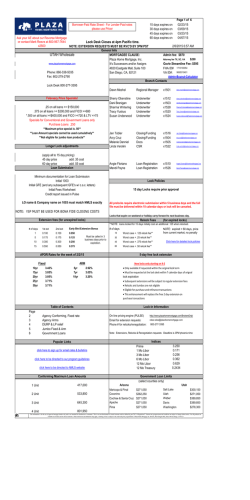

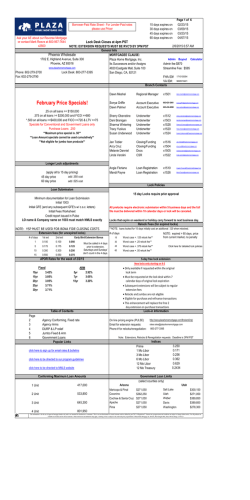

Sac Wholesale Rates - Plaza Home Mortgage

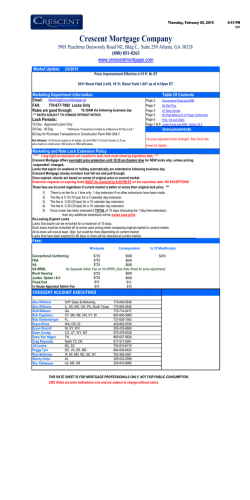

2/5/2015 7:02 AM Page 1 of 8 Sac Wholesale Rates To sign up for daily rate sheets APOR Calculator: http://www.ffiec.gov/ratespread/newcalc.aspx Lock Expiration Dates Regional & Operations Managers Northern Cal Regional Manager Jeanine Thomas Operations Manager: [email protected] Dianne Watters Northern CA Sales Manager Robin Ylitalo 916-705-8751 Northen CA Sales Manager [email protected] Leo Whitton 916-804-4768 [email protected] 15 days expires on 30 days expires on 45 days expires on 60 days expires on CLICK HERE (Allowed if CTC) 02/20/15 03/09/15 03/23/15 04/06/15 Reduced fee* 0.125 0.250 0.375 *Must be requested at least 3 business days prior to expiration [email protected] 5 days 10 days (ALL PTDs must be signed off) 15 days (ALL PTDs must be received) Mortgage Clause 0.175 0.300 0.550 General Info www.PlazaHomeMortgage.com Phone: (916) 353-4800 Toll Free: (888)-512-7863 PLAZA HOME MORTGAGE, INC. ITS SUCCESSORS AND/OR ASSIGNS 4820 EASTGATE MALL, SUITE 100 SAN DIEGO, CA 92121 Lock Desk (800) 277-3395 Lock Desk Closes at 4:00 PM PST Sacramento Fullfillment Center 400 Plaza Drive, #140 Folsom, CA 95630 916-353-4800 (888)512-7863 Toll Free FHA ID#: 1710100206 VA ID#: 9065310000 Lock Policies Fees Underwriting Fee Streamline Refinance Redraw (if applicable) Partial redraw $945 $595 $150 $75 All prelocks require an electronic submission within 5 business days, with the full loan package to be delivered to Plaza within 5 calendar days or the lock will be automatically canceled. If the day falls on a weekend or holiday, it will be canceled on the next business day. Admin-Buyout-Calculator Loan must be clear to close for 15 day locks Indices Prime 1 Mo Libor 3 Mo Libor 6 Mo Libor 12 Mo Libor 12 Mo Treasury APOR Tables : County Sac/Placer/Eldorado Fresno Humbolt Yuba Solano San Luis Obispo Marin Nevada Santa Barbara 3.25000 0.15425 0.23285 0.33150 0.56410 0.1315 http://www.ffiec.gov/ratespread/aportables.htm FHA High Balance 1 Unit 2 Unit 3 Unit 4 Unit $474,950 $608,000 $734,950 $913,350 $417,000 $533,850 $645,300 $801,950 $417,000 $533,850 $645,300 $801,950 $417,000 $533,850 $645,300 $801,950 $417,000 $533,850 $645,300 $801,950 $561,200 $718,450 $868,400 $1,079,250 $625,500 $800,775 $967,950 $1,202,925 $477,250 $610,950 $738,500 $917,800 $625,500 $800,775 $967,950 $1,202,925 Link to Additional County Limits FHA Standard Loan Amounts 1 Unit 2 Unit 3 Unit 4 Unit 417,000 533,850 645,300 801,950 Click here for detailed lock policies 5 Day Free Lock Extention · Only available if requested within the original lock term · Must be requested at the lock desk within 7 calendar days of orignal lock expiration · Subsequent extensions will be subject to regular extension fees · Relocks and Jumbos are not eligible · Eligible for purchase and refinance transactions No admin feee on VA Loans! * 100% financing allowed to county limit (Jumbo pricing and guides apply to loans over $417,000) * No minimum reserves required on conforming loans * Ficos to 620 on purchase and refi for conforming limits * Manual u/w with compensating factors on conforming with back end up to 50% * VA IRRRL no Appraisal Required * VA Cash out refi structured as r/t to 100% ltv (<=500 cash out to borr.) loan amounts up to $1,094,625 VAJUMBO30 * Back end ratio per DU/LP conforming & Jumbo loans to 60% DTI * Remaining entitlement allowed * BK, Foreclosure and short sale seasoning 2 years for conforming loan limits VA High Balance Link to all state Jumbo County Loan Limits: Conforming Maximum Loan Amounts 2 Unit 3 Unit 4 Unit http://go.usa.gov/Z4rP Plaza Does Reverse Mortgages Use a Reverse Mortgage as a Financial Tool 533,850 645,300 801,950 Link to Loan Limits Programs Did you know that about 50%1 of baby boomers have no retirement savings? There is hope, though, since about 80%1 of baby boomers have substantial equity in their homes. With a reverse mortgage, seniors can leverage the equity in their homes to pay off an existing mortgage while keeping the rest of the funds in a line of credit that actually grows in value. Page Conforming Fixed Rates & High Balance 2 Home Path, Home Possible, My Community 3 Conforming ARMS 4 HARP Refi Plus & LP Relif 5 FHA, FHA HB, FHA 203k, FHA EEM, USDA 6 The credit line growth rate feature allows funds on the credit line to grow at the same rate VA, VA High Balance, IRRRLS, VA EEM 7 as the interest being charged regardless of the homeowner’s equity position. Elite Jumbo 8 Ask your Plaza AE about our non branded marketing material for this program 1. A Profile of Housing and Health Among Older Americans. Research Institute for Housing America November 2013. Community Enrichment Program Plaza now offers a Community Enrichment Program for O/O purchases. The program allows the borrower to receive enhanced pricing on conventional, VA, USDA, & VA products. Contact your AE Today for more details!! This information is for the use of approved mortgage lenders only and is not intended for distribution to consumers. This is not an advertisement to extend customer credit as defined by part 226.2 of Regulation Z. Interest rate, program terms and conditions are subject to change without notice. Not all products are available in all