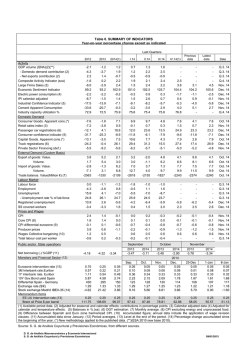

Summary Indicators Gross Domestic Product Industrial Production

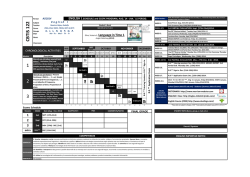

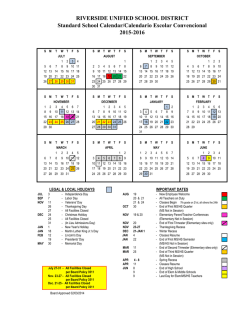

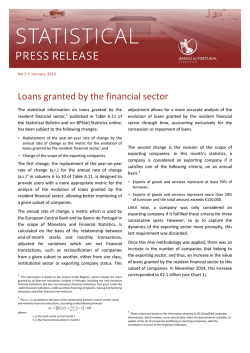

US Summary Indicators Gross Domestic Product 4.0 Industrial Production Four-quarter percentage change 115 3.5 110 3.0 105 Q4 2.5 2.5 95 1.5 90 1.0 85 2010 2011 2012 2013 2014 2015 80 Unemployment Rate 11 Dec 106.5 100 2.0 0.5 Index, 1997=100 2010 2011 2012 2013 2014 2015 Consumer Price Index Percent 5 10 12-Month Percentage Change 4 9 3 8 2 7 1 6 5 Dec 0.8 Dec 5.6 2010 2011 2012 2013 2014 2015 0 2010 2011 2012 2013 2014 2015 Source: Haver February 5, 2015 UNITED STATES Output Indicators GDP Growth 8 Industrial Production Annualized Percentage Change 10 8.4 8.6 6 4.6 4.6 4.5 8 5.0 6.7 3.9 4 3.5 2.9 2.7 2.5 2 Annualized Percentage Change 1.7 2.7 2.5 2.2 6 2.6 1.6 0.8 3.9 4 0.1 0 5.7 5.3 5.0 1.8 5.0 4.0 3.8 2.5 -2 -4 2 -1.5 2010 2011 2012 2013 2014 2015 0 GDP Growth 4.0 12 10 3.0 8 Q4 2.5 2.5 4 1.5 2 1.0 0 2011 1.3 2011 1.5 2012 2.4 1.9 2013 2014 2015 2012 2013 2014 2015 Percent Change Over Year-Ago Level 6 2.0 2010 2010 2.5 4.2 Industrial Production Percent Change Over Year-Ago Level 3.5 0.5 1.5 -2.1 3.9 -2 Dec 4.8 2010 2011 2012 2013 2014 2015 Source: Haver February 5, 2015 UNITED STATES Contribution to Change in GDP (1) Investment and Inventories Personal Consumption Expenditures 5 Percentage points 5 4 2.5 2.5 1.4 1.2 1 0.6 2 1.8 1.2 1.4 1.3 1.3 0.9 0.9 0 -1 -1 -2 -2 2011 2012 2013 2014 2015 -3 Percentage points 5 4 4 3 3 2 0 0.6 0.3 0.2 -0.5 -0.8 -1.1 2010 2011 2012 -1.1 2013 2014 2015 Percentage points 0.0 -0.2 -0.1 -0.0 -0.3 -1 -1.0 2011 2012 2013 2014 0.8 0.5 0.3 0.0 0.0 -0.1 -0.6 -0.1 -0.5 -0.9 -0.3 -0.1 -0.2 -0.6 -0.8 -0.4 -0.7 -1.2 -1.7 -1.8 2010 0.6 0 -0.1 -0.5 -0.8 -0.9 1 0.8 0.6 0.4 -0.2 -3 1.1 0.8 0.3 -2 1.2 1.2 1.1 1.0 1.0 0.9 2 1.1 1 -1 2.1 1.9 1.8 Government Consumption and Investment Net Exports of Goods and Services 5 2.5 1 0.8 0 2010 2.9 2.9 2.2 1.9 1.8 1.5 3 2.9 2.8 2.2 -3 4.2 4 3 2 Percentage points -1.6 -2 2015 -3 2010 2011 2012 2013 2014 2015 NOTE: All of the above are seasonally adjusted data at annual rates in real dollars. Source: Haver Analytics February 5, 2015 UNITED STATES Contribution to Change in GDP (2) Fixed Investment 4 Inventories Percentage points 4 3 Percentage points 3 2.8 2.3 2 1.8 1.1 1 0 1.1 1.5 1.4 1.2 1.0 0.6 0.5 0.7 1.0 1.0 2 0.1 -0.2 -1 -2 -2 -3 -3 2011 2012 2013 2014 2015 4 3 3 2 2 1 1 0.6 0.1 0 -2 -1.0 -1.2 -1.8 -2.1 2010 -0.0 -0.3 2011 2012 2013 2014 2015 Exports Percentage points -0.4 -0.5 -0.5 -0.6 -1 -0.2 -1.6 -4 Imports 4 0.3 0 -0.1 2010 0.8 0.7 0.3 -1 -4 1.4 1.0 0.4 0.0 -0.0 1.5 1.1 1 0.4 1.9 1.7 1.2 -0.1 -0.2 -0.3 -0.8 -0.7 1.4 1.5 1.4 1.3 0.8 0.7 0.8 0.7 0.6 0.6 0.6 0.2 0 -0.4 0.6 0.3 0.2 0.4 -0.1 -1 -1.4 -1.6 1.1 0.3 0.2 0.0 Percentage points -1.3 -1.4 -2 -1.8 -2.2 -3 -4 -3 -2.9 2010 2011 2012 2013 2014 2015 -4 2010 2011 2012 2013 2014 2015 NOTE: All of the above are seasonally adjusted data at annual rates in real dollars. Source: Haver Analytics February 5, 2015 UNITED STATES Growth Indicators 130 Leading Indicators Composite Index Institute for Supply Management 2004=100 PMI and NMI Composite Indexes Dec 121.1 120 60 56 110 54 105 52 100 50 95 48 2010 2011 2012 2013 2014 2015 46 Percent Change Over Year-Ago Level, Chained 2005 Dollars 8 2011 2012 2013 2014 4 Dec 3.7 1 -4 0 2011 2012 2013 2014 2015 Dec 2.8 2 0 2010 2015 Percent Change Over Year-Ago Level 3 4 -8 2010 Real Personal Consumption Expenditures Real Personal Disposable Income 12 Non-Manu. (Jan: 56.7) 58 115 90 Manu. (Jan: 53.5) 62 125 -1 2010 2011 2012 2013 2014 2015 Source: Haver; Leading Indicators Composite Index Source: The Conference Board February 5, 2015 UNITED STATES ISM Diffusion Index 62 General Conditions for Manufacturing Current Production/Activity Diffusion Index Diffusion Index 60 70 58 66 56 62 Jan 53.5 54 52 Non-manu. (Jan: 61.5) 58 54 50 50 48 46 Manu. (Jan: 56.5) 2010 2011 2012 2013 2014 2015 46 2010 2011 New Orders Employment Diffusion Index Diffusion Index Manu. (Jan: 52.9) 70 Non-manu. (Jan: 59.5) 2012 2013 Manu. (Jan: 54.1) 68 2014 2015 Non-manu. (Jan: 51.6) 64 66 60 62 56 58 52 54 48 50 46 44 2010 2011 2012 2013 2014 2015 40 2010 2011 2012 2013 2014 2015 Source: Haver February 5, 2015 UNITED STATES Manufacturers’ Shipments 280 Durable Goods Nondefense Capital Goods Billions of dollars Billions of dollars 95 Total (Dec: 79.2) Excl. Aircraft (Dec: 70.0) 260 Dec 247.4 240 85 75 220 200 65 180 55 160 2010 2011 2012 2013 2014 2015 45 Motor Vehicles and Parts 60 2010 2011 2012 2013 2014 2015 Computer and Electronic Products Billions of dollars 32 Billions of dollars 55 Dec 49.4 50 45 30 Dec 28.7 28 40 26 35 30 24 25 20 2010 2011 2012 2013 2014 2015 22 2010 2011 2012 2013 2014 2015 NOTE: Seasonally adjusted Source: Haver February 5, 2015 UNITED STATES Price and Cost Indicators Consumer Prices Personal Consumption Expenditure Percent