Legg Mason Brandywine Global Fixed Income Fund

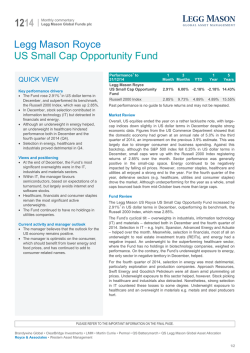

1214 Monthly Commentary Legg Mason Global Funds plc Legg Mason Brandywine Global Fixed Income Fund 1 QUICK VIEW Key performance drivers The Fund fell 1.50%¹ in December, and underperformed its benchmark index, which was down 0.66%. Underweight exposure to the euro contributed but exposures to Mexico, Hungary and South Africa detracted. On the whole, currency positions proved detrimental. Views and positioning In December, the manager increased exposure to floating-rate US Treasuries. At the end of the month, US dollar exposure was 44.6%. Current activity and manager outlook The manager sees better-than-expected growth in developed markets being led by the US. The manager also believes European economies should improve in 2015. In the manager’s opinion, US economic strength could bring about a modest repricing in US Treasury yields. Performance to 1 3 1 31/12/14 Month Months YTD Year Legg Mason Brandywine -1.50% -0.60% 2.92% 2.92% Global Fixed Income Fund Citigroup World Government -0.66% -1.49% -0.48% -0.48% Bond Index 5 Years 4.55% 1.67% Past performance is no guide to future returns and may not be repeated. Market Review Government bond markets recorded mixed returns in local currency terms over December, with strong positive returns coming from bond markets such as Norway, Australia, UK, Spain, Germany and Italy. Most currency performance across developed and emerging markets (EM) versus the US dollar in December was negative as the US dollar strengthened sharply. Amongst the few positive currency returns were the South Korean won, Chilean peso and New Zealand dollar. The Russian ruble fell the most over the month, down 17.3% in December versus the US dollar. Other currencies that underperformed included the Mexican peso, Hungarian forint, South African rand, Norwegian krone, Polish zloty, Brazilian real and the Australian dollar. Fund Review The Legg Mason Brandywine Global Fixed Income Fund decreased by 1.50%¹ in US dollar terms in December, underperforming its benchmark, the Citigroup World Government Bond Index, which fell 0.66%. Underweight exposure to the euro contributed. The single currency fell over the month after European Central Bank quantitative easing became an unavoidable and near-term reality in the context of expected negative inflation data in early January. There were no other notable contributors for the month. Overweight exposure to the Mexican peso from unhedged Mexican bonos positions detracted. Risk spreads between Mexican and US Treasury yields widened on falling oil prices, which led investors to expect less foreign direct investment in Mexico’s recently liberalised oil sector. The Mexican peso fell precipitously on the collapse in oil prices and strong US data, which contributed to fears of prolonged policy-rate divergence between the economies. Overweight exposure to the Hungarian forint was detrimental. Hungary’s forint and sovereign debt traded off in sympathy with the Russian ruble’s unraveling in mid-December. Hungary has meaningful ties to Russia and experienced rising bond yields in December despite the deflationary malaise in Europe. Overweight exposure to the South African rand and South African sovereign bonds weighed on relative performance. Falling global oil prices and worries over global growth prospects drew investor concerns resulting in the rand weakening and South African yields rising over the month. In terms of changes during the month, the manager increased exposure to floating-rate US Treasuries by 1.2% as part of cash management, leaving total exposure to the US dollar at 44.6% as of month-end. PLEASE REFER TO THE IMPORTANT INFORMATION ON THE FINAL PAGE. Brandywine Global • ClearBridge Investments • LMM • Martin Currie • Permal • QS Batterymarch • QS Legg Mason Global Asset Allocation • Royce & Associates • Western Asset Management 1/2 1214 Monthly Commentary Legg Mason Global Funds plc Legg Mason Brandywine Global Fixed Income Fund Outlook The manager continues to anticipate better-than-expected growth in developed markets with the US leading the recovery and the UK poised to follow with better external support. In the absence of further policy paralysis, the manager believes that European economies should also firm up in 2015. Despite better developed market growth, the manager expects long-term safe-haven rates to remain capped as a result of the still formidable debt overhang, a benign global inflation environment, institutional equity derisking, a low terminal level expected for policy rates, weak credit growth and entrenched concerns of global economic fragility. At current prices, however, the manager believes US Treasury yields may be overpriced by 30-50 basis points and sees latent US economic strength as a catalyst that could bring about a modest re-pricing. Meanwhile, the manager continues to believe that emerging markets sovereigns and currencies offer attractive sources of yield in 2015. This Fund is managed by Brandywine Global Investment Management ¹ Source: Legg Mason, as of 31 December 2014. Class A Dis (S) performance is net of fees and is calculated on a NAV to NAV basis (USD), with any income and dividends reinvested, if any, without any initial charges but reflecting annual management fees. Performance figures inclusive of sales charge is -6.42% for 1 Month, -5.57% for 3 Months, -2.23% for YTD, -2.23% for 1 Year and 3.49% for 5 Years. Performance for periods above one year is annualised. Investment involves risks. Past performance is not indicative of future results. IMPORTANT INFORMATION The Fund may invest in certain types of derivatives for investment and/or efficient portfolio management purposes. Please refer to the prospectus for more information. Source: Brandywine Global Investment Management. This document is issued by Legg Mason Asset Management Singapore Pte. Limited in Singapore (“Legg Mason”) and is for information only and does not constitute an offer or invitation to the public to purchase any shares in any fund in Singapore. This document is for information only and is not intended to provide investment advice. All data, opinions, estimates and other information are provided as of the date of this document and may be subject to change without notice. The prospectus of the fund is available and maybe obtained from Legg Mason or its authorised distributors. Investors should check with Legg Mason or its authorized distributors on whether a particular class of the fund is available for subscription. Investors should read the most current prospectus prior to any subscription. All applications for units in the fund must be made on the application forms accompanying the prospectus. Past performance is not necessarily indicative of future performance. All investments involve risk, including possible loss of principal. The value of the units in the fund and the income accruing to the units, if any, may fall or rise. Although information has been obtained from sources that Legg Mason believes to be reliable, no guarantee can be given as to its accuracy and such information may be incomplete or condensed and may be subject to change at any time without notice. Any views expressed are opinions of the respective investment affiliates as of the date of this document and are subject to change based on market and other conditions without notice and may differ from other investment affiliates or of the firm as a whole. These opinions are not intended to be a forecast of future events, a guarantee of future results or investment advice. The mention of any individual securities/ funds should neither constitute nor be construed as a recommendation to purchase or sell securities, and the information provided regarding such individual securities/ funds is not a sufficient basis upon which to make an investment decision. Portfolio allocations, holdings and characteristics are subject to change at any time. Legg Mason, its affiliates, officers or directors, may have an interest in the acquisition or disposal of the securities mentioned herein. Distribution of this document may be restricted in jurisdictions, other than Singapore. Any person coming into possession of this document should seek advice for details of, and observe such restrictions (if any). Neither Legg Mason nor any officer or employee of Legg Mason accepts any liability whatsoever for any loss arising from any use of this document or its contents. The information in this document is confidential and proprietary and may not be used other than by the intended user. This document may not be reproduced, distributed or published without prior written permission from Legg Mason. Legg Mason Asset Management Singapore Pte. Limited is the legal representative of Legg Mason, Inc. in Singapore. (Registration Number (UEN): 200007942R) PLEASE REFER TO THE IMPORTANT INFORMATION ON THE FINAL PAGE. 2/2

© Copyright 2026