states and for all loan amounts. Other restrictions and limitations may apply. Granting of loan is subject to the credit and policy requirements of Plaza Home Mortgage, Inc. 2/5/2015 7:02 AM Page 2 of 8 Conforming Agency Fixed Rates 30 Yr Fixed CF300 Rate 4.125 4.000 3.875 3.750 3.625 3.500 3.375 3.250 15 Day (3.980) (3.437) (3.027) (2.329) (1.599) (0.542) 0.274 0.959 Rate 4.125 4.000 3.875 3.750 3.625 3.500 3.375 3.250 15 Day (3.980) (3.437) (2.865) (2.310) (1.474) (0.542) 0.274 0.959 30 Day (3.805) (3.262) (2.852) (2.154) (1.424) (0.367) 0.449 1.134 20 Yr Fixed CF200 - DU or LP 45 Day (3.630) (3.087) (2.677) (1.979) (1.249) (0.192) 0.624 1.309 60 Day (3.455) (2.912) (2.502) (1.804) (1.074) (0.017) 0.799 1.484 Rate 4.125 4.000 3.875 3.750 3.625 3.500 3.375 3.250 15 Day (3.851) (3.438) (3.106) (2.602) (1.898) (1.118) (0.320) 0.482 60 Day (3.455) (2.912) (2.340) (1.785) (0.949) (0.017) 0.799 1.484 Rate 3.750 3.625 3.500 3.375 3.250 3.125 3.000 2.875 15 Day (4.444) (4.254) (3.921) (3.428) (2.996) (2.601) (2.039) (1.281) 30 Yr Fixed Retained RCF30 - DU Only 30 Day (3.805) (3.262) (2.690) (2.135) (1.299) (0.367) 0.449 1.134 30 Day (3.676) (3.263) (2.931) (2.427) (1.723) (0.943) (0.145) 0.657 10 Yr Fixed CF100 - DU or LP 15 Day (4.444) (4.254) (3.921) (3.428) (2.996) (2.601) (2.039) (1.281) 30 Day (4.269) (4.079) (3.746) (3.253) (2.821) (2.426) (1.864) (1.106) 60 Day (3.919) (3.729) (3.396) (2.903) (2.471) (2.076) (1.514) (0.756) Rate 4.375 4.250 4.125 4.000 3.875 3.750 3.625 15 Yr Fixed Retained RCF15 - DU Only 45 Day (3.630) (3.087) (2.515) (1.960) (1.124) (0.192) 0.624 1.309 30 Day (4.269) (4.079) (3.746) (3.253) (2.821) (2.426) (1.864) (1.106) 30 Yr Fixed HIGH BALANCE CF300HB - DU Only Rate 4.250 4.125 4.000 3.875 3.750 3.625 3.500 3.375 15 Yr Fixed CF150- DU or LP Rate 3.750 3.625 3.500 3.375 3.250 3.125 3.000 2.875 15 Day (3.522) (2.855) (2.312) (1.902) (1.204) (0.474) 0.583 1.399 30 Day (3.347) (2.680) (2.137) (1.727) (1.029) (0.299) 0.758 1.574 45 Day (3.172) (2.505) (1.962) (1.552) (0.854) (0.124) 0.933 1.749 Rate 3.250 3.125 3.000 2.875 2.750 2.625 2.500 15 Day (2.810) (2.387) (1.908) (1.329) (0.752) (0.169) 0.665 30 Day (2.635) (2.212) (1.733) (1.154) (0.577) 0.006 0.840 30 Yr Fixed Retained HB RCF300HB - DU Only 45 Day (4.094) (3.904) (3.571) (3.078) (2.646) (2.251) (1.689) (0.931) 15 Day (2.798) (2.470) (2.046) (1.612) (1.150) (0.704) 0.154 30 Day (2.623) (2.295) (1.871) (1.437) (0.975) (0.529) 0.329 45 Day (2.448) (2.120) (1.696) (1.262) (0.800) (0.354) 0.504 15 Yr Fixed HIGH BALANCE CF150HB - DU Only Rate 4.000 3.875 3.750 3.625 3.500 3.375 3.250 3.125 15 Day (4.170) (3.979) (3.819) (3.629) (3.296) (2.803) (2.371) (1.976) 30 Day (3.995) (3.804) (3.644) (3.454) (3.121) (2.628) (2.196) (1.801) 45 Day (3.820) (3.629) (3.469) (3.279) (2.946) (2.453) (2.021) (1.626) Freddie Programs 30 Yr Fixed Super Conforming CF300SC - LP Only Rate 4.500 4.375 4.250 4.125 4.000 3.875 15 Day (3.751) (4.027) (3.522) (2.767) (1.986) (1.777) 30 Day (3.576) (3.852) (3.347) (2.592) (1.811) (1.602) 15 Yr Fixed Super Conforming CF150SC -LP Only Rate 4.250 4.125 4.000 3.875 3.750 15 Day (4.266) (3.854) (3.387) (3.572) (3.163) 30 Day (4.091) (3.679) (3.212) (3.397) (2.988) 30 Yr Fixed Retained RCF30 - Freddie Rate 4.375 4.250 4.125 4.000 3.875 3.750 3.625 3.500 15 Day (5.109) (4.642) (4.095) (3.361) (2.800) (2.271) (1.633) (0.786) 15 Yr Fixed Retained RCF15 - Freddie 30 Day (4.934) (4.467) (3.920) (3.186) (2.625) (2.096) (1.458) (0.611) Rate 3.750 3.625 3.500 3.375 3.250 3.125 3.000 2.875 15 Day (4.788) (4.373) (3.912) (3.307) (2.962) (2.548) (2.057) (1.371) 30 Day (4.613) (4.198) (3.737) (3.132) (2.787) (2.373) (1.882) (1.196) Conventional Conforming Adjustments 2 units 3-4 units Condo LTV > 75% & Loan Term >15yrs; (Excludes Detached Condo w/ DU) Investment LTV <= 75% Property: LTV > 75% - 80% LTV > 80% - 85% 1.000 1.000 0.750 1.750 3.000 3.750 Loan Amounts Loan Amount <$140k Loan Amount <$100k Loan Amount <$75k 0.125 0.250 0.500 Community Enrichment O/O only (0.500) LTV 95.01 - 97 0.500 Subordinate Financing 0.500 0.250 0.750 LTV >65<=75, CLTV/HCLTV >80<=95, FICO >=720 0.500 LTV >75<=95, CLTV/HCLTV >90<=95, FICO <720 1.000 LTV >75<=95, CLTV/HCLTV >90<=95, FICO >=720 0.750 LTV >75<=90, CLTV/HCLTV >76<=90, FICO <720 1.000 LTV >75<=90, CLTV/HCLTV >76<=90, FICO >=720 0.750 LTV <=95, CLTV/HCLTV >95<=97 1.500 MANUFACTURED HOMES are not allowed. Risk-Based Adjustments Credit Score 620 640 660 680 700 720 No FICO or <620 639 659 679 699 719 739 LTV% <= 60 N/A 0.500 0.500 0.000 0.000 (0.250) (0.250) 60.01 - 70 N/A 1.500 1.250 1.000 0.500 0.500 0.000 70.01 - 75 N/A 3.000 2.500 2.000 1.250 0.750 0.250 75.01 - 80 N/A 3.000 3.000 2.500 1.750 1.000 0.500 80.01 - 85 N/A 3.250 3.250 2.750 1.500 1.000 0.500 85.01 - 90 N/A 3.250 2.750 2.250 1.250 1.000 0.500 90.01 - 95 N/A 3.250 2.750 2.250 1.250 1.000 0.500 95.01 - 97 N/A 3.250 2.750 2.250 1.250 1.000 0.500 97.01 - 100 N/A N/A N/A N/A N/A N/A N/A LTV<=65, CLTV/HCLTV >80<=95, FICO <720 LTV<=65, CLTV/HCLTV >80<=95, FICO >=720 LTV >65<=75, CLTV/HCLTV >80<=95, FICO <720 Freddie Super Conforming Adds Super Conforming ARM - Purch, R/T >75% LTV/CLTV High Balance / Super Conforming Cash-Out 0.750 1.000 Agency State Adjustments >= 740 (0.250) 0.000 0.000 0.250 0.250 0.250 0.250 0.250 N/A Risk-Based Adjustments do not apply to loans with ammortization terms <=180 