Em 31 de Agosto de 2005, o valor dos activos geridos pelos F

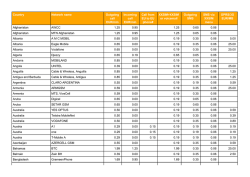

Portuguese Real Estate Funds’ Market – December 20141 On December 31, 2014, total net assets of Portuguese Real Estate Funds stood at EUR 11,398.3 million, which reflects a decrease of 3.1 percent when compared with the previous month. Since end December 2013, total net assets fell by 7.3 percent. On the same date, the value of the real estate assets held by these Funds (includes buildings, shares of real estate companies and units/shares of other Real Estate Funds) totalled EUR 13,340.4 million. This figure represents 117.0 percent of the Total Net Asset Value and includes the amount of leverage used by these Funds. The value of the real estate assets decreased 1.1 percent from the previous month, while since December 2013 they reduced 6.9 percent. During the month, there was no new Fund’s launch or liquidation. Therefore, the number of active Real Estate Funds remained stable at 248. In December, the Management Company ESAF – F.I. changed its name to GNB – Sociedade Gestora de Fundos de Investimento Imobiliário, SA. Total Net Assets (EUR million) Change (%)* Real Estate Assets (EUR million) Change (%)* Number of Funds December 2014 November 2014 December 2013 11,398.3 11,760.0 12,289.7 - -3.1% -7.3% 13,340.4 13,486.0 14,329.6 - -1.1% -6.9% 248 248 254 * - Change between December 2014 and the month in question. Management Companies In December 2014, Interfundos was the Management Company with the largest market share, with total net assets standing at EUR 1,518.6 million, which represents 13.3 percent of the total Real Estate Funds’ market. Fundger ranks second, with total net assets of EUR 1,326.7 million and a market share of 11.6 percent, and Montepio Valor ranks third, with EUR 928.7 million and a market share of 8.1 percent. MNF Gestão de Activos was the Management Company that registered the highest percentage growth, with 13.8 percent (EUR 6.4 million), while Selecta is the Management Company with the largest increase in total net assets with EUR 46.9 million (11.0 percent). 1 The figures presented for the period after July 2013 do not include information about the Fund “Golden Eagle – F.E.I.I.F.” managed by MNF Gestão de Activos. 1 Since end December 2013, MNF Gestão de Activos is, also, the Management Company registering the highest percentage growth with 65.5 percent (EUR 20.7 million), while Norfin is the Management Company with the largest increase in total net assets with EUR 79.8 million (9.6 percent). Management Company Interfundos Fundger Montepio Valor Norfin Square Asset Management GNB - SGFII Banif Gestão de Activos Gesfimo Imofundos Santander Asset Management Selecta Sonaegest Silvip Fund Box - SGFII Fimoges Fundiestamo BPI Gestão de Activos Gef TF Turismo Fundos Popular Gestão de Activos TDF Refundos Atlantic Imorendimento MNF Gestão de Activos Vila Gale Gest Floresta Atlântica Imopolis Libertas Invest Gestão de Activos Orey Financial Fibeira Fundos Patris Gestão de Activos Margueira Total December 2014 November 2014 Share Monthly Change (%) Change Year-todate (%) 12.9% 11.8% 9.0% 6.7% 6.5% 8.5% 6.0% 6.0% 4.6% 4.3% 3.3% 3.4% 2.4% 1.9% 2.2% 1.5% 1.6% 0.7% 0.9% 1.4% 0.7% 0.6% 0.6% 0.5% 0.3% 0.3% 0.3% 0.3% 0.3% 0.1% 0.1% 0.1% 0.0% 0.0% - -1.1% -1.7% -14.9% 4.3% 0.0% -13.3% -7.9% -7.0% -0.5% -0.1% 11.0% 0.9% 0.3% -6.7% -0.2% -1.4% 0.0% -0.6% 1.2% -0.3% -0.2% 0.0% 0.4% -4.5% 13.8% -2.0% -0.7% 1.3% -29.3% 0.7% -0.3% -1.6% -1.5% -2.8% -3.1% -4.3% -8.8% -16.4% 9.6% -0.7% -26.5% -12.9% -12.7% -4.5% -6.9% 17.0% 0.5% 0.7% -9.2% -24.9% 1.3% -7.5% 40.3% 1.9% -44.2% -2.9% 2.4% -5.0% -3.9% 65.5% 0.7% -0.8% 8.6% -32.7% -0.5% -0.5% 27.6% -21.7% -32.1% -7.3% December 2013 N.