2015 PLAN YEAR BENEFITS | FOR YOU AND YOUR FAMILY

2015 PLAN YEAR BENEFITS | FOR YOU AND YOUR FAMILY

1

Dear Fellow Employee,

CPSI is dedicated to providing a comprehensive and competitive benefits package for you

and your family. Having the resources and programs available to help you maintain a

work/life balance is important to our organization.

Our benefit plans have been intentionally designed to provide you a full range of coverage

and protection for your short and long-term needs. We offer our employees medical, dental,

pharmacy, and vision programs focused on prevention. Our insurance and wellness plans

are uniquely designed to cover a full range of services including free preventive care, toprated provider networks and savings accounts to help pay for out-of-pocket expenses.

Our insurance programs provide a full range of services to help you get back on track in the

event of an illness or injury and help preserve your income. You will have an opportunity to

purchase life insurance, accident insurance, critical illness insurance, and a new Hospital

Indemnity Plan as your individual circumstances dictate.

We are pleased to offer all eligible members one-on-one personal and confidential

enrollment meetings with licensed and knowledgeable Benefits Educators from Enrollment

Advisors. Please schedule a time to make an appointment with a Benefits Educator at

www.enrollappointments.com/CPSI to review your benefit options, ask any questions you may

have, and complete your enrollment on the spot. Please take a few minutes to review the

guide and the benefit options we proudly offer to you.

Sincerely,

BOYD DOUGLAS

President and Chief Executive Officer

S C H E D U L E Y O U R A P P O I N T M E N T A T W W W. E N RO LL APPO I NTM E NT S .COM/CPS I

1

BENEFITS FOR YOU AND YOUR FAMILY

CPSI is pleased to announce our 2015 benefits

program, which is designed to help you stay

healthy, feel secure, and maintain a work/life

balance. Offering a rich benefits package is just

one way we strive to provide our employees with a

rewarding workplace. Please read the information

provided in this guide carefully. For full details

about our plans, please refer to the summary plan

descriptions.

BENEFITS AVAILABLE DURING OPEN

ENROLLMENT

•

•

•

•

•

•

•

•

•

•

Medical Insurance

Flexible Spending Account Plan

Dental Insurance

Hospital Indemnity Plan

Vision Insurance

Accident Insurance

Short-Term Disability

Long-Term Disability

Life Insurance

Optional Critical Illness

has permanent legal custody.

WHEN AND HOW DO I ENROLL?

We have Benefits Educators with Enrollment

Advisors available on site and through the

Enrollment Call Center to meet one-on-one with

each eligible employee. These knowledgeable,

trained Benefits Educators will answer questions

about the benefits program, help you choose your

benefit options, and assist you with completing the

enrollment process.

You may schedule your enrollment appointment

online or by telephone. To schedule your

enrollment appointment online, go to www.

enrollappointments.com/CPSI. If you do not have

internet access, please contact the Enrollment

Advisors Enrollment Center at (877) 759-7667 to

schedule your appointment. All eligible employees

are required to complete the enrollment process

even if you do not wish to make any changes to

your benefits.

OTHER CPSI BENEFITS INCLUDED IN

WHEN IS MY COVERAGE EFFECTIVE?

THIS GUIDE

Your coverage is effective the first of the month

after 30 days of employment.

• Symbol Onsite Clinic

• Virgin Pulse

WHO IS ELIGIBLE?

All regular employees scheduled to work at least

20 hours per week (30 hours per week for BCBS)

are eligible to participate in the CPSI benefits

program. Eligible employees may also enroll their

legal spouse (as recognized by Alabama statute)

and dependent children (married or unmarried).

A dependent child may be the natural child,

stepchild, legally adopted child, child placed for

adoption, or other child for whom the employee

CHANGING COVERAGE DURING THE

YEAR

You can change your coverage during the year

when you experience a qualified change in

status, such as marriage, divorce, birth, adoption,

placement for adoption, or loss of coverage. The

change must be consistent with the event. For

example, if your dependent child no longer meets

eligibility requirements, you can drop coverage

only for that dependent.

