Company Report

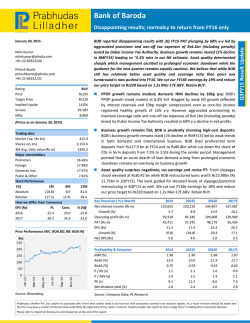

Friday, January 30, 2015 China Merchants Securities (HK) Co., Ltd. Hong Kong Equity Research Company Report KWG Property (1813 HK) John So +852 3189 6357 Key takeaways from meeting with KWG ■ ■ [email protected] We met KWG’s IR head, Linda Wu yesterday KWG expects to maintain 10-20% contracted sales growth in 2015 and the chairman is actively meeting investors recently which we think it would help boost market confidence WHAT’S NEW ■ BUY We cut FY14-15E earnings by 5-6% but upgraded FY16E by 10%. Valuation is distressed at 68% disc. to NAV and 3.6x FY15E P/E Maintain stable GPM and target 10-20% annual growth Though competition was keen and KWG had to lower some project selling prices last year, the company was confident that the margin pressure was not significant through their cautious new land purchases. We estimate its FY14/15E GPM could be 35.1%/33.5%, not much lower than the 36.2% in FY13. Looking ahead in 2015, KWG expects it has less pressure on price cut and it preliminarily targets to have 10-20% contracted sales growth (our estimate at 15% or RMB23.6bn), based on 10-20% growth in its saleable resource. In 2015, we believe KWG’s prospect remains robust as it has accumulated lots of quality land sites over the past two years. As KWG would keep some Grade A offices for long-term rental purposes, we slightly revise down FY14/15E core profits by 5%/6% so as to reflect lower bookings of office projects. We expect KWG to achieve 16%/18% earnings growth in FY14/15E after the revision. We believe KWG would keep its 25-30% dividend pay-out ratio and we forecast FY14/15E dividend yield of 7.6%/8.4%. We estimate the net gearing is about 67% at FY14E year-end, lower than its peer average at 79%. Target price unchanged at HK$7.50 Current valuation at 68% discount to NAV and 3.6x FY15E P/E appears distressed. We believe the market will gain confidence on KWG when it announces annual results and the chairman meets more investors in coming March, which could be potential short-term catalysts. We maintain our 12-month target price at HKD7.5, based on 52% discount to end-FY14 NAV or equal to 1SD above its 5-year mean. RMB mn 2012 2013 2014E 2015E 2016E Revenue 9,676 9,468 12,661 13,702 19,251 -4% -2% 34% 8% 40% 1,924 2,344 2,723 3,205 4,585 43% 3% 22% 16% 18% Core EPS (HK$) 0.84 1.02 1.19 1.40 2.00 Net gearing (%) 63% 56% 67% 67% 57% P/E (core EPS) 6.0x 4.9x 4.2x 3.6x 2.5x P/B 0.8x 0.6x 0.6x 0.5x 0.4x 3.6% 7.3% 7.6% 8.4% 12.0% Core profit growth (%) Dividend yield Price HK$4.99 12-month Target Price (Potential upside) HK$7.5 (+50%) Previous HK$7.5 Price Performance (%) 1813 80 HSI Index 40 20 0 -20 Jan/14 May/14 Sep/14 Dec/14 Source: Bigdata % 1813 HK HSI 1m 0.2 6.5 6m (12.0) 1.8 12m 31.7 13.2 Industry: Property Hang Seng Index HSCEI Key Data 52-week range (HK$) Market cap (HK$ mn) Avg. daily volume (mn) BVPS (HK$) Shareholdings Structure Financials Core net profit BUY 60 Sound earnings growth and dividend yield Revenue growth (%) Previous Kong’s Family Morgan Stanley Free float 24596 11736 3.46-6.49 14,437 7.71 7.70 60.5% 6.5% 33.0% Source: Company data, CMS (HK) estimates To access our research reports on the Bloomberg terminal, type CMHK <GO> 1 2015 年 1 月 30 日(星期五) 公司报告 招商证券(香港)有限公司 合景泰富 (1813 HK) 苏淳德 +852 3189 6357 与公司沟通纪要 ■ ■ [email protected] 我们昨天与公司的投资者关系总监会面。 