months, if both LTV <= 95.00 & FICO >= 620. Use the above matrix for all programs excluding My Community and Home Possible programs. Cash Out Credit Score 620 640 660 680 700 720 No FICO or <620 639 659 679 699 719 739 >= 740 LTV% <= 60 N/A 0.250 0.250 0.250 0.000 0.000 0.000 0.000 60.01 - 75 N/A 1.250 1.250 0.750 0.750 0.625 0.625 0.250 75.01 - 80 N/A 2.750 2.250 1.500 1.375 0.750 0.750 0.500 80.01 - 85 N/A 3.000 3.000 2.500 2.500 1.500 1.500 0.625 LTV > 85 N/A N/A N/A N/A N/A N/A N/A N/A Lender Paid Mortgage Insurance (LPMI) Options Lender-Paid MI 25yr & 30yr (CF300MIR, CF250MIR, CF30HBMIR, CF300SCMI and all ARMs) MI Coverage 760 740-759 720-739 680-719 660-679 640-659 620-639 LTV 35 2.8 3.08 3.08 3.85 6.84 7.09 7.38 95.01 - 97 30 1.6 1.9 2.23 3.29 4.93 5.12 5.79 90.01 - 95 25 1.1 1.33 1.6 2.17 3.28 3.53 4.08 85.01 - 90 12 0.7 0.87 1.12 1.33 1.54 1.73 1.97 80.01 - 85 Lender-Paid MI 15yr & 20yr (CF200MIR, CF150MIR, CF150SCMI) MI Coverage 760 740-759 720-739 680-719 660-679 640-659 620-639 LTV 35 2.62 2.9 2.9 3.57 6.45 6.7 6.99 95.01 - 97 25 1.25 1.46 1.88 2.66 3.79 3.96 4.52 90.01 - 95 12 0.87 0.91 1.19 1.26 1.42 1.54 1.81 85.01 - 90 6 0.55 0.6 0.87 0.91 1.09 1.13 1.17 80.01 - 85 AL AR AZ CA CO DE FL GA ID MN MO MT NM NV OK OR SC TN 0.000 (0.125) 0.000 0.000 0.000 0.000 (0.250) (0.125) 0.000 (0.125) (0.125) 0.000 0.000 0.000 (0.125) (0.125) 0.000 (0.125) Lender Paid MI Adjustments FICO 740+ 0.00 0.50 0.25 1.19 0.40 (0.18) 680-719 Rate-and-Term Refinance 0.53 Cash Out 1.00 Second Home 0.70 Investment Property 1.75 Loan Amounts > $417,000 1.40 Loan Term = 25yr (0.28) Note: Minimum single rate is .54 Rate-and-Term Refinance Cash Out Second Home Investment Property Loan Amounts > $417,000 Loan Term = 25yr 720-739 0.00 0.70 0.49 1.33 0.88 (0.18) 620-679 1.05 1.30 1.23 0.00 2.10 (0.39) This information is for the use of approved mortgage lenders only and is not intended for distribution to consumers. This is not an advertisement to extend customer credit as defined by part 226.2 of Regulation Z. Interest rate, program terms and conditions are subject to change without notice. Not all products are available in all states and for all loan amounts. Other restrictions and limitations may apply. Granting of loan is subject to the credit and policy requirements of Plaza Home Mortgage, Inc. 2/5/2015 7:02 AM Page 3 of 8 Home Possible CF30HP (Home Possible 30yr Fixed) Rate 15 Day 30 Day 45 Day 4.625 (4.802) (4.627) (4.452) 4.500 (4.126) (3.951) (3.776) 4.375 (4.109) (3.934) (3.759) 4.250 (3.642) (3.467) (3.292) 4.125 (3.095) (2.920) (2.745) 4.000 (2.361) (2.186) (2.011) 3.875 (1.800) (1.625) (1.450) 3.750 (1.271) (1.096) (0.921) 3.625 (0.633) (0.458) (0.283) 3.500 0.214 0.389 0.564 CA51HP (Home Possible 5/1 ARM) Rate 15 Day 30 Day 45 Day 4.500 (4.567) (4.392) (4.217) 4.375 (4.317) (4.142) (3.967) 4.250 (4.050) (3.875) (3.700) 4.125 (3.784) (3.609) (3.434) 4.000 (3.581) (3.406) (3.231) 3.875 (3.362) (3.187) (3.012) 3.750 (3.055) (2.880) (2.705) 3.625 (2.757) (2.582) (2.407) 3.500 (2.377) (2.202) (2.027) 3.375 (1.995) (1.820) (1.645) 5/1 ARM Refinance 3-4 units LTV>90 Loan Amounts Loan Amount <$140k Loan Amount <$100k Loan Amount <$75k 0.250 0.750 1.000 0.125 0.250 0.500 (0.500) Community Enrichment (O/O Only) My Community Rate 4.375 4.250 4.125 4.000 3.875 3.750 3.625 CF300MC (My Community) 15 Day 30 Day (5.152) (4.977) (4.647) (4.472) (3.980) (3.805) (3.437) (3.262) (3.027) (2.852) (2.329) (2.154) (1.599) (1.424) 45 Day (4.802) (4.297) (3.630) (3.087) (2.677) (1.979) (1.249) MyCommunityMortgage and Home Possible Lender-Paid MI LTV 95.01 - 97 90.01 - 95 FANNIE MAE LLPA add MI Coverage FICO >= 760 18 16 2.07 1.30 740-759 720-739 680-719 660-679 640-659 620-639 2.07 1.43 2.07 1.79 2.70 2.52 3.75 2.84 3.88 2.95 4.04 3.32 0.750 (including loan amount hits) Subordinate Financing Subordinate Financing with non-Community Second 0.500 Loan Amounts Loan Amount <$140k Loan Amount <$100k Loan Amount <$75k 0.125 0.250 0.500 Community Enrichment (O/O conforming only) (0.500) Plaza My Community Guidelines Manufactured Home are not Allowed Fannie Mae My Community Matrix This information is for the use of approved mortgage lenders only and is not intended for distribution to consumers. This is not an advertisement to extend customer credit as defined by part 226.2 of Regulation Z. Interest rate, program terms and conditions are subject to change without notice. Not all products are available in all states and for all loan amounts. Other restrictions and limitations may apply. Granting of loan is subject to the credit and policy requirements of Plaza Home Mortgage, Inc. 2/5/2015 7:02 AM Page 4 of 8 Conventional Arm Rates and Adjustments 5/1 Conforming ARM CA512L - DU/LP Rate 3.750 3.625 3.500 3.375 3.250 3.125 3.000 2.875 2.750 15 Day (4.055) (3.757) (3.377) (2.995) (2.561) (2.125) (1.681) (1.121) (0.085) MARGIN 2.25 Conforming 7/1 ARM CA712L - DU/LP 30 Day (3.880) (3.582) (3.202) (2.820) (2.386) (1.950) (1.506) (0.946) 0.090 Rate 3.750 3.625 3.500 3.375 3.250 3.125 3.000 2.875 2.750 5/1 Super Conforming ARM CA51LSC - LP Only Rate 4.000 3.875 3.750 3.625 3.500 3.375 3.250 3.125 3.000 15 Day (3.831) (3.612) (3.305) (3.007) (2.627) (2.245) (1.811) (1.375) (0.931) MARGIN 2.25 15 Day (3.831) (3.612) (3.305) (3.007) (2.627) (2.245) (1.811) (1.375) (0.931) (0.371) MARGIN 2.25 Conforming 10/1 ARM CA1012L - DU/LP 