Change Over Year-Ago Level Percent Change Over Year-Ago Level Overall CPI (Dec: 0.8) 5 Core CPI (Dec: 1.6) Overall PCE (Dec: 0.7) 3.5 Core PCE (Dec: 1.3) 3.0 4 2.5 3 2.0 2 1.5 1 0 8 1.0 2010 2011 2012 2013 2014 2015 0.5 2010 2011 2012 2013 2014 Compensation per Hour and Unit Labor Cost Producer Prices, Except Food and Energy Percent Change Over Year-Ago Level Percent Change Over Year-Ago Level Compensation (Q4: 1.9) Unit Labor Cost (Q4: 1.9) 10 PPI, Fin. Goods (Dec: 1.8) 2015 PPI, Int. Goods (Dec: 0.3) 8 6 6 4 4 2 2 0 0 -2 -4 -2 2010 2011 2012 2013 2014 2015 -4 2010 2011 2012 2013 2014 2015 NOTE: Unit Labor Cost and Compensation are from the Nonfarm Business Sector. Source: Haver February 5, 2015 UNITED STATES Consumer Price Index Total (100%) 5 Total excluding Food and Energy (77%) Percent Change Over Year-Ago Level 5 4 4 3 3 2 2 Dec 0.8 1 0 -1 -1 2010 2011 2012 2013 2014 2015 -2 5 5 4 4 3 3 2 2 1 1 2011 2012 2013 2014 2015 Percent Change Over Year-Ago Level Dec 2.4 0 Dec -0.8 -1 -2 2010 Services excluding Energy (54%) Commodities excluding Food and Energy (23%) Percent Change Over Year-Ago Level 0 Dec 1.6 1 0 -2 Percent Change over Year-Ago Level 2010 2011 2012 2013 2014 2015 -1 -2 2010 2011 2012 2013 2014 2015 NOTE: Numbers in parentheses represent share of Total CPI. Source: Haver February 5, 2015 UNITED STATES Producer Price Index Finished Goods Intermediate Goods Percent Change Over Year-Ago Level Percent Change over Year-Ago Level Total (Dec: -0.5) 16 Core (Dec: 1.8) 12 12 8 8 4 4 0 0 -4 16 2010 2011 2012 2013 2014 Total (Dec: -2.2) 16 2015 -4 2010 2011 Core (Dec: 0.3) 2012 2013 Finished Capital Goods Finished Consumer Goods Percent Change Over Year-Ago Level Percent Change Over Year-Ago Level Total (Dec: -1.0) 16 2014 2015 Core (Dec: 2.3) 12 12 8 8 4 Dec 1.1 0 -4 2010 2011 2012 2013 2014 2015 4 0 -4 2010 2011 2012 2013 2014 2015 NOTE: For all of the above, core excludes food and energy. Source: Haver February 5, 2015 U.S. Import Prices for Manufactured Goods by Region 16 World Economies Canada and Latin America Percent change over year-ago level Percent change over year-ago level Industrialized (Dec: -1.1) Developing (Dec: -1.8) 16 12 12 8 8 4 4 0 0 -4 -4 -8 16 2010 2011 2012 2013 2014 2015 -8 Canada (Dec: -2.3) 2010 2011 Latin America (Dec: -2.3) 2012 2013 European Union 15 Japan and China* Percent change over year-ago level Percent change over year-ago level Japan (Dec: -1.4) 16 12 2014 2015 China* (Dec: -0.1) 12 8 8 4 4 Dec 0.4 0 -4 -8 0 -4 2010 2011 2012 2013 2014 2015 -8 2010 2011 2012 2013 2014 2015 NOTE: China import price data is available from December 2003 going forward and includes nonmanufactured goods, as well. Source: Haver February 5, 2015 U.S. Import Prices by End-Use Industrial Supplies, excl. Petroleum Capital Goods Percent change over year-ago level 6 Excl. computers (Dec: -0.2) Computers (Dec: -1.3) 20 Percent change over year-ago level 15 4 2 10 0 5 -2 Dec -0.7 0 -4 -5 -6 -8 5 2010 2011 2012 2013 2014 2015 -10 2010 2011 2012 Automotive Vehicles, Parts and Engines Consumer Goods Percent change over year-ago level Percent change over year-ago level 4 6 3 4 2013 Durable (Dec: -1.2) 2014 2015 Non-durable (Dec: 2.1) 2 2 1 0 Dec -0.8 -1 -2 -3 2010 2011 2012 2013 2014 2015 0 -2 -4 2010 2011 2012 2013 2014 2015 NOTE: Computers include peripherals and semiconductors. Source: Haver February 5, 2015 UNITED STATES Employment Unemployment, Whole Economy Unemployment Rate 11 Percent 40 Percent Change Over Year-Ago Level 30 10 20 9 10 8 0 7 -10 6 5 Dec 5.6 2010 2011 2012 2013 2014 2015 -20 -30 2010 2011 2012 2013 2014 2015 Hours Worked: Private Non-Farm Payrolls Non-Farm Payroll Employment 6 Dec -16.3 Percent Change Over Year-Ago Level 8 Percent Change Over Year-Ago Level 6 4 Dec 2.1 2 Dec 3.6 4 2 0 0 -2 -2 -4 -6 -4 2010 2011 2012 2013 2014 2015 -6 2010 2011 2012 2013 2014 2015 Source: Haver February 5, 2015 UNITED STATES Corporate Profits 13.5 Corporate Profits Corporate Profits: Payments Abroad Percent of Nominal GDP Percent of Nominal GDP 1.7 13.0 1.6 12.5 Q3 12.3 12.0 Q3 1.6 1.5 1.4 1.3 11.5 1.2 11.0 10.5 1.1 2010 2011 2012 2013 2014 2015 1.0 Percent of Nominal GDP 4.4 10.5 2012 2013 2014 2015 Percent of Nominal GDP 4.3 Q3 10.0 10.0 4.2 9.5 4.1 9.0 4.0 8.5 3.9 8.0 3.8 7.5 2011 Corporate Profits: Receipts from Abroad Corporate Profits: Domestic Industries 11.0 2010 2010 2011 2012 2013 2014 2015 3.7 Q3 3.9 2010 2011 2012 2013 2014 2015 NOTE: Corporate profits include inventory valuation and capital consumption adjustments. Total profits equal domestic industries plus receipts from abroad minus payments abroad. Source: Haver February 5, 2015 UNITED STATES Trade Indicators Current Account Balance Goods and Services SA, Bil.$ -300 Imports (Dec: 241.4) 285 Exports (Dec: 194.9) 265 -330 -360 225 205 185 165 145 2010 2011 2012 2013 2014 2015 -450 -480 -510 -540 -570 -600 Trade Balance -30 -349 -390 -420 245 125 SAAR, Bil.