PROCUREMENT MATTERS - Expense Reduction Analysts

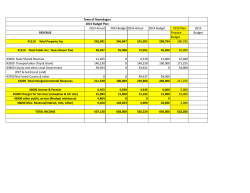

PROCUREMENT MATTERS The latest news from Expense Reduction Analysts Issue No. 15.1 Karndean Designflooring Continues to drive its costs lower Expense Reduction Analysts’ specialists deliver significant cost reduction and multiple process improvements across a wide range of categories. Karndean International, based in Evesham, is a leading global supplier of commercial and residential luxury vinyl flooring, faithfully reproducing the beauty and look of natural materials such as wood and stone. They operate in a very competitive market place, so control and reduction of overhead costs is a key priority in continuing to deliver the best prices to its customer base. Steve Rundle, one of ERA’s Business Development Managers met with Karndean’s Alan Massey and 11 categories were originally agreed upon – Electricity and Gas, IT Hardware, Fleet, Postage, Couriers, Office Supplies, Packaging, Print (not Media), Merchant Cards and Communications – with a further seven joining them over the next couple of years, assuming results warranted such action – Photocopiers, Inbound Freight, Water/Wastewater, Business Rates, Insurance, Waste and Recycling, and Facilities Management. Tony Catling, Client Relationship Manager for these projects, takes up the story: “The European Outbound Courier project was conducted by Charles Reid, and this proved to be a catalyst in our evolving relationship with Karndean. Having been pretty confident that they were achieving very good value from their incumbent provider, Karndean were greatly impressed by the... (Continued on the back page) In association Also in this issue... Utilities Market Update ‘Broke’ the Broker Eyesight Tests for At-Work Drivers Finding the Perfect Match BRC Pushes for Rates Relief S amsung Shakes Up Managed Print S tretching the Meeting’s Budget Plotting Your Transformation There can be no discussion about procurement without talking about cost savings. Being defined by something as narrow as savings means that teams are often bound to transactional ways of thinking and the better they perform here, the more they become siloed, stereotyped and, perhaps, disregarded. This paradigm forces the savvy procurement chief to orchestrate change that can simultaneously deliver to expectations, but also demonstrate potential and open internal conversations that touch on value, the kind recognised by finance, treasury and even shareholders. In a sense, there is no roadmap for that kind of journey, but for every team that attempts to break out from that well-worn view of the function there are key changes that need to happen, both in terms of capabilities, communications, attitude and priorities. Individuals that can make that happen are worth their weight in gold. That is precisely why Procurement Leaders has teamed up with Expense Reduction Analysts (ERA) to deliver a white paper designed to spearhead innovation in procurement. smarter spending > www.expense-reduction.co.uk with INSIGHT PL OTTING YO UR TRANSF ORMATION For your free copy of this white paper, visit our website expense-reduction.co.uk or call us on 02380 829 737. Procurement Matters > Issue No. 15.1 Utilities Market Report By Richard Clayton UK wholesale energy prices rose during November with gas rising just under 5% to 1.90 p/kWh and electricity up 2.5% to 5.00 p/kWh. Oil prices continued their dramatic fall and ended the month 19% down at $70.00/ barrel whilst coal rose 2% to $74.00/ tonne. UK wholesale energy prices rose during November with gas rising just under 5% to 1.90 p/kWh and electricity up 2.5% to 5.00 p/kWh. Oil prices continued their dramatic fall and ended the month 19% down at $70.00/ barrel whilst coal rose 2% to $74.00/ tonne. With very little consensus on the likely winter weather, and the gas market jittery with an unplanned outage in the Norwegian sector of the North Sea, UK energy prices were prone to considerable volatility during November and this uncertainty countered significant falls in the price of oil and LNG. It is likely that more LNG cargoes will find their way to the UK as LNG prices have fallen in Asia (as they are indexed to falling oil prices) and the Japanese regulators have now given the green light for the restart of two nuclear plants in early 2015 with more likely to follow. The glut in the oil market has been caused in part by increased supplies from US shale and reduced demand from Europe and China. OPEC members have recently failed to find a compromise on supply cuts. Power prices rose in line with gas costs as gas fuelled power generation rose to about 40% of total electricity generation. As ever at this time of the year market sentiment depends very heavily on the weather. Accelerated closure or “retirement” of significant conventional power generating capacity has left the UK market with very little marginal capacity. Whilst there has been considerable year on year growth in renewable input, particularly with on and offshore wind and some solar, the problem of intermittency remains and so conventional capacity is still required for those periods, especially during winter when there is little sun or wind. The need for investment in the power sector is likely to continue to be reflected in rises in the non-commodity cost elements, both in terms of distribution and transmission costs and in periodic increases in government environmental taxes designed to subsidise continued investment in renewables. Daily Market Price Report – Annualised Baseload Gas (p/therm) Electricity (£/MWh) 75 70 65 60 55 50 02 .1 2. 