1

HEALTH REIMBURSEMENT ACCOUNT (HRA)

One of your medical plan options is a Health Reimbursement Account (HRA). An HRA has an employer

contribution that may be used for deductibles, coinsurance, and copays. In this plan, CPSI will add $250

to your HRA account each year; $500 will be added each year if you have any dependents (spouse and/

or child{ren}) covered. Your HRA gives you the opportunity to manage your health care expenses in

partnership with CPSI. If employment ends, you cannot take the balance of your account with you.

Your HRA is designed to pay your physician or hospital directly on your behalf.

FLEXIBLE SPENDING ACCOUNT (FSA)

The Flexible Spending Account (FSA) plan allows you to set aside pre-tax dollars to cover qualified expenses

you would normally pay out of your pocket with post-tax dollars. The plan is comprised of a health care

spending account and a dependent care account. You pay no federal or state income taxes on the

money you place in an FSA.

Health Care Flexible Spending Account

The health care flexible spending account is available for any team member, spouse or dependent child

and may be used for any health, dental, and vision expenses not reimbursed by any other benefit plans.

These expenses include deductibles, copays, coinsurance, dental services, eyeglasses, contact lenses,

Lasik eye surgery, orthodontics for adults and children, hearing aids, chiropractor, some diabetic supplies,

medical equipment, and other out-of-pocket costs.

Dependent Care Flexible Spending Account

The dependent care flexible spending account allows

you to set aside pre-tax dollars for dependent care

expenses, such as day care, preschool, after-school

care, or elder care for qualified dependents. If you are

married, both you and your spouse must be employed

full-time in order to participate in this tax savings plan.

HOW AN FSA WORKS:

• Choose a specific amount of money to contribute

each pay period, pre-tax, to one or both

accounts during the year. Budget according

to your and your family’s typical health care and

dependent care spending.

• The amount is automatically deducted from your

pre-tax pay at the same level each pay period.

IMPORTANT RULES TO KEEP IN MIND:

•

•

•

•

The IRS has a strict “use it or lose it” rule. If you do not use the full amount in your FSA, you will

lose any remaining funds.

You have until March 15, 2016, to use your FSA funds for services rendered in 2015.

Once you enroll in the FSA, you cannot change your contribution amount during the year unless you experience a qualifying life event.

You cannot transfer funds from one FSA to another.

MAXIMUM ANNUAL ELECTION

Health Care FSA: $2,550

Dependent Care FSA: $5,000 married filing jointly / $2,500 single or married filing separately

S C H E D U L E Y O U R A P P O I N T M E N T A T W W W. E N RO LL APPO I NTM E NT S .COM/CPS I

2

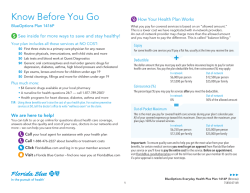

MEDICAL INSURANCE

CPSI offers employees two plan options: The Traditional Plan and Health Reimbursement Account (HRA)

Plan. The following chart is a brief outline of the plan. Employees have two levels of benefits with the plan:

BCBS In-Network: You receive this level of benefit when the service provider is contracted with BCBS.

BCBS Out-of-Network (Non-PPO) Facility or Physician: You receive this level of benefit when using a facility

or physician not contracted with Blue Cross.

Please refer to the summary plan description for complete plan details.

MEDICAL BENEFITS OVERVIEW

Benefits

Traditional (Blue Cross Blue Shield)

HRA (Blue Cross Blue Shield)

Lifetime Maximum

Unlimited

Unlimited

Plan Year Deductible

$500 ($1,500 per family)

In-Network: $500 ($1,000 per family)

Out-of-Network: $1,000 ($2,000 per family)

Out-of-Pocket Maximum (Includes all copays,

$900 ($2,700 per family)

Certain benefits pay at 100% of the allowed

amount thereafter.