º of Funds Million € Share Million € Share Million € 42 27 8 15 5 28 13 17 6 4 10 3 1 16 1 3 2 9 2 4 1 1 7 5 4 1 3 1 2 2 2 1 1 1 248 1,518.6 1,326.7 928.7 909.2 796.7 765.3 642.5 641.6 538.2 489.7 475.4 413.9 300.7 210.3 206.0 187.2 177.5 124.9 117.9 96.2 89.4 76.3 73.8 57.2 52.4 38.2 37.6 36.3 25.5 18.1 11.5 10.0 3.7 1.3 11,398.3 13.3% 11.6% 8.1% 8.0% 7.0% 6.7% 5.6% 5.6% 4.7% 4.3% 4.2% 3.6% 2.6% 1.8% 1.8% 1.6% 1.6% 1.1% 1.0% 0.8% 0.8% 0.7% 0.6% 0.5% 0.5% 0.3% 0.3% 0.3% 0.2% 0.2% 0.1% 0.1% 0.0% 0.0% - 1,535.1 1,349.7 1,090.7 871.4 797.0 882.7 698.0 689.5 541.0 490.1 428.5 410.1 299.8 225.2 206.5 189.9 177.5 125.7 116.6 96.5 89.5 76.2 73.5 60.0 46.0 39.0 37.9 35.8 36.0 18.0 11.5 10.2 3.8 1.3 11,760.0 13.1% 11.5% 9.3% 7.4% 6.8% 7.5% 5.9% 5.9% 4.6% 4.2% 3.6% 3.5% 2.5% 1.9% 1.8% 1.6% 1.5% 1.1% 1.0% 0.8% 0.8% 0.6% 0.6% 0.5% 0.4% 0.3% 0.3% 0.3% 0.3% 0.2% 0.1% 0.1% 0.0% 0.0% - 1,586.1 1,455.1 1,110.8 829.5 802.0 1,040.7 737.8 734.9 563.3 526.2 406.4 411.8 298.6 231.5 274.5 184.8 191.9 89.0 115.7 172.4 92.0 74.5 77.6 59.6 31.6 37.9 37.9 33.4 37.9 18.2 11.5 7.8 4.8 1.9 12,289.7 2 Categories of Funds Closed-ended Funds are the largest category of Real Estate Funds with EUR 6,170.4 million of assets under management. Open-ended Accumulation Funds rank second, with EUR 2,102.5 million, followed by Open-ended Income Funds with EUR 1,581.5 million. Funds for Investment in Urban Renovation was the category that registered the highest percentage growth, with a 6.9 percent increase from the previous month, and the largest increase in total net assets, with EUR 4.1 million. Since end December 2013, Funds for Investment in Urban Renovation registered, also, the highest growth, both in percentage, with 1.3 percent and in value, with EUR 0.8 million. December 2014 November 2014 December 2013 Million € Share Million € Share Million € Share Monthly Change (%) Closed-ended Funds 6,170.4 54.1% 6,232.5 53.0% 6,411.0 52.2% -1.0% Change Year-todate (%) -3.8% Open-ended Accumulation Funds 2,102.5 18.4% 2,127.6 18.1% 2,200.4 17.9% -1.2% -4.4% Open-ended Income Funds 1,581.5 13.9% 1,706.1 14.5% 1,949.5 15.9% -7.3% -18.9% Funds for Investment in Residential Letting 1,426.3 12.5% 1,580.4 13.4% 1,611.9 13.1% -9.8% -11.5% Funds for Investment in Urban Renovation 64.2 0.6% 60.1 0.5% 63.4 0.5% 6.9% 1.3% Forestry Funds 53.4 0.5% 53.3 0.5% 53.6 0.4% 0.2% -0.4% - 12,289.7 - -3.1% -7.3% Category of Funds Total 11,398.3 11,760.0 Notes: Series adjusted due to the change of some Funds’ classification. Returns The following table shows the returns for the 12 months period ending on December, 2014 of a sample of Real Estate Funds managed by APFIPP Members. 3 24 Real Estate Funds were included in this analysis (9.7 percent of the total) that managed at end-November EUR 4,236.1 million (37.2 percent of the total). Of these, 12 are Open-ended Funds that managed total net assets worth EUR 3,243.3 million (representing 80.0 percent of the number of Open-ended Funds and 88.0 percent of the respective total net assets). The remaining 12 Funds are Closed-ended Funds that were responsible for the management of EUR 992.8 million (5.7 percent of the number of Closed-ended Funds and 16.1 percent of their total net assets). Average 2 Return Category of Funds Open-ended Accumulation Funds -4.22% Management Company Effective Return CA Patrimonio Crescente Square Asset Managment 2.52% AF Portfólio Imobiliário Interfundos -2.57% Finipredial Montepio Valor -2.90% Imonegócios -4.14% Popular Predifundo Imofundos Santander Asset Management Popular Gestão de Activos Banif Imopredial Banif Gestão Activos -12.28% VIP Silvip 2.53% Imofomento BPI Gestão Activos 1.09% Novimovest Open-ended Income Funds -2.09% Closed-ended Funds -2.73% 3 Open-ended Index 3 Closed-ended Index 4 -4.80% -6.48% Fundimo Fundger -1.98% Gespatrimónio Rendimento GNB - SGFII -4.00% ES Logística - FEIIA GNB - SGFII -13.88% Imosaúde Selecta 3.53% TDF TDF 2.59% Fundiestamo I Fundiestamo 2.41% Maxirent Refundos 2.40% Imosocial Selecta 1.65% Imocomercial Selecta 0.34% Imoreal -2.24% Real Estate Imofundos Santander Asset Management Imofundos Imomarinas Imofundos -13.21% Banif Imogest Banif Gestão Activos -17.09% Lusimovest APFIPP Real Estate Index 3 Funds -2.64% -2.88% Imoglobal Imofundos -26.48% -3.24% - - - -3.29% - - - -3.09% - - - 2 - Weighted average return for portfolios of the Funds in the previous month - Effective Return of the last 12 months 4 - Based on the value of the Index in November 2014 and November 2013 3 4

© Copyright 2026