US EQUITIES - Sanlam Private Wealth

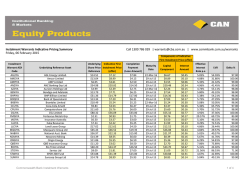

27 January 2015 www.privatewealth.sanlam.co.za INDEX DOW JONES PTS INDEX / COMMODITY % PTS % 17679 6 0.03 JSE ALL SHARE 50338 521 1.05 S&P 500 2057 5 0.26 JSE RESOURCES 40596 -102 -0.25 NASDAQ COMPOSITE 4772 14 0.29 JSE FINANCIALS 15870 180 1.15 FTSE 100 6852 20 0.29 JSE INDUSTRIALS 63542 1048 1.68 17710 241 1.38 GOLD AT 07H00 1281 -13 -0.98 16 -1 -6.84 PLATINUM AT 07H00 1252 -16 -1.25 NIKKEI 225 VIX VOLATILITY INDEX US EQUITIES The S&P 500 added 0.3 percent to 2,057.09 at 4 p.m. in New York, extending gains in the final 30 minutes of trading. The Dow Jones Industrial Average climbed 6.10 points, or less than 0.1 percent, to end almost flat at 17,678.70. The Nasdaq 100 Index slipped 0.1 percent, while the Russell 2000 Index of small caps rallied 1 percent. About 6.2 billion shares changed hands on U.S. exchanges on Monday, seven percent below the three-month average. United Technology slid 2.1 percent in late trading after cutting its earnings forecast. Microsoft slid 1.7 percent in after-market trading. Of the S&P 500 companies that have reported so far, 77 percent have exceeded earnings projections after analysts reduced their estimates. Energy companies rose 1.4 percent, the most in three weeks, to lead gains among six of the ten main S&P 500 groups. Chevron Corp. gained 1.9 percent for the biggest rise in the Dow. D.R. Horton Inc. gained 5.5 percent. The largest U.S. homebuilder by revenue posted better-than-expected first-quarter profit as sales and orders jumped. 1 MORNING DIGEST US ECONOMY For the world economy, it’s a case of U.S. and them. That was the conclusion of investors, executives and policy makers as they ended their annual trip to Davos, Switzerland last week with the U.S. poised to outpace world growth for the first time since 1999. The multi-speed global economy is already threatening the U.S. by driving the dollar to an 11 year-high against the euro, with few in Davos willing to bet against further gains for the greenback. A strong US dollar may hurt multinational US based companies that derive the majority of their income from abroad, one has to take heed of the US dollar strength and what effect this will have on exports. Berkshire Hathaway seems to be an all American play that investors will be looking at. EUROPEAN AND ASIAN EQUITIES European equities rose and the region’s shared currency strengthened, while Greek stocks retreated, after Syriza, whose leader has pledged to renegotiate the nation’s international bailout, won 149 out of a possible 300 seats in Parliament. The ASE dropped after jumping the most since October on Friday, Prime Minister-elect Alexis Tsipras’ mandate is now to confront the nation’s program of austerity, imposed in return for pledges of 240 billion euros in aid since May 2010. Greece’s debt makes up about 175% of its gross domestic product‚ making it the second-most indebted country in the world. European stocks rose for an eighth day amid optimism about central-bank stimulus. The Stoxx Europe 600 Index advanced 0.6 percent to 372.39 at the close of trading in London, the gauge jumped 5.1 percent last week, its biggest gain in three years. National benchmark