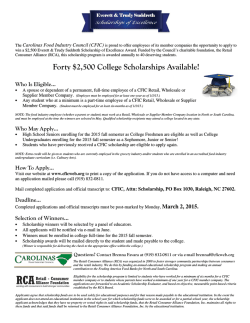

Export-supporting FDI