Explaining Consequential Loss Claims

Consequential Loss Claims Explaining Consequential Loss Claims All Square. All Fair. January 2015 1 This guide will help you identify if your mis-sold business banking financial product has the potential for a Consequential Loss claim and how All Square would be able to provide the appropriate expertise to manage your claim. Our Values About All Square All Square are one of the UK’s leading firms for complex business bank mis-selling claims, including: Fixed Rate Business Loans We are focussed on We are entirely results the needs of our clients driven for our clients Tailored Business Loans We stand shoulder to shoulder with our clients Interest Rate Hedging Products Foreign Exchange Products Our clients are at the core of everything we do We share the risk of winning with our clients We act professionally and ethically at all times All Square offers a full claims service for all our clients, which includes a comprehensive Consequential Loss claims service for mis-sold business banking products. This means that you don’t need to spend time sourcing a Forensic Accountant for your Consequential Loss claim as we have our own in-house specialist to assist. with our clients Please call our specialists on 0113 323 1950 to discuss how we can help. 2 3 Explaining Consequential Loss Claims NO WIN NO FEE!* I have received your offer of compensation, but I am confused about Consequential Losses? BA N K M A N A G E R SHOP What are Consequential Loss Claims? Consequential Loss claims tend to form the second part of the claim process that arises from the mis-sale of a financial product. SM ALL B U SI N E S S O W The first part of the claim relates to something called ‘basic redress’, which is redress or compensation related directly to the mis-sold financial product. These are losses that have arisen due to the payments made under the financial product itself. It is important to get any basic redress offer checked by an expert to ensure that the bank is awarding a full and fair amount of compensation. The second part of the claim relates to Consequential Losses. A Consequential Loss claim arises from more indirect losses that are materially caused by the mis-selling of the financial product. These additional losses, or costs, can be suffered by an individual, partnership or a company and can potentially amount to significant sums of money. Consequential Loss claims broadly fall into 3 categories; namely: 4 1. Lost Business Opportunities These losses can flow from the loss of profits from forsaken investment opportunities, curtailed capital expenditure in capital-intensive industries, or consequential fire sales of property and stock at below market prices. 2. Increased Business Costs The impact of the financial product can create cash flow (liquidity) problems, which can be remedied with the use of short-term liquidity measures. Typical tactics employed by businesses include customer incentive discounting and debt factoring, which improve short-term cash flow to the detriment of overall income. 3. Additional Bank Charges, Fees and Penalties This part of the Consequential Loss claim relates to additional bank charges and fees that are materially caused by the payments made under the mis-sold financial product. Examples could include overdraft charges, valuation fees and referral penalties. NE R Let me explain. As part of our offer you can get an extra 8% interest which covers any Consequential Losses, so you don’t need to claim for Consequential Loss. THE BANK But this does not even cover my losses. They were far greater than 8%! SHOP Hold on! Before you sign anything, we can assess your Consequential Losses and see if you could be entitled to more than 8% extra. SHOP Sounds good. But this all sounds quite complex! Don’t worry. We are specialists in the area of claims and have our Forensic Accountant on hand to help you. But how much will this cost me? SHOP We provide a ‘No Win No Fee’* service. You only pay us if we are successful with your claim. *Fee payable if case is not pursued at client’s request. 5 All Square’s Consequential Loss Claims Process Initial Call with Forensic Accountant Call Report or ‘Shopping List’ Identify if there is a potential Consequential Loss claim. • Summary of meeting • Request for further information & documentation (20 minutes) Describing the Report Process 1. First part of report Scope, principles, counterparts and components of claim. 2. Second part of report Preliminary Consequential Loss Claim Report Instruction Business formally instructs All Square. • Provides a probability on the viability of the claim Produces the ‘meat’ of the report containing detailed financial forensics including a full evaluation of the businesses finances over the period under review. 3. Final part of report • Includes summary background, details of legal tests and key components of the claim. Summarises and concludes the loss and states the financial redress to be paid. 4. Submission of report Direction Meeting Full Report & Submission Meeting with Forensic Accountant to finalise direction, information requests and delivery timeline. Includes details of bound file containing all the cross-referenced contemporaneous documentary evidence. Report and supplementary files are submitted by registered courier to the Bank to initiate the claim and subsequent negotiation. Approximate Timeline 4 weeks 6 7 Consequential Loss Case Study The following case study is based on a real Consequential Loss (CL) claim currently being undertaken by All Square. Background: Industry: CL Claim: Agriculture £1.25 Million Mis-sold Product: Interest Rate Collar CL claim size: £1.25 million Expected Time: 12 Months Our client has been running a successful business supplying agricultural produce for over thirteen years. With a view to investing in the future, in 2006 our client approached his bank of many years for a business mortgage of £1 million to purchase