Jan 28, 2015 - Moneycontrol

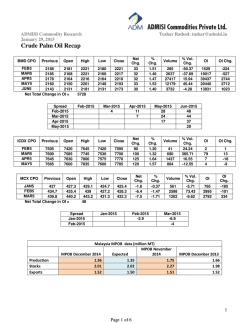

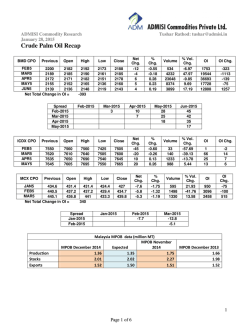

ADMISI Commodity Research January 28, 2015 Contents Tushar Rathod: [email protected] (Click on the topics) 1. Recap 2. Physical Market Rates 3. Arrivals 4. Weather 5. Charts and Outlook 6. Disclaimer 1 ADMISI Commodity Research January 28, 2015 Tushar Rathod: [email protected] Recap Indian markets NCDEX Previous Close Soybean FEB5 3334 3356 APR5 3358 3383 JUN5 3374 3406 AUG5 3388 3400 Net Total Change in OI = Open High Low 3350 3355 3367 3371 -3650 3388 3398 3414 3440 3292 3314 3337 3310 Spread Feb-2015 Apr-2015 Jun-2015 NCDEX Previous Close Soy Oil FEB5 616.2 623.15 APR5 591.1 593.05 JUN5 572.25 566.05 AUG5 572.85 563.4 Net Total Change in OI = High Low 611.2 585.45 568 568 3665 626 596 569 568 609 583.2 562.5 562.8 • • Feb-2015 High Low 3340 3383 3416 3466 -2090 3397 3434 3468 3510 3325 3364 3405 3453 Apr-2015 % Chg. Volume 0.66 0.74 0.95 0.35 51460 31100 10310 450 Jun-2015 -50 -23 Net Chg. 6.95 1.95 -6.2 -9.45 Apr-2015 30.10 Open Spread Apr-2015 May-2015 Jun-2015 • • Apr-2015 -27 Open Spread Feb-2015 Apr-2015 Jun-2015 NCDEX RM Previous Close Seed APR5 3377 3388 MAY5 3411 3428 JUN5 3449 3430 JUL5 3504 3471 Net Total Change in OI = Feb-2015 Net Chg. 22 25 32 12 May-2015 -40 Net Chg. 11 17 -19 -33 Volume 1.13 0.33 -1.08 -1.65 65145 21165 16225 3200 66660 41430 18100 1730 OI Chg. -4510 -1560 2560 -140 % Vol. Chg. 29.91 35.33 83.02 -42.91 OI 64130 63455 59075 15340 OI Chg. -5360 3695 4475 855 Aug-2015 59.75 29.65 2.65 % Chg. Volume 0.33 0.50 -0.55 -0.94 33180 7120 1690 670 Jun-2015 -42 -2 OI Aug-2015 -44 -17 6 % Chg. Jun-2015 57.10 27.00 % Vol. Chg. 30.41 28.67 46.45 -4.26 % Vol. Chg. -15.59 19.46 39.67 235.00 OI 31010 5410 2380 420 OI Chg. -2250 -380 430 110 Jul-2015 -83 -43 -41 Indian oilseed complex prices closed firmer yesterday after the recent losses. Rupee ended higher. According to reports, Indian Soy meal exports in 2014-15 could hit its lowest level since 1988-89 at 800,000 MT due to higher global Soy supplies. Traders estimate this year’s Soybean crop between 9 – 10 million MT. USDA estimates Indian Soybean crop at 11.0 million MT. COOIT expects Indian Soy crop at 9.17 million MT. Indian RM Seed output in 2014-15 may be 7.0 million MT vs. 7.4 million MT in the previous year. 2 ADMISI Commodity Research January 28, 2015 • • • • Tushar Rathod: [email protected] Latest sowing data shows, RM Seed was sowed in 6.49 million hectares across India vs. 7.04 million hectares in the corresponding period in the previous year. According to 1st Advance estimates for 2014-15 released by GoI, India’s output for Soybean is estimated at 11.82 million MT. Soy meal exports from India rose to 193,832 MT in December from 110,806 MT in November. India's oil meal exports in December 2014 were 389K MT vs. 188K MT in previous month. Veg. oil imports in December 2014 were at 1.12 million MT vs. 1.05 million MT in Dec 2013. Soybean - Akola Soybean - Indore Soybean - Kota Soybean - Vidisha TOTAL SOYBEAN NCDEX Warehouse Inventory 23-Jan-15 731 3524 140 170 4565 26-Jan-15 731 3300 140 170 4341 10 1757 6172 128 8067 10 1757 6172 128 8067 RM Seed - Alwar RM Seed - Jaipur RM Seed - Kota RM Seed - Sri Ganganagar TOTAL RM Seed Date 27-Jan-15 27-Jan-15 27-Jan-15 27-Jan-15 27-Jan-15 27-Jan-15 27-Jan-15 27-Jan-15 27-Jan-15 27-Jan-15 India Physical Market Rates Commodity Soybean - Indore - NCDEX Soybean - Kota - NCDEX Refined Soy oil - Indore - NCDEX Refined Soy oil - Mumbai - NCDEX Refined Soy oil - Nagpur - NCDEX Soybean meal Export - Kandla - NCDEX Soybean meal - Indore - NCDEX Soy meal Export Kandla FAS - SEA Mustard meal Export Kandla FAS - SEA Mustard oil - Sri Ganganagar - NCDEX Rate 3295.00 3177.95 639.55 620.00 637.00 28450.00 28000.00 455.00 275.00 725.00 Units Rs. / 100 Kg Rs. / 100 Kg Rs. / 10 Kg Rs. / 10 Kg Rs. / 10 Kg Rs. / MT Rs. / MT USD / MT USD / MT Rs. / 10 Kg 3 ADMISI Commodity Research January 28, 2015 International • • • • • Tushar Rathod: [email protected] CBOT Soybean Previous Close Open High Low MAR5 MAY5 JUL5 AUG5 SEP5 983.5 990.25 996 996.25 982.75 973.75 981.25 987 987.25 973.5 982.25 989.75 995 993.75 983.25 985.5 992.5 998.25 997.75 983.75 972.25 979 985.25 985.75 971.25 CBOT Soy Meal Previous Close Open High Low MAR5 MAY5 JUL5 AUG5 SEP5 338.9 331.6 329.8 328.9 327.4 336.6 328.8 326.5 325.3 323.8 338.9 331.6 329.4 328 328.3 342.6 335.1 333.1 330.3 328.8 335 327.2 325.3 324.3 323 Net Chg. -9.75 -9.00 -9.00 -9.00 -9.25 Net Chg. -2.3 -2.8 -3.3 -3.6 -3.6 % Chg. -1.00 -0.92 -0.91 -0.91 -0.95 % Chg. -0.68 -0.85 -1.01 -1.11 -1.11 CBOT Soy Oil Previous Close Open High Low Net Chg. % Chg. MAR5 MAY5 JUL5 AUG5 SEP5 31.08 31.28 31.48 31.52 31.54 31.17 31.37 31.57 31.6 31.6 31.06 31.27 31.5 31.54 31.57 31.29 31.49 31.7 31.71 31.71 30.87 31.07 31.28 31.34 31.34 0.09 0.09 0.09 0.08 0.06 0.29 0.29 0.29 0.25 0.19 CBOT Soy complex prices closed mixed yesterday with bean and meal moving lower on Chinese cancellations. USDA confirmed that private exporters cancelled sales of 120,000 MT of Soybeans to China for delivery in 2014/15. USDA said exporters also reported fresh sales of 111,000 MT of Soybeans to unknown destinations. USDA's announcement marked the third cancellation this month of Soybean sales to top buyer China. The moves reflect a seasonal shift in the focus of the export market from the United States to South America, where the Soy harvest is getting started. According to CFTC CoT report, for the week ending 20 January, non commercial traders decreased their net long positions in CBOT Soybeans. ICE Canola prices closed lower yesterday. 4 ADMISI Commodity Research January 28, 2015 Tushar Rathod: [email protected] Physical Market Rates Date 28-Jan-15 28-Jan-15 27-Jan-15 28-Jan-15 Physical Market Rates - Soybean Commodity Brazil Soybean January - FOB Paranagua Argentina Soybean May - FOB Up River China Imported Soybean Dalian USA Soybean January - FOB Gulf Date 28-Jan-15 28-Jan-15 27-Jan-15 Physical Market Rates - Soy meal Commodity Brazil Soy meal January - FOB Paranagua Argentina Soy meal February - FOB Up River China HQ Soy meal Dalian Date 28-Jan-15 28-Jan-15 27-Jan-15 27-Jan-15 Physical Market Rates - Soy Oil Commodity Brazil Soy Oil February - FOB Paranagua Argentina Soy Oil February - FOB Up River China Standard Soy Oil Dalian India Soy Oil Degummed CIF Mumbai Rate 404.04 373.62 3300.00 393.70 Rate 383.50 423.39 3180.00 Rate 735.70 736.79 5500.00 827.00 Units $ / MT $ / MT CNY / MT $ / MT Units $ / MT $ / MT CNY / MT Units $ / MT $ / MT CNY / MT $ / MT 5 ADMISI Commodity Research January 28, 2015 Tushar Rathod: [email protected] Arrivals 6 ADMISI Commodity Research January 28, 2015 Tushar Rathod: [email protected] IMD 7 ADMISI Commodity Research January 28, 2015 Tushar Rathod: [email protected] Charts & Outlook NCDEX Charts Source: - Reuters NCDEX Soybean April (3383.00) Trade Recommendation: - Sell below 3395, S/L 3435, TGT 3331 - 3285. Source: - Reuters NCDEX Soy Oil April (591.10) Trade Recommendation: - Sell in the range 595 - 597, S/L 600.50, TGT 588 - 581. 