Download English Version (pdf )

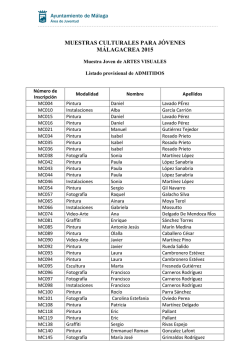

PT PLN (Persero) POWER GENERATION AND RENEWABLE ENERGY : ROADMAP AND OPPORTUNITIES PT PLN (Persero) – New and Renewable Division “P PRE-SUBMISSION MEETING HIBAH PEMBIAYAAN BERSAMA ENERGI TERBARUKAN” 1 JAKARTA, 03 FEBRUARY, 2015 AGENDA AGENDA PLN PROFILE IN RENEWABLE ENERGY DEVELOPMENT GEOTHERMAL POWER PLANT PROJECTS (GPPP) HYDRO POWER PLANT PROJECTS (HPPP) SOLAR PV PROJECTS BIOMASS POWER PLANT PROJECTS OPPORTUNITIES AND CHALLENGES ON RE DEVELOPMENT O O U S C G SO O AGENDA PLN PROFILE IN RENEWABLE ENERGY DEVELOPMENT GENERAL DESCRIPTION OF NATIONAL ELECTRICITY • High electricity load demand projection, with growth of 8.4% per year. • Relatively low electrification ratio (national average 78%), with average level of consumption per capita is 754 kWh. • The composition of the fossil fuel usage remained high – National : 12%. • Enormous potential for renewable energy (hydro and geothermal), but the use is still limited. • PLN limited investment capabilities • Private sector sector'ss role in the development of renewable energy driven by FIT (Feed in Tariff). 4 STATUS PENGEMBANGAN RE RENEWABLE ENERGY DEVELOPMENT PROGRESS Hydropower and Geothermal dominated the RE development in Indonesia because of the great potential and economical factors. Hydropower H d which hi h has h been b d l developed d to t the th stage t off operation ti are 3,867 3 867 MW (excluding own use HPP by a private developer), while geothermal been operating at 1,310 MW. Solar energy (PV): 9 locations have been operating at 3.6 MWp; The 100 island Solar PV program (21 MW) are under construction; The 1,000 islands solar PV program p g ((225 MW)) in the evaluation p phase. The role of the p private sector has indicated to develop 305 MW. Biomass: 61 MW already operating with most schemes as excess power to the grid. grid Minihidro: 1,394.6 MW will be developed by the IPP with appropriate FIT price. 112.3 MW phase in operation, 246.9 MW under construction, 221.0 MW in f di process, 415.7 funding 415 7 MW in i PPA process and d 400.2 400 2 MW is i still till a proposal.l Electricity Demand Forecast 2014‐2022 (High demand growth as of 8.4% annually) Year 2014 2015 2016 2017 2018 2019 2020 2021 2022 Demand (TWh) Demand (TWh) 207 226 244 264 284 306 329 356 385 Elec. Ratio ( % ) 82.6 85.9 88.9 91.9 93.7 96.3 96.8 97.4 97.7 6 AGENDA GEOTHERMAL POWER PLANT PROJECTS (GPPP) GEOTHERMAL POTENTIAL MAP GEOTHERMAL POTENTIAL MAP 55 LOCATIONS 2.519 MW 8 LOCATIONS 115 MW 26 LOCATIONS 954 MW 3 LOCATIONS 75 MW 86 LOCATIONS 13.516 MW 71 LOCATIONS 10,092 MW 27 LOCATIONS 1.767 MW Source : Geology Agency, MEMR (2010) Preliminary y survey Detailed Survey RESOURCE (MW) Speculative Hypothetical 8.780 4.391 Ready to be implemented % 45.36% Installed RESERVE (MW) % Possible Probable Proven 12.756 823 2.288 13.171 15.867 29.038 54.64% MAP OF GEOTHERMAL DEVELOPMENT 1 2 1 14 17 1 3 2 1 12 2 13 2 3 3 5 6 7 9 18 4 5 11 6 1 4 4 6 10 1 4 7 2 5 12 6 10 7 2 3 GEOTHERMAL PROJECTS IN BIDDING STAGE (940 MW) 1. SEULAWAH AGAM (2x55 MW) 2. PUSUK BUKIT (2x55 MW) 3. SIPOHOLON (1x55 MW) 4. BONJOL (3x55 MW) 5. WAY