Executive pay up down or sideways - Jan 2015

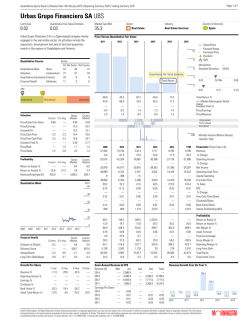

www.pwc.co.uk Up, down or sideways What’s really happening to executive pay? January 2015 What’s really happening to executive pay? The data shows continued restraint in executive pay, despite some headlines to the contrary. However, pressure is beginning to build. Executive pay is a complicated beast, which makes it tough to interpret trend data. Most executives receive a salary, some benefits, a bonus (part of which will be deferred into shares) and at least one long-term incentive plan. Awards made by a remuneration committee in any given year can crystallise for the executive one, two, three or more years later. The value at the time they crystallise normally depends on how the company does against performance conditions. Awards are often made in shares, so the value depends on the share price too. This creates a lot of volatility, and consequently noise in the data, which makes interpretation difficult. In this short briefing we aim to demystify some of the analysis and give a clear view of what is happening to executive pay. Valuing executive pay What figure should you ascribe to an executive’s pay? Four different approaches lead to very different answers (see appendix for more details): • Target pay is the level of pay that an executive could receive from their package assuming a target level of performance • Maximum pay is the level of pay that an executive could receive from their package assuming all performance targets are met in full These approaches measure the intended pay opportunity that a remuneration committee is setting for an executive. As such they are commonly used in benchmarking when remuneration committees are setting an executive’s pay. These measures are also the best reflection of the decisions that remuneration committees are making today about the intended future trajectory of executive pay. However, these approaches don’t reflect what is actually delivered from pay plans, which depends on how well companies do against performance targets and also on how the share price changes for awards which are paid in shares. Two approaches which address this are: • Crystallised pay, which measures the value of pay received at the point at which performance is measured. This is the basis of the ‘single figure’ for executive pay that companies must now disclose in their Directors’ Remuneration Report. It will generally comprise a mix of pay elements: salary and bonus for the year in question and the value coming out of long-term incentive plans awarded several years earlier, but which have only now come to the end of their performance period. • Realised pay, which measures the gains an executive actually receives in their pocket. This approach only measures a pay element when it is delivered to the executive or, in the case of share options, when they actually exercise the option. Therefore this measure will typically include pay elements originally awarded in a number of different years. Both these approaches are a closer reflection of what an executive actually receives. However, they are highly influenced by what has happened to the company’s share price over the period since long-term incentive awards were made. Whether this figure goes up or down is therefore as much to do with what has happened to stock markets as it is to do with remuneration committee decision making. Measuring changes in executive pay If the different ways of measuring executive pay weren’t complicated enough, more difficulties arise when looking at how to measure changes. There are three main approaches. • Compare average executive pay from one year to the next • Compare median executive pay from one year to the next • Compare pay from one year to the next by individual and look at the median change Comparing an average or median pay figure from one year to the next shows how the typical pay package for a FTSE-100 CEO has changed, but can be distorted by a number of factors: • The companies in the FTSE-100 may differ from year to year • The executives in post may differ from year to year So these overall statistics can be distorted by changes in the population of companies being looked at or by changes in the executives in post, due to joiners or leavers. The use of average rather than median is even more problematic. Whereas a median looks at the mid-point of the data set, and so isn’t affected by outliers, a single extreme case can distort the average. For example, in 2009 Bart Becht, then CEO of Reckitt Benckiser was reported to have ‘taken home’ £90m, most of which resulted from exercise of share options accumulated over a decade. This single data point increased the average realised pay for FTSE-100 CEOs by nearly £1m relative to the median figure. This is why average realised pay is generally used by commentators when they want to create the impression of the greatest increase in executive pay. Even the median has problems – in a volatile and widely dispersed dataset, the median can move a significant amount due to a change in one company, even if the overall shape of the dataset hasn’t changed. This is particularly a problem with crystallised and realised pay measures, where long-term incentives give rise to a lot of volatility. The most reliable way to look at pay trends is to analyse changes by individual and then to look at the median of these changes. This