$ -432 -449 -436 -458 -474 -474 -482 -449 -476 -496 2010 2011 2012 3 2 -38 1 1.1 2015 1.1 0.8 -0.2 Dec -46.6 -46 -50 2013 2014 2015 -0.2 -0.1 -0.0 -0.1 -0.3 -0.5 -1 -2 2012 0.8 0.6 0.4 0.0 0 2011 2014 SAAR, percent 0.3 -42 2010 2013 Net Export Contribution to Real GDP SA, Bil.$ -34 -54 -394 -401 -408 -405 -423-422-425 -408 -3 -0.8 -0.9 -1.0 -1.7 -1.8 2010 2011 2012 2013 2014 2015 Source: Haver, Bureau of Economic Analysis/U.S. Census. February 5, 2015 UNITED STATES Financial Flows In and Out of United States (1) Total Foreign Direct Investment Billions of dollars Billions of dollars Net Outflow (Q3: -367) 1200 Net Inflow (Q3: 358) 900 Net Outflow (Q3: -102) 200 Net Inflow (Q3: 67) 100 600 300 0 0 -100 -300 -200 -600 -900 2010 2011 2012 2013 2014 2015 -300 2011 Portfolio Banking and Other Billions of dollars Billions of dollars Net Outflow (Q3: -153) 600 Net Inflow (Q3: 251) 400 200 200 0 0 -200 -200 2010 2011 2012 2013 2014 2015 -400 2012 2013 Net Outflow (Q3: -111) 600 400 -400 2010 2010 2011 2012 2014 2015 Net Inflow (Q3: 40) 2013 2014 2015 NOTE: U.S. official outflows are in Other. Excludes financial derivatives. Not Seasonally Adjusted. Source: Haver February 5, 2015 UNITED STATES Financial Flows In and Out of United States (2) Portfolio: Equity Securities Banking Billions of dollars Billions of dollars Net Outflow (Q1: 83) 200 Net Inflow (Q1: 74) 150 Net Outflow (Q1: 17) 600 Net Inflow (Q1: 96) 400 100 50 200 0 0 -50 -200 -100 -150 2009 2010 2011 2012 2013 2014 2015 2009 2010 Portfolio: Debt Securities Other Billions of dollars Billions of dollars Net Outflow (Q1: 28) 400 Net Inflow (Q1: 127) 2011 2012 Net Outflow (Q1: -42) 150 2013 2014 2015 Net Inflow (Q1: 45) 120 90 60 30 0 -30 300 200 100 0 -100 -400 2009 2010 2011 2012 2013 2014 2015 -60 -90 -120 2009 2010 2011 2012 2013 2014 2015 NOTE: U.S. official outflows are in Other. Source: Haver February 5, 2015 UNITED STATES Financial Flows In and Out of United States By Region 525 450 375 300 225 150 75 0 -75 -150 -225 -300 Europe Canada Billions of dollars Billions of dollars Net Outflow (Q1: 63) Net Inflow (Q1: 110) Net Outflow (Q1: 21) 70 Net Inflow (Q1: 8) 60 50 40 30 20 10 0 2009 2010 2011 2012 2013 2014 2015 -10 2009 2010 Asia, Africa, and Australia Latin America Billions of dollars Billions of dollars Net Outflow (Q1: 194) 300 Net Inflow (Q1: 16) 2011 2012 Net Outflow (Q1: 11) 200 2013 2014 2015 Net Inflow (Q1: 35) 250 100 200 150 0 100 -100 50 0 -200 -50 -100 2009 2010 2011 2012 2013 2014 2015 -300 2009 2010 2011 2012 2013 2014 2015 NOTE: Data are from Financial Account and do not include flows affecting domestic reserves. Source: Haver February 5, 2015 ALL FOREIGN COUNTRIES Net Purchase of Long-Term US Securities Treasury Bonds and Notes Agency Bonds Nov: $-4.833 Billion 100 75 75 50 50 25 25 0 0 -25 -25 -50 -50 -75 -75 -100 2012 2013 2014 2015 -100 Corporate Bonds 75 50 50 25 25 0 0 -25 -25 -50 -50 -75 -75 2012 2013 2013 2014 2015 2014 2015 Nov: $5.771 Billion 100 75 -100 2012 Corporate Stocks Nov: $24.983 Billion 100 Nov: $33.290 Billion 100 2014 2015 -100 2012 2013 Source: Haver February 5, 2015 NET PURCHASE OF LONG-TERM US SECURITIES By Region Asia Europe Nov: $20.918 Billion 90 60 60 30 30 0 0 -30 -30 -60 -60 -90 -90 -120 2012 2013 2014 2015 -120 Latin America 60 30 30 0 0 -30 -30 -60 -60 -90 -90 2012 2013 2014 2015 2013 2014 2015 Nov: $-9.175 Billion 90 60 -120 2012 Caribbean Nov: $1.441 Billion 90 Nov: $46.653 Billion 90 2014 2015 -120 2012 2013 NOTE: Categories not covered include: ’Other Countries’, Int’l and Reg. Organizations, and Africa. Source: US Treasury Department February 5, 2015 UNITED STATES Net Borrowing by Nonfinancial Corporations Total 1000 Loans and Mortgages Billions of Dollars, SAAR 400 Billions of Dollars, SAAR 800 585 600 400 362 295300 284 184 200 317 561 61 70 404 382378 353 324 38 33 -12 -141 -211 -400 -330 -435-446 2010 2011 2012 2013 2014 2015 -600 Billions of Dollars, SAAR 600 120 90 72 70 63 30 26 30 29 29 20 300 19 0 100 -35 359 352 2014 2015 373 324 287 267 184 178 225 200 205 215217 175 151 146 -20 -35 -60 2013 446 401 200 -7.9 -30 2012 Billions of Dollars, SAAR 400 55 50 44 2011 500 92 50 2010 Bonds Commercial Paper 53 -59 0 -90 -120 63 -8.9 168 86 163 -22 -600 60 105 11 0 302 202 155 142 -117 -400 150 222 200 -200 0 -200 625 2010 2011 2012 2013 2014 2015 -100 2010 2011 2012 2013 2014 2015 NOTE: Equity issues are not included. Source: Board of Governors, Haver February 5, 2015 UNITED STATES Gross Saving and Investment as a Percent of Nominal GDP 26 Private Saving (Q3: 20.0) Private Domestic Investment (Q4: 16.7) 22 Saving (Q3: 18.2) Domestic Investment (Q4: 20.1) 24 20 22 20 18 18 16 16 14 14 12 10 9 2010 2011 2012 Government Saving (Q3: -1.8) 2013 2014 2015 Government Investment (Q4: 3.4) 6 12 1 2010 2011 2012 Saving Gap (Q3: -1.7) 2013 2014 2015 Net Foreign Investment (Q3: -2.5) 0 3 -1 0 -2 -3 -6 -3 -9 -4 -12 -15 2010 2011 2012 2013 2014 2015 -5 2010 2011 2012 2013 2014 2015 NOTE: The saving gap (S-I) and Net Foreign Investment differ by a statistical