RATAI (1x55 MW) 6. DANAU RANAU (2x55 MW) 7. G.ENDUT (1x55 MW) 8. G. CEREMAI (2x55 MW) 9. UMBUL TELOMOYO (1x55 MW) 10.SEMBALUN (1x20 MW) 11.MATALOKO (3X5 MW) 12.MERANA/MASAINGI (2X10 MW) 13.SONGA WAYAUA (1x5 MW) 14.BORA PULU (1x55 MW) 15.OKA ILE ANGE (10 MW) 3 8 8 7 4 5 1. JABOI (2x5 MW) 2. SORIK MERAPI (3X80 MW) 3. SARULLA II (2X55 MW) 4. S. SEKINCAU (4X55 MW) 5 C. 5. C CISUKARAME (1X50 MW) 6. RAWA DANO (1X110 MW) 7. W. WINDU 3&4 (2X110 MW) 8. T. PERAHU I & II (170 MW) 9. TAMPOMAS (1X45 MW) 10.GUCI (1X55 MW) 11.BATU RADEN (2X110 MW) 12.NGEBEL/WILIS (3X55 MW) 13.IYANG ARGOPURO (1X55 MW) 14 BEDUGUL (1X10 MW) 14.BEDUGUL 15.HU’U (2X10 MW) 16.SOKORIA (3X5 MW) 17.JAILOLO (2X5 MW) 18.DIENG 2 & 3 (115 MW) 6 15 4 13 3 9 PPA DISCUSSION/ RENEGOTIATION 11 8 2 14 3 10 9 6 15 16 PPA SIGNED/PREPARATION EXPLORATION 1. 2. 3. 4. RAJABASA (220 MW) UNGARAN (1X55 MW) IJEN (2X55 MW) ATADEI (1x5 MW) CONSTRUCTION STAGE (155 MW) 1. PATUHA (120 MW) 2. ULUMBU (5 MW) 3. KAMOJANG 5 (30 MW) EXPLORATION STAGE 1. 2. 3. 4. 5. 6. 7. MUARA LABOH (220 MW) RANTAU DADAP (220 MW) SUNGAI PENUH (110 MW) HULULAIS (110 MW) ULUMBU (5 MW) KOTA MOBAGU (80 MW) TULEHU (20 MW) READY FOR EXPLOITATION/ FINACING CLOSE 1. 2. 3. 4. 5. 6. SARULLA I (330 MW) LUMUT BALAI (220 MW) ULUBELU 3&4 (110 MW) CIBUNI (10 MW) KARAHA BODAS (140 MW)) LAHENDONG 5&6 (40 MW) Contact us : PT PLN (Persero), Jl. Trunojoyo Blok M I/135, Jakarta 12160 Phone : 62‐21‐7261875 Fac : 62‐21‐7221330 PRODUCTION STAGE (1313.5 (1313 5 MW) 1. SIBAYAK (12 MW) 2. KAMOJANG (210 MW) 3. WAYANG WINDU (220 MW) 4. GN. SALAK (360 MW) 5. DARAJAT (255 MW) 6. DIENG (60 MW) 7 ULUMBU (5 MW) 7. 8. MATALOKO (1,5 MW) 9. LAHENDONG (80 MW) 10. ULUBELU 1&2 (110 MW) Additional Capacity of Geothermal as of PLN ‐ RUPTL 2013‐ 2022 (Total 6060 MW) • Most geothermal plants are expected to be commissioned between 2017 – 2022. Pengembangan PLTP sesuai RUPTL (2013‐2022) 2000 • Exploration and financing are the critical factors Some of those WKP not yet offered factors. to investors/bidding has not taken place. 1800 1600 1400 1200 MW 1000 IPP/Liswas 800 PLN 600 400 • Strong Regulatory and permits are required . • Most geothermal (93%) will be developed in Java and Sumatra, 89 % will be developed byy IPP. 200 0 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 RENCANA TAMBAHAN KAPASITAS PLTP MASUK SISTEM PLN SESUAI RUPTL 2013‐2022 TAHUN 2013 2014 2015 2016 2017 SUMATRA 0 0 0 55 330 JAWA‐BALI 0 55 30 30 225 LUAR JBS 0 5 0 0 25 TOTAL 0 60 30 85 580 KOMULATIF 0 60 90 175 755 2018 445 0 50 495 1250 2019 360 1275 30 1665 2915 2020 490 110 50 650 3565 2021 405 220 45 670 4235 2022 770 855 200 1825 6060 TOTAL 2855 2800 405 6060 10 AGENDA HYDRO POWER PLANT PROJECTS (HPPP) HYDROPOWER POTENTIAL IN INDONESIA HYDROPOWER POTENTIAL IN INDONESIA 75 GW (Hydropower Potential Study 1983) with 3,9 GW IN OPERATION 75 GW (Hydropower Potential Study 1983) SOUTH, CENTRAL & EAST KALIMANTAN 16.844 MW ACEH 5.062 MW NORTH SUMATERA 3.808 MW NORTH & CENTRAL SULAWESI 3.967 MW WEST SUMATERA & RIAU 3.607 MW WEST KALIMANTAN 4.737 MW SOUTH SUMATERA, JAMBI, BENGKULU & LAMPUNG 3.102 MW CENTRAL JAVA 813 MW MOLUCCA 430 MW PAPUA & WEST PAPUA 22.371 MW SOUTH, SOUTH-EAST & WEST SULAWESI 6.340 MW BALI & NUSA TENGGARA 624 MW WEST JAVA 2.861 MW EAST JAVA 525 MW 12 HYDROPOWER DEVELOPMENT STATUS Construction (1,525.4MW), PPA process (1,819 MW) & Study/Design (2,131 MW) ACEH( 144 MW ) ACEH ( 86.4 MW ) 1. PEUSANGAN 1&2 (86.4 MW) NORTH SUMATERA ( 219 MW ) 1 MASANG-2 (52 MW) 1. 