equity gauges from Italy, Spain and Portugal advanced more than 1 percent on Monday, while Germany’s DAX Index climbed 1.4 percent. The Swiss Market Index added 1.7 percent for a second day of gains as the franc slipped against the euro. Energy companies and automakers rallied the most among 19 industry groups in the Stoxx 600 with european car manufacturers benefiting from the weakening Euro. Royal Dutch Shell Plc rose 1.5 percent and BG Group Plc climbed 2.9 percent. Fiat Chrysler Automobiles NV added 3.7 percent and Bayerische Motoren Werke AG gained 2.4 percent. The Nikkei 225 ended 0.25% softer on Monday morning, in today’s trading the index is 1.59 percent positive. Australia’s ASX was closed on Monday due to Australia day, the S&P/ASX 200 Index increased 0.3 percent this morning as trading resumed following yesterday’s holiday, the index is currently trading at 0.89 percent in the green. Japan’s Topix index climbed 0.8 percent as the yen extended yesterday’s 0.6 percent slide against the greenback. South Korea’s Kospi index added 0.5 percent. New Zealand’s NZX 50 Index rose 0.4 percent. The MSCI Asia Pacific Index advanced 0.4 percent to 141.24 as of 9:03 a.m. in Tokyo. China’s shanghai composite index is negative 2.17 percent in today’s trading 2 MORNING DIGEST CURRENCIES The rand was steady against the dollar in late trade‚ with traders continuing to watch offshore developments‚ particularly the euro zone. The local currency had earlier in the day found support from a firmer euro‚ which against expectations gathered some strength against the dollar despite the results from the Greek election increasing the possibility Greece could exit the euro zone. The Rand is trading at 11,45 rand to the US dollar, 17,28 rand to the British pound and 12,89 rand to the Euro. The Swiss franc is trading at 1.01 to the Euro and one US dollar will give you 118,45 Japanese Yen. COMMODITIES West Texas Intermediate is trading 0.94 percent lower at 45.16 dollars a barrel, Brent lost 1.27 percent and is trading at 48.17 dollars a barrel at 11 pm South African time. The spot price of Gold is almost 1 percent lower at 1,281.31 dollars a fine ounce. As the dollar continues to strengthen, precious metals are feeling the squeeze as investors seem to find comfort in the dollar as a safe haven asset, as compared to gold. Platinum is down 1.25 percent to 1,252.88 dollars a fine ounce, where copper strengthened 1.66 percent after a week long slide in its price to trade at 254.32 dollars a pound at 11 pm South African time. Iron ore retreated to the lowest level in more than five years as a slowdown in China hurt the outlook for demand in the world’s biggest user, while the largest mining companies add to supply, boosting a surplus. Ore with 62 percent content delivered to Qingdao, China, tumbled 4.3 percent to 63.54 dollars a dry metric ton, according to data by Metal Bulletin Ltd. That’s the lowest price on record going back to May 2009, and was the biggest one-day fall since November 18. The commodity is 11 percent lower this year. JSE The JSE ended Monday above the 50‚000 point mark for the first time since December 29‚ supported by banks and industrials. The banking and industrial indices shot up 1.50% and 