the land and buildings that he was operating from. Following a ‘bank-led’ negotiation, our client entered into a Base Rate Swap (Interest Rate Hedging Product, IRHP) at 4.75%, meaning his total cost of lending was fixed at 6.00% for 10 years. On 5th March 2009 the Bank of England reduced its base rate to 0.5% in a bid to support the Government’s strategy of stimulating investment and hence economic growth. At this stage our client was still locked into a fixed interest rate equal to 6.00%, and would have continued to pay this rate until 2016 had the Financial Services Authority (from 1 April 2013 know as the Financial Conduct Authority) not imposed the IRHP Review process on the Bank. 8 During the course of 2010/11 our client identified an investment opportunity in renewable energy that was being promoted by ofgem and the UK Government. A plan, business case and numerous financial scenarios were developed, a project initiated and tenders sought from four accredited suppliers. The required investment was £0.4 million, which would generate £2.5 million in gross profit over a contractual period of 25 years. Due to liquidity issues, the investment could not go ahead until mid 2014. In August 2014 our client instructed All Square to pursue a Consequential Loss Claim on his behalf. All Square: You may be aware that the current average amount of Consequential Loss claims that have been paid in the FCA Review is only £7,530 per claim*. We believe that one of the reasons for the low amounts paid on Consequential Loss claims so far is due to the poor identification, formulation, presentation and negotiation of these types of claims. We believe that this is very much a specialist area of claim which requires the skills, experience and approach of a fully qualified Forensic Accountant. The banks will typically give you 28 days in which to prepare and submit a Consequential Loss claim. We believe this is entirely unreasonable to undertake the process properly. If you are getting near your 28 day deadline, contact your bank and ask them for a further extension of the deadline. All Square take a professional approach to our Consequential Loss report process which we believe is required to get the best results. If done properly, Consequential Loss claims can potentially dwarf those claims relating to ‘basic redress’ as we have seen in this case. Our clients should also be aware that the process of claiming Consequential Loss should not be done with a ‘light-touch’ approach, but rather, will require their full engagement and co-operation in order to stand the best chance of success. This is most definitely one of those professional services that require a high element of ‘co-creation’ and a like-minded professional approach. * Source: http://www.fca.org.uk/consumers/financial-services-products/banking/interest-rate-hedging-products/claims-for-consequential-loss 9 Why use All Square? What to do next We believe there are four key reasons why you should consider appointing us to manage your claim for Consequential Loss: We hope this guide has provided you with some clear information regarding business banking product Consequential Loss claims, and our forensic accounting techniques employed to validate those claims. 1. Experienced and Qualified Banking Forensic Accountant We utilise the skills, knowledge and experience of a fully qualified banking Forensic Accountant. We understand this can seem a complex and daunting process, so we are keen to keep the claims process as simple as possible. 2. Thorough and Diligent Claims Process There is no interpretation, no subjectivity and all determinations are based solely on objective, verifiable and contemporaneous documentary evidence held on file. We let the facts speak for themselves. We look to resolve your claim in the quickest possible time frame without compromising on quality. 3. Maximising the Amount of Redress We aim to claim to the full amount of redress due to you. We check that any offer of redress is a ‘full and fair’ amount. 4. No Win No Fee* We provide our Consequential Loss services on a No Win No Fee* basis with our clients. We are happy to share the risk of successfully resolving the claim with our clients, so we will only take your case on if we think you have a higher probability of securing redress. We would be delighted to have an initial conversation with you to discuss your circumstances. We will then be able to assess the strength of your claim, size of your claim and determine a plan to progress your claim. We are the specialists Remember, we only deal with claims for mis-sold business banking products, including Consequential Losses associated with these claims. That’s all we do, day in day out, so we know how best to progress your claim. We look forward to hearing from you. CALL TODAY! 0113 323 1950 10 *Fee payable if case is not pursued at client’s request. 11 Consequential Loss Claims Explaining Consequential Loss Claims 0113 323 1950 [email protected] www.allsquare.co.uk Disclaimer This document is designed to be informative but is not intended to constitute advice, whether legal, financial or otherwise. We make no warranties or representations about any of the content (including, without limitation, the quality, accuracy, completeness or fitness for any particular purpose of such content). 12 All Square is a trading style of All Square Finance Limited. All Square Finance Limited is regulated by the Claims Management Regulator in respect of regulated claims management activities, it’s registration is recorded on the website www.justice.gov.uk/claims-regulation (Authorisation No. CRM31952). All Square Finance Limited is registered in England and Wales under Co. No. 08246245. Registered office at Unit 1C, Riparian Way, The Crossings Business Park, Cross Hills, Keighley, BD20 7AA Telephone: +44 (0) 800 083 0286 Facsimile: +44 (0) 844 288 9629 VAT NO: 135536417.

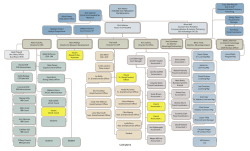

© Copyright 2026