Morning Note 01-29-15 NAVB

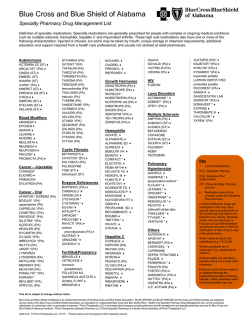

Unlocking the Value of Science ™ Morning Note – January 29, 2015 Data Shows Lymphoseek Requires Fewer SNL Removals in Breast Cancer Lymphoseek® Begins 2015 US Sales Push with New Commercialization Team Gold Standard Lymphoseek® Plus Game-Changer Macrophage Therapeutics $2.5M Funding for Macrophage Therapeutics – Navidea Retains 99.5% Please See Last 2 Pages For Important Disclosures And Analyst Certification Company Ticker Price Mkt. Cap. Daily Volume 3-month Navidea Biopharma NAVB $1.61 $242M 1,266,550 10-day 529,829 Rating Strong Speculative Buy Target Analysts $3.25 Sr. Managing Director Research Stephen M. Dunn [email protected] (954) 240-9968 Summary The results of a study comparing Lymphoseek (99mTc tilmanocept) against sulfur colloid (fTcSC) in breast cancer patients was published in “Annals of Surgical Oncology”. The paper titled “Comparison of [99mTc]Tilmanocept and Filtered [99mTc]Sulfur Colloid for Identification of SLNs in Breast Cancer Patients”, which showed that significantly fewer Sentinel Lymph Nodes were removed using Lymphoseek while maintaining comparable identification of node-positive patients and the number of positive nodes. A PDF of the paper may be accessed here: http://bit.ly/1DjQfi9 Comparison Number of Sentinel Lymph Nodes Removed SLN mapping with [99mTc]tilmanocept/VBD (blue) resulted in the removal of fewer total lymph nodes compared to fTcSC/VBD (yellow) Source: Baker, JL et al, “Comparison of [99mTc]Tilmanocept and Filtered [99mTc]SulfurColloid for Identification of SLNs in Breast Cancer Patients” Ann Surg Oncol (2015) 22:40–45 Page 1 of 8 www.LifeTechCapital.com January 29, 2015 Highlights: Fewer nodes were removed among patients mapped with TcTM compared to fTcSC (mean TcTM: 1.85 vs. fTcSC: 3.24, p < 0.001). Logistic regression analysis adjusted for tumor characteristics showed that injection of fTcSC (p < 0.001) independently predicted removal of greater than 3 nodes. A similar proportion of patients was identified as node-positive, whether mapped with TcTM or with fTcSC (TcTM: 24 % vs. fTcSC: 17 %, p = 0.3) TcTM detected a greater proportion of positive nodes among node-positive patients compared with fTcSC (0.73 vs. 0.43, p = 0.001). Macrophage Therapeutics – Initial Funding Plan On January 21, 2015, Navidea announced that Board member and CEO of Navidea’s Macrophage Therapeutics subsidiary submitted a non-binding term sheet to raise $2.5M to fund Macrophage Therapeutics. The investment would represent 0.5% ownership yielding a $500M valuation. Proceeds will be used for pipeline development, general working capital and recruitment of a scientific advisory board, who will take the lead in the design and management of foundational animal studies funded through a combination of government grants, corporate and not-for-profit partnerships. Closing is subject to completion of definitive written agreements. We believe the proposed transaction represents a good value for Navidea shareholders who would retain 99.5% ownership of Macrophage Therapeutics. We believe the internal implied $500M valuation for Macrophage Therapeutics is a result of other immunology company valuations such as Juno Therapeutics $4.3B (Nasdaq:JUNO Not Rated), Kite Pharma $3.2B (Nasdaq: KITE Not Rated), NewLink Genetics $1.1B (Nasdaq:NLNK) and Bellicum Pharmaceuticals $683M (Nasdaq:BLCM Not Rated). Reiterating Strong Speculative Buy: With the recent broad FDA approvals for Lymphoseek, higher pricing, a new CEO with commercial experience and a potential game-changer in their Macrophage Therapeutics subsidiary, we believe savvy investors will give Navidea a fresh look in light of the weakness in the share price. Our model values the Lymphoseek program at $3.00 per share based on a 35x multiple on projected fiscal year 2018 EPS and discounted 20% for cumulative risk plus $0.25 per share based on our internal estimates for program valuations (Macrophage Therapeutics $20M, NAV4694 $8M, NAV5001 $5M, NAV1800 $2M). Lymphoseek® Commercialization Team Strengthened On January 5, 2015, Navidea’s CEO Rick Gonzalez announced two additions to his Lymphseek® commercialization team by naming Thomas J. Klima as Senior Vice President and Chief Commercial Officer and Michael Tomblyn, M.D., M.S. as Executive Medical Director. Investors should