1.48% apiece‚ more than offsetting the poor showing in the resources complex that was largely the result of a globally strong dollar. The all share gained 1.05 percent to 50‚337.98 by the close‚ with the blue-chip top 40 gaining 1.26 percent. Meanwhile‚ the resource complex - in particular gold and platinum stocks - had a torrid session due to a combination of a globally strong dollar and some profit-taking. The gold and platinum indices lost 3.58 percent and 3.54 percent respectively. Platinum counters were the hardest hit‚ with shares of Anglo American Platinum (AMS)‚ the world’s largest miner of the metal‚ nose-diving more than 5 percent to end on R349.41. Kumba Iron ore lost another 4.68 percent to end on a new 52-week low of R213.83. As recently as February last year, the share traded 3 MORNING DIGEST at a 52-week high of R465. The stock has now lost 37.7% over the last three months and 50.8% over the last 12 months. Glencore, which lost almost 6% on Friday, dropped another 1.98 percent to reach a new 52-week low of R42.00. The share is 29.2 percent softer for the past 12 months. Naspers, is again trading at an all-time high which again pushed the All-share index to just above 50 000 points. Shares like SABMiller, Naspers and Richemont that have a big weight in the Industrial index, were the top performers on Monday. The Industrial index gained 1.42 percent and the Financial index rose 0.57 percent, while the market is trying to anticipate the South African Reserve Bank’s reaction to calls for interest rates to follow inflation lower. The stronger industrial shares could be the forerunner of increased interest by foreign investors using the cheap money that will become available in the ECB’s bond-buying programme to chase higher yields in developing markets. PPC sees headline earnings per share for the six months ended March 2015 to decline by between 25% and 45% compared with the year-earlier period. Resilient property fund sees first-half distribution up between 15% and 17%. Italtile is entrenching its position as the frontrunner in the do-it-yourself and home-improvement sector‚ achieving double-digit growth in a languishing retail market. On Friday‚ Italtile said basic earnings per share from continuing operations for the six months to December 31 last year would be between 36.3c and 36.9c‚ reflecting an increase of 27%-29% compared with the previous corresponding period. BONDS South African bonds eased amid some profit-taking following a strong run in recent sessions. The yield on the R186 government bond reached its lowest level since May 2013 last week following the announcement of the European Central Bank’s multi-billion euro stimulus package. The bond market is already strengthening, discounting the possibility, but it is extremely doubtful if the Reserve Bank will take such a major decision at this week's monetary policy committee meeting as the monetary authorities will first want to check the sustainability of the lower oil price and inflation dip. The benchmark R186 was bid at 7.225 percent and offered at 7.195 percent from a Friday close of 7.160 percent. The middle-dated R207 was offered at 6.605 percent from a previous close of 6.570 percent. Data released on Monday showed