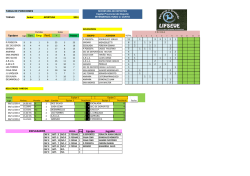

Reportes Corporativos EUA - Monex

27 de octubre de 2014 www.monex.com.mx Internacional @monexanalisis Reportes Corporativos EUA Elaborado por: Carlos Gonzalez Tabares Astianax Cuanalo Dorantes Fecha Reporte Utilidad por Acción Empresa 3T14e 3T14 3T13 3T14 (e/c) vs. 3T13 Influencia en el Índice 3T14 vs. 3T14E Dow Jones S&P Nasdaq 9.2% 20/10/2014 Apple Inc 1.31 1.07 1.07 0% -18% 3.6% 20/10/2014 Halliburton Co 1.10 1.32 0.73 81% 20% 0.3% 20/10/2014 Illumina Inc 0.56 2.36 0.43 449% 323% 20/10/2014 International Business Machines Corp 4.32 0.81 3.22 -75% -81% 0.3% 20/10/2014 Texas Instruments Inc 0.71 0.99 0.58 71% 39% 0.3% 0.7% 21/10/2014 Broadcom Corp 0.84 1.19 0.70 70% 42% 0.1% 0.3% 21/10/2014 Intuitive Surgical Inc 3.80 0.90 3.90 -77% -76% 0.1% 0.3% 21/10/2014 Lockheed Martin Corp 2.71 0.63 2.64 -76% -77% 0.3% 21/10/2014 Mcdonald'S Corp 1.37 0.80 1.38 -42% -42% 3.6% 0.5% 21/10/2014 The Coca-Cola Co 0.53 0.90 0.63 43% 71% 1.7% 1.0% 21/10/2014 Travelers Companies Inc 2.27 0.93 2.13 -56% -59% 3.6% 0.2% 21/10/2014 United Technologies Corp 1.81 1.14 1.70 -33% -37% 3.9% 0.5% 21/10/2014 Verizon Communications Inc 0.90 0.47 0.73 -36% -48% 1.9% 1.2% 22/10/2014 Abbott Laboratories 0.59 1.50 0.46 226% 153% 22/10/2014 At&T Inc 0.64 1.42 0.67 112% 123% 22/10/2014 Biogen Idec Inc 3.46 0.65 2.30 -72% -81% 22/10/2014 Boeing Co 1.97 0.62 1.67 -63% -69% 22/10/2014 Ca Inc 0.62 3.68 0.78 372% 491% 0.0% 0.2% 22/10/2014 Citrix Systems Inc 0.73 0.75 0.66 14% 3% 0.1% 0.2% 22/10/2014 Dow Chemical Co 0.68 0.38 0.64 -41% -44% 0.3% 22/10/2014 Emc Corp 0.46 -0.95 0.42 -328% -305% 0.3% 22/10/2014 Nxp Semiconductors Nv 1.30 2.47 0.71 248% 89% 22/10/2014 O'Reilly Automotive Inc 1.95 12.51 1.58 692% 541% 0.1% 22/10/2014 Simon Property Group Inc 0.83 1.28 1.10 16% 54% 0.3% 22/10/2014 Thermo Fisher Scientific Inc 1.69 1.42 1.32 8% -16% 0.3% 22/10/2014 Tractor Supply Co 0.50 0.93 0.88 6% 85% 0.0% 22/10/2014 U.S. Bancorp 0.78 1.14 0.76 50% 46% 0.4% 23/10/2014 3M Co 1.96 2.11 1.71 23% 7% 23/10/2014 Alexion Pharmaceuticals Inc 1.16 0.90 0.73 23% -22% 0.2% 0.5% 23/10/2014 Altera Corp 0.37 1.86 0.31 500% 399% 0.1% 0.1% 23/10/2014 Amazon.Com Inc -0.74 6.35 -0.02 31850% 964% 0.7% 2.2% 23/10/2014 Caterpillar Inc 1.36 0.76 1.45 -48% -44% 23/10/2014 Celgene Corp 0.95 0.91 0.76 20% -4% 0.4% 1.1% 23/10/2014 Cerner Corp 0.42 3.92 