note that both were previously with Norway-based Algeta, which developed Xofigo (formerly called Alpharadin) radium-223 chloride drug is an alpha emitter radiotherapeutic for castration-resistant prostate cancer that has metastasized to the bone. Subsequent to Xofigo’s FDA and EMA approvals in 2013, development partner Bayer AG acquired Algeta for $2.6B in February 2014. While Lymphoseek® is a radiodiagnostic, we believe their experience in the radioisotope and oncology markets should help boost adoption and sales in 2015 and beyond. Their bios from the press release are as follows: Thomas J. Klima joins Navidea having held numerous commercial leadership positions, including Head of Sales for oncology company, Algeta (recently acquired by Bayer AG) and Senior Director of Marketing at Dendreon Corporation. Mr. Klima also led various U.S. and global commercial efforts at Eli Lilly, including U.S. Marketing for the Cymbalta Brand Team. Mr. Klima has a B.A. degree in Business Administration and Marketing from Western State College. Michael Tomblyn, M.D., M.S. served as Senior Medical Director of Bayer Healthcare/Algeta focusing on targetedPage 2 of 8 www.LifeTechCapital.com January 29, 2015 radiation therapies. Prior to this Dr. Tomblyn was Assistant Member and Director of Clinical Research, Department of Radiation Oncology, at H. Lee Moffitt Cancer Center and Assistant Professor, Department of Oncologic Science, at University of South Florida. Dr. Tomblyn has a M.D. degree from Rush Medical College, a M.S. in Toxicology from University of Kentucky, a M.A. in Biomedical Sciences from Marshall University, and a B.A. in Medical Ethics from Carnegie Mellon University. Manocept Therapeutics INVESTOR NOTE: A recording of the presentation and the slideshow is available to the public on our website at http://lifetechcapital.com/ltc/2014/12/navidea-navb-note-12-15-14/ Macrophage Therapeutics is Real: Macrophage Therapeutics (division of Navidea) showed data underpinning their Manocept™ CD206 mannose receptor science and mechanism of action in targeting activated macrophages for immunotherapy. Specifically, pre-clinical data for Manocept was shown for Kaposi Sarcoma, HIV and HCV by Dr. Michael McGrath (UCSF), Cardiovacular Vulnerable Plaque and Atherosclerosis by Dr. Steven Grinspoon (Harvard) and Rheumatoid Arthritis and Tuberculosis by Dr. Fredrick Cope (Macrophage Therapeutics/Navidea). Diseasemodifying agents targeting the innate immune system (the body’s first line of defense) have been focused on the cell signaling chemokines and cytokines produced by activated macrophages. In contrast, Macrophage Therapeutics is focusing on the activated macrophages themselves. We believe investors should also note that a.) Manocept could be used in many more macrophage-involved diseases than just those presented and b.) Manocept is already used in the FDA-approved Lymphoseek® imaging agent for sentinel lymph node detection in cancer. The high-level takeaways from the presentation was that Manocept: Can target, with high-affinity, CD206 on activated macrophages Can kill the activated macrophages Can distinguish between CD206+ (activated) and CD206- macrophages Can deliver an active drug payload to a desired target Can deliver double drug payloads to a desired target (imaging & therapeutic) Patent portfolio is being expanded with multiple proprietary linkers Existing manufacturing process is low cost and proven (FDA-approved) Attractive Today: Although Macrophage Therapeutics’s gameplan is still in the planning stages, we believe the investment proposition is unusually favorable today. The Manocept scaffold is already de-risked for safety, efficacy and manufacturing as it is already FDA-approved in Lymphoseek. The unique mechanism of action and utility in a wide variety of diseases makes it especially attractive for NIH grants and partnerships, both which are sources of nondilutive financing. Savvy investors will get ahead of the expected significant 2015 newsflow while Navidea remains below the radar as a “biotech” on Wall Street. Parallels to Monoclonal Antibody Development: Investors should note that monoclonal antibodies were first developed and used successfully as imaging agents before they were developed into successful therapeutics, spawning dozens of drugs and billions in sales. While Manocept™ has a fixed