公司预计在2015年合同销售将保持10-20%的增长。公司主席近期积极 与投资者见面,我们认为这将有助于提振市场信心。 ■ 最新变动 我们将2015-15财年的盈利预测调低5-6%,但同时将2016年的预测值 调高10%。目前估值受压,对应3.6倍2015年市盈率,较NAV有68%的折 让。 买入 毛利率保持稳定,合同销售目标增长率为10-20% 股价 尽管在激烈的竞争下,公司去年不得不降低部分项目的售价,公司相信由 于买地谨慎,利润率压力并不大。我们预计公司2014/15财年的毛利率为 35.1%/33.5%,仅略低于2013年度的水平(36.2%)。公司预计2015年降 价的压力将减小,同时基于可供出售资源10-20%的增长率,初步设定合同 销售增长目标为10-20% (我们的预计为+15%或236亿元人民币) 。 HK$7.5 (+50%) 前次目标价 HK$7.5 股价表现 80 我们相信公司2015年前景向好。公司在过去两年积累了大量的优质土地。 由于公司将保留部分甲级写字楼用于长期出租,我们将2014/15财年的核 心利润预测下调5%/6%。调整后,我们预计公司2014/15财年的盈利增长 为 16% /18% 。 我 们 相 信 公 司 将 维 持 25-30% 的 股 息 支 付 率 , 并 预 计 2014/15年度的股息收益率为7.6%/ 8.4%。我们预计2014财年末净负债率 约为67%,低于行业79%的平均水平。 HK$4.99 12个月目标价 (上涨空间) (%) 良好的盈利增长和股息率 买入 前次评级 1813 HSI Index 60 40 20 0 -20 Jan/14 May/14 Sep/14 Dec/14 资料来源:贝格数据 维持7.50港元的目标价不变 当前估值受压,对应3.6倍的2015财年市盈率,较NAV有68%的折让。我们 相信三月业绩公布及公司高管与更多投资者会面后,市场将重拾对公司的 信心。这些因素均可能是短期的催化剂。基于相对2014财年末NAV 52%的 折让或高于5年平均值1个标准差的水平,我们维持7.50港元的12个月目标 价不变。 % 1813 HK HSI 行业:房地产 恒生指数 国企指数 1m 0.2 6.5 6m (12.0) 1.8 12m 31.7 13.2 24596 11736 重要数据 52周股价区间(港元) 港股市值(百万港元) 日均成交量(百万股) 盈利预测及估值 人民币百万元 2012 2013 2014E 2015E 2016E 营业额 9,676 9,468 12,661 13,702 19,251 同比增长 (%) 核心净利润 同比增长 (%) -4% -2% 34% 8% 40% 1,924 2,344 2,723 3,205 4,585 3% 22% 16% 18% 43% 核心每股盈利 (港元) 0.84 1.02 1.19 1.40 2.00 净负债率 (%) 63% 56% 67% 67% 57% 市盈率 (核心每股盈利) 6.0x 4.9x 4.2x 3.6x 2.5x 市净率 0.8x 0.6x 0.6x 0.5x 0.4x 股息率 3.6% 7.3% 7.6% 8.4% 12.0% 每股净资产(港元) 主要股东 孔氏家族 Morgan Stanley 自由流通量 3.46-6.49 14,437 7.71 7.70 60.5% 6.5% 33.0% 资料来源:公司资料、招商证券(香港)估计 彭博终端报告下载: CMHK <GO> 2 Friday, January 30, 2015 Focus charts Figure 1: Discount to NAV Band Figure 2: Contracted sales YoY chg RMB mn 9.0 2SD = 46%discount+ 30,000 50% 8.0 +1SD = 53% discount Share Price (HKD) 7.0 25,000 40% 20,000 6.0 Mean = 61% discount 5.0 30% 15,000 -1SD = 69% discount 4.0 20% 10,000 3.0 -2SD = 77% discount 10% 5,000 2.0 - 1.0 Oct-09 Jan-10 Apr-10 Jul-10 Oct-10 Jan-11 Apr-11 Jul-11 Oct-11 Jan-12 Apr-12 Jul-12 Oct-12 Jan-13 Apr-13 Jul-13 Oct-13 Jan-14 Apr-14 Jul-14 Oct-14 Jan-15 0% FY12 FY13 FY14 Total FY15E FY16E YoY change Source: Bloomberg, CMS(HK) Source: Company data, CMS(HK) Figure 3: Revenue and profit growth Figure 4: Net gearing Net gearing (%) 50% 80% 40% 75% 30% 70% 65% 20% 60% 10% 55% 0% 2012 2013 2014E 2015E 2016E -10% 50% 45% Revenue 40% Recurring net profit 2010 2011 2012 Source: Company data, CMS(HK) Source: Company data, CMS(HK) Figure 5: Interest coverage Figure 6: Landbank (GFA) 2013 2014E 2015E Tier-3 city, 14% (x) 3.0 2.5 2.0 Tier-2 city, 35% 1.5 1.0 Tier-1 city, 51% 0.5 2012 2013 2014E 2015E 2016E Source: CMS(HK) Source: Company data, CMS(HK) Note: Operating profit / total interest (including capitalized portion) To access our research reports on the Bloomberg terminal, type CMHK <GO> 3 Friday, January 30, 2015 Sector’s valuation Figure 7: Peer comparison: valuation (Based on market close at 29 January 2015) Company Mkt cap 3-mth avg t/o Discount (USDm) (USDmn) NAV (HKD) to NAV (%) P/E