0.34 1053% 831% 0.1% 0.3% 23/10/2014 Check Point Software Technologies Ltd 0.91 2.76 0.83 233% 205% 23/10/2014 Comcast Corp 0.71 2.04 0.65 214% 189% 0.8% 1.7% 7.2% 1.0% 0.4% 1.3% 1.0% 0.4% 4.7% 1.1% 0.5% 0.2% 5.3% 3.6% 0.2% 0.1% 0.5% 0.3% 0.2% 23/10/2014 Eli Lilly And Co 0.67 0.22 1.16 -81% -67% 0.4% 23/10/2014 Kla-Tencor Corp 0.46 2.49 0.82 204% 438% 0.1% 0.2% 23/10/2014 Maxim Integrated Products Inc 0.37 2.05 0.44 366% 460% 23/10/2014 Microsoft Corp 0.49 -0.42 0.66 -164% -186% 2.1% 5.7% Occidental Petroleum Corp Dato conocido 1.57 2.47 ha presentado 1.58 56% (e/c) 23/10/2014 Dato estimado cuando la empresa no ha reportado. cuando la empresa su reporte Fuente: Monex con baseSigma-Aldrich en Thomson Reuters 23/10/2014 Corp y Bloomberg 1.06 1.59 1.05 51% 57% 0.4% 50% 0.1% 0.2% -57% 0.1% 0.1% -51% 0.1% 1.8% 23/10/2014 Stericycle Inc 1.06 0.46 0.93 23/10/2014 Union Pacific Corp 1.52 0.12 1.19 -90% -92% 0.5% 24/10/2014 Bristol-Myers Squibb Co 0.42 1.42 0.44 223% 240% 0.5% 1 MONEX Grupo Financiero / Mercado Accionario 22/10/2014 Tractor Supply Co 0.50 0.93 0.88 6% 22/10/2014 Ca Inc 0.62 3.68 0.78 372% 22/10/2014 U.S. Bancorp 0.78 1.14 0.76 50% 22/10/2014 Citrix Systems Inc 0.73 0.75 0.66 14% 23/10/2014 3M Co 1.96 2.11 1.71 23% 22/10/2014 Dow Chemical Co 0.68 0.38 0.64 -41% 23/10/2014 Alexion Pharmaceuticals Inc 1.16 0.90 0.73 23% 22/10/2014 Emc Corp 0.46 -0.95 0.42 -328% 23/10/2014 Altera Corp 0.37 1.86 0.31 500% 22/10/2014 Nxp Semiconductors Nv 1.30 2.47 0.71 248% 23/10/2014 Amazon.Com Inc -0.74 6.35 -0.02 31850% 22/10/2014 O'Reilly Automotive Inc 1.95 12.51 1.58 692% 23/10/2014 Caterpillar Inc 1.36 0.76 1.45 -48% 22/10/2014 Simon Property Group Inc 0.83 1.28 1.10 16% 23/10/2014 Celgene Corp 0.95 0.91 0.76 20% 22/10/2014 Thermo Fisher Scientific Inc 1.69 1.42 1.32 8% 23/10/2014 Cerner Corp 0.42 3.92 0.34 1053% 22/10/2014 Tractor Supply Co 0.50 0.93 0.88 6% 23/10/2014 Check Point Software Technologies Ltd 0.91 2.76 0.83 233% 22/10/2014 U.S. Bancorp 0.78 1.14 0.76 50% 23/10/2014 Comcast Corp 0.71 2.04 0.65 214% 23/10/2014 3M Co 1.96 2.11 1.71 23% 23/10/2014 Eli Lilly And Co 0.67 0.22 1.16 -81% 23/10/2014 Alexion Pharmaceuticals Inc 1.16 0.90 0.73 23% 23/10/2014 Kla-Tencor Corp 0.46 2.49 0.82 por Acción 204% Utilidad Fecha Reporte Empresa 23/10/2014 Altera Corp 0.37 1.86 0.31 500% 23/10/2014 Maxim Integrated Products Inc 0.37 