Key Australian Industrial Transactions

Key Australian Industrial Transactions Savills Research February 2015 contents 03 Overview 04 Australian Industrial Property 05 Industrial Investment Market 06 Adelaide 08 S A Key Industrial Transactions 2014 10 Brisbane 12 Q LD Key Industrial Transactions 2014 16 Melbourne savills research team Our highly regarded research division is dedicated to understanding and giving in-depth insight into the office, industrial, retail, hotels and residential markets throughout Australia. 24 W A Key Industrial Transactions 2014 Savills provides free research reports on all major property markets, and some example papers include: We also provide in-depth consultancy services, ranging from tenant representation to property site selection for multinational businesses. Office Markets Retail Markets Residential Trends Industrial Markets International Markets Our research teams are highly qualified real estate professionals with comprehensive knowledge of property markets across Australia. The Savills Research & Consultancy team has years of experience, and is supported by our extensive agency, 18 V IC Key Industrial Transactions 2014 23 Perth property management and valuation professionals, who are highly regarded and respected along with Savills Research teams across the globe. Savills Research Western Australia Spotlight Perth Industrial October 2014 Highlights A total of 143,877 square metres of industrial space was reported leased in the 12 months to September 2014 Prime rents in Perth’s industrial core precinct range from $95 to $125 per square metre Approximately $435 million of industrial property was reported sold over the year Core land values range from $400 to $1,150 per square metre for assets up to 5,000 square metres A large amount of forecast new supply will likely lead to softening conditions in industrial capital and leasing markets over the next 12 to 18 months Prime rents in Perth’s core precinct range from $95 to $125 per square metre Savills Research For our latest reports, contact one of the team or visit savills.com.au/research Savills Research New South Wales Spotlight Sydney CBD Office October 2014 Highlights The latest numbers from PCA indicate that overall vacancy has decreased to 8.4%, down from 9% six months earlier Supply remains severely constrained over the shortterm, with less than 50,000 square metres of net supply due to complete in the second half of 2014 Full floor availability as at August 2014 is currently sitting at 13.8%, with nine available options for tenants >10,000 square metres Savills Research South Australia Spotlight Adelaide CBD Retail October 2014 Highlights Net absorption of 57,272 square metres was recorded in the 12 months to June 2014 Sales activity in the 12 months to September 2014 totalled $3.7 billion, up 42 % on the amount recorded in the prior 12 month period Indicative A Grade yields currently range from 6.25% to 7.00%, a decrease of 25 basis points at both ends of the range in the last 12 months Retail vacancy rates have risen in Rundle Mall to 3.5 percent, together with an increase to 5.7 percent in Rundle Street as at September 2014 Retail turnover in South Australia has risen by 3.0 percent (seasonally adjusted) in the year to July 2014 The Rundle Mall masterplan is expected to draw consumers back into the CBD once complete Clothing, footwear & personal accessory is the dominant tenant Savills Research Queensland Savills Research Victoria Spotlight Melbourne Industrial October 2014 Spotlight Brisbane CBD Office October 2014 Highlights group in Rundle Mall, with 55 percent of the tenant mix Economic benefits of the mining and defence industries are being offset by a lack of population growth and consumer spending in the State Recent reductions to interest rates are anticipated to further boost retail spending Retail turnover in South Australia has risen by 3 percent Savills Research Melbourne’s infrastructure continues to give it a competitive advantage A total of 681,5520 square metres A total of $1.45 billion of industrial property was sold in the year to September 2014 was reported leased in the year to September 2014 Land values range from $100 to $200 a for 216,858 square metres of reported leasing Investment yields for prime industrial Pre-commitment activity accounted Industrial rents generally range from $65 to $95 a square metre for prime industrial space square metre for land between 1 and 5 hectares property in a range of 7.00% to 8.00% Signs of a recovery in tenant demand are underway with significant increase in recent levels of leasing Institutions & Privates help provide investor demand not seen since the onset of the GFC Savills Research Highlights According to the Property Council Savills recorded approximately Savills recorded 79,185 square Leasing demand is significantly the vacancy rate in the Brisbane CBD was 14.7% at July 2014 metres of leasing activity for the 12 months to September 2014 Negative absorption of 44,129 square metres in the 12 months to June 2014 $1.030 billion of transactions in the 12 months to September 2014 down on historic averages The CBD property market continues to experience a high level of interest from investors of all categories 27 Sydney 28 N SW Key Industrial Transactions 2014 Download the Savills App for insights at your fingertips This information is general information only and is subject to change without notice. No representations or warranties of any nature whatsoever are given, intended or implied. Savills will not be liable for any omissions or errors. Savills will not be liable, including for negligence, for any direct, indirect, special, incidental or consequential losses or damages arising out of our in any way connected with use of any of this information. This information does not form part of or constitute an offer or contract. You should rely on your own enquiries about the accuracy of any information or materials. All images are only for illustrative purposes. This information must not be copied, reproduced or distributed without the prior written consent of Savills. 