(EMX $0.030) Spec. Buy, Initiation of Coverage

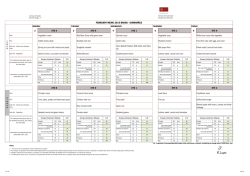

Energia Minerals Ltd (EMX $0.030) Spec. Buy, Initiation of Coverage Price Target: $0.087/sh Key Points We value Energia at $0.087/sh. Energia owns two advanced good quality mineral projects in Zinc and Uranium located in low political risk countries. Both projects have potentially economic resources, of modest scale with modest capital requirements, have strategic or corporate appeal and can be fast tracked due to the advanced level of work already done and provide leverage to commodities with looming supply deficits. Energia is well capitalised with $7m in cash and no debt through an $8m equity raise at $0.025/sh in Nov’14. Alex Burns and Marcello Cardaci, former directors of Sphere Minerals emerged as significant shareholders and directors. Gorno Zn project in Italy, previously mined by ENI, should deliver a JORC resource in 2015 leading to commencing a feasibility study into re-development. Rehabilitation of underground access will commence Jan’15 to enable confirmatory and extensional drilling in May and July respectively. The Exploration Target of 6-10mt grading 7-10% Zn+Pb is supported by historic drilling results. Existing underground mine infrastructure, historic drill hole data and production records, and granted Mining Concession suggest Gorno can be fast tracked. Corporate Data Share Price Issued Capital Ordinary Options (O-O-M) Total Diluted 0.030 $/sh 609.0 m 36.7 m 609 m Mkt Capital’n Enterprise Value Debt Cash 18 $m 11 $m 0 $m 7 $m Valuation Turnover 12 mth Hi-Lo Balance Date $0.087 1.1 m sh per day 6.3-1.7cps June 30th Directors A Burns K Robinson M Cozijn M Cardaci Ex Chair MD Fin Dir NE Dir Shareholders Directors Zero Noms Jetosea 28.9% 11.6% 5.4% Share Price Chart 30000 $0.06 25000 20000 $0.04 15000 10000 $0.02 VOL '000 Initation of Coverage Energia Minerals Share Price ($) Analyst: Greg Chessell Date: 29th January 2015 5000 A future supply deficit of clean, high grade zinc concentrates gives Gorno a strategic value as elsewhere globally mature mines are closing. Gorno could produce ~30ktpa Zn in a high quality concentrate over a long life at moderate costs. Carley Bore Uranium project in WA, is heading towards Field Leach Trials as recommended in the 2014 scoping study. The FLT would form part of a feasibility study into an In-Situ Recovery operation potentially producing 1.5mlbpa U3O8. A high grade starter zone, excellent porosity, low acid consumption make this modest resource look interesting. Exploration potential for resource growth is good. $0.00 Jan-14 0 Apr-14 Jul-14 Oct-14 Disclosure Euroz Securities declares that it has acted as underwriter to and/or arranged an equity issue in and/or provided corporate advice to Energia Minerals Ltd during the last year. Euroz Securities has received a fee for these services. This analyst declares that he has a beneficial interest in Energia Minerals Ltd. Paladin Energy (ASX:PDN) and Cauldron Energy (ASX:CXU) have neighboring uranium projects in the Carnarvon Basin. Potential for EMX’s Carley Bore featuring in a future consolidation is good. Third party validation of Carley Bore value is that CXU made an unsuccessful takeover offer for EMX in 2013; and Chinese controlled Enterprise Uranium (ASX:ENU) acquired an 18.5% stake in late 2013 which has now largely been disposed into the market progressively since the recent capital raising. The positive outlook for uranium demand and price is driven by a growing political ambition to reduce carbon emissions in electricity generation on a global scale. A restart of nuclear electricity generation in Japan would tip the market into deficit in the short term. All information and advice is confidential and for the private information of the person to whom it is provided and is provided without any responsibility or liability on any account whatsoever on the part of Euroz Securities Limited or any member or employee thereof. Refer to full disclaimer at the end of this document. Energia Minerals Ltd (EMX $0.030) Spec. Buy, Initiation of Coverage Analyst: Greg Chessell Discussion Energia Minerals Ltd is a minerals exploration and development company with a focus on Zinc and Uranium with tenements in Australia and Italy. Energia listed on the ASX in Dec 2009 as a spin out from Carbon Energy Ltd (ASX:CNX). It raised $7.5m in an IPO at $0.20/sh, valuing it at $14m. Its key assets today are the same as in 2009, the Carley Bore Uranium project in WA and the Gorno Zn-Pb project near Bergamo, Italy. Both projects have evolved significantly since 2009. Source: Energia Minerals ASSET VALUATION A$m A$/sh Gorno Carley Bore Other Expl’n Corporate Working Cap’l Debt Cash Total shares A$m A$m A$m A$m A$m A$m A$m A$m m 24 25 1 -4 0 0 7 53 609 A$/sh 0.087 Total We value Energia Minerals at $0.087/sh. The valuation is based on a risk adjusted potential NPV of the two key projects, Gorno and Carley Bore which contribute equally to the valuation. We have applied a 50% risk adjustment in both cases, reflecting the early stage of development in each case. Energia has been hamstrung in the last 2-3 years by lack of access to equity capital to advance its projects. The recent $8m rights issue with Alex Burns and Marcello Cardaci emerging as large shareholders and directors gives Energia new life to demonstrate value. The Gorno Zn-Pb project is an opportunity to capitalize on inherited existing mine infrastructure, permitting precedent and demonstrated mineable mineralisation (not yet JORC complaint resource). A shortage of new zinc mine developments globally relative to demand growth is already widely reported. This also evident as a dearth of zinc equity exposure listed on ASX. We have identified 13 companies with zinc as their principal commodity focus. Energia ranks alongside peers such as Heron Resources (HRR, Euroz Recommendation: Speculative Buy), Mungana Mines (MUX) and Red River Resources (RVR) as modestly capitalized hence offering leverage, with credible zinc assets in a good location. Ironbark Zinc (IBG) and Terramin (TZN) have larger, lower grade deposits in less desirable locations, while Aurelia’s (AMI) modest Hera deposit will produce zinc as a by-product to gold and copper. We have excluded Independence Group (IGO, Euroz Recommendation: Buy) as their zinc output is dwarfed by the value of gold and nickel. All information and advice is confidential and for the private information of the person to whom it is provided and is provided without any responsibility or liability on any account whatsoever on the part of Euroz Securities Limited or any member or employee thereof. Refer to full disclaimer at the end of this document. 