Download - Investec

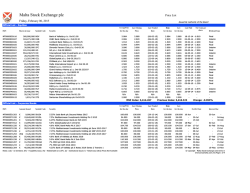

Friday, 06 February 2015 Sales Note Gabelli Value Plus+ Trust Plc Please find the most recent issue of Barron’s attached, with comments from a roundtable of industry figures including Mario Gabelli, on the outlook for the US and where to find value. This Mornings News Fund Focus Hedge BACIT (BACT) Discount With a fairly solid start to the year of an estimated c.1.2% NAV return, the fund has held up well given the background market volatility. The fund is now trading at a small discount of -0.5% and looks to be an attractive point to pick up stock Access Fund Detail Here UK Equity Income Merchants (MRCH) Performance MRCH has managed to outperform so far this year, with close to an 8% return compared to the benchmark return of 4.3%. This has seen the price lag, rising by just 4.1% and the fund is now trading at a small discount of 1.5% and we like the trust given its 4.9% dividend. The portfolio is concentrated, with the top 10 at 48.2% and the gearing is a consideration at 1.2x again something investors should be aware of. Access Fund Detail Here Intention to Float Woodford Investment Management LLP has announced its intention to raise £200m through the launch of Woodford Patient Capital Trust. Woodford Patient Capital Trust will invest in a diversified portfolio consisting predominantly of UK companies, both quoted and unquoted Investec Economics MPC reaction – Steady, but key steers due next week The Monetary Policy Committee left the Bank rate at 0.5% and its outstanding QE target at £375bn at its February meeting, thus maintaining the stance of policy and providing no surprises. It was not clear whether the volatility of energy prices and revised expectations for CPI inflation would prompt the committee to issue an explanatory statement, but members chose not to. However two events over the following week will help to convey the MPC’s key thoughts. February’s Quarterly Inflation Report (IR) is due next Thursday (note, this has been pushed back from Wednesday). In November the projections showed the economy growing a little above trend over the medium-term with inflation expected to Heads of Product Sales Sales Trading Market Making Corporate Jamie Lowe Charles Stagg Carl Goossens Peter Brown David Anderson +44 (0) 20 7597 5015 +44 (0) 20 7597 5042 +44 (0) 20 7597 5787 +44 (0) 20 7597 5063 +44 (0) 20 7597 5097 [email protected] [email protected] [email protected] [email protected] Fin Bodman Edward Malone +44 (0) 20 7597 5247 +44 (0) 20 7597 5098 [email protected] [email protected] Readers in all geographies please refer to important disclosures and disclaimers starting on page 6 [email protected] be at 2% in three years’ time, conditioned on a set of gradual increases in the Bank rate from this summer. IRs tend to convey a number of messages, but three key points to watch this time are as follows. First, the short-term CPI profile will probably show that there is a significant chance that the targeted measure moves into negative territory for a while during the spring. This compares with a central forecast three months ago where CPI was expected to bottom out around 1%. We suspect though that, in common with November, the inflation projections will rise towards the 2% target over the medium-term. In fact it is possible that the central projection lies a little above 2% in Q1 2018, as the path of implied market rates which the BoE builds into its forecasts does