Federal Reserve in its meeting last week said it will remain "patient" with regard to any interest rate increase decisions. • After its first policy-setting meeting of the year, the Federal Open Market Committee (FOMC) said the U.S. economy is on track despite turmoil in other markets around the world. • The statement no longer contains the closely watched "considerable time" phrase in connection to interest rates. • The Fed said the U.S. economy was expanding "at a solid pace" but reiterated it would be patient in deciding when to increase benchmark borrowing costs. • The prospect of higher U.S. rates could encourage investors to pull back from the metal, a non-interest-bearing asset. • In the international markets, spot gold prices declined by 0.88 percent last week and closed at $1282.8/oz • On the MCX, gold prices rose marginally by 0.11 percent last week and closed at Rs.27895/10 gms. SPDR Gold Holdings • Last week, holdings in the SPDR Gold Trust rose by 14.93 tonnes to 758.37 tonnes. • Spot Gold Vs Dollar Index 90.0 1,650 85.0 1,550 1,450 80.0 1,350 75.0 1,250 1,150 70.0 Spot Gold -$/oz US Dollar Index MCX and Comex Gold Price Performance 35,000 1,900 34,000 1,800 33,000 1,700 32,000 31,000 1,600 30,000 1,500 29,000 1,400 28,000 1,300 27,000 26,000 1,200 25,000 1,100 On a year-to-date basis, holdings have declined by 39.85 tonnes, or around 5 percent. MCX- Near Month Gold Futures - Rs/10 gms Comex Gold Futures - $/oz Commodities Weekly Tracker Monday | February 2, 2015 Gold CFTC holdings: • The Commodity Futures Trading Commission (CFTC) Commitments of Traders report in the week to January 27th showed that investors have raised their net longs positions in gold by 21961 contracts to 167693 contracts, up by 15.1 percent week on week. India overtook China as the world’s biggest gold consumer in 2014 • India overtook China as the world's biggest gold consumer in 2014 as global physical demand fell, an industry report showed last week, forecasting that prices that have declined for the last two years would bottom out this year. • Chinese gold demand slid by more than a third last year to a four-year low of 866 tonnes, while the country's scrap gold supply rose 21 percent to an unprecedented 182 tonnes, the report by GFMS analysts at Thomson Reuters showed. Outlook • Investment demand seems to have gained grounds in the recent weeks with an addition of gold holdings in the SPDR gold trust. • Uncertainty in Greece with regards to its new government and the austerity policies required for Greece to be a part of the Euro-zone will bring in the avenues of safe haven demand and support prices. • The FOMC meeting last week said that the economic optimism in the US is growing, although it maintains a patient stance on rise in the interest rates is a key development that markets will have to closely watch for. • Money managers have raised their long side bets on the commodity in the recent week acting as a positive factor for prices. • Spot gold prices in the international markets can trade in the range of $1270-1300/oz. • In the Indian markets, we expect gold prices to trade in the range of Rs.27500-28300 mark/10gms. Weekly Technical Levels – Trend sideways • Spot Gold : Support $1270/$1248 Resistance $1307/$1320. (CMP: $1279.20) • MCX Gold :Support Rs.27500/27000 Resistance Rs.28300/28600 (CMP: Rs.27915) Commodities Weekly Tracker Monday | February 2, 2015 Silver Weekly Price Performance • Last week, spot silver prices in the international markets trade lower for most of trading sessions • Profit booking at higher levels, decline in gold prices and declining speculative activity exerted downside pressure • Weakness in the Indian rupee cushioned downfall in the Indian markets • Spot silver prices in the international markets declined by 5.64 percent and closed at $17.22/oz. • On the MCX, silver prices declined by 4.65 percent and closed at Rs.38105/kg. 45.0 Spot Silver Vs US Dollar Index 40.0 90.0 35.0 85.0 30.0 80.0 25.0 75.0 20.0 15.0 CFTC Holdings • The Commodity Futures Trading Commission (CFTC) Commitments of Traders report in the week to January 27th reported that net longs rose by 6540 contracts to 40164 contracts, up by 19.45% week on week. Outlook • Negative momentum in gold prices will exert downside pressure on silver. • On the contrary, money managers have been raising net long positions for five continuous weeks in a row which will act as a positive factor for prices. • Weakness in copper prices will be a drag to silver prices. • International silver prices might head lower towards $16.8/oz. • In the Indian markets, silver prices is expected to trade lower taking cues from weak international markets and possibly correct lower towards Rs.36500 mark. Weekly Technical Levels –Trend Sideways to Down • Spot Silver: Support $16.80/$16.40 Resistance $17.6/$18.00 (CMP: $17.10) • Sell MCX Silver March between 38800 – 38900, SL- 39800, Target – 37200 / 36800(CMP: Rs.37881) 95.0 70.0 Spot Silver -$/oz US Dollar Index MCX and Comex Silver Price Performance 58,500 34 32 30 53,500 28 26 48,500 24 22 43,500 20 18 38,500 16 33,500 14 MCX- Near Month Silver Futures - Rs/ kg Comex Silver Futures - $/oz Commodities Weekly Tracker Monday | February 2, 2015 Copper Weekly Price Performance • LME Copper prices declined by 0.5 percent last week and hovered near five-and-a-halfyear lows on concerns over slowing growth and weak demand in top consumer China as well as rising metal inventories. Data showed China's factory profits grew at their weakest rate in two years in 2014 as economic growth slipped to a 24-year low, underscoring the challenges the country faces. • Further, News that top metals consumer China plans to cut its economic growth target to the lowest in 11 years at around 7 percent in 2015 also hurt sentiment. Also, the Federal Reserve signaled it would keep short-term interest rates near zero at least until midyear, while providing a relatively upbeat assessment of current US growth and labour market conditions. • MCX copper prices rose by 0.4 percent last week and closed at Rs.342.9/kg owing to Rupee depreciation. LME and MCX Copper Price Performance 525 8,300 505 485 7,800 465 445 7,300 425 405 6,800 385 6,300 365 LME Copper Future ($/tonne) MCX Near Month Copper Contract (Rs/kg) LME Copper v/s LME Inventory CFTC Holdings • The CFTC Commitments of Traders report in the week to January 27 have raised their net short position by 4971 contracts to 12976 contracts. Outlook • We expect LME Copper prices to trade sideways after factory growth in China shrank for the first time in more than two years, thereby strengthening calls for more aggressive monetary and fiscal stimulus to boost the economy. • However, estimates of weak employment data from the US will restrict sharp upside. • In the Indian markets, Copper prices will trade on a sideways note in line with trend in the international markets. Technically we recommend – Trend Sideways • LME Copper: Support $5420/$5380 Resistance $5590/$5740. (CMP: $5516) • Buy MCX Copper Feb between 336 – 337, SL – 331, Target – 347 / 350(CMP: Rs.343.85) 700,000 8,300 600,000 7,800 500,000 400,000 7,300 300,000 6,800 200,000 100,000 6,300 Copper LME Inventory (tonnes) LME Copper Future ($/tonne) Commodities Weekly Tracker Monday | February 2, 2015 Crude Oil Weekly Price Performance • Oil markets traded higher last week, after preliminary U.S. data showed weekly jobless claims at a near 15-year low, indicating further strength in the world's largest economy • • • • • In the mid week, prices declined after the government reported record-high inventories in the United States that raised anxieties about the global oil glut that had pressured the market since last summer. Oil prices roared back from six-year lows last Friday, rocketing more than 8 percent as a record weekly decline in U.S. oil drilling fueled a frenzy of short-covering. In a rally that may spur speculation that a seven-month price collapse has ended, global benchmark Brent crude shot up to more than $53 per barrel, its highest in more than three weeks in its biggest one-day gain since 2009. WTI oil prices in the international markets rose by 5.81 percent and closed at $48.24/bbl. Nymex and MCX Crude Oil Price Performance 7,700 120.0 6,700 100.0 5,700 4,700 80.0 3,700 60.0 2,700 1,700 40.0 MCX crude oil (Rs/bbl) NYMEX Crude Oil ($/bbl) On the MCX, crude prices rose by 0.63 percent and closed at