20 02 12 .0 1. 20 02 13 .0 2. 20 02 13 .0 3. 20 02 13 .0 4. 20 02 13 .0 5. 20 02 13 .0 6. 20 02 13 .0 7. 20 02 13 .0 8. 20 02 13 .0 9. 20 02 13 .1 0. 20 02 13 .1 1. 20 02 13 .1 2. 20 02 13 .0 1. 20 02 14 .0 2. 20 02 14 .0 3. 20 02 14 .0 4. 20 02 14 .0 5. 20 02 14 .0 6. 20 02 14 .0 7. 20 02 14 .0 8. 20 02 14 .0 9. 20 02 14 .1 0. 20 03 14 .1 1. 20 14 45 Whilst every reasonable care is taken in the compilation of the information contained within this document, any opinions expressed, errors or omissions are not the responsibility of the publisher. smarter spending > www.expense-reduction.co.uk Procurement Matters > Issue No. 15.1 Finding the Perfect Match Picking the right supplier depends on client priorities, the relative size of both parties and spend levels, and ensuring the right cultural fit An interview with Simon Phippen & Sue Cooke Finding the right supplier for your requirements is not as it easy as it perhaps sounds. As well as identifying potential options and assessing the likely costs, organisations need to consider a multitude of other factors, some of which are all too often overlooked. Knowing Where to Begin A good starting point, says Simon Phippen, project specialist at Expense Reduction Analysts, is to understand the current situation, particularly around just how important a category of spend is to the ability of the business to operate effectively. “The most important thing to do is to understand how important a particular supplier is to you and where the power lies in that relationship,” he says. “If they’re a monopoly supplier and it’s a product that is absolutely strategic to your business then the power is on their side, whereas if you’re buying some biros and paper from a stationery company the boot is very much on the other foot.” Phippen suggests dividing categories – and suppliers – into strategic and transactional, depending on just how important they are to the business and the necessity of what is being procured. “Sometimes companies spend a lot of time on a transactional supplier, saying they don’t want to single source, but even if it went down on Monday they would find another by Wednesday and the goods would be in their warehouse by Friday,” he says. In that scenario, picking a single supplier and leveraging buying power to get the best deal is often the best option. On the other hand, some products may seem insignificant – and not account for much value in terms of spend – but are in fact essential to the overall working of the business, and here it is key that the right suppliers are found and risk minimised. Spend Doesn’t Always Mean Value Phippen gives the example of a high-end manufacturing organisation which had used a pallet supplier from around the corner for years, but was effectively relying on a one-man band. “If they had no pallets they couldn’t make any deliveries,” he says. “If that one man got hit by a bus or the factory went up in fire, they would be very exposed. It doesn’t really link to the spend amount; it’s what it is and where could you get it from if the supplier went down.” A supplier review is also a good opportunity to check organisations are using the supply chain in their particular industry to best effect. Phippen gives the example of buying pallet loads of products from a distributor, where such orders could be better served – and cheaper – by going direct to a manufacturer. “But if you’re running an engineering supplies project you’re not going to go to 26 different manufacturers; that’s where you need the value-add of a distributor,” he adds. Size Does Matter Once a strategy has been adopted, the process of finding the best fit can begin. Being clear about priorities is important. “If a business is really focused on reducing costs then you might choose to involve a supplier that has good ability to come in with low pricing, but you might compromise a bit on the service,” says Dr Sue Cooke, project specialist at Expense Reduction Analysts. identifying the supplier’s turnover and the estimated value of spend that would be put their way. “If you account for more than 5% of their turnover then you will come on their radar, both in terms of what you’re requesting in price and conditions but also risk,” he says. Finding the Perfect Match Once a shortlist of potential suppliers has