FIN_Market Wrap_2-proof

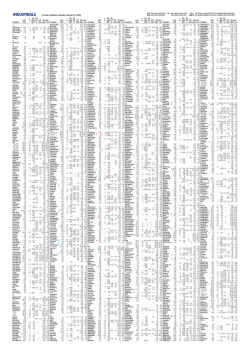

INDUSTRIALS Company Last Sale Last The price at which the + or - The change in price from Sale stock was last traded the previous day’s close to close of business: Thursday, January 29, 2015. + No. Div or Sold Yld P/E 52 week 100s % Ratio High Low Company 3 360 Cap Gp 1.07 1701 4.73 8.9 1.085 .65 1 1237 6.97 6.0 2.78 1.991 360 Cap Ind ▲ 2.69 360 Cap Office 2.13 788 2.15 1.92 3P Learning 2.23 1 393 2.60 1.94 8 8common .20 61 .295 .20 8I Hldgs .415 343 .43 .25 9 99 Wuxian .38 265 380.0 .73 .30 A A1 Invest .001 .002 .001 Abacus 3.06 4 4552 5.56 13.7 3.23 2.20 Aberdeen 1.11 100 6.53f 36.8 1.36 1.04 Academies 1.17 53 4.70f 11.9 1.40 .835 Aconex 1.90 +4.5 322 1.95 1.65 Acorn Capital .72 .96 .715 Acrux 1.52 3242 5.26f 9.0 2.452 .75 Actinogen .058 .2 530 .079 .011 Acuvax .001 .001 .001 Adacel .28 .49 .20 Adcorp Aust .051 .095 .04 Adelaide Brtn 3.62 +3 10264 4.56f 16.4 4.375 3.12 ADMEDUS .125 +.5 16395 .185 .094 Adslot Ltd .115 9321 .17 .062 ADV Brake .008 % +.1 8270 .014 .005 Adv Share .64 +4 100 5.78f 17.4 .72 .595 Aeris Env .28 +1 370 .30 .08 Affinity Edu 1.30 +.5 851 1.446 1.07 AFT Corp .001 .001 .001 AG Financial .025 .063 .025 Agenix .014 2.2 .029 .01 AGL Energy 14.39 +32 22286 4.38f 14.1 15.590 12.55 frn jun39 104.945 +19.5 28 109.00 102.401 Agri Land .076 6.84 .105 .075 AIMS Prop .125 +.5 2615 1.60 2.4 .13 .072 Ainsworth 2.90 6 9582 3.45 15.3 4.65 2.03 Air NZ 2.46 +1 228 3.72 11.1 2.58 1.484 AJ Lucas .41 +1 350 1.26 .40 .68 .072 Alchemia ▼ .075 % 1.5 15315 Alcoa 22.00 95 3 .43 22.95 12.70 ALE Prop Grp 3.40 +1 679 4.84 17.9 3.47 2.81 Alexium .74 +1.5 25663 .80 .082 Algae.Tec .076 .17 .06 Allegra Ortho .06 .06 .044 Alliance Avn .52 +1.5 301 10.96f 5.3 1.62 .36 ALS 5.06 14 14342 6.13p 17.8 9.30 4.33 Alt Inv Tr .16 50 400.0 .16 .125 Altium 2.86 10840 4.20 26.3 3.49 2.07 Am Patriot .12 .21 .11 AMA Group .37 1627 4.32f 21.8 .38 .225 Amalg Hldg 11.28 12 112 3.72f 22.7 11.51 8.03 Ambertech .20 .20 .11 Ambition .15 .18 .10 AMCB Fd5 57.30 5.29f 16.1 72.50 54.351 Amcil .855 .5 557 2.92f 36.7 1.010 .83 Amcom 2.84 5 1475 2.18f 31.1 2.99 1.84 Amcor 12.75 +12 48669 3.37 27.2 13.78 9.88 AMP 5.80 +10 144428 4.14p 25.6 5.96 4.11 frn dec23 103.99 29 14 105.49 101.17 AMP China 1.14 1.5 3017 1.68 1.22 .63 AnaeCo .005 1000 .015 .003 Analytica .027 +.1 1433 .05 .021 Anatara .30 810 .49 .28 Ansell 22.43 +4 3835 1.87 72.1 23.00 17.73 Antaria .022 1000 220.0 .031 .008 .1 30610 .285 .086 Anteo ▼ .091 Antisense .11 +1 2159 .232 .084 ANZ 32.95 +31 64164 5.40f 12.3 35.07 28.84 frn jun22 103.60 35 121 105.91 102.70 pref cps2 101.01 +36 205 4.00f 104.30 99.251 pref cps3 100.91 +1 101 3.97f 105.90 98.499 cap note 100.00 114 4.22f 107.60 98.131 cap note2 98.27 +2 106 4.19f 105.48 97.40 AP Eagers 6.21 3 72 3.86f 16.8 6.32 4.65 APA Group 8.10 1 15985 4.48 19.7 8.135 5.717 APN N&M .80 9564 89.9 .865 .351 APN Outdoor 2.65 +1 353 2.77 2.42 APN Prop .38 300 3.29f 9.6 .38 .25 Appen .565 +1.5 1680 .675 .48 Applabs Tech .20 +.5 300 .285 .14 APT Pipeline 105.00 85 36 109.00 104.00 Aquaint Cap .35 2.86 .55 .255 ARB Corp 11.41 +7 1397 2.54f 19.4 12.674 9.656 Ardent Lsr 2.72 25333 4.85 22.4 3.49 1.95 Arena REIT 1.61 +4.5 664 6.15 7.6 1.70 1.06 Argo 7.93 713 3.53f 26.3 8.14 7.18 Ariadne .385 74 2.60p 12.6 .43 .32 Aristocrat 7.09 +7 15896 2.26 7.14 4.39 Armidale .105 6.1 .125 .08 Arowana 1.00 1.00 1.00 Arowana Intl .94 50 2.55f 1.4 1.05 .441 Arrium .205 +1 239176 43.90 1.4 1.630 .15 Arunta Res .002 30000 .006 .001 Asaleo Care 1.645 +.5 9761 2.13 1.605 Asciano 6.05 +1 20796 2.36f 23.2 6.61 5.13 ASF Group .23 92.0 .255 .097 ASG Group .65 .5 10014 f 15.0 .82 .345 Ashley Grp 1.46 +6 1645 1.94 1.29 Asia Pac Data 1.24 +.5 1376 5.44 6.6 1.255 1.01 Asia Pac Dig .35 170 .575 .25 Asian Am Med .08 1.25 .096 .07 Asian Master 1.33 2.26 1.35 .99 ASK Funding .095 f .115 .092 Aspen 1.23 +2 178 6.91 1.44 1.15 Aspermont .02 .035 .015 Astivita .075 .16 .071 Astro Japan 5.00 +1 1161 2.00 2.2 5.21 3.57 Astron .275 .425 .173 1 5986 4.68f 19.2 38.19 34.07 ASX ▲ 38.09 Atcor Med .10 1000 .16 .08 Atlas Pearls .063 10.3 .14 .058 Au Dairy Farms .27 698 .38 .003 Auckland Air 4.10 15 566 1.52 26.5 4.40 3.197 Audio Pixel 8.90 +40 81 14.50 3.15 Aurizon 4.93 +5 46320 3.35 41.8 5.265 4.15 Aurora ARF .965 6.55f 68.0 1.08 .955 Aurora Fd .55 42 1.82f 7.0 .72 .48 Aurora Glb .825 85 8.01 .935 .803 Aurora Prop 5.50 12 7.79 5.52 5.09 Aurora Tr .89 1477 6.65 15.9 1.035 .88 Aus Gov Mstr 1.96 751 4.59f 26.2 2.03 1.82 Aus Unity 102.55 10 9 105.75 101.50 Ausdrill .395 +3 7895 11.39f 1.37 .36 Ausenco .44 % +4.5 962 .725 .375 AusNet 1.37 +.5 38207 6.10p 44.3 1.45 1.18 Aust Agri .01 .014 .007 Aust Agric 1.635 +.5 6462 1.67 1.15 +10 2268 1.85 1.235 Aust Careers▲ 1.85 Aust China .001 10.0 .003 .001 Aust EIF 6.36 47 7.86p 9.7 6.72 6.30 Aust Ethical 38.00 +40 6 5.26f 15.3 47.00 29.00 Aust Found 6.15 1795 3.74f 26.1 6.30 5.80 6.25% cn 119.28 +108 12 122.00 113.25 Aust Ind Reit 2.28 1 2354 5.00 18.7 2.30 