Rs.2855/bbl. Crude Oil Inventories (mn barrels) 400 Oil Inventories 395 • 390 • The American Petroleum Institute (API), an industry group, said after the market's close that U.S. oil stockpiles surged by nearly 13 million barrels last week. That would add to the previous week's build of over 10 million barrels, the biggest in 14 years, which had already brought inventories to the highest level on record for this time of year The U.S. Energy Information Administration (EIA) said domestic crude oil stocks rose by almost 9 million barrels last week to reach nearly 407 million, their highest since the government began keeping records in 1982. The EIA report citing positives like a near 3 million barrel drop in gasoline stocks and almost 4 million barrel decline in diesel and heating oil inventories. 397.5 397.6 384 385 391.3 388.6 385.4 383.2 377.5 380 375.9 375.21 370.54 375 369.1 370 363.76 365 360 355 350 395.7 392 394.1 361.3 370 363.8 364.2 355.6 351.2 374 368.3 366.3 358.4 Commodities Weekly Tracker Monday | February 2, 2015 CFTC Holdings • The Commodity Futures Trading Commission (CFTC) Commitments of Traders report in the week to January 27th reported that net longs in crude oil have increased by 3042 contracts to 228968 contracts, up by 1.35% week on week. US driller reduce their spending on exploration • • ConocoPhillips and Occidental Petroleum Corp slashed exploration spending plans for this year, as the third- and fourth-largest U.S. oil companies attempt to cope with a steep slide in crude prices. The cuts follow similar steps by rival Hess Corp ,while Royal Dutch Shell , Europe's largest oil company, said last week that it would reduce its spending the next three years by $15 billion. Outlook • Money managers have increased their net long positions last week, although major fundamentals remain bearish for the commodity. • US drillers reducing their spending on exploration of crude indicates that crude output might slowdown in the coming months. • Also, refineries in the US remain shut on account of union strikes in turn positive for WTI crude prices. • The monetary easing by the ECB might be a push factor for incremental demand for crude in the coming months. • Since, oil prices are reduced by half, markets are trying to bargain hunt this commodity. • Since cost of oil production in the US stands at $65, the operations would be unsustainable at current levels ($45), hence prices will have to rise in the near term. • In the international markets, crude prices are expected to trade higher towards $49 mark. • On the MCX, crude prices are expected to trade higher and possibly headed towards Rs.2950mark. Weekly Technical Levels – Sideways to Up • Nymex Crude: Support $46.40/44.50 Resistance $49.00/50.30 (CMP: $47.20) • MCX Crude: Buy MCX Crude oil Feb between 2780 – 2790, SL – 2700, Target – 2930 / 2950 (CMP: Rs.2935) Commodities Weekly Tracker Monday | February 2, 2015 Rupee Weekly Price Performance • The Indian Rupee depreciated by 0.9 percent last week owing to month-end dollar demand by importers. Also, dollar inflows from foreign institutional investors (FIIs) were being absorbed by state-owned banks. In addition, investors booked profits ahead of the expiry of January derivative contracts. • However, sharp losses were cushioned owing to fresh dollar selling by exporters tracking heavy foreign capital inflows amid strong equity market. The currency touched an weekly low of 62.02 and closed at 62.01 on Friday. Foreign Inflows • For the month of January 2015, FII inflows in equities totaled at Rs.1825.90 crores ($296.89 million) as on 30th January 2015. • Year to date basis, net capital inflows stood at Rs.1825.90 crores ($296.89 million) as on 30th January 2015. India’s HSBC manufacturing PMI declines; new orders growth still on track • India’s manufacturing PMI fell to 52.9 in January from December's 54.5 levels. • Despite falling in January, latest data signaled sustained growth of India's manufacturing economy at the start of 2015, with output and new orders rising simultaneously for the fifteenth consecutive month. Outlook • We expect Indian Rupee to trade on a sideways note during the week as domestic markets will shift their focus on