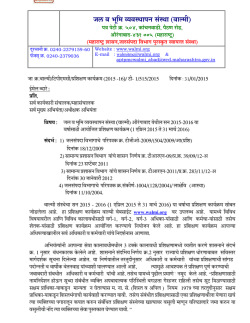

2014 - Golden Valley County, Montana

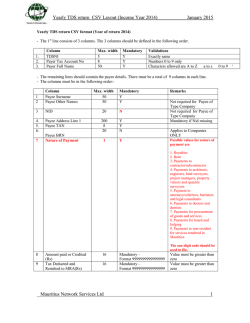

02/05/15 GOLDEN VALLEY COUNTY 08:44:21 Uncollected Taxes with Delinquents with Legals Page: 1 of 10 Report ID: TX190F Property Type = REAL, Year 2014, Delinquent Only Interest Due as of 02/05/15 Tax Sale Tax ID Name/Legal ---------- ---------------------------------------1010000000 SCHAFF KEVIN Certificate # Year Tax Amount ------------- ---- ------------ 10-Sub/Blk/Lot FARM SECOND ADD/ PO BOX 107 Twn/Rng/Sect 06N/20E /05 RYEGATE MT 59074-0107 FARM SECOND ADD (RYEGATE), 1/ Penalty ---------- Interest Total ---------- ------------ 1 LOT 1 - 3 20-Sub/Blk/Lot FARM SECOND ADD/ / Twn/Rng/Sect 06N/20E /05 FARM SECOND ADD (RYEGATE), 1959 BILTMORE MOBILEHOME/SHED 10 X 37 Geo: 1514-05-3-01-03-0000 14 340.72 6.81 6.26 353.79 340.72 6.81 6.26 353.79 30.29 0.61 0.55 31.45 30.29 0.61 0.55 31.45 15.40 0.31 0.28 15.99 15.40 0.31 0.28 15.99 10.87 0.22 0.20 11.29 10.87 0.22 0.20 11.29 145.38 2.90 2.66 150.94 145.38 2.90 2.66 150.94 Total Due for Tax Payer 1028000000 PATE CURT & TAMMY 10-Twn/Rng/Sect 06N/20E /05 3471 STATE HIGHWAY 31 A TRACT OF LAND IN THE HUBBARD TX 76648-2885 NW4SE4 LYING SOUTH OF THE RR-R/W,CONTAINING 12 ACRES MORE OR LESS Geo: 1514-05-4-01-02-0000 14 Total Due for Tax Payer 1043000000 COTTONWOOD CREEK PROPERTIES LLC Sub/Blk/Lot RYEGATE ORIGINA/ 2629 RAVENWAY DR Twn/Rng/Sect 06N/20E /05 LAKE CHARLES LA 70611-4252 RYEGATE ORIGINAL TOWNSITE, 6/ 17 LOT 17 - 18 Geo: 1514-05-3-07-02-0000 14 Total Due for Tax Payer 1061000000 STRADTMAN PENNY R Sub/Blk/Lot MIL LD CO SECON/ PO BOX 78 Twn/Rng/Sect 06N/20E /06 RYEGATE MT 59074-0078 MIL LD CO SECOND ADD 17/ 9 (RYEGATE), LOT 9 Geo: 1514-06-4-15-02-0000 14 Total Due for Tax Payer 1078000000 HENDERSON DANIEL F & ETAL Sub/Blk/Lot FARM THIRD ADD / 125 IRONWEED DR Twn/Rng/Sect 06N/20E /05 PUEBLO CO 81001-1044 FARM THIRD ADD (RYEGATE), 3/ 2 LOT 2 - 4, LESS HWY R/W Geo: 1514-05-4-02-03-0001 14 Total Due for Tax Payer 1083000000 HIGGINS LOREN Twn/Rng/Sect 06N/20E /05 774 RINAY RD C.O.S. #13-1984, AMENDED HELENA MT 59602-9610 LOTS 7A,8A,9A,10A,11A IN BLK 4 RYEGATE ORIGINAL TOWNSITE 20-Sub/Blk/Lot RYEGATE ORIGINA/ 4/ 12 02/05/15 GOLDEN VALLEY COUNTY 08:44:21 Uncollected Taxes with Delinquents with Legals Page: 2 of 10 Report ID: TX190F Property Type = REAL, Year 2014, Delinquent Only Interest Due as of 02/05/15 Tax Sale Tax ID Name/Legal Certificate # Year Tax Amount ------------- ---- ------------ ---------- ---------------------------------------- Penalty Interest Total ---------- ---------- ------------ 61.08 1.23 1.12 63.43 61.08 1.23 1.12 63.43 514.86 10.29 9.45 534.60 514.86 10.29 9.45 534.60 52.25 1.04 0.96 54.25 52.25 1.04 0.96 54.25 228.91 4.58 4.20 237.69 228.91 4.58 4.20 237.69 121.91 2.44 2.24 126.59 121.91 2.44 2.24 126.59 Twn/Rng/Sect 06N/20E /05 RYEGATE ORIGINAL TOWNSITE, LOT 12 30-Twn/Rng/Sect 06N/20E /05 C.O.S. #13-1984, AMENDED LOT 19 IN BLK 4 RYEGATE ORIGINAL TOWNSITE Geo: 1514-05-3-04-01-0000 14 Total Due for Tax Payer 1163000000 WILLIAMS HERBERT K & BARBARA L 10-Sub/Blk/Lot MIL LD CO THIRD/ PO BOX 105 Twn/Rng/Sect 06N/20E /06 RYEGATE MT 59074-0105 MIL LD CO THIRD ADD 36/ 1 36/ 4 (RYEGATE), LOT 1 - 3 20-Sub/Blk/Lot MIL LD CO THIRD/ Twn/Rng/Sect 06N/20E /06 MIL LD CO THIRD ADD (RYEGATE), LOT 4 - 6 Geo: 1514-06-4-02-01-0000 14 Total Due for Tax Payer 1167000000 BAUER RONALD M & KIM K 10-Sub/Blk/Lot MIL LD CO SECON/ 350 ROTHIEMAY RD Twn/Rng/Sect 06N/20E /06 RYEGATE MT 59074-9610 MIL LD CO SECOND ADD 22/ 4 (RYEGATE), LOT 4 Geo: 1514-06-4-08-03-0001 14 Total Due for Tax Payer 1206000000 CLARK KARL Sub/Blk/Lot FARM ADD (RYEGA/ PO BOX 97 Twn/Rng/Sect 06N/20E /05 RYEGATE MT 59074-0097 FARM ADD (RYEGATE), LOT 8 - 1/ 8 10, & A TRACT OF LAND BETWEEN NORTH LINE OF LOTS 8,9,10 BLK 1 & RIM Geo: 1514-05-3-25-08-0000 14 Total Due for Tax Payer 1215000000 GUNVILLE RANDY P Sub/Blk/Lot MIL LD CO SECON/ %WRIGHT CLARISSA Twn/Rng/Sect 06N/20E /05 1803 US HIGHWAY 87 E SPC 16 MIL LD CO SECOND ADD BILLINGS MT 59101-6615 (RYEGATE), LOT 10 - 11, & 14/ 10 THE E2 OF LOT 9 Geo: 1514-05-3-20-11-0000 14 Total Due for Tax Payer 1224000000 RUZICK JAMES A Sub/Blk/Lot MIL LD CO SECON/ 19/ 1 02/05/15 GOLDEN VALLEY COUNTY 08:44:21 Uncollected Taxes with Delinquents with Legals Page: 3 of 10 Report ID: TX190F Property Type = REAL, Year 2014, Delinquent Only Interest Due as of 02/05/15 Tax Sale Tax ID Name/Legal ---------- ---------------------------------------- Certificate # Year Tax Amount ------------- ---- ------------ ---------- ---------- ------------ 164.56 3.29 3.02 170.87 164.56 3.29 3.02 170.87 45.43 0.90 0.83 47.16 45.43 0.90 0.83 47.16 34.33 0.68 0.63 35.64 34.33 0.68 0.63 35.64 48.12 0.96 0.88 49.96 48.12 0.96 0.88 49.96 71.74 1.44 1.32 74.50 71.74 1.44 1.32 74.50 266.32 5.33 4.89 276.54 266.32 5.33 4.89 276.54 PO BOX 201 Twn/Rng/Sect 06N/20E /06 RYEGATE MT 59074-0201 MIL LD CO SECOND ADD Penalty Interest Total (RYEGATE), LOT 1 Geo: 1514-06-4-11-04-0000 14 Total Due for Tax Payer 1233000000 BARBULA GLENDA R Sub/Blk/Lot MIL LD CO FIRST/ HC 69 BOX 2274 Twn/Rng/Sect 06N/20E /05 WINNETT MT 59087-9500 MIL LD CO FIRST ADD 7/ 3 (RYEGATE), LOT 3 - 6 Geo: 1514-05-3-15-06-0001 14 Total Due for Tax Payer 1280000000 STRADTMAN TIMOTHY JAMES & PENNY RAE Twn/Rng/Sect 06N/20E /06 PO BOX 78 C.O.S. #01-2008, TRACT 2 IN RYEGATE MT 59074-0078 NE4 & NW4 13.564 AC (IN CITY LIMITS) Geo: 1514-06-4-23-01-0000 14 Total Due for Tax Payer 2008000000 ANDERSON ROY E Twn/Rng/Sect 07N/19E /08 937 12TH AVE E SE4NE4NW4 SEATTLE WA 98102-4515 Geo: 1609-08-2-01-02-0000 14 Total Due for Tax Payer 2042000000 DENGENHART LONNY Twn/Rng/Sect 06N/19E /06 36 S BARBER RD C.O.S. #10-1987, TRACT 2, IN RYEGATE MT 59074-9732 THE NE4; 25 AC Geo: 1513-06-1-10-01-0000 14 Total Due for Tax Payer 2050000000 PATE CURT & TAMMY Twn/Rng/Sect 06N/20E /05 3471 STATE HIGHWAY 31 SW4SE4 & A M&B TRACT IN THE HUBBARD TX 76648-2885 SE4SW4 SEE DEED 595, CONTAINING 5.75 ACRES MORE OR LESS Geo: 1514-05-4-10-01-0001 14 Total Due for Tax Payer 2144000000 SCHAFF JEFFREY Twn/Rng/Sect 06N/20E /29 441 MT HIGHWAY 300 A M&B TRACT IN SW4SW4 SEE BK RYEGATE MT 59074-9714 D,PG 3135;19.18 AC;1998 HIGHLAND/ENDINBURGH 28 X 72 MOBILE SN:HM7546AB TN:E271580 Geo: 1514-29-3-03-01-0000 02/05/15 GOLDEN VALLEY COUNTY 08:44:21 Uncollected Taxes with Delinquents with Legals Page: 4 of 10 Report ID: TX190F Property Type = REAL, Year 2014, Delinquent Only Interest Due as of 02/05/15 Tax Sale Tax ID Name/Legal Certificate # Year Tax Amount ------------- ---- ------------ ---------- ---------- ------------ 341.07 6.82 6.26 354.15 341.07 6.82 6.26 354.15 42.96 0.86 0.78 44.60 42.96 0.86 0.78 44.60 42.96 0.86 0.78 44.60 42.96 0.86 0.78 44.60 171.60 3.44 3.15 178.19 171.60 3.44 3.15 178.19 250.22 5.00 4.59 259.81 250.22 5.00 4.59 259.81 226.16 4.53 4.15 234.84 226.16 4.53 4.15 234.84 333.34 6.66 6.12 346.12 333.34 6.66 6.12 346.12 ---------- ---------------------------------------- 14 Total Due for Tax Payer 2169000000 SCHANZ KAREN G Sub/Blk/Lot / %FLECKENSTEIN KATHLENE A Twn/Rng/Sect 06N/20E /32 46 PARK ST GOLDEN RYE SUBDIVISION, COS FRANKLIN NH 03235-1349 #31-2006 LOT 5, IN THE NW4; Penalty Interest Total / 20.01AC Geo: 1514-32-2-01-02-0000 14 Total Due for Tax Payer 2201000000 SAMUELSON ARTHUR & ETAL Twn/Rng/Sect 07N/19E /10 MAIL TO VIRGINIA SAMUELSON E2SE4NW4 900 UNIVERSITY ST APT 9E Geo: 1609-10-2-04-02-0000 SEATTLE WA 98101-2730 14 Total