discrepancy. NFI plus some small adjustment factors equals the Current Account. Source: Haver February 5, 2015 JAPAN Summary Indicators Industrial Production Gross Domestic Product 8 Four-quarter percentage change 112 Index, 2000=100 108 6 104 4 100 2 96 92 0 Q3 -1.2 -2 -4 88 84 2010 2011 2012 2013 2014 2015 80 Unemployment Rate 6.0 Dec 98.9 2010 2011 2012 2013 2014 2015 Consumer Price Index Percent 5 12-Month Percentage Change 4 5.5 3 5.0 Dec 2.4 2 4.5 1 4.0 0 Dec 3.4 3.5 3.0 2010 2011 2012 2013 2014 2015 -1 -2 2010 2011 2012 2013 2014 2015 Source: National Sources February 5, 2015 JAPAN Output Indicators GDP Growth 16 12 8 4 Industrial Production Annualized Percentage Change 50 40 11 6.0 6.0 6.0 5.8 20 4.6 4.5 12 10 0.5 -2.3 -4 -2.4 -1.7 -2.0 -0.9 -1.5 4.0 5.3 0 -1.9 -6.7 -7.1 2010 2011 2012 2013 2014 -30 GDP Growth 40 6 30 4 20 2 10 0 0 Q3 -1.2 -2 2011 -14 -15 2010 2011 -7.0 -8.3 -13 2012 -7.5 -14 2013 2014 2015 Industrial Production Percent Change Over Year-Ago Level 2010 2.1 -1.7 -20 2015 6.5 7.0 7.6 3.9 3.2 -10 -8 -4 18 3.0 0 8 32 30 1.6 -12 Annualized Percentage Change 2012 2013 2014 2015 Percent Change Over Year-Ago Level Dec -1.1 -10 -20 2010 2011 2012 2013 2014 2015 Source: Haver February 5, 2015 JAPAN Contribution to Change in GDP (1) Private Consumption Expenditures 12 Investment and Inventories Percentage points 12 8 Percentage points 8 5.2 4 3.6 3.2 2.4 1.6 2.0 0.0 -4 -4.0 0.8 1.6 1.2 -1.2 -1.6 -3.2 -12 -12 2010 2011 2012 2013 2014 2015 -16 2010 2011 2012 2013 2014 2015 Government Consumption Expenditures Net Exports of Goods and Services Percentage points 12 8 Percentage points 8 4.0 3.6 2.0 4 1.6 0.0 0.4 0.4 -0.4 -1.2 -1.6 -2.0 1.2 0.4 0.4 -0.4 -2.8 -4 -1.6 0 -0.8 -2.4 -8 -12 -12 2010 2011 2012 2013 0.4 0.4 0.0 0.4 0.0 0.4 0.8 -0.4 0.4 0.4 0.8 0.4 0.0 0.0 -0.4 0.4 0.4 -0.4 -4 -4.4 -8 -16 -0.8 -2.0 0.4 0.4 -8 -16 0 2.4 2.0 2.0 0.4 -1.2 -12 4 2.8 2.0 0 -8 12 3.2 2.4 0.8 -0.8 -1.2 -4 0.8 0.4 0.0 0 4 3.2 1.2 1.2 1.6 2014 2015 -16 2010 2011 2012 2013 2014 2015 NOTE: Contributions to GDP growth may include errors due to rounding. Source: Haver February 5, 2015 JAPAN Contribution to Change in GDP (2) Inventories Fixed Investment 8 Percentage points 8 6 6 4 4 Percentage points 4.8 2.0 2 0 3.2 3.2 1.2 1.2 0.8 0.8 0.4 0.0 2.4 1.6 2 1.2 2.0 0.4 -0.4 -1.2 -2 -0.8 -0.4 1.6 0.8 0.0 0.0 0 -0.4 2.0 1.6 1.2 -0.8 -2 -1.6 -0.4 -0.8 -0.8 -1.2 -1.2 -2.0 -2.4 -4 -6 -4 -4.0 2010 2011 2012 2013 2014 2015 -6 Imports 8 -2.4 2010 2011 2012 2013 2014 Exports Percentage points 8 6 Percentage points 6 5.6 4.4 4 4 4.0 3.6 2.8 2 -1.2 -0.4 2.4 1.6 -1.2 -1.2 -1.2 -2.0 -0.4 -0.8 -1.6 0.0 -0.4 -1.2 -0.4 -2 -2.0 -2.4 -2.8 -4 -0.4 -2.4 -0.4 -2.0 -4 -4.8 -4.8 -6 1.6 0.0 0 -0.8 1.6 0.8 0.4 0.0 0 -2 2 1.2 -0.8 2015 2010 2011 2012 2013 2014 2015 -6 2010 2011 2012 2013 2014 2015 NOTE: Contributions to GDP growth may include errors due to rounding. Source: Haver February 5, 2015 JAPAN Growth Indicators Tankan Survey 20 Manufacturing Producers’ Shipments Headline - Large Manufacturers 30 15 Q4 12.0 10 Percent Change Over Year-Ago Level (SA) 20 5 10 0 0 Dec -1.0 -5 -10 -10 -15 2010 2011 2012 2013 2014 2015 -20 2011 2012 2013 2014 2015 Retail Sales Core Machinery Orders 25 2010 Percent Change Over Year-Ago Level (SA) 15 Percent Change Over Year-Ago Level (SA) 20 10 15 10 5 5 -5 Nov -9.2 -10 -15 Dec 0.3 0 0 2010 2011 2012 2013 2014 2015 -5 -10 2010 2011 2012 2013 2014 2015 Source: National Sources February 5, 2015 JAPAN Tankan Survey Results Business Conditions: Large, Manufacturing Business Conditions: Large, Non-Manufacturing Net Percentage ’Favorable’ responses Net Percentage ’Favorable’ responses Actual (Q4: 12.0) 20 Forecast (Q1: 9.0) 15 Actual (Q4: 16.0) 30 Forecast (Q1: 15.0) 20 10 5 10 0 0 -5 -10 -10 -15 -20 2010 2011 2012 2013 2014 2015 2016 -20 Corporate Finance: Financial Position, Large 22 Diffusion Index of ’Easy’ minus ’Tight’ 2012 2013 2014 2015 2016 Diffusion index of ’Accomodative’ minus ’Severe’ Q4 25.0 25 Q4 19.0 18 2011 Lending Attitude: Large Financial Enterprises 30 20 2010 20 16 15 14 10 12 5 10 8 2010 2011 2012 2013 2014 2015 2016 0 2010 2011 2012 2013 2014 2015 2016 Source: National Sources February 5, 2015 JAPAN Consumer Price Index 5 Total Core Percent Change Over Year-Ago Level Percent Change Over Year-Ago Level 4 4 Dec 2.4 2 2 1 1 0 0 -1 -1 2010 2011 2012 2013 2014 2015 -2 Goods 8 ex. Food and Energy (Dec: 2.1) 3 3 -2 ex. Fresh Foods (Dec: 2.5) 2010 2011 2012 2013 2014 2015 Services Percent Change Over Year-Ago Level 2.5 Percent Change Over Year-Ago Level 2.0 6 Dec 1.8 1.5 4 Dec 3.1 2 1.0 0.5 0.0 0 -0.5 -2 -4 -1.0 2010 2011 2012 2013 2014 2015 -1.5 2010 2011 2012 2013 2014 2015 Source: Ministry of Internal Affairs and Communications. February 5, 2015 JAPAN Producer Price Index Intermediate Goods Total 6 Percent Change Over Year-Ago Level 6 4 4 Dec 1.9 2 2 0 0 -2 -2 -4 2010 2011 2012 2013 2014 2015 -4 Percent Change Over Year-Ago Level 6 4 2010 2011 2012 2013 2014 2015 Percent Change Over Year-Ago