Westminster Business Forum Keynote Seminar: The future of payments

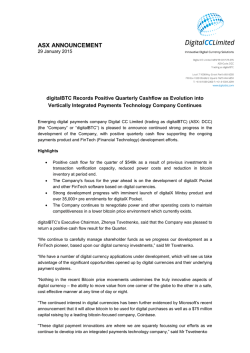

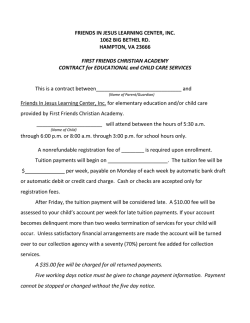

Westminster Business Forum Keynote Seminar: The future of payments regulation Timing: Morning, Wednesday, 25th February 2015 Venue: Glaziers Hall, 9 Montague Close, London SE1 9DD Draft agenda subject to change 8.30 ‐ 9.00 Registration and coffee 9.00 ‐ 9.05 Chair’s opening remarks Senior Parliamentarian 9.05 ‐ 9.20 Payment markets ‐ an overview of latest trends Chris Skinner, Chairman, The Financial Services Club and Owner, Balatro Questions and comments from the floor 9.20 ‐ 9.40 UK Payments in ten years’ time ‐ next steps for driving change Maurice Cleaves, Interim Chief Executive Officer, Payments Council Questions and comments from the floor 9.40 ‐ 10.35 Payments and the UK economy ‐ innovation, security and consumer inclusion Frontline perspectives on the key innovations that will determine the future of the UK payments landscape, and implications for consumers, businesses and the wider UK economy. What has been the impact so far of recently established services such as the mobile payments system (Paym) and Faster Payments Service (FPS), and what can be learnt from their uptake by consumers and businesses? In light of Government’s consultation on image‐based cheque processing, what are the operational challenges for speeding up cheque payments, and what more can payment innovation do to reduce costs and make banking easier for consumers? How warranted are concerns raised about the increasing use of alternative settlement mechanisms, such as Bitcoin, and what are the implications for financial stability and regulation? In light of recent technological advancements across payment schemes, what are the priorities ahead for tackling unintended security and integrity concerns, such as e‐crime, cyber‐attacks, and payment fraud; what are the next steps for further developing authentication technologies and biometric solutions? What more can be done to raise consumer confidence and improve consumer engagement and choice? What more can be done to make payment systems more inclusive for end‐users ‐ particularly older consumers or those living with cognitive and physical disabilities ‐ and how can the design of infrastructure support access and usability? Sarah Francis, Consultant, Polymath Consulting Jane Vass, Head of Public Policy, Age UK Peter Robinson, Commercial Manager Payments, Dixons Carphone Group and Chair, British Retail Consortium’s Payments Policy Action Group Dominic Frisby, Commentator on Gold and Commodities, MoneyWeek and Author, Bitcoin ‐ the Future of Money? Jamie Martin, Head of Payments & Cash Services, Clydesdale and Yorkshire Bank Questions and comments from the floor 10.35 ‐ 10.40 Chair’s closing remarks Senior Parliamentarian 10.40 ‐ 11.05 Coffee 11.05 ‐ 11.10 Chair’s opening remarks Steve Baker MP, Member, Treasury Committee 11.10 ‐ 11.35 The revised Payment Services Directive (PSD2) Erik Nooteboom, Head of Unit, Retail Financial Services and Consumer Policy, DG Internal Market and Services, European Commission Questions and comments from the floor 11.35 ‐ 11.45 Payment systems supervision and implications for financial stability David Bailey, Director, Financial Market Infrastructure Supervision, Bank of England 11.45 ‐ 12.30 The future for UK payments services ‐ market competition, infrastructure and access to payments schemes In what ways will the new Payment Systems Regulator (PSR) ‐ scheduled for operational launch in April 2015 ‐ impact on the future market structure for UK payments and the range of businesses comprising the industry ‐ such as payment system operators, infrastructure providers, banks and other payment service providers? What challenges will the PSR face in opening up the market and developing effective competition between all market participants, particularly in relation to ensuring that smaller financial organisations can access services? In light of the revised European Payment Services Directive (PSD2) ambition to level the playing field between banks and non‐banks (by granting non‐banks access to payment systems), what more can policymakers do on a domestic level to enhance access to financial infrastructure, and to address concerns relating to the ownership of payment systems? How warranted are concerns that opening up the payments market and facilitating access to payments infrastructure might increase risks such as settlement, operational and business risk? What are the next steps for implementing effective safeguards against such risks, and what more can be done to protect the financial and operational stability of payment systems? Fiona Ghosh, Partner, Payment Systems Group, Addleshaw Goddard David Yates, Chief Executive Officer, VocaLink Richard Koch, Head of Policy, The UK Cards Association Luke Olbrich, Senior Director and Head of EMEA Core Payments, PayPal Questions and comments from the floor with David Bailey, Director, Financial Market Infrastructure Supervision, Bank of England 12.30 ‐ 12.55 Implementing the new regulatory framework ‐ priorities and challenges ahead Hannah Nixon, Managing Director, Payment Systems Regulator Questions and comments from the floor 12.55 ‐ 13.00 Chair’s and Westminster Business Forum closing remarks Steve Baker MP, Member, Treasury Committee Marc Gammon, Senior Producer, Westminster Business Forum

© Copyright 2026

![[7.1.2] Compensation Payments in respect of Personal Injuries](http://s2.esdocs.com/store/data/000502603_1-53ac1a989b68853ba6f6b00260848dd2-250x500.png)