Due for Tax Payer 2225000000 SCHUCHARD DUANE A & SHIRLEY MAE Twn/Rng/Sect 08N/19E /02 901 ALDERSON AVE E2SE4 BILLINGS MT 59101-5820 Geo: 1710-02-4-01-01-0000 14 Total Due for Tax Payer 2295000000 WRZESINSKI JON & MICHELE Twn/Rng/Sect 11N/19E /20 PO BOX 391 NE4NW4 HARLOWTON MT 59036-0391 Geo: 2030-20-2-01-01-0000 14 Total Due for Tax Payer 2309000000 HINER TODD W & KAY L Twn/Rng/Sect 07N/19E /30 PO BOX 466 C.O.S. #14-1995, TRACT A IN HARLOWTON MT 59036-0466 THE S2S2, DOCUMENT 72511; 56.127 AC 20-Twn/Rng/Sect 07N/19E /31 C.O.S. #14-1995, TRACT A IN THE N2S2, DOCUMENT 72511; 590.170 AC Geo: 1609-30-3-04-01-0000 14 Total Due for Tax Payer 2313000000 WILLIAMS HERBERT K & BARBARA L PO BOX 105 RYEGATE MT 59074-0105 10-Twn/Rng/Sect 06N/19E /21 W2; 320 AC 20-Twn/Rng/Sect 06N/19E /31 W2; 315.76 AC Geo: 1513-21-2-01-01-0000 14 Total Due for Tax Payer 02/05/15 GOLDEN VALLEY COUNTY 08:44:21 Uncollected Taxes with Delinquents with Legals Page: 5 of 10 Report ID: TX190F Property Type = REAL, Year 2014, Delinquent Only Interest Due as of 02/05/15 Tax Sale Tax ID Name/Legal Certificate # Year Tax Amount ------------- ---- ------------ ---------- ---------------------------------------2346000000 THOMPSON JEAN M 10-Sub/Blk/Lot BARBER ORIGINAL/ 137 NIGHTINGALE DR Twn/Rng/Sect 06N/19E /06 BILLINGS MT 59101-6637 BARBER ORIGINAL TOWNSITE, Penalty ---------- Interest Total ---------- ------------ / THE EAST 130' OF WEST 173' BLK 6 20-Sub/Blk/Lot BARBER ORIGINAL/ 2/ 16 5/ 8 Twn/Rng/Sect 06N/19E /06 BARBER ORIGINAL TOWNSITE, LOT 16 30-Sub/Blk/Lot BARBER ORIGINAL/ Twn/Rng/Sect 06N/19E /06 BARBER ORIGINAL TOWNSITE, LOT 8 - 12 40-Sub/Blk/Lot BARBER ORIGINAL/ 5/ Twn/Rng/Sect 06N/19E /06 BARBER ORIGINAL TOWNSITE, THE EAST 100' OF LOTS 13 THRU 24 Geo: 1513-06-1-01-02-0000 14 44.04 0.88 0.80 45.72 44.04 0.88 0.80 45.72 2.80 0.06 0.05 2.91 2.80 0.06 0.05 2.91 370.70 7.41 6.80 384.91 370.70 7.41 6.80 384.91 85.91 1.72 1.58 89.21 85.91 1.72 1.58 89.21 85.91 1.72 1.58 89.21 85.91 1.72 1.58 89.21 Total Due for Tax Payer 2352000000 BROCKWAY NOLA SWAN AS TRUSTEE 10-Sub/Blk/Lot SECTION 31-8-19/ 1517 LONGRIDGE CT Twn/Rng/Sect 08N/19E /31 THOUSAND OAKS CA 91360-2018 SECTION 31-8-19, NE4 OF GOVT / LOT 2 Geo: 1710-31-2-01-11-0000 14 Total Due for Tax Payer 2436000000 DEBOER KENNETH F & CATHERINE A %CROWLEY JOHN J Twn/Rng/Sect 07N/19E /25 W2W2 PO BOX 101 20-Twn/Rng/Sect 07N/19E /26 RYEGATE MT 59074-0101 NE4 Geo: 1609-25-3-03-01-0001 14 Total Due for Tax Payer 2505000000 