3 overview The calendar year 2014 marked a continuation of strong performance in investment markets with property sales turnover at record levels and strong gains made on local and global sharemarkets. Interest rates have stayed low, the search for yield and security remained strong however there has been more capital allocated for higher risk property, including development. The S&P500 index rose 12 percent to a record high reflecting cheap capital and a sense of economic recovery in the United States. This was further emphasised by the official end of quantitative easing. The Australian ASX AREIT Index rose 21 percent and the Australian dollar fell 9 percent against the US dollar. Nationally, over $24 billion of commercial property has been transacted and over 3.6 million square metres of industrial and office space has been reported leased which gives us confidence that the markets are operating normally. Commercial property yields in particular continue to look attractive. The Australian economy is being rebalanced as growth in mining investment softens. This means housing and retail should continue to lift with positive knock-on effects to industrial and office markets. As consumer confidence continues to rise, so should business confidence. As profit margins are restored, business decision making should gain momentum. Some State Governments will move into election mode and could be expected to provide some stimulus to parts of the economy providing further momentum to investment markets. China (even at a lower level of growth) and the United States are forecast to contribute positively to Australia’s economic outlook whilst Europe remains a drag. 4 australian industrial property Industrial property in Australia ranges from local service industrial such as plumbing and other wholesale trade supplies to heavy industry such as refining, tanning and petrochemicals to warehouse and logistics facilities, to manufacturing, assembly and food production. Some industrial properties also include research and development facilities, cold stores and highly specialised facilities. Savills Research estimates there to be some 100 million square metres of industrial floorspace in Australia, of which 40 million square metres is owner-occupied and 10 million square metres is small industrial units under 2,000 square metres. This leaves some 50 million square metres of leasable space, of which between 5 and 8 million square metres fall due for lease renewal each year. Savills captures between 2 and 2.5 million square metres of industrial leasing activity (largely excluding renewals) and so captures a large quantity of the types and style of demand to occupy industrial property. Whilst some types of manufacturing have been in decline in Australia for decades, the growth in the population, the number of cars on the roads and the spread of urban growth have seen large demand for local service industrial in every capital city. The need to get goods to the population has seen ongoing demand for warehousing and logistics facilities, and the advent and adoption of new technology has seen increasing demand for larger and more sophisticated industrial facilities. As the population grows, a great deal of manufacturing is required for housing and food production. First class infrastructure (road, rail and ports) as well as an abundance of appropriate land is required to meet this demand. Melbourne has been a standout performer in this regard over the past 15 years. Sydney has had to move further afield and continues to deal with infrastructure bottlenecks whilst Brisbane continues to make up ground. Adelaide has held steady whilst Perth has had problems providing enough supply to deal with the resources boom and a growing population. Authorities will need to carefully watch the amount of industrially zoned land in each city to ensure land shortages do not eventuate. 5 industrial investment market Savills recorded approximately $4.6 billion worth of industrial transactions in the 12 months to December 2014, up from $3.38 billion in the previous year, and up on the five year average ($3.1 billion). In the 12 months to December 2014, 223 properties were sold, up from the previous 12 months total of 172, and up on the five year average of 189. Australian institutional investors (Funds, Trusts and Syndicates) are increasingly active as flows to superannuation continue unabated. Private Investors continue to be attracted to industrial property investments nationally due to the high yields and generally long leases to single tenants in simple buildings. If the RBA is successful in stimulating growth in the non-resources side of the economy, then the industrial markets nationally should be the beneficiaries of stronger tenant demand. Signs of this were seen in the last six months of 2014 and Savills Research expects this trend to strengthen in 2015. Australian Industrial Industrial Property Sales by Price Range ($m) December 2004 to December 2014 $7,000 $6,000 $5,000 $4,000 $3,000 $2,000 $1,000 $0 Dec 04 Dec 05 Dec 06 Dec 07 Dec 08 Dec 09 Dec 10 Dec 11 <$10m $10m-$15m $15m-$20m $20m-$30m Dec 12 Dec 13 Dec 14 Source: Savills Research >$30m Australian Industrial Industrial Property Sales Buyer Profile (%) 12 Months to December 2014 19% 25% Trust Fund 1% Government 2% Undisclosed 8% Owner Occupier 18% 4% Private Investor Syndicate 9% Foreign Investor 14% Developer Source: Savills Research 6 adelaide Savills recorded approximately $337 million worth of reported industrial property transactions in the 12 months to December 2014, up from $231 million in the previous year, and up on the five year average ($238 million). In the 12 months to December 2014, 54 properties were sold, down from the previous 12 months total of 60, and down on the five year average of 67. The 'Fund' purchaser category was the most active in the investment market for the year ended December 2014, purchasing 45 percent of stock reported sold. However, the Private Investor category recorded the most transactions (23). The last 12 months saw the number of transactions fall from 60 to 54. Sales volumes have been strong in the years following the GFC and 2014 saw a firm continuation of this trend. Sales volumes below $10 million continue to be a prominent part of the industrial market activity, with 49 transactions accounting for $114 million worth of sales recorded over the last 12 months. Traditionally, there has been a significant difference between the lower and higher end sales volumes, reflecting strong demand for smaller scale investment opportunities by local private investors and owner occupiers. Although there has been a rise in interest from institutional investors during the last 12 months, there remains limited opportunity to satisfy this demand. Hence private investors and owner occupiers are expected to remain as the predominant buyer groups over the medium term. Prime industrial yields as at December 2014 are estimated to range between 8.25 percent and 9.00 percent in the North West, and between 8.50 percent and 9.50 percent in the North. The average yield for investment properties in the North West in the quarter to December 2014 is 8.63 percent, no change over the year. Prime industrial capital values as at December 2014 are estimated to range from $778 to $1,333 per square metre for buildings in the North West, and between $632 and $1,000 per square metre for buildings in the North. Average