gives the most reliable picture of how pay is changing year on year for individual executives, and is also the most robust measure of trends and gives the best insight into remuneration committee decision making. This is the measure we focus on in this summary. So what’s the story? The table below summarises the most recent results for FTSE-100 CEO pay from our Executive Remuneration Survey. In each case the median increase is shown for those executives who were in post for at least two years to enable a consistent year on year comparison. Target pay for 2014 Value (£000s) Base salary Increase (%) 850 Base + Bonus Maximum pay for 2014 3 Value (£000s) 2.4 850 1,691 2,484 Base + Bonus + LTI 3,021 4,655 Total remuneration 3,225 1 2 2.5 4,909 Actual pay for 2013 Value (£000s) Actual base salary Actual bonus Crystallised pay 4 Increase3 (%) 841 N/A 1,060 3.6 4,049 2.7 LTI = long-term incentive plan, comprising shares with performance conditions, options, bonus match Total remuneration = base + bonus + LTI + pension + benefits Median increase based on CEOs in post for two full years to enable like for like comparison 4 Single-figure as disclosed in Directors Remuneration Report for CEOs in post for the full year 1 2 3 The following key messages come out of the data: • Target levels of pay increased broadly in line with inflation or less at around 2.5% • The maximum opportunity for CEOs increased slightly more rapidly at 5%, reflecting a few cases of increased maximum incentive levels • Bonus payments were up slightly last year, by just under 4%, following two years of falls • However, total crystallised pay (the new ‘single figure’ basis) increased only 2.7% at median • Over a quarter of FTSE-100 CEOs received no pay rise and one in 10 did not receive a bonus Overall this data represents a fairly flat picture in aggregate for CEO pay. One point of interest is the difference between the target level of pay, at £3.2m and the total crystallised pay at £4.0m. What explains this difference? In essence there are four potential drivers of the difference: • Above or below target achievement against bonus targets • Above or below target achievement against long-term incentive plan targets • Share price growth, which affects the value of long-term incentives in the crystallised pay calculation but is excluded from target and maximum pay estimates • Differences between current year award levels, which drive target values, and award levels in previous years which are now emerging into crystallised pay, which can also be affected by changes in incumbent Increase3(%) 2.4 5.0 It is not possibly precisely to disaggregate all of these influences, but the chart below shows an estimated reconciliation between the median figures above: Remuneration (£000s) 0 1,000 2,000 3,000 4,000 5,000 6,000 Maximum remuneration Target remuneration Base Bonus outperformance of target Bonus Long-term incentive LTI* outperformance of target Benefits Single figure excluding share price Total rem Share price growth on LTI* Crystallised pay (single figure) *Long-term incentive plan Performance has been above-target on incentives (particularly annual bonus) but the biggest factor driving the difference between target pay and crystallised pay is movements in share price which feed through into crystallised long-term incentive values. The median level of total shareholder return for the companies analysed was 14% pa over the relevant long-term incentive plan performance periods, meaning that over three years the value of shares underlying a long-term incentive plan typically increased by around 50%. In less favourable market conditions this increase will be lower or could even be reversed. Pressure building? Overall the data suggests that remuneration committees continue to be restrained in their decision making, reflecting the current economic, political, and investor climate around pay. The key signals of decisions remuneration committees are making today – base salary movements, target incentive awards, and bonus payments – all show relatively modest increases in the 2% to 4% range. This is acting to keep executive pay flat in real terms and broadly aligned with wider workforce increases. Of course there are significant variations within this, and here we start to see some pressure beginning to build. Although increases to base salaries were fairly uniformly subdued, increases to bonus payments, and to target and maximum total remuneration levels showed wide variation, with some significant increases. Increase on prior year Lower quartile (%) Base salary Median (%) Upper quartile (%) 0.0 2.4 2.9 Actual bonus (5.8) 3.6 37.2 Target total remuneration (0.7) 2.5 9.6 0.0 5.0 14.3 (19.6) 2.7 31.9 Maximum total remuneration Crystallised pay Although median bonus and crystallised pay increases were 3.6% and 2.7% respectively, one in four CEOs received increases above 30% (in the case of bonuses often from a very low prior year comparator). Equally double digit increases in target or maximum levels of future remuneration were seen at a quarter of companies. It’s possible that these will result in higher bonus and total crystallised pay outcomes in future years. At the same time, it’s possible these changes reflected one-off adjustments being made as companies approved new binding policies for three years rather than signifying a changing trend. Conclusion Overall, when carefully analysed on