2014-2015 Plan Options - Tulare Joint Union High School District

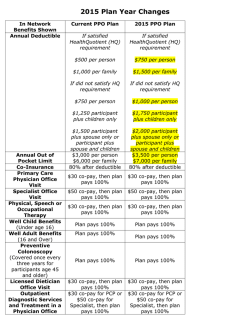

Tulare Joint Union High School District Certificated Management Plan Options 2014-2015 Plan Option #1 SISC Classic 90% plan PBC 90-E $20 PLANS Provider Network(s): Hospital Professional Calendar Year Deductible(s) Maximum Co-Insurance (Out-of-Pocket Max) Co-insurance is the member's responsibility to pay when the plan is paying less than 100% ( i.e. plan pays 80%, member pays the other 20%) Services Office Visits Inpatient Hospital Room, Board & Support Services (prior authorization required) Ambulatory Surgery Center Emergency Room (non-emergency) Facility Expenses: Professional Expenses: Accident Care (48 hrs)/Emergency Room* Facility Expenses: Professional Expenses: Prudent Buyer Prudent Buyer $300 per individual up to $600 per family $600 per individual up to $1,800 per family Once the member's 10% co-insurance totals $600, the plan will pay 100% of the allowable amount for the remainder of the calendar year. Participating Non-Participating Providers Providers Subscriber and Dependent - Same Benefits $20 co-pay Non-Par Fee deductible waived 90% $600 per day 90% $350 per day $100 co-pay (waived if admitted) 90% 50% C&R 90% Plan Option #3 SISC Classic 100% plan PBC 100-C $20 Plan Option #2 SISC Classic 90% plan PBC 90-A $20 Prudent Buyer Prudent Buyer $100 per individual up to $300 per family $300 per individual up to $900 per family Once the member's 10% co-insurance totals $300, the plan will pay 100% of the allowable amount for the remainder of the calendar year. Participating Non-Participating Providers Providers Subscriber and Dependent - Same Benefits $20 co-pay Non-Par Fee deductible waived 90% $600 per day 90% $50 co-pay, 50% up to $350 per day $100 co-pay (waived if admitted) 90% 50% C&R Non-Par Fee 90% Non-Par Fee $100 co-pay (waived if admitted) 90% 90% C&R $100 co-pay (waived if admitted) 90% 90% C&R Plan Option #4 SISC Classic 100% plan PBC 100-C $20 Prudent Buyer Prudent Buyer $200 per individual up to $400 per family $0 per individual up to $0 per family Once the member's 0% co-insurance totals $0, the plan will pay 100% of the allowable amount for the remainder of the calendar year. Participating Non-Participating Providers Providers Subscriber and Dependent - Same Benefits $20 co-pay Non-Par Fee deductible waived 100% $600 per day 100% $50 co-pay, 50% up to $350 per day Prudent Buyer Prudent Buyer $200 per individual up to $400 per family $0 per individual up to $0 per family Once the member's 0% co-insurance totals $0, the plan will pay 100% of the allowable amount for the remainder of the calendar year. Participating Non-Participating Providers Providers Subscriber and Dependent - Same Benefits $20 co-pay Non-Par Fee deductible waived 100% $600 per day 100% $50 co-pay, 50% up to $350 per day $100 co-pay (waived if admitted) 100% 50% C&R $100 co-pay (waived if admitted) 100% 50% C&R 100% 100% Non-Par Fee Non-Par Fee $100 co-pay (waived if admitted) 100% 100% C&R $100 co-pay (waived if admitted) 100% 100% C&R 90% 90% C&R 90% 90% C&R 100% 100% C&R 100% 100% C&R Surgeon & Anesthetist Well Baby/Child Preventative Care Birth