Hist (x) P/E FY1 (x) P/E FY2 (x) Div yld Div yld FY1 Hist (%) (%) Net gearing Hist (%) P/B Hist (x) P/B FY1 (x) Net gearing FY1 (%) Ticker Price 33.0 8.0 7.0 6.4 6.0 3.9 1.3 1.2 62.7 84.9 688 HK 22.90 24,146 74.8 28.2 18.8 9.7 8.5 7.6 2.1 2.1 1.7 1.4 28.2 39.3 CR Land 1109 HK 20.20 17,017 35.3 33.0 38.8 12.5 10.0 8.3 2.2 2.1 1.6 1.4 38.8 46.7 Country Garden 2007 HK 3.06 8,033 15.9 5.0 39.2 5.5 5.1 5.1 6.9 5.9 1.1 0.9 64.3 68.6 Ev ergrande 3333 HK 3.20 6,022 12.6 5.3 39.6 4.9 5.3 5.9 16.9 4.7 0.8 0.8 147.6 282.4 Longf or 960 HK 10.12 7,583 4.7 14.6 30.7 7.2 6.4 5.2 2.8 3.1 1.2 1.0 57.9 59.4 Shimao Property 813 HK 16.22 7,266 24.0 27.3 40.6 6.1 5.4 5.2 5.0 5.6 1.1 0.9 57.4 57.6 2202 HK 16.92 23,074 28.8 22.0 23.1 10.0 8.7 7.4 N/A 3.5 2.0 1.7 44.7 40.4 55.7 5.4 6.8 6.8 5.6 5.0 0.6 0.6 63.2 75.8 3383 HK 4.71 2,380 10.9 14.4 67.3 3.3 3.7 3.8 10.1 6.0 0.4 0.4 97.6 106.1 978 HK 1.11 702 1.6 3.3 66.4 9.4 10.6 6.9 1.1 1.0 0.8 0.8 3.7 45.3 81 HK 4.16 1,225 2.4 9.0 53.8 3.4 4.3 3.6 2.6 2.4 0.8 0.7 44.0 64.9 CIFI Holdings 884 HK 1.55 1,205 0.5 3.9 60.3 5.4 3.8 3.2 4.5 5.7 0.9 0.7 67.9 69.8 Franshion Ppt 817 HK 2.26 2,644 3.1 4.5 49.8 4.9 6.3 5.4 4.2 4.5 0.7 0.6 44.9 54.3 3900 HK 6.85 1,909 8.4 18.1 62.2 2.8 5.9 3.7 7.9 3.4 0.5 0.5 71.2 89.3 754 HK 6.87 1,989 0.7 25.0 72.5 5.6 12.3 18.6 N/A 0.0 0.3 N/A 61.6 N/A Kaisa 1638 HK 1.59 1,053 4.2 2.5 36.4 2.2 2.1 1.8 9.4 10.8 0.4 0.3 70.0 90.0 KWG Property Large peer average China Ov erseas China Vanke Co-H Mid-and-small peer average Agile Property CM Land COGO Greentown China Hopson 1813 HK 4.99 1,896 7.0 15.7 68.2 4.9 4.2 3.6 7.3 7.6 0.6 0.6 56.3 67.0 Poly Property 119 HK 3.64 1,716 13.0 8.1 55.1 4.9 6.7 6.0 6.1 5.2 0.4 0.4 94.4 102.1 Shenzhen Inv estment 604 HK 2.28 1,958 2.4 6.0 62.0 3.9 7.0 6.3 6.6 7.9 0.5 0.4 80.7 N/A Shui On Land 272 HK 1.76 1,817 1.7 n.a. n.a. 12.2 15.1 13.4 3.5 3.1 0.3 0.3 76.6 62.0 3377 HK 4.89 4,717 3.3 8.0 38.9 6.7 8.1 7.0 4.8 4.7 0.7 0.7 53.9 54.8 410 HK 5.41 3,629 2.9 8.6 37.1 4.9 10.4 18.4 5.8 5.7 0.6 0.6 18.0 12.5 1918 HK 6.94 3,028 14.9 15.3 54.6 5.2 4.5 3.1 3.5 4.2 1.3 1.0 69.7 71.6 123 HK 1.53 2,448 6.0 3.5 56.3 7.9 6.9 6.5 5.2 5.2 0.5 0.5 47.0 66.9 48.8 6.2 6.9 6.7 5.7 4.7 0.8 0.8 63.1 78.7 Sino Ocean SOHO China Sunac Yuexiu Property Average Source: CMS (HK), Bloomberg Figure 8: KWG’s discount to NAV band 9.0 2SD = 46% discount+ 8.0 +1SD = 53% discount Share Price (HKD) 7.0 6.0 Mean = 61% discount 5.0 4.0 -1SD = 69% discount 3.0 -2SD = 77% discount 2.0 1.0 Oct-09 Jan-10 Apr-10 Jul-10 Oct-10 Jan-11 Apr-11 Jul-11 Oct-11 Jan-12 Apr-12 Jul-12 Oct-12 Jan-13 Apr-13 Jul-13 Oct-13 Jan-14 Apr-14 Jul-14 Oct-14 Jan-15 Source: CMS (HK), Bloomberg To access our research reports on the Bloomberg terminal, type CMHK <GO> 4 Friday, January 30, 2015 Change in earnings forecasts Fine-tuned FY14/15E earnings forecast by -5%/-6% As KWG would keep some Grade A offices for long-term rental purposes, we slightly revise down FY14/15E core profits by 5%/6% so as to reflect lower bookings of office projects. We estimate KWG to achieve 16%/18% earnings growth in FY14/15E after the revision. Upgrade FY16E earnings by 10%. We revise up FY16E profits by 