RBI monetary policy statement scheduled on Feb 3. • Also, robust foreign capital inflows into equity market will support the currency. Weekly Technical Levels • USDINR: Support 61.80/61.50 Resistance 62.50/63.00. (CMP: 61.86) • Buy MCXSX/NSE USDINR Feb between 61.80 – 61.90, SL – 61.50, Target – 62.50/62.60. $/INR - Spot 69.0 67.0 65.0 63.0 61.0 59.0 57.0 55.0 53.0 Economic Data to be released during the week HSBC Markit Services PMI – 3rd Feb’15 Time : 10:30pm Prior: 51.1 Commodities Weekly Tracker Monday | February 2, 2015 Dollar Index Weekly Price Performance • The US Dollar Index (DX) traded lower by 0.1 percent last week as weak business spending and a wider trade deficit pushed GDP lower in the last quarter of 2014. • Also, speculation the victorious Syriza party in Greek elections will pursue its antiausterity agenda without forcing an exit from the currency bloc coupled with mixed economic data from the nation acted as negative factors. • However, sharp losses were cushioned against the other major currencies on Thursday, after the Federal Reserve signaled that interest rates could start to rise around mid-year. The currency touched a weekly low of 93.96 and closed at 95.00 on Friday. US economic data • US Advance GDP fell to 2.6 percent in the quarter ended December from 5 percent in the prior quarter. Chicago PMI rose to 59.4-mark in Jan’15 from 58.3 levels in Dec’14. • U.S. consumer confidence improved to an eight-year high of 102.9 this month from a reading of 93.1 in December. New home sales climbed to 481,000 units in Dec’14 from 438,000 units in Nov’14. Core durable goods orders declined by 0.8% in December. • US Unemployment Claims fell to 265,000 in the last week from 308,000 in the prior week. Pending Home Sales plunged by 3.7 percent in December as against a gain of 0.6 percent in November. Outlook • We expect the dollar index to trade on a sideways note as risk in risk aversion in the markets owing to Grexit concerns will be supportive. • While on the other hand, estimates of weak manufacturing and employment data from the US will drag the currency lower. Weekly Technical Levels • Dollar Index (DX) : Support 93.80/92.80 Resistance 95.60/96.50. (CMP: 94.75) US Dollar Index 93.0 91.0 89.0 87.0 85.0 83.0 81.0 79.0 Economic data to be released during the week: ISM Manufacturing PMI – 2nd Feb’15 Time: 8:30 pm Previous : 55.5, Forecast : 54.9 ADP Non-Farm Employment Change– 4th Feb’15 Time: 6:45pm Previous : 241K, Forecast : 221K Non-Farm Employment Change – 6th Feb’15 Time: 7:00pm Previous : 252K, Forecast : 231K Commodities Weekly Tracker Monday | February 2, 2015 Euro Weekly Price Performance • The Euro gained 0.7 percent last week as investors are hopeful that the leftwing Syriza party leader, Alexis Tsipras, is willing to negotiate, easing concern that a confrontation with its international creditors could lead Greece to leave the Euro. • Also, Germany's Federal Statistics Office said the number of unemployed people declined for the fourth consecutive month in January and unemployment rate hit a record-low 6.5% in January, down from 6.6% in December, in line with expectations. • However, strength in the DX after the Federal Reserve’s policy-making committee signaled it would keep interest rates near zero at least until June exerted pressure. The Euro touched a weekly high of 1.1422 and closed at 1.1286 on Friday. Economic data from the Euro Zone • Euro zone’s CPI Flash Estimate fell by 0.6 percent in January as against a decline of 0.2 percent in December. • French Consumer Spending jumped by 1.5 percent in December as compared to a rise of 0.2 percent in November. • German Retail Sales rose by 0.2 percent in December as against a rise of 0.9 percent in November. Outlook • The Euro will trade on a negative note over the week as uncertainty regarding Greece exit coupled with estimates of mixed economic data from the region will exert pressure on the currency. Weekly Technical Levels • EURO/USD SPOT: Support 1.1120/1.0950 Resistance 1.1450/1.1600. (CMP: 1.13) Euro/$ - Spot 1.4 1.36 1.32 1.28 1.24 1.2 Economic Data to be released during the week: Spanish Unemployment Change – 2nd Feb’15 Time: 1:30pm Previous: -64.4K, forecast: -32.4K Retail Sales m/m– 4th Feb’15 Time: 3:30pm Previous: 0.6 percent, forecast: -0.1 percent German Factory Orders m/m – 5th Feb’15 Time: 12:30pm Previous: -2.4 percent, forecast: 1.4 percent Commodities Weekly Tracker Monday | February 2, 2015 Chana Weekly Price Performance • During last week, Chana Feb. futures traded on negative note, down 4.42 per cent due to sluggish demand on expectation of new crop arrivals in less than a month’s time. The prices have made a high of 3481 levels and low of 3262 levels and close on 3286. Overall sentiments are mixed for Chana due good demand, lower sowing and expected lower output in 2014-15. Fundamentals • According to latest estimates as on Jan 22, 2014, coverage under Rabi pulses has reached 133.55 lakh hectares (lh), 11% lower as compared to previous year. Chana has been sown over 81.97 lh, 17% lower against 98.68 lh sown during the same period previous year. • Alarmed by the adverse impact of slow progress in sowing of chana during the current rabi season, the government has decided not to impose a proposed 10% import duty on 'chana' (gram) till March 2015. • The CCEA has set Chana MSP for 2014-15 season at Rs. 3175/qtl. from Rs. 3100 last year. • Canada chickpeas/chana production for 2014 is estimated at 123 thousand tonnes which is 27.39% lower than previous year while 7.66% lower than previous estimates released in September 2014. Outlook • Chana futures are expected to trade on a mixed note due to restricted supply, cheap imports and lower acreage during the current rabi season. The market may have corrections during the next week due to profit bookings. Weekly Strategy • Sell NCDEX Chana Feb between 3300 – 3320, SL – 3400, Target- 3220 / 3210 (cmp – 3270) NCDEX Chana Feb. Commodities Weekly Tracker Monday | February 2, 2015 Turmeric Weekly Price Performance • Turmeric Apr. futures traded on a negative note down by 9.25%. Market witnessed four successive days drop last week due to subdued demand from retailers and traders at high prices. The new crop has now hit the markets in Maharashtra, Andhra Pradesh and Karnataka. During the week the prices have made high of Rs 9240 per quintal and low of Rs 8164 per quintal. Fundamentals • As per the market sources, the total production of turmeric in the current year is expected to be around 35-37 lakh bags against 52 lakh bags of the last year. The new crop has now hitting the markets in Maharashtra, Andhra Pradesh and Karnataka • Exports between Apr-Sep 2014 stood at 43,000 tn, up 9% compared to 39,200 tn. in Apr-Sep2013. (Source: Spices Board). • Sowing of Turmeric in AP for the 2014-15 season is reported at 0.13 lakh ha, as against 0.1 lakh. The area in Telangana stood at 0.446 lakh ha against 0.431 lakh ha last year. • In the last week (17th - 23rd Jan, 2015), more than 2000 tonnes arrivals were recorded across the country. Highest arrivals are recorded in Karnataka (622 tonnes) followed Maharashtra (503 tonnes) and West Bengal (472 tonnes). (Source: Agmarknet) Outlook • Turmeric futures may trade on a mixed note. Good arrivals and subdued demand from retailers and traders at high prices may drag the prices. Weekly Strategy • Sell NCDEX Turmeric Apr between 8100 – 8150, SL – 8300, Target – 7700 / 7650 (CMP – 7960) NCDEX Turmeric Apr. Commodities Weekly Tracker Tuesday | January 27, 2015 Jeera Weekly Price Performance • Last week Jeera Feb. futures were volatile and closed on a negative note down by 3.8% as market participants has off loaded their positions for profit booking. The weekly prices moved up to the high of Rs 17290 per Qtl and touch low of Rs 15325 per qtl. Fundamentals • According to Gujarat government data releases on 19th Jan 15, Jeera recorded 2.67 lakh hac which is 41.3% less sowing compared to last year’s 4.55 lakh hac. Sowing of the spice has almost over both in Gujarat and Rajasthan reported lower acreage. • Last year production of jeera in India was 55 lakh bags (around 3 lakh tons). Around 35 lakh bags stocks from this year crop has come to the market so far. • Exports of Jeera between Apr-Sep 2014 stood at 87500 tn, up 24% as against 70,243 tn against same time last year. (Source: Spices Board). • Geo-political tensions in Syria, one