1. WARSAMSON (46.5 MW) 2. ORYA-2 (10 MW) SOUTH & WEST SULAWESI( 640 MW ) NORTH SUMATERA ( 589 MW ) 1. MALEA (90MW) 2. BONTOBATU (100 MW) 3. KARAMA ( 450 MW ) 1. BATANG TORU (550 MW) 2. HASANG (39 MW) 1. ASAHAN III (174 MW) 2. WAMPU (45 MW) WEST SUMATERA ( 52 MW ) PAPUA( 56.5 MW ) 1. PEUSANGAN IV (85 MW) 2. MEUREBO-2 (59 MW) PAPUA ( 70 MW ) 1. GENYEM (20 MW) 2. BALIEM (50 MW) NORTH SUMATERA ( 90 MW ) MOLUCCU ( 54 MW ) 1. SIMANGGO-2 (90 MW) 1. TALA (54 MW) KALIMANTAN ( 313 MW ) 1. KUSAN (65 MW) 2. NANGA PINOH (98 MW) 3. KELAI (150 MW) JAMBI ( 350 MW ) 1. MERANGIN (350 MW) JAVA( 1,094 MW ) 1. 2. 3. 4. KARANGKATES 4&5 (100 MW) KESAMBEN (32 MW) KALIKONTO (62 MW) MATENGGENG PS (900 MW) LAMPUNG( 56MW ) 1. SEMANGKA(56MW) SULAWESI ( 437 MW ) 1. 2. 3. 4. 5. SAWANGAN (12 MW) BAKARU II (126 MW) POKO (234 MW) KONAWE-1 (50 MW) WATUNOHU (15 MW) NUSA TENGGARA( 34.5 MW ) 1. WAI RANCANG (16.5 MW) 2. BEH-1 (18 MW) TAHAP KONSTRUKSI WEST JAVA ( 1,150 , MW ) 1. UPPER CISOKAN PS (1,040 MW) 2. JATIGEDE (110 MW) WEST JAVA( 40 MW ) 1. RAJAMANDALA (40 MW) NEGOSIASI PPA TAHAP STUDY / DESIGN 13 HYDROPOWER DEVELOPMENT PLAN HYDROPOWER POTENTIAL IN INDONESIA HYDROPOWER DEVELOPMENT PLAN 75 GW (Hydropower Potential Study 1983) with 3,9 GW OPERATION (6.3 GW up to 2021 and 12.9 GW up to IN 2027) (6.3 GW up to 2021 and 12.9 GW up to 2027) Hydro Power Potential Study (1983) : 75.000 75 000 MW – 1,249 Location Kalimantan K li t 431 MW Review Hydro Power Potential Study (1999) 3rd Screening : 21.480 MW -167 Location Sulawesi 3239,6 MW Hydropower Master Plan Study ( 2011 ) : 12.894 12 894 MW – 89 Location Maluku 156,4 MW Papua 49 MW Sumatera 4.408,4 MW JAWA 44.594,5 594 5 MW Nusa Tenggara 15 MW 14 HYDROPOWER DEVELOPMENT PLAN ( Add. Capacity : 5.684 MW + 1.480 MW small Hydro ) 1400 Innstalled Capacity (MW W) 1200 1000 800 Java‐Bali West Indonesia 600 East Indonesia 400 200 0 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 Year • FTP II (11 projects with total 1753 MW) o PLN Projects : 3 large hydro power projects with the total 1269 MW (174 MW under construction, 1040 MW Pre construction and 55 MW under study and design) o IPP Projects : 8 large hydro power projects with the total 484 MW (45 MW HEPP under construction) • Non FTP II : o 4 PLN’s hydropower projects (266.4 MW) under construction o 4 IPP’s hydropower projects (1,409 MW) under PPA negotiation o 42 Mini hydro ( PLN & IPP ) projects (190 MW) under construction 15 Minihydro Development Program (PLN 10 (PLN 10 years planning/RUPTL) l i /RUPTL) 16 MHPP DEVELOPMENT BY IPP ( October 2014 ) REGION / STATUS EAST INDONESIA Operation Construction Financing PPA process P Proposal l SUMATERA Operation Construction Financing PPA process Proposal JAVA BALI Operation Construction Financing PPA process p Proposal GRAND TOTAL NUMBER 82 20 11 6 22 23 119 11 23 20 33 32 112 17 13 12 33 37 313 