COTTONWOOD CREEK PROPERTIES LLC 10-Twn/Rng/Sect 10N/19E /09 2629 RAVENWAY DR N2SE4NW4, N2SW4NW4 LAKE CHARLES LA 70611-4252 Geo: 1911-09-2-03-01-0000 14 Total Due for Tax Payer 2506000000 COTTONWOOD CREEK PROPERTIES LLC Twn/Rng/Sect 10N/19E /09 2629 RAVENWAY DR S2SW4NW4, S2SE4NW4 LAKE CHARLES LA 70611-4252 Geo: 1911-09-2-03-03-0000 14 Total Due for Tax Payer 2543000000 SAGA PETROLEUM CORPORATION Twn/Rng/Sect 05N/19E /25 02/05/15 GOLDEN VALLEY COUNTY 08:44:21 Uncollected Taxes with Delinquents with Legals Page: 6 of 10 Report ID: TX190F Property Type = REAL, Year 2014, Delinquent Only Interest Due as of 02/05/15 Tax Sale Tax ID Name/Legal ---------- ---------------------------------------- Certificate # Year Tax Amount ------------- ---- ------------ ---------- ---------- ------------ 659.35 13.18 12.10 684.63 659.35 13.18 12.10 684.63 145.40 2.91 2.67 150.98 145.40 2.91 2.67 150.98 806.96 16.14 14.81 837.91 806.96 16.14 14.81 837.91 114.35 2.29 2.10 118.74 114.35 2.29 2.10 118.74 404.57 8.09 7.42 420.08 404.57 8.09 7.42 420.08 0.37 0.34 19.17 600 17TH ST STE 1700N A M&B TRACT IN SE4,SEE BK DENVER CO 80202-5417 D,PG 6331 Penalty Interest Total Geo: 1420-25-4-01-02-0000 14 Total Due for Tax Payer 2590000000 STRADTMAN TIMOTHY JAMES & PENNY RAE Twn/Rng/Sect 6N /20E /6 PO BOX 78 S6, T6N, R20E, C.O.S. RYEGATE MT 59074-0078 #01-2008, TRACT 2,IN THE NE4 & NW4 50.207AC (OUTSIDE CITY LIMITS) Geo: 1514-06-1-01-04-0000 14 Total Due for Tax Payer 6008000000 DAUM TYLER S Sub/Blk/Lot LAVINA ORIGINAL/ PO BOX 163 Twn/Rng/Sect 06N/22E /02 LAVINA MT 59046-0163 LAVINA ORIGINAL TOWNSITE, 1/ 1 LOT 1 - 2 20-Geo: 1516-02-4-08-04-0001 14 Total Due for Tax Payer 6022000000 TINKER MICHAEL ANTHONY & ETAL 10-Sub/Blk/Lot LAVINA ORIGINAL/ PO BOX 243 Twn/Rng/Sect 06N/22E /02 LAVINA MT 59046-0243 LAVINA ORIGINAL TOWNSITE, 12/ 17 LOT 17 - 18 20-Twn/Rng/Sect 06N/22E /02 TITLE # K789453, MAKE CHAMPION, MODEL SEQUOIA, YEAR 1986, SIZE 24' X 56', MOBILE SN #2461947116 LOCATED ON LOTS 17-18 BLK 12 LAVINA OR Geo: 1516-02-3-04-06-0001 14 Total Due for Tax Payer 6027000000 HABENER STEVEN D & SHERRY L 10-Twn/Rng/Sect 06N/22E /02 PO BOX 14 A M & B TRACT IN THE SW4SW4, LAVINA MT 59046-0014 S2NW4 OF THE SW4 SEE DEED 115 Geo: 1516-02-3-07-01-0000 14 Total Due for Tax Payer 6047000000 ADAMS FLORENCE L Sub/Blk/Lot MIL LD CO FIRST/ 122 EGGE RD Twn/Rng/Sect 06N/22E /02 LAVINA MT 59046-7132 MIL LD CO FIRST ADD 13/ 13 (LAVINA), LOT 13 - 14 Geo: 1516-02-3-19-05-0000 14 18.46 02/05/15 GOLDEN