capital values for properties in the North West are $1,056 per square metre, a 9.1 percent increase over the year. Adelaide Industrial Metropolitan Industrial Sales by Price Range ($m) (>$1m) December 2004 to December 2014 $500 $450 $400 $350 $300 $250 $200 $150 $100 $50 $0 Dec 04 Dec 05 Dec 06 Dec 07 Dec 08 Dec 09 Dec 10 Dec 11 $1m-$10m $10m-$15m $15m-$20m $20m-$30m >$30m Dec 12 Dec 13 Dec 14 Source: Savills Research 7 8 SA key industrial transactions 2014 [2] Netley Commercial Park, 300 Richmond Road, Netley Price: $30.25 million Date: May 2014 Initial Yield: 7.27% Market Yield: 9.18% Rate per sq m of GLA: $883 Vendor: Government of South Australia Purchaser: [1] [1] C oles Distribution Centre, 2 Sturton Road, Edinburgh Price: $153.00 million Date: June 2014 Initial Yield: 7.40% Market Yield: 7.50% Rate per sq m of GLA: $2,252 Vendor: Goodman Group Purchaser: Charter Hall Comment: The distribution centre provides two-storey offices to the front (eastern side) of the building together with two satellite offices to the rear (western side) of the building. The warehouse features high clearance accommodation separated into three main sections being ambient storage (35,765 square metres), chiller storage (17,440 square metres) and a freezer (8,071 square metres). Significant canopies and loading docks are also provided. Harmony Corp Comment: The property was originally developed in the 1970s and has been upgraded over time. Improvements comprise numerous individual office buildings of 12,173 square metres (36 percent of GLA) together with warehousing and storage sheds totalling 22,087 square metres. Significant hardstand and car parking is located to the western end of the site and accounts for the relatively low site coverage of circa 25 percent. The property sold with a leaseback to the Government of South Australia for 10 years with two further five year rights of renewal. Commencing rental is $3,800,000 per annum gross ($111/sq m) with the Lessor responsible for all property outgoings. Rent is reviewed annually to fixed 3.0 percent reviews and to market on lease renewal. 9 [3] [4] [5] [3] 1 13 Ledger Road, Beverley [4] 7 -19 Tikalara Street, Regency Park [5] D evelopment Site, Gallipoli Drive, Regency Park Price: $7.33 million Price: $3.90 million Price: $14.40 million Date: June 2014 Date: July 2014 Date: January 2014 Initial Yield: 11.32% Initial Yield: VP Initial Yield: N/A Market Yield: 9.70% Market Yield: Market Yield: N/A VP Rate per sq m of GLA: $838 Rate per sq m of GLA: $841 Rate per sq m of land: $177 Vendor: Motor Accident Commission of South Australia Vendor: BWP Management Vendor: Purchaser: ARB Corporation Purchaser: Aldi Purchaser: Lynair Investments Pty Ltd Comment: Improvements comprise a large high clearance office warehouse development incorporating concrete sealed driveways and hardstand space together with on-site parking areas. The property is leased to Paperlinx Australia Pty Ltd on a five year term expiring 14 September 2014. The lease is structured on a net basis with the Lessee responsible for all outgoings including state land tax. Comment: Improvements consist of air conditioned offices with open plan and partitioned workspaces, staff room and amenities of 794 square metres and showroom of 153 square metres (947 square metres combined reflecting 20 percent of GLA), together with a warehouse of 3,691 square metres. The warehouse is of brick dado construction and has internal clearances of 7.0 to 8.7 metres. Access is via four high clearance roller doors to the western side covered by two external canopies of 290 square metres, with a further roller door to the southern side of the building adjacent to the showroom. Asciano Services Comment: A 30,000 square metre distribution centre is to be built for Aldi to service their South Australian retail operations. Completion expected in 2016. The site is approximately 81,440 square metres. 10 brisbane Savills recorded approximately $595 million worth of reported industrial property transactions in the 12 months to December 2014, up from $511 million in the previous year, and up on the five year average $559 million. In the 12 months to December 2014, 69 properties were sold, up from the previous 12 months total of 62, and down on the five year average of 73. The 'Fund' purchaser category was the most active in the investment market for the year ended December 2014, purchasing 26 percent of stock reported sold. However, the Private Investor category recorded the most transactions (25). Prime industrial yields as at December 2014 are estimated to range between 7.00 percent and 8.00 percent in the Southside, and between 7.25 percent and 8.00 percent in the Northside. The average yield for investment properties in the Southside in the quarter to December 2014 is 7.50 percent, a 50 basis point firming over the year. Prime industrial capital values as at December 2014 are estimated to range from $1,313 to $1,857 per square metre for buildings in the Southside, and between $1,375 and $1,793 per square metre for buildings in the Northside. Average capital values for properties in the Southside are $1,585 per square metre, an 11.5 percent increase over the year. Brisbane Industrial Metropolitan Industrial Sales by Price Range ($m) December 2004 to December 2014 $1,400 $1,200 $1,000 $800 $600 $400 $200 $0 Dec 04 Dec 05 Dec 06 Dec 07 Dec 08 Dec 09 Dec 10 Dec 11 $2m-$10m $10m-$15m $15m-$20m $20m-$30m >$30m Dec 12 Dec 13 Dec 14 Source: Savills Research 11 “Savills recorded $4.6 billion of sales with active institutional buyers.” Tony Crabb, Savills Research [8] 1425 Boundary Road, Wacol 12 QLD key industrial transactions 2014 [1] 163-183 Viking Drive, Wacol Price: $37.96 million Date: March 2014 Initial Yield: 7.73% Market Yield: 7.73% Rate per sq m of GLA: $1,472 Vendor: Dexus Purchaser: Propertylink Comment: A circa 2013 constructed complex of three detached industrial buildings over two adjoining allotments which sold as a single asset. The buildings are all of tilt concrete panel construction to the warehouses, each with an office component and awning areas. Two buildings have the benefit of direct street frontage while the third building is at the rear with shared access to a common driveway. Note: The property was bought by Propertylink, a Sydney based investor and was conditional upon the purchase of a second multi-tenant property at 57-101 Balham Road, Archerfield. The combined purchase price $62.27 million, indicating an equated market yield of 8.64 percent and a sale rate of $1,239 per square metre. [2] [2] 3 3-37 Mica Street, Carole Park Price: $23.88 million Date: August 2014 Initial Yield: 8.00% Market Yield: 8.00% Rate per sq m of GLA: $1,333 Vendor: Green’s Intellectual Holdings Pty Ltd Purchaser: 360 Capital Industrial Fund Comment: A slightly irregular shaped parcel of land improved by a facility providing accommodation suitable for food production, packaging, storage and ancillary offices. Sold on a ‘sale and leaseback arrangement’ with a 15 year lease and fixed annual reviews of 3.5 percent. All outgoings are recoverable. 