been developed, organisations need to find the one that best suits their requirements, and culture can be important here. “To determine the best cultural fit, I’d suggest a beauty parade because personal relationships become key,” says Cooke. “Here you would invite suppliers in to evaluate the products and/or services they are suggesting they would supply. That will also give procurement teams and internal customers the chance to identify which supplier they think they could work with. With complex categories it also gives the supplier the chance to check their offer, having seen for themselves what is required.” The size of the supplier can be important, particularly in strategic categories. “You need to think about how far up the food chain within the supplier you can go if something goes wrong,” warns Cooke. “Often with larger, national suppliers, procurement only ever gets as far as an account manager so if there are problems they have no means of escalating it to get it resolved. If you’re dealing with larger spend categories you then become more important to that supplier.” Buying organisations can even work out just how important their business would be to a particular supplier, says Phippen, by smarter spending > www.expense-reduction.co.uk Another option is to conduct site visits to potential suppliers, says Phippen. “That allows you to look at the suppliers’ health and safety, quality manuals and other documentation, and how they process orders; you can go the full 10 yards in terms of their process management,” he says. “While you’re doing that you’re getting an overall impression of how the company is run, right from the moment you walk up to the front door.” Ultimately the most effective and longest-lasting relationships are those which are built around mutual trust and respect and where there is a realisation on both sides that everyone has to benefit. “The most efficient category reviews are those where you have a functional business relationship between the person with responsibility in the buying organisation and the one who has responsibility on the supplier side,” says Cooke. “Being fair, open and honest with suppliers is the best way to make it work.” Procurement Matters > Issue No. 15.1 BRC Pushes for Rates to be Dropped for Small Retailers By Paul Giness Back in June, the British Retail Consortium (BRC) called for some smaller retail properties to be freed from paying business rates. As part of a wider consultation on business tax structure reform, the BRC argued that such a move could slash costs for up to 100,000 small businesses. But would dropping thousands of business spaces from tax leave a massive hole in the Exchequer’s coffers? Business rates have been around for hundreds of years in various guises. Despite their burden on high street businesses, the system of taxation has changed very little. The government recently undertook a consultation on shaking up the system, however, and the BRC had a pretty radical suggestion: dropping properties with a rateable value of less than £12,000 from paying anything at all. Business Rates net the government over £27bn annually so, on the surface of it, this could leave the treasury with a hole in its finances. But numbers from the BRC tell another story. According to the Consortium, the smaller businesses that might benefit from the change make up 64% of the total number of firms paying the charge. Despite this, however, the amount that the government makes from them is just 6% of the total income generated by Business Rates. Although not announcing any radical changes in his Autumn Statement, Chancellor George Osborne did confirm the doubling of the Small Business Rates Relief incentives for 2015/16, with inflation-linked increase in business rates being capped at 2%. Targeting the high streets, Osborne also announced that the Retail Relief aimed at many shops, pubs and restaurants will be increased by 50% to £1,500 next year. Considering changes already in the pipeline, would dropping rates for some businesses be necessary to boost growth on the high street? “Business rates are a constant worry for our clients,” says Paul Giness of Expense Reduction Analysts Property Team, “but the government is helping by providing incentives to small businesses and giving more powers to councils via the Localism Act. In addition, assuming the 2017 revaluation goes ahead as indicated by recent announcements, this should Samsung Shakes up Managed Print By Andrew Kinnear The Managed Print Services (MPS) market continues to evolve beyond the core services of device consolidation towards driving improved business efficiency around paper processes. Xerox, Ricoh, HP, Canon, Konica Minolta and Lexmark remain the market leaders but there are some notable new strong performers. Kyocera are continuing to increase market share and increase their dealers and service network. Samsung last month launched 10 new Multifunction Devices (MFDs) to the