10% mainly because we included the profit contributions from some of the newly acquired projects in 2014. Figure 9: Change in P&L forecasts Original 12,754 (8,281) 4,473 (360) (874) (105) 76 1,292 (7) FY14E New 12,661 (8,223) 4,438 (360) (874) (105) 76 1,183 (7) chg (%) -1% -1% -1% 0% 0% 0% 0% -8% 0% Original 14,033 (9,318) 4,715 (451) (1,028) (227) 97 1,898 0 FY15E New 13,702 (9,118) 4,584 (424) (967) (227) 95 1,680 0 chg (%) -2% -2% -3% -6% -6% 0% -2% -12% n.a. Original 18,304 (11,887) 6,417 (519) (1,182) (366) 105 1,851 0 FY16E New 19,251 (12,059) 7,192 (488) (1,112) (366) 103 1,771 0 chg (%) 5% 1% 12% -6% -6% 0% -2% -4% n.a. 4,494 (1,449) 6 3,052 4,351 (1,436) 6 2,921 -3% -1% 0% -4% 5,004 (1,550) (32) 3,423 4,741 (1,504) (32) 3,205 -5% -3% 0% -6% 6,305 (2,076) (49) 4,180 7,099 (2,465) (49) 4,585 13% 19% 0% 10% Recurring net profit 2,854 2,723 -5% 3,423 3,205 -6% 4,180 4,585 10% Gross profit margin (%) Reported net profit margin (%) Recurring net profit margin (%) 35.1% 23.9% 22.4% 35.1% 23.1% 21.5% 0.0% -0.9% -0.9% 33.6% 24.4% 24.4% 33.5% 23.4% 23.4% -0.1% -1.0% -1.0% 35.1% 22.8% 22.8% 37.4% 23.8% 23.8% 2.3% 1.0% 1.0% (RMB mn) Revenue Cost of goods sold Gross Profit Selling expense General & admin expense Interest Expense Interest Income JCE & Associate items Others Pre-tax profit Income tax & LAT Minority Interests Reported net profit Source: CMS (HK) Figure 10: Profit and Loss Highlights (RMB mn) Revenue and GFA sales details Total GFA delivered (k sqm) (1) Average selling price booked (RMB psm) (2) Property sales (1) x (2) Others Total Revenue Gross profit Profits from JCEs / Asso. FY12 796 11,715 9,330 346 9,676 3,536 479 FY13 937 9,582 8,977 491 9,468 3,432 884 FY14E 1,003 11,974 12,010 651 12,661 4,438 1,183 FY15E 1,194 10,846 12,950 752 13,702 4,584 1,680 FY16E 1,269 14,481 18,377 874 19,251 7,192 1,771 2,406 1,924 2,750 2,344 2,921 2,723 3,205 3,205 4,585 4,585 12,201 16,268 20,500 23,575 27,111 7,488 1,814 6,109 1,558 7,766 1,535 7,268 1,278 9,089 2,218 YoY changes (In %) GFA delivered Average selling price Revenue Gross profit Profits from JCEs / Asso. Reported net profit Recurring net profit Contracted sales -13.2% 9.6% -4.4% -20.9% n.a. 14.4% 3.5% 6.6% 17.6% -18.2% -2.1% -2.9% 84.6% 14.3% 21.8% 33.3% 7.1% 25.0% 33.7% 29.3% 33.8% 6.2% 16.2% 26.0% 19.0% -9.4% 8.2% 3.3% 42.0% 9.7% 17.7% 15.0% 6.3% 33.5% 40.5% 56.9% 5.4% 43.1% 43.1% 15.0% Margin ratios (In %) Gross margin Reported net profit margin Recurring net profit margin 36.5% 24.9% 19.9% 36.2% 29.0% 24.8% 35.1% 23.1% 21.5% 33.5% 23.4% 23.4% 37.4% 23.8% 23.8% Reported net profit Recurring net profit Total contracted sales Property development cost (RMB psm) Recurring profit per GFA delivered (RMB psm) Source: Company, CMS (HK) To access our research reports on the Bloomberg terminal, type CMHK <GO> 5 Friday, January 30, 2015 Financial Summary Balance Sheet Profit & Loss Statement RMB mn 2012 2013 2014E 2015E 2016E RMB mn Current Assets 29,699 36,450 42,050 49,785 57,605 Gross Revenue Cash 4,927 9,414 8,451 8,823 10,902 Cost of goods sold Restricted cash 1,517 1,444 1,214 1,214 1,214 Gross Profit 3,536 Current receivables 1,316 