2 of 19 Energia Minerals Ltd (EMX $0.030) Spec. Buy, Initiation of Coverage ASX listed Uranium Stocks EV & Resource (Mlb U308) Enterprise Value $m (blue) 4,800 140 4,200 120 3,600 100 3,000 80 2,400 60 1,800 40 1,200 20 600 0 Enterprise Value $m (blue) $182 $240 Resource kt Zn+Pb (red) EV & Resource (Zn+Pb cont) 160 $344 $927 160 160 140 140 120 120 100 100 80 80 60 60 40 40 20 20 Resource Mlb U308 (red) ASX listed Zinc Stocks Analyst: Greg Chessell 0 OVR AUQ SBR PLD VXR EMX HRR RXL MUX RVR IBG AMI 0 0 TZN AEE Source: Euroz EMX AEK AGS DYL BKY BMN CXU LAM VMY PEN TOE ERA PDN Source: Euroz Energia offers an excellent value leverage proposition as value can be created on both projects. We envisage a separation of the assets eventually which should lead to greater value recognition by the market as pure zinc and uranium plays. The field of ASX listed Uranium companies with demonstrated resources is more diverse and competitive. Carley Bore’s differentiation lies with it’s location nearby to two other advanced projects, good metallurgy, and high grade starting opportunity. ASX listed Zinc Stocks by Enterprise Value Sh Price Mkt Cap Cash Debt EV Zn+Pb cont EV/t Zn+Pb Ownership $/sh $m $m $m $m Zn+Pb Resource mt grade kt $/t % Description OVR 0.007 1 1 0 1 12.6 6.2% 779 1 100% Yukon, Canada, Glencore & Macq shareholders, in permitting. AUQ 0.015 3 2 0 1 26.0 3.3% 429 2 50% Khnaiguiyah, Saudi, Ore reserve, project stalled due to dispute with local partner SBR 0.017 4 2 0 2 16.0 2.1% 336 7 100% Border deposit, Namibia PLD 0.005 3 1 0 2 72 6.0% 4,320 1 100% Admiral Bay, Kimberley, WA, deep 1,300m, opt to acquire VXR 0.004 6 2 0 4 26.4 3.7% 977 4 100% Pilbara, WA (Whim Ck & Sulphur Springs), DFS done, capex opt pending, marginal, also Cu cont. EMX 0.029 18 7 0 11 8.0 8.5% 680 16 100% Gorno, Italy, Expln Target mid HRR 0.125 47 31 0 16 21.7 8.5% 1,840 9 100% Woodlawn, NSW, combined Underground & Tailings resources RXL 0.027 23 3 0 20 90.0 12.5% 3,375 6 30% Teena, NT, Teck 51%, earning 70%, Expln Target mid, other assets Ni in WA & Cu in NT owned 100% MUX 0.098 24 3 0 21 9.7 7.0% 676 30 100% Chillagoe, Qld - King Vol, Red Cap, ex-Kagara historical Rsc, 0.6mtpa mill RVR 0.170 30 4 0 26 3.8 10.6% 403 65 100% Thalanga, Qld, ex-Kagara, Rsc update imminent, 0.6mtpa mill, restart end '15 IBG 0.100 43 3 0 40 70.8 5.7% 4,036 10 100% Citronen, Greenland, Mining Licence under appl'n AMI 0.240 97 20 105 182 2.4 6.6% 158 1,149 100% Hera, NSW, value in Au 4.1g/t, Pb+Zn by-product, in commissioning TZN 0.155 211 0 30 240 68.0 5.7% 2,519 95 65% Tala Hamza, Algeria, DFS completed, development pending, Source: Euroz All information and advice is confidential and for the private information of the person to whom it is provided and is provided without any responsibility or liability on any account whatsoever on the part of Euroz Securities Limited or any member or employee thereof. Refer to full disclaimer at the end of this document. 3 of 19 Energia Minerals Ltd (EMX $0.030) Spec. Buy, Initiation of Coverage Analyst: Greg Chessell Gorno Zn-Pb, Italy The Gorno Zn-Pb project is owned 100% by Energia Minerals and lies 40km by road north of Bergamo (population of about 120,000 – 1hr by car from Milan) in the Lombardia region of northern Italy. It is in the vicinity of four small populations (Zambla, Gorno, Oneta and Oltre il Colle) centre within 0.5-1hr by car from Bergamo.’ Gorno comprises 10 granted exploration licences and 4 licence applications covering a former mine operated by the Italian state mining company, Samin, a subsidiary of ENI. EMX has also recently acquired a granted Mining Concession covering the Forcella Portal from a third party for €0.2m over 3 years, plus a 1% NSR. Source: Energia Minerals Euroz believes that Gorno is an attractive low cost, low risk, strategically important while modest scale zinc development opportunity capable of capitalising on a looming supply deficit in zinc in the coming years. Energia is aiming to define mineral resources, complete a feasibility study and recommence mining and zinc concentrate production. The historical records, inherited infrastructure, proven metallurgical performance and existing permits suggest an expedient and low cost path to development is possible. Historically Zinc production, primarily the mostly mined out Colonna Fortuna deposit near Gorno, is estimated at 800,000t Zn in concentrate from 6mt grading 14.5% Zn+Pb mined entirely from underground means. Mine workings date back to Celtic times and are spread over an area of 60km2. The mine is understood to have closed in 1985 as ENI ceased all mineral production globally to focus on oil & gas operations. Energia has searched, compiled and digitized historical mine data from archives at both local and regional authorities. It has identified: • 230km of underground mine workings, including the 12.5km Riso Parina adit; • 2 portals (Forcella at 940RL and Riso at 600RL); • 146 diamond drill holes and 319 percussion sludge drill holes, numerous mineralized and unmined intercepts. Plant site adjacent to Riso portal. • All information and advice is confidential and for the private information of the person to whom it is provided and is provided without any responsibility or liability on any account whatsoever on the part of Euroz Securities Limited or any member or employee thereof. Refer to full disclaimer at the end of this document. 