that foreigners sold net R1.742bn South African bonds on Friday. The yield on 10 year US Treasuries is 1.82 percent. The yield on the German ten year government bond is 0.39 percent, the British ten year government bond is yielding 1.51 percent, French ten year government bonds are yielding 0.58 percent and Swiss ten year government bonds are yielding negative 0.25 percent. JSE TODAY US futures are negative but only just, European futures are all in the green, Asian markets are mixed. The markets should take its direction from the sliding commodity prices overnight, expect commodity companies to start on the 4 MORNING DIGEST back foot this morning, Tencent is in the red at negative 2.48 percent so expect Naspers to have a slower start, Bhp Billiton in Australia is down 1.46 percent today. QUOTE OF THE DAY ‘ If you plan for one year, plant rice. If you plan for 10 years, plant trees. If you plan 100 years educate mankind’Chinese proverb KEY INDICATORS 26/27 January 2015 LAST DOW JONES PREV CLOSE CHG. CHG. PTS. % CLOSE PREV YEAR YTD CHG. YTD CHG. % LOCAL % US $ PE Mean PE RATIO LAST 12 MTHS Object 17679 17673 6 0.03 17823 -0.8 -0.8 S&P 500 2057 2052 5 0.26 2059 -0.1 -0.1 15.9 reference Object 18.2 reference Object NASDAQ 4772 4758 14 0.29 4736 0.8 0.8 35.7 reference MSCI WORLD $ 1713 1708 5 0.28 1710 0.2 0.2 FTSE 100 6852 6833 20 0.29 6566 4.4 1.1 FRANKFURT DAX 10798 10650 149 1.40 9806 10.1 2.4 Object 19.6 reference Object 18.6 reference Object NIKKEI 225 17710 17469 241 1.38 17451 1.5 1.5 HANG SENG 24710 24910 -200 -0.80 23605 4.7 4.8 5507 5468 39 0.71 5389 2.2 -0.9 JSE ALL SHARE 50338 49817 521 1.05 49771 1.1 2.0 17.2 17.5 JSE RESOURCES 20 40596 40698 -102 -0.25 41930 -3.2 -2.4 10.3 14.0 JSE FINANCIALS 15 15870 15690 180 1.15 15642 1.5 2.3 15.3 14.5 JSE INDUSTRIALS 25 63542 62494 1048 1.68 62353 1.9 2.8 23.0 22.1 GOLD PRICE $/OZ 1 281 1 294 -12.72 -0.98 1184.86 8.1 PLATINUM PRICE $/PZ 1 252 1 268 -15.85 -1.25 1208.00 3.7 BRENT CRUDE OIL $/BARREL 48.30 48.16 0.140 0.29 57.33 -15.8 RAND/$ 11.46 11.44 0.017 0.15 11.551 0.8 RAND/£ 17.30 17.28 0.021 0.12 18.023 4.0 RAND/€ 12.88 12.90 -0.018 -0.14 13.980 7.8 1.12 1.13 -0.003 -0.28 1.210 7.0 AUSTRALIA ALL ORDINARIES $/€ reference Object reference 5 MORNING DIGEST ALL SHARE TOP 40 INDEX - DAY'S MOVES (AND YEAR TO DATE) LAST (C) PREV. (C) ANGLO AMERICAN PLC 18985 19062 -0.4% -11.8% ANGLO AMERICAN PLAT LTD 34941 36779 -5.0% 2.4% ANGLOGOLD ASHANTI LTD 12270 12757 -3.8% 20.6% ASPEN PHARMACARE HLDGS L 44300 43419 2.0% BARCLAYS AFRICA (ABSA) 19122 18863 1.4% BHP BILLITON PLC 24266 24346 -0.3% -2.4% NASPERS LTD -N- BRITISH AMERICAN TOB PLC 64737 64525 0.3% 2.4% BIDVEST LTD 31431 30959 1.5% 3.4% CAPITAL&COUNTIES PROP PL 6739 6551 2.9% 2.1% COMPAGNIE FIN RICHEMONT 9664 9545 1.2% -8.0% DISCOVERY 11489 11430 0.5% 3.1% FIRSTRAND 4975 4903 1.5% -1.6% RAND MERCHANT INS HLDGS GROWTHPOINT PROP LTD 3040 2943 3.3% 10.6% SABMILLER PLC IMPALA PLATINUM HLGS LTD 7650 7914 -3.3% 1.0% STANDARD 14750 INVESTEC LTD 9790 9724 0.7% 0.4% STEINHOFF INT HLDGS LTD 6000 INVESTEC PLC 9779 9663 1.2% 0.6% SHOPRITE HOLDINGS LTD 20002 20000 0.0% 8.1% SANLAM SHARE IMPERIAL HOLDINGS LTD LAST (C) PREV. (C) MONDI LTD 20263 19551 3.6% MONDI PLC 20265 19650 3.1% 6.9% MR PRICE GROUP LTD 