13 [3] [4] [5] [3] L ots 1, 2 & 3, 2828-2840 Ipswich Road, Darra [4] 7 31 Boundary Road, Darra [5] 248 Fleming Road, Hemmant Price: $16.70 million Price: $15.46 million Price: $11.50 million Date: May 2014 Date: May 2014 Date: July 2014 Initial Yield: 8.93% Initial Yield: 8.09% Initial Yield: 8.30% Market Yield: 8.51% Market Yield: 8.09% Market Yield: 8.30% Rate per sq m of GLA: $1,809 Rate per sq m of GLA: $1,564 Rate per sq m of GLA: $2,209 Vendor: Action Property (Qld) Pty Ltd Vendor: Bective Station Pty Ltd Vendor: Redbank Pty Ltd and Huskie Pty Ltd Purchaser: Purchaser: APPF Industrial Comment: A circa 1990s industrial building, built over two stages, of dado tilt concrete panel / portal steel frame and metal clad construction on a 25,920 square metre site. The property has been built over two levels with the rear section below road height. The building is strata titled comprising three lots but sold in one line. Sold, fully leased in a reported off-market transaction. Fife Capital Comment: A circa 2001 built industrial facility, purpose built for the sitting tenant. It is of tilt concrete panel construction and includes a two-level office area with warehouse adjoining the rear on a 17,320 square metre site. The internal clearance is 10 metres with multiple electric door access and awning along the eastern side (not included in the lettable area). Leased, with a remaining term of 4.66 years, to an international logistics company. Purchaser: Indigenous Business Australia Comment: A regular shaped site of 10,190 square metres improved by two tilt concrete panel buildings utilised as food distribution facilities. The eastern building was constructed in 1995 and the western structure was completed in 2013. Combined, the property provides a modern cold store, freezer storage and transport facility. Sold, fully leased on a leaseback arrangement with a term of 11.9 years. 14 QLD key industrial transactions 2014 (cont.) [6] [7] [6] 70 Fulcrum Street, Richlands [7] 6 80 MacArthur Ave Central, Pinkenba Price: $15.60 million Price: $9.40 million Date: September 2014 Date: January 2014 Initial Yield: 9.98% Initial Yield: 8.88% Market Yield: 8.76% Market Yield: 8.36% Rate per sq m of GLA: $1,002 Rate per sq m of GLA: $2,508 Vendor: Hills Industries Ltd Vendor: Afk Investments Purchaser: APPF Industrial Purchaser: Leopold Station Comment: Office and warehouse constructed around 1994 with an extension to its western side circa 2001. It comprises a two-level office and an all-weather drive through awning area. The warehouse includes the extension and as such, it is not clear span, although it has multiple roller door access points for drive-through access (no docks). Has full drive-around building and good parking on the 36,760 square metre site. Comment: A circa 2004 constructed industrial building of masonry and metal clad dado construction comprising a two-level office component with adjoining warehouse area which has multiple roller door access points along both sides on a 13,270 square metre site. The property includes a hardstand area estimated at 5,250 square metres. Sold, fully leased to an auto auction house with 8.66 years remaining on the lease. 15 [8] [9] [10] [8] 1425 Boundary Road, Wacol [9] 125 Axis Place, Larapinta Price: $9.40 million Price: $8.25 million Price: $5.30 million Date: May 2014 Date: April 2014 Date: November 2014 Initial Yield: 8.33% Initial Yield: 7.62% Initial Yield: 7.20% Market Yield: 8.25% Market Yield: 7.62% Market Yield: 7.20% Rate per sq m of GLA: $1,689 Rate per sq m of GLA: $3,930 Rate per sq m of GLA: $1,601 Vendor: Makybe Pty Ltd and Project Pty Ltd Vendor: Radius Industrial Pty Ltd Purchaser: Purchaser: Geylang Holdings Pty Ltd Vendor: Beyville Pty Ltd, Kathco Pty Ltd and Polgrove Pty Ltd Makro Pty Ltd Comment: A circa 2009 built industrial complex of tilt concrete panel construction comprising two detached buildings on the one site of 13,600 square metres. Each building with two-storey office accommodation and warehousing with multiple at grade roller doors and nine metre clearance. Sold, fully tenanted across four areas. Comment: Sold as land 15,820 square metres with a design and construct approved and a 10 year lease pre-commitment to a private transport company which has been in operation since 1922. The building to be developed will be a modern dado style providing two levels of office, a rear warehouse area and a particularly large awning. The property sold as a site for $4.0 million ($253 per square metre) with the balance of the price representing a construction contract for the proposed building. [10] 18-28 Calcium Court, Crestmead Purchaser: Private Investor Comment: A recently completed (2014) industrial complex providing office and warehouse accommodation. The office is two levels with rear adjoining warehouse providing clear span and nine metre internal clearance, 10t travelling crane (6.5m under hook) and nine electric container height roller doors on a 5,994 square metre site. Sold, with a new five year lease to an international farm machinery company. 16 melbourne Savills recorded approximately $1,174 million worth of reported industrial property transactions in the 12 months to December 2014. This is up from $599 million in the previous year, and up on the five year average ($820 million). In the 12 months to December 2014, 103 properties were sold, up from the previous 12 months total of 74, and up on the five year average of 94. The 'Private Investor' purchaser category was the most active in the investment market for the year ended December 2014, purchasing 30 percent of stock reported sold. Similarly, the Private Investor category recorded the most transactions (56). Prime industrial yields as at December 2014 are estimated to range between 7.00 percent and 8.00 percent in the North West, and between 7.00 percent and 8.00 percent in the South East. The average yield for investment properties in the North West in the quarter to December 2014 is 7.50 percent, a 62 basis point firming over the year. Prime industrial capital values as at December 2014 are estimated to range from $838 to $1,143 per square metre for buildings in the North West, and between $875 and $1,286 per square metre for buildings in the South East. Average capital values for properties in the North West are $980 per square metre, an 8.3 percent increase over the year. Melbourne Industrial Metropolitan Industrial Sales by Price Range ($m) (>$2m) December 2004 to December 2014 $2,000 $1,800 $1,600 $1,400 $1,200 $1,000 $800 $600 $400 $200 $0 Dec 04 Dec 05 Dec 06 Dec 07 Dec 08 Dec 09 Dec 10 Dec 11 $2m-$10m $10m-$15m $15m-$20m $20m-$30m >$30m Dec 12 Dec 13 Dec 14 Source: Savills Research 17 18 VIC key industrial transactions 2014 [2] [1] K mart Distribution Centre, Banfield Court, Truganina [2] Murray Goulburn, 85 William Angliss Drive, Laverton North Price: $95.00 million Price: $92.60 million Date: December 2014 Date: January 2014 Initial Yield:6.44% Initial Yield: 6.75% Market Yield: Market Yield: 6.75% N/A Rate per sq m of GLA: $1,235 Rate per sq m of GLA: $1,535 Vendor: Vendor: Goodman Group Murray Goulburn Purchaser:Invesco Purchaser: ISPT Comment: Situated approximately one kilometre from the Princes Freeway diamond key entry ramp and 18 kilometres west of the Port of Melbourne, the site is a prime industrial location. The property was completed in 2011 with a 15 year lease to Kmart with fixed 3 percent increases. The property comprises warehouse, office space and hardstand. Comment: The property comprises a large industrial facility built circa 2003. The improvements comprise office areas and multiple industrial buildings, including high bay warehousing, chiller area, pallet stores and semi enclosed canopies. The property also includes large hardstand areas and surplus land areas to the north eastern spur of the site. The property is leased to Murray Goulburn Co-Operative Co. Ltd for an initial term of 20 years (on a leaseback arrangement) from December 2013. There are three further terms, the first for 10 years and the remaining two for 5 years. 19 [4] [3] M elbourne Wholesale Markets, Cooper Street, Epping [4] 2 15 Browns Road, Noble Park Price: $77.40 million Price: $21.78 million July 2014 Date: August 2014 Date: Initial Yield: 9.60% Initial Yield: 9.83% Market Yield: N/A Market Yield: 10.84% Rate per sq m of GLA: $1,018 Rate per sq m of land: $358 Vendor: Hansen Yuncken and State Government Vendor: Undisclosed Syndicate Purchaser: Propertylink Purchaser: Comment: Five separate warehouse buildings interconnected to the Markets trading floor. Heads of Agreement and Agreements for Lease includes 41 tenants. A diversified tenant mix spread over about 76,070 square metres with no tenant holding more than 4 percent of the total space. Leases of between 5 and 10 years providing a WALE of 5.4 years at completion in second quarter 2015. Comment: Multi-tenanted office/ warehouse including two low clearance warehouses of 19,310 square metres, modern warehouse of 22,0400 square metres and two level office/showroom of 1,800 square metres. On-site car parking for more than 400 vehicles. Land area 5.814 hectares. Aspen Group [5] G ateway Business Park, 495-501 Blackburn Road, Mount Waverley Price: $63.00 million Date: September 2014 Initial Yield: 8.64% Market Yield: N/A Rate per sq m of GLA: $2,656 Vendor: AMP Capital Purchaser: EG Funds Management Comment: High tech business park located 18 kilometres southeast of the Melbourne CBD. Fully leased to Vision Properties and Metricon Homes with a WALE of 5.4 years. 20 VIC key industrial transactions 2014 (cont.) [6] [7] [8] [6] 254-294 Wellington Road, Mulgrave [7] 13-19 William Angliss Drive, Laverton North [8] 32-58 William Angliss Drive, Laverton North Price: $62.00 million Price: $49.00 million Price: $43.50 million Date: February 2014 Date: September 2014 Date: September 2014 Initial Yield: 6.94% Initial Yield: 7.29% Initial Yield: 8.03% Market Yield: 7.51% Market Yield: 7.29% Market Yield: 8.08% Rate per sq m of GLA: $1,852 Rate per sq m of GLA: $873 Rate per sq m of GLA: $941 Vendor: Peters Ice Cream Vendor: Goodman Group Vendor: Goodman Group Purchaser: Charter Hall Purchaser: AMP Capital Purchaser: Charter Hall Comment: Sale and leaseback to Peters Ice Cream. The 14.4 hectare site includes 5.5 hectares of surplus land. The property contains a 1970s ice cream manufacturing facility with low site coverage. There is a development clause allowing for the construction of a new office building. Comment: The property comprises a distribution centre with a total of three warehouses, one of which adjoins associated offices. The three warehouse buildings each provide a similar standard of accommodation being typically high clearance, steel portal frame warehouses with internal columns. All warehouses have good loading access and associated canopy coverage. A development parcel of land which is approximately 15,608 square metres is located to the rear of the site with Dohertys Road frontage. ACI Operations Pty Ltd occupy the property for a seventeen (17) year term which expires 2 October 2019 with the tenant having one (1) further option period of three (3) years. Comment: The property comprises of a distribution centre consisting of four warehouses, two of which are adjoined units. The warehouses have two RSD’s with associated canopy area providing covered loading. The two larger warehouse facilities, located to the north eastern corner of the site and western site boundary fronting William Angliss Drive, generally comprise modern high clearance steel portal frame warehouse accommodation with associated offices. The warehouses feature good loading access and canopy coverage. The adjoining units are leased to Australian Postal Corporation and Silver Chef Limited for terms of 11 years (commenced September 2004) and 21 [10] 7 years (commenced September 2013) respectively. The leases include one further option term of 3 years (Australia Post) and 5 years (Silver Chef). The two larger warehouse facilities are leased to Fast Line International Pty Ltd and Kimberly-Clark Australia Limited for terms of 12 years (commenced November 2005) and five years (commenced February 2014) respectively. The leases include one option term of 6 years (Fast Line) and 5 years (Kimberly-Clark). [9] 324-332 Frankston-Dandenong Road, Dandenong South [10] 28-38 Salta Drive, Altona North Price: $24.60 million Price: $14.50 million Date: April 2014 Date: August 2014 Initial Yield: 9.40% Initial Yield: Vacant Possession Market Yield: 8.75% Market Yield: Vacant Possession Rate per sq m of GLA: $847 Rate per sq m of GLA: $608 Vendor: Vendor: Centuria Direct Property Fund Primewest Purchaser: Australian Industrial REIT Comment: The property was sold as part of a national portfolio of six industrial properties. The property provides three highly-specified office and warehouse facilities with drive around access and extensive canopy areas. The property is located approximately 33 kilometres south east of the Melbourne CBD. A 10 year lease to Gerard Corporation expires in December 2016. Gerard Corporation has sublet all three buildings on the property to three separate tenants. Purchaser: Private Investor Comment: The property comprises a modern office/warehouse facility featuring a medium clearance three bay warehouse with a single level office attached to the rear. The warehouse is of steel portal frame construction with loading access available via multiple at-grade RSD’s to the northern and southern warehouse elevations. Canopy coverage is provided to the southern warehouse elevation. On-site car parking and container rated hardstand is located to the north western corner of the site. 22 23 perth Savills recorded approximately $355 million worth of reported industrial property transactions in the 12 months to December 2014, down from $818 million in the previous year, and down on the five year average ($618 million). In the 12 months to December 2014, 56 properties were sold, down from the previous 12 months total of 205, and down on the five year average of 135. The 'Fund' purchaser category was the most active in the investment market for the year ended December 2014, purchasing 31 percent of stock reported sold. In the 12 months to December 2014, approximately 58 percent of the total value of industrial properties reported transacted in Perth were valued in the range $1-$10 million. Over the same period $111 million worth of reported transactions occurred in the ‘North’ precinct, accounting for 32 percent of the industrial sales. In the year prior, the ‘Core’ recorded the highest value of transactions, worth $286 million. The 'Trust' purchaser category was the most active in the investment market for the year ended December 2014, purchasing 30 percent or $104 million of stock reported sold, followed closely by ‘Private Investors’ at 25 percent ($88 million). Prime industrial yields as at December 2014 are estimated to range between 7.25 percent and 8.75 percent in the North, and between 7.75 percent and 9.00 percent in the South. The average yield for investment properties in the North in the quarter to December 2014 is 8.00 percent, a 38 basis point firming over the year. Prime industrial capital values as at December 2014 are estimated to range from $971 to $1,517 per square metre for buildings in the North, and between $833 and $1,355 per square metre for buildings in the South. Average capital values for properties in the North are $1,244 per square metre, a 3 percent fall over the year. Perth Industrial Metropolitan Industrial Sales by Price Range ($m) (>$1m) December 2004 to December 2014 $900 $800 $700 $600 $500 $400 $300 $200 $100 $0 Dec 04 Dec 05 Dec 06 Dec 07 Dec 08 Dec 09 Dec 10 Dec 11 $1m-$10m $10m-$15m $15m-$20m $20m-$30m >$30m Dec 12 Dec 13 Dec 14 Source: Savills Research 24 WA key industrial transactions 2014 [1] [2] [1] B rownes Food, 22 Geddes Street, Balcatta [2] 2 94 Treasure Road, Welshpool Price: $53.50 million Price: $8.50 million Date: May 2014 Date: May 2014 Initial Yield: 7.50% Initial Yield: 8.47% Market Yield: 7.60% Market Yield: 8.47% Rate per sq m of GLA: $1,417 Rate per sq m of GLA: $1,305 Vendor: Brownes Food Operations Vendor: W and L A Mais Family Trust Purchaser: Stockland Purchaser: Comment: The property is a large purpose built industrial facility comprising a large dairy processing, logistics and distribution facility complete with administration offices, amenities, fully insulated and cooled production, storage, large freezer areas and ambient warehousing. The sale was based on a 20 year leaseback arrangement with fixed 3.25 percent annual reviews and two further 10 year options available to the tenant. Comment: The property comprises a large industrial land holding within the heart of Welshpool being improved with two separate buildings. The main building comprises an early 1990s distribution facility of 4,380 square metres comprising two levels of office internally within the warehouse which has a truss height of eight metres. The property was sold on a leaseback to the MIAS Bakery (occupies the full site) on a 10 year lease term plus a 5 year option period. Reviews are fixed to 3.5 percent with market every five years. Private Investor 25 [3] [4] [5] [3] 1 03 Welshpool Road, Welshpool [4] 2 3 Selkis Road, Bibra Lake Price: $17.00 million Price: $15.80 million Price: $15.50 million Date: June 2014 Date: February 2014 Date: February 2014 Initial Yield: 8.75% Initial Yield: 9.18% Initial Yield: 9.03% Market Yield: 8.75% Market Yield: 9.18% Market Yield: 9.03% Rate per sq m of GLA: $3,240 Rate per sq m of GLA: $866 Rate per sq m of GLA: $944 Vendor: Milne AgriGroup Vendor: Vendor: Purchaser: Charter Hall Purchaser: Australian Industrial REIT Purchaser: Australian Industrial REIT Comment: The property comprises an office/warehouse facility, zoned Industry and situated in the middle of the Phoenix Business Park in Bibra Lake. Existing improvements comprise of a major workshop/warehouse facility used in the manufacture and distribution of cardboard packaging. The property is leased to Amcor Packaging for a 5 year period at a passing rent of $1,450,230 or $80/sq m. The lease has a further two 5 year options remaining and the passing rent was considered to be reflective of market rent. The property was sold as part of a national portfolio of six industrial properties. Comment: The subject comprises two workshops on a fully developed 3.2468 hectare lot. The workshops are located at the front and rear of the property, with a two level office constructed within the rear workshop. The property was released to CBI and Kentz for a five year period at a passing rent of $1,400,000 or $85/sq m. The property was sold as part of a national portfolio of six industrial properties. Comment: The sale of the subject property is subject to a triple net leaseback arrangement with Milne AgriGroup for a period of 10 years. Initial passing rent is $1,487,500 per annum with reviews annually to 3.50 percent. The lease is to incorporate a ‘makegood’ provision which will obligate Milne, at lease expiry, to demolish all improvements and handover a cleared site in an uncontaminated state. Primewest [5] 9 9 Quill Way, Henderson Primewest 26 27 sydney Savills recorded approximately $2.2 billion worth of industrial transactions in the 12 months to December 2014, up from $1.5 billion in the previous year, and up on the five year average ($1.4 billion). In the 12 months to December 2014, 100 properties were sold, up from the previous 12 months total of 51, and up on the five year average of 63. The 'Fund' purchaser category was the most active in the investment market for the year ended December 2014, purchasing 25 percent of stock reported sold. However, the Private Investor category recorded the most transactions (29). Prime industrial yields ranged between 7.00 percent and 7.75 percent in South Sydney, between 7.00 percent and 7.75 percent in the West, and between 8.00 percent and 