NiveshDaily Currency

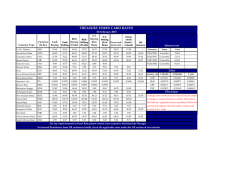

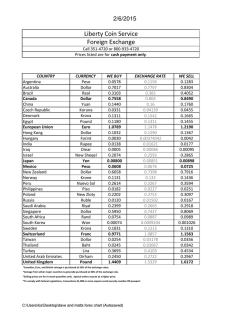

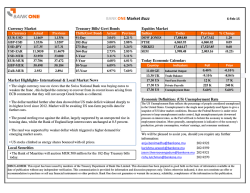

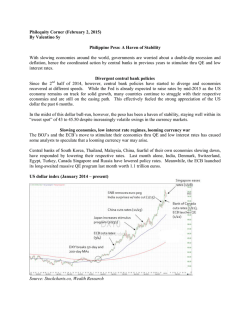

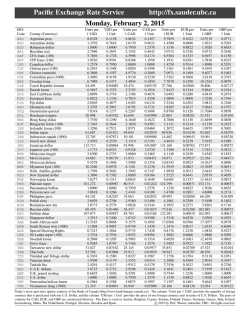

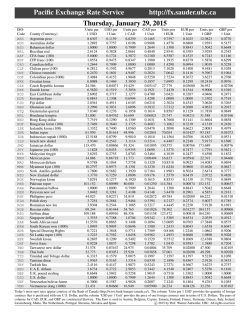

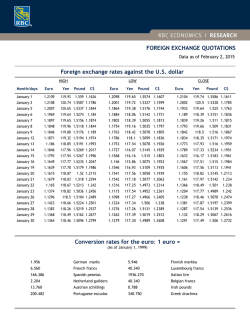

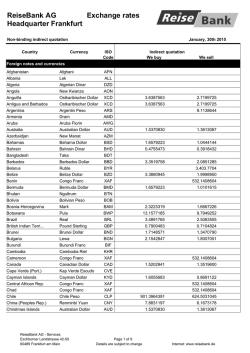

Nivesh Daily Currency January 28, 2015 Currency Pivot Levels Currency Pair Close % Change OI % Change Prev OI %Change R* Pivot S* USDINR 61.72 -0.19 -10.85 13.79 61.9650 61.8 61.67 EURINR GBPINR JPYINR 69.64 93.09 52.24 0.26 0.56 -0.1 -32.74 -31.37 -43.81 0.56 24.95 4.3 70.9450 93.6267 52.9283 69.6 93.1 52.2 69.21 92.93 52.01 * R= Resistance. S = Support Reference Rate 1 USD 61.4640 1 GBP 92.7676 1 EURO 69.0302 100 YEN 52.000 Foreign Currency Update . Currency Pair Dollar Index EURUSD GBPUSD JPYUSD Last close * % Change 94.26 1.1379 1.5192 117.84 -1.43 1.16 0.64 -0.39 Option Update Feb Future at 61.7250 Strike Close % Change CALL CALL CALL 61.50 62.00 62.50 0.5375 0.3075 0.16 -17.31 -24.07 -31.18 113.38 43.95 1.11 2550.65 57.02 6.61 5.50 5.86 6.10 PUT PUT PUT 61.50 62.00 62.50 0.3225 0.5875 0.945 2.38 6.82 11.5 54.55 8.11 0.20 130.29 5.570 -1.59 6.53 6.84 7.39 Option Seema Yadav Research Analyst Tel: +91-0731-4262702 [email protected] OI % Change Prev. OI% IV Note: Previous day movement of Option, OI and IV is suggesting negative move in USDINR. * IV-Implied volatility India Nivesh Securities Private Limited 601 & 602, Sukh Sagar, N. S. Patkar Marg, Girgaum Chowpatty, Mumbai 400 007. Tel: (022) 66188800 Technical View on Major Currency Pair USDINR (February Future) Succinct Summary of Previous Day Dollar/rupee settled at over twelve week low after bunched up and month-end dollar demand from oil importers. Technical Review USDINR settled down by 0.20% at 61.3975 levels on Tuesday. Today, January Future expiry related volatility could expect in first half. In near term weakness will expect to continue towards 61.30-61.20 following to a failure of trend reversal candles tick formation on EOD chart. Traders may remain bearish with stop loss 61.85. Recommendation : Sell USDINR below 61.70 Target 61.40-61.20 with stop loss 61.85 (LTP: 61.7250). Daily Chart Important Factor: U.S. FOMC Statement, Federal Funds Rate EURINR ( February Future) Succinct Summary of Previous Day Euro/dollar were trading up Tuesday as investors took advantage of the steep losses sustained during the last two days that pushed the currency pair to fresh 11-year low after elections in Greece put an anti-austerity government in power. Anti-austerity Syriza party's sweeping election victory in Greece amid concerns over its pledge to renegotiate the terms of Greece's €240 billion international bailout, which could cause the country to leave the euro zone. Technical Review: After decent fall in last week, EURINR saw a volatile move in between 69.70-69.24 levels and settled at 69.25. An inverted hammer on EOD chart is indicating short term pullback in EURINR and its expected that any jump towards 69.80-69.85 could bring huge selling with stop loss 70.10. Recommendation Important Factor : Daily GfK German Consumer Climate Sell on rise at 69.85-69.80 TARGET 69.50-69.00 with a stop loss 70.10. GBP ( February Future) Succinct Summary of Previous Day Pound/dollar fell to intraday low Tuesday after United Kingdom's fourth quarter Gross Domestic Product came lower than market expectation. UK's annualized GDP growth expanded to 2.7% on-year in the fourth quarter compared to market consensus of a growth of 2.8% on-year. In the third-quarter, the Island nation posted a 2.6% on-year economic growth Technical Review GBPINR witnessed volatile move on Tuesday and after hitting a high of 92.8750 levels settled at 92.65. 