1.96 Aust Leaders 1.365 +1.5 3543 8.79f 6.7 1.80 1.295 Aust Mast Y1 80.92 5.13f 20.7 103.00 79.99 Aust Mast Y2 90.45 4.36f 23.0 101.54 90.04 Aust Mast Y3 94.17 +14 5.78f 18.5 94.786 92.51 Aust Mast Y4 85.74 +13 20 3.78f 25.1 90.91 84.71 Aust New Agri .16 +1 29 .24 .09 Aust Pharm .915 +5 12520 3.83f 18.3 .975 .49 Aust Rural .55 .65 .06 Aust Utd Inv 8.06 +1 432 3.97f 21.7 9.24 7.64 +.5 4583 4.84f 8.9 .465 .30 Aust Vintage▲ .455 Aust Wealth .19 166 .42 .16 Austal 1.56 +2 2084 17.3 1.60 .75 Austbroker 8.35 +5 491 4.61f 14.3 11.30 8.21 1 684 6.25f 63.2 3.55 .68 Austin Eng ▼ .72 Austock .36 5.56f .37 .20 Auth Invest .025 6.6 .029 .02 Auto Hldgs 3.89 +5 4415 5.40f 14.5 4.16 3.42 Aveo Grp 2.29 8618 1.75 38.8 2.39 1.927 Avexa .015 +.1 2569 .027 .011 Avita Med .086 200 .14 .076 AVJ .58 1 786 3.45f 11.7 .67 .52 Axiom .055 8.6 .06 .03 Axxistech .001 5000 .002 .00 Azure Health .30 675 14.7 .49 .20 B Bailador Tech .895 +4 454 1.00 .83 Bank of Qld 12.50 +13 18691 5.28f 16.1 13.25 10.615 pref 106.50 +69 29 5.11f 110.15 103.00 Barrackst .85 77 1.10 .81 Beacon Ltg 1.56 +1 10146 f 1.60 .96 Bega 5.13 +3 1405 1.66f 11.8 5.63 4.69 Bell Fin Grp .435 2 680 3.45f 24.3 .74 .42 Bellamys Au 1.80 +4.5 673 1.835 1.21 +15 15470 4.73f 15.4 13.53 10.83 Ben & Ad Bk ▲ 13.53 pref b 99.90 +5 11 2.92f 100.61 97.20 pref 105.35 +75 18 5.17f 110.00 103.15 39 2.80f 99.50 95.70 pref 2 ▼ 96.101 69.9 Benitec .755 2 911 2.38 .52 Bentley .145 13.45f 13.4 .165 .135 Beta Agric 8.72 8 11 12.00 8.25 Beta Au 200 12.64 +3 42 p 12.97 11.51 BetaBearFund 17.38 6 1243 19.44 17.18 18 2 16.82 11.28 Beta Comm ▼ 11.28 57.30 23.52 Beta CrOil ▼ 23.53 60 412 Beta DivHarv 25.25 +6 225 25.34 24.41 Beta Euro 14.06 +8 3 15.32 13.63 Beta Financ 11.78 +7 77 p 11.88 10.00 Beta GBP 18.92 19.10 17.28 Beta Gold 13.52 7 5 14.80 11.86 Beta HiIntCsh 50.22 +3 851 50.24 50.07 Beta Res 4.48 3 6 p 5.95 4.26 Beta S&P 500 16.35 3 79 16.71 14.36 Last Sale + No. Div or Sold Yld P/E 52 week 100s % Ratio High Low Company Beta US 1000 25.76 30 42 26.29 24.99 +18 1343 12.49 10.37 Beta USD ▲ 12.49 Beta YldMax 10.99 +4 1254 p 11.79 10.50 Beta Geared 20.73 +7 70 p 21.95 17.31 Beyond Int'l 1.165 200 7.73 9.0 1.72 1.05 BigAir Grp .865 +2.5 3282 1.27f 27.9 1.05 .61 Billabong .635 +2.5 13321 .735 .43 Bio Capital .095 +.5 404 .10 .018 Bionomics .415 1 433 51.9 .80 .37 Biotron .125 1915 .296 .068 Bioxyne .011 % .4 6857 1.7 .037 .005 Birch&Prestg .41 .41 .41 Bisalloy .33 2 1074 f .80 .25 Bisan .007 % +.1 1000 .05 .005 BKI Invest 1.665 1.5 2616 4.23f 21.7 1.73 1.535 BKM Mgt .001 .004 .001 74 3.08f 27.6 41.83 20.51 Blackmores ▲ 41.25 +25 Blackwall .34 +1 90 7.35f 4.3 .35 .19 Blackwall Tr .10 851 11.00 3.3 .15 .075 Blue Sky Fd .97 +4 1196 1.02 .89 Blue Sky Inv 2.88 2 440 2.43f 35.3 3.03 1.90 Bluechiip .085 1004 .215 .031 BlueScope 5.01 5 30914 6.64 4.70 BluGlass .10 .20 .087 Boart .17 +.5 2176 .48 .085 Bone Medical .008 32089 .036 .004 Boom .135 +1 3776 .18 .115 Boral 5.57 +16 37195 2.69f 25.1 5.965 4.67 BPH Energy .006 200 .014 .006 BPS Tech .79 % +8.5 445 1.00 .70 Bradken 2.62 2 33335 9.92 20.6 5.30 2.59 Brain Res .25 % 4.5 4597 .36 .19 Brambles 10.59 19 45776 2.55p 12.3 10.90 8.61 Breville 7.22 6 9050 3.74f 19.3 10.10 6.06 Brickworks 11.97 +7 553 3.51f 17.2 14.98 11.52 Brierty .42 +2.5 1337 7.14f 4.7 .567 .281 Bris Bronco .255 1.96f 14.7 .30 .24 Broad Inv .003 .003 .001 Bronson Gr .015 1253 .03 .003 Brook Prime 5.10 17 1.57 12.5 5.75 4.05 BSA Aust .145 +.5 5337 .164 .089 BT Invest 7.15 15 432 4.90p 14.6 7.45 5.65 Bud Ginger .59 +1 150 .701 .478 Burson 2.40 +5 686 2.60 1.895 BWP Trust 2.84 1 8707 5.18 11.7 2.93 2.19 Byte Power .001 .003 .001 C Cabcharge 4.34 26 8262 5.76f 9.3 6.05 3.655 Cadence 1.405 .5 1494 7.12f 10.2 1.535 1.34 Caltex 33.18 80 6513 1.12f 18.0 35.48 18.82 notesep37 106.20 45 10 109.50 104.50 Capilano 7.70 +22 93 1.95f 14.2 8.20 3.718 Capitol Hlth .865 +6.5 23544 1.04f 51.5 .90 .375 Capral .12 +.5 7820 23.5 .18 .105 Carbon Consc .019 .2 904 .035 .018 Cardia .002 50000 .004 .001 Cardno 3.07 +4 4628 11.73f 5.9 7.34 2.52 Carindale 6.70 +11 102 4.63 6.5 6.80 5.34 Carlton Inv 28.90 5 3.46f 21.7 29.52 24.75 .2 55086 .07 .043 Carnegie ▲ .064 carsales.com 10.50 14 5636 3.06f 26.1 12.61 8.69 Cash Conv 1.10 +1.5 5052 3.64f 19.4 1.205 .855 Catapult Intl .54 3 1994 .66 .535 CBA ▲ 88.76 +106 33525 4.52f 16.6 89.04 72.14 bonddec15 100.49 +19 754 101.40 99.70 perls vi 101.919 +56.9 94 4.45f 107.40 100.00 perls vii 96.00 +20 134 1.82f 98.49 94.96 CBG Capital .98 +.5 10940 1.05 .95 CC Amatil 9.70 +8 17288 5.36p 159.0 11.93 8.19 Cedar Woods 5.85 15 227 4.70f 10.8 7.96 5.33 Cellmid .025 .1 776 .039 .023 Cellnet .305 .5 189 .335 .14 Centrept All .48 +.5 2933 4.58f 15.0 .575 .287 Centuria .905 3.04f 7.8 .97 .74 +1 160 2.15 2.05 Centuria REIT▲ 2.15 Century Aust .885 +1 610 5.65f 20.9 .945 .825 418131 .048 .004 Ceram Cell ▼ .005 Cervantes .01 .013 .001 Challenger 6.25 3 14282 4.16p 9.4 8.27 5.605 cap note 99.00 139 1.81 99.98 97.90 Chalmers 2.85 2.63f 20.0 3.00 2.50 Chandler .535 +.5 3938 5.98f 19.7 .54 .29 Chapmans .01 .1 2405 .04 .008 Chart Hall Ret 4.38 3 21532 6.24 18.3 4.50 3.50 Charter Hall 4.83 6 8402 4.84 18.9 4.95 3.67 Charter Pac .021 .075 .02 China Int .20 .20 .20 ChongHerr .007 .011 .003 Chorus 2.36 +1 1684 6.7 2.60 1.225 CI Res .80 f 5.2 .95 .77 CIC Aust .83 f 7.5 .83 .66 Circadian .175 % +2 420 .274 .15 Citadel Grp 2.10 +7 2628 2.39 2.00 Clarius .28 .5 210 .31 .19 Clean Seas .078 +.1 9223 6.8 .092 .04 Clean TeQ .125 +1 16389 .13 .04 Clearview .90 114 2.22f 28.8 1.15 .665 Clime Cap .925 +.5 1178 4.97f 18.5 1.07 .90 Clime Inv .72 +2 381 7.64f 10.6 .90 .68 Clinuvel 3.75 49 5.20 1.30 Clover .295 869 3.39f 50.0 .59 .26 CMI 1.30 320 4.62f 12.6 1.715 1.25 CML Grp .235 2647 4.68f 15.2 .32 .14 Cochlear 82.33 +12 1176 3.09p 50.0 84.03 51.79 Codan .80 609 3.75f 15.4 1.01 .592 Coffey Int .265 .5 1550 14.7 .365 .20 CogState .185 .385 .16 Coll House 2.08 +2 993 3.85f 14.1 2.30 1.675 Collaborate .022 .1 6960 .035 .01 +5 2821 4.40f 2.53 1.81 Collins Fd ▲ 2.50 Colonial 103.75 194 104.98 101.021 Colorpak .66 5.30f .86 .56 Commod Grp .065 1583 .081 .039 CommStrat .056 .056 .015 ComOps .024 .045 .022 Compumedic .11 1305 20.4 .16 .07 Computershr 11.64 22 14538 2.49p 24.3 13.17 10.78 .5 2954 .32 .005 Connexion ▲ .285 Cont Inves .055 .16 .05 Contango 1.06 838 8.11p 5.0 1.195 .99 Coretrack .004 .015 .003 Corp Travel 9.66 3 1731 1.24f 50.8 10.73 4.871 Corum Grp .135 +1 5294 8.15 7.9 .165 .10 Countplus 1.115 1.5 338 8.97f 11.0 1.83 1.05 Coventry 2.40 2 291 9.17f 150.0 3.45 2.25 CoverMore 1.90 +1 7395 f 2.460 1.676 CPT Global .74 +5 857 6.08f 12.6 .93 .575 +41 1425 3.45f 15.4 11.65 8.52 Credit Corp ▲ 11.60 Cromwell 1.065 +2 108976 7.28 10.0 1.09 .935 Crowd .185 +1 13012 .22 .002 Crown Resrts 13.79 +9 22910 2.68p 15.3 17.97 11.66 notesep72 105.97 +37 11 112.39 104.20 Cryosite .39 3.85 36.1 .471 .296 CSG 1.17 .5 258 4.27 29.3 1.355 .805 CSL 87.57 +45 9926 1.41 30.5 89.07 63.77 +18 47282 3.36 18.4 4.02 2.87 CSR ▲ 4.02 CTI Logistic 1.35 4 7 5.93f 8.7 2.49 1.22 CVC 1.43 3.50f 6.8 1.555 1.076 CVC Prop .014 15.6 .015 .007 Cyclopharm .285 14.5 .35 .20 Cynata .36 .545 .28 D Data#3 .67 +1.5 299 6.72f 13.7 .945 .54 DataDot .027 +.2 51078 .039 .02 Decimal .115 .32 .10 Decmil Grp 1.29 2 3111 10.08f 4.1 2.25 1.11 Delecta .003 .012 .003 Desane .83 2.41f 20.2 .88 .654 Devine .92 373 1.17 .60 Dexus Prop 7.58 +1 31829 4.96 15.3 7.66 .995 Dick Smith 2.03 9909 3.94f 25.4 2.36 1.805 Dicker Data 1.59 2.42f 39.2 1.97 .94 Digga 1.145 f 1.885 1.07 Digital CC .091 .3 623 .41 .022 Diploma .031 2.6 .05 .031 Disruptive .015 % +.3 60105 .03 .006 Diversa .38 .513 .37 Diversified 3.50 +6 796 4.00f 22.6 3.850 3.27 +1 1201 3.39 3.13 new ▲ 3.36 DJW Invest 4.59 17 1147 5.66f 24.8 4.95 4.36 Dominos 25.50 29 1794 1.44f 50.5 29.41 15.69 Donaco Intl .545 24.5 1.609 .535 Dorsavi .40 1680 .59 .36 Downer EDi 4.23 +1 12594 5.44f 8.8 5.59 3.93 Draig Res .015 .035 .011 Dromana .001 .023 .001 DTI Grp .325 .35 .305 DUET Grp 2.52 +1 25654 6.85 16.4 2.551 2.005 DuluxGrp 5.99 1 14418 3.42f 21.3 6.17 5.11 DWS 1.08 +1.5 1127 8.10f 10.8 1.39 .94 Dyesol .20 .5 2004 .305 .20 E E&A .38 +1.5 877 14.47f 5.9 .675 .355 Easton .65 .97 .60 eBet 3.98 277 1.38p 21.0 4.215 2.728 EBOS Grp 8.57 4.00 14.7 9.50 7.872 Ecargo Hldgs .31 2 31 .415 .205 Echo Ent 4.00 +3 31702 2.00f 31.0 4.07 2.13 Ecosave .95 f 1.40 .82 Elanor 1.64 50 1.64 1.24 Elders 3.31 19 4416 57.1 3.53 .85 7 67.50 17.00 hybrids ▲ 67.00 Elec Optic .75 +2 81 1.25 .295 Ellerston 1.14 1.17 1.00 Ellex .35 % +4 563 47.9 .44 .23 Embelton 6.45 4.73f 11.5 7.40 6.45 .12 10354 .30 .11 Emeco Hldg ▼ Emerchants .61 +.5 3155 .89 .445 Last Sale + No. Div or Sold Yld P/E 52 week 100s % Ratio High Low Company Emerg Mkts 1.84 Empired .625 +2 Eneabba Gas▲ .03 % +.5 Energy Act 2.71 9 Energy Dev 5.26 Energy One .38 Energy Tech .008 Energy Ven .003 Enerji .009 Enero .87 +2 Engenco .09 Enhncd Oil Gas .011 +.1 Ensogo .12 +.5 Entellect .001 ENV Clean Tec .008 % +.1 .1 Env Mission ▼ .036 Enverro .90 Environ Grp .018 Ephraimres .002 Equity Tr 19.50 +46 Erin Res .005 ERM Power 2.18 1 eServGlobal .48 +1.5 Estia Hlth ▲ 5.09 +24 ETFS BrCrude 38.67 +9 ETFS PhyPlat 153.79 +66 ETFS PhySilv 22.07 +18 Ethane Pipe 1.76 +1 Etherstack .50 Eumundi .052 Eureka Grp .30 +1 Euroz 1.04 1 Evolve Edu .98 EVZ .031 EZA Corp .11 1 F F&P Health 5.80 3 Fairfax .87 1.5 Fantastic 1.85 +1 Farm Pride .22 Fatfish Grp .20 Fed Centres 3.03 +2 FFI Hldg 3.85 Fiducian 1.80 +1 Finbar 1.275 2.5 Firstfolio .011 Flagship 1.51 .5 Flat Glass .06 Fleetwood 1.40 3 Fletcher Bld 7.92 +16 FlexiGroup 2.92 +1 Flight Centre 37.59 +14 Folkestn Ed 2.01 2 Folkestone .21 +.5 Fonterra SH 5.44 2 Freedom FGL 3.19 Freelancer .60 1 Freshtel .002 FSA Group 1.24 +.5 Funtastic .022 .1 Future Gen Inv 1.115 .5 G G8 Educate 4.14 2 Gage Roads .15 Gale Pac .195 +1 Galicia Engy .005 Galileo JP 1.775 +.5 Gazal 2.70 GBL Master 1.60 GBST Hldgs 3.84 +6 GDI Prop Grp .845 1 Gen Health 1.53 +1 Gene Tech .012 % .2 Genera Bio .23 +6 Genesis Ene ▲ 2.11 Gentrack 