25997 25739 1.0% 10.6% 9.1% MTN GROUP LTD 20876 20405 2.3% -5.7% 5.1% NEDCOR 24874 24750 0.5% -0.1% 170400 164900 3.3% 12.5% NETCARE LIMITED 3779 3729 1.3% -0.4% OLD MUTUAL PLC 3539 3503 1.0% 2.0% REINET INV SOC ANON 2540 2499 1.6% 0.6% 26809 26423 1.5% 5.6% 6368 6282 1.4% -1.0% 4190 4200 -0.2% 2.5% 59344 58550 1.4% -2.0% 14500 1.7% 2.8% 6020 -0.3% 1.0% 18450 18077 2.1% 9.7% 6762 6801 -0.6% -3.4% SASOL LIMITED 41530 40238 3.2% -3.6% TIGER BRANDS LTD 38656 38119 1.4% 5.0% VODACOM GROUP LTD 13550 13370 1.3% 5.5% 8457 8457 0.0% 9.7% CH. YTD CH. INTU PROPERTIES PLC 6296 6221 1.2% 4.2% KUMBA IRON ORE LTD 21654 22432 -3.5% -9.7% 4277 4197 1.9% 0.0% 11745 11569 1.5% 16.7% LIFE HEALTHC GRP HLDGS L MEDICLINIC INTERNAT LTD SHARE REMGRO LTD RMB HOLDINGS LTD WOOLWORTHS HOLDINGS LTD CH. YTD CH. 7.4% 6 MORNING DIGEST MID CAP INDEX - DAY'S MOVES (AND YEAR TO DATE) LAST (C) PREV. (C) ARCELORMITTAL SA LIMITED 2380 2350 1.3% -9.9% ACUCAP PROPERTIES LTD 5700 5520 3.3% 9.9% MURRAY & ROBERTS HLDGS 12700 12610 0.7% -5.1% NEW EUROPE PROP INV PLC 939 941 -0.2% -1.2% 4360 4250 2.6% -11.0% AFRICAN RAINBOW MIN LTD 12061 12430 -3.0% 1.4% ASSORE LTD 17200 17750 -3.1% 14.9% ATTACQ LIMITED 2295 2300 -0.2% AVI LTD 8175 8099 0.9% BRAIT SE 7695 7675 0.3% BARLOWORLD LTD 8989 8712 CLICKS GROUP LTD 8620 8595 10650 SHARE AECI LIMITED ALEXANDER FORBES GRP HLD ADCOCK INGRAM HLDGS LTD CORONATION CAPITAL PROPERTY FUND LT LAST (C) PREV. (C) 17283 17351 -0.4% 21.0% 1999 2000 0.0% -6.0% 11700 11700 0.0% 2.6% NORTHAM PLATINUM LTD 3966 4140 -4.2% 8.1% NAMPAK LTD 4070 4008 1.5% -6.7% OCEANA GROUP LTD 10900 10950 -0.5% 3.9% OMNIA HOLDINGS LTD 17000 17000 0.0% -6.1% 4.3% PIONEER FOODS GROUP LTD 15635 15550 0.5% 9.3% 4.7% PIK N PAY STORES LTD 5704 5631 1.3% 8.4% -2.2% PPC LIMITED 2220 2369 -6.3% -19.3% 3.2% -6.1% PSG GROUP LTD 4.1% 0.3% 6.4% 10968 -2.9% CH. YTD CH. SHARE MASSMART HOLDINGS LTD CH. YTD CH. 13296 12900 3.1% ROYAL BAFOKENG PLATINUM 5385 5510 -2.3% 2.2% -7.5% RCL FOODS LIMITED 1819 1840 -1.1% -6.2% 8.3% 1496 1480 1.1% 12.7% REDEFINE PROPERTIES LTD 1159 1150 0.8% CAPITEC/PSG 36600 35580 2.9% 7.6% RESILIENT PROP INC FUND 8837 8441 4.7% 5.2% DATATEC LTD 5915 5866 0.8% 6.2% REUNERT LTD 5989 6097 -1.8% -1.3% EOH HOLDINGS LTD 11950 11869 0.7% 10.1% REDEFINE INTERNATIONAL P 950 942 0.8% -3.6% EXXARO RESOURCES LTD 10200 10482 -2.7% -1.4% SAPPI LTD 4735 4704 0.7% 12.2% FORTRESS INC FUND LTD A 1780 1764 0.9% 9.5% 34.1% FORTRESS INC FUND LTD B 2000 1980 1.0% 14.2% 926 911 1.6% 9.6% GOLD FIELDS LTD 6036 6306 -4.3% 15.4% GRINDROD LTD 1831 1955 -6.3% -18.3% FOUNTAINHEAD PROP TRUST SIBANYE GOLD LIMITED 3025 3093 -2.2% 22287 22400 -0.5% 3.7% 3275 3270 0.2% -4.2% THE SPAR GROUP LTD 17694 17565 0.7% 9.7% SUN INTERNATIONAL LTD 12376 12500 -1.0% -4.0% THE FOSCHINI GROUP LIMIT 16280 16237 0.3% 22.2% 6863 6685 2.7% -2.0% 16077 16400 -2.0% -7.0% SANTAM SUPER GROUP LTD HARMONY GM CO LTD 3191 3299 -3.3% 47.7% HOSKEN CONS INV LTD 14924 14900 0.2% 0.2% HYPROP INV LTD 10740 10541 1.9% 10.2% TONGAAT HULETT LTD 2330 2390 -2.5% -4.9% TRENCOR LTD 7160 7148 0.2% 1.7% 494 495 -0.2% 0.8% TRUWORTHS INT LTD 8330 8328 0.0% 7.8% 12870 12825 0.4% 4.9% TSOGO SUN HOLDINGS LTD 2990 2990 0.0% 3.1% LONMIN PLC 2960 3000 -1.3% -6.4% 12343 12463 -1.0% 2.2% MMI HOLDINGS 3086 