4 of 19 Energia Minerals Ltd (EMX $0.030) Spec. Buy, Initiation of Coverage Analyst: Greg Chessell Source: Energia Minerals An exploration target at Gorno of 6-10mt grading 7%-10% Zn+Pb has been estimated by Energia. Gorno - Exploration Target grade tonnes Zn+Pb Zn eq cont mt % mt Col. Fortuna 1-2 6-7 0.1-0.2 Col. Zorzone >550RL 3-5 7-10 0.2-0.5 Col. Zorzone <550RL 2-3 7-10 0.2-0.3 6-10 7-10 0.4-1.0 Total Source: Energia Minerals Two main bodies of mineralization are 6km apart, connected by the Riso Parina adit. • Colonna Fortuna has been mined extensively, some remnant mineralization remains but is not the initial focus. ENI records indicate 0.62mt grading 6.5%Zn+Pb was defined and remained unmined at closure, between levels 500RL & 340RL. • Colonna Zorzone (formerly Panel 7) is a virgin orebody partially developed but unmined prior to closure in 1985. Energia intends to establish a JORC resource based on the areas of known mineralization. Some 3-5mt is expected above the 550RL level and 2-3mt between the 550RL and 200RL. Historical drilling in Colonna Zorzone is supportive of the Exploration Target. • Results from 5 DD holes and numerous grade control percussion holes on 940RL & 900RL average 4.6m @ 8.6% Zn+Pb. • Results from 5 DD holes on 600RL average 6.2m @ 10.1% Zn+Pb. All information and advice is confidential and for the private information of the person to whom it is provided and is provided without any responsibility or liability on any account whatsoever on the part of Euroz Securities Limited or any member or employee thereof. Refer to full disclaimer at the end of this document. 5 of 19 Energia Minerals Ltd (EMX $0.030) Spec. Buy, Initiation of Coverage Analyst: Greg Chessell The following table outline Energia’s planned work program at Gorno. Source: Energia Minerals Energia has engaged local contractor Edilmac to rehabilitate underground access to enable confirmatory drilling. The contract is for rehabilitation of 1.4km of historical workings from the Forcella portal, 710m of new decline development and 480m diamond drilling aimed to twin existing drilling between 1000RL and 900RL. The contract value is €3.5m incl VAT (A$5.0m), and should commence in January 2015 and complete by October 2015. The drilling will commence early May 2015. Edilmac is an experienced underground contractor, having been involved in many high profile European tunnelling projects. Another drilling contract for 25 diamond drill holes totalling 3,750m will be awarded shortly, with a value ~€0.5m (A$0.7m). This will define the resource between the 900RL and 600RL. This drilling will occur once the Edilmac decline development is complete, expected in July 2015. Source: Energia Minerals, SRK Energia has appointed Graeme Collins, an Australian mining engineer with experience in developing underground zinc mines, as Director of Operations, to oversee the development of Gorno. All information and advice is confidential and for the private information of the person to whom it is provided and is provided without any responsibility or liability on any account whatsoever on the part of Euroz Securities Limited or any member or employee thereof. Refer to full disclaimer at the end of this document. 6 of 19 Energia Minerals Ltd (EMX $0.030) Spec. Buy, Initiation of Coverage Analyst: Greg Chessell Gorno is a Mississippi Valley style deposit hosted in Alpine limestone setting. Typical of this style of deposit, Gorno produces a clean, coarse grained, high grade concentrate, historically grading 55%-58% Zn, and importantly low in iron (1-2% Fe). Metallurgical recovery is high at +95%. We believe these metallurgical characteristics will make Gorno strategically important as the closure of mature Zn mines globally creates a dearth of high quality concentrates which are required to blend with lower quality concentrates for optimal feed to smelters. The granted Mining Concession enables Energia to commence mining as is. The 1km2 lease surrounds the Forcella portal. Under Italian mining law a Mining Concession is required to surround the surface expression of workings, and not necessarily cover the entirety of the orebody. Energia is expected in future to seek amendment of the Mining Concession to encompass all possible surface expression of mining activity. Approval for amendment of an existing lease should logically be more expedient than grant of a new lease. Energia will require environmental permission to enable construction and operation of a processing plant. Prima facie this would seem the greatest risk to a successful development by Energia. We believe it is achievable because: • Gorno is already a disturbed site with a history of Zn & Pb mining and concentrate processing; • The nearby town of Ponte Nossa, 3km from Gorno and in the same valley, is host to an operating zinc oxide residue refinery which recently received environmental approval for an expansion within 9 months of application. Construction of the expansion was ongoing during our site visit in August 2014; • The Mayor of Gorno, Mr Walter Quistini, indicated to us in a meeting during our site visit strong local support for a mine development at Gorno, encouraging establishment of a processing plant near the existing plant site, within the Gorno municipality; • The regional mining authority, Regione Lombardia Mines Dept was awarded the European Industrial Minerals Assoc award in 2010 recognising its efforts in advancing mineral development; • Local press coverage during our site visit was clearly positive; • Gorno has a proud history of mining, and is sister city to Kalgoorlie-Boulder. Grade is the biggest potential swing factor, and the 7.5% Zn + Pb assumed in our model in the low end of possibility given historical production was +14% Zn. We value Gorno at $24m, risk adjusted. We have developed a cashflow model of a potential mine development at Gorno. We assume mining rate 0.5mtpa at a Zn+Pb grade of 7.5% over a 10 year life, producing 30ktpa Zn & 6ktpa Pb. Development costs are expected at €65m (A$92m), and total cash costs of US$0.61/lb. Our model produces an NPV of $48m (10% dcf, AT) and an IRR of 25%. These assumptions are subject to feasibility study, with mineable tonnes, grade, mining rate, development costs and operating costs uncertain. All information and advice is confidential and for the private information of the person to whom it is provided and is provided without any responsibility or liability on any account whatsoever on the part of Euroz Securities Limited or any member or employee thereof. Refer to full disclaimer at the end of this document. 