of the largest exporters of the spice has led to good demand for Indian Jeera from the overseas markets. Outlook • Jeera futures are expected to trade on a positive note but profit book on higher levels are also expected. Lower acreage, high export demand and steady domestic demand may pushed up prices. Weekly Strategy • Sell NCDEX Jeera Feb between 15200 –15250, SL – 15500, Target –14600/14500. (CMP – 14900) NCDEX Jeera Feb. Commodities Weekly Tracker Tuesday | January 27, 2015 Soybean & Refine Soy Oil Weekly price performance • Soybean Feb futures last week traded in a very narrow range Rs 3320 - 3490/ quintal and closed on negative by 1.54% due on ample supply of soybean in the spot market and lower demand for soy oil and soy meal in the international market. Ref soy oil also closed down by 8.77% last week. NCDEX Soybean Feb. Fundamentals • In 2014/15, Soybean sowing in country reported a decline of 12 lakh hac to 112 lakh and production estimated to decline by 3.5% to 9.17 mt compared to 9.5 mt last year. • As per Solvent Extractors’ Association data, total import of vegetable oils jumped 26% in Nov 2014. which stood at 1.2 mt compared to 944,309 tonnes last year. • December 2014 soymeal exports decline by almost 59% to 1.94 mt as compare to 4.7 mt exported during same month last year. Global Update • Global Soybean production is projected at a record 312.8 mt in Dec 2014/15 up 9.6% compared to 2013/14 estimates. China is projected to import more than 2.7 billion bushels (2700 million or 73.48 Million tonnes) in 2014/15. • Global oilseed ending stocks are projected at 104.1 million tons, up 1.1 million from last month and 23.5 million above year-earlier levels. Outlook • Soybean and Ref soy oil futures may trade on a mixed note. Expectation of higher global oil seed production and lower world demand may pressurize the prices. Weekly Strategy • Sell NCDEX Soybean Feb between 3350 – 3380, SL – 3480, Target – 3200 / 3150 (CMP – 3315) • Sell NCDEX Ref Soya Oil Feb between 620 – 625, SL – 640, Target – 595/ 590 (CMP – 613) NCDEX Ref Soy Oil Feb. Commodities Weekly Tracker Tuesday | January 27, 2015 Cotton Weekly Price Performance • As Expected in the last week prices were closed on a negative note on increasing arrivals of cotton in physical market and lower export demand. NCDEX Kapas and MCX Cotton Futures settled 5.6% lower and 6.1% lower respectively w-o-w. Fundamentals • Cotton Advisory Board (CAB) has estimated production at 400 lakh bales, while, Cotton Association of India (CAI) and Indian Cotton Federation has projected over 400 lakh bales for 2014-15 marketing season. • Domestic consumption is estimated at 306 lakh bales during the current fiscal. • State-run Cotton Corporation of India (CCI) has procured 50 lakh bales of cotton so far this year at the MSP from key growing states. Global Cotton Updates • World production is estimated to 26.1 million tons, down 1%, due to reductions in China and the Southern Hemisphere. • A world production surplus of 1.7 million tons is still anticipated, despite expected growth in cotton consumption. World ending stocks in 2014/15 estimated to 21.3 million tons, up 9% from 2013/14. • According to Chinese Government survey, the cotton production is down 2.2% and fell by 6.16 mt as cotton area shrank nearly 3%. Outlook • Cotton futures may trade on a mixed note to negative. Lower levels buying interest may supports the prices, however international weak trend may pressurize the prices. Weekly Levels • MCX Cotton Jan Trend Down, S1- 13800 , S2- 13400, R1– 14300, R2- 14700. (cmp – 14070) • NCDEX Kapas April Trend Down. S1- 710, S2 – 695, R1 – 750, R2 – 765 (cmp – 723) NCDEX Kapas Apr’15. MCX Cotton Jan. Commodities Weekly Tracker Monday | February 2, 2015 Chana Weekly Price Performance • During last week, Chana Feb. futures traded on positive note and closed 6.6 per cent higher due to good support at lower levels by the market participants. The prices have made a high of 3503 levels and low of 3286 levels and close on 3503. Overall sentiments are mixed for Chana due good demand, lower sowing and expected lower output in 2014-15. Fundamentals • According to latest estimates as on Jan 30, 2014, coverage under