European market. Their printers are the first to be equipped with an Android operating system, featuring a 10 inch full touch screen that enables users to search and print from web browsers, email, images, and other content without the need to connect to a PC or Server. Customers now want more from a traditional MPS model, as they are already receiving cost savings and energy efficiencies derived from device consolidation. Now they are seeking MPS Suppliers to understand in more detail the complexity of their print infrastructure, removing the IT burden and focusing more on users’ printing habits rather than device usage. This enables them to make decisions based on fact rather than on a ‘print volume count’, whilst helping them focus on innovation and employee satisfaction. The likes of Samsung with their new devices are likely to focus other manufacturers on providing their own new range of products using their own innovative uniques and enhance existing services such as mobile print. The next couple of years will see a transformation of a new generation of Managed Print Services. smarter spending > www.expense-reduction.co.uk rebalance the valuations to reflect the current state of the property market”. While the BRC argues that a boost in high street business and a drop in enforcement costs would even out any losses, there is some hesitation about the idea. “Asking any government to drop taxes is a hard sell and although there’s no guarantee that the treasury will act on this Consultation, we await the news in 2016 with interest,” continues Paul. “In the meantime, however, there are already substantial rate reliefs available, if you know where to find them.” Procurement Matters > Issue No. 15.1 ‘Broke’ the Broker By Chris Coomber Most people think that when it comes to buying a product or service, obtaining the best possible deal means getting prices and specifications from the widest possible range of potential suppliers and then comparing the results. This might be true where the product in question is office stationery, IT equipment or services such as telecoms and utilities. However, it’s emphatically not the case when the product being purchased is an insurance programme or package. Despite this, most purchasers persist in the belief that by placing their existing intermediary in direct competition with another broker, or even better a number of brokers, they will achieve the best possible combination of premium, cover and service for their business or organisation. Unfortunately, they are completely mistaken. insurer’s perception of the exposure presented carries more weight than the reality, particularly where that reality is not effectively presented by the intermediary. Despite its large economic size, the insurance market – especially at the insurer level – is still quite an intimate one, built on personal relationships. The current insurance market remains very competitive, despite brokers talking up the market. To ensure you are receiving the most effective and economic programme bespoke to your requirements it is necessary to engage with a truly independent market review where there are no vested interests impacting on the outcome. Because of this, underwriting decisions can, and often are, driven by market sentiment or commercial relationships rather than the individual merits of the risk being presented. All too often the A broker is not in this position as they will be looking to ‘win’ or retain your business. It is therefore necessary to ‘broke’ the broker whilst also examining the market avoiding the aforementioned issues. Eyesight Test for At-Work Drivers – Where do you see it going? By Sean Bingham EU legislation states that every commercial driver has to have an eye test every 5 years. The unanswered question is who is going to be responsible for making sure it happens? Duty of Care would suggest that it’s down to the employer but should it be something the employer wants to do willingly without an EU directive? The Royal National Institute for the Blind (RNIB) has found that around 13 million motorists on Britain’s roads are not wearing the glasses or contact lenses needed to correct their vision while behind the wheel and that’s just the drivers who have prescription eye wear. How many more haven’t even had an eye test since 2011? RAC figures suggest there’s just under 36 million drivers on the UK roads so that means that a third of the drivers probably aren’t wearing their correct prescription eyewear at the wheel and this only covers drivers with up to date prescriptions. Would having an eye test policy mean fewer accidents? Eye tests cost less than £20 per employee and the fine for driving with below standard vision is up to £1,000. There are a number of questions for you: •D oes your Fleet policy cover eyesight tests and advise drivers to wear prescription eyewear to comply? • Do you need to collect eye test results along with other documentation for employees