7 of 19 Energia Minerals Ltd (EMX $0.030) Spec. Buy, Initiation of Coverage Analyst: Greg Chessell Gorno - Euroz estimate of cashflow potential Zinc US/lb Lead US/lb FY17 FY18 FY19 FY20 FY21 FY22 FY23 FY24 1.15 1.20 1.20 1.15 1.15 1.10 1.10 1.10 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 A$1.0=US$ 0.80 0.80 0.80 0.80 0.80 0.80 0.80 0.80 Euro:US$1 1.15 1.15 1.15 1.15 1.15 1.15 1.15 1.15 0.0 0.5 0.5 0.5 0.5 0.5 0.5 0.5 Ore Mined mtpa Prod’n Zn kt C1 Cash Costs US$/lb 0 30 30 30 30 30 30 30 0.26 0.58 0.58 0.58 0.58 0.58 0.58 0.58 Revenue A$m 0 67 67 64 64 61 61 61 EBITDA A$m 0 33 33 30 30 27 27 27 EBIT A$m 0 28 28 25 25 21 21 21 Capex A$m 93 4 4 4 4 4 4 4 Net CF (pretax) A$m -93 37 37 33 33 30 30 30 NPV (10% posttax) A$m 48 IRR (AT, ungeared) % 25% Source: Euroz estimates Ground conditions are excellent in the limestone host rock. We noted in our site visit roof conditions mostly stable after laying dormant for +30 years. Mine production records indicate adit development rates at a creditable 150m per month. Concentrate tailings are naturally benign due to the limestone host rock acting as neutralising agent against natural acid generation from oxidising sulphide typical in base metal production. Underground storage of tailings will be considered in a feasibility study. This would be a low cost and environmentally favourable use of the extensive underground voids at Gorno, preferable to surface tailing storage. Groundwater make is typically elevated in MVT style deposits. Historical records indicate Samin successfully mined at Colonna Fortuna at levels up to 110m below the current water table. MVT style deposits can have erratic distribution of mineralisation. The abundant historical drilling and mining information at Gorno has significantly reduced this risk. The Gorno mineralisation is sphalerite (Zn) and galena (Pb) with a Zn:Pb ratio of ~5:1. Gangue minerals include calcite, quartz, dolomite and ankerite. Minor silver , fluorite and barite is also noted. The mineralised bodies are stratabound with dimensions typically 1000m x 400m x 3-20m. The Colonna Zorzone body has a dip of ~26 degrees. All information and advice is confidential and for the private information of the person to whom it is provided and is provided without any responsibility or liability on any account whatsoever on the part of Euroz Securities Limited or any member or employee thereof. Refer to full disclaimer at the end of this document. 8 of 19 Energia Minerals Ltd (EMX $0.030) Spec. Buy, Initiation of Coverage Analyst: Greg Chessell Carley Bore U, WA The Carley Bore project lies within the greater Nyang project area, comprising 4 EL’s located east of the North West Coastal Hwy between Carnarvon and Exmouth. The project is 100% owned by Energia. Source: Energia Minerals Carley Bore is a defined uranium deposit with a mineral resource (JORC 2012) estimated by Coffey Mining in Feb’14: Carley Bore - JORC Mineral Resource cutoff tonnes grade U cont. ppm mt ppm mlb Indicated 150 5.4 420 5.0 Inferred 150 17.4 280 10.6 22.8 310 15.6 300-500 15-25 Total Exploration Target The resource is based on 239 drill holes and uses a 150ppm lower cutoff. A total of 425 holes have been drilled in the entire project Nyang project area. Grade is based on geochemical assay rather than gamma log data for greater accuracy. Mineralised zones are avg 4.5m thick. All information and advice is confidential and for the private information of the person to whom it is provided and is provided without any responsibility or liability on any account whatsoever on the part of Euroz Securities Limited or any member or employee thereof. Refer to full disclaimer at the end of this document. 9 of 19 Energia Minerals Ltd (EMX $0.030) Spec. Buy, Initiation of Coverage Analyst: Greg Chessell Significant resource upside exists as suggested by the stated exploration target. Just 10% of the prospective strike length has been tested to date. Carley Bore lies within the Carnarvon Basin where mineralisation is hosted in the Birdrong Sandstone Formation (Cretaceous age). It is a sandstone hosted roll-front deposit similar to Honeymoon (UraniumOne), Beverly (Heathgate), and Manyingee (Paladin). Mineralisation occurs at reduction-oxidation (redox) boundaries within the permeable sandstone unit where it is thickened in paleochannels. Previous explorers were Minatome, Urangesellschaft, Aquitane and Total since the 1970’s. A scoping study was completed in April 2014 by independent mining consultants, Jorvik Resources. It concluded the project: • Should be amenable to In-Situ Recovery (ISR), followed by standard elution, precipitation and calcining process, recovering 70% of the in-situ mineable resource; • Production and sale of 8.0mlb of U3O8 over a 6 year life with total cash costs of US$32/lb and start-up capex of A$105m; • Is economically sound at a Uranium price of US$60/lb; • Recommended proceeding to Field Leach Trial in anticipation of a full feasibility study. Key financial outcomes from the scoping study are: Carley Bore Scoping Study Outcomes Plant capacity 2.0mlb pa Production rate 1.4mlb pa Mine Life 6 years Capex - preproduction A$106m Capex - life of mine A$116m Uranium price US$60/lb Exhange Rate A$1.00=US$0.85 Net Cashflow pretax EBITDA avg pa A$225m A$56m Opex C1 US$20/lb Opex Total US$32/lb Source: Energia Minerals Using Euroz’ price assumptions (uranium = US$50/lb, FX A$1.0=US$0.80) produces financial results of $156m of undiscounted net cashflow pretax, a post tax NPV of $50m and an IRR of 28%. We value Carley Bore at $25m, risk adjusted. All information and advice is confidential and for the private information of the person to whom it is provided and is provided without any responsibility or liability on any account whatsoever on the part of Euroz Securities Limited or any member or employee thereof. Refer to full disclaimer at the end of this document. 