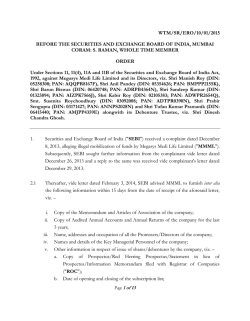

printmgr file - Australian Securities Exchange