1. A doji candle stick is indicating for continuation of recent volatility and GBPINR is appearing to trade in between 93.50-92.80 levels in days to come. Daily Chart Important factor/data from U.K.: NIL JPYINR (February Future) Succinct Summary of Previous Day Dollar/yen fell Tuesday after Japanese economic minister Akira Amari comment on Japan's real wages amid inflows from Euro-zon. Japanese Economics Minister Akira Amari said Monday he expects real wages to trun positive in the fiscal year starting April as the economy recovers from nearly two decades of mild deflation.. Technical Review A high wave doji candle stick formation on EOD chart is yet indicating for continuation of volatile move in JPYINR. Near term resistance is seen at 52.50 and risky traders can sell with this stop loss for target 52.00-51.80. Daily Chart Important factor/data from Japan : NIL Major Economic Data & Events Schedule today Time 12:30pm Tentative 9:00pm 12:30am Currency EUR EUR EUR USD USD USD Economic Indicators GfK German Consumer Climate German Import Prices m/m German 30-y Bond Auction Crude Oil Inventories FOMC Statement Federal Funds Rate Forecast 9.20 -1.40% <0.25% Previous 9.00 -0.80% 1.77|1.2 10.1M <0.25% Possible Impact Positive Negative Depend on Statement Neutral Impact: High Low Medium Note: Economic data expectations are based on median forecast by economists or Reuters and Bloomberg survey. Here positive impact indicates currency could appreciate and negative indicates currency could depreciate in comparison with US Dollar. Technical Chart Source: Ticker News Source: Ticker news, Forexfactory.com and investing.com IndiaNivesh Securities Private Limited 601 & 602, Sukh Sagar, N. S. Patkar Marg, Girgaum Chowpatty, Mumbai 400 007. Tel: (022) 66188800 / Fax: (022) 66188899 e-mail: [email protected] | Website: www.indianivesh.in Disclaimer: This document has been prepared by IndiaNivesh Securities Private Limited (IndiaNivesh), for use by the recipient as information only and is not for circulation or public distribution. This document is not to be reproduced, copied, redistributed or published or made available to others, in whole or in part without prior permission from us. This document is not to be construed as an offer to sell or the solicitation of an offer to buy any currency pair. Recipients of this document should be aware that past performance is not necessarily a guide for future performance and price and value of investments can go up or down. The suitability or otherwise of any investments will depend upon the recipients particular circumstances. The information contained in this document has been obtained from sources that are considered as reliable though its accuracy or Completeness has not been verified by IndiaNivesh independently and cannot be guaranteed. Neither IndiaNivesh nor any of its affiliates, its directors or its employees accepts any responsibility or whatever nature for the information, statements and opinion given, made available or expressed herein or for any omission or for any liability arising from the use of this document. Opinions expressed are our current opinions as of the date appearing on this material only. IndiaNivesh directors and its clients may have holdings in the currencies mentioned in the report. To unsubscribe please send a mail to [email protected]

© Copyright 2026