9.25 percent on Sydney's North Shore. When compared to the 12 months prior, prime yields firmed 37.5 basis points. Prime industrial capital values in December 2014 range between $1,625 per square metre and $2,375 per square metre net in South Sydney, between $1,290 per square metre and $1,714 per square metre net in the West, and between $1,459 per square metre and $2,375 per square metre net on Sydney's North Shore. When compared to the 12 months prior, prime capital values in South Sydney remained constant. Sydney Industrial Metropolitan Industrial Sales by Price Range ($m) (>$5m) December 2004 to December 2014 $3,000 $2,500 $2,000 $1,500 $1,000 $500 $0 Dec 04 Dec 05 Dec 06 Dec 07 Dec 08 Dec 09 Dec 10 Dec 11 $5m-$10m $10m-$15m $15m-$20m $20m-$30m >$30m Dec 12 Dec 13 Dec 14 Source: Savills Research 28 NSW key industrial transactions 2014 [1] 9 -10 John Morphett Place, Erskine Park [2] 8 Brabham Drive, Huntingwood Price: $61,716,500 Price: $20.10 million Date: October 2014 Date: November 2014 Initial Yield: 6.99% Initial Yield: 7.10% Market Yield: Market Yield: 6.88% Rate per sq m of GLA: $1,463 6.98% [3] 133-145 Lenore Lane, Erskine Park Price: $77.70 million (approximately) Date: November 2014 Initial Yield: 6.25% Market Yield: N/A Rate per sq m of GLA: $1,655 Vendor: Washington H. Soul Pattinson Purchaser: Logos on behalf of KWAP Comment: The property is located in a prime Western Sydney industrial logistics location and comprises a nearly new warehouse and logistics facility of 44,702 square metres (GLA) which includes approximately 977 square metres office areas and full drive around access. At the time of sale the property was leased to Super Retail Group for a further 14 years. [4] 3 00 Coward Street, Mascot Rate per sq m of GLA: $2,150 Price: $22.50 million (approximately) Vendor: Valad Vendor: Altis Date: 2014 Purchaser: M&G Real Estate Purchaser: Initial Yield: 6.43% Market Yield: N/A Comment: The property is located in a prime Western Sydney industrial logistics location and comprises a new generic warehouse and logistics facility of 42,186 square metres (GLA) which includes a breezeway of 5,026 square metres. At the time of sale the property was leased to Bluestar Logistics for a further 11 years with rent reviews fixed to 3.5 percent per annum. Mirvac Group Comment: The property is located in an established Western Sydney industrial location and comprises a new crossdock warehouse and logistics facility of 6,048 square metres (GLA) with awning and hardstand areas. At the time of sale the property was leased to BagTrans Pty Ltd for a further 9.33 years with rent reviewed annually to CPI. The property was purchased by Mirvac as part of the Altis Portfolio. Rate per sq m of GLA: $1,655 Vendor: Bricktop Purchaser: Private Investor Comment: The property is located in a prime South Sydney industrial logistics location close to Sydney Airport and comprises a refurbished warehouse of 10,420 square metres (GLA) currently used for food production purposes. At the time of sale the property was leased to GateGourmet for a further 8 years. 29 [5] [6] [7] [5] 1 Johnson Road, Campbelltown [6] 4 3-49 Stennett Road, Ingleburn [7] Reconciliation Drive, Greystanes Price: $19.40 million Price: $72.50 million Price: $50.50 million Date: June 2014 Date: June 2014 Date: June 2014 Initial Yield: 7.80% Initial Yield: 7.17% Initial Yield: N/A Market Yield: 8.03% Market Yield: N/A Market Yield: N/A Rate per sq m of GLA: $1,165 Rate per sq m of land: $259 Vendor: Hyperion Property Syndicate Vendor: Asciano Property Operations Rate per sq m of land: $190 (ex site works) Purchaser: Purchaser: Stockland Purchaser: Comment: The property comprises of an approximately 28 hectare industrial holding in South Western Sydney and is configured in three sections, identified as Areas A, B & C. Area A is the north eastern section of the site and is bounded by Stennett Road and the Main Southern Railway Line. Area B is the middle section of the site with frontage to Stennett Road and is of an irregular shape. Area C is the western section of the site and includes an office/warehouse building, workshop and fuel station. The property is located in Ingleburn, an established South Western suburb of Sydney, situated approximately 46 kilometres southwest by road from Sydney CBD and approximately 10 kilometres south of the Liverpool commercial precinct. Comment: The property is in a prime Western Sydney industrial logistics location. Quarrywest comprises 25.65 hectares of industrial development land located on Reconciliation Road in a core industrial market in Western Sydney and with access to key infrastructure. Quarrywest will provide approximately 115,000 square metres of prime space. The site is part of the former Prospect Quarry which until late 2007 had been in operation for more than 100 years. The site will undergo extensive civil works in preparation for development. Heathley Group Comment: The property is located on the corner of Johnson and Badgally Roads at Campbelltown, a secondary industrial suburb in South Western Sydney. The M5 Motorway is within three kilometres whilst the M5/M7 Motorway interchange is within 14 kilometres to the north. The site is improved with a freestanding office/ warehouse facility of prefabricated concrete slab construction. The building has internal clearance of 10.4 to 12.9 metres with a small (circa 5.7 percent of GLA) single level office component which provides a reception area, meeting rooms and open plan office areas. An ESFR system is fitted throughout the warehouse and part of the office. Vendor: Boral Dexus/Future Fund 30 NSW key industrial transactions 2014 (cont.) [8] [9] [10] [8] 1 Inglis Road, Ingleburn [9] 42 Airds Road, Minto [10] 4 4 Biloela Street, Villawood Price: $13.80 million Price: $12.60 million Price: $19.50 million Date: February 2014 Date: May 2014 Date: December 2014 Initial Yield: 7.66% Initial Yield: 8.44% Market Yield: 7.95% Market Yield: N/A Initial Yield: 11.59% (ex surplus land) Market Yield: 9.31% Rate per sq m of GLA: $774 Vendor: AMP Capital Rate per sq m of GLA: $1,170 Rate per sq m of GLA: $1,231 Vendor: Hyperion Property Syndicate Vendor: Purchaser: Quintessential Purchaser: Comment: The property is located at Ingleburn, an established South Western suburb of Sydney, situated approximately five kilometres south of the Prestons on ramps to the M5 and M7 Motorways and approximately 46 kilometres southwest by road from the Sydney CBD. Ingleburn is considered a secondary locality. The site is improved with a purpose built office/warehouse facility on a site area of 65,690 square metres. There is surplus land to the west of 20,070 square metres that is largely cleared and generally level, and a separate component of 25,235 square metres to