2.00 Genworth 3.47 +7 Geodynamic .035 % .4 GI Dynamics .23 .5 GLG Corp .22 Global Const .50 +3 Global Hlth ▼ .225 % 5.5 Global Res 1.50 Globalval 1.045 +1.5 +3 Globe Intl ▲ .76 GoConnect .006 Godfreys Grp 3.07 +4 Goldfields 1.00 Goodman 6.03 9 Goodman Fldr .645 +.5 Goodman Plus 103.01 49 Gowing Brs 2.95 +4 GPS Alliance .17 GPT 4.53 1 GPT Metro 1.975 .5 GR Engin .815 +1.5 GrainCorp 8.85 42 Grandbridge .036 Grays Ecom 1.27 +6 Green Inv .025 Greencross 8.71 +3 Growthpoint 2.83 3 GUD 7.81 +16 Guinness .425 GWA Group 2.67 +3 H Hansen Tech 1.735 .5 +12 Harvey Norm▲ 3.94 Hasting HY .175 Healthscope 2.74 1 Helloworld .25 Henderson 4.47 +4 Heritage Bk 106.70 +5 HFA Hldgs 1.555 .5 HGL ▼ .25 Hillcrest .002 Hills 1.07 +3 Hitech Grp .042 HJB Corp .02 Holista .025 Homeloans .625 Hotel Prop 2.61 2 HUB24 .90 +2 Hudson Inv .042 Hunter Hall 1.92 HuntHall GV 1.275 1.5 Huon Aqua 4.65 Hutchison .065 +.4 I IAG 6.41 +13 cps 102.00 +38 IAG Fin NZ 102.10 iCar Asia 1.095 +4.5 iCash .075 ICollege .135 ICS Global 1.01 +6 IDT Aust .145 iiNet 7.48 10 IM Medical .001 Imdex .30 +1 IMF Bentham 2.10 4 Immuron .19 % +2 Impedimed .90 +5 Imperial Pac .70 Imugene .009 % .1 Inabox Grp .985 .5 Incitec Pv 3.58 3 Indskydive .48 Industria 2.01 1 Infigen .25 +.5 Infomedia .92 3.5 Infratil 2.65 Ingenia .41 Innate .19 .5 INT Corp .02 INT Resrch 1.29 +2 Inter Eq .06 Intueri Edu 2.75 +4 Inventis .011 Investa Offc 3.86 +2 Invigor Grp .088 Invion .047 InvoCare 13.05 4 IOOF 9.39 +5 IPE .305 IPH 3.83 +1 iProperty 2.67 13 IRESS 10.30 +1 Ironbark .54 iSelect 1.19 1 Isentia Grp 2.69 4 iSENTRIC .20 +1 iShAsia50 62.03 +26 iShASX20 25.20 +13 iShAust200 24.02 +2 iShChinaLCap 53.59 51 iShComp 107.86 +40 iShEurope 54.24 60 iShGl100ETF 95.02 66 iShGlbCons 116.62 55 iShGlbHlth 130.67 82 iShGlbTelco 78.37 50 iShHighDiv 14.88 +5 iShMsciEafe 78.10 43 iShMsciEmM 51.01 6 iShMsciJpn ▲ 14.82 +20 iShRussell 148.35 256 70 752 1500 47 110 3.26 23.6 1.84 1.55 1.60f 14.4 .83 .485 .03 .008 2.71f 19.9 3.80 1.90 5.32f 19.1 6.05 4.82 20.0 .495 .10 .014 .007 .01 .003 .016 .001 152 1.30 .64 4 .19 .09 4727 .017 .008 5120 .682 .074 .003 .001 6410 .014 .002 1338 .083 .036 1.00 .80 2.8 .059 .017 .25 .002 411 4.82f 22.0 22.10 16.80 .025 .003 1272 5.50f 2.60 1.51 16 8.6 1.10 .45 13124 5.15 4.25 14 76.79 37.29 1 161.27 133.77 167 25.01 16.96 1276 8.99p 39.6 1.78 .725 140 .55 .20 f 3.7 .053 .042 2179 37.5 .35 .10 1005 10.34f 5.7 1.43 .965 1.02 .97 433 .043 .01 234 .135 .051 7632 2.05 33.8 6.05 105381 4.60f 9.2 1.065 10 3.24f 32.6 2.03 5.6 .26 1500 .29 70136 5.35 9.8 3.06 120 4.55f 10.6 4.50 29 5.06f 14.1 2.10 936 7.84f 7.8 1.80 700 .021 122 4.47f 111.9 1.705 .056 577 2.86f 1166.7 3.05 3500 3.90 17.3 9.27 6472 5.65f 15.4 4.39 8013 4.04f 18.3 55.72 1882 6.14 7.2 2.08 3450 30.0 .254 8631 1.44 29.7 5.95 27 .94f 36.9 3.51 431 1.76 .005 349 4.84f 11.5 1.545 6483 22.73f .16 1445 f 1.125 3.56 .65 1.41 .09 .165 2.245 3.66 1.48 1.24 .009 1.40 .028 1.10 7.40 2.70 31.41 1.49 .171 5.23 2.41 .515 .001 .93 .022 .004 16282 4.59f 33.5 5.63 241 .26 4150 13.59 7.0 .30 .185 50 5.92 4.0 1.85 6.67f 12.4 3.00 91 192.8 1.60 794 2.21f 25.5 4.20 5550 .98 2205 5.36 14.5 1.57 24865 .074 .38 548 2.14 p 2.57 18738 .81f 53.4 3.90 4182 .095 116 .82 150 3.8 .26 75 10.4 .60 369 5.1 .80 1.70 500 1.06 467 f .76 1534 .019 500 3.25 76.9 1.10 40907 3.43 15.8 6.195 36313 3.10f .695 12 110.00 86 4.07f 10.3 3.00 .21 94879 4.59 14.9 4.55 2326 2.01 692 8.59f 8.6 .965 9069 2.26f 40.2 9.30 .064 279 1.98 .046 3667 1.44f 10.78 1435 6.86 11.0 3.00 2943 4.87f 18.4 7.99 56.7 .66 3341 2.06f 44.0 3.19 3.12 .14 .185 .004 1.495 2.60 1.13 2.60 .84 1.176 .012 .09 1.565 1.85 2.90 .035 .195 .215 .36 .225 1.42 .97 .30 .004 2.78 .915 4.55 .475 99.00 2.55 .12 3.565 1.88 .51 7.50 .03 1.13 .017 7.15 2.368 5.09 .37 2.44 1464 3.46f 26408 3.55f 430 20.51 25928 f 88845 3.40 8 5571 5.61 650 16.00f 2769 6.54f f 800 37 8.00f 921 3.37 50 148 6.98p 1108 5.10p 348 1260 18.9 1.865 1.15 19.8 3.94 2.839 7.6 .18 .096 2.75 2.09 .39 .235 10.5 4.87 3.40 109.65 104.50 21.9 1.745 .895 .59 .24 .009 .002 10.3 2.10 .97 .08 .042 .198 .016 .08 .025 10.7 .855 .57 5.8 2.75 1.96 1.27 .74 .066 .041 13.8 2.38 1.55 6.1 1.33 .99 4.96 4.60 .115 .054 118528 6.08f 11.4 6.61 5.32 35 4.62f 107.50 100.85 34 109.50 102.00 6939 1.88 .76 .093 .03 173 .20 .013 115 2.97 16.8 1.087 .80 .40 .145 5927 2.94f 19.1 8.50 6.41 .003 .001 6026 f .77 .275 1083 4.76f 32.0 2.25 1.52 102 .36 .006 4314 .915 .17 7.14f .90 .70 830 .018 .008 119 12.7 1.39 .95 38735 3.02p 23.9 3.61 2.65 .916 .46 2751 2.10 1.805 30199 .305 .185 6586 4.11f 22.9 1.32 .61 3.98 4.4 2.65 1.800 11281 2.80 22.8 .533 .405 400 .30 .155 .035 .001 930 3.88p 25.6 1.34 .92 5.5 .06 .011 1115 70.3 3.01 2.28 .014 .005 21300 4.87 12.9 3.93 2.995 .12 .004 1950 .105 .043 2514 2.70f 29.6 13.29 9.82 6515 5.06f 21.5 9.93 8.01 120 19.67f 14.7 .431 .30 1090 3.85 2.96 7162 4.04 2.10 3273 3.93p 46.0 11.13 7.93 92 5.56f 10.7 .582 .52 4423 49.6 1.44 1.01 336 3.14 2.30 575 .315 .004 141 62.74 48.05 173 4.70p 2.9 26.06 22.95 