January 2015: Currency Wars (301 KB)

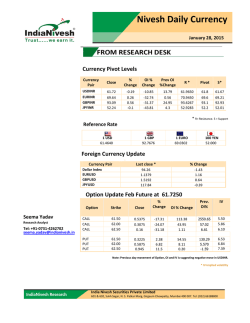

January 2015 investmentbulletin THE INVESTMENT BULLETIN IS ISSUED AS A MARKETING COMMUNICATION NOT A RESEARCH RECOMMENDATION CURRENCY WARS George Finlay Director Obama recently addressed the nation to outline a new executive order that could allow millions of illegal immigrants to remain in the US. Figures have been bandied about, particularly by the Republicans, but the median findings suggest around 11m people could be involved, of which 6m are from Mexico. The irony is that Mexico is itself having a lot of trouble on its own borders. Mexico is having a lot of trouble on its own borders with Guatemala and is now suffering a lot of criticism from a number of Central American States because of the ferocity of its largely US financed clampdowns on border activity. The pressure to migrate to Mexico from Central American States such as Honduras and the Dominican Republic continues to build despite the best efforts of the authorities, both US and Mexican. The disparity in wealth coupled with the knowledge created by electronic media is just too powerful a combination to supress. The domino theory resurrects itself. But the disparity in wealth coupled with the knowledge created by electronic media is just too powerful a combination to supress. Illegal immigration will continue to multiply and the skills and education of the immigrant will increase, threatening the employment of the traditional US labour force. Despite the best efforts of Homeland Security, which is now apparently the fifth largest employer in the US, this is a problem which will not likely go away. More likely, it will multiply, as will the queues at Miami Airport to get through customs. Last count, over one hour. It is estimated that shale oil states such as Dakota and Texas have added 1.3m new jobs since the beginning of 2008. All this makes what has happened to the shale industry in the US of interest. The broad message to investors at the moment remains that the recent fall in the oil price will have a favourable impact on GDP growth, particularly in the US, because of transport costs and auto utilisation. But the reverse side of the equation is job losses. It is estimated that around 1m people work in the oil and gas industry, adding some $400 bn annually to the economy. Shale is quite people intensive, consisting of around 20,000 small and medium size businesses. And for every one person directly employed in the industry, there is probably one more employed in an oil related business. It is estimated that shale oil states such as Dakota and Texas have added 1.3m new jobs since the beginning of 2008. To put this into perspective, the whole country has added no more than 6m jobs since 2008. And the question remains what sort of jobs are they? The evidence suggests that the total hours of all those working full-time in the non-farm sector is below that of 2008 and is not growing so fast. This signals part-time jobs, non-skilled, fast food, tourism etc. Just the sort of jobs likely to be taken by illegal immigrants from Central America via Mexico. In these circumstances if the shale industry is indeed “taken out” by the Saudi challenge, then the US would start to look a lot more like Europe in terms of the The Investment Bulletin is issued as a marketing communication not a research recommendation Risk Warning – Please be aware that the capital value of, and the income derived, from any market investment can go down as well as up. Investors may not get back the original amount invested. Significant losses can be made even on “low risk” investments. If you are not prepared to accept these risks to your capital please do not invest. e: [email protected] www.hargreave-hale.co.uk investmentbulletin extent of its recovery since the 2008 crash. Certainly the idea that the non-specialist labour force could negotiate higher wages and therefore create wage led inflation seems highly unlikely. Most people argue that QE has been a benefit to those western economies that embraced it. It provided some breathing space for the banks although there is little evidence that it facilitated bank lending on a meaningful scale. It certainly forced up asset prices and those who owned bonds, equities, property and pictures not to forget antique cars benefitted accordingly. On the debit side, the social divide widened, resulting in calls for higher taxation on the rich. On the debit side, the social divide widened, resulting in calls for higher taxation on the rich. QE also contributed to a rise in the price of commodities, a tribute to the warehouses full of copper and other industrial metals still sitting on the books of the Bank of China and possibly even Standard and Chartered. You could argue that it forced up the price of oil, remembering the very large crude carriers storing speculative oil tonnage for their owners and causing congestion in the ports of Singapore and Shanghai. You could say that, however indirectly, such prices encouraged much increased capacity being built in the mining industry so making the subsequent bust that much bigger. You could also argue that cheap money created the shale industry. The shale boom has been financed by $450 bn of high yield bonds, not yet junk bonds but at least one fifth of the high yield market is, one way or another energy related. As a result, there is an accident waiting January 2015 to happen with further potential job losses, albeit this time in the financial services industry. All this suggests that the consensus view of continued Dollar strength throughout 2015 might be challenged if the oil price falls to a level which breaks