not include a tightening until summer 2016. Essentially the CPI projection may be interpreted as whether the MPC collectively endorses the extent of the flattening of the yield curve over the past three months or refutes it. Second, while the provisional outturn for GDP in 2014 of 2.6% lies some way below the MPC’s November projection of 3.5%, those for ensuing years may not see much change from 2.9% and 2.6% for 2015 and 2016, respectively. However a meaningful downgrade of the committee’s GDP projections would support the likelihood of a later tightening. Third, a strengthening in pay growth is almost a necessary condition for the MPC to begin to raise interest rates. Both headline and underlying measures of wage pressure have firmed modestly since the previous IR (total weekly earnings growth is currently running at 1.7%) and the committee’s view on pay may be seen as a broad litmus test on its potential appetite to raise rates before the end of the year. Given this recent trend the MPC still seems set to continue to forecast increasing compensation growth, though the new assumptions may not quite match the 3¼% by the end of this year that has been in the BoE’s arithmetic in the last two IRs. The second set of clues on the MPC’s intentions will be the Governor’s open letter to the Chancellor, thanks to inflation having fallen below 1% in December. Under the terms of the remit, Dr Carney has to set out the outlook for inflation, which of course will be the principal subject of the IR. But he also needs to explain the policy action which the committee is taking in response, perhaps giving markets a more explicit policy steer i.e. how concerned the committee is over the current period of low inflation and its inclination to ‘look through’ it. Overall the clues on growth, pay and any apparent rejection or endorsement of the shallowness of the yield curve will shape our expectations of when the committee believes that it may begin to normalise the level of interest rates. Our view is that rates will begin to rise in Q4 this year but any guidance from the central bank will help to shape our views. We stand by our view that despite the fall in the short-term inflation outlook and a number of surprises from a number of central banks, restarting the BoE QE programme is not on the cards. To access a printable version of this note please click here Daily Article Investors Like Pfizer Deal Even Though It Paid a High Premium Pfizer Inc. paid a high premium to land Hospira Inc. and investors appear to be happy that the U.S. pharmaceutical giant was willing to pay up for the seller of injectable drugs. Shares of Pfizer jumped 2.9% Thursday, following the announcement of its $16 billion all-cash deal for Hospira. Pfizer paid Hospira a premium of 39% to the company’s one-day and one-week closing price. The average one-week premium for U.S. deals this year was 31% overall and 26% for all U.S. healthcare deals, according to Dealogic. And that comes on top of the already high multiple that the market was valuing the company at ahead of the deal announcement. Hospira was trading at roughly 33 times its earnings per share of the previous twelve months, above the majority of its key competitors, according to FactSet. Pfizer, by contrast, trades at roughly 20 times its EPS over the last twelve months. Even with an elevated price tag, Pfizer expects the deal to immediately add between 10 to 12 cents to its EPS within the first year the deal closes, and