IPP COMMULATIVE CAPACITY (kW) 306,170 56 840 56,840 20 42,700 31 22,700 37 98,330 59 85 600 85,600 82 699,042 37,625 11 149,858 34 143,748 54 204,900 87 162,911 119 389,405 17,870 17 54,390 30 54,600 42 112,926 75 149,619 112 1,394,617 COMMULATIVE CAPACITY (kW) 56,840 56 840 99,540 122,240 220,570 306 170 306,170 37,625 187,483 331,231 536,131 699,042 17,870 72,260 126,860 239,786 389,405 17 BUSINESS SCHEME – MHPP DEVELOPMENT BY IPP Consortium Consortium C ti Member Consortium Member Consortium Member Consortium C ti Member EQUITY • Local Government • MEMR • MOPW • M-FORESTRY • ETC. Lenders Permits Special Purpose Company PPA EPC Contractor 18 MHPP IPP DEVELOPMENT STATUS MHPP IPP DEVELOPMENT STATUS Status IPP N b Number C Capacity (kW) it (kW) Operation 49 115,335 Under Construction Under Construction 49 255 428 255,428 Financing Process 42 249,068 PPA Process PPA Process 80 385 936 385,936 Proposal 94 408,218 314 1 413 985 1,413,985 Grand Total Grand Total 19 TIMELINE BEFORE PPA TIMELINE BEFORE PPA Application for appointment as hydropower developer Proposal (Pre FS) 30 WD Technical Verification 30 WD Submission of certificate of deposit 30 WD / penalty 1 appointment as hydropower hydropower developer Penalty 1 : • Revocation of appointment as hydropower developer • Prohibition for similar application for 2 years in a row Penalty 2 : • Penalty 1 + • 25% of the deposit belongs to the government 20 WD : Working Day Submission of FS and other documents 90 HK Temporary IUPTL 30 WD / Penalty 2 PPA Signing TIMELINE AFTER PPA TIMELINE AFTER PPA • > 3 - 15 monthsÎ Tariff Recuction Penalty • > 15 monthsÎ Penalty 4 End of PPA End of PPA PPA Signing IUPTL Construction 15 months/ Penalty 3 20 months Fi Financial i l Close Cl 18 8 months COD Fi Financing Date i D 24 months Penalty 3 : • Penalty 1 + • 50% of the deposit belongs to the government Tariff Reduction Penalty (applied for the first 8 year) : • Delay start construction up to 3 months, subject to a 1% tariff reduction; • Delay start construction of more than 3 months to 6 months, subject to a 2% tariff reduction; • Delayy start construction over 6 months,, subject j to a 3% % tariff reduction Penalty 4 : (Delay start construction over 15 months) • Penalty 1 + • The entire deposit certificates submitted and has not been used for physical development belongs to the government 21 MHPP FEED‐IN‐TARIFF MHPP FEED IN TARIFF 22 MHPP DEVELOPMENT ISSUES • TECHNICAL ASPECT (location and design, hydrology, planning & management of dam, infrastructure safety, reliability & efficiency of assets) • ENVIRONMENTAL ASPECT (downstream (d t flow fl off the th dam, d erosion i & sedimentation, water & air quality, biodiversity & endangered species, trash, etc) • SOCIAL ASPECT ((Communities affected by y the p project, j , relocation & resettlement,, communities around the project site, historic buildings, public health, etc) • ECONOMIC, FINANCIAL & REGULATION ASPECT (economic & financial feasibility project benefits, feasibility, benefits procurement, procurement financing, financing permit, permit etc) • INTEGRATIVE ASPECT (suitability of demand & development strategy, communication & consultation, g governances, integrated g project j management, g planning integration, environmental management & social issues, etc) 23 AGENDA SOLAR PV AND WIND PROJECTS 24 PLN SOLAR PV DEVELOPMENT STRATEGIES Background : • Indonesia has many remote islands, • Electricity in remote islands are still used a lot of HSD Electricity in remote islands are still used a lot of HSD Diesel fuel, • Transportation of fuel to remote islands are very expensive and complex expensive and complex. Objectives : • To reduce the use of fossil fuel, To reduce the use of fossil fuel • To increase the electrification ratio. Prioritization :: Prioritization • For areas with low electrification ratio ( below 60% ) and no other sources of renewable energy, • Will not increase the electricity production cost of the existing electricity systems. 25 IMPLEMENTATION PROGRAM FOR SOLAR PV (2012‐2014) TOURISM ISLANDS (6 LOCATION – 0.92 MWp) : IN OPERATION 100 ISLANDS STAGE I (2011) ((36 LOCATIONS)) SOLAR PV PROGRAM FRONTIER ISLAND (8 LOCATIONS – 1.34 MWp) IN OPERATION 100 ISALNDS STAGE II (2012) (78 LOCATIONS) 1000 ISLANDS (672 LOCATIONS) 1000 ISLANDS PROGRAM (861 LOCATIONS) TOTAL REGION LOCATIONS CAPACITY (MWp) WEST IND 358 61,8 EAST IND 293 50,5 JAVA ‐ BALI 21 , 6,3 TOTAL 672 118,6 IPP ISOLATED (LARGER THAN 1 MW) : 71 LOCATIONS 1. The 1000 islands project : 141 locations start in 2012 (PLN Budget) and 402 locations under funding preparation 2. The IPP Solar PV project : more than 5 MW capacity (Regulation under preparation) 3. FIT for Solar PV has been issued 4. PLN standard for Solar PV has been issued. Under reviewed additional location (185 locations), total will be 857 locations 26 PV AND WIND POWER PLANT PROJECTS OF PLN INDONESIA -Average Solar Irradiation between 4 – 6 kW/m2 . Most higher radiation is in Eastern of Indonesia - Estimating, the radiation can generate energy about 3.7 kWh/day. EAST KALIMANTAN EAST KALIMANTAN Location: SEBATIK SEBATIK Island Capacity : 300 kWp Status : Operation Location: DERAWAN Island Capacity : 170 kWp + Battery Status : Operation on March 2011 RIAU&KEPRI Location: TAREMPA ANAMBAS Island Capacity: 200 kWp Status : Operation RIAU&KEPRI Location: MORO. KARIMUN Island Capacity: 200 kWp Status : Operation NORTH SULAWESI Location : MIANGAS Island Capacity : 30 kWp Status : Operation on Oct 2011 EAST KALIMANTAN NORTH MALUKU NORTH SULAWESI Location: BUNYU BUNYU IIsland l d Capacity : 150 kWp Status : Construction Location : MOROTAI Island Capacity : 600 kWp Status: Operation on April 2012 Location : MARAMPIT Island Capacity : 50 kWp Status : Final Construction NORTH SULAWESI Location : BUNAKEN Island Capacity : 335 kWp + Battery Status : Operation on Feb. 2011 WEST SUMATERA Location: SIMALEPET SIPORA Island Capacity: 40 kWp Status : Operation WEST NUSA TENGGARA SOUTH SULAWESI Location : GILI TRAWANGAN Capacity : 200 kWp Status : Operation on Feb 2011 Location: TOMIA Island Capacity : 75 kWp Status : Operation on May 2011 PAPUA Location: SAONEK RAJA AMPAT Islands Capacity : 40 kWp Status : Operation on Dec. 2010 MALUKU WEST SUMATERA Location: BANDA NAIRA Capacity : 100 kWp Status : Operation on Dec. 