the shale industry and leads to big job losses as well as debt write offs. Schlumberger, the world’s largest oil services company, has already signalled the loss of 13000 jobs. Companies announcing job cuts and project delays recently include BP, Royal Dutch Shell, Suncor Energy and Premier Oil. It is far too early to get much idea of the impact of QE on the US and UK economies. The Bank of England started QE in March 2009 with an initial spending target of £75 bn over three months which very quickly multiplied to £375 bn over the next three years. A few months before the US Federal Reserve initiated QE with a $80 bn a month injection which totalled $3.5 tn over five years. Interest rates have been effectively manipulated to zero or minus levels as a result of QE. It has got to be a good idea that interest rates have been effectively manipulated to zero or minus levels as a result of QE. Rising asset prices do make people feel richer and does encourage spending but it does have the somewhat perverse effect of reducing the pressure on politicians to reform the structure of their economies, reduce budget deficits and make labour more competitive. Although when economies recover and interest rates normalise, getting from a one per cent interest rate to a normalised say five per cent interest rate could pose some difficulties for the equilibrium of markets. Thankfully all this has been postponed as a result of the collapse of oil prices. If the oil price sits at $45 and stays there, all industrial economies will be experiencing some degree of deflation, so real interest rates might actually be on the rise and nominal interest rates could actually still fall. Certainly wage cost inflation is most unlikely to bail anybody out. Too much labour chasing too few jobs. The big question relates to the US Sovereign debt market and who will continue to buy it in the event that a serious recovery with some inflation somehow takes hold and interest rates start to rise towards “normalised” levels. China’s appetite for US Treasuries is on the wane. The promotion of the renmimbi as an international currency and the change of policy towards a consumption rather than an export led economy has rather changed the rules. China does not have to finance US Sovereign bond issuance any more now that it is no longer so export dependent and it is now on the lookout for higher returns much more like a normal Sovereign fund, buying property, power stations etc. “We want to use our reserves more constructively by investing in development projects rather than just reflexively buying US Treasuries … In any case we usually lose money on Treasuries … we need to improve returns.” A Senior Chinese Official But in the immediate term, rising rates should probably not be the problem. As the recent fun and games in Euroland imply, the problem continues to be not inflation and rising interest rates but deflation and continuing falling interest rates. The news on QE, Euroland style has been well received. This must be e: [email protected] www.hargreave-hale.co.uk investmentbulletin something to do with the sheer size of the offering, being 60 bn Euros a month for at least 19 months with more to come in the event that inflation is still under 2%. Wow! A 1.1 tn Euro stimulus from “Super Mario” Draghi. But there is a very distinct difference between the US/ UK style QE and QE in Europe. Forget about the big picture and have a look at the small print. In the UK, QE is underwritten by the Bank of England. No mucking about. My word is my bond. In the US, the same. The Federal Reserve is the issuer, forget about the smaller reserve banks scattered about the regions. In the Euroland, the mechanism is somewhat different. Only 20% of any potential losses which might result from Sovereign bond purchases will be underwritten by all 19 nations in the Euro block which comprise the European Union. Mr Draghi is vulnerable to the massive concerns of the German people that QE will remove market pressure to reform non-performing economies, which is why it is the local central banks who will be responsible for 80% of the debts incurred, if indeed they are incurred during the QE process. The German approach to the economies of both Greece and Spain, which is to lower their cost base, reduce their budget deficits and collapse wages, whilst brutal, has been effective Anybody looking at this from Mars might well conclude that the biggest contributor to the European adventure had some serious doubts as to the viability of the whole project. Otherwise why would the European Bank, unlike the US Fed or the UK Bank of England not stand up and be counted like a man. There are distinct problems associated with January 2015 the European Bank’s approach. It could for example encourage fringe economies to monetise debt rather than pursue the path to reform. Curiously the German approach to the economies of both Greece and Spain, which is to lower their cost base, reduce their budget deficits and collapse wages, whilst brutal, has been effective and appears actually to be working. The signs are that a number of such “problem” economies in peripheral Europe will experience much stronger levels of GDP growth this year. However, for currency speculators, it is clear that, in reality, Europe no longer speaks with its own voice, if it ever did. If the Central Bank of Europe will not underwrite local central banks in its own territories, there is a fundamental lack of faith in the idea of European Unity and the European experience in general. The cynics amongst the currency speculators might even conclude that the complex mechanisms revealed in European style QE is very revealing and