Rabi pulses has reached 138.68 lakh hectares (lh), 10% lower as compared to previous year. Chana has been sown over 83.93 lh, 15.5% lower against 99.27 lh sown during the same period previous year. • The area reported by the respective state agriculture department, under chana decline by 17%, 28% and 32% respectively in Maharashtra, Andhra Pradesh and Gujarat till last week of Jan 2015. • According to Dept of Commerce, 154.72 thousand tonnes of Chick pea is imported in India during April-October 2014. • The imports of pulses were reported around 191322.263 tonne for the reported period (Jan.19-25,2015) mainly from Australia, Canada, USA, Myanmar, Russia, Uzbekistan, Afghanistan, China and Ethiopia.(Source-IBIS) Outlook • Chana futures are expected to trade on a mixed note due to restricted supply, cheap imports and lower acreage during the current rabi season. The market may have corrections during the next week due to profit bookings. Weekly Strategy • NCDEX Chana Feb, Support – 3450 / 3300, Resistance – 3650 / 3750 (cmp – 3500) NCDEX Chana Feb. Commodities Weekly Tracker Monday | February 2, 2015 Turmeric Weekly Price Performance • Turmeric Apr. futures traded on a negative note down by 1.50%. Market witnessed a steep drop last week to Rs 7716 per quintal due to new crop arrivals, subdued to demand from retailers and traders at high prices. The new crop has now hit the markets in Maharashtra, Andhra Pradesh and Karnataka. During the week the prices have made high of Rs 8470 per quintal. Fundamentals • As per the market sources, the total production of turmeric in the current year is expected to be around 35-37 lakh bags against 52 lakh bags of the last year. The new crop has now hitting the markets in Maharashtra, Andhra Pradesh and Karnataka • For the new season crop, turmeric traders have received enquiries from upcountry for quality turmeric. • Turmeric crop reported damaged in Nizamabad and Erode, the major growing regions. (Source: Agriwatch) • In the last week (23rd - 30th Jan, 2015), more than 1700 tonnes arrivals were recorded across the country. Highest arrivals are recorded in Karnataka (614 tonnes) followed West Bengal (388 tonnes) and Tamil Nadu (250 tonnes). (Source: Agmarknet) Outlook • Turmeric futures may trade on a mixed note. Good arrivals and subdued demand from retailers and traders at high prices may drag the prices. Weekly Strategy • Sell NCDEX Turmeric Apr between 8100 – 8150, SL – 8300, Target – 7700 / 7650 (CMP – 8020) NCDEX Turmeric Apr. Commodities Weekly Tracker Monday | February 2, 2015 Jeera Weekly Price Performance • Last week Jeera Feb. futures were volatile and closed on a negative note down by 6.0% as market participants has off loaded their positions on expectation of the new crop to hit the market next. The weekly prices opened at Rs 15900 per quintal moved up to the high of Rs 16090 per Qtl and touch low of Rs 14365 per qtl. Fundamentals • According to Gujarat government data releases on 19th Jan 15, Jeera recorded 2.67 lakh hac which is 41.3% less sowing compared to last year’s 4.55 lakh hac. Sowing of the spice has almost over both in Gujarat and Rajasthan reported lower acreage. • Last year production of jeera in India was 55 lakh bags (around 3 lakh tons). Around 35 lakh bags stocks from this year crop has come to the market so far. • Exports of Jeera between Apr-Sep 2014 stood at 87500 tn, up 24% as against 70,243 tn against same time last year. (Source: Spices Board). • Geo-political tensions in Syria, one of the largest exporters of the spice has led to good demand for Indian Jeera from the overseas markets. Outlook • Jeera futures are expected to trade on a mixed note as demand may be weak on expectation of prices to fall more. Export enquiries at lower level and higher supply during the next month may pressured jeera price. Lower acreage, high export demand and steady domestic demand may pushed up prices. Weekly Strategy • Buy NCDEX Jeera Feb between 14400 – 14450, SL – 14100, Target –15000/15200. (CMP – 14650) NCDEX Jeera Feb. Commodities Weekly Tracker Monday | February 2, 2015 Soybean & Refine Soy Oil Weekly price performance • Soybean Feb futures last week traded on positive note and closed 