280 3.96p 3.5 24.83 21.73 116 55.39 36.25 20 3.06 21.8 110.00 100.04 204 55.86 47.02 201 97.24 80.70 14 117.81 86.87 65 133.61 92.34 13 79.05 66.80 475 12.29 11.3 17.44 13.91 39 79.41 67.82 84 52.06 40.00 431 14.82 11.53 28 155.00 116.33 Last Sale + No. Div or Sold Yld P/E 52 week 100s % Ratio High Low Company iShS&P500 256.27 201 400 262.08 194.10 iShSmOrds 3.69 1 83 4.17p 13.2 4.14 3.48 iSonea .075 .5 2213 .36 .066 ITL .235 .5 190 4.26f 9.8 .30 .20 iWebGate .205 .5 1729 .25 .031 J James Hardie 13.10 +25 23656 3.36 79.0 14.982 11.16 Japara 1.88 1 9607 2.79 1.825 JB HiFi 16.65 +25 6103 5.05f 13.0 21.45 14.35 JCurve .014 .065 .011 Joyce .63 +2 131 5.71 11.1 .675 .40 3 1044 3.16f 14.8 1.95 .95 Jumbo Int ▼ .95 JV Global .003 .003 .001 K K&S Corp 1.29 +1 109 4.65f 14.3 1.90 1.125 K2 Asset Mgt .52 4 319 15.38f 7.4 .83 .48 K2 Energy .013 32.5 .026 .006 Kangaroo Isl 3.80 4.00 1.85 Katana .935 +.5 32 6.15 5.2 .999 .825 Kathmandu 1.865 +1 3124 4.99f 9.7 3.85 1.715 Keybridge .18 .5 810 .20 .16 Kingston .022 316 .034 .01 KipMcGrath .29 50 17.0 .42 .19 Kogi Iron .029 .3 4100 .108 .021 Kollakorn .009 % .1 3000 .023 .002 Konekt .125 1600 9.3 .15 .045 Koon Hldgs .15 37.5 .17 .14 Korvest 4.50 5 191 10.67f 7.0 6.99 4.50 Kresta .25 .5 83 f .255 .16 L Landmark .50 +.5 400 7.50f 11.9 .52 .41 Lantern Hotel .08 .089 .062 Laserbond .092 4.35f 12.6 .12 .079 .21 2 4440 .27 .21 LAT Am ▼ LBT Innov .074 +.4 486 22.4 .255 .05 Leaf Res .165 .23 .037 Legend Corp .235 7.45f 7.6 .365 .21 Leighton 20.72 8 2924 5.65p 16.1 23.48 15.39 Lend Lease 16.41 12 16053 4.33 10.9 16.95 10.135 Life corp .11 .27 .084 Life Hlthcare 2.60 +6 224 2.88f 4.9 2.79 1.975 Lifestyle 1.93 +3 31 15.7 2.08 1.11 Lindsay Aust .425 .5 178 4.71f 15.2 .50 .29 Lion Selectn .25 .54 .18 Lionhub .175 28 .24 .019 Living Cell .06 .1 1459 .088 .045 LogiCamms .675 2 519 8.15f 9.4 1.45 .57 London City .22 4.55f 11.3 .29 .20 Lovisa Hldgs 2.34 1 878 2.65 2.00 Lycopodium 1.40 3 33 4.64f 14.0 4.55 1.40 M M Pharma .61 .5 2122 16.4 1.045 .562 M'plex Sites 88.55 +15 14 94.50 82.50 M2 Grp 8.90 +7 6541 2.92f 23.8 8.96 5.27 Macmahon .06 +.2 20891 2.5 .145 .057 Macq Atlas 2.90 10 37381 4.55 3.53 2.54 Macq Group 61.75 +20 14003 4.70p 12.8 62.49 52.51 cap.nte 102.10 +10 108 5.56p 107.00 99.65 Macq Income 81.30 +130 7 89.25 78.50 cap note 97.84 75.9 44 2.42p 16.5 99.79 96.00 Macq Radio 1.15 8.70f 15.1 1.40 .99 Macq Telcom 5.00 24 2.40f 8.45 4.56 Magellan Fin 19.00 15 7448 2.02f 35.6 19.27 10.55 Magellan Flg 1.94 +3 2814 1.03 13.8 1.96 1.375 Magontec .02 3 .039 .019 Managed Acct .18 .5 350 .265 .165 Mantra Grp 2.80 1568 2.96 1.69 Mariner Corp .135 +.5 1 .23 .015 Mastermyne .24 126 10.00f 6.0 .73 .225 4 628 17.8 1.60 .57 Matrix Ce ▼ .57 MaxiTRANS .56 2.5 2386 10.71f 6.0 1.295 .47 Maxsec .04 40.0 .078 .008 MBD Corp .01 .04 .01 McAleese .29 63 1.20 .165 McMillan 10.89 +32 4404 4.78f 14.8 11.98 8.82 McPherson 1.20 +2 504 9.17f 1.46 1.03 MDS Fin .003 % .1 57300 .009 .002 Medibank Pte 2.35 2 67988 2.44 2.08 Medibio .003 % .1 30000 .005 .002 Medical Au .095 67.9 .395 .059 +10 721 f 120.0 1.85 .945 Medical Dev ▲ 1.80 Medigard .045 536 .045 .013 Medtech .15 .225 .06 Melb IT 1.35 +5 296 5.19p 1.835 1.21 Mercantile .12 .145 .115 Merchant .22 4.55 1.9 .235 .16 Mesoblast 4.00 6 4205 6.07 3.64 Metcash 1.48 4 80313 10.47f 7.6 3.25 1.45 Metro Glass 1.78 404.5 1.80 1.55 MGM Wire 1.15 4 84 .96 13.5 1.45 .85 MGT Res .045 .068 .015 Mighty River 3.15 13 311 3.90 22.2 3.37 1.805 Migme .69 1.07 .024 Millinium 6.51 1.92 61.6 6.59 6.20 Milton 4.61 4 394 3.88f 23.9 4.896 4.11 Mineral Res 6.67 +18 17151 9.30f 5.4 12.74 6.27 Mint Payments .062 .2 2846 .37 .055 Mirrabooka 2.50 +1 483 4.00f 49.2 2.90 2.378 .5 78049 4.65 15.9 1.96 1.63 Mirvac ▲ 1.935 Mission New .025 .03 .006 MMA Offshore▼ .81 2.5 135667 15.43f 4.3 2.896 .79 MNC Invest 3.60 3.91 1.51 Mobilarm .058 .067 .02 Mobile Embr .185 +.5 3890 24.0 .31 .13 MOKO Media .15 1 8513 .28 .125 Monadel 8.31 7 5480 14.80f 5.2 19.00 8.175 1 3133 1.97 1.305 Monash IVF ▼ 1.305 Money3 1.68 +6.5 1174 2.68f 20.7 1.74 .95 Mongolian Res .061 +.5 182 .12 .018 Montec .001 .003 .001 Montech .042 .2 .05 .022 Moreton Res .003 % .1 25000 1.3 .006 .003 Mort Choice 2.40 +1 1622 6.46f 15.0 3.23 2.13 Motopia .001 .002 .001 MUI Corp .001 .001 .001 Multiplex EU .04 700 6.3 .045 .016 Multistack .01 .011 .008 Murchison .13 .15 .10 Mustera Prop .225 450 .225 .20 MV Au Em Res 6.73 p 10.40 6.28 MV Au Eq Wt 21.42 +2 50 p 21.68 19.66 +15 5 p 27.57 23.71 MV Aust Banks▲ 27.57 MV Aust Prop 18.50 18.61 14.52 MV Aust Res 17.49 +48 3 p 21.40 16.331 MV WrldQual 17.11 21 251 17.50 15.19 My Net Fone 2.94 +17 2828 1.53f 31.7 4.00 1.75 Myer 1.54 +3 94129 9.42f 9.2 2.82 1.285 MYOB Finance 104.00 15 105.75 96.05 MyState 4.74 1 141 6.01f 14.0 5.04 4.37 N NAB 35.50 +30 65129 5.58f 16.0 36.00 31.33 natincsec 76.40 15.9 286 83.00 74.052 notejun22 103.42 1 125 105.70 102.30 cps 98.70 +50 104 4.18f 104.249 97.51 cps ii 98.00 90 4.24f 105.30 97.05 Namoi Cotton .28 2 300 1.79 3.5 .37 .26 