VALLEY COUNTY 08:44:21 Uncollected Taxes with Delinquents with Legals Page: 7 of 10 Report ID: TX190F Property Type = REAL, Year 2014, Delinquent Only Interest Due as of 02/05/15 Tax Sale Tax ID Name/Legal ---------- ---------------------------------------- Certificate # Year Tax Amount ------------- ---- ------------ ---------- ---------- ------------ 18.46 0.37 0.34 19.17 129.24 2.59 2.37 134.20 129.24 2.59 2.37 134.20 271.30 5.42 4.97 281.69 271.30 5.42 4.97 281.69 182.55 3.64 3.34 189.53 182.55 3.64 3.34 189.53 128.94 2.58 2.37 133.89 128.94 2.58 2.37 133.89 Total Due for Tax Payer 6062000000 HORPESTAD FRED A Sub/Blk/Lot MIL LD CO FIRST/ %FORD AMY Twn/Rng/Sect 06N/22E /02 PO BOX 174 MIL LD CO FIRST ADD LAVINA MT 59046-0174 (LAVINA), LOTS 3 - 4 BLK 16 Penalty Interest Total / 20-Sub/Blk/Lot MIL LD CO FIRST/ / Twn/Rng/Sect 06N/22E /02 MIL LD CO FIRST ADD (LAVINA), 1974 GALLATIN 14 X 76 MOBILE Geo: 1516-02-3-09-02-0001 14 Total Due for Tax Payer 6079000000 WARNER BRYSON K & ANN 10-Sub/Blk/Lot MIL LD CO FIRST/ PO BOX 113 Twn/Rng/Sect 06N/22E /02 LAVINA MT 59046-0113 MIL LD CO FIRST ADD / (LAVINA), THE W2 OF LOTS 8,9,10 BLK 13 20-Sub/Blk/Lot MIL LD CO FIRST/ / Twn/Rng/Sect 06N/22E /02 MIL LD CO FIRST ADD (LAVINA), THE E2 OF LOTS 8,9,10 BLK 13 Geo: 1516-02-3-19-08-0000 14 Total Due for Tax Payer 6081000000 LARSSEN BJORN TERJE 10-Sub/Blk/Lot LAVINA ORIGINAL/ 163 BUTLERTOWN RD Twn/Rng/Sect 06N/22E /02 WATERFORD CT 06385-4021 LAVINA ORIGINAL TOWNSITE, / LOT 12 BLK 8 20-Sub/Blk/Lot LAVINA ORIGINAL/ / Twn/Rng/Sect 06N/22E /02 LAVINA ORIGINAL TOWNSITE, LOT 11 BLK 8 Geo: 1516-02-4-06-03-0000 14 Total Due for Tax Payer 6128000000 URSITTI SARA ELIZABETH 10-Sub/Blk/Lot LAVINA ORIGINAL/ PO BOX 264 Twn/Rng/Sect 06N/22E /02 LAVINA MT 59046-0264 LAVINA ORIGINAL TOWNSITE, / LOTS 3 - 4 BLK 3 Geo: 1516-02-3-21-03-0000 14 Total Due for Tax Payer 6149000000 OTTERSTROM JAMIE SANGUINS PO BOX 554 Twn/Rng/Sect 06N/22E /02 LAVINA TRACT A M & B TRACT 02/05/15 GOLDEN VALLEY COUNTY 08:44:21 Uncollected Taxes with Delinquents with Legals Page: 8 of 10 Report ID: TX190F Property Type = REAL, Year 2014, Delinquent Only Interest Due as of 02/05/15 Tax Sale Tax ID Name/Legal Certificate # Year Tax Amount ------------- ---- ------------ ---------- ---------- ------------ 183.74 3.67 3.37 190.78 183.74 3.67 3.37 190.78 763.81 15.27 14.00 793.08 763.81 15.27 14.00 793.08 30.97 0.62 0.57 32.16 30.97 0.62 0.57 32.16 147.11 2.94 2.69 152.74 147.11 2.94 2.69 152.74 80.73 