8 ADMISI Commodity Research January 28, 2015 Tushar Rathod: [email protected] Source: - Reuters NCDEX RM Seed April (3388.00) Trade Recommendation: - None. NCDEX Outlook: - Rupee is trading weaker. Downside towards 3300/580 levels may be seen in Soybean/Soy oil with resistance at 3400/600 levels. RM Seed prices may move lower towards 3300 levels. CBOT Charts Source: - Reuters CBOT Soybean March (974.75) Trade Recommendation: - None. 9 ADMISI Commodity Research January 28, 2015 Tushar Rathod: [email protected] Source: - Reuters CBOT Soy meal March (337.70) Trade Recommendation: - None. Source: - Reuters CBOT Soy Oil March (30.91) Trade Recommendation: - None. Outlook: - Ideas of new supplies from S. America amid China cancellations are bearish. Soy complex prices may move lower towards 960/315/30.00 levels. Resistance is at 1000/350 levels for Soybean/ Soy meal. 10 ADMISI Commodity Research January 28, 2015 Tushar Rathod: [email protected] DISCLAIMER: This document is not for public distribution and has been furnished to you solely for your information and must not be reproduced or redistributed to any other person. Persons into whose possession this document may come are required to observe these restrictions. This material is for the personal information of the authorized recipient, and we are not soliciting any action based upon it. This report is not to be construed as an offer to sell or the solicitation of an offer to buy any commodity or commodity derivative in any jurisdiction where such an offer or solicitation would be illegal. It is for the general information of clients of ADMISI Commodities Private Limited. It does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. We have reviewed the report, and in so far as it includes current or historical information, it is believed to be reliable though its accuracy or completeness cannot be guaranteed. Neither Archer Daniels Midland Company (ADM), nor ADMISI Commodities Private Limited, nor any person/entity connected with it, accepts any liability arising from the use of this document. The recipients of this material should rely on their own investigations and take their own professional advice. Price and value of the investments referred to in this material may go up or down. Past performance is not a guide for future performance. Certain transactions -including those involving futures, options and other derivatives as well as non-investment grade securities - involve substantial risk and are not suitable for all investors. Reports based on technical analysis centers on studying charts of a stock's price movement and trading volume, as opposed to focusing on a commodity’s fundamentals and as such, may not match with a report on a commodity's fundamentals. Opinions expressed are our current opinions as of the date appearing on this material only. While we endeavor to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. Prospective investors and others are cautioned that any forward-looking statements are not predictions and may be subject to change without notice. Our investment businesses may make investment decisions that are inconsistent with the recommendations expressed herein. No part of this material may be duplicated in any form and/or redistributed without ADMISI Commodities Private Limited prior written consent. 11

© Copyright 2026