10 of 19 Energia Minerals Ltd (EMX $0.030) Spec. Buy, Initiation of Coverage Analyst: Greg Chessell Carley Bore - Euroz cashflow estimates U3O8 US/lb A$1.0=US$ Production mlb C1 Cash Costs A$/lb FY17 FY18 FY19 FY20 FY21 FY22 FY23 50 50 50 50 50 50 50 Total 0.80 0.80 0.80 0.80 0.80 0.80 0.80 0.00 1.68 1.38 1.38 1.38 1.38 0.81 8.0 21 21 26 26 26 26 20 24 Revenue A$m 0 105 86 86 86 86 50 500 Cash Costs A$m 0 35 36 36 36 36 16 195 Other Costs A$m 0 7 6 6 6 6 3 32 EBITDA A$m 0 63 45 45 45 45 31 273 D&A A$m 0 20 20 20 20 20 20 120 EBIT A$m 0 43 25 25 25 25 11 153 Capex A$m 105 3 2 2 2 2 2 117 Net CF (pretax) A$m -105 60 43 43 43 43 29 156 NPV (10% posttax) A$m 50 IRR (AT, ungeared) % 28% Source: Euroz estimates Features of Carley Bore that make it attractive are: • A high grade Zone 6 (grade 460ppm) allowing fast capital payback; • Amenable to ISR, a low cost (capex & opex) and widely used technique (~50% of global uranium production) with low environmental impact; • Low acid consumption due to low carbonate in host rock, ~7.5kg/t of ore; • Shallow depths of 50-70m; • High host rock porosity (estimated average at >30%, range 18-45%); • Gas pipeline passes 10km east of the deposit. A rotary mud drilling program is planned to commence post wet season, aiming to select suitable sites for field leach trials, with focus on Zone 6. Drill density will be closed from current 100m x 100m to 50m x 20m in part. The FLT has not yet been committed to but is expected during 2015. Exploration at Carley Bore in late 2014 comprised 2 geophysical surveys (Sub Audio Magnetics and Induced Polarisation) and a 10 hole regional drilling program cofunded with WA DMP. The SAM was successful in mapping paleochannel within the host rock unit, efficiently defining potential trap sites. The regional drilling was unsuccessful in defining new mineralisation. In our view Carley Bore has much technical and strategic merit already, and will have commercial merit in a higher uranium price environment. It would benefit significantly from further grade optimisation in early years, and a longer tail to its life. The grade optimisation is possible with a greater understanding paleochannel & roll-front geometry, perhaps through applying the SAM technique further. The longer life is possible though further exploration along the prospective strike trend, potentially realising the stated exploration target. All information and advice is confidential and for the private information of the person to whom it is provided and is provided without any responsibility or liability on any account whatsoever on the part of Euroz Securities Limited or any member or employee thereof. Refer to full disclaimer at the end of this document. 11 of 19 Energia Minerals Ltd (EMX $0.030) Spec. Buy, Initiation of Coverage Analyst: Greg Chessell Peninsular Energy (ASX:PEN) has recently completed financing of Stage 1 of its 3 Stage Lance, Wyoming, USA, ISR project. Lance Stage 2 has similar characteristics to Carley Bore. It will produce ~1.2mlbpa with total cash cost ~US$31/lb after total capex of US$85m, including expenditure completed to date. Source: Cauldron Energy Carley Bore lies ~100km south of Paladin’s (ASX:PDN) 100% Manyingee project and Cauldron Energy’s (ASX:CXU) Bennet Well project. Cauldron Energy launched an unsuccessful scrip based takeover offer for Energia Minerals in 2013, with CXU failing to acquire a meaningful stake. This suggests to us some 3rd party validation of the project quality. Paladin has recently indicated that it intends to conduct a Field Leach Trial at Manyingee, WA in FY’16, and expects to commence development in 2018, targeting production of 2.0mlbpa from a targeted resource of 40mlb. It currently has a resource of 26mlb grading 850ppm U3O8. Paladin raised $205m in new equity in late 2014, confirming that it is fully funded until at least June 2016. Both major Federal political parties support uranium mining in Australia. The Howard Gov’t (Lib-Nat) abandoned the ALP’s previous “three mine policy” in 1996, and the Gillard Gov’t (ALP) approved a fourth mine at Beverley in SA in 2009. The ban on uranium mining in Western Australia was lifted in 2008 by Premier Barnett (Lib-Nat). The ALP Opposition in WA remains opposed to uranium mining. This leads to some uncertainty should a change of government occur at the next election which is due March 2017. Toro Energy received final permitting for its proposed $270m Lakeway mine in April 2013 from the Federal Environment Minister, after receiving approval from the WA Minister for Environment in October 2012. All information and advice is confidential and for the private information of the person to whom it is provided and is provided without any responsibility or liability on any account whatsoever on the part of Euroz Securities Limited or any member or employee thereof. Refer to full disclaimer at the end of this document. 