In-Network: $1,000 ($2,000 per family)

Out-of-Network: No out-of-pocket maximum

In-Network: 100% of the allowed amount, subject

to a $25 facility copayment

Out-of-Network: 80% of the allowed amount,

subject to the calendar year deductible

In-Network: 90% of the allowed amount, subject

to the calendar year deductible

Out-of-Network: 70% of the allowed amount,

subject to the calendar year deductible

In-Network: 100% of the allowed amount, subject

to a $25 facility copayment

Out-of-Network: 80% of the allowed amount,

subject to the calendar year deductible

In-Network: 90% of the allowed amount, subject

to the calendar year deductible

Out-of-Network: 90% of the allowed amount,

subject to the calendar year deductible

100% of the allowed amount, no

deductible, subject to a $25 facility copayment

for mental health and substance abuse

90% of the allowed amount, subject to the innetwork calendar year deductible for mental

health and substance abuse

Emergency Room – Accident

In-Network: 100% of the allowed amount, no

deductible or copayment

Out-of-Network: 100% of allowed amount, no

deductible within 72 hours of accident; 80% after

72 hours

In-Network: 90% of the allowed amount, subject

to the calendar year deductible

Out-of-Network: 90% of the allowed amount,

subject to the calendar year deductible when

services are rendered within 72 hours of the

accident; after 72 hours 70% of the allowed

amount, subject to the calendar year deductible

Outpatient diagnostic lab, X-ray, and

pathology

In-Network: 100% of the allowed amount, no

deductible or copayment

Out-of-Network: 80% of the allowed amount,

subject to the calendar year deductible

In-Network: 90% of the allowed amount, subject

to the calendar year deductible

Out-of-Network: 70% of the allowed amount,

subject to the calendar year deductible

Outpatient dialysis, IV therapy,

chemotherapy, and radiation therapy

In-Network: 100% of the allowed amount, no

deductible or copayment

Out-of-Network: 80% of the allowed amount,

subject to the calendar year deductible

In-Network: 90% of the allowed amount, subject

to the calendar year deductible

Out-of-Network: 70% of the allowed amount,

subject to the calendar year deductible

deductibles, and coinsurance with the exception

of prescriptions)

Outpatient Surgery (Including ambulatory

surgical centers)

Emergency Room – Medical Emergency

Services billed by the facility for an

emergency room visit when the patient’s

condition does not meet the definition of

a medical emergency (including any lab

and X-ray exams and other diagnostic

tests associated with the emergency

room fee)

In-Network: 80% of the allowed amount, subject

to the calendar year deductible

Out-of-Network: 80% of the allowed amount,

subject to the calendar year deductible

In-Network: 90% of the allowed amount, subject

to the calendar year deductible

Out-of-Network: 70% of the allowed amount,

subject to the calendar year deductible

Outpatient hospital services or supplies

not listed above

In-Network: 80% of the allowed amount, subject

to the calendar year deductible

Out-of-Network: 80% of the allowed amount,

subject to the calendar year deductible

In-Network: 90% of the allowed amount, subject

to the calendar year deductible

Out-of-Network: 70% of the allowed amount,

subject to the calendar year deductible

Office visits, consultations, and

psychotherapy

In-Network: 100% of the allowed amount, no

deductible, subject to a $15 copayment

Out-of-Network: 80% of the allowed amount,

subject to the calendar year deductible

In-Network: 100% of the allowed amount, no

deductible, subject to a $30 copayment

Out-of-Network: 70% of the allowed amount,

subject to the calendar year deductible

3

Benefits

Traditional (Blue Cross Blue Shield)

HRA (Blue Cross Blue Shield)

Emergency Room Physician

In-Network: 100% of the allowed amount, no

deductible, subject to a $15 copayment

Out-of-Network: 80% of the allowed amount,

subject to the calendar year deductible

100% of the allowed amount, subject to a $15

copayment for mental health and substance

abuse

In-Network: 100% of the allowed amount, subject

to a $30 copayment

90% of the allowed amount, subject to the innetwork calendar year deductible for mental

health and substance abuse

Out-of-Network: 100% of the allowed amount,

subject to the calendar year deductible, and a

$30 copayment

90% of the allowed amount, subject to the innetwork calendar year deductible for mental

health and substance abuse

Surgery, second surgical opinion, and

anesthesia for a covered service

In-Network: 100% of the allowed amount, no

deductible or copayment

Out-of-Network: 80% of the allowed amount,

subject to the calendar year deductible

In-Network: 100% of the allowed amount, no

deductible or copayment

Out-of-Network: 70% of the allowed amount,

subject to the calendar year deductible

Maternity care

In-Network: 100% of the allowed amount, no

deductible or copayment

Out-of-Network: 80% of the allowed amount,

subject to the calendar year deductible

In-Network: 90% of the allowed amount, subject

to the calendar year deductible

Out-of-Network: 70% of the allowed amount,

subject to the calendar year deductible

Inpatient visits

In-Network: 100% of the allowed amount, no

deductible or copayment

Out-of-Network: 80% of the allowed amount,

subject to the calendar year deductible;