driving their own cars on business? • Should it be part of an organisation’s Duty of Care procedure and Fleet Policy? smarter spending > www.expense-reduction.co.uk Procurement Matters > Issue No. 15.1 Stretching the Meeting’s Budget By Alastair Baker Faced with the demand for a meeting space most organisers will pick up the phone to the nearest hotel. Think outside the box a little and you will find all sorts of inspiring and inexpensive options which could have the benefit of breathing new life into your meetings programme. OK the summer is over so outside spaces such as gardens and parks are probably not practical for now, but don’t overlook public spaces like: libraries, museums and churches, many have great value meeting rooms available. Temporary office supplier Regus has been investing heavily in its network of motorway service station and railway station meeting rooms. Take out a membership (from just £35/mth) and then just book discounted spaces by the hour. If a table in the window of the local Starbucks is too public then ask your local (Continued from front page) ...recommendations that Charles made, with savings eventually exceeding 40% through a combination of a change of supplier and other process improvements. The Print project, crucial to Karndean’s brochure and catalogue quality was carried out by one of ERA’s print experts, Keith Copestake. Keith explained: “Although the board had given us approval to carry this out, the catalogue and brochure colour work was initially excluded from our remit, as it was felt that this was too important and colour critical to be taken externally. Once the project was underway however, it became clear that our knowledge of colour and the print process would add a lot of value in this area. These responsibilities were added to the project. After our Recommendations Report, four suppliers made presentations, including the incumbent. Print trials were carried out and the business was subsequently placed with two new suppliers. Now, all of the colour work is performed by suppliers introduced by ERA. independent coffee shop if you can take over an upstairs room for a couple of hours. Joining a Members Club in London can pay dividends providing access to small, characterful meeting rooms at prices well below the big name hotel chains. Finally always question the need to meet at all – high quality tele-conferencing suites (available for hire in London and other major cities) can enable global meetings to take place without the executive travel, whilst skype can work well for one to ones. “I have to say that the experience and knowledge of the Expense Reduction Analysts Project Specialists is second to none. They have managed to find us savings across a broad range of costs and have recommended process enhancements which will help us continue to enjoy such savings long into the future.” Alan Massey, Group Finance Director, Karndean International The colour quality remains the highest available and there is a marked improvement in the printed material. This has proved especially valuable as the international print requirement is satisfied through the UK. “In addition, we recommended a number of operational enhancements, including providing ongoing updates and advice on legislative changes, and act as an intermediary for any service issues there may be with the supplier”. Sean Bingham conducted the Fleet Project. He said: “We looked at the entire Fleet process for Karndean, considering it holistically offering solutions that eased the internal processes from procurement to disposal. In addition to direct savings from contract hire rentals, we improved Karndean’s contractual terms in areas such as tyre replacements, end of contract fair wear and tear and pooled mileage.” Tony Catling concludes on the value of the overall Karndean engagement: “I was very fortunate to be able to call upon 16 Project Specialists from within the Expense Reduction Analysts network. Each of them proved their worth to Karndean with their category knowledge, market analysis and ongoing advice.” Not just savings – process improvements and enhanced control Alan Massey, Group Finance Director at Karndean, summarises the benefits that his company has enjoyed: “The great thing about engaging with Expense Reduction Analysts is that not only do you achieve best value in all of these categories of expenditure, you know you do, as you audit the achievements. Their help in tackling such a wide range of overhead costs through one relationship is very efficient – it means that a sometimes neglected proportion of a company’s costs gets the full cost reduction experience.” Sector Savings Achieved: Water and Waste Water 60% Communications–Data 50% Couriers–International 44% Office Supplies 36% Communications–Fixed Lines30% Communications–Mobility 28% Marketing Print 25% Insurance 18% Gas 17% Electricity 15% Photocopiers 14% Fleet 7% Postage 5% www.expense-reduction.co.uk

© Copyright 2026