2010 Location: TUA PEJAT SIPORA Island Capacity: 150 kWp Status : Operation BALI Location L ti : NUSA PENIDA Capacity : 3x85 kW : Wind Turbine Projects Status Blok M I/135, Jakarta 12160 Phone : 62‐21‐7261875 Fac : Existing owned by PLN Contact us : PT PLN (Persero), Jl. Trunojoyo EAST NUSATENGGARA : 62‐21‐7221330 Location: L ti LEMBATA Capacity : 200 kWp Status : Operation on Sept 2011 : Photovoltaic Projects Contact us : PT PLN (Persero), Jl. Trunojoyo Blok M I/135, Jakarta 12160 Phone : 62‐21‐7261875 Fac : 62‐21‐7221330 27 1000 ISLANDS – PV DEVELOPMENT PROGRAM PV Development Program up to 2020 : 620 MW NAD: 44 lokasi, 7.4 MWp Kaltim: 30 lokasi 24,9 MWp Sumut: 27 lokasi 6.1 MWp Ri Riau: 151 lokasi l k i 60.1 60 1 MWp MW Babel: 16 lokasi 35.0 MWp Sulut, Sulteng, Sulut Sulteng Gorontalo: 39 lokasi 30.9 MWp Maluku, Malut: 29 lokasi 33.5 MWp Kalbar: 63 lokasi 40.1 MWp Papua, Pabar: 66 lokasi 44.9 44 9 MWp Sumbar: 42 lokasi 7.7 MWp Sumsel, Jambi, Bengkulu: 6 lokasi 3.4 MWp Kalselteng: 96 lokasi 48.7 MWp Sulselrabar: 17 lokasi l k i 29.7 29 7 MWp MW Lampung: 18 lokasi 2.5 2 5 MWp Jabar, Banten: 3 lokasi 1.1 MWp Jateng DIY: 5 lokasi 0.7 MWp NTT: 99 lokasi 45.2 MWp Jatim: 12 lokasi 4.3 MWp Bali: 1 lokasi 0.3 MWp NTB: 15 lokasi 44.5 MWp 28 PENGEMBANGAN WIND POWER WIND POWER DEVELOPMENT • The wind power potential in Indonesia is relatively low because the average wind speed in Indonesia is also low (<5 m/s). • Wind Power development program up to 2020 are 200 MW, and currently still in the procurement process or studies. p North Maluku : 1 location, 10 MW South Sulawesi (): 1 llocation, ti 70 MW West Java (Sukabumi): 2 locations, 10 & 30 MW Yogyakarta (Samas): 1 location, 50 MW NTT (Sumba & Timor): 2 locations, 10 & 10 MW Bali (Nusa Penida): 1 location, < 1 MW 29 AGENDA BIOMASS POWER PLANT PROJECTS 30 PLN PROGRAM ON BIOMASS POWER PLANT (1) • Biomass Power Plant using palm shells, bagasse, rice husk, wood chips and municipal waste has great potential in I d Indonesia, i • Private role in the development of Biomass PP driven by IPP scheme or Excess Power transaction scheme or Excess Power transaction, • PLN is preparing Pilot Plants on small scale Biomass PP (capacity of 500 kW to 1 MW) using wood chips to replace (capacity of 500 kW to 1 MW) using wood chips to replace the role of Diesel PP, • PLN plan to reduce the fuel consumption of 12% (2013) to PLN plan to reduce the fuel consumption of 12% (2013) to only 2% (2022). Small‐scale renewable energy development including Biomass PP use as an option. g p Biomass PP Development until 2022 : 363 MW 31 PLN PROGRAM ON BIOMASS POWER PLANT (2) Pilot project Biomass PP – Gassification scale 1 MW p model of Biomass PP – small scale • PLN is testingg the development Gassification (0.5 to 1 MW) : Demonstration Plant in Bangli is in the development process. • Biomass PP planned for areas which still operates Diesel PP. • Using thermal conversion technology (gassification) which has good efficiency, high reliability and ease of operation. • Sources of raw materials is from energy forests managed by local communities iti (C (Community it B Base Development). D l t) • Cooperation