80% of the allowed amount, no deductible or

copayment for mental health and substance

abuse

In-Network: 90% of the allowed amount, subject

to the calendar year deductible

Out-of-Network: 70% of the allowed amount,

subject to the calendar year deductible

Inpatient consultations by a specialty provider

(limited to one consult per specialist per stay)

In-Network:100% of the allowed amount, no

deductible or copayment

Out-of-Network: 80% of the allowed amount,

subject to the calendar year deductible;

80% of the allowed amount, no deductible or

copayment for mental health and substance

abuse

In-Network: 90% of the allowed amount, subject

to the calendar year deductible

Out-of-Network: 70% of the allowed amount,

subject to the calendar year deductible

Diagnostic lab, X-rays, and pathology

In-Network: 100% of the allowed amount, no

deductible or copayment

Out-of-Network: 80% of the allowed amount,

subject to the calendar year deductible

In-Network: 90% of the allowed amount, subject to

the calendar year deductible

Out-of-Network: 70% of the allowed amount,

subject to the calendar year deductible

Chemotherapy and radiation therapy

In-Network: 100% of the allowed amount, no

deductible or copayment

Out-of-Network: 80% of the allowed amount,

subject to the calendar year deductible

In-Network: 90% of the allowed amount, subject to

the calendar year deductible

Out-of-Network: 70% of the allowed amount,

subject to the calendar year deductible

Psychological testing

In-Network: 100% of the allowed amount, no

deductible or copayment

Out-of-Network: 80% of the allowed amount,

subject to the calendar year deductible

In-Network: 90% of the allowed amount, subject to

the calendar year deductible

Out-of-Network: 70% of the allowed amount,

subject to the calendar year deductible

Allergy testing and treatment

In-Network: 80% of the allowed amount, subject to

the calendar year deductible

Out-of-Network: 80% of the allowed amount,

subject to the calendar year deductible

In-Network: 90% of the allowed amount, subject to

the calendar year deductible

Out-of-Network: 70% of the allowed amount,

subject to the calendar year deductible

2015 BI-WEEKLY RATES-TRADITIONAL

Tier

Amount

Employee

$60.00

Family

$125.00

2015 BI-WEEKLY RATES-HRA PLAN

Tier

Amount

Employee

$27.50

Family

$70.00

S C H E D U L E Y O U R A P P O I N T M E N T A T W W W. E N RO LL APPO I NTM E NT S .COM/CPS I

4

Prescription drugs can be

dispensed up to a maximum

90-day supply. Refills of

prescriptions are allowed

after 75% of the allowed

amount of the previous

prescription has been used

(for example, 23 days into a

30-day supply).

PRESCRIPTION DRUG PLAN OVERVIEW

You automatically receive prescription drug coverage through Medco when

you enroll for medical insurance. The chart below is a brief outline of the

plan.

Please refer to the summary plan description for complete plan details.

Traditional (Blue Cross Blue Shield)

Service or Supply

Prescription Generic Drugs

Brand Name Drugs

In-Network

Out-of-Network

Plan pays 80% of the allowed

amount

80% of the allowed amount,

subject to the calendar year

deductible

Plan pays 80% of the allowed

amount, subject to calendar year

deductible

80% of the allowed amount,

subject to the calendar year

deductible

HRA

Service or Supply

Prescription Generic Drugs

Brand Name Drugs

In-Network

Out-of-Network

$5 Copay

Not covered

$30 Copay

($60 Copay for non-preferred

brand)

Not covered

HOSPITAL INDEMNITY PLAN

Unum’s Group Hospital Indemnity Insurance can complement your health insurance to help you pay for the

costs associated with a hospital stay. It can also provide funds for the out-of-pocket expenses your medical

plan may not cover, such as co-insurance, co-pays and deductibles. You may also purchase coverage for

your spouse and dependent children.

Employees must be a U.S. citizen or legally authorized to work in the U.S. to receive coverage. Spouses and

dependents must live in the U.S. to receive coverage.