target it can theoretically carry multiple payloads. Combined with the fact that macrophages are involved in such a broad range of diseases, Macrophage Therapeutics could quickly build a pipeline of drug candidates. Therefore, we believe Navidea will eventually become a biotech drug company rather than “just” a diagnostic imaging company. Funding: Navidea stated that Macrophage Therapeutics will remain under Navidea’s control so existing shareholders benefit, “but also allow funding of future development in a standalone, non-dilutive manner to Navidea’s existing shareholders”. We believe this ultimately means one or more spin-offs to unlock and maximize value. Lymphoseek® Sales Just Getting Started: Navidea’s Lymphoseek only recently (October 15th) became the “Gold Standard” on October 15th with the first and only FDA approval for Sentinel Lymph Node detection in Breast, Melanoma and Oral head & Neck cancers and also for use in all solid tumors. Lymphoseek was also just recently (November 20th) approved in Europe. With CEO Rick Gonzalez specializing in commercialization, we now Page 3 of 8 www.LifeTechCapital.com January 29, 2015 believe that Navidea has the pieces in place to begin driving Lymphoseek into the marketplace successfully. The September 4th China partnership announcement also represents additional sales upside. Cash Management: Navidea has reduced cash burn on their neuroimaging programs NAV4694 and NAV5001 resulting in a 20% reduction in sequential research and development expenses and they are actively seeking out partnerships to continue these programs. With expected Lymphoseek sales increases, the recent $1.1M FDA refund for the PDUFA filing fee as a result of Lymphoseek gaining orphan drug status along with $32M available under their $35M credit line, Navidea stated that they do not expect to raise money through a stock offering in the near future. Reiterating Strong Speculative Buy: With Lymphoseek only recently achieving broad FDA and European approval, we expect commercialization will begin in earnest during 2015. We also believe Macrophage Therapeutics will begin to bring previously unlocked value to shareholders during 2015. Furthermore, with 29.5 million shares short, 19.9% of the float, a significant short squeeze is possible should these value drivers emerge in a timely fashion. We recommend savvy investors to give Navidea a fresh look. Our model values the Lymphoseek program at $3.00 per share based on a 35x multiple on projected fiscal year 2018 EPS and discounted 20% for cumulative risk plus $0.25 per share based on our internal estimates for program valuations (Manocept $15M, NAV4694 $10M, NAV5001 $8M, NAV1800 $2M). Company Description Dublin, Ohio-based Navidea Biopharmaceuticals is a medical technology company focusing on the development and commercialization of radiopharmaceuticals and medical devices. Navidea is developing Lymphoseek®, an oncology diagnostic imaging agent for radiolabeling and subsequent administration in radiodetection and visualization of the lymphatic system, which was FDA approved on March 13, 2013 and launched for sale in the U.S. on May 1, 2013. Lymphoseek is also currently under review by the EMA for the European market. Navidea is also developing their Manocept™ platform using CD206 mannose receptors as a diagnostic and therapeutic for disease macrophage inflammatory cells. On July 2014 Navidea entered a Manocept joint venture, R-NAV, focusing on rheumatologic and arthritic diseases and on December 10, 2014 Navidea formed their own specialized division called Macrophage Therapeutics. Navidea intends to partner their two on-going late-stage Phase III programs in Alzheimer’s disease and Parkinson’s disease, NAV4694, a radiopharmaceutical imaging agent for Alzheimer’s disease (AD), which is a Fluorine-18 labeled radiopharmaceutical that binds to β-amyloid deposits in the brain that can then be imaged using a PET (Positron Emission Tomography) scanner and NAV5001 ([123I]-E-IAFCT Injection formerly Altropane®), an Iodine-123 radiolabeled imaging agent, being developed as an aid in the diagnosis of Parkinson’s disease and movement disorders. MILESTONES & EVENTS Calendar Quarter (estimates subject to significant changes) Lymphoseek® Manocept™ NAV4694 (PET) Alzheimer’s NAV5001 (SPECT) Parkinson’s Q1 2011 Q1 2012 Q2 2012 NEO3-09 Top-Line Data - May