2.2% higher on good demand from the stockists and oil millers on lower prices and fall in supplies in the spot market. Ref soy oil also closed higher by 0.6% last week. NCDEX Soybean Feb. Fundamentals • As per Solvent Extractors’ Association data, total import of vegetable oils jumped 26% in Nov 2014. which stood at 1.2 mt compared to 944,309 tonnes last year. • December 2014 soymeal exports decline by almost 59% to 1.94 mt as compare to 4.7 mt exported during same month last year. • In 2014/15, Soybean sowing in country reported a decline of 12 lakh hac to 112 lakh and production estimated to decline by 3.5% to 9.17 mt compared to 9.5 mt last year. Global Update • Global Soybean production is projected at a record 312.8 mt in Dec 2014/15 up 9.6% compared to 2013/14 estimates. China is projected to import more than 2.7 billion bushels (2700 million or 73.48 Million tonnes) in 2014/15. • Global oilseed ending stocks are projected at 104.1 million tons, up 1.1 million from last month and 23.5 million above year-earlier levels. Outlook • Soybean and Ref soy oil futures may trade on a mixed note. Expectation of higher global oil seed production and lower world demand may pressurize the prices but good domestic demand may keep prices at higher levels. Weekly Strategy • Buy NCDEX Soybean Feb between 3350 – 3380, SL – 3280, Target – 3500 / 3550 (CMP – 3415) • Buy NCDEX Ref Soya Oil Feb between 615 – 620, SL – 600, Target – 650/ 655 (CMP – 625) NCDEX Ref Soy Oil Feb. Commodities Weekly Tracker Monday | February 2, 2015 Cotton Weekly Price Performance • In the last week, prices were closed on a positive note as there is good demand for quality cotton at lower prices. NCDEX Kapas and MCX Cotton Futures settled 2.6% higher and 1.4% higher respectively w-o-w. India's Cotton exports in December2014 has grew to US$ 816.81 M, a increase of 19.15% compared to November 2014 according to infodriveindia. Fundamentals • Cotton Advisory Board (CAB) has estimated production at 400 lakh bales, while, Cotton Association of India (CAI) and Indian Cotton Federation has projected over 400 lakh bales for 2014-15 marketing season. Domestic consumption is estimated at 306 lakh bales during the current fiscal. State-run Cotton Corporation of India (CCI) has procured 50 lakh bales of cotton so far this year at the MSP from key growing states. Global Cotton Updates • World production is estimated to 26.1 million tons, down 1%, due to reductions in China and the Southern Hemisphere. A world production surplus of 1.7 million tons is still anticipated, despite expected growth in cotton consumption. World ending stocks in 2014/15 estimated to 21.3 million tons, up 9% from 2013/14. According to Chinese Government survey, the cotton production is down 2.2% and fell by 6.16 mt as cotton area shrank nearly 3%. Outlook • Cotton futures may trade on a mixed note. Lower levels buying interest may supports the prices, however international weak trend may pressurize the prices. Weekly Levels • MCX Cotton Feb Trend Down, S1- 14200 , S2- 13700, R1– 15000, R2- 15400. (cmp – 14640) • NCDEX Kapas April Trend Sideways, S1- 710, S2 – 695, R1 – 750, R2 – 765 (cmp – 734) NCDEX Kapas Apr’15. MCX Cotton Feb. Commodities Weekly Tracker Monday | January 27, 2015 Thank You! Angel Commodities Broking Pvt. Ltd. Registered Office: G-1, Ackruti Trade Centre, Rd. No. 7, MIDC, Andheri (E), Mumbai - 400 093. Tel: (022) 3083 7700 Corporate Office: 6th Floor, Ackruti Star, Central Road, MIDC, Andheri (E), Mumbai - 400 093. Tel: (022) 2921 2000 MCX Member ID: 12685 / FMC Regn No: MCX / TCM / CORP / 0037 NCDEX : Member ID 00220 / FMC Regn No: NCDEX / TCM / CORP / 0302 Disclaimer: The information and opinions contained in the document have been compiled from sources believed to be reliable. The company does not warrant its accuracy, completeness and correctness. The document is not, and should not be construed as an offer to sell or solicitation to buy any commodities. This document may not be reproduced, distributed or published, in whole or in part, by any recipient hereof for any purpose without prior permission from “Angel Commodities Broking (P) Ltd”. Your feedback is appreciated on [email protected]

© Copyright 2026