30 Day (3.769) (3.392) (2.911) (2.428) (1.924) (1.429) (0.900) (0.268) (0.032) Rate 4.500 4.375 4.250 4.125 4.000 3.875 3.750 3.625 3.500 7/1 Super Conforming ARM CA71LSC - LP Only 30 Day (3.656) (3.437) (3.130) (2.832) (2.452) (2.070) (1.636) (1.200) (0.756) Rate 4.125 4.000 3.875 3.750 3.625 3.500 3.375 3.250 3.125 5/1 Conforming HB ARM CA51LHB - DU Only Rate 4.000 3.875 3.750 3.625 3.500 3.375 3.250 3.125 3.000 2.875 15 Day (3.944) (3.567) (3.086) (2.603) (2.099) (1.604) (1.075) (0.443) (0.207) MARGIN 2.25 15 Day (4.074) (3.814) (3.549) (3.194) (2.817) (2.336) (1.853) (1.349) (0.854) MARGIN 2.25 Rate 4.125 4.000 3.875 3.750 3.625 3.500 3.375 3.250 3.125 3.000 15 Day (4.074) (3.814) (3.549) (3.194) (2.817) (2.336) (1.853) (1.349) (0.854) (0.325) MARGIN 2.25 30 Day (4.979) (4.778) (4.617) (4.317) (3.812) (3.280) (2.727) (2.080) (1.332) 10/1 Super Conforming ARM CA101LSC - LP Only 30 Day (3.899) (3.639) (3.374) (3.019) (2.642) (2.161) (1.678) (1.174) (0.679) Rate 4.625 4.500 4.375 4.250 4.125 4.000 3.875 3.750 3.625 7/1 Conforming HB ARM CA71LHB - DU Only 30 Day (3.656) (3.437) (3.130) (2.832) (2.452) (2.070) (1.636) (1.200) (0.756) (0.196) 15 Day (5.154) (4.953) (4.792) (4.492) (3.987) (3.455) (2.902) (2.255) (1.507) MARGIN 2.25 15 Day (4.510) (4.279) (4.078) (3.917) (3.617) (3.112) (2.580) (2.027) (1.380) MARGIN 2.25 30 Day (4.335) (4.104) (3.903) (3.742) (3.442) (2.937) (2.405) (1.852) (1.205) 10/1 Conforming HB ARM CA101LHB - DU Only 30 Day (3.899) (3.639) (3.374) (3.019) (2.642) (2.161) (1.678) (1.174) (0.679) (0.150) Rate 4.625 4.500 4.375 4.250 4.125 4.000 3.875 3.750 3.625 3.500 15 Day (4.510) (4.279) (4.078) (3.917) (3.617) (3.112) (2.580) (2.027) (1.380) (0.632) MARGIN 2.25 30 Day (4.335) (4.104) (3.903) (3.742) (3.442) (2.937) (2.405) (1.852) (1.205) (0.457) Conventional Conforming Adjustments Agency State Adjustments 2 units 3-4 units Condo LTV > 75% & Loan Term >15yrs; (Excludes Detached Condo w/ DU) Investment LTV <= 75% Property: LTV > 75% - 80% LTV > 80% - 90% 1.000 1.000 0.750 1.750 3.000 3.750 Subordinate Financing 0.500 0.250 0.750 0.500 1.000 0.750 1.000 0.750 1.500 LTV<=65, CLTV/HCLTV >80<=95, FICO <720 LTV<=65, CLTV/HCLTV >80<=95, FICO >=720 LTV >65<=75, CLTV/HCLTV >80<=95, FICO <720 LTV >65<=75, CLTV/HCLTV >80<=95, FICO >=720 LTV >75<=95, CLTV/HCLTV >90<=95, FICO <720 LTV >75<=95, CLTV/HCLTV >90<=95, FICO >=720 LTV >75<=90, CLTV/HCLTV >76<=90, FICO <720 LTV >75<=90, CLTV/HCLTV >76<=90, FICO >=720 LTV <=95, CLTV/HCLTV >95<=97 My Community My Community 97 2.000 Loan Amounts Loan Amount <$140k Loan Amount <$100k Loan Amount <$75k 0.125 0.250 0.500 HB / SC Cash-Out 1.000 LTV >95<=97 0.500 SC ARMs - Purch, R/T >75% LTV/CLTV 0.750 0.000 (0.125) State adj. (AZ, CA, UT) State adj. (MI, MN) LTV% <= 60 60.01 - 70 70.01 - 75 75.01 - 80 80.01 - 85 85.01 - 90 90.01 - 95 95.01 - 97 97.01 - 100 620 639 0.500 1.500 3.000 3.000 3.250 3.250 3.250 3.250 N/A 640 659 0.500 1.250 2.500 3.000 3.250 2.750 2.750 2.750 N/A 660 679 0.000 1.000 2.000 2.500 2.750 2.250 2.250 2.250 N/A 0.000 (0.125) 0.000 0.000 0.000 0.000 (0.250) (0.125) 0.000 (0.125) (0.125) 0.000 0.000 0.000 (0.125) (0.125) 0.000 (0.125) Community Enrichment (O/O Only) MANUFACTURED HOMES are not allowed. Risk-Based Adjustments Credit Score No FICO or <620 N/A N/A N/A N/A N/A N/A N/A N/A N/A AL AR AZ CA CO DE FL GA ID MN MO MT NM NV OK OR SC TN Lender-Paid Mortgage Insurance Nonfixed Rate 680 699 0.000 0.500 1.250 1.750 1.500 1.250 1.250 1.250 N/A 700 719 (0.250) 0.500 0.750 1.000 1.000 1.000 1.000 1.000 N/A 720 739 (0.250) 0.000 0.250 0.500 0.500 0.500 0.500 0.500 N/A 680 699 0.000 0.750 1.375 2.500 N/A 700 719 0.000 0.625 0.750 1.500 N/A 720 739 0.000 0.625 0.750 1.500 N/A CA512LMIR, CA712LMIR, CA1012LMIR LPMI through Essent, Genworth, MGIC and Radian >= 740 (0.250) 0.000 0.000 0.250 0.250 0.250 0.250 0.250 N/A LTV/MI % 90.01-95 35% 85.01-90 30% 85 &under 25% R/T 2nd Home FICO 740+ FICO 720-739 FICO 680-719 FICO <680 2.15 1.37 0.99 0.00 0.25 2.35 1.72 1.12 0.00 0.49 3.29 2.17 1.33 0.53 0.70 4.20 2.66 1.54 1.05 1.23 Split MI - ( Radian only- CA512LSMIR, CA&12LSMIR & CA1012LSMIR) - Upfront 1 point charge separate from pricing through secondary. Use the above matrix for all programs excluding My Community and Home Possible programs. Caps Cash Out Credit Score LTV% <= 60 60.01 - 75 75.01 - 80 80.01 - 85 LTV > 85 No FICO or <620 N/A N/A N/A N/A N/A 620 639 0.250 1.250 2.750 3.000 N/A 640 659 0.250 1.250 2.250 3.000 N/A 660 679 0.250 0.750 1.500 2.500 N/A >= 740 0.000 0.250 0.500 0.625 N/A 3/1 5/1 7/1 10/1 2/2/6 2/2/5 5/2/5 5/2/5 This information is for the use of approved mortgage lenders only and is not intended for distribution to consumers. This is not an advertisement to extend customer credit as defined by part 226.2 of Regulation Z. Interest rate, program terms and conditions are subject to change without notice. Not all products are available in all states and for all loan amounts. Other restrictions and limitations may apply. Granting of loan is subject to the credit and policy requirements of Plaza Home Mortgage, Inc. 2/5/2015 7:02 AM Page 5 of 8 HARP Programs FNMA DU Refi Plus- Click HERE for Guides 15 Year Fixed<105% 30yr Fixed High Balance<105% RCF150DURP RCF30DURPH Rate 15 Day 30 Day 45 Day Rate 15 Day 30 Day 4.000 (4.795) (4.620) (4.445) 4.750 (4.468) (4.293) 3.875 (4.604) (4.429) (4.254) 4.625 (4.087) (3.912) 3.750 (4.444) (4.269) (4.094) 4.500 (3.743) (3.568) 3.625 (4.254) (4.079) (3.904) 4.375 (3.364) (3.189) 3.500 (3.921) (3.746) (3.571) 4.250 (2.989) (2.814) 3.375 (3.428) (3.253) (3.078) 4.125 (2.480) (2.305) 3.250 (2.996) (2.821) (2.646) 4.000 (1.937) (1.762) 3.125 (2.601) (2.426) (2.251) 3.875 (1.365) (1.190) 3.000 (2.039) (1.864) (1.689) 3.750 (0.810) (0.635) 2.875 (1.281) (1.106) (0.931) 3.625 0.026 0.201 2.750 (0.650) (0.475) (0.300) 3.500 0.958 1.133 20 Year Fixed 15 Year Fixed RCF20DURPX (LTV >105) RCF15DURPX (LTV >105) Rate 45 Days Rate 15 Day 30 Day Rate 15 Day 30 Day 45 Day 4.625 (4.953) 4.625 (5.303) (5.128) 4.250 (3.139) (2.964) (2.789) 4.500 (4.343) 4.500 (4.693) (4.518) 4.125 (3.113) (2.938) (2.763) 4.375 (3.698) 4.375 (4.048) (3.873) 4.000 (3.000) (2.825) (2.650) 4.250 (3.057) 4.250 (3.407) (3.232) 3.875 (2.778) (2.603) (2.428) 4.125 (2.274) 4.125 (2.624) (2.449) 3.750 (2.587) (2.412) (2.237) 4.000 (1.449) 4.000 (1.799) (1.624) 3.625 (2.365) (2.190) (2.015) 3.875 (0.597) 3.875 (0.947) (0.772) 3.500 (1.966) (1.791) (1.616) 3.750 0.240 3.750 (0.110) 0.065 3.375 (1.364) (1.189) (1.014) 3.625 1.367 3.625 1.017 1.192 3.250 (0.823) (0.648) (0.473) 3.500 2.596 3.500 2.246 2.421 3.125 (0.319) (0.144) 0.031 3.375 3.708 3.375 3.358 3.533 3.000 0.476 0.651 0.826 Adjustments All adjustments apply to all conventional programs and are cumulative unless otherwise stated. Loan Amounts Loan Amount <$140k 0.125 2 units 1.000 Loan Amount <$100k 0.250 3-4 units 1.500 Loan Amount <$75k 0.500 Condo LTV > 75% & Loan Term >15yrs; (Excludes Detached Condo w/ DU) 0.750 Subordinate Financing 0.375 CLTV/HCLTV >95, FICO >=720 1.500 DURP w/ MI CLTV/HCLTV >95, FICO <720 1.500 1.750 CLTV/HCLTV >90<=95, FICO >=720 0.250 Investment LTV <= 75% LTV > 75% 80% 1.750 CLTV/HCLTV >90<=95, FICO <720 0.500 Property: LTV > 80% 1.750 CLTV/HCLTV >75<=90, FICO >=720 0.000 CLTV/HCLTV >75<=90, FICO <720 0.250 Rate 4.375 4.250 4.125 4.000 3.875 3.750 3.625 3.500 3.375 3.250 3.125 30 Year Fixed<105% RCF300DURP 15 Day 30 Day (4.864) (4.689) (4.489) (4.314) (3.980) (3.805) (3.437) (3.262) (2.865) (2.690) (2.310) (2.135) (1.474) (1.299) (0.542) (0.367) 0.274 0.449 0.959 1.134 2.059 2.234 30yr Fixed RCF30DURPX (LTV > 105) 15 Day 30 Day (5.303) (5.128) (4.693) (4.518) (4.048) (3.873) (3.407) (3.232) (2.624) (2.449) (1.799) (1.624) (0.947) (0.772) (0.110) 0.065 1.017 1.192 2.246 2.421 3.358 3.533 45 Day (4.514) (4.139) (3.630) (3.087) (2.515) (1.960) (1.124) (0.192) 0.624 1.309 2.409 20 Year Fixed<105% RCF20DURP 15 Day 30 Day (5.285) (4.994) (4.956) (4.501) (4.593) (4.071) (4.233) (3.680) (3.834) (3.144) (3.438) (2.383) (2.989) (1.617) (2.532) (0.852) (1.898) 0.355 (1.118) 2.119 Rate 4.625 4.500 4.375 4.250 4.125 4.000 3.875 3.750 3.625 3.500 *All state adjustments apply to this program. See state adjustments on page 2 under Conventional Conforming Adjustments. Risk-Based Adjustments LTV% 105.01-125 < 620 N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A Rate 5.250 5.125 5.000 4.875 4.750 4.625 4.500 4.375 4.250 30 Year Fixed CF300LPRR 15 Day (7.535) (7.097) (6.490) (6.759) (6.311) (5.802) (5.126) (5.109) (4.642) <= 60 60.01-70 70.01-75 75.01-80 80.01-85 85.01-90 90.01-95 95.01-97 97.01-105 620 639 0.750 1.500 1.750 1.750 1.750 1.750 1.750 1.750 3.500 3.500 640 659 0.500 1.250 1.750 1.750 1.750 1.750 1.750 1.750 2.500 2.500 Credit Score 660 679 0.000 1.000 1.500 1.750 1.750 1.750 1.750 1.750 2.000 2.000 680 699 0.000 0.500 0.750 0.750 0.750 0.750 0.750 1.250 1.750 1.750 700 719 (0.250) 0.500 0.500 0.500 0.500 0.500 0.500 1.000 1.500 1.500 720 739 (0.250) 0.000 0.000 0.000 0.000 0.000 0.000 0.500 1.000 1.000 >= 740 (0.250) 0.000 0.000 0.000 0.000 0.000 0.000 0.500 1.000 1.000 Maximum Cumulative Adjustments (excludes lock term, loan amts, MI transfer & state adj) LTV >80, Owner Occupied, Loan Term <=20yrs 0.000 LTV >80, Owner Occupied, Loan Term >20yrs 0.750 2nd Home or N/O/O 1.750 1.750 LTV <=80% Risk-Based Adjustments do not apply to loans with amortization terms <=180 months. CONFORMING FIXED RATES - LP Relief Refinance 30 Day (7.360) (6.922) (6.315) (6.584) (6.136) (5.627) (4.951) (4.934) (4.467) Closing costs, financing costs (including discount costs) and prepaids/escrows, are limited to the lesser of 4% of the current unpaid balance of the mortgage being refinanced or $5,000. Rate 4.250 4.125 4.000 3.875 3.750 3.625 3.500 3.375 3.250 15 Year Fixed CF150LPRR 15 Day (5.891) (5.479) (5.012) (5.197) (4.788) (4.373) (3.912) (3.307) (2.962) 30 Day (5.716) (5.304) (4.837) (5.022) (4.613) (4.198) (3.737) (3.132) (2.787) 30yr Fixed High Balance CF300LPRRH 15 Day 30 Day (6.035) (5.860) (5.597) (5.422) (4.990) (4.815) (5.259) (5.084) (4.811) (4.636) (4.302) (4.127) (3.626) (3.451) (3.609) (3.434) (3.142) (2.967) Rate 5.250 5.125 5.000 4.875 4.750 4.625 4.500 4.375 4.250 30yr Fixed >105 LTV RCF30LPRRX 15 Day 30 Day (1.300) (1.125) (0.771) (0.596) (0.133) 0.042 0.714 0.889 1.626 1.801 2.486 2.661 Rate 3.875 3.750 3.625 3.500 3.375 3.250 All adjustments apply to all conventional programs and are cumulative unless otherwise stated. Loan Amounts Loan Amount <$140k Loan Amount <$100k Loan Amount <$75k 0.125 0.250 0.500 Condo LTV > 75% & Term >15yrs 2 units 3-4 units <=80 LTV 3-4 units >80<=85 LTV 3-4 units >85 LTV Investment Property LTV >95<=97 LTV >97<=105 LTV >105 0.750 1.000 1.000 1.500 2.000 1.750 0.500 