Full Data at ASCO in June NDA Submission Notification of PDUFA date EMA Guidance ASCO Data Presentation Q3 2012 Interim Data NEO3-06 Q4 2012 FDA NDA ReSubmission Q2 2011 Q3 2011 Q4 2011 In-License Sign Option Begin Phase IIb Extended Option to July 31st Option Exercised Page 4 of 8 www.LifeTechCapital.com January 29, 2015 EMA MAA Submission Q1 2013 Data Phase IIb Begin Phase IIb Mild Cognitive Impairment FDA Approval March 13 Interim Data NEO3-06 (DSMB recommends ending due to successful results) Q2 2013 Q3 2013 Begin Phase III Dementia US Launch-Cardinal Health Begin Phase II IST in Colon Cancer NEO3-06 Head & Neck Phase III Concludes Begin Phase III Movement Disorders – NAV5001 Only in 275 patients NAV05-01 CMS C-Code October 1st EU Marketing Partnership Q4 2013 File sNDA for Sentinel Lymph Node Biopsy Begin Phase II IST in Kaposi Sarcoma HIV Q1 2014 Begin IST Phase IIb Dementia with Lewy Bodies NAV05-03 Nature Magazine PreClinical Data for Rheumatoid Arthritis, Kaposi Sarcoma, Tuberculosis Begin Phase III Movement Disorders – NAV5001 vs. DaTscan in 275 patients NAV05-02 Interim Data Phase IIb Mild Cognitive Impairment Initiate Injection Site Pain Study All Phase III Dementia Clinical Sites Initiated Q2 2014 JUNE 16th PDUFAFDA H&N Sentinel Lymph Node (APPROVED) China Partnership Q3 2014 Q4 2014 EU CHMP Recommendation OCTOBER 15th PDUFA – Sentinel Lymph Node Breast & Melanoma – Lymph Mapping All Tumor Types (APPROVED) 7/16/14 Partner to Develop for rheumatologic and arthritic diseases (R-NAV) Form Macrophage Therapeutics Division EMA European Marketing Approval Q1 2015 Interim Data Phase IIb Page 5 of 8 www.LifeTechCapital.com January 29, 2015 Mild Cognitive Impairment Interim Data Phase III Dementia Source: Navidea Biopharmaceuticals and LifeTech Capital Estimates Risks Some of the operational and financial risks to Navidea are: Possible Need to Raise Additional Funds: Navidea may have sufficient cash for operations should their efforts to increase Lymphoseek sales and reduce NAV4694 and NAV5001 expenses be successful. However, should those efforts be unsuccessful we believe that Navidea may be required to raise additional funds through the issuance of stock which would be dilutive to existing shareholders and could potentially affect the share price. We have included estimates of future share issuance in our financial model but there can be no guarantee that our estimates are accurate. FDA and Regulatory risks: All of Navidea’s products are reliant on approvals by the U.S. FDA and other national regulatory bodies. There can be no guarantee of timely or definite FDA or other national regulatory body approvals for any of their products. Reimbursement: Navidea’s business is dependent on government and private insurance for reimbursement with Centers for Medicare and Medicaid Services (CMS) providing significant coverage as well as payment by other national entities. Should the current or anticipated reimbursement rates be reduced, consolidated or eliminated, Navidea’s business would be adversely impacted. Partnerships: Navidea is currently dependent on partners for development, clinical trials, and/or regulatory filings of some its products and will be reliant on partners to successfully market its products. Failure of Navidea’s existing or future partners to perform satisfactorily or in a timely fashion could adversely impact the company’s financial position. Limited Number of Suppliers: Navidea relies on contract manufacturers for clinical trials and commercialization of their products. Any delays or difficulties in their relationships with manufacturers, clinical research organizations or distributors could adversely impact Navidea’s clinical trials, regulatory approvals and/or commercialization. Competition: Navidea’s strategy is based on developing “best-in-class” candidates rather than being “first-inclass”. This results significant development and marketing efforts against pre-existing competitors. There is no guarantee that Navidea’s products, regardless of their merits, will capture market share against any existing competition. Patent Litigation: Third-party claims of infringement of intellectual property could require Navidea to spend time and money on defending their intellectual property rights up to and including adverse judgments against Navidea. Sector Rotation: Navidea is a