2,632 2,222 2,222 2,222 Admin exp (251) Properties held for sale 3,988 4,036 3,798 4,111 5,775 Selling exp Properties under development & land prepaid 17,951 18,924 26,365 33,416 37,492 Other current assets 0 0 0 0 0 Non-current assets 19,166 25,140 29,506 28,723 28,035 7,943 9,311 9,601 9,539 9,480 Fixed Assets Land and properties under development 2012 2013 2014E 2015E 2016E 9,468 12,661 13,702 19,251 (6,140) (6,036) (8,223) (9,118) (12,059) 3,432 4,438 4,584 7,192 (261) (360) (424) (488) (643) (753) (874) (967) (1,112) Finance cost (69) (214) (105) (227) (366) JCE & Associates 479 884 1,183 1,680 1,771 Others Pre-tax profit Income tax 9,676 714 616 69 95 103 3,766 3,704 4,351 4,741 7,099 (1,333) (954) (1,436) (1,504) (2,465) (27) 0 6 (32) (49) 1,056 859 849 849 849 Other non-current assets 10,167 14,970 19,056 18,336 17,706 MI Total assets 48,865 61,590 71,555 78,508 85,641 Reported net profit 2,406 2,750 2,921 3,205 4,585 Current liabilities 35,543 Core profit 1,924 2,344 2,723 3,205 4,585 18,895 24,987 31,491 34,083 Bank and other loans 3,100 3,065 3,653 3,653 3,653 Presales receipts in advance 4,125 5,699 7,029 10,087 10,920 Accounts payable & other payables 5,842 6,086 6,693 6,693 6,693 Core EPS (RMB) 0.66 0.81 0.94 1.11 1.58 Other current liabilities 5,828 10,137 14,116 13,650 14,277 DPS (RMB) 0.15 0.29 0.30 0.33 0.48 Non-current Liabilities 14,616 18,760 20,240 22,240 24,240 Bank and other loans 13,090 17,840 19,304 21,304 23,304 Note: We deduct property revaluations and other exceptional items to arrive at recurring net profit 1,526 920 936 936 936 Total Liabilities 33,511 43,747 51,731 56,323 59,783 Shareholders' Equity 15,282 17,818 19,806 22,134 25,758 72 25 19 51 100 Others Minority interests Ratios % 2012 2013 2014E 2015E 2016E Growth (%) Total equity & Liabilities 48,865 61,590 71,555 78,508 85,641 Note: Total cash includes both cash and restricted cash -4% -2% 34% 8% 40% -21% -3% 29% 3% 57% Recurring net profit 3% 22% 16% 18% 43% PUD and inventory 4% 4% 30% 24% 15% Contracted sales 7% 33% 26% 15% 15% Gross profit Cashflow Statement RMB mn Revenue 2012 2013 2014E 2015E 2016E Operating cashflow 2,811 6,256 8,800 4,853 6,639 Profit before tax 3,766 3,704 4,351 4,741 7,099 Profitability (%) Working capital chg 2,755 6,855 9,190 5,736 5,167 Gross margin 37% 36% 35% 33% 37% Tax paid (1,149) (548) (1,659) (1,970) (1,838) Recurring net profit margin 20% 25% 22% 23% 24% Interest paid (1,595) (1,915) (2,097) (2,269) (2,441) Effective tax rate 35% 26% 33% 32% 35% (966) (1,840) (986) (1,386) (1,348) ROE 13% 14% 14% 15% 19% Investing cashflow (3,916) (6,875) (10,976) (5,605) (5,597) ROA 4% 4% 4% 4% 6% Fixed assets additions (1,017) (547) (200) (100) (100) 18% 31% 30% 30% 30% Deposits paid for land purchase (8,000) Other operating cashflow (1,800) (2,200) (8,000) (8,000) Subsidiary acquisitions / disposals (218) (366) 0 0 0 JCE and associates movements (898) (3,743) (2,852) 2,400 2,400 17 (19) 76 95 103 Financing cashflow 2,007 5,126 1,213 1,124 Dividend paid (637) (434) (839) (876) Increase/decrease in loans 2,623 5,558 2,052 2,000 2,000 21 2 0 0 0 Other investing cashflow Other financing