Level 4 2 Dec 1.0 2 0 0 -2 -2 -4 Dec -0.6 Consumer Goods Capital Goods 6 Percent Change Over Year-Ago Level 2010 2011 2012 2013 2014 2015 -4 Dec -1.6 2010 2011 2012 2013 2014 2015 Source: National Sources February 5, 2015 JAPAN Employment and Wages Unemployment, Job Seekers Unemployment Rate 6.0 Percent 20 Percent Change Over Year-Ago Level 15 5.5 10 5.0 5 4.5 0 -5 4.0 Dec -7.0 -10 Dec 3.4 3.5 3.0 2010 2011 2012 2013 2014 2015 -15 -20 2011 2012 2013 2014 2015 Average Hourly Wage (NSA) Total Labor Force 1.5 2010 Percent Change Over Year-Ago Level (NSA) 30 1.0 Dollars 28 0.5 Dec 0.3 0.0 -0.5 26 24 -1.0 22 -1.5 -2.0 2010 2011 2012 2013 2014 2015 20 Sep 21.2 2010 2011 2012 2013 2014 2015 Source: National Sources February 5, 2015 JAPAN Trade Indicators 375 300 225 150 75 0 -75 -150 -225 -300 Trade and Current Account Balances Merchandise Imports In Billions of Dollars, SAAR Percent Change Over Year-Ago Level TB (Dec: -71.6) CAB (Nov: 94.4) Volumes (Dec: -0.1) 50 Values (Dec: 1.9) 40 30 20 10 0 -10 2010 2011 2012 2013 2014 2015 -20 2010 2011 2012 2013 Merchandise Trade Merchandise Exports In Billions of Dollars, SA Percent Change Over Year-Ago Level Imports (Dec: 61.1) 95 Exports (Dec: 55.1) Volumes (Dec: 6.0) 80 2014 2015 Values (Dec: 12.8) 60 85 40 75 20 65 0 55 45 -20 2010 2011 2012 2013 2014 2015 -40 2010 2011 2012 2013 2014 2015 Source: Haver February 5, 2015 JAPAN Financial Flows In and Out of Japan (1) Total Foreign Direct Investment Billions of dollars Billions of dollars Net Outflow (Q3: -45) 200 Net Inflow (Q3: 19) 150 10 100 0 50 -10 0 -20 -50 -30 -100 -40 -150 -50 -200 2010 2011 2012 2013 2014 2015 Net Outflow (Q3: -21) 20 -60 2010 2011 2012 Portfolio Banking and Other Billions of dollars Billions of dollars Net Outflow (Q3: -80) 200 Net Inflow (Q3: 51) 150 Net Inflow (Q3: 2) 2013 Net Outflow (Q3: 58) 300 2014 2015 Net Inflow (Q3: -34) 200 100 100 50 0 0 -50 -100 -100 -200 -150 -200 2010 2011 2012 2013 2014 2015 -300 2010 2011 2012 2013 2014 2015 NOTE: Data are from Financial Account and do not include flows affecting domestic reserves. Source: National Sources February 5, 2015 JAPAN Financial Flows In and Out of Japan (2) Portfolio: Equity Securities Banking Billions of dollars Billions of dollars Net Outflow (Sep: -13) 120 100 80 60 40 20 0 -20 -40 -60 2010 2011 2012 Net Inflow (Sep: 7) 2013 2014 2015 Net Outflow (Sep: -20) 150 120 90 60 30 0 -30 -60 -90 -120 2010 2011 Portfolio: Debt Securities Other Billions of dollars Billions of dollars Net Outflow (Sep: -18) 90 Net Inflow (Sep: -12) 150 30 100 2013 Net Outflow (Sep: 33) 200 60 2012 Net Inflow (Sep: -8) 2014 2015 Net Inflow (Sep: 20) 50 0 0 -30 -50 -60 -100 -90 -150 -120 2010 2011 2012 2013 2014 2015 -200 2010 2011 2012 2013 2014 2015 NOTE: Data are from Financial Account and do not include flows affecting domestic reserves. Source: National Sources February 5, 2015 JAPAN Financial Indicators Short-Term and Long-Term Interest Rates Money Growth 3-Month CD Rate, 10-year Government Bond Rate Percent change over year-ago levels Short (Feb 4: 0.21) 1.8 Long (Feb 4: 0.37) 1.5 M2 + CD (Dec: 3.6) 80 Base (Jan: 37.4) 60 1.2 0.9 40 0.6 20 0.3 0 0.0 -0.3 2010 2011 2012 2013 2014 2015 -20 Monetary Policy 0.12 2010 2011 2012 2013 2014 2015 Stock Market Index Uncollateralized Overnight Call Rate 1600 0.10 Tokyo Stock Exchange Topix Feb 4 1417.0 1400 0.08 Feb 2 0.07 0.06 1200 1000 0.04 800 0.02 0.00 2010 2011 2012 2013 2014 2015 600 2010 2011 2012 2013 2014 2015 Source: National Sources February 5, 2015 JAPAN Exchange Rates 135 Yen per Dollar 160 Yen per Euro 150 125 Jan 30 117.4 115 140 Jan 30 132.6 130 105 120 95 110 85 100 75 65 90 2010 2011 2012 2013 2014 2015 80 Nominal Effective Exchange Rate 140 2010 2011 2012 2013 2014 2015 Real Effective Exchange Rate Narrow Index, 2000=100 110 130 Narrow Index, 2000=100 100 120 90 110 80 100 90 Feb 4 82.3 80 Jan 63.7 60 70 60 70 2010 2011 2012 2013 2014 2015 50 2010 2011 2012 2013 2014 2015 Source: Haver February 5, 2015 EURO AREA Summary Indicators Industrial Production Gross Domestic Product 4 Four-quarter percentage change 106 3 104 2 102 Q3 0.8 1 98 -1 96 2010 2011 2012 2013 2014 2015 94 2010 2011 2012 2013 2014 2015 Consumer Price Index Harmonized Unemployment Rate 13.0 Nov 101.2 100 0 -2 Index, 2000=100 Percent 5 12.5 12-Month Percentage Change 4 12.0 3 Dec 11.4 11.5 2 11.0 1 10.5 0 10.0 -1 9.5 9.0 Jan -0.6 2010 2011 2012 2013 2014 2015 -2 2010 2011 2012 2013 2014 2015 Source: Haver February 5, 2015 EURO AREA Output Indicators GDP Growth 5 4 Industrial Production Annualized Quarterly Percentage Change 6 4 3.6 Annualized Quarterly Percentage Change 3.7 2.6 3 2 1.5 0.7 2 1.3 0 0.7 -1.1 -0.4 2012 -1.5 2014 2015 -10 GDP Growth 4 16 12 2 8 Q3 0.8 1 0 -1 -4 2012 -7.7 2011 2012 2013 2014 2015 2013 2014 Monthly Percent Change Over Year-Ago Level 4 0 2011 -5.3 Industrial Production Quarterly Percent Change Over Year-Ago Level 3 -2 -1.5 -2.6 -2.7 -8 2013 0.1 -0.8 -6 -1.1 -1.8 2011 -2 0.6 -4 -0.4 -2 -3 1.3 