12 of 19 Energia Minerals Ltd (EMX $0.030) Spec. Buy, Initiation of Coverage Analyst: Greg Chessell Commodity price discussion Zinc We believe that a Zn concentrate supply deficit is impending over the next 12-24 months. This should lead to a significant improvement in prices by 2016, if not later 2015 in anticipation of the deficit. Zinc has not sustained prices above US$2200/t (US$1.00/lb) since 2007. Weak prices in the ensuing 7 years leading to under investment has created a dearth of new greenfield globally significant deposits needed to replace the maturing deposits. It is estimated that the closure of Century from Q3 2015, Lisheen and other small closures might remove 900ktpa of zinc from a market that is already in deficit by ~250ktpa. The deficit has been supplied by metal inventory which has been drawn down by ~400kt in the last 2 years. Planned new mine supply of small scale nonChinese projects might offset the deficit by 120ktpa. The total annual zinc demand is ~14.0mtpa. Chinese production has historically kept the zinc market balanced. Glencore estimates that China has grown supply by ~225ktpa avg over the last 10 years in a price environment of ~US$2200/t. It estimates Chinese annual growth in Zinc production will have to double in the next five years (to 450-500ktpa) to meet demand. This will require a price incentive above the prior 10 year avg. China’s increased environmental awareness may actually limit new zinc mine supply going forward. China is the largest Zinc concentrate producer in the world. However its consumption growth has outstripped its supply growth leading to it becoming a consistent net importer since 2009. Glencore estimates zinc metal stocks will fall below the critical 3 week stock to consumption ratio in 2016. We have noted other commentary suggesting >US$3000/t is likely. We envisage zinc prices sustaining levels of US$2,600/t (+20%) for 3 years from 2016. Zinc spot price US$/lb Tonnes 1.3 1600000 Euroz forecast 1.2 1200000 1.1 1.0 800000 0.9 0.8 400000 0.7 0.6 Jan-11 LME inventory 0 Jan-12 Jan-13 Jan-14 Jan-15 Jan-16 Jan-17 Source: Bloomberg, EZL Source: Euroz, IRESS All information and advice is confidential and for the private information of the person to whom it is provided and is provided without any responsibility or liability on any account whatsoever on the part of Euroz Securities Limited or any member or employee thereof. Refer to full disclaimer at the end of this document. 13 of 19 Energia Minerals Ltd (EMX $0.030) Spec. Buy, Initiation of Coverage Analyst: Greg Chessell Uranium Uranium spot price US$/lb 140 Euroz forecast 120 100 80 60 40 20 0 Jan-06 Jan-07 Jan-08 Jan-09 Jan-10 Jan-11 Jan-12 Jan-13 Jan-14 Jan-15 Jan-16 Jan-17 Source: Euroz, IRESS The uranium spot price is last quoted at US$36.75/lb by Ux Consulting, up 3.5% so far in 2015. Term contract prices are understood to be between US$39/lb (mid) and US$50/lb (long) (TradeTech). We assume long term uranium price recovering to US$50/lb during 2016. We recognise potential for it to be higher still in time, but reserve this call until later. The uranium price has been weak since a tsunami destroyed the Fukushima nuclear reactor facility in Japan in March 2011. A total of 48 reactors were taken offline following the tsunami. The spot price trended down from US$75/lb to a low of US$28/ lb in mid 2014. Destocking by closed Japanese reactors exacerbated a market that was suddenly placed into surplus by the event. The price remains well below the incentive level to bring new supply required for the planned growth in nuclear electricity generation. Some 10-12mlb of mine supply has been removed from the spot market in the last year, including Paladin’s Kayelekera closure, 25% of Langer Heinrich production diverted to Chinese buyers and RIO’s Rossing cutback. The potential restart of nuclear electricity generation in Japan is a possible positive catalyst for the uranium price. Authority to restart 2 reactors at the Sendai facility of Kyushu Electric Power Co. was given in November 2014, and the actual restart is imminent. Other reactors are expected to follow suit, with 20 applications lodged. The spot price rallied in Nov’14 on news of the restart permission coupled with speculation of more numerous approvals pending. It has been reported that the volume of material traded in the spot market has diminished, suggesting a tightening, coincident with firmer prices in term contracts. However in recent months the weak oil price has spilled over to spot pricing of all energy fuel types, including thermal coal and uranium. Longer term, increased demand from 70 new nuclear reactors under construction (half in China), is expected to result in a 25% increase in total uranium demand to 250mlbpa by 2019. Currently there are 437 nuclear reactors operational with a generating capacity of 378GW. The share of nuclear generation by OECD countries is expected to drop from 80% now to 50% by 2040. The spot price was edged up 3.5% so far in 2015. On a policy level, China, US and India stated targets for increased nuclear power generation at the APEC summit in late 2014, driven by a desire for improved environmental emission performance. All information and advice is confidential and for the private information of the person to whom it is provided and is provided without any responsibility or liability on any account whatsoever on the part of Euroz Securities Limited or any member or employee thereof. Refer to full disclaimer at the end of this document. 14 of 19 Energia Minerals Ltd (EMX $0.030) Spec. Buy, Initiation of Coverage Analyst: Greg Chessell Source: International Atomic Energy Agency All information and advice is confidential and for the private information of the person to whom it is provided and is provided without any responsibility or liability on any account whatsoever on the part of Euroz Securities Limited or any member or employee thereof. Refer to full disclaimer at the end of this document. 