1.000 2.000 Subordinate Financing CLTV/HCLTV >95, FICO >=720 CLTV/HCLTV >95, FICO <720 LTV >65<=75, CLTV/HCLTV >90<=95, FICO >=720 LTV >65<=75, CLTV/HCLTV >90<=95, FICO <720 LTV >75<=80, CLTV/HCLTV >75<=90, FICO >=720 LTV >75<=80, CLTV/HCLTV >75<=90, FICO <720 LTV >75<=80, CLTV/HCLTV >90<=95, FICO >=720 LTV >75<=80, CLTV/HCLTV >90<=95, FICO <720 LTV >80<=90, CLTV/HCLTV >80<=95, FICO >=720 LTV >80<=90, CLTV/HCLTV >80<=95, FICO <720 LTV >90, CLTV/HCLTV >90, FICO >=720 LTV >90, CLTV/HCLTV >90, FICO <720 LPRR w/ MI 1.500 1.500 0.250 0.500 0.750 1.000 0.750 1.000 0.750 1.000 0.250 0.500 0.375 *All state adjustments apply to this program. See state adjustments on page 2 under Conventional Conforming Adjustments. Risk-Based Adjustments LTV% <= 60 60.01 - 70 70.01 - 75 75.01 - 80 80.01 - 85 85.01 - 90 90.01 - 95 95.01 - 97 >97 < 620 N/A N/A N/A N/A N/A N/A N/A N/A N/A 620 639 0.500 1.500 3.000 3.000 3.250 3.250 3.250 3.250 3.250 640 659 0.500 1.250 2.750 3.000 3.250 2.750 2.750 2.750 2.750 Credit Score 660 679 0.000 1.000 2.250 2.750 2.750 2.250 2.250 2.250 2.250 680 699 0.000 0.500 1.250 1.750 1.500 1.250 1.250 1.250 1.250 700 719 (0.250) 0.500 0.750 1.000 1.000 1.000 1.000 1.000 1.000 720 739 (0.250) 0.000 0.250 0.500 0.500 0.500 0.500 0.500 0.500 Maximum Cumulative Adjustments >= 740 (0.250) 0.000 0.000 0.250 0.250 0.250 0.250 0.250 0.250 (excludes lock term, loan amts, impound waivers, MI transfer & state adj) LTV >80, O/O & 2nd Home, Loan Term <=20yrs LTV >80, O/O & 2nd Home, Loan Term >20yrs N/O/O LTV <=80% 0.000 0.750 1.750 1.750 Risk-Based Adjustments do not apply to loans with amortization terms <=180 months. This information is for the use of approved mortgage lenders only and is not intended for distribution to consumers. This is not an advertisement to extend customer credit as defined by part 226.2 of Regulation Z. Interest rate, program terms and conditions are subject to change without notice. Not all products are available in all states and for all loan amounts. Other restrictions and limitations may apply. Granting of loan is subject to the credit and policy requirements of Plaza Home Mortgage, Inc. 2/5/2015 7:02 AM Page 6 of 8 FHA Rates and Adjustments Rate 4.500 4.375 4.250 4.125 4.000 3.875 3.750 3.625 3.500 3.375 3.250 Rate 4.625 4.500 4.375 4.250 4.125 4.000 3.875 3.750 Rate 4.250 4.125 4.000 3.875 3.750 3.625 3.500 3.375 3.250 FHA 30 Yr Fixed Conforming FHA 300 15 Day 30 Day (6.111) (5.936) (5.621) (5.446) (5.725) (5.550) (5.299) (5.124) (4.923) (4.748) (4.414) (4.239) (3.990) (3.815) (3.524) (3.349) (3.611) (3.436) (3.051) (2.876) (2.112) (1.937) FHA 30 Yr HB FHA300HB 15 Day (5.204) (4.861) (4.371) (4.475) (4.049) (3.673) (3.164) (2.740) 30 Day (5.029) (4.686) (4.196) (4.300) (3.874) (3.498) (2.989) (2.565) FHA 30Yr Fixed Conforming FHA30S (FHA Streamline) 15 Day 30 Day (5.600) (5.425) (5.174) (4.999) (4.798) (4.623) (4.289) (4.114) (3.865) (3.690) (3.399) (3.224) (3.486) (3.311) (2.926) (2.751) (1.987) (1.812) 45 Day (5.761) (5.271) (5.375) (4.949) (4.573) (4.064) (3.640) (3.174) (3.261) (2.701) (1.762) Rate 3.750 3.625 3.500 3.375 3.250 3.125 3.000 FHA 15 Yr Conforming FHA150 15 Day 30 Day (4.288) (4.113) (4.218) (4.043) (3.882) (3.707) (3.548) (3.373) (3.158) (2.983) (2.583) (2.408) (2.191) (2.016) FHA 15 Yr High Bal. (FHA150HB) (FHA150HB) Rate 15 Day 30 Day 45 Day 3.500 (1.132) (0.957) (0.782) 3.375 (0.798) (0.623) (0.448) 3.250 (0.408) (0.233) (0.058) 3.125 0.167 0.342 0.517 3.000 0.559 0.734 0.909 2.875 0.952 1.127 1.302 2.750 1.394 1.569 1.744 2.625 2.252 2.427 2.602 45 Day (5.250) (4.824) (4.448) (3.939) (3.515) (3.049) (3.136) (2.576) (1.637) Rate 4.625 4.500 4.375 4.250 4.125 4.000 3.875 3.750 3.625 30 Year Fixed High Balance FHA300HBS (Streamline) 15 Day 30 Day (5.204) (5.029) (4.861) (4.686) (4.371) (4.196) (4.475) (4.300) (4.049) (3.874) (3.673) (3.498) (3.164) (2.989) (2.740) (2.565) (2.274) (2.099) Rate 4.000 3.875 3.750 3.625 3.500 3.375 3.250 3.125 45 Day (3.938) (3.868) (3.532) (3.198) (2.808) (2.233) (1.841) FHA51THB 5 Yr 15 Day 30 Day (4.281) (4.106) (4.093) (3.918) (3.840) (3.665) (3.529) (3.354) (3.204) (3.029) (2.878) (2.703) (2.492) (2.317) (2.041) (1.866) 45 Day (3.931) (3.743) (3.490) (3.179) (2.854) (2.528) (2.142) (1.691) 30 Year FHA 203(k) 45 Day (4.854) (4.511) (4.021) (4.125) (3.699) (3.323) (2.814) (2.390) (1.924) Rate 4.750 4.625 4.500 4.375 4.250 4.125 4.000 3.875 3.750 FHA30KS 15 Day (4.668) (3.910) (3.605) (3.303) (2.932) (2.885) (2.517) (2.153) (1.709) Rate 4.000 3.875 3.750 3.625 3.500 3.375 3.250 3.125 3.000 2.875 2.750 FHA51T Conforming 5 Yr 15 Day (4.531) (4.343) (4.090) (3.779) (3.454) (3.128) (2.742) (2.291) (1.848) (1.395) (0.891) 30 Day (4.356) (4.168) (3.915) (3.604) (3.279) (2.953) (2.567) (2.116) (1.673) (1.220) (0.716) Rate 4.500 4.375 4.250 4.125 4.000 3.875 3.750 3.625 FHA 30 Yr Fixed RFHA30BTW 15 Day (5.855) (5.553) (5.182) (5.135) (4.767) (4.403) (3.959) (3.524) 30 Day (5.680) (5.378) (5.007) (4.960) (4.592) (4.228) (3.784) (3.349) 30 Year FHA Full 203(k) 30 Day (4.493) (3.735) (3.430) (3.128) (2.757) (2.710) (2.342) (1.978) (1.534) Rate 4.750 4.625 4.500 4.375 4.250 4.125 4.000 3.875 3.750 FHA30K 15 Day (4.668) (3.910) (3.605) (3.303) (2.932) (2.885) (2.517) (2.153) (1.709) 30 Day (4.493) (3.735) (3.430) (3.128) (2.757) (2.710) (2.342) (1.978) (1.534) FHA 203(k) Streamlined: Supplemental Origination Fee