0.3 0.1 0.0 -1 1.0 0.9 0.1 0 1 2.3 1.1 2015 -8 Nov -0.3 2011 2012 2013 2014 2015 Source: Haver February 5, 2015 EURO AREA Contribution to Annualized GDP Growth Rate Private Consumption Expenditures 6 Investment and Inventories Percentage points 6 4 Percentage points 4 3.2 2 2 0.8 0.4 -2 -4 -1.2 -0.4 -1.2 2011 -0.4 -0.4 -1.2 2012 2013 2014 2015 -1.6 -1.2 -0.8 -0.8 -0.8 -1.6 -2.0 -4 2011 2012 2013 2014 2015 Government Consumption Expenditures Percentage points 6 4 Percentage points 4 2 1.6 1.6 2.0 2.0 2 1.6 1.2 0.8 0.4 0.8 0.4 0.4 0.4 0 0.0 2011 2012 0.4 0.0 0.4 0.4 -0.4 -1.6 -2 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0 -0.4 -4 -0.4 -1.2 -1.6 -2 Net Exports of Goods and Services 6 0.0 0 -0.4 -1.2 0.8 0.4 0.4 0.4 0.4 0.0 0 1.6 1.2 2013 -2 2014 2015 -4 2011 2012 2013 2014 2015 NOTE: Contributions to growth may include errors due to rounding. Source: Haver February 5, 2015 Euro Area Contribution to Change in GDP (2) Inventories Fixed Investment 6 Percentage points 6 4 2 Percentage points 4 2 1.6 2.0 1.2 0.4 0.4 0.4 0.4 0 0.0 0 -0.4 -0.4 -0.4 -0.4 -0.4 -0.4 -0.4 -0.8 -0.8 -0.8 -0.8 -2 2011 2012 2013 2014 2015 -4 Imports 6 -0.4 -0.4 -0.4 -0.8 -1.2 2011 2012 2013 2014 2015 Exports Percentage points 6 4 Percentage points 4 3.2 2.0 2 0 0.0 0.0 0.0 2.4 2.4 2.0 1.6 1.6 1.2 1.2 1.2 1.2 1.2 0.0 0 0.8 0.4 -0.4 -0.4 -0.8 -2 -2.0 -2.8 -2.0 -2.8 2011 2.8 2 0.8 0.4 -4 0.4 -1.6 -2 -2.0 -4 0.0 0.0 0.4 2012 2013 -1.6 -2 -2.4 2014 2015 -4 2011 2012 2013 2014 2015 NOTE: Contributions to growth may include errors due to rounding. Source: Haver February 5, 2015 EURO AREA Growth Indicators Business Climate Index Consumer Confidence 0 Percentage Balance 2.0 Standard Deviation Points 1.5 -5 Jan -8.5 -10 1.0 0.5 -15 Jan 0.2 0.0 -20 -0.5 -25 -1.0 -30 -35 115 -1.5 2010 2011 2012 2013 2014 2015 -2.0 2011 2012 Economic Sentiment Index Business Confidence Long-Term Average = 100 Percentage Balance 2013 Industry (Jan: -5.0) 30 110 2014 2015 Services (Jan: 4.8) 20 105 Jan 101.2 100 10 95 0 90 -10 85 -20 80 2010 2010 2011 2012 2013 2014 2015 -30 2010 2011 2012 2013 2014 2015 Source: Haver February 5, 2015 EURO AREA Industrial Confidence Indicators Total 15 Order Books Percentage Balance 20 10 10 5 0 0 -10 Jan -5.0 -5 -30 -15 -40 -20 -50 2010 2011 2012 2013 2014 2015 -60 2010 2011 2012 2013 2014 2015 Production Expectations Stocks of Finished Products 16 Jan -14.8 -20 -10 -25 Percentage Balance Percentage Balance 30 12 Percentage Balance 20 8 Jan 6.9 10 Jan 6.8 4 0 0 -10 -4 -8 2010 2011 2012 2013 2014 2015 -20 2010 2011 2012 2013 2014 2015 Source: Haver February 5, 2015 EURO AREA Retail Sales and Turnover Retail Trade excl. Autos 101 Car Registrations Volume, 2010=100 950 Thousands of Units 900 100 Dec 99.2 99 850 800 Dec 775.6 98 750 97 700 96 95 115 650 2010 2011 2012 2013 2014 2015 600 2010 2011 2012 Manufacturing Turnover: Domestic Manufacturing Turnover: Foreign 2005=100 2010=100 135 Intra-Euro Area (Oct: 110.8) 2013 2014 2015 Extra-Euro Area (Oct: 125.2) 110 125 105 Oct 102.1 100 105 95 90 115 95 2010 2011 2012 2013 2014 2015 85 2010 2011 2012 2013 2014 2015 NOTE: Above charts are seasonally adjusted Source: Haver February 5, 2015 EURO AREA Price and Cost Indicators Consumer Prices Producer Prices Percent Change Over Year-Ago Level Percent Change over Year-Ago Level Overall CPI (Jan: -0.6) 5 Core CPI (Jan: 0.6) 10 6 3 4 2 2 1 0 0 -2 -1 -4 2010 2011 2012 2013 2014 2015 -6 Unit Labor Cost (Q3: 1.1) 2010 2011 2012 2013 2014 2015 Import Prices - Manufactured Products Unit Labor Costs and Compensation Percent Change Over Year-Ago Level 4 PPI (Cons.Goods) (Dec: -0.4) 8 4 -2 PPI (Dec: -2.3) Compensation (Q3: 1.3) 15 Percent Change Over Year-Ago Level 10 3 2 5 1 Oct 3.2 0 0 -5 -1 -2 2010 2011 2012 2013 2014 2015 -10 2010 2011 2012 2013 2014 2015 NOTE: Core CPI excludes Energy, Food, Alcohol and Tobacco. Unit Labor Costs and Compensation are Per Employee. Source: Haver, National Sources February 5, 2015 EURO AREA Harmonized Index of Consumer Prices 4 Total HICP Total excluding Energy and Unprocessed Food Percent Change Over Year-Ago Level Percent Change Over Year-Ago Level 4 3 3 2 2 1 1 Jan 0.5 0 -1 0 2010 2011 2012 2013 2014 Jan -0.6 2015 -1 4 4 3 3 2 2 1 1 Dec -0.0 -1 2010 2011 2012 2013 2014 2015 2011 2012 2013 2014 2015 Services Goods excluding Energy, Food, Alcohol and Tobacco Percent Change Over Year-Ago Level 0 2010 Percent Change Over Year-Ago Level Dec 1.2 0 -1 2010 2011 2012 2013 2014 2015 Source: Haver February 5, 2015 EURO AREA Producer Price Index Intermediate Goods Total 10 Percent Change Over Year-Ago Level 10 8 8 6 6 4 4 2 2 0 0 Dec -2.3 -2 -4 2010 2011 2012 2013 2014 2015 -4 2010 2011 2012 2013 2014 2015 Consumer Goods Percent Change Over Year-Ago Level 10 8 8 6 6 4 4 2 Dec 0.8 0 -2 -4 Dec -0.9 -2 Capital Goods 10 Percent Change Over Year-Ago Level Percent Change Over Year-Ago Level 2 Dec -0.4 0 -2 2010 2011 2012 2013 2014 2015 -4 2010 2011 2012 2013 2014 2015 Source: Haver February 5, 2015 EURO AREA