a consistent basis, the data shows that executive pay continues to operate in an environment of restraint. But there are signs of inflationary pressure building in the system. We continue to believe it’s unlikely we’ll see a return to the levels of executive pay increases that were seen before the financial crisis. As outlined in our publication What goes up must come down, the forces that drove executive pay upwards over the two decades preceding the crisis have abated or even gone into reverse. It seems most likely to us that executive pay will, largely, move sideways in real terms over the coming years, although there will be ups and downs along the way. And it’s probably important that it does so. Austerity is guaranteed to continue whoever wins the General Election. Real wages are now some 10% below pre-crisis levels and have yet to experience sustained increases even at the level of inflation. Trust in business is at a low ebb, and is damaged by the perception of unjustified rewards to executives that contrast with the experience of the wider workforce. British companies are highly international and need to be competitive in that context, and to pay in a way that attracts, retains and motivates the best executives. But at the same time trust needs to be rebuilt and societal acceptance of business – the licence to operate – needs to be nurtured. Remuneration committees and executives have exercised commendable restraint since the financial crisis. They need to be vigilant to ensure remuneration remains fully justified by performance, and to avoid returning to the inflationary environment of the past. Life isn’t going to get easier for remuneration committee chairs any time soon. Appendix Different approaches to valuing executive pay Target pay Maximum pay Crystallised pay Realised pay Definition The level of pay that an executive could receive from their package assuming a target level of performance The maximum level of pay that an executive could receive from their package assuming all performance targets are met in full The total level of pay that has crystallised for an executive based on achievement against performance targets over the year The total level of pay actually received in their pocket by the executive over the year including share option exercises Usage Commonly used in benchmarking as these measures give a good indication of the level of pay opportunity a remuneration committee intends to offer its executives Prescribed format for measuring total pay in the Directors’ Remuneration Report Not a widely used measure other than by some niche survey providers Crystallised pay Realised pay Valuation approach Target pay Base salary Amount paid in the year in question Benefits Bonus Deferred bonus Long-term incentives Maximum pay Potential value assuming target performance including any portion deferred into shares Maximum possible level of bonus assuming all targets met including any portion deferred into shares Actual amount paid, including any portion deferred into shares Potential value of award assuming mid-level performance against performance targets but ignoring future share price growth Potential value of award assuming all performance targets met in full but ignoring future share price growth Value of award at the point performance targets are assessed, based on actual achievement against targets and the share price at that time Actual cash bonus received, excluding deferred portion Deferred bonuses from previous years that are actually received in the year Value of actual award received by the executive at the point it vests or when they choose to exercise it (in case of options) Contacts Tom Gosling, Head of Pay, Performance & Risk Fiona Camenzuli Carol Dempsey M: +44 (0) 20 7212 3973 E: [email protected] M: +44 (0) 20 7804 4175 E: [email protected] M: +44 (0) 20 7212 4641 E: [email protected] Sean Drury Dean Farthing John Harding M: +44 (0) 20 7212 5552 E: [email protected] M: +44 (0) 20 7212 5323 E: [email protected] M: +44 (0) 161 247 4542 E: [email protected] Isabel McGarvie Phillippa O’Connor Marcus Peaker M: +44 (0) 141 355 4060 E: [email protected] M: +44 (0) 20 7213 4589 E: [email protected] M: +44 (0) 20 7804 0249 E: [email protected] Julian Sansum Jon Terry Paul Wolstenholme M: +44 (0) 20 7212 1652 E: [email protected] M: +44 (0) 20 7212 4370 E: [email protected] M: +44 (0) 20 7212 6225 E: [email protected] This publication has been prepared for general guidance on matters of interest only, and does not constitute professional advice. You should not act upon the information contained in this publication without obtaining specific professional advice. No representation or warranty (express or implied) is given as to the accuracy or completeness of the information contained in this publication, and, to the extent permitted by law, PricewaterhouseCoopers LLP, its members, employees and agents do not accept or assume any liability, responsibility or duty of care for any consequences of you or anyone else acting, or refraining to act, in reliance on the information contained in this publication or for any decision based on it. © 2015 PricewaterhouseCoopers LLP. All rights reserved. In this document, “PwC” refers to the UK member firm, and may sometimes refer to the PwC network. Each member firm is a separate legal entity. Please see www.pwc.com/structure for further details. 141223-105411-SS-OS

© Copyright 2026