This information is not intended to be a complete description of the insurance coverage available. The

policy or its provisions may vary or be unavailable in some states. The policy has exclusions and limitations

which may affect any benefits payable. For complete details of coverage and availability, please refer to

Policy form GHI-1, or contact your Unum representative.

THIS IS A LIMITED POLICY

This coverage is a supplement to health insurance. It is not a substitute for comprehensive health insurance and does not qualify as minimum essential health coverage.

Underwritten by: Unum Life Insurance Company of America, Portland, Maine

Unum complies with state civil union and domestic partner laws when applicable.

unum.com

©2014 Unum Group. All rights reserved. Unum is a registered trademark and marketing brand of Unum Group and its insuring subsidiaries.

CU-9732 (10-14)

5

VISION INSURANCE

CPSI offers vision insurance through Humana VisionCare. The plan deducts from your pay before any

federal income or FICA taxes are withdrawn, which makes your taxable wage base lower so you would pay

less tax.

Service

In-Network Benefits

Out-of-Network

Lenses - one pair per year

-Single

-Bifocal

-Trifocal

-Lenticular

Fully covered after $20 Materials

Copayment

Allowances per 12 months ($25

Single; $40 Bifocal; $60 Trifocal; $100

Lenticular)

Frames - one every two

years

Fully covered after $20 Materials

Copayment

$45 allowance every 12 months

$150 retail allowance if elective;

Covered in full if medically necessary

after $20 Materials Copay

$150 retail allowance if elective; $210

if medically necessary

Discounted services available

None

Contact Lenses

LASIK Surgery

Coverage Tier

Monthly Rate

Employee Only

$9.40

Employee Only - Exam Only*

No Charge

Employee + Family

$25.10

*This coverage includes one exam every 12 months,

but does not include any discounts on frames or lenses

ADDITIONAL DISCOUNTS:

You also receive a 20% discount on a second pair

of glasses and a 15% discount on professional

service fees for elective contact lenses when ordering

from one of the Humana network eye doctors.

DENTAL INSURANCE

CPSI offers a dental plan through Blue Cross Blue Shield of Alabama. The chart below is a brief outline of

the plan.

DENTAL BENEFITS OVERVIEW

Plan Feature

Dental Benefit

Deductible

$25 per member per year (maximum of 3 deductibles

per family each year)

Calendar Year Maximum (1/1-12/31)

$1,000

Diagnostic & Preventive

Routine oral exams

X-rays

Cleanings

Covered at 100%, with no deductible

Basic Services

Fillings

Extractions

Oral surgery

Periodontal treatment

Root canal therapy

Covered at 100%, subject to the deductible

S C H E D U L E Y O U R A P P O I N T M E N T A T W W W. E N RO LL APPO I NTM E NT S .COM/CPS I

6

Major Services

Crowns, inlays & onlays

Gold fillings

Replacement or installation of dentures, partials, or bridgework

Covered at 50%, subject to the deductible

Periodontic (Gum Disease)

Covered at 80%, subject to the deductible

Orthodontics

Braces

Covered at 50%, subject to a per member lifetime

deductible of $25. Lifetime maximum of $1,500. Age

19 and under.

GROUP LIFE INSURANCE

This life insurance plan provides financial protection for you and your beneficiaries

by paying a benefit in the event of your death. The amount your beneficiaries

receive is based on the amount of coverage in effect just prior to the date of

your death according to the terms and provisions of the plan. You also have the

opportunity to elect coverage for your dependents.

Other features

of the

Life Insurance Plan:

• Accelerated Benefit

• Conversion

• Portability

Employee Maximum Benefits

Spouse Maximum Benefits

Children Maximum Benefits

The lesser of 5x annual earnings or

$500,000

The lesser of 100% of your amount

of insurance or $100,000*

The lesser of 100% of your amount

of insurance or $10,000

* Note: The amount of your spouse’s life insurance will reduce by the same percentage and at the same

time your life insurance reduces.

ACCIDENT INSURANCE

Unum’s Accident Insurance can pay benefits based on the injury you receive and the treatment you

need, including emergency-room care and related surgery. The benefit can help offset the out-of-pocket

expenses that medical insurance does not pay, including deductibles and co-pays. Family coverage is

available.

Employees must be a U.S. citizen or legally authorized to work in the U.S. to receive coverage. Spouses and

dependents must live in the U.S. to receive coverage.

