AAA/3(MEX) F - Fondos de Inversión Banamex

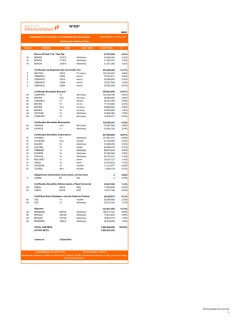

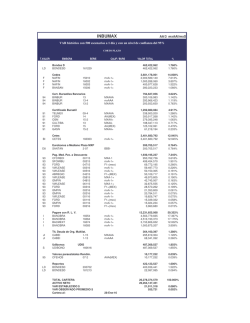

BNMMD AAA/3(MEX) F BANAMEX MEDIANO PLAZO NO CONTRIBUYENTES HORIZONTE EN INSTRUMENTOS DE DEUDA, S.A. DE C.V. SOCIEDAD DE INVERSIÓN EN INSTRUMENTOS DE DEUDA “EN PROCESO DE TRANSFORMACIÓN A FONDO DE INVERSIÓN.” CORTO PLAZO GENERAL Tipo de Valor Emisora Serie / % T. I. % T. I. Valor Total Cartera al: 29-Jul-2016 % Cal-Bur Bondes D LD BONDESD 181213 305,811,094 2.365% AAA(mex) LD BONDESD 190328 330,138,483 2.553% AAA(mex) LD BONDESD 315,788,576 2.442% Bonos de prot. al ahorro Trim. IT BPAT 160929 7,708,512 0.060% AAA(mex) 153,489,642 1.187% AAA(mex) Bonos Prot. Ahorro pago Trim. IQ BPAG91 160811 IQ BPAG91 160929 43,574,548 0.337% AAA(mex) IQ BPAG91 170209 113,442,131 0.877% AAA(mex) IQ BPAG91 170420 17,741,792 0.137% AAA(mex) IQ BPAG91 170629 23,940,091 0.185% AAA(mex) IQ BPAG91 170831 46,883,106 0.363% AAA(mex) Bonos Prot.Ahorro pago mensual IM BPAG28 160818 397,292,850 3.072% AAA(mex) IM BPAG28 161020 41,639,257 0.322% AAA(mex) IM BPAG28 161222 4,126,961 0.032% AAA(mex) IM BPAG28 170727 56,877,611 0.440% AAA(mex) IM BPAG28 171123 284,917,900 2.203% AAA(mex) IM BPAG28 180222 288,858,480 2.234% AAA(mex) IM BPAG28 180726 78,757,642 0.609% AAA(mex) BPAS 182 IS BPA182 395,037,771 3.055% Cert. Bursatiles Bancarios 94 BACOMER 94 BANAMEX 94 BINBUR 16 58,999,745 0.456% AAA(mex) 10 66,401,454 0.514% AAA(mex) 13-3 21,241,892 94 BINBUR 94 BINBUR 0.164% mxAAA 13-4 7,475,224 0.058% mxAAA 16-3 9,619,924 94 0.074% mxAAA BSANT 16 30,706,481 0.237% AAA(mex) 94 COMPART 11 48,410,310 0.374% mxAAA 94 COMPART 12 65,322,619 0.505% mxAAA 94 COMPART 14 15,054,001 0.116% mxAAA 94 SCOTIAB 13 14,090,147 0.109% AAA(mex) Certificado Bursatil 91 BLADEX 14 6,415,846 0.050% AAA(mex) 91 CFCREDI 15 15,620,129 0.121% AAA(mex) 91 DAIMLER 15 14,752,507 0.114% AAA(mex) 91 DAIMLER 15-2 14,674,713 0.113% AAA(mex) 91 DAIMLER 16 19,184,964 0.148% AAA(mex) 91 DANHOS 16-2 11,269,588 0.087% AAA(mex) 91 FACILSA 14-2 34,133,171 0.264% AAA(mex) 91 FACILSA 15 17,257,978 0.133% AAA(mex) 91 FACILSA 16 15,164,178 0.117% AAA(mex) 91 FUNO 13 42,194,943 0.326% AAA(mex) 91 FUNO 16 13,315,370 0.103% AAA(mex) 91 GASN 15-2 7,284,520 0.056% AAA(mex) 91 GCARSO 12 110,537,645 91 KIMBER 07 74,694,516 0.578% AAA(mex) 91 MOLYMET 12 58,214,691 0.450% AA+(mex) 91 NRF 13 39,142,910 0.303% mxAAA 91 SORIANA 15 59,523,581 0.460% AA+(mex) 91 SORIANA 16 15,046,486 0.116% AA+(mex) 91 UFINCB 15 19,935,504 0.154% mxAAA 91 UFINCB 16 6,757,339 0.052% mxAAA 91 UNFINCB 15 36,010,310 0.278% mxAAA 91 UNIRECB 14 8,779,919 0.068% mxAAA 91 VWLEASE 13 5,656,947 0.044% mxAAA 91 VWLEASE 13-2 22,229,752 0.172% mxAAA 91 VWLEASE 14 2,418,063 0.019% mxAAA 0.855% HR AAA Certificado Bursatil Descuento 92 FEFA 01616 30,668,967 0.237% AAA(mex) 92 FEFA 02016 9,846,131 0.076% AAA(mex) 92 FEFA 02216 29,954,978 0.232% AAA(mex) Cetes BI CETES 161013 481,393,377 3.723% AAA(mex) BI CETES 161208 526,241,904 4.070% AAA(mex) BI CETES 161222 561,566,916 4.343% AAA(mex) BI CETES 311,669,213 2.410% 2-07 179,423,844 1.388% A- Eurobonos a Mediano Plazo MXP D8 SANTAN Reportos LD BONDESD 161027 296,152,317 2.290% AAA(mex) LD BONDESD 170622 1,155,229,983 8.934% AAA(mex) LD BONDESD 190627 1,195,188,465 9.243% AAA(mex) LD BONDESD 190808 593,745,201 4.592% AAA(mex) M BONOS 181213 671,191,424 5.191% AAA(mex) IS BPA182 170629 656,730,025 5.079% AAA(mex) IQ BPAG91 190417 584,067,340 4.517% AAA(mex) IQ BPAG91 191219 611,109,519 4.726% AAA(mex) IQ BPAG91 191219 999,506,843 7.730% AAA(mex) Valores paraestatales Rendim. 95 CFEHCB 08 11,925,286 0.092% AAA(mex) 95 FEFA 15-4 22,086,999 0.171% AAA(mex) 95 FEFA 16 89,710,234 TOTAL CARTERA 12,930,972,780 ACTIVO NETO Cartera al: 12,928,192,749 29-Jul-2016 LIMITE MAX. VALOR RIESGO PROMEDIO 0.0900% SUPUESTOS Nivel de Confianza: 95%, Observaciones: 500, Ventana de Tiempo: 1 días Var Histórico METODOLOGIA PARA CÁLCULO 0.0036% 0.694% AAA(mex) 100.000%

© Copyright 2026