the north that is undulating with some existing vegetation. Development approvals have been granted (current to April 2014 over the western parcel only) for the construction of industrial premises. Comment: The building was purpose built for distribution, however is currently utilised for manufacturing by the current tenant. There is an awning of 3,303 square metres running the length of the building’s northern alignment. An ESFR system is in place throughout the building and awning. Four on-grade roller shutter doors are located beneath the awning, with a further two doors to the rear of the building. Circulation is good, with full drive around access available. Additional hardstand is provided to the rear of the property, with circa 1,900 square metres provided in addition to conventional cartilage. The property sold fully leased to VIP Plastic Packaging, who are a subsidiary of the publicly listed Pact Group. The existing lease was renewed as at 1 January 2014 for a 6 year term. Charter Hall Realgrace Pty Ltd Purchaser: Altis Property Partners Comment: The property is located in one of Sydney’s most established industrial precincts, approximately midway between Parramatta central business district and Liverpool central business district. The property is wellsituated in relation to transport routes, with direct access to Woodville Road (within one kilometre to the south) and in turn the M4 Motorway and M5 Motorways, which are both within seven kilometres of the property. This modern facility was developed in 1993 by Industrial Constructions Pty Ltd as a high clearance warehouse facility with an office and assembly building at the front for DAS Distribution. It is currently occupied by Custom Coaches for the repair and manufacturing of buses and coaches until June 2017. savills key contacts Australian Capital Territory Research Simon Hemphill +61 (0) 2 8215 8892 [email protected] Valuations Phil Harding +61 (0) 2 6221 8293 [email protected] Industrial & Business Services Theo Dimarhos +61 (0) 2 6221 8275 [email protected] Project Management Mitchell Thomas +61 (0) 2 6221 8294 [email protected] Asset Management Phil Pearsall +61 (0) 2 8215 8874 [email protected] Project Management David Nicholas +61 (0) 2 8913 4813 [email protected] Queensland Research Paul Day +61 (0) 7 3002 8860 [email protected] Valuations Leigh Atkinson +61 (0) 7 3002 8852 [email protected] Industrial & Business Services Callum Stenson New South Wales +61 (0) 7 3002 8832 Research [email protected] Simon Hemphill +61 (0) 2 8215 8892 Asset Management [email protected] Chris Ainsworth Valuations Russell Nicolson +61 (0) 2 8215 8987 [email protected] Industrial & Business Services Darren Curry +61 (0) 2 9761 1304 [email protected] Metro & Regional Sales Robert Lowe +61 (0) 2 8215 8841 [email protected] Sales & Investment Greg Cohen +61 (0) 2 8215 8836 [email protected] +61 (0) 7 3002 8831 [email protected] Project Management Gary Finnegan +61 (0) 7 3018 6703 [email protected] Sales & Investment Anthony Ott +61 (0) 7 3002 8904 [email protected] Sunshine Coast Dustin Welch +61 (0) 7 5313 7519 [email protected] Gold Coast Kevin Carmody +61 (0) 7 5509 1700 [email protected] South Australia Research Tony Crabb +61 (0) 3 8686 8012 [email protected] Valuations Alastair Johnston +61 (0) 8 8237 5041 [email protected] Industrial Sales Steve Bobridge +61 (0) 8 8237 5015 [email protected] Industrial Leasing Geoff Shuttleworth +61 (0) 8 8237 5017 [email protected] Industrial Investments Ben Hegerty +61 (0) 3 8686 8074 [email protected] Valuations Ross Smillie +61 (0) 3 8686 8068 [email protected] Asset Management Sarah Coster +61 (0) 3 8686 8025 [email protected] Project Management Chris Adam +61 (0) 3 9445 6841 [email protected] Western Australia Asset Management Jeffrey Klaebe +61 (0) 8 8237 5018 [email protected] Research Tony Crabb +61 (0) 422 221 604 [email protected] Project Management Steve Christodoulou +61 (0) 8 8237 5004 [email protected] Valuations Mark Foster-Key +61 (0) 8 9488 4145 [email protected] Industrial & Business Services James Condon 61 (0) 8 9488 4169 [email protected] Victoria Research - National Tony Crabb +61 (0) 422 221 604 [email protected] Research - VIC Glenn Lampard +61 (0) 3 8686 8034 [email protected] Industrial – North & West Greg Jensz +61 (0) 3 8686 8005 [email protected] Industrial – South & East Lynton Williams +61 (0) 3 9947 5100 [email protected] Asset Management Jason Ridge +61 (0) 8 9488 4118 [email protected] Project Management Graham Nash +61 (0) 8 6271 0306 [email protected] Sales & Investment Miles Rowe +61 (0) 8 9488 4116 [email protected] With a rich heritage and a reputation for excellence that dates back to 1855, Savills is a leading global real estate provider listed on the London Stock Exchange. Savills advises corporate, institutional and private clients, seeking to acquire, lease, develop or realise the value of prime residential and commercial property across the world’s key markets. Savills is expert in delivering results across all key commercial, retail, industrial and residential sectors in the following areas: Savills is a company that leads rather than follows with over 600 offices and associates throughout the UK, Europe, Americas, Asia Pacific, Africa and the Middle East. With over 27,000 staff, we seek out people who possess that rare mix of entrepreneurial flair and rock solid integrity, and are focused on delivering clients with advice and expertise of the highest calibre. Sales A powerful combination of global connections and deep local knowledge provides Savills with an almost unparalleled ability to connect people and property. Savills extensive Asia Pacific network spans 50 offices throughout Australia, New Zealand, China, Hong Kong, India, Indonesia, Japan, Korea, Macao, Malaysia, Myanmar, Philippines, Singapore, Taiwan, Thailand and Vietnam. In Australia, we offer the full spectrum of services from providing strategic advice to managing assets and projects and transacting deals. With a firmly embedded corporate culture that values initiative, innovation and integrity, clients receive outstanding service and can be assured of the utmost professionalism. Adelaide +61 (0) 8 8237 5000 Brisbane +61 (0) 7 3221 8355 Canberra +61 (0) 2 6221 8200 Gold Coast +61 (0) 7 5509 1700 Melbourne +61 (0) 3 8686 8000 Notting Hill +61 (0) 3 9947 5100 Parramatta +61 (0) 2 9761 1333 Perth +61 (0) 8 9488 4111 Sunshine Coast +61 (0) 7 5313 7500 Sydney +61 (0) 2 8215 8888 savills.com.au Leasing Valuations Asset Management Project Management Strategic Corporate Real Estate Services Property Accounting Facilities Management Luxury Residential Sales Residential Projects Research For Advice that gives Advantage, contact Savills.

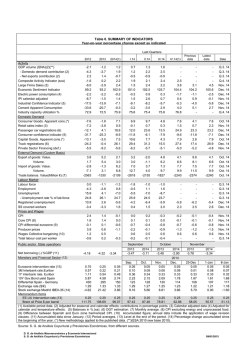

© Copyright 2026