might represent an attempt, amongst other things to make the Euro more competitive at a time when worldwide demand seems to be slowing. If this is the case, then things kicked off very nicely yesterday when the Euro fell to its lowest level in eleven years, falling nearly 2% against the Dollar to $1.1405. But, at least for the moment the Dollar seems to be all conquering. Where the vulnerability lies is surely in the Yen / Euro level. Japan is getting increasingly serious in its desire to collapse its currency. A significant proportion of its exports go to the European community. These are clearly very big moves and investors should be on the alert, just in case they actually happen. Fighting for your share of world trade by “weaponising” your currency is very tempting for nation states. The Euro fell to its lowest level in eleven years, falling nearly 2% against the Dollar to $1.1405. You only have to look at the increasing instability of the forex world. Just the last week has seen the Swiss abandon their currency peg with the Euro and it has seen the Central Bank of Denmark and Turkey reduce interest rates in an attempt to remain competitive against the Euro. Turkey and Denmark and indeed Switzerland are not big economies in the scheme of things but they could be a portent of things to come. When nation states start to fine investors for holding their currencies on deposit, which is what effectively is happening in Germany and Switzerland, you know something must be up. The cost of holding another currency, gold, starts to look increasingly attractive. It has certainly proved a safe haven in previous currency wars. However, as its critics are fond of saying: gold has no intrinsic value and you buy it or gold producing companies at your peril. George Finlay, Director Recently the newly formed Government has stated that it will do more or less anything to achieve a 2% inflation rate in 2016. This requires a collapsed Yen something like 140 to the Dollar and a similar fall in percentage terms against the Euro. e: [email protected] www.hargreave-hale.co.uk investmentbulletin January 2015 Office Network Registered Office: 9-11 Neptune Court, Hallam Way, Blackpool FY4 5LZ Tel: 01253 754700 Blackpool: 4 Neptune Court, Hallam Way, Blackpool FY4 5LZ Tel: 01253 621575 Bangor: 2nd Floor, 30 Dean Street, Bangor, Gwynedd LL57 1UR Tel: 01248 353242 Carlisle: 10b Clifford Court, Cooper Way, Parkhouse, Carlisle, Cumbria CA3 0JG Tel: 01228 515224 London: Accurist House, 44 Baker Street, London W1U 7AL Tel: 020 7009 4900 Lancaster: 25 Brock Street, Lancaster LA1 1UR Tel: 01524 541560 Worcester: Saggar House, Princes Drive, Worcester WR1 2PG T: 01905 723551 York: 23 High Petergate York , YO1 7HS Tel: 01904 232780 Important Information Hargreave Hale Limited has approved this communication. In preparation of the Investment Bulletin, Hargreave Hale are not obliged in accordance with FCA rules to comply with legal requirements designed to promote the independence of investment research; which include a prohibition on dealing ahead of the dissemination of investment research. The Investment Bulletin is not intended to address the circumstances of any particular individual or entity and it does not constitute either a personal or research recommendation. The opinions and suppositions contained within the Investment Bulletin are those of the author and are held at the time of issue. All information contained in the Investment Bulletin is believed to be correct at the time of issue but cannot be guaranteed. Jurisdiction - The information herein is intended for publication to UK residents who are clients of Hargreave Hale Limited. It is not intended to be published or made available to any person in the USA or any other jurisdiction that would result in contravention of any applicable laws or regulations. Therefore, if it is prohibited to make such information available to you, it is not directed at you and you should not review it. By reviewing the information contained in this newsletter, you confirm that you are satisfied that you are not in contravention of any laws and regulations and that your reading this newsletter is not prohibited. Information - The accuracy of the information, the reliability of its sources, nor it’s completeness cannot be guaranteed, and neither Hargreave Hale Limited nor any of its directors, officers, representatives or employees accepts liability for any loss arising from the use hereof, no representation or warranty, either express or implied is made. Information, opinions and estimates contained in this newsletter reflect a judgement of individual stockbrokers acting for Hargreave Hale Limited at the original date of the opinion’s publication by Hargreave Hale Limited and are subject to change, without notice. Distribution of information - The contents of this newsletter cannot be reproduced in whole or in part without consent from Hargreave Hale Limited. If permission is granted you must not distribute any information in this newsletter to any other person without attaching a copy of this ‘Important Information’ and obtaining the agreement of such other person to comply with the above terms. Hargreave Hale Limited is authorised and regulated by the Financial Conduct Authority and is a Member and SETS participant of the London Stock Exchange and Member of Wealth Management Association. The company is incorporated in England and Wales, Company Number 3146580. The registered office is: 9-11 Neptune Court, Hallam Way, Blackpool, FY4 5LZ. Telephone: +44 (0) 1253 754700. Telephone calls may be recorded. © Hargreave Hale Limited 2015. e: [email protected] www.hargreave-hale.co.uk

© Copyright 2026