cashflow Cashflows for the year Cash at the beginning Exchange difference Cash at the end Dividend Pay Out Liquidity (1,122) (600) (2,252) (847) 939 Total Debt - Total Equity Ratio 105% 117% 116% 112% 104% 1,038 Net Debt - Total Equity Ratio 63% 56% 67% 67% 57% (962) Interest coverage (x) 1.9 1.7 2.1 2.1 3.0 902 4,507 (963) 372 2,080 4,025 4,927 9,414 8,451 8,823 0 (20) 0 0 0 4,927 9,414 8,451 8,823 10,902 Free cashflow (Rmb mn) Note: we reclassify land capex from operating cashflows into investing cashflows, which is different from the company’s financial statements. Source: Company data, CMS (HK) estimates To access our research reports on the Bloomberg terminal, type CMHK <GO> 6 Friday, January 30, 2015 Investment Ratings Rating BUY Definition Expected to outperform the market index by >10% over the next 12 months NEUTRAL Expected to outperform or underperform the market index by 10% or less over the next 12 months SELL Expected to underperform the market index by >10% over the next 12 months Analyst Disclosure The analysts primarily responsible for the preparation of all or part of the research report contained herein hereby certify that: (i) the views expressed in this research report accurately reflect the personal views of each such analyst about the subject securities and issuers; and (ii) no part of the analyst’s compensation was, is, or will be directly or indirectly, related to the specific recommendations or views expressed in this research report. Regulatory Disclosure Please refer to the important disclosures on our website http://www.newone.com.hk/cmshk/en/disclosure.html. Disclaimer This document is prepared by China Merchants Securities (HK) Co., Limited (“CMS HK”). CMS HK is a licensed corporation to carry on Type 1 (dealing in securities), Type 2 (dealing in futures), Type 4 (advising on securities), Type 6 (advising on corporate finance) and Type 9 (asset management) regulated activities under the Securities and Futures Ordinance (Chapter 571). This document is for information purpose only. Neither the information nor opinion expressed shall be construed, expressly or impl iedly, as an advice, offer or solicitation of an offer, invitation, advertisement, inducement, recommendation or representation of any kind or form whatsoever to buy or sell any security, financial instrument or any investment or other specific product. The securities, instruments or strategies discussed in this document may not be suitable for all investors, and certain investors may not be eligible to participate in some or all of them. Certain services and products are subject to legal restrictions and cannot be offered worldwide on an unrestricted basis and/or may not be eligible for sale to all investors. CMS HK is not registered as a broker-dealer in the United States and its products and services are not available to U.S. persons except as permitted under SEC Rule 15a-6. The information and opinions, and associated estimates and forecasts, contained herein have been obtained from or are based on sources believed to be reliable. CMS HK, its holding or affiliated companies, or any of its or their