Greater of $350 or 1.50% of the total cost of renovations USDA Rural Housing Full Doc & Refinance Pilot USDA RH 30 Yr (USDARH30 & USDARH30P) Rate 4.250 4.125 4.000 3.875 3.750 3.625 3.500 15 Day (4.975) (4.549) (4.173) (3.664) (3.240) (2.774) (2.611) 30 Day (4.800) (4.374) (3.998) (3.489) (3.065) (2.599) (2.436) Adjustments Loan amount >= $100,000 to $124,999 Loan amount >= $75,000 to $99,999 Loan amount >= $50,000 to $74,999 Loan amount <$50,000 FHA Streamline: FICO 640-679 FHA Streamline: FICO 620-639 FHA Full Doc & USDA : FICO 640-679 FHA Full Doc & USDA: FICO 620-639 FHA Full Doc: FICO 600-619 FHA Full Doc: FICO 580-599 Full Doc, FHA Streamline & USDA: FICO 680-719 Min FICO of 620 required for standard FHA *Min FICO of 620 required for FHA Streamline Unit 1 2 3 4 0.125 0.250 0.375 0.750 0.500 1.000 0.500 1.000 1.250 1.750 0.250 FHA 203(k) Streamlined: Supplemental Origination Fee - Greater of $350 or 1.50% of the total cost of renovations Contiguous States Standard $417,000 $533,850 $645,300 $801,950 Maximum Base Loan Amount Contiguous States Alaska & Hawaii High Balance Standard $625,500 $625,500 $800,775 $800,775 $967,950 $967,950 $1,202,925 $1,202,925 0.500 FHA Streamline: NOO For FHA's Back to Work use code RFHA30BTW State Adj. OR NV ID MN WA AZ MT CA Alaska & Hawaii High Balance $721,050 $923,050 $1,115,800 $1,386,650 (0.125) 0.000 (0.125) 0.000 (0.125) 0.000 0.000 0.000 Use FHA High Balance for base loan amounts >417,000 Loans outside of the state of CA may be subject to additional price adjustments. This information is for the use of approved mortgage lenders only and is not intended for distribution to consumers. This is not an advertisement to extend customer credit as defined by part 226.2 of Regulation Z. Interest rate, program terms and conditions are subject to change without notice. Not all products are available in all states and for all loan amounts. Other restrictions and limitations may apply. Granting of loan is subject to the credit and policy requirements of Plaza Home Mortgage, Inc. 2/5/2015 7:02 AM Page 7 of 8 VA Rates and Adjustments Rate 4.250 4.125 4.000 3.875 3.750 3.625 3.500 3.375 Rate 3.500 3.375 3.250 3.125 3.000 2.875 2.750 2.625 Rate 5.000 4.875 4.750 4.625 4.500 4.375 4.250 4.125 4.000 3.875 3.750 3.625 30 Year Fixed VA300 15 Day (5.350) (4.924) (4.548) (4.039) (3.615) (3.149) (3.236) (2.676) 20 Year Fixed VA200 15 Day (3.882) (3.548) (3.158) (2.583) (2.191) (1.798) (1.356) (0.498) 30 Day (5.175) (4.749) (4.373) (3.864) (3.440) (2.974) (3.061) (2.501) 30 Day (3.707) (3.373) (2.983) (2.408) (2.016) (1.623) (1.181) (0.323) VA IRRRL Conforming 30 Yr VA300IRRRL No Appraisal Required Rate 15 Day 30 Day 4.625 (5.910) (5.735) 4.500 (5.605) (5.430) 4.375 (5.303) (5.128) 4.250 (4.932) (4.757) 4.125 (4.885) (4.710) 4.000 (4.517) (4.342) 3.875 (4.153) (3.978) 3.750 (3.709) (3.534) 3.625 (3.274) (3.099) 3.500 (2.830) (2.655) 3.375 (2.386) (2.211) 3.250 (1.862) (1.687) 30 Year Fixed VAJUMBO30 15 Day 30 Day (6.080) (5.905) (5.611) (5.436) (5.205) (5.030) (4.704) (4.529) (4.361) (4.186) (3.871) (3.696) (3.975) (3.800) (3.549) (3.374) (3.173) (2.998) (2.664) (2.489) (2.240) (2.065) (1.774) (1.599) Rate 3.750 3.625 3.500 3.375 3.250 3.125 3.000 2.875 25 Year Fixed VA250 15 Day (4.288) (4.218) (3.882) (3.548) (3.158) (2.583) (2.191) (1.798) 30 Day (4.113) (4.043) (3.707) (3.373) (2.983) (2.408) (2.016) (1.623) Energy Efficient Mortgage VA300EM Rate 15 Day 30 Day 4.250 (5.350) (5.175) 4.125 (4.924) (4.749) 4.000 (4.548) (4.373) 3.875 (4.039) (3.864) 3.750 (3.615) (3.440) 3.625 (3.149) (2.974) 3.500 (3.236) (3.061) 3.375 (2.676) (2.501) 15 Year Fixed VA150 Rate 15 Day 30 Day 3.750 (4.288) (4.113) 3.625 (4.218) (4.043) 3.500 (3.882) (3.707) 3.375 (3.548) (3.373) 3.250 (3.158) (2.983) 3.125 (2.583) (2.408) 3.000 (2.191) (2.016) 2.875 (1.798) (1.623) VA IRRRL Conforming 15 Yr VA150IRRRL No Appraisal Required Rate 15 Day 30 Day 3.750 (4.038) (3.863) 3.625 (3.968) (3.793) 3.500 (3.632) (3.457) 3.375 (3.298) (3.123) 3.250 (2.908) (2.733) 3.125 (2.333) (2.158) 3.000 (1.941) (1.766) 2.875 (1.548) (1.373) 2.750 (1.106) (0.931) 2.625 (0.248) (0.073) 2.500 0.199 0.374 2.375 0.650 0.825 Jumbo Energy Efficient VAJUMBO30EEM Rate 15 Day 30 Day 5.000 (6.080) (5.905) 4.875 (5.611) (5.436) 4.750 (5.205) (5.030) 4.625 (4.704) (4.529) 4.500 (4.361) (4.186) 4.375 (3.871) (3.696) 4.250 (3.975) (3.800) 4.125 (3.549) (3.374) 4.000 (3.173) (2.998) 3.875 (2.664) (2.489) 3.750 (2.240) (2.065) 3.625 (1.774) (1.599) Adjustments Loan amount >= $100,000 to $124,999 Loan amount >= $75,000 to $99,999 Loan amount >= $50,000 to $74,999 Loan amount <$50,000 2nd Home or Non-owner Streamline Purchase special on conforming loans up to 417K 0.125 0.250 0.375 0.750 0.500 (0.125) Rate 4.000 3.875 3.750 3.625 3.500 3.375 3.250 3.125 Rate 4.500 4.000 3.500 3.000 VA 5/1 Arm VA51T 15 Day (4.531) (4.343) (4.090) (3.779) (3.454) (3.128) (2.742) (2.291) 15 Year Fixed VA1510 15 Day (4.513) (4.966) (3.888) (2.122) 30 Day (4.356) (4.168) (3.915) (3.604) (3.279) (2.953) (2.567) (2.116) 30 Day (4.338) (4.791) (3.713) (1.947) Jumbo VA IRRRL *** 30 Yr VAJ30IRRRL No Appraisal Required Rate 15 Day 30 Day 4.750 (5.168) (4.993) 4.625 (4.410) (4.235) 4.500 (4.105) (3.930) 4.375 (3.803) (3.628) 4.250 (3.432) (3.257) 4.125 (3.385) (3.210) 4.000 (3.017) (2.842) 3.875 (2.653) (2.478) 3.750 (2.209) (2.034) Rate 3.750 