Pfizer is predicting a closing time in the second half of 2015. Investors also like the potential for cost cuts that will help ratchet down the actual cost to Pfizer over time. Pfizer predicted that it would find so-called synergies of $800 million over three years with this deal. The cost savings exceed Hospira’s earnings before taxes, interest and deprecation for the trailing 12 months through Sept. 30, 2014. Full Article Here Page 2 | Friday, February 06, 2015 | UK Listed CEFs: Price, NAV and Volume 5.0 4.0 3.0 2.0 1.0 0.0 -1.0 -2.0 -3.0 Price 1wk Price Fallers 1 Week NAV 1wk Price Gainers 1 Week Fund Name Ticker Tiger Resource Finance Ord TIR Pioneer High Income Trust Ord CATCo Reinsurance Opps Ord % Fund Name Ticker -23.3 Cushing Roy alty & Income Fund Ord SRF 10.9 PHT -16.6 CapMan Ord CPMBV 10.4 CAT -10.5 Elephant Capital Ord ECAP 8.8 Golden Prospect Precious Metal Ord GPM -8.5 Kay ne Anderson MidstreamEnergy Ord KMF 8.7 International Biotechnology Ord IBT -8.5 Tortoise Energy Independence F Ord NDP 8.3 El Oro Ord ELX -8.3 Cushing Renaissance Fund Ord SZC 8.0 Arc Capital Holdings Ord ARCH -6.6 BlackRock World Mining Trust Ord BRWM 7.1 Dragon Ukrainian Properties Ord DUPD -5.2 JPMorgan Russian Securities Ord JRS 6.7 International Oil & Gas Techno Ord OGT -4.9 Voy a Natural Resource Equity Ord IRR 6.6 Ottoman Fund Ord OTM -4.8 Duff & Phelps Select Energy ML Ord DSE 5.9 Fund Name Ticker % BB Biotech AG Ord BION Turkish Inv estment Fund Ord JPMorgan Brazil Ord NAV Fallers 1 Week % NAV Gainers 1 Week Fund Name Ticker -6.4 RAB Special Situations Ord RSS 12.2 TKF -5.2 JPMorgan Russian Securities Ord JRS 9.1 JPB -4.6 Cushing Roy alty & Income Fund Ord SRF 8.7 MS China A Share Ord CAF -4.6 BlackRock Commodities Income Ord BRCI 6.1 JPMorgan Indian Ord JII -4.3 New City Energy Ord NCE 6.1 Vietnam Enterprise Inv estments Ord VIETENI -4.1 Mint Income Fund Ord MID.UN 6.0 Third Point Offshore USD Ord TPOU -4.1 Nuv een All Cap Energy MLP Opps Ord JMLP 6.0 India Fund Inc Ord IFN -3.9 BlackRock World Mining Trust Ord BRWM 5.7 Vietnam Grow th Fund Ord VIETNGF -3.9 Goldman Sachs MLP and Energy R Ord GER 5.6 New India Ord NII -3.6 Tortoise Pipeline & Energy Ord TTP 5.4 Fund Name Ticker Ratio Fund Name Ticker Artemis Alpha Trust Ord ATS 2.3 Central Fund of Canada Ord CEF 12.6 Dex ion Absolute GBP Ord DAB 2.3 BB Biotech AG Ord BION 10.6 BBGI SICAV Ord BBGI 2.1 Kay ne Anderson MLP Ord KYN 10.1 Scottish Oriental Smaller Cos Ord SST 1.9 3i Ord III 8.2 Inv esco Asia Ord IAT 1.9 MS China A Share Ord CAF 7.4 Third Point Offshore USD Ord TPOU 1.6 PIMCO Dy namic Credit Income Ord PCI 6.7 JPMorgan Asian Ord JAI 1.6 EV Tax -Managed Global Fund Ord EXG 6.0 Henderson Far East Income Ord HFEL 1.5 Tortoise Energy Infrastructure Ord TYG 5.7 Aberdeen Asian Income Ord AAIF 1.5 Pershing Square Holdings Ord PSH 5.3 JPMorgan Clav erhouse Ord JCH 1.5 DoubleLine Income Solutions Fu Ord DSL 5.3 Daily Volume / 3m Volume % 1 Month Average Daily Volume £m £m So urce: 2015 M o rningstar Page 3 | Friday, February 06, 2015 | US Listed CEFs: Price, NAV and Volume Price 1wk 1.00 NAV 1wk 0.50 0.00 -0.50 -1.00 -1.50 -2.00 -2.50 -3.00 So urce: 2013 M o rningstar Price Fallers 1 Day Fund Name MS China A Share Ord MFS Gov ernment Markets Income Ord TCW Strategic Income Ord Stone Harbor Emerging Mkts FI Ord Mac/First Glb Infrastructure Ord AGIC Gbl Equity & Conv Income Ord Asia Tigers Fund Ord Aberdeen Asia-Pacific Income Ord First Trust Specialty Finance Ord JPMorgan China