This information is not intended to be a complete description of the insurance coverage available. The

policy or its provisions may vary or be unavailable in some states. The policy has exclusions and limitations

which may affect any benefits payable. For complete details of coverage and availability, please refer to

policy form GA-1 or contact your Unum representative.

See schedule of benefits for a full list of covered injuries and treatments.

THIS IS A LIMITED POLICY

Underwritten by: Unum Life Insurance Company of America, Portland, Maine

Unum complies with state civil union and domestic partner laws when applicable.

unum.com

©2014 Unum Group. All rights reserved. Unum is a registered trademark and marketing brand of Unum Group and its insuring subsidiaries.

CU-9732 (10-14)

7

GROUP CRITICAL ILLNESS INSURANCE

Unum’s Group Critical Illness Insurance can help protect your finances from the expense of a serious health

problem, such as a stroke or heart attack. Cancer coverage is also available. You choose a lump-sum

benefit up to $50,000 that’s paid directly to you at the first diagnosis of a covered condition. You can use

the benefit any way you choose. You can use this coverage more than once. If you receive a full benefit

payout for a covered illness, your coverage can be continued for the remaining covered conditions.

The diagnosis of a new covered illness must occur at least 90 days after the most recent diagnosis. Each

condition is payable once per lifetime.

Employees must be a U.S. citizen or legally authorized to work in the U.S. to receive coverage. Spouses and

dependents must live in the U.S. to receive coverage.

This information is not intended to be a complete description of the insurance coverage available. The

policy or its provisions may vary or be unavailable in some states. The policy has exclusions and limitations

which may affect any benefits payable. For complete details of coverage and availability, please refer to

policy form CI-1, or contact your Unum representative.

THIS IS A LIMITED POLICY

Underwritten by: Unum Life Insurance Company of America, Portland, Maine

Unum complies with state civil union and domestic partner laws when applicable.

unum.com

©2014 Unum Group. All rights reserved. Unum is a registered trademark and marketing brand of Unum Group and its insuring subsidiaries.

CU-9732 (10-14)

SHORT-TERM DISABILITY INSURANCE

Unum’s Short Term Disability Insurance can pay you a percentage of your gross weekly earnings (up to the

maximum allowed by your plan) if you are unable to work for a few weeks or months due to an illness or

injury —or childbirth. It can help you cover your expenses and protect your finances at a time when you’re

not getting a paycheck and have extra medical bills. The amount of benefit you receive from the plan may

be reduced or offset by income from other sources. You can take advantage of affordable group rates and

your cost is conveniently deducted from your paycheck.

Employees must be a U.S. citizen or legally authorized to work in the U.S. to receive coverage. Spouses and

dependents must live in the U.S. to receive coverage.

This information is not intended to be a complete description of the insurance coverage available. The

policy or its provisions may vary or be unavailable in some states. The policy has exclusions and limitations

which may affect any benefits payable. For complete details of coverage and availability, please refer

to policy form C.FP-1 et al., or contact your Unum representative for specific provisions and details of

availability.

Underwritten by: Unum Life Insurance Company of America, Portland, Maine

Unum complies with state civil union and domestic partner laws when applicable.

unum.com

©2014 Unum Group. All rights reserved. Unum is a registered trademark and marketing brand of Unum Group and its insuring subsidiaries.

CU-9732 (10-14)

S C H E D U L E Y O U R A P P O I N T M E N T A T W W W. E N RO LL APPO I NTM E NT S .COM/CPS I

8

ID

YER-PA

EMPLO

T

BENEFI

LONG-TERM DISABILITY INSURANCE

CPSI provides Long-Term Disability Insurance to all eligible employees. Unum’s Long Term Disability Insurance

can pay you a percentage of your gross monthly earnings (up to the maximum allowed by your plan) if you

become ill or injured and can’t work for an extended period. It can help you pay your bills and protect your

finances at a time when you have extra medical costs but don’t get a paycheck. The amount of benefit

you receive from the plan may be reduced or offset by income from other sources — such as Social Security

Disability Insurance. The length of time you can receive benefits is based on your age when you become

disabled.

Employees must be a U.S. citizen or legally authorized to work in the U.S. to receive coverage. Spouses and

dependents must live in the U.S. to receive coverage.