15 of 19 Energia Minerals Ltd (EMX $0.030) Spec. Buy, Initiation of Coverage Analyst: Greg Chessell Other Assets Val Vedello and Novazza are located in the Lombardia region of Northern Italy, some 10-20km north of Gorno. Both projects are EL applications over previously identified significant uranium mineralisation with substantial underground development in place for bulk sampling for pilot plant testwork. Both deposits were discovered and evaluated by Italian gov’t company AGIP, also a subsidiary of ENI, between 1959 and 1982. They are volcanogenic or vein-hosted uranium-polymetallic mineralisation hosted in volcanics and volcanogenic sediments. Energia has confirmed the extent of historical work by AGIP in a report prepared in 2013. It confirms Exploration Targets of: • Val Vedello: 15-30mlb grading 1000-2000ppm U308; • Novazza: 2-3mlb grading 1000-2000ppm U308. The permits are at application stage and cannot be worked until granted, the timing of which is uncertain. Energia intends to continue to compile historical data. Val Vedello will be the priority target for development. It is located ~2,000m asl to the south of Sondrio slightly more remote than Novazza. Historic data reveals 10.4km of underground development and 65,000m of diamond drilling from underground over 14 years. Novazza occurs at 1,000m asl. Well-preserved underground workings are over 6.7km and with 24,000m of drilling. The June 2011 Italian referendum removed any likelihood for Italian nuclear power generation. In Australia a similar policy does not necessarily preclude the mining of uranium. Energia understands there is no legal impediment to authorisation for grant of uranium Exploration Licence applications in Italy. Energia believes that its local presence and progress at Gorno may assist grant of Val Vedello and Novazza licences. Energia also holds exploration projects at Table Top in the Paterson Province WA, 15km NW of Kintyre uranium deposit, and Duncan Pool in the Gascoyne Province, WA. Source: Energia Minerals All information and advice is confidential and for the private information of the person to whom it is provided and is provided without any responsibility or liability on any account whatsoever on the part of Euroz Securities Limited or any member or employee thereof. Refer to full disclaimer at the end of this document. 16 of 19 Energia Minerals Ltd (EMX $0.030) Spec. Buy, Initiation of Coverage Analyst: Greg Chessell Directors Alexander Burns - Executive Chairman Mr Burns was the Managing Director of Sphere Minerals Ltd (ASX: SPH) from 1998 – 2010. During this period, the company acquired and evaluated multiple, largescale iron ore deposits situated near existing transport infrastructure in Mauritania, West Africa. Sphere was subsequently taken over by Xstrata PLC in November 2010 for A$514 million. Mr Burns was also non-executive Chairman of Shield Mining Ltd, which was spun out of Sphere in 2006. Shield was a gold and base metals exploration company active in Mauritania and was taken over by Gryphon Minerals Ltd in mid2010. The Executive Chairman role at Energia is the only board position that Mr Burns has accepted since the friendly takeovers of both Sphere and Shield in the latter half of 2010. Kim Robinson - Managing Director Mr Robinson has over 35 years’ experience in mineral exploration and mining having graduated from the University of Western Australia in 1973 with a degree in Geology. His experience is extensive including 10 years as Executive Chairman of Forrestania Gold NL. During his time at Forrestania, Mr Robinson played a key role in the discovery and development of the Bounty Gold Mine, the development of the Mt McClure Gold Mine and the discovery of the Maggie Hays and Emily Ann nickel sulphide deposits. Mr Robinson was also a Non-Executive Director of Jubilee Mines NL in the period leading up to the discovery and development of the Cosmos Nickel Mine. Mr Robinson was a founding Director of Kagara Ltd where he held the position of Executive Chairman for a period of 12 years until February 2011. During this time he oversaw the development of Kagara’s North Queensland base metal operations, the listing of Mungana Goldmines Ltd on the ASX and the acquisition and development of the high grade Lounge Lizard nickel deposit in Western Australia. Max D.J. Cozijn - Finance Director and Company Secretary Mr Cozijn has a Bachelor of Commerce Degree from the University of Western Australia having graduated in 1972 and is an Associate of the Australian Society of Certified Practising Accountants. He has over 30 years experience in the administration of listed mining and industrial companies, as well as various private operating companies including 10 years as a non-executive Director of Forrestania Gold NL and 20 years as a non-executive Director of Kagara Ltd. Mr Cozijn is currently a Non Executive Director of Carbon Energy, Oilex, Magma Metals and Malagasy Minerals. Marcello Cardaci - Non-Executive Director Mr Cardaci is a partner in Gilbert + Tobin’s Corporate Advisory group. Mr Cardaci advises on a range of corporate and commercial matters including public and private equity fund raisings and public and private mergers, acquisitions and divestment. Mr Cardaci also regularly advises on issues relating to the Corporations Act and Australian Securities Exchange Listing Rules. He has cross-border experience, having advised on numerous overseas transactions including capital raisings, takeovers, schemes of arrangements and the structuring of acquisitions and joint ventures in numerous countries. All information and advice is confidential and for the private information of the person to whom it is provided and is provided without any responsibility or liability on any account whatsoever on the part of Euroz Securities Limited or any member or employee thereof. Refer to full disclaimer at the end of this document. 17 of 19 Energia Minerals Ltd (EMX $0.030) Spec. Buy, Initiation of Coverage Analyst: Greg Chessell Top 20 Shareholders 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 Shareholders Zero Nom PL Asim Hldgs PL Burns Elizabeth + A S Jetosea PL Pollara PL Shl PL Cairnglen Inv PL Rentier Inv PL Roberts John Barry + J E Robinson Kim Enterprise Uranium Ltd Lomacott PL Bsn Hldgs PL Malvasia PL Robinson Kim + Jennifer Iannello Delia Robinson Kim + Jennifer Bell Potter Nom Ltd Jayleaf Hldgs PL Bridgelane Cap PL Total UNITS 77.56 72.95 58.33 32.92 17.50 17.00 11.67 9.33 8.75 8.72 8.51 7.50 7.00 5.83 5.78 5.75 5.70 5.25 5.00 4.80 375.85 as at 16/01/2015 % 12.73 11.98 9.58 5.41 2.87 2.79 1.92 1.53 1.44 1.43 1.40 1.23 1.15 0.96 0.95 0.94 0.86 0.82 0.79 0.70 61.48 All information and advice is confidential and for the private information of the person to whom it is provided and is provided without any responsibility or liability on any account whatsoever on the part of Euroz Securities Limited or any member or employee thereof. Refer to full disclaimer at the end of this document. 