3.625 3.500 3.375 3.250 3.125 3.000 2.875 2.750 2.625 2.500 2.375 15 Year Fixed VAJUMBO15 15 Day (1.038) (0.968) (0.632) (0.298) 0.092 0.667 1.059 1.452 1.894 2.752 3.199 3.650 State Adj. OR NV ID MN WA AZ VA 5/1 Jumbo Arm VAJ51T Rate 15 Day 4.000 (4.031) 3.875 (3.843) 3.750 (3.590) 3.625 (3.279) 3.500 (2.954) 3.375 (2.628) 3.250 (2.242) 3.125 (1.791) 3.000 (1.348) 2.875 (0.895) 2.750 (0.391) 2.625 0.167 30 Day (0.863) (0.793) (0.457) (0.123) 0.267 0.842 1.234 1.627 2.069 2.927 3.374 3.825 (0.125) 0.000 (0.125) 0.000 (0.125) 0.000 MT CA 0.000 0.000 (branch special not included in branch Pricing) VA250 VA200 VA Streamline: FICO 620-659 VA Streamline: FICO 660-699 0.125 0.500 1.125 0.125 *** Plaza & Wells Fargo serviced Jumbo IRRRLS please use our pricing engine in Pulse Plaza has waived the admin fee on all VA loans VA Full Doc, FICO 680-719 VA Full Doc: FICO 640-679 VA Full Doc: FICO 620-639 0.250 0.500 1.000 VA Down Payment worksheet Loans outside of the state of CA may be subject to additional price adjustments. This information is for the use of approved mortgage lenders only and is not intended for distribution to consumers. This is not an advertisement to extend customer credit as defined by part 226.2 of Regulation Z. Interest rate, program terms and conditions are subject to change without notice. Not all products are available in all states and for all loan amounts. Other restrictions and limitations may apply. Granting of loan is subject to the credit and policy requirements of Plaza Home Mortgage, Inc. 2/5/2015 7:02 AM Page 8 of 8 Elite Jumbo 30yr Fixed Jumbo EJF30 15yr Fixed Jumbo EJF15 Rate 15 Day 30 Day 45 Day 60 Day Rate 15 Day 30 Day 45 Day 60 Day 4.375 (1.926) (1.751) (1.576) (1.401) 4.000 (1.559) (1.384) (1.209) (1.034) 4.250 (1.500) (1.325) (1.150) (0.975) 3.875 (1.359) (1.184) (1.009) (0.834) 4.125 (1.088) (0.913) (0.738) (0.563) 3.750 (1.217) (1.042) (0.867) (0.692) 4.000 (0.618) (0.443) (0.268) (0.093) 3.625 (1.055) (0.880) (0.705) (0.530) 3.875 (0.080) 0.095 0.270 0.445 3.500 (0.829) (0.654) (0.479) (0.304) 3.750 0.589 0.764 0.939 1.114 3.375 (0.547) (0.372) (0.197) (0.022) 3.625 1.378 1.553 1.728 1.903 3.250 (0.212) (0.037) 0.138 0.313 3.125 0.157 0.332 0.507 0.682 3.000 0.551 0.726 0.901 1.076 2.875 1.019 1.194 1.369 1.544 2.750 1.582 1.757 1.932 2.107 5yr ARM Jumbo EJA51 7yr ARM Jumbo EJA71 10yr ARM Jumbo EJA101 Rate 15 Day 30 Day 45 Day 60 Day Rate 15 Day 30 Day 45 Day 60 Day Rate 15 Day 30 Day 45 Day 3.750 (1.634) (1.459) (1.284) (1.109) 3.750 (1.579) (1.404) (1.229) (1.054) 4.250 (2.109) (1.934) (1.759) 3.625 (1.509) (1.334) (1.159) (0.984) 3.625 (1.430) (1.255) (1.080) (0.905) 4.125 (1.891) (1.716) (1.541) 3.500 (1.384) (1.209) (1.034) (0.859) 3.500 (1.225) (1.050) (0.875) (0.700) 4.000 (1.624) (1.449) (1.274) 3.375 (1.227) (1.052) (0.877) (0.702) 3.375 (1.001) (0.826) (0.651) (0.476) 3.875 (1.356) (1.181) (1.006) 3.250 (1.039) (0.864) (0.689) (0.514) 3.250 (0.779) (0.604) (0.429) (0.254) 3.750 (1.064) (0.889) (0.714) 3.125 (0.820) (0.645) (0.470) (0.295) 3.125 (0.520) (0.345) (0.170) 0.005 3.625 (0.667) (0.492) (0.317) 3.000 (0.570) (0.395) (0.220) (0.045) 3.000 (0.171) 0.004 0.179 0.354 3.500 (0.196) (0.021) 0.154 2.875 (0.328) (0.153) 0.022 0.197 2.875 0.248 0.423 0.598 0.773 3.375 0.264 0.439 0.614 2.750 (0.075) 0.100 0.275 0.450 2.750 0.692 0.867 1.042 1.217 3.250 0.705 0.880 1.055 2.625 0.245 0.420 0.595 0.770 2.625 1.220 1.395 1.570 1.745 3.125 1.319 1.494 1.669 2.500 0.570 0.745 0.920 1.095 3.000 2.067 2.242 2.417 Elite Jumbo Adjustments LTV/CLTV/HCLTV FICO 700-719 <= 60% (0.125) 60.01 - 65% 65.01 - 70% 70.01 - 75% 75.01 - 80% 0.375 0.625 N/A N/A FICO 720-739 (0.250) 0.125 0.375 0.625 1.000 FICO 740-759 (0.375) (0.125) 0.000 0.375 0.625 FICO >=760 (0.500) (0.375) (0.250) 0.000 0.250 LTV <= 60% <= $1.0M (0.250) (0.250) (0.125) 0.000 0.000 > $1.0M to $1.5M (0.250) 0.000 0.125 0.250 0.375 > $1.5M to $2.0M (0.125) 0.000 0.250 0.375 N/A > $2.0M to $2.5M 0.000 0.125 0.250 N/A N/A C/O Refinance 0.250 0.250 0.250 N/A N/A 2 unit 0.250 0.250 N/A N/A N/A 2nd Home 0.125 0.250 0.375 0.750 N/A No Escrows (NY excluded) 0.125 0.125 0.125 0.125 0.125 15yr Fixed 0.000 0.000 0.000 0.000 0.000 FL, NV 0.000 0.000 0.000 0.000 0.375 ARM 0.000 0.000 0.000 0.000 0.250 Purchase (0.375) (0.375) (0.375) (0.375) (0.375) 30 yr Fixed, Non CA (0.375) (0.375) (0.375) (0.375) (0.375) Texas A6 0.500 0.500 0.500 0.500 0.500 30 yr Fixed, CA (0.250) (0.250) (0.250) 0.000 Fixed Max Rebate 30 yr - Loan Amounts <= $1,000,000 (0.125) (2.125) Fixed Max Rebate 15 yr - Loan Amounts <= $1,000,000 (1.750) Fixed Max Rebate 30 yr - Loan Amounts > $1,000,000 (1.750) Fixed Max Rebate 15 yr - Loan Amounts > $1,000,000 (1.500) ARM Max Rebate - Loan Amounts <= $1,000,000 (1.125) ARM Max Rebate - Loan Amounts > $1,000,000 (1.000) 60.01 - 65% 65.01 - 70% 70.01 - 75% 75.01 - 80% This information is for the use of approved mortgage lenders only and is not intended for distribution to consumers. This is not an advertisement to extend customer credit as defined by part 226.2 of Regulation Z. Interest rate, program terms and conditions are subject to change without notice. Not all products are available in all states and for all loan amounts. Other restrictions and limitations may apply. Granting of loan is subject to the credit and policy requirements of Plaza Home Mortgage, Inc.

© Copyright 2026