to age six 90% Deductible Waived 100% Non-Par Fee Non-Par Fee 90% Deductible Waived 100% Non-Par Fee Non-Par Fee 100% Deductible Waived 100% Non-Par Fee Non-Par Fee 100% Deductible Waived 100% Non-Par Fee Non-Par Fee Routine Preventative Care Members age 7 and older Deductible Waived 100% *medical emergencies as defined by the plan Diagnostic X-Ray & Lab MRI, CT, PET & nuclear cardiac scan (UR) Other diagnostic x-ray & lab Cancer Screenings (Industry standard, routine screenings) Physical Medicine (OT, PT, Chiro) (some limits may apply) Chiropractic Speech Therapy Acupuncture 12 visits per year Durable Medical Equipment Rental or Purchase of DME Hearing Aid ($700 maximum every 24 months) Hospice Ambulance (Ground or Air) Home Health Care 100 4-hour visits/yr (prior authorization req'd) Home Infusion Psychiatric & Substance Abuse Inpatient Outpatient Outpatient Prescription Drugs Deductible Waived 100% Not Covered 90% 90% Deductible Waived 100% 90% Non Par Fee Non Par Fee Non Par Fee Not Covered 90% 90% Deductible Waived 100% Non Par Fee Non Par Fee 90% Non-Par Fee Non Par Fee Deductible Waived 100% Not Covered 100% 100% Deductible Waived 100% Non Par Fee Non Par Fee 100% Non-Par Fee Non Par Fee Deductible Waived 100% Not Covered 100% 100% Deductible Waived 100% Non Par Fee Non Par Fee 100% Non-Par Fee Non Par Fee Non-Par Fee 90% Non-Par Fee 90% Non-Par Fee 100% Non-Par Fee 100% Non-Par Fee 90% up to $50 per visit Non-Par Fee up to $25 per visit 90% up to $50 per visit Non-Par Fee up to $25 per visit 100% up to $50 per visit Non-Par Fee up to $25 per visit 100% up to $50 per visit Non-Par Fee up to $25 per visit 90% 90% 90% 90% 90% Non Par Fee Non-Par Fee 90% 90% Non-Par Fee 90% 90% 90% 90% 90% Non-Par Fee Non-Par Fee 90% 90% Non-Par Fee 100% 100% 100% 100% 100% Non-Par Fee Non-Par Fee 100% 100% Non-Par Fee 100% 100% 100% 100% 100% Non-Par Fee Non-Par Fee 100% 100% Non-Par Fee 90% 100% up to $600/day 90% 100% up to $600/day 100% 100% up to $600/day 100% 100% up to $600/day Same as other medical benefits Same as other medical benefits Same as other medical benefits Same as other medical benefits SISC Medco Rx Plan $200/$10-35 Retail Mail 30 days 90 days $200 per individual / $500 per family $10 $25 $35 $90 SISC Medco Rx Plan $7-25 Retail Mail 30 days 90 days Not applicable $7 $14 $25 $60 SISC Medco Rx Plan $9-35 Retail Mail 30 days 90 days Not applicable $9 $35 SISC Medco Rx Plan $200/$15-50 Retail Mail 30 days 90 days $200 per individual / $500 per family $15 $50 This is only a brief summary of benefits. For details, limitations and exclusions, please refer to the Summary Plan Description. PBC 90-E $20 SISC 200/10-35 DENTAL $1500 max VISION LIFE TOTAL PER EMPLOYEE PER MONTH TOTAL COST PER EMPLOYEE PER YEAR EMPLOYEE PAYS (SEP-JUN) PBC 90-A $20 SISC 5-20 DENTAL $1500 max VISION LIFE $1,111.00 $108.00 $22.10 $9.50 $1,250.60 $15,007.20 $ 86.40 PBC 100-C $20 SISC 9-35 DENTAL $1500 max VISION LIFE $1,233.00 $108.00 $22.10 $9.50 $1,372.60 $16,471.20 $ 232.80 PBC 100-C $20 SISC $200/15-50 DENTAL $1500 max VISION LIFE $1,232.00 $108.00 $22.10 $9.50 $1,371.60 $16,459.20 $ 231.60 $1,182.00 $108.00 $22.10 $9.50 $1,321.60 $15,859.20 $ 171.60

© Copyright 2026