18 of 19 Disclaimer Contact Details Euroz Securities Ltd Copyright & Distribution The material contained in this communication (and all attachments) is prepared for the exclusive use of clients of Euroz Securities Ltd (ACN 089 314 983) (“Euroz”) only. Euroz is the holder of an Australian Financial Services Licence (AFSL 243302) issued by the Australian Securities and Investments Commission (“ASIC”) and is a participant of the Australian Securities Exchange Group (“ASX Group”). The information contained herein is confidential and may be legally privileged. If you are not the intended recipient no confidentiality is lost nor privilege waived by your receipt of it. Please delete and destroy all copies, and contact Euroz on (+618) 9488 1400. You should not use, copy, disclose or distribute this information without the express written authority of Euroz. Disclaimer & Disclosure Euroz and its associates declare that they deal in securities as part of their securities business and consequently may have a relevant interest in the securities recommended herein (if any). This may include providing equity capital market services to their issuing company, hold a position in the securities, acting as principal or agent, or make a market therein and as such may effect transactions not consistent with the recommendation (if any) in this report. Euroz declares that it may have acted as an underwriter, arranger, co-arranger or advisor in equity capital raisings, and will have received a fee for its services, for any company mentioned within this report during the last 12 months. You should not act on any recommendation issued by Euroz without first consulting your investment advisor in order to ascertain whether the recommendation (if any) is appropriate, having regard to your investment objectives, financial situation and particular needs. Nothing in this report shall be construed as a solicitation to buy or sell a security, or to engage in or refrain from engaging in any transaction. Euroz believes that the information and advice contained herein is correct at the time of compilation, however we make no representation or warranty that it is accurate, complete, reliable or up to date, nor do we accept any obligation to correct or update the opinions in it. The opinions expressed are subject to change without notice. No member of Euroz accepts any liability whatsoever for any direct, indirect, consequential or other loss arising from any use of this material. We cannot guarantee that the integrity of this communication has been maintained, is free from errors, virus interception or interference. +61 8 9488 1400 International Toll Free (If calling to Euroz from the following Countries) Germany 0800 1800 554 Switzerland 0800 835 385 Hong Kong 800 900 936 Malaysia 1800 805 002 Singapore 800 6161 759 New Zealand 0800 441 271 USA 18 772 804 390 United Kingdom 08 000 929 851 Research Analysts Greg Chessell - Head of Research Gavin Allen - Industrials Analyst Jon Bishop - Resources Analyst Andrew Clayton - Resources Analyst Richard Hamersley - Industrials Analyst Michael Skinner - Resources Analyst Julian Lake - Associate Analyst +61 8 9488 1409 +61 8 9488 1413 +61 8 9488 1481 +61 8 9488 1427 +61 8 9488 1414 +61 8 9488 1431 +61 8 9488 1470 Institutional Sales Andrew McKenzie - Executive Chairman Rob Black - Managing Director David Curnow - Executive Director Jay Hughes - Executive Director Russell Kane - Executive Director Ben Laird - Executive Director Simon Yeo - Executive Director Peter Schwarzbach - Associate Director Timothy Bunney - Institutional Adviser Tom Ruello - Institutional Adviser +61 8 9488 1407 +61 8 9488 1423 +61 8 9488 1422 +61 8 9488 1406 +61 8 9488 1426 +61 8 9488 1429 +61 8 9488 1404 +61 8 9488 1492 +61 8 9488 1461 +61 8 9488 1420 Private Client Advisors James Mackie - Head of Private Clients Tony Kenny - Executive Director Tim Lyons - Executive Director Lucas Robinson - Executive Director Tim Weir - Executive Director Ben Statham - Associate Director Steve Grove - Associate Director Giles McCaw - Associate Director Cameron Murray - Associate Director Ryan Stewart - Associate Director Jonathan van Hazel - Associate Director Christian Zerovich - Associate Director Michael Bartley - Investment Adviser Brian Bates - Associate Director Paul Berson - Associate Director Michael Bowden - Investment Adviser Paul Cooper - Investment Adviser Nick Dempster - Investment Adviser Richard Gardner - Investment Adviser Phil Grant - Associate Director Jamie Mann - Investment Adviser Duncan Relf - Investment Adviser Brett Stapleton - Investment Adviser Steve Wood - Investment Adviser Nicholas Blakiston - Associate Adviser David Salmon - Associate Adviser +61 8 9488 1416 +61 8 9346 0302 +61 8 9346 0324 +61 8 9488 1424 +61 8 9346 0303 +61 8 9488 1417 +61 8 9488 1410 +61 8 9488 1462 +61 8 9488 1440 +61 8 9488 1441 +61 8 9488 1443 +61 8 9488 1436 +61 8 9346 0352 +61 8 9346 0314 +61 8 9346 0314 +61 8 9346 0307 +61 8 9346 0316 +61 8 9346 0357 +61 8 9488 1444 +61 8 9346 0306 +61 8 9346 0301 +61 8 9346 0322 +61 8 9488 1435 +61 8 9346 0305 +61 8 9488 1473 +61 8 9488 1419 All information and advice is confidential and for the private information of the person to whom it is provided and is provided without any responsibility or liability on any account whatsoever on the part of Euroz Securities Limited or any member or employee thereof. Refer to full disclaimer at the end of this document. 19 55 of 19 11

© Copyright 2026