Employment and Wages Harmonized Unemployment Rate 13.0 Harmonized Unemployment, Whole Economy Percent 25 12.5 Percent Change Over Year-Ago Level 20 12.0 15 Dec 11.4 11.5 10 11.0 5 10.5 0 10.0 9.0 2010 2011 2012 2013 2014 2015 -10 2010 2011 2012 2013 2014 2015 Index of Total Labor Cost Employment in the Whole Economy 1.5 Dec -3.7 -5 9.5 Percent Change Over Year-Ago Level 4.0 Percent Change Over Year-Ago Level 3.5 1.0 Q3 0.6 0.5 3.0 2.5 0.0 2.0 -0.5 1.5 -1.0 1.0 -1.5 -2.0 Q3 1.3 0.5 2010 2011 2012 2013 2014 2015 0.0 2010 2011 2012 2013 2014 2015 Source: Haver, National Sources February 5, 2015 EURO AREA Trade Indicators Trade and Current Account Balances Total Exports In Billions of Dollars, SAAR Percent Change Over Year-Ago Level TB (Nov: 298.7) 600 CAB (Nov: 270.9) Volumes (Oct: 2.5) 40 Values (Nov: -3.7) 500 30 400 300 20 200 10 100 0 0 -100 -200 2010 2011 2012 2013 2014 2015 -10 2011 2012 2013 Total Imports and Exports Total Imports In Billions of Dollars, SA Percent Change Over Year-Ago Level Exports (Nov: 206.2) 240 Imports (Nov: 181.3) 30 200 20 180 10 160 0 140 -10 120 -20 2010 2011 2012 2013 2014 2015 Volumes (Oct: 1.0) 40 220 100 2010 -30 2010 2011 2012 2014 2015 Values (Nov: -6.4) 2013 2014 2015 Source: Haver February 5, 2015 Gross Operating Surplus and Mixed Income As a percent of nominal GDP 0.42 Euro Area 0.42 Germany 0.41 0.41 0.40 Q2 0.40 0.40 Q2 0.39 0.39 0.39 0.37 2010 2011 2012 2013 2014 2015 France 0.38 0.49 2010 2011 2012 2013 2014 2015 Italy 0.36 0.48 0.35 0.33 0.47 Q2 0.34 0.34 2010 2011 2012 2013 2014 Q2 0.47 2015 0.46 2010 2011 2012 2013 2014 2015 Source: Haver November 24, 2014 EURO AREA Financial Flows In and Out of Euro Area (1) Total Foreign Direct Investment Billions of dollars Billions of dollars Net Outflow (Q3: -222) 600 Net Inflow (Q3: 152) Net Outflow (Q3: -74) 400 Net Inflow (Q3: 38) 300 400 200 200 100 0 0 -100 -200 -200 -400 -600 375 300 225 150 75 0 -75 -150 -225 -300 -375 -300 2010 2011 2012 2013 2014 2015 -400 2010 2011 2012 Portfolio Banking and Other Billions of dollars Billions of dollars Net Outflow (Q3: -150) Net Inflow (Q3: 51) 2013 Net Outflow (Q3: 2) 600 2014 2015 Net Inflow (Q3: 64) 400 200 0 -200 -400 2010 2011 2012 2013 2014 2015 -600 2010 2011 2012 2013 2014 2015 NOTE: Data are from Financial Account and do not include flows affecting domestic reserves. Source: Haver February 5, 2015 EURO AREA Financial Flows In and Out of Euro Area (2) Portfolio: Equity Securities Banking (MFIs excluding Eurosystem) Billions of dollars Billions of dollars Net Outflow (Q3: -36) 300 Net Inflow (Q3: 87) 200 100 100 0 0 -100 -100 -200 -200 2010 2011 2012 2013 2014 2015 -300 2010 2011 Portfolio: Debt Securities Other Billions of dollars Billions of dollars Net Outflow (Q3: -114) 400 Net Inflow (Q3: -36) 150 200 100 2012 Net Inflow (Q3: 63) 2013 Net Outflow (Q3: 17) 200 300 2014 2015 Net Inflow (Q3: 1) 50 100 0 0 -50 -100 -100 -200 -150 -300 Net Outflow (Q3: -15) 200 2010 2011 2012 2013 2014 2015 -200 2010 2011 2012 2013 2014 2015 NOTE: Data are from Financial Account and do not include flows affecting domestic reserves. Source: Haver February 5, 2015 EURO AREA Financial Indicators 5 3-month Euro Market Rate, 10-year German Bond Yield Money and Credit Growth Short-Term and Long-Term Interest Rates Percent Change Over Year-Ago Level Long (Feb 4: 0.34) Short (Feb 4: 0.06) M3 (Dec: 3.4) 6 4 Loans (Dec: -0.5) 4 3 2 2 0 1 -2 0 -1 2010 2011 2012 2013 2014 2015 -4 Monetary Policy 2.1 2011 2012 2013 2014 400 Euro-Stoxx, Overall Feb 4 372.1 370 340 310 280 250 220 1.5 1.2 0.9 0.6 0.3 Jan 0.05 0.0 2010 2011 2015 Stock Market Index ECB Refinancing Rate 1.8 -0.3 2010 2012 2013 2014 2015 190 160 130 100 2010 2011 2012 2013 2014 2015 NOTE: Loans are to euro area residents excluding MFIs and general government. Source: National Sources, Haver February 5, 2015 EURO AREA Exchange Rates Euro-Dollar Exchange Rates Dollars per Euro (Feb 5: 1.14) Euros per Dollar (Feb 5: 0.88) 160 Yen per Euro 150 1.5 140 1.3 130 Feb 5 133.6 120 1.1 110 0.9 100 0.7 0.5 90 2010 2011 2012 2013 2014 2015 80 2011 2012 2013 2014 2015 Real Effective Exchange Rate Nominal Effective Exchange Rate 150 2010 Narrow Index, 2000=100 128 Narrow Index, 2000=100 124 140 120 130 116 120 112 Feb 4 114.4 110 100 108 Jan 105.9 104 2010 2011 2012 2013 2014 2015 100 2010 2011 2012 2013 2014 2015 Source: National Sources February 5, 2015 FRANCE Summary Indicators Gross Domestic Product 4 Industrial Production Four-quarter percentage change 106 Index, 2000=100 104 3 102 2 100 1 Q3 0.4 0 -1 98 Nov 97.1 96 2010 2011 2012 2013 2014 2015 94 2010 2011 2012 2013 2014 2015 Consumer Price Index Harmonized Unemployment Rate Percent 3.5 Dec 10.3 10.3 10.0 12-Month Percentage Change 3.0 2.5 2.0 9.7 1.5 1.0 9.4 0.5 9.1 8.8 Dec 0.1 0.0 2010 2011 2012 2013 2014 2015 -0.5 2010 2011 2012 2013 2014 2015 Source: Haver February 5, 2015 GERMANY Summary Indicators Industrial Production Gross Domestic Product 8 Four-quarter percentage change 116 Index, 