3083 0.1% 2.9% ILLOVO SUGAR LTD KAP INDUSTRIAL HLDGS LTD LIBERTY TELKOM SA SOC LTD WILSON BAYLY HLM-OVC LTD 7 MORNING DIGEST SMALL CAP INDEX - DAY'S MOVES (AND YEAR TO DATE) SHARE LAST (C) PREV. (C) CH. YTD CH. SHARE AFROCENTRIC INV CORP LTD 520 528 -1.5% 0.0% GROUP FIVE LTD ADVTECH LTD 894 880 1.6% 2.8% HUDACO INDUSTRIES LTD ADCORP HOLDINGS LIMITED 3289 3184 3.3% 2.4% HULAMIN LTD AVENG GROUP LIMITED 1710 1682 1.7% -1.7% ALLIED ELECTRONICS CORP 1850 1800 2.8% 12.1% ALLIED ELEC CORP N 1780 1752 1.6% AFRIMAT LIMITED 1630 1606 1.5% AFRICAN OXYGEN LIMITED 1499 1520 -1.4% -6.5% ASCENSION PROP LTD A 550 550 0.0% 4.8% INVICTA HOLDINGS LTD ASCENSION PROP LTD B 250 250 0.0% 1.6% JSE LTD ACCELERATE PROP FUND LTD 699 685 2.0% -0.1% PSG KONSULT LIMITED AQUARIUS PLATINUM LTD LAST (C) PREV. (C) CH. YTD CH. 2670 2671 0.0% -8.7% 10999 10800 1.8% 13.5% 835 813 2.7% 3.1% HOSPITALITY PROP FUND A 1674 1650 1.5% 20.4% HOLDSPORT LIMITED 4900 4825 1.6% 4.0% 6.6% HOWDEN AFRICA HLDGS LTD 4394 4390 0.1% 3.4% -4.0% INVESTEC AUSTRALIA PROP 1170 1180 -0.8% -1.7% INVESTEC PROPERTY FUND L 1730 1701 1.7% 8.8% 8300 8619.1296 -3.7% 11.7% 12255 12100 1.3% 1.3% 710 710 0.0% -1.7% 252 258 -2.3% -7.7% LEWIS GROUP LTD 8270 8352 -1.0% 11.7% 19501 19500 0.0% 11.5% MIX TELEMATICS LTD 270 268 0.7% -11.5% 1629 1639 -0.6% -1.9% MONTAUK HOLDINGS LTD 305 305 0.0% 7.0% ARROWHEAD PROPERTIES A 999 968 3.2% 6.8% MPACT LIMITED 3492 3650 -4.3% -5.0% ARROWHEAD PROPERTIES B 1015 962 5.5% 8.0% MERAFE RESOURCES LTD 92 93 -1.1% -2.1% BUSINESS CONNEXION GRP L 620 609 1.8% -3.1% METAIR INVESTMENTS LTD 3270 3240 0.9% 2.3% NIVEUS INVESTMENTS LTD ASTRAL FOODS LTD ASCENDIS HEALTH LTD BLUE LABEL TELECOMS LTD 820 826 -0.7% -6.8% 3040 3040 0.0% 1.3% BRIMSTONE INV CORP LTD-N 1650 1650 0.0% 0.0% NET 1 UEPS TECH INC 14600 14600 0.0% 8.1% CAXTON CTP PUBLISH PRINT 1491 1500 -0.6% -1.3% OCTODEC INVEST LTD 2775 2760 0.5% 18.1% CONS INFRASTRUCTURE GRP 2775 2788 -0.5% -4.3% PAN AFRICAN RESOURCE PLC 208 208 0.0% 7.2% 12450 12237 1.7% 3.6% PALLINGHURST RES LTD 390 395 -1.3% -7.1% CLIENTELE LTD 1780 1775 0.3% 4.7% PEREGRINE HOLDINGS LIMIT 2290 2270 0.9% -1.3% CLOVER INDUSTRIES LTD 1930 1916 0.7% 2.8% RAUBEX GROUP LTD 2150 2183 -1.5% -2.1% CURRO HOLDINGS LIMITED 3189 3150 1.2% 10.0% REBOSIS PROPERTY FUND LT 1270 1232 3.1% 2.4% CITY LODGE HOTELS LTD CASHBUILD LTD 18184 17921 1.5% 10.7% RHODES FOOD GRP HLDG LTD 1672 1660 0.7% 10.5% CAPEVIN HOLDINGS LTD 850 850 0.0% -4.2% SA CORP REAL ESTATE FUND 536 521 2.9% 12.1% DELTA PROPERTY FUND LTD 979 955 2.5% 12.5% SPUR CORPORATION LTD 3594 3675 -2.2% 14.9% EMIRA PROPERTY FUND FAMOUS BRANDS LTD GRAND PARADE INV LTD 1900 1879 1.1% 9.7% 10819 10834 -0.1% -6.2% TRANSACTION CAPITAL TIMES MEDIA GROUP LTD 670 699 -4.1% -3.6% TRUSTCO GROUP HLDGS LTD 810 810 0.0% 1.9% 2060 2058 0.1% 3.0% 258 258 0.0% -4.4% 8 MORNING DIGEST BANK & OTHER PREFERENCE SHARES INVESTEC INVESTEC INVESTEC STANDARD FIRSTRAND NEDBANK BANK LIMITED PLC ( £ ) ** BANK BANK ABSA Share code NBKP INLP INPR INPP SBPP FSRP ABSP Issue price c ( * £' p) 1000 10000 10450 1000 10000 10000 100000 Yield on issue price as % of prime 83.33 83.33 77.77 77.77 75.56 70 Prime % ( ** UK Base rate) 9.25 9.25 9.25 0.5 ** 9.25 9.25 9.25 Yield on issue price % 7.71 7.71 7.19 1.50 7.19 6.99 