small medical diagnostic company often kept in a portfolio with similar companies. In such cases, a significant event for one company may have a material impact on the valuation of all similar companies regardless of their unique qualities. Page 6 of 8 www.LifeTechCapital.com January 29, 2015 DISCLOSURES Ratings and Price Target Changes over Past 3 Years Initiated March 25, 2011 – Strong Speculative Buy - Price Target $5.75 Updated December 2, 2013 – Strong Speculative Buy – Price Target $3.75 Updated May 23, 2014 – Strong Speculative Buy – Price Target $3.25 Analyst Certification: I, Stephen M. Dunn, the author of this research report certifies that a.) All of the views expressed in this report accurately reflect my personal views about any and all of the subject securities or issuers discussed b.) No part of my compensation is directly or indirectly related to the specific recommendations or views expressed in this research report and c.) Analysts may be eligible to receive other compensation based upon various factors, including total revenues of the Firm and its affiliates as well as a portion of the proceeds from a broad pool of investment vehicles consisting of components of the compensation generated by investment banking activities, including but not limited to shares of stock and/or warrants, which may or may not include the securities referenced in this report. DISCLOSURES Does the Analyst or any member of the Analyst’s household have a financial interest in any securities of the Company? Does the Analyst or any member of the Analyst's household or Firm serve as an officer, director or advisory board member of the Company? Has the Analyst or any member of the Analyst’s household received compensation directly or indirectly from the Company in the previous 12 months? Does the Firm or affiliates beneficially own ≥1% of the Company’s common stock? Has the Firm or affiliates received investment banking services compensation in previous 12 months? Has the Firm or affiliates received non-investment banking securities-related services compensation in previous 12 months? Does the Firm or affiliates expect to receive or intend to seek investment banking compensation in next 3 months? Has the Firm or affiliates received non-securities services compensation in previous 12 months? Does the Firm or affiliates make a market in the Company’s securities? NO NO NO NO NO NO YES YES NO The Firm and/or its directors and employees may own securities of the company(s) in this report and may increase or decrease holdings in the future. The Firm, its officers, directors, analysts or employees may effect transactions in and have long or short positions in the securities (or options or warrants with respect thereto) mentioned herein. The Firm may effect transactions as principal or agent in the securities mentioned herein. Ratings Definitions: 1) Strong Buy: the stock is expected to appreciate and produce a total return of at least 40% over the next 12-18 months; 2) Buy: the stock is expected to appreciate and produce a total return of at least 20% over the next 12-18 months; 3) Strong Speculative Buy: the stock is expected to appreciate and produce a total return of at least 40% over the next 12-18 months but the volatility and investment risk is substantially higher than our "Strong Buy" recommendation; 4) Speculative Buy: the stock is expected to appreciate and produce a total return of at least 20% over the next 12-18 months but the volatility and investment risk is substantially higher than our "Buy" recommendation; 5) Neutral: the stock is fairly valued for the next 12-18 months; 6) Avoid/Sell: the stock is expected to decline at least 20% over the next 12-18 months and should be avoided or sold if held; 7) Under Review: the previous rating and/or price target is suspended due to a significant event which now requires additional analysis and the previous rating and/or price target cannot be relied upon; 8) Not Rated: the stock has too much business or financial uncertainty to form an investment conclusion or is currently in the process of being acquired and 9) Restricted: coverage cannot be initiated or has been temporarily suspended to comply with applicable regulations and/or firm policies in certain circumstances such as investment banking or an advisory capacity involving the company. Page 7 of 8 