1.62 1.48 83.83 80.73 1.62 1.48 83.83 279.30 5.59 5.12 290.01 279.30 5.59 5.12 290.01 213.54 4.27 3.92 221.73 213.54 4.27 3.92 221.73 ---------- ---------------------------------------HARLOWTON MT 59036-0554 Penalty Interest Total IN SW4,SEE DEED-150 Geo: 1516-02-3-16-01-0000 14 Total Due for Tax Payer 6152000000 OX BOW RANCH COMPANY INC Twn/Rng/Sect 06N/22E /02 PO BOX 223 TRACT IN SW LYING SOUTH & LAVINA MT 59046-0223 WEST OF TOWN LOTS,CONTAINING 42.37 ACRES Geo: 1516-02-3-26-01-0001 14 Total Due for Tax Payer 6168000000 DAUM RONALD D & MARILYNN M TRUSTEES Sub/Blk/Lot LAVINA ORIGINAL/ PO BOX 63 Twn/Rng/Sect 06N/22E /02 LAVINA MT 59046 LAVINA ORIGINAL TOWNSITE, / LOTS 7 - 8 BLK 1 Geo: 1516-02-4-08-06-0000 14 Total Due for Tax Payer 6170000000 BULLOCK DAVID & TANISIA Sub/Blk/Lot LAVINA ORIGINAL/ PO BOX 80834 Twn/Rng/Sect 06N/22E /02 BILLINGS MT 59108-0834 LAVINA ORIGINAL TOWNSITE, / LOTS 3 - 4 BLK 5 Geo: 1516-02-3-10-04-0000 14 Total Due for Tax Payer 7003000000 PETERS JOHN J & MARY D Twn/Rng/Sect 06N/23E /09 54 JENSEN RD C.O.S. #18-2002, A TRACT OF LAVINA MT 59046-7161 LAND LOCATED IN THE NE4 LOT 1 OF PETERS SUBDIVISION COS#18-2002 Geo: 1517-09-1-02-02-0000 14 Total Due for Tax Payer 7005000000 MARTIN MICHELLE LAUREE ANDERSON & ETAL Twn/Rng/Sect 07N/23E /20 917 4TH ST W NE4SE4 ROUNDUP MT 59072-2229 Geo: 1613-20-4-01-01-0001 14 Total Due for Tax Payer 7006000000 MARTIN MICHELLE LAUREE ANDERSON & ETAL Twn/Rng/Sect 07N/23E /33 917 4TH ST W W2NW4 ROUNDUP MT 59072-2229 Geo: 1613-33-2-02-01-0000 14 Total Due for Tax Payer 7034000000 ADAMS FLORENCE L Twn/Rng/Sect 06N/23E /09 02/05/15 GOLDEN VALLEY COUNTY 08:44:21 Uncollected Taxes with Delinquents with Legals Page: 9 of 10 Report ID: TX190F Property Type = REAL, Year 2014, Delinquent Only Interest Due as of 02/05/15 Tax Sale Tax ID Name/Legal ---------- ---------------------------------------- Certificate # Year Tax Amount ------------- ---- ------------ 122 EGGE RD C.O.S. #17-1998, LOT 1 IN LAVINA MT 59046-7132 THE SE4NE4 OF PETERS Penalty Interest Total ---------- ---------- ------------ 273.15 5.46 5.01 283.62 273.15 5.46 5.01 283.62 827.90 16.56 15.19 859.65 827.90 16.56 15.19 859.65 86.26 1.73 1.59 89.58 86.26 1.73 1.59 89.58 147.53 2.95 2.70 153.18 147.53 2.95 2.70 153.18 320.45 6.41 5.88 332.74 320.45 6.41 5.88 332.74 0.08 0.07 4.08 SUBDIVISION & COS#20-2002 IN THE SE4NE4; 3.961 AC, 1999 MARLETTE/PACIFICA 27 X 57 MOBIL Geo: 1517-09-1-04-04-0000 14 Total Due for Tax Payer 7039000000 