Nanosonics 1.26 1.5 2412 1.45 .735 NAOS 1.02 196 5.64f 23.9 1.14 .995 NAOS Abs Opp .99 400 .995 .955 Narhex LS .006 .009 .002 Natl Storage 1.44 10630 2.64 1.55 1.075 Navitas 5.23 13 2662 3.73f 38.2 7.88 4.43 Nearmap .565 .5 9247 26.0 .835 .375 Neptune 1.16 1.50 1.00 Netcomm .46 +1 271 58.2 .82 .315 Neuren .17 +1 21023 .185 .064 Newfield .65 96 .80 .235 Newhaven .95 7.37f 12.5 .95 .735 News Corp 18.75 3 459 43.1 20.20 16.16 a nonvote 19.15 35 355 20.62 16.61 .3 33454 69.2 .515 .078 NewSat ▼ .083 Newzulu .10 .215 .05 Next DC 1.83 2 5670 2.34 1.445 NIB Hldgs 3.30 +9 3921 3.33f 20.8 3.455 2.414 Nick Scali 2.65 70 4.91f 15.1 3.12 2.40 Nine Ent 1.66 19397 2.53 25.2 2.39 1.62 Nomad .043 402 .061 .035 Noni B .50 3.00f .66 .34 Novarise .11 5.9 .195 .08 Novion Prop 2.30 37307 5.96 16.9 2.34 1.86 Novogen .115 +.5 1950 .27 .081 1 11993 30.51f 1.9 1.517 .29 NRW Hldgs ▼ .295 NSX .074 .19 .067 Nufarm 5.72 28 13103 1.40 59.6 6.12 3.77 Nuplex 2.95 5.58 12.2 3.25 2.55 NuSep .063 .085 .041 O Oakajee .031 .2 169 .045 .023 Oakdale Res .13 .21 .007 OBJ .089 .1 13138 .13 .032 Objective 1.50 +5 12 2.33f 25.0 1.76 .64 Oceania Cp 1.385 1.80 1.275 Oilfield .25 .31 .17 Oldfield H .076 .11 .076 OnCard Intl .287 +2.2 8628 19.1 .30 .16 .4 1707 .15 .067 Oncosil Med ▼ .069 Onevue Hldgs .27 .36 .23 Onthehouse .62 1798 119.2 .72 .425 +4 782 2.10 1.80 oOh! Media ▲ 2.03 Optiscan .06 .4 11934 .185 .028 Opus Grp .45 .60 .32 Orbital .35 2 461 10.3 .48 .14 Orica 17.82 45 15435 5.39p 10.9 24.63 16.87 Oriental Tech .13 .035 .010 Origin Engy 10.60 19 41459 4.72 22.0 16.21 10.28 frn dec71 100.25 5 92 105.50 98.40 Last Sale Div The return on investment. This is calculated daily by dividing yield % the annual dividend per share of a company by its share price + No. Div or Sold Yld P/E 52 week 100s % Ratio High Low Company Orion Eq .19 .28 .19 Orionhealt 5.60 86 6.05 5.40 Orora 2.10 36427 2.22 1.235 OrotonGrp 2.67 3 230 5.99f 13.2 4.98 2.55 Orthocell .40 .5 530 .54 .30 Osprey Med .51 .5 100 .68 .45 Otoc .135 +.5 3350 4.8 .235 .097 Oz Brewing .004 % +.1 40588 .015 .001 OzForex Grp 2.46 +6 15245 2.39f 49.3 3.50 2.03 Ozgrowth .175 +.5 353 8.57f 5.8 .23 .145 P Pac Brands .50 +1.5 20651 4.00f .745 .42 Pacific Engy .425 1.5 262 5.88f 10.5 .58 .39 Pacific Enviro .092 +.7 544 7.1 .195 .049 Pacific Star .30 5.33 16.7 .34 .23 Pacsmiles 1.82 1.97 1.67 +16 10030 2.03p 13.4 4.79 3.10 Pact Gp Hldg▲ 4.69 Panorama .305 4521 .545 .04 PaperlinX .037 .1 1863 .076 .032 Papyrus .025 .2 1001 .062 .007 Paragon .46 112 2.72f 23.0 .475 .225 Pasgroup .68 1 141 1.14 .62 Patrys .017 8000 .052 .014 Patties 1.35 5 699 5.26f 11.3 1.45 1.105 Payce Cons 5.55 1.80 105.9 6.00 3.98 PBD Dev .016 .026 .012 Peet 1.02 10828 3.43 14.6 1.44 1.005 Pental .45 400 4.00f 8.8 .57 .36 Perls III 196.01 79 30 f 198.00 192.00 Perpetual .965 1.5 2591 .985 .965 Perpetual 47.79 11 2276 3.66f 24.4 53.16 41.30 PharmAust .006 % .1 50407 .019 .006 Pharmaxis .097 .2 2586 .21 .04 Phileo 5.80 .34f 6.15 3.05 Phoslock .052 .3 14300 .055 .025 Phosphagen .077 442 .12 .061 PHW Cons .002 .576 .002 Phylogica .024 +.1 8520 .039 .01 Phytotech .545 +3 90284 .92 .305 .5 40 .18 .155 Pine Capital ▼ .155 Pioneer Cr 1.87 +2 151 f 1.96 1.54 2 13377 3.97f 26.1 8.64 5.72 Plat Asset ▲ 8.56 Platinum 1.81 3 2498 4.42f 11.2 2.03 1.54 PLD Corp .005 51442 .017 .004 PM Global .975 +.5 896 1.00 .89 PM Global 1.08 +.5 4150 1.11 .76 PMP .415 +.5 308 37.7 .515 .375 Polynovo .081 .8 1500 .16 .071 PPK Group .60 200 5.83f 12.5 .88 .60 Praemium .25 14696 .26 .125 Prana .175 +1 900 1.37 .155 Premier Inv 10.53 +23 2243 3.80f 22.4 11.27 7.31 Prescient .11 +.5 1000 .40 .10 Prim Gold .02 .06 .01 Prima BioM .035 5120 .059 .03 Primary 4.59 +2 14837 4.36f 14.3 5.04 4.09 bondsep15 101.55 6 5 105.00 101.10 Primary Opin .05 .10 .035 Prime Fin .10 +.1 919 8.00f 5.6 .14 .085 Prime Media .825 2 3094 8.24f 9.0 1.08 .78 Pro Pac .48 4.17f 16.5 .525 .42 Probiotec .235 30 13.7 .65 .235 Progen .19 % 3.5 199 1.29 .155 Programmed 2.30 6 1672 7.61f 9.8 3.09 2.10 Promedicus 1.325 +6 982 1.51f 88.3 1.50 .71 .5 10627 4.62 35.6 .62 .35 Prophecy ▲ .595 PS&C .76 50 3.95f 7.4 .985 .65 pSivida Corp 4.87 23 5 5.52 3.61 PTB Group .30 f .36 .26 Public .022 .055 .02 Pulse Hlth .43 .5 891 1.16f 58.9 .745 .38 Q Q Tech .009 .034 .009 Qantas 2.57 +9 196697 2.64 1.025 QBE Ins 10.53 3 55119 2.56f 13.23 10.13 QRxPharma .021 +.1 300 .93 .015 Quant Energy .014 .048 .01 Qube Hldgs 2.35 14018 2.17f 25.5 2.62 1.96 Quest Inv .05 .058 .03 Queste .14 .15 .11 Questus .036 750 18.0 .063 .02 Quickflix .002 550 .018 .002 Quickstep .225 1439 .245 .16 .5 968 1.075 .945 Qvequities ▲ 1.06 R Raffles Cap .20 .30 .20 Ramsay 59.58 +34 2416 1.43f 41.3 60.16 41.06 cares 105.00 80 14 5.00f 109.49 102.57 RCG Corp .72 +2.5 3344 6.25f 15.3 .88 .56 RCR 2.08 4 1149 4.81f 6.5 3.50 1.50 REA Group 49.75 +69 1578 1.15f 43.8 52.45 39.45 Real Est Cap .11 .5 .335 .10 Recall Hldgs 7.22 +8 2571 7.75 4.30 Reckon 1.96 +7 759 4.59p 14.7 2.29 1.72 Reclaim .021 .1 20566 .039 .006 Rectifier .002 4.0 .006 .002 Redflex .95 p 1.26 .78 Redflow .30 +1.5 1148 .41 .093 Redhill Ed 1.39 372 8.7 1.51 .74 Reece 32.50 1.97f 26.2 33.49 29.19 Reef Casino 3.00 202 8.76 11.2 4.22 2.60 Refresh Grp .068 1.47f 11.3 .068 .035 Reg Ex Hldg 1.05 295 f 15.0 1.10 .69 Regeneus .17 1 483 .53 .10 Regis Hlth 4.29 +10 3839 4.44 3.75 Reject Shop 5.84 14 3746 5.14f 11.6 11.38 5.71 Res Equip .26 7707 .265 .11 Res&Engy Grp .07 .10 .002 ResMed 7.99 10 57992 1.32 30.8 8.465 4.68 Resonance .04 2500 .082 .031 Reva Medic .46 847 .565 .11 Reverse .14 % +1.5 1500 8.0 .17 .069 Rewardle .225 2403 .30 .195 Rhinomed .021 5286 .054 .018 Rhipe 1.00 +2 3503 196.1 1.20 .031 Richfield .15 10.1 .165 .08 Ridley .95 1 2088 3.68f 16.7 .99 .755 RNY Prop Tr .325 108 26.6 .345 .265 Royal Wolf 2.51 4.18 15.8 3.70 2.51 RPM .565 +1.5 615 .76 .545 2880 3.55f 23.4 6.26 3.67 RTL Food ▲ 6.19 Rubicor Grp .036 % +.6 902 .0 .08 .03 Rubik Fin .185 .5 2722 8.2 .565 .165 Ruralco 3.58 +3 508 4.47f 23.4 4.00 3.04 Ruralfunds 1.035 2 207 1.11 .72 Russell AGB 21.63 22.00 19.62 Russell ASCB 20.40 +9 72 20.80 20.14 Russell ASGB 20.81 4 35 21.60 20.02 Russell AV 32.15 +9 6 p 35.28 30.52 Russell HD 30.65 +13 137 p 31.24 27.35 RXP Services .40 157 7.1 .79 .32 S Saferoads .125 .215 .064 SAI Global 3.92 +7 4504 3.95p 23.3 5.26 3.49 Salmat 1.60 +1 35 9.38f 1000.0 2.11 1.085 Sandon .94 100 f 59.1 .979 .86 Saunders ▼ .775 % 17.5 13259 7.74f 9.5 1.05 .62 SCA Prop 1.92 11786 5.83 11.1 1.94 1.48 Scantech .61 +3 30 .76 .41 Scentre 3.85 +2 89103 1.9 3.90 3.07 Schaffer 5.40 10 15 4.63f 12.2 6.29 5.15 SciGen .012 7.1 .055 .011 SDI .675 .5 408 1.04f 12.5 .72 .43 SEALINK Trvl 2.30 +5 1413 3.20f 21.1 2.36 1.54 Sedgman .525 2.5 382 7.62f .68 .395 Seek 17.77 +19 7264 1.69f 30.8 18.54 11.76 Select 6.40 +6 2859 3.13 12.7 7.24 4.73 Select Exp .005 .011 .003 Senetas .077 +.4 37504 27.5 .082 .026 Servcorp 5.03 +11 413 3.98p 18.6 5.95 4.20 Seven Grp 5.21 17 7972 7.68f 6.8 9.42 5.05 pref 84.40 21 6.14f 92.74 83.38 Seven West 1.27 +2 18841 9.45f 8.5 2.26 1.21 Seymour 1.545 2.5 434 4.85f 11.7 2.24 1.17 Sgfleet 1.85 1 2493 f 2.15 1.61 Shearer J. 1.70 1.70 1.14 Shenhua .60 6.67 9.0 .60 .38 Shine Corp 2.80 8 1278 1.25 19.6 3.15 1.631 Shoply .016 +.1 85671 .041 .011 Sietel 4.71 46.5 5.00 3.60 Sigma Pharm .80 .5 8380 5.00f 14.5 .86 .56 Silex .50 1.5 2345 2.27 .47 Silver Chef 6.50 +4 202 4.62f 15.0 7.03 4.62 Simavita .43 .5 177 1.11 .42 Simonds Grp 1.575 2.5 1587 1.75 1.44 Sims Metal 11.14 11 7435 .90f 12.30 9.15 SingTel 3.79 +6 10072 3.94 18.8 3.81 3.00 Sirtex Med 27.01 +13 1473 .52f 63.6 29.49 13.80 Site Group .12 .18 .10 Skilled Grp 1.38 7 10348 12.32f 7.3 3.27 1.04 Sky Network 5.63 10 2296 4.72 14.2 6.52 5.23 SkyCity 3.70 10 1940 4.56 23.4 3.90 3.09 Skyfii .195 +.5 1064 .26 .007 Slater & G 6.50 +7 5164 1.23f 21.5 6.63 4.13 .205 .09 Smart Park ▼ .09 % 1 5125 Smartgroup 1.53 +4 2051 1.60 1.215 Smartpay .18 14.1 .35 .17 Smiles 6.00 +4 66 2.42f 28.6 6.98 5.35 SMS M&T 3.55 5 605 3.52f 19.6 4.44 3.12 Soil Sub .002 .012 .001 SomnoMed 2.74 11 717 288.4 3.20 1.33 Sonic Hlth 18.85 5 10311 3.55p 19.6 19.30 15.80 Soul WH 12.72 589 3.77f 23.1 15.97 12.18 Spark Infr 2.17 1 22099 5.18 20.6 2.19 1.62 Spark NZ 3.14 14 17028 4.93 13.4 3.28 2.11 SPDR 200 51.57 +13 1151 4.35p 6.9 53.36 46.99 SPDR 200Fin 21.80 +13 5 5.13p 6.0 22.00 18.78 Last Sale + No. Div or Sold Yld P/E 52 week 100s % Ratio High Low SPDR 200Res 8.04 7 503 3.39p 5.7 10.64 7.68 SPDR 50 fd 54.19 +24 237 6.14p 7.5 56.04 50.40 SPDR 500 ETF 253.37 262 2 260.12 212.42 SPDR ASHDY 30.29 +10 26 4.52p 10.0 31.47 27.92 +12 61 26.54 24.56 SPDR ABond ▲ 26.54 SPDR DJ Reit 21.43 3 35 p 21.57 15.38 SPDR GBond 26.43 +18 50 26.50 24.36 SPDR Prop 11.71 +5 527 4.79p 12.1 11.76 9.03 SPDR SmOrd 10.97 +3 4 2.63 8.3 12.16 10.29 SPDR WDiv 18.44 12 95 p 18.65 15.40 SPDR Wemg 18.03 25 1 18.28 14.79 SPDR WexAU 23.38 22 50 23.78 19.26 SPDR WexAuH 18.48 33 18 19.02 16.25 Specialty .72 1 127 5.56f 11.1 1.01 .69 SpeedCast 1.85 +.5 453 2.16 1.69 Spotless Gp 1.88 +1 12825 2.05 1.64 Sprintex .004 .012 .002 SRG .59 +1 681 6.78f 29.5 .665 .465 SRV Stream .20 +.5 1394 f 26.3 .25 .155 Starpharma .46 +1.5 1678 .985 .41 Steadfast 1.425 +2 6965 3.16f 26.2 1.75 1.25 Steamship 28.80 2.73 14.6 40.00 28.00 Sterling Plant .016 .115 .015 Sthn X Elec .45 2 20 6.00f 9.4 .91 .35 Sthn X Media 1.055 .5 7938 7.11f 1.65 .79 Stockland 4.34 4 79939 5.53 19.0 4.43 3.59 Stokes .50 .50 .30 Stream Grp .13 % 2.5 385 f .237 .13 Struct Mon .38 750 .66 .145 STW Comm .88 10438 9.77f 7.1 1.535 .855 Style .008 8.9 .014 .006 Subzero Grp .005 .13 .005 .1 7900 .075 .037 Suda ▼ .038 Summerset 2.95 1.24 44.6 3.40 2.20 Sun Biomed .009 .013 .005 Sunbridge .064 .4 69221 .94 4.5 .26 .054 Suncorp 14.58 +18 36558 5.14f 25.5 15.08 11.548 pref cps2 103.801 +30.1 58 4.94f 108.60 101.20 nte nov23 104.00 +50 34 5.30 105.73 100.87 pref cps3 100.00 +40 43 3.66f 105.39 98.10 Sunland 1.61 2 1720 2.48f 20.1 1.85 1.52 Sunvest .30 12.0 .41 .25 Super Retail 8.74 +4 8345 4.58f 15.9 11.71 6.70 Supply Net 2.05 