Region Fund Ord Price Gainers 1 Day Ticker CAF MGF TSI EDF MFD NGZ GRR FAX FGB JFC % -3.9 -2.2 -1.4 -1.2 -1.2 -1.2 -1.2 -1.0 -1.0 -1.0 Fund Name Templeton Russia & East Europe Ord New Germany Fund Ord Tekla Healthcare Inv estors Ord Tekla Life Sciences Inv estors Ord Cornerstone Total Return Ord BlackRock Energy & Resources Ord First Trust Energy Infra. Fund Ord Gabelli Conv ertible & Income Ord BlackRock Health Sciences Ord Economic Inv estment Trust Ord Ticker TRF GF HQH HQL CRF BGR FIF GCV BME EVT So urce: 2013 M o rningstar NAV Fallers 1 Week Fund Name Turkish Inv estment Fund Ord MS China A Share Ord India Fund Inc Ord MS India Inv estment Ord Central Fund of Canada Ord Tekla Life Sciences Inv estors Ord China Fund Inc Ord Aberdeen Asia-Pacific Inc Inv Ord Cohen & Steers Div idend Majors Ord Special Opportunities Fund Ord So urce: 2013 M o rningstar NAV Gainers1 Week Ticker TKF CAF IFN IIF CEF HQL CHN FAP DVM SPE % -5.2 -4.6 -3.9 -3.0 -2.8 -2.6 -2.6 -2.3 -2.3 -2.3 Fund Name Tortoise Pipeline & Energy Ord BlackRock Energy & Resources Ord Petroleum & Resources Ord GAMCO Glb Gold Natural Res&Inc Ord Aberdeen Australia Equity Ord BlackRock Resources & Commdty Ord MS Eastern Europe Ord ASA Gold and Precious Metals Ord Brookfield Glo List Infr Inc Ord Nuv een Div ersified Commodity Ord So urce: 2013 M o rningstar Daily Volume/ 3m ADV Fund Name Cohen & Steers Closed-End Opp Ord Clough Global Allocation Ord AGIC Equity & Conv ertible Inc Ord Central Securities Corporation Ord First Trust Energy Infra. Fund Ord Cohen & Steers Infrastructure Ord Liberty All-Star Equity Ord Nuv een Div ersified Div & Inc Ord Alpine Total Dy namic Div idend Ord Clough Global Opportunities Ord Ticker TTP BGR PEO GGN IAF BCX RNE ASA INF CFD % 5.4 5.3 4.8 4.0 3.6 3.2 2.9 2.8 2.7 2.6 So urce: 2013 M o rningstar 1 Month Average Daily Volume £m Ticker FOF GLV NIE CET FIF UTF USA JDD AOD GLO Ratio 2.4 2.0 1.9 1.9 1.8 1.8 1.8 1.7 1.7 1.5 So urce: © 2013 M o rningstar Page 4 | Friday, February 06, 2015 | % 2.6 2.3 2.2 2.0 1.9 1.8 1.5 1.4 1.4 1.4 Fund Name MS China A Share Ord BlackRock Resources & Commdty Ord Tekla Healthcare Inv estors Ord India Fund Inc Ord GAMCO Glb Gold Natural Res&Inc Ord BlackRock Energy & Resources Ord DNP Select Income Ord Nuv een Credit Strat. Income Ord EV Tax Adv antaged Div idend Inc Ord MS Emerging Markets Domestic Ord Ticker CAF BCX HQH IFN GGN BGR DNP JQC EVT EDD £m 7.4 3.3 3.1 2.9 2.9 2.8 2.6 2.6 2.4 2.3 So urce: © 2013 M o rningstar Source: © 2014 Morningstar UK Listed CEFs: 1yr Z-Scores UK funds > £150m F&C Investment Trust Ord 3.88 JPMorgan Indian Ord 2.76 BBGI SICAV Ord 2.28 Fidelity European Values Ord 2.07 D E A R 1.59 1.44 1.4 Third Point Offshore USD Ord BH Macro GBP Ord Schroder Asia Pacific Ord 1.36 JPMorgan European Growth Pool Ord 1.32 Polar Capital Technology Ord 1.24 BH Macro USD Ord Brunner Ord -1.93 JPMorgan Claverhouse Ord -2.05 C H E A P -2.21 Henderson Value Trust Ord -2.3 Aberdeen Asian Income Ord -2.32 Perpetual Income & Growth Ord -2.36 Murray International B Ord Dunedin Income Growth Ord -2.51 Lowland Ord -2.84 Merchants Trust Ord -3.41 -5.04 Temple Bar Ord 5 4 3 2 1 0 -1 -2 -3 -4 -5 -6 Source: 2015© Morningstar US Listed CEFs: 1yr Z-Scores UK funds > £150m BlackRock Energy & Resources Ord 3.24 Petroleum & Resources Ord 2.57 1.87 EV Tax Advantaged Dividend Inc Ord 1.85 India Fund Inc Ord 1.85 Calamos Convertible & High Ord D E A R 1.77 1.75 1.46 PIMCO Income Strategy Fund II Ord JH Tax-Advantaged Dividend Inc