www.LifeTechCapital.com LifeTech Capital Research Ratings Distribution Strong Buy Strong Speculative Buy Buy Speculative Buy Neutral Avoid/Sell Under Review Not Rated Restricted Total Research Coverage % of Total 0% 50% 0% 0% 0% 50% 0% 0% 0% 100% Investment Banking % of Total 0% 50% 0% 0% 0% 0% 0% 0% 0% 25% FINRA RULE 2711 Ratings Distribution Buy Hold/Neutral Sell Total January 29, 2015 Research Coverage % of Total 50% 0% 50% 100% Investment Banking % of Total 50% 0% 0% 25% Legal Disclaimer THE INFORMATION IN THIS REPORT IS NOT INTENDED TO BE USED AS THE BASIS FOR INVESTMENT DECISIONS AND SHOULD NOT BE CONSTRUED AS ADVICE INTENDED TO MEET THE PARTICULAR INVESTMENT NEEDS OF ANY INVESTOR. THE INFORMATION IN THIS REPORT IS NOT A REPRESENTATION OR WARRANTY AND IS NOT AN OFFER OR SOLICITATION OF AN OFFER TO BUY OR SELL ANY SECURITY. TO THE FULLEST EXTENT OF THE LAW, LIFETECH CAPITAL, AURORA CAPITAL LLC, OUR OFFICERS, ADVISORS, AND PARTNERS WILL NOT BE LIABLE TO ANY PERSON OR ENTITY FOR THE QUALITY, ACCURACY, COMPLETENESS, RELIABILITY OR TIMELINESS OF THE INFORMATION PROVIDED IN THIS REPORT, OR FOR ANY DIRECT, INDIRECT, CONSEQUENTIAL, INCIDENTAL, SPECIAL OR PUNITIVE DAMAGES THAT MAY ARISE OUT OF THE USE OF INFORMATION PROVIDED TO ANY PERSON OR ENTITY (INCLUDING BUT NOT LIMITED TO, LOST PROFITS, LOSS OF OPPORTUNITIES, TRADING LOSSES AND DAMAGES THAT MAY RESULT FROM ANY INACCURACY OR INCOMPLETENESS OF THIS INFORMATION). Investors are expected to take full responsibility for any and all of their investment decisions based on their own independent research and evaluation of their own investment goals, risk tolerance, and financial condition. Investors are further cautioned that Small-Cap and Micro-Cap stocks have additional risks that may result in trading at a discount to their peers. Liquidity risk, caused by small trading floats and very low trading volume can lead to large spreads and high volatility in stock price. Small-Cap and Micro-Cap stocks may also have significant company-specific risks that contribute to lower valuations. Investors need to be aware of the higher probability of financial default and higher degree of financial distress inherent in the Small-Cap and Micro-Cap segments of the market. The information, opinions, data, quantitative and qualitative statements contained in this report have been obtained from sources believed to be reliable but have not been independently verified and are not guaranteed as to accuracy nor does it purport to be a complete analysis of every material fact regarding the company, industry, or security. The information, opinions, or recommendations are solely for advisory and informational purposes and are only valid as of the date appearing on the report and are subject to change without notice. Statements in this report that are not historical facts are “forward-looking statements” that involve risks and uncertainties. “Forward looking statements" as defined under Section 27A of the Securities Act of 1933, Section 21B of the Securities Exchange Act of 1934 and the Private Securities Litigation Act of 1995 include words such as “opportunities,” “trends,” “potential,” “estimates,” “may,” “will,” “could,” “should,” “anticipates,” “expects” or comparable terminology or by discussions of strategy. These forward looking statements are subject to a number of known and unknown risks and uncertainties outside of the company's or our control that could cause actual operations or results to differ materially from those anticipated. Factors that could affect performance include, but are not limited to, those factors that are discussed in each profiled company's most recent reports or registration statements filed with the SEC. Investors should consider these factors in evaluating the forward looking statements included in this report and not place undue reliance upon such statements. Investors are encouraged to read investment information available at the websites of the SEC at http://www.sec.gov and FINRA at http://www.finra.org. Copyright © 2015 LifeTech Capital. All Rights Reserved. LifeTech Capital is a division of Aurora Capital LLC Member FINRA / SIPC Boca Raton Office 4431 Woodfield Blvd. Boca Raton, FL 33432 Tel: 561-988-9129 Fax: 561-988-9129 New York Office 17 Park Avenue #201 New York, NY 10016 Tel: 917-834-7206 Fax: 415-887-7814 Page 8 of 8

© Copyright 2026