Lorem ipsum dolor sit amet, consectetuer adipiscing elit

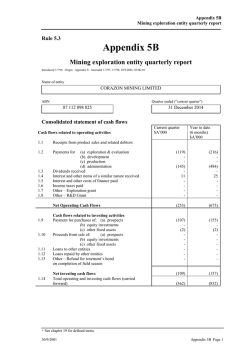

For personal use only February 2, 2015 December 2014 Quarterly Activity Report ASX Release Stock Code: CDB Condor Blanco Mines Limited – Quarterly Activities Report In the quarter Condor Blanco Mines Limited (ASX: CDB; “Condor”, “the Company”) maintained its tenement position, while seeking to improve its financial position in the face of a difficult operating environment and falling commodity prices. This has involved delaying payments on the Marianas Iron Ore Project and a reconsideration of the exploration expenditures. In the period, Condor also announced the completion of four trial pits at the “Uludere Project” in Southeast Turkey. All four pits reached the bottom of the iron-rich zone and intersected blocks of leadsilver containing material. 53 tonnes of material that is saleable under the Meskan Olmez Madencilik Ltd Şti offtake agreement was shipped to the location of the flotation plant. Assessment of the profitability of future mining is underway, with a local consultancy completing a desktop evaluation of the mining potential. This included a draft mine costings and will be used to complete a cash flow analysis for future potential mining. Chilean Project Update Condor is seeking to rationalise its expenditure in Chile. This has meant suspending payments on the Marianas Project. This is in response to a falling Iron Ore price which is more than 65% down from its peak of over US$190/t in early 2011 to around US$65 today. The previous assessment work undertaken by Condor was at a significantly higher iron ore price, and Condor does not intend to make further investments in the project until conditions improve in the Iron Ore sector. Despite the ability to produce a 65% Fe product, the pricing of these fines does not warrant development at this time. Given the rapid deterioration in the Iron Ore price, Condor has not made further payments on the Marianas Iron Ore tailings project. Condor holds 50% of the shares in the holding company. It is withholding further payments on the project pending a positive change in the iron price. In the future should it seek to recommence operations a new replacement agreement should be formed. Should Condor’s joint venture partner formally demand already due payments by lodging a legal petition to that effect, Condor could then at that time elect to meet these and form new agreements at that time or to relinquish its stake. No formal demand has been made at this time. 805 For personal use only Condor is also seeking to reduce the option fees payable on its exploration tenements Carachapampa and Gold Iron. Condor is in discussions about reductions as well as extensions and hopes to have a positive outcome soon. Should a formal demand be made for these option fees Condor would need to meet those or begin procedures to relinquish the titles. Option fees are currently due. Condor believes that it will be able to structure an arrangement for increased exploration to occur in the future. Condor’s other directly owned portfolio, including the a 100% interest in the Yaretas and Fraga Copper-Gold Projects and 70% in the historically mined Cautiva-Victoria Copper Project, all remain in good standing and require only minimal expenditures to be retained in perpetuity. Uludere Zinc-Lead Project On 26 November 2014, Condor announced that all four planned trial mining pits had been completed at the Uludere Project (on Mining Licence 200806380). Under its 11 September 2014 agreement, Condor has a 6-month exclusive right to undertake trial mining and can elect to continue to larger scale mining prior to the expiry of the take period. Through completion of the four pits, Condor has fulfilled its stage 1 obligations, and now can assess stage 2. In the period, 53 tonnes of Pb-Ag bearing material that is saleable under the Meskan Olmez Madencilik Ltd Şti offtake agreement has been shipped to the location of the flotation plant in Olgunlar, Turkey where it was weighed and sampled. Several hundred tonnes of Zn and Pb bearing iron-rich material was also stockpiled at site. This material requires further beneficiation for sale, which has been investigated with the engineers at the flotation plant. Although not economic for the current trial scale, a limited investment in a wet high intensity magnetic separation unit (which has been costed at $90,000) will enable larger volume to be processed for sale. Assessment of the profitability of future mining was also undertaken with a local consultancy in the period. A draft report on mine costing has been completed and a cash flow assessment is being undertaken. Sabaleta Gold Project in Ecuador During the period Condor undertook negotiations and due diligence over the Sabaleta Gold Project in the Republic of Ecuador with Australian unlisted public company, Rio Perdido Gold Limited (“RPG”). A Heads of Agreement (“HOA”) was signed on 25 September 2014 just prior to the start of the period. Despite two extensions to the term of the HOA, Condor was not able to reach a suitable agreement with RPG. The HOA then lapsed as announced on 14 November 2014. Albany Fraser Range Western Australia As part of Condor’s strategy, the company has also entered into discussions regarding a significant land holding in Western Australia’s Albany Fraser Range. The Albany Fraser Range is host to a number of newly discovered prospective Nickel targets. Condor will update the market as soon as any binding agreements are reached. 2 For personal use only Corporate Events The Annual General Meeting of the company was held on 26 November 2014. All resolutions were passed, which included the re-election of Mr Stavros Vlahos and Mr Michael Stafford as directors, the approval of a 10% placement facility, a planned future placement of ordinary shares as well as the adoption of the remuneration report. Enquiries: Mr Glen Darby Managing Director Condor Blanco Mines Limited Office: +61 (2) 8064 3624 Email: [email protected] 3 Appendix 5B Mining exploration entity quarterly report Rule 5.3 For personal use only Appendix 5B Mining exploration entity quarterly report Introduced 01/07/96 Origin Appendix 8 Amended 01/07/97, 01/07/98, 30/09/01, 01/06/10, 17/12/10 Name of entity Condor Blanco Mines Limited ABN Quarter ended (“current quarter”) 16 141 347 640 31 December 2014 Consolidated statement of cash flows Cash flows related to operating activities 1.1 Receipts from product sales and related debtors 1.2 Payments for (a) exploration & evaluation (b) development (c) production (d) administration Dividends received Interest and other items of a similar nature received Interest and other costs of finance paid Income taxes paid Other (provide details if material) 1.3 1.4 1.5 1.6 1.7 Net Operating Cash Flows 1.8 1.9 1.10 1.11 1.12 1.13 Current quarter $A’000 Year to date $A’000 (118) (920) (217) (740) 2 (335) (1,658) - - (335) (1,658) Cash flows related to investing activities Payment for purchases of: (a) prospects (b) equity investments (c) other fixed assets Proceeds from sale of: (a) prospects (b) equity investments (c) other fixed assets Loans to other entities Loans repaid by other entities Other (provide details if material) Net investing cash flows Total operating and investing cash flows (carried forward) Page 1 Appendix 5B Mining exploration entity quarterly report For personal use only 1.13 1.14 1.15 1.16 1.17 1.18 1.19 Total operating and investing cash flows (brought forward) (335) (1,658) Cash flows related to financing activities Proceeds from issues of shares, options, etc. Proceeds from sale of forfeited shares Proceeds from borrowings Repayment of borrowings Dividends paid Other (provide details if material) 973 - 973 (335) (685) 348 698 13 13 Net financing cash flows Net increase (decrease) in cash held 1.20 1.21 Cash at beginning of quarter/year to date Exchange rate adjustments to item 1.20 1.22 Cash at end of quarter Payments to directors of the entity and associates of the directors Payments to related entities of the entity and associates of the related entities Current quarter $A'000 1.23 Aggregate amount of payments to the parties included in item 1.2 1.24 Aggregate amount of loans to the parties included in item 1.10 1.25 Explanation necessary for an understanding of the transactions (149) - Non-cash financing and investing activities 2.1 Details of financing and investing transactions which have had a material effect on consolidated assets and liabilities but did not involve cash flows Nil 2.2 Details of outlays made by other entities to establish or increase their share in projects in which the reporting entity has an interest Nil Page 2 Appendix 5B Mining exploration entity quarterly report Financing facilities available For personal use only Add notes as necessary for an understanding of the position. Amount available $A’000 3.1 Loan facilities 3.2 Credit standby arrangements Amount used $A’000 Estimated cash outflows for next quarter $A’000 4.1 Exploration and evaluation 4.2 Development 4.3 Production 4.4 Administration (500) (200) (150) (170) (1,020) Total Reconciliation of cash Reconciliation of cash at the end of the quarter (as shown in the consolidated statement of cash flows) to the related items in the accounts is as follows. 