LINDEN KATHY L Twn/Rng/Sect 05N/22E /06 54 LEGARD RD C.O.S. #22-2004, LOT 1, IN LAVINA MT 59046-7146 THE SE4 PARKS ESTATES SUB; 40 AC 20-Twn/Rng/Sect 05N/22E /06 C.O.S. #22-2004, LOT 2, IN THE SE4 PARKS ESTATES SUB; 115.42 AC Geo: 1423-06-4-01-01-0001 14 Total Due for Tax Payer 7107000000 LEGARD GERALD D & MARGARET 10-Twn/Rng/Sect 05N/22E /05 223 NW 21ST ST SW4; 160 AC MCMINNVILLE OR 97128-2623 Geo: 1423-05-3-01-01-0000 14 Total Due for Tax Payer 7159000000 HAMILTON BRIAN & ETAL Twn/Rng/Sect 06N/23E /02 5910 2ND ST NE C.O.S. #40 6-8-1970, TRACT FRIDLEY MN 55432-5443 13 IN THE W2SW4NE4 (REFORESTATION)19.96 AC, 1973 CHAMPION 14 X 66 MOBILE TN:M659079 Geo: 1517-02-1-01-01-0002 14 Total Due for Tax Payer 7305000000 WINTERS BERNICE F & ETAL Twn/Rng/Sect 10N/21E /13 MAIL TO WINTERS NORMAN NW4SE4, S2SE4 1710 INDIAN GARDENS DR Geo: 1913-13-4-02-01-0000 CLEARLAKE CA 95422-9736 14 Total Due for Tax Payer 7325000000 KEITH KERMIT W & PATRICIA A Sub/Blk/Lot BELMONT ORIGINA/ 424 DEAVERVIEW RD Twn/Rng/Sect 06N/22E /33 ASHEVILLE NC 28806-1315 BELMONT ORIGINAL TOWNSITE, 9/ 16 LOT 16 - 17 Geo: 1516-33-2-01-02-0000 14 3.93 02/05/15 GOLDEN VALLEY COUNTY 08:44:21 Uncollected Taxes with Delinquents with Legals Page: 10 of 10 Report ID: TX190F Property Type = REAL, Year 2014, Delinquent Only Interest Due as of 02/05/15 Tax Sale Tax ID Name/Legal ---------- ---------------------------------------- Certificate # Year Tax Amount ------------- ---- ------------ ---------- ---------- ------------ 3.93 0.08 0.07 4.08 2,054.45 41.10 37.70 2,133.25 2,054.45 41.10 37.70 2,133.25 123.22 2.47 2.26 127.95 123.22 2.47 2.26 127.95 476.25 9.53 8.74 494.52 476.25 9.53 8.74 494.52 13,023.30 260.47 238.91 13,522.68 Total Due for Tax Payer 7331000000 DAUM RONALD D & MARILYNN M TRUSTEES Penalty Interest Total Twn/Rng/Sect 06N/22E /05 PO BOX 63 N2 NORTH OF RR R/W, LESS LAVINA MT 59046-0063 HWY; 150.31 AC 20-Twn/Rng/Sect 06N/22E /06 N2 NORTH OF RR R/W, LESS HWY & LESS COS #2-2009 IN GOVT LTS 3 & 4 & COS #02-2010 IN THE S2NW4; 101.63 AC 30-Twn/Rng/Sect 07N/22E /31 ALL; 638.14 AC Geo: 1516-05-2-01-01-0000 14 Total Due for Tax Payer 7362000000 OX BOW RANCH COMPANY INC 10-Twn/Rng/Sect 06N/22E /11 PO BOX 223 NW4NW4, N2SW4NW4 LAVINA MT 59046-0223 Geo: 1516-11-2-02-01-0000 14 Total Due for Tax Payer 9932000001 MTPCS LLC Telecommunication Company Pers MR. ROSS DONOGHUE 1170 DEVON PARK DR STE 104 WAYNE PA 19087--2128 14 Total Due for Tax Payer # of Delq. 54 Grand Total

© Copyright 2026