2000=100 112 6 Nov 107.8 108 4 104 100 2 Q3 1.2 0 -2 96 92 2010 2011 2012 2013 2014 2015 88 Harmonized Unemployment Rate 8.0 3.5 3.0 7.0 2.5 6.5 2.0 6.0 1.5 5.5 1.0 5.0 Dec 4.8 4.5 2010 2011 2012 2013 2011 2012 2013 2014 2015 Consumer Price Index Percent 7.5 4.0 2010 2014 2015 12-Month Percentage Change 0.5 Dec 0.1 0.0 -0.5 2010 2011 2012 2013 2014 2015 Source: Haver February 5, 2015 ITALY Summary Indicators Industrial Production Gross Domestic Product 4 Four-quarter percentage change 110 Index, 2000=100 3 105 2 1 100 0 Q3 -0.5 -1 -2 95 Nov 90.2 90 -3 -4 2010 2011 2012 2013 2014 2015 85 2011 2012 2013 2014 2015 Consumer Price Index Harmonized Unemployment Rate 16 2010 Percent 5 12-Month Percentage Change 4 14 Dec 12.9 12 3 2 10 1 8 6 Dec -0.1 0 2010 2011 2012 2013 2014 2015 -1 2010 2011 2012 2013 2014 2015 Source: Haver February 5, 2015 UK Summary Indicators Industrial Production Gross Domestic Product 5 Four-quarter percentage change 104 4 102 Q2 3.2 3 100 2 98 1 96 0 94 -1 2010 2011 2012 2013 2014 2015 92 Harmonized Unemployment Rate 9.0 Index, 2000=100 Sep 98.9 2010 2011 2012 2013 2014 2015 Consumer Price Index Percent 6.5 8.5 12-Month Percentage Change 5.5 8.0 4.5 7.5 3.5 7.0 6.5 2.5 Aug 5.9 6.0 5.5 5.0 2010 2011 2012 2013 2014 1.5 2015 0.5 Sep 1.2 2010 2011 2012 2013 2014 2015 Source: Haver November 24, 2014 CANADA Summary Indicators Industrial Production Gross Domestic Product 5 Four-quarter percentage change 16 Percent change over year-ago level 12 4 8 3 Q3 2.6 4 Nov 2.3 2 0 1 0 -4 2010 2011 2012 2013 2014 2015 -8 Unemployment Rate 9.1 5 4 8.1 3 7.6 2 7.1 1 Dec 6.7 6.6 2010 2011 2012 2011 2012 2013 2014 2015 Consumer Price Index Percent 8.6 6.1 2010 2013 2014 2015 12-Month Percentage Change Dec 1.6 0 -1 2010 2011 2012 2013 2014 2015 Source: National Sources February 5, 2015 MEXICO Summary Indicators Industrial Production Gross Domestic Product 10 Four-quarter percentage change 112 8 Index, 1993=100 108 Nov 106.7 6 104 4 Q3 2.1 2 96 0 -2 100 2010 2011 2012 2013 2014 2015 92 Urban Unemployment Rate 6.5 2010 2011 2012 2013 2014 Consumer Price Index Percent 5.5 6.0 12-Month Percentage Change 5.0 5.5 4.5 5.0 Dec 4.1 4.0 4.5 3.5 4.0 Dec 3.8 3.5 3.0 2015 2010 2011 2012 2013 2014 2015 3.0 2.5 2010 2011 2012 2013 2014 2015 Source: National Sources February 5, 2015 U.S. DOLLAR AGAINST FOREIGN CURRENCIES Monthly Average Values 135 Yen per Dollar Euros per Dollar (Feb 2: 0.88) Dollars per Euro (Feb 2: 1.13) 125 Feb 2 117.7 115 1.5 1.3 105 95 1.1 85 0.9 75 0.7 65 0.72 2010 2011 2012 2013 2014 2015 0.5 Pound per Dollar 2010 2011 2012 2013 2014 2015 Canadian Dollar per Dollar 0.70 1.3 0.68 Feb 4 0.66 0.66 Feb 4 1.25 1.2 0.64 1.1 0.62 0.60 1.0 0.58 0.56 2010 2011 2012 2013 2014 2015 0.9 2010 2011 2012 2013 2014 2015 Source: National Sources February 5, 2015 EFFECTIVE EXCHANGE RATES Index, 2000=100 U.S. dollar (real) U.S. dollar (nominal) 95 Major Currencies Index - 7 Currencies 100 90 Feb 4 87.4 85 Major Currencies Index - 16 Currencies Jan 94.5 95 90 80 85 75 80 70 75 65 60 2010 2011 2012 2013 2014 2015 70 Euro area euro (nominal) 132 140 130 124 120 120 110 116 Dec 31 113.5 112 104 70 2012 2013 2014 2015 2013 2014 2015 Major Currencies Index - 26 Currencies 90 80 2011 2012 100 108 2010 2011 Japanese yen (nominal) ECB Narrow Index - 12 Currencies 128 100 2010 60 Jan 29 82.9 2010 2011 2012 2013 2014 2015 Source: Board of Governors, National Sources February 5, 2015 INTERNATIONAL LONG-TERM INTEREST RATES Monthly Average Values, Percent 5 United States 5 4 4 3 3 Feb 4 1.81 2 1 5 2 1 0 -1 Feb 4 0.37 0 2010 2011 2012 2013 2014 2015 Japan -1 5 4 4 3 3 2 2 1 1 Feb 4 0.37 0 -1 Euro Area 2010 2011 2012 2013 2014 2015 2010 2011 2012 2013 2014 2015 Canada Feb 4 1.28 0 -1 2010 2011 2012 2013 2014 2015 NOTE: Yields on government bonds with maturities of ten years or longer. Source: National Sources, Board of Governors February 5, 2015 INTERNATIONAL SHORT-TERM INTEREST RATES Monthly Average Values, Percent 2.5 United States 2.5 2.0 2.0 1.5 1.5 1.0 1.0 0.5 0.5 Jan 0.03 0.0 -0.5 2.5 2010 2011 2012 2013 2014 2015 Japan -0.5 2.0 2.0 1.5 1.5 1.0 1.0 0.5 0.5 Jan -0.06 -0.5 2010 2011 2012 2013 2014 2015 Jan 0.06 0.0 2.5 0.0 Euro Area 2010 2011 2012 2013 2014 2015 Canada Jan 1.12 0.0 -0.5 2010 2011 2012 2013 2014 2015 NOTE: 3-month Treasury Bill Rate; EU - 3-month euribor; JP - 3-month Yen rate; CA - 3-month finance paper rate. Source: National Sources, Board of Governers. February 5, 2015 STOCK MARKET INDICES Monthly Average 2400 United States: SP500 400 2200 Feb 4 2042 2000 1800 1600 1400 1200 1000 800 1600 2010 2011 2012 2013 2014 2015 EU: Euro-Stoxx, Overall 370 340 Feb 3 348 310 280 250 220 190 160 130 100 Japan: Topix 2010 2011 2012 2013 2014 2015 Canada: TSE 300 16500 Feb 4 1417 1400 15500 Feb 4 15007 14500 1200 13500 1000 12500 800 600 11500 2010 2011 2012 2013 2014 2015 10500 2010 2011 2012 2013 2014 2015 NOTE: Dots represent last reported daily close. Source: National Sources February 5, 2015

© Copyright 2026