5.1 Cash on hand and at bank 5.2 Current quarter $A’000 Previous quarter $A’000 13 348 Deposits at call - - 5.3 Bank overdraft - - 5.4 Other (provide details) - - 13 348 Total: cash at end of quarter (item 1.22) Changes in interests in mining tenements Tenement reference 6.1 Interests in mining tenements relinquished, reduced or lapsed Nature of interest (note (2)) Interest at beginning of quarter Interest at end of quarter Nil Page 3 Appendix 5B Mining exploration entity quarterly report Interests in mining tenements acquired or increased Nil For personal use only 6.2 Page 4 Appendix 5B Mining exploration entity quarterly report Issued and quoted securities at end of current quarter For personal use only Description includes rate of interest and any redemption or conversion rights together with prices and dates. 7.1 7.2 7.3 7.4 7.5 7.6 Preference +securities (description) Changes during quarter (a) Increases through issues (b) Decreases through returns of capital, buybacks, redemptions +Ordinary securities Total number Number quoted 938,004,494 938,004,494 Issue price per security (see note 3) (cents) Amount paid up per security (see note 3) (cents) Changes during quarter (a) Increases through issues (b) Decreases through returns of capital, buybacks +Convertible debt securities (description) Changes during quarter (a) Increases through issues (b) Decreases through securities matured, converted Page 5 Appendix 5B Mining exploration entity quarterly report For personal use only 7.7 7.8 7.9 7.10 7.11 7.12 Options (description and conversion factor) Total Number Quoted Exercise Price Expiry Date 122,290,236 $0.0120 16-Sept-2019 37,876,666 20,000,000 15,000,000 283,444 406,556 227,966 547,259 562,500 595,000 595,000 476,000 $0.20 $0.06 $0.0333 $0.0470 $0.0920 $0.0460 $0.0370 $0.0330 $0.0210 $0.0210 $0.0270 23-Feb-2016 01-Aug-2015 01-Aug-2017 13-Sep-2015 24-Sep-2015 07-Jan-2016 11-Feb-2016 18-Feb-2016 25-Mar-2016 03-Apr-2016 10-Apr-2016 Issued during quarter Exercised during quarter Expired during quarter Debentures (totals only) Unsecured notes (totals only) Page 6 Appendix 5B Mining exploration entity quarterly report For personal use only Compliance statement 1 This statement has been prepared under accounting policies which comply with accounting standards as defined in the Corporations Act or other standards acceptable to ASX (see note 5). 2 This statement does give a true and fair view of the matters disclosed. Sign here: 2/02/2015 ............................................................ Date: ............................ Secretary Peter Dunoon Print name:........................................................ Notes 1 The quarterly report provides a basis for informing the market how the entity’s activities have been financed for the past quarter and the effect on its cash position. An entity wanting to disclose additional information is encouraged to do so, in a note or notes attached to this report. 2 The “Nature of interest” (items 6.1 and 6.2) includes options in respect of interests in mining tenements acquired, exercised or lapsed during the reporting period. If the entity is involved in a joint venture agreement and there are conditions precedent which will change its percentage interest in a mining tenement, it should disclose the change of percentage interest and conditions precedent in the list required for items 6.1 and 6.2. 3 Issued and quoted securities The issue price and amount paid up is not required in items 7.1 and 7.3 for fully paid securities. 4 The definitions in, and provisions of, AASB 6: Exploration for and Evaluation of Mineral Resources and AASB 107: Statement of Cash Flows apply to this report. 5 Accounting Standards ASX will accept, for example, the use of International Financial Reporting Standards for foreign entities. If the standards used do not address a topic, the Australian standard on that topic (if any) must be complied with. == == == == == Page 7

© Copyright 2026