program with the Local Government / Ministry of F Forestry t in i th the provision i i off llandd / ffeedstock. d t k 32 BIOMASS POWER PLANT PROJECTS SUMATERA UTARA SUMATERA UTARA SUMATERA UTARA SUMATERA UTARA RIAU Harga Rp/kWh : Rp.785.4 Kapasitas : 6 MW Jenis Kontrak : Excess Power Harga Rp/kWh : Rp.785.4 Kapasitas : 9 MW Jenis Kontrak : Excess Power Harga Rp/kWh : Rp.785.4 Kapasitas : 10 MW Jenis Kontrak : Excess Power Harga Rp/kWh : Rp.785.4 Kapasitas : 10 MW Jenis Kontrak : Excess Power Harga Rp/kWh : Rp. 787 Kapasitas : 5 MW Jenis Kontrak : Excess Power RIAU Harga Rp/kWh : Rp. 650 Kapasitas : 2 MW Jenis Kontrak : Excess Power RIAU Harga Rp/kWh : Rp. 764 Kapasitas : 5 MW Jenis Kontrak : Excess Power RIAU Harga Rp/kWh : Rp. 764 Kapasitas : 2 MW Jenis Kontrak : Excess Power BANGKA Harga Rp/kWh : Rp. 766 Kapasitas : 5 MW Jenis Kontrak : IPP JAWA BARAT JAWA BARAT Harga Rp/kWh : Rp. 820 Kapasitas : 6 MW Jenis Kontrak : IPP Harga Rp/kWh : Rp. 820 Kapasitas : 6.5 MW Jenis Kontrak : IPP BALI Harga Rp/kWh : Rp. Rp 820 Kapasitas : 2 MW Jenis Kontrak : IPP BELITUNG Harga Rp/kWh : Rp. 787 Kapasitas : 7 MW Jenis Kontrak : IPP Contact us : PT PLN (Persero), Jl. Trunojoyo Blok M I/135, Jakarta 12160 Phone : 62‐21‐7261875 Fac : 62‐21‐7221330 Contact us : PT PLN (Persero), Jl. Trunojoyo Blok M I/135, Jakarta 12160 Phone : 62‐21‐7261875 Fac : 62‐21‐7221330 33 PROGRAM ON BIOMASS POWER PLANT – IPP Increasing participation of the private developers, both as a IPP developers and/or excess power. p / p • The technology used is generally "Combustion" and “Gassification" • Facilitating private developers in the development of Biomass PP and Biogas PP, which PLN will be the Offtaker or Buyer. • Until now 92.5 MW Biomass PP has contracted and operates, and another 54 MW Biomass PP under construction. 34 BIOMASS PP DEVELOPMENT PROGRAM ( IPP & Excess Power ) Biomass PP Development Summary 2014 Status Operation p Construction PPA process FS Proposal G dT t l Grand Total Number Capacity (MW) 20 92.5 6 54 5 25.4 6 43 7 58.5 44 273 4 273.4 COD (estimated) 2014‐2016 2015‐2016 2016 ‐2017 2017‐2018 35 AGENDA OPPORTUNITIES AND CHALLENGES OPPORTUNITIES AND CHALLENGES ON RE DEVELOPMENT OPPORTUNITIES • Huge of renewable energy resources availability. • High electricity demand growth rate. • Availability of commercially proven technology. • Supported by government policy and PLN. • In line with the international perspective of clean energy. CHALLENGES • Availability of renewable energy resources and the electricity demand are not always match. Availability of renewable energy resources and the electricity demand are not always match • Readiness rudimentary regulation while RE is highly dependent on many regulations, because it involves many stakeholders (ministries, local governments) that could potentially inhibit each other inhibit each other • RE development costs relatively more expensive. • RE relatively newer technology and more complex, especially Solar PV, Wind and Biomass. • Risk factors are higher because of the nature, location, etc. • The availability of competent human resources are still limited. 37 Thank You 38

© Copyright 2026