This information is not intended to be a complete description of the insurance coverage available. The

policy or its provisions may vary or be unavailable in some states. The policy has exclusions and limitations

which may affect any benefits payable. For complete details of coverage and availability, please refer

to policy form C.FP-1 et al., or contact your Unum representative for specific provisions and details of

availability.

Underwritten by: Unum Life Insurance Company of America, Portland, Maine

Unum complies with state civil union and domestic partner laws when applicable.

unum.com

©2014 Unum Group. All rights reserved. Unum is a registered trademark and marketing brand of Unum Group and its insuring subsidiaries.

CU-9732 (10-14)

9

CPSI WELLNESS

CPSI promotes wellness through offering the Symbol Onsite Clinic and participating in Virgin Pulse. Both benefits are

explained in the following two sections.

SYMBOL ONSITE CLINIC

For more

information about

Symbol Onsite Clinic,

visit

www.symbolhealth.

com/symbol-clinic.

CPSI offers healthcare through the Symbol Onsite Clinic, paid for by CPSI and

free for all employees, their spouse, and dependents who are covered under

CPSI’s BCBS plans. Employees can conveniently make appointments with

medical practitioners for a routine checkup or basic care. The onsite clinic

offers employees enhanced convenience while promoting employee wellness.

The onsite clinic also provides assistance for employees who desire to change

and sustain changes in their lifestyle behaviors.

VIRGIN PULSE

Virgin Pulse is an engaging employee program not only for physical wellness but also for financial security,

a healthy family life, and social connections. Virgin Pulse encourages a long-term high quality of life by

engaging and inspiring employees to stay active and healthy.

Virgin Pulse: Programs That People Can Love

Virgin Pulse offers:

o Fun, social programs that touch every part of life

oCompetitions

o Friends and family for support

oChallenges

o Daily engagement

o

Promotions & Contests

o

Connections with Friends

o

Recognition

o

Gadgets

o Real-time analytics so you know what’s going on and

what’s changing

o A place for it all to be centralized and simplified to make use easy

To create a new account, go to www.join.virginpulse.com/cpsi.

NEXT STEPS

Schedule an appointment with a Benefits Educator at enrollappointments.com/CPSI. Please have your

dependent & beneficiary information (SSNs, date of birth) with you at your enrollment session.

S C H E D U L E Y O U R A P P O I N T M E N T A T W W W. E N RO LL APPO I NTM E NT S .COM/CPS I

10

IMPORTANT TELEPHONE NUMBERS & WEBSITES

Benefit

Carrier

Phone Number

Website

Accident Insurance

Unum

800-633-5597

www.unum.com/employees

Critical Illness Insurance

Unum

800-633-5597

www.unum.com/employees

Dental Insurance

Blue Cross and Blue Shield of

Alabama

800-544-0865

www.bcbsal.com

Flexible Spending

Account

Discovery Benefits

866-451-3399

www.discoverybenefits.com

Long-Term Disability

Insurance

Unum

866-779-1054

www.unum.com/employees

Hospital Indemnity Plan

Unum

800-633-7479

www.unum.com/employees

Blue Cross and Blue Shield of

Alabama

800-292-8868

www.bcbsal.com

Medical Insurance

Onsite Clinic

Short-Term Disability

Insurance

Vision Insurance

Wellness Program

Symbol Onsite Clinics

Main Campus:

251-459-6450

Festival Center:

251-300-8907

www.symbolhealth.com

Unum

866-779-1054

www.unum.com/employees

Humana

866-537-0229

www.HumanaVisionCare.com

Virgin Pulse

866-852-6898

www.virginpulse.com

The information in this guide should in no way be construed as a promise or guarantee of employment or benefit coverage. Pricing, underwriting, plan specifics and all other

product features are solely that of the Insurance Company and not Enrollment Advisors, LLC. If there is a conflict between the information in this guide and the actual plan

document or policies, the documents or policies will always govern. Complete details about the benefits can be obtained by reviewing current plan descriptions, contracts,

certificates, policies and plan documents available from the Benefits Department.

11

a

p

Em nform

I

O

n

IMP yee Be ion

lo

t

NT ts

A

T

R

efi

6600 Wall Street

Mobile, AL 36695

© Copyright 2026