6.48 Annual dividend 77.1 770.8 751.7 15.0 719.4 698.9 6475.0 Current market price c 947 7860 7300 521 8650 8700 78001 Approximate days of dividend accrued 158 60 60 60 151 165 144 Approximate dividend accrued c 33 127 124 2 298 316 2555 Calculated ex-dividend price 914 7733 7176 518 8352 8384 75446 Yield on calculated ex-dividend price 8.44 9.97 10.48 2.89 8.61 8.34 8.58 Yield as % of prime 91.21 107.75 113.25 93.11 90.12 92.78 Last dividend amount c 36.86 380.29 354.92 129.54 317.59 341.11 3197.47 22-Aug-14 28-Nov-14 28-Nov-14 28-Nov-14 29-Aug-14 15-Aug-14 5-Sep-14 Payment date 1-Sep-14 15-Dec-14 15-Dec-14 15-Dec-14 8-Sep-14 25-Aug-14 15-Sep-14 Approx. next LDT date 13-Mar-15 6-Jun-15 6-Jun-15 6-Jun-15 28-Mar-15 14-Feb-15 28-Mar-15 Approx. next payment date 24-Mar-15 24-Jun-15 24-Jun-15 24-Jun-15 7-Apr-15 24-Feb-15 7-Apr-15 LDT ** UK Base rate 9 MORNING DIGEST BANK & OTHER PREFERENCE SHARES IMPERIAL HOLDINGS PSG CAPITEC SASFIN STEINHOFF GRINDROD NETCARE ASTRAPAK Share code IPLP PGFP CPIP SFNP SHFF GNDP NTCP APKP Issue price c 10300 10000 9500 10300 10000 10000 10000 10000 Yield on issue price as % of prime 83.33 83.33 87.72 83.33 83.33 88.89 83.33 88.89 Prime % 9.25 9.25 9.25 9.25 9.25 9.25 9.25 9.25 Yield on issue price % 7.71 7.71 8.114 7.71 7.71 8.22 7.71 8.22 Annual dividend 793.9 770.8 770.8 793.9 770.8 822.2 770.8 822.2 Current market price c 7900 8000 8111 7500 8450 7950 8057 5450 Approximate days of dividend accrued 131 137 137 123 102 137 95 102 Approximate dividend accrued c 285 289 289 268 215 309 201 230 Calculated ex-dividend price 7615 7711 7822 7232 8235 7641 7856 5220 Yield on calculated ex-dividend price 10.43 10.00 9.86 10.98 9.36 10.76 9.81 15.75 Yield as % of prime 112.71 108.07 106.54 118.67 101.19 116.33 106.07 170.28 Last dividend amount c 366.28 380.64 336.58 364.92 380.00 389.00 349.66 351.12 LDT 18-Sep-14 12-Sep-14 12-Sep-14 26-Sep-14 17-Oct-14 12-Sep-14 24-Oct-14 17-Oct-14 Payment date 29-Sep-14 22-Sep-14 22-Sep-14 6-Oct-14 27-Oct-14 22-Sep-14 3-Nov-14 27-Oct-14 Approx. next LDT date 26-Feb-15 20-Mar-15 20-Mar-15 28-Mar-15 10-Apr-15 13-Mar-15 30-Apr-15 23-Apr-15 Approx. next payment date 20-Mar-15 31-Mar-15 31-Mar-15 7-Apr-15 22-Apr-15 24-Mar-15 12-May-15 5-May-15 10 MORNING DIGEST BANK & OTHER PREFERENCE SHARES DISCOVER Y BRAIT INVICTA Share code DSBP BATP IVTP Issue price c 10300 10000 10400 Yield on issue price as % of prime 100 104 102.00 Prime % 9.25 9.25 9.25 Yield on issue price % 9.25 9.62 9.44 Annual dividend 952.8 962.0 981.2 Current market price c 10800 9800 9779 Approximate days of dividend accrued 137 67 67 Approximate dividend accrued c 358 177 180 10442 9623 9599 Calculated ex-dividend price Yield on calculated ex-dividend price 9.12 10.00 10.22 Yield as % of prime 98.64 108.07 110.51 Last dividend amount c 442.19 474.7 387.39 LDT 12-Sep-14 21-Nov-14 21-Nov-14 Payment date 22-Sep-14 1-Dec-14 1-Dec-14 Approx. next LDT date 7-Mar-15 12-Jun-15 20-Jun-15 Approx. next payment date 17-Mar-15 23-Jun-15 30-Jun-15 DISCLAIMER This document is not intended to constitute financial advice. You are urged to seek financial advice from a registered financial advisor. Should you not have a financial advisor, we can make one available to you. 11

© Copyright 2026