6 1 4.39f 11.7 2.65 1.96 +5 2339 1.05 .90 Surfstitch ▲ 1.03 Swick Min .185 897 2.16f 26.1 .305 .185 SWW Energy .003 .01 .003 Syd Airport 5.00 +1 46470 4.70 50.2 5.02 3.86 T 1 24422 3.55f 26.2 4.60 3.27 Tabcorp ▲ 4.51 notemar37 104.80 +18 25 107.25 102.65 Tag Pacific .11 +1 909 .175 .085 Tamawood 3.55 5 3564 5.92f 18.0 4.10 2.70 Tandou .44 8 2.27 338.5 .534 .40 Tassal Grp 3.77 2921 3.05p 13.4 4.265 3.26 45237 3.51f 27.3 3.91 2.85 Tatts Grp ▲ 3.85 bondjul19 105.78 20 107.90 102.80 Tech One 3.34 +2 2592 1.84f 33.2 3.57 2.11 Techniche .084 2.62 7.6 .105 .061 Telpacific .76 f 1.5 1.296 .11 Telstra 6.47 2 175927 4.56f 18.8 6.49 4.96 +8 1611 2.33f 68.2 1.50 1.23 Templeton ▲ 1.50 Tempo .039 % +.4 500 26.0 .115 .035 Ten Network .20 +.5 100697 .37 .18 Tfield Srvcs 1.42 7 42021 13.3 1.97 .737 TFS Corp 1.47 +6 6773 2.04f 5.1 2.24 1.005 Think Child 1.08 1 290 1.18 1.01 ThinkSmart .355 +1 750 f 24.5 .45 .31 Thomas Cof .01 .4 .02 .009 Thorn Grp 2.85 +6 2455 4.04f 14.2 3.20 1.965 Thorney Opp .43 +.5 1735 .622 .40 Tissue Th .295 1364 .465 .25 Toll Hldgs 6.15 +4 26409 4.55f 15.4 6.235 5.01 Tower 2.11 +1 152 5.33 19.2 2.27 1.41 Tox Free 2.77 +3 2812 2.17f 17.0 3.76 2.15 TPG Telecom 6.69 1 12441 1.38f 31.0 7.83 4.89 Trade Me 3.40 9 10961 4.33 18.1 3.86 3.06 Traffic .047 .1 1900 f .073 .045 Trans Sol .004 10500 .008 .003 Transmetro 1.00 5.00f 30.1 1.11 1.00 Transpacific .84 2.5 52268 1.79f 84.0 1.23 .735 Transurban 9.21 2 39527 4.07p 50.3 9.33 6.619 Treasury 12.06 5 528 4.15f 21.3 12.99 8.27 Treasury Wn 4.95 +3 16882 2.63 5.35 3.41 Treyo LE .15 8.4 .195 .15 Trustees .105 .105 .06 TTA Holding .029 f .062 .029 TTG Fintech .47 +2.5 682 4.04 .20 TTN Energy .15 1064 50.00f .6 2.244 .13 TW Hold .002 .01 .002 Tyrian .001 10.0 .002 .001 TZ Limited .115 2 .21 .098 U UBS Aus Div 20.26 +1 69 p 21.67 19.25 UBS IQ RPASF 21.00 +10 1 12.17p 6.0 23.97 19.70 UGL 1.855 +1.5 12124 5.0 3.351 1.81 Uni Biosensor .235 +.5 43 .50 .135 Unilife Co .87 9 6176 1.045 .385 United OS Aus .49 5.10 7.3 .585 .44 Unity Pacific 1.005 25 76.1 1.08 .27 Urbanise .83 170 .90 .60 US Masters .20 .20 .20 US ResProp 2.13 4.69 1065.0 2.28 1.77 7.75nte19 102.50 102.50 101.00 US Select II 2.00 12.1 2.01 1.60 US Select POF 1.92 28.8 1.92 1.64 USCOM .20 .32 .14 UXC .73 1 4602 5.14f 14.7 1.075 .675 V Valmec .185 1 350 1.1 .285 .17 Vangd 300 70.31 +19 182 p 72.80 63.86 Vangd AGBI 49.47 +22 99 50.91 46.08 Vangd APSI 73.82 +16 131 p 74.05 56.69 Vangd AustFI 50.59 +28 441 51.50 47.42 Vangd Emerg 58.20 12 19 60.00 46.69 Vangd HiYld 65.55 +16 72 p 69.68 61.15 Vangd LgeCo 62.46 +48 21 p 64.69 57.26 Vangd MSCI 54.18 32 60 58.00 50.60 Vangd MSCI H 50.59 73 35 51.53 48.47 Vangd SmlCo 42.86 +6 14 p 47.08 40.60 Vangd US 131.66 132 171 134.79 100.50 Vangd World 60.01 25 120 61.02 52.80 VDM Grp .009 % +.1 7778 .017 .007 Veda Grp 2.27 +1 7179 1.76 70.9 2.55 1.835 Viagold Cap .49 .49 .49 Victor Grp .28 .28 .22 Viento Grp .03 2.2 .30 .03 Vietnam Ind .08 .12 .08 Villa World 2.06 5 36700 7.28f 9.4 2.29 1.685 Village 6.00 +2 1197 4.50f 20.9 8.275 5.385 Viralytics .30 478 .37 .265 Virgin Aus .47 17590 .475 .28 Virtus Hlth 8.00 +2 3108 3.25f 20.6 8.93 6.90 Vision Eye .70 1102 1.79f 8.9 .82 .56 Vista Intl 3.50 13 13 3.70 2.28 Vita Group 1.40 +6 793 3.31f 1.45 .575 Vita Life 1.435 +4.5 155 2.44 11.2 1.85 1.38 Vmoto .038 .1 87817 31.7 .06 .033 Vocation .25 f 3.40 .135 Vocus 6.19 5 2706 .29f 39.0 6.59 3.12 Vtxholding .015 257038 .04 .007 W WAM Active 1.28 +2 428 7.50f 13.2 1.50 1.06 WAM Capital 2.03 +2 3485 6.65f 9.8 2.11 1.885 WAM Resrch 1.205 2.5 1290 6.43f 10.1 1.23 1.095 Warr Cheese 7.82 f 20.5 9.45 7.25 Water Res .001 .005 .001 Waterco 1.10 90 5.45f 42.3 1.30 1.025 Watermark .845 1 1459 5.92f 9.4 1.08 .845 Watpac .80 +1 714 7.50p 8.3 1.03 .71 WDS .19 .5 2528 38.16f 2.1 1.19 .125 Webjet 2.86 10 719 4.72f 11.8 3.56 2.22 Webster 1.27 +5 739 2.76f 20.5 1.40 .83 Wellcom 3.45 5.51f 15.7 3.46 2.75 Wesfarmers 43.70 +25 23207 4.35f 18.6 45.756 39.61 +7 68220 10.01 6.70 Westfield ▲ 9.88 Westoz IC 1.065 842 8.45f 6.4 1.345 .875 Westpac 34.64 4 59039 5.25f 14.2 35.99 30.00 frn aug22 104.14 16 280 105.95 102.15 frn aug23 102.25 48 113 104.10 99.92 cps 101.10 +30 94 2.01 110.38 97.652 perpetual 99.28 17 71 104.90 97.80 perptl ii 97.65 22 1.04 103.99 96.557 WestpacTPS 97.59 +29 58 98.58 95.20 Whitefield 4.40 +1 35 3.86f 26.7 4.40 3.82 Wide Bay 5.61 10 34 4.99f 14.5 6.31 5.06 +5 439 2.99f 19.6 .92 .52 Wilson HTM ▲ .92 Woolworths 31.60 +6 54458 4.34f 16.1 38.92 29.11 frn nov36 104.45 +64 24 107.00 103.00 World.Net .03 .033 .03 Worldreach .115 3.3 .264 .076 WorleyPars 9.65 1 15827 8.81p 9.6 18.97 8.52 X Xero 14.74 21 155 42.96 13.76 XRF Scientfc .19 +1.5 1000 5.79f 10.6 .30 .17 XTEK .425 2.5 214 .61 .041 Y Yanghao .30 500.0 .30 .10 Yellow Brick .60 459 .77 .48 Yowie .60 .92 .23 Z Z Energy 4.59 +2 1024 4.38 93.7 4.90 3.30 Zeta Res .38 200 .8 .74 .38 Zicom .225 .5 711 4.00 13.9 .265 .185 Zingmobile .06 % +2.8 1500 28.6 .075 .032 ZipTel .505 +1.5 4081 .585 .001

© Copyright 2026