Ord Tekla Healthcare Investors Ord 1.4 Reaves Utility Income Ord 1.36 MS Emerging Markets Ord Central Securities Corporation Ord -1.6 EV Tax Adv Global Dividend Inc Ord -1.61 JH Financial Opportunities Ord -1.71 TCW Strategic Income Ord -1.86 C H -2.08 E -2.21 A -2.23 P -2.26 GDL Fund Ord Nuveen Diversified Div & Inc Ord Source Capital Inc Ord Nuveen NASDAQ 100 Dynamic Over Ord Liberty All-Star Equity Ord -2.4 -2.44 Delaware Enhanced Gbl Div&Inc Ord 4 3 2 1 0 -1 -2 -3 Source: © 2015 Morningstar Page 5 | Friday, February 06, 2015 | Contact Disclaimer Investec Securities: This is a financial promotion issued by the sales team of Investec Bank plc. It is a "marketing communication", but not a "research recommendation" as those terms are defined by The Financial Conduct Authority (the "FCA"). Investec Bank plc is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority (register number 172330). In the United Kingdom refers to Investment Banking & Securities a division of Investec Bank plc. Investec Bank plc is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and a member of the London Stock Exchange. This document is not for general distribution and should not be passed, directly or indirectly, to persons outside your organisation. Registered in England No. 489604 Registered Office Address: 2 Gresham Street London EC2V 7QP Telephone: +44 20 7597 4000 Fax: +44 20 7597 4070 Investec Securities (US) LLC (New York) 1270 Avenue of the Americas, 29th Floor New York, NY 10020 USA Telephone: +1 212 259 5600 Fax: +1 917 206 5102 Head of Product Jamie Lowe, Head of Product Tel: +44 (0) 20 7597 5015 [email protected] This document and any investment to which this document relates is intended for the sole use of the persons to whom it is addressed, being persons who are Eligible Counterparties or Professional Clients as described in the FCA rules or persons described in Articles 19(5) (Investment professionals) or 49(2) (High net worth companies, unincorporated associations etc) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (as amended). It is not intended to be distributed or passed on, directly or indirectly, to any other class of persons and may not be relied upon by such persons and is therefore not intended for private individuals or those who would be classified as Retail Clients. This document has been produced for information purposes only and is not to be construed as investment advice or a solicitation or an offer to purchase or sell investments or related financial instruments. Any expressions of opinion in this document are subject to change without notice. The investments referred to in this document may not be suitable for all recipients. Recipients of this document should make their own investment decisions based upon their own financial objectives and financial resources and, if in any doubt, should seek advice from an investment advisor. Sales Charles Stagg Tel: +44 (0) 20 7597 5042 [email protected] Fin Bodman Tel: +44 (0) 20 759 5247 [email protected] Market Making Peter Brown Tel: +44 (0) 20 759 5063 [email protected] Edward Malone Tel: +44 (0) 20 7597 5098 [email protected] Sales Trading Carl Goossens Tel: +44 (0) 20 7597 5787 [email protected] Corporate Finance Darren Vickers Tel: +44 (0) 20 7597 5043 [email protected] Jeremy Ellis Tel: +44 20 7597 5153 [email protected] Research Paul Locke Tel: +44 20 7597 5138 [email protected] Page 6 | Friday, 06 February 2015 | www.investec.co.uk/research

© Copyright 2026