directors, officers or employees (“CMS Group”) do not represent or warrant, expressly or impliedly, that it is accurate, correct or complete and it should not be relied upon. CMS Group will not accept any responsibility or liability whatsoever for any use of or reliance upon this document or any of the content thereof. The contents and information in this document are only current as of the date of their publication and will be subject to change without prior notice. Past performance is not indicative of future performance. Estimates of future performance are based on assumptions that may not be realized. The analysis contained herein is based on numerous assu mptions. Different assumptions could result in materially different results. Opinions expressed herein may differ or be contrary to those expressed by other business divisions or other members of CMS Group as a result of using different assumptions and/or criteria. This document has been prepared without regard to the individual financial circumstances and investment objectives of the persons who receive it. Use of any information herein shall be at the sole discretion and risk of the user. Investors are advised to independently evaluate particular investments and strategies, take financial and/or tax advice as to the implications (including tax) of investing in any of the securities or products mentioned in this document, and make their own investment decisions without relying on this publication. CMS Group may have a long or short position, make markets, act as principal or agent, or engage in transactions in securities of companies referred to in this document and may also perform or seek to perform investment banking services or provide advisory or other services for those companies. This document is for the use of intended recipients only and this document may not be reproduced, distributed or published in whole or in part for any purpose without the prior consent of CMS Group. CMS Group will not be liable for any claims or lawsuits from any third parties arising from the use or distribution of this document. This document is for distribution only under such circumstances as may be permitted by applicable law. This document is not directed at you if CMS Group is prohibited or restricted by any legislation or regulation in any jurisdiction from making it available to you. In particular, this document is only made available to certain US persons to whom CMS Group is permitted to make available according to US securities laws, but cannot otherwise be made available, distributed or transmitted, whether directly or indirectly, into the US or to any US person. This document also cannot be distributed or transmitted, whether directly or indirectly, into Japan and Canada and not to the general public in the People’s Republic of China (for the purpose of this document, excluding Hong Kong, Macau and Taiwan). Hong Kong China Merchants Securities (HK) Co., Ltd. Address: 48/F, One Exchange Square, Central, Hong Kong Tel: +852 3189 6888 Fax: +852 3101 0828 To access our research reports on the Bloomberg terminal, type CMHK <GO> 7

© Copyright 2026