2.05 0.44 3T14366% (e/c) vs. 3T14e 3T14 3T13 23/10/2014 Amazon.Com Inc -0.74 6.35 -0.02 31850% 3T13 23/10/2014 Microsoft Corp 0.49 -0.42 0.66 -164% 23/10/2014 Caterpillar Inc 1.36 0.76 1.45 -48% 20/10/2014 Apple Inc Petroleum Corp 1.31 1.07 1.07 0% 23/10/2014 Occidental 1.57 2.47 1.58 56% 23/10/2014 Celgene Corp 0.95 0.91 0.76 20% 20/10/2014 Halliburton CoCorp 1.10 1.32 0.73 81% 23/10/2014 Sigma-Aldrich 1.06 1.59 1.05 51% 23/10/2014 Cerner Corp 0.42 3.92 0.34 1053% 20/10/2014 Illumina Inc 0.56 2.36 0.43 449% 23/10/2014 Stericycle Inc 1.06 0.46 0.93 -51% 23/10/2014 Check Point Software Technologies Ltd 0.91 2.76 0.83 233% 20/10/2014 International Business Machines Corp 4.32 0.81 3.22 -75% 23/10/2014 Union Pacific Corp 1.52 0.12 1.19 -90% 23/10/2014 Comcast Corp 0.71 2.04 0.65 214% 20/10/2014 Texas Instruments IncCo 0.71 0.99 0.58 71% 24/10/2014 Bristol-Myers Squibb 0.42 1.42 0.44 223% 23/10/2014 Eli Lilly And Co 0.67 0.22 1.16 -81% 21/10/2014 Broadcom Corp Co 0.84 1.19 0.70 70% 24/10/2014 Colgate-Palmolive 0.76 2.61 0.70 273% 23/10/2014 Kla-Tencor Corp 0.46 2.49 0.82 204% 21/10/2014 Intuitive Surgical 3.80 0.90 3.90 -77% 24/10/2014 Ford Motor Co Inc 0.19 1.58 0.45 251% 23/10/2014 Maxim Integrated Products Inc 0.37 2.05 0.44 366% 21/10/2014 Lockheed Martin Corp 2.71 0.63 2.64 -76% 24/10/2014 Procter & Gamble Co 1.07 12.51 0.79 1484% 23/10/2014 Microsoft Corp 0.49 -0.42 0.66 -164% 21/10/2014 Mcdonald'S 1.37 0.80 1.38 -42% 24/10/2014 United ParcelCorp Service Inc 1.28 0.61 1.13 -46% 23/10/2014 Occidental Petroleum Corp 1.57 2.47 1.58 56% 21/10/2014 The la Coca-Cola Coha reportado. Dato conocido 0.53 0.90 ha presentado 0.63 43% (e/c)27/10/2014 Dato estimado cuando empresa cuando la empresa su reporte Allergan Inc no 1.68 1.22 37% 23/10/2014 Sigma-Aldrich Corp y Bloomberg 1.06 1.59 1.05 51% Fuente: Monex con base en Thomson Reuters 21/10/2014 Travelers 2.27 0.93 2.13 -56% 27/10/2014 Amgen IncCompanies Inc 2.11 1.89 12% 23/10/2014 Stericycle Inc 1.06 0.46 0.93 -51% 21/10/2014 United&Technologies Corp 1.81 1.14 1.70 -33% 27/10/2014 Merck Co Inc 0.88 0.84 5% 23/10/2014 Union Pacific Corp 1.52 0.12 1.19 -90% 21/10/2014 Verizon Technology Communications 0.90 0.47 0.73 -36% 27/10/2014 Seagate Plc Inc 1.25 1.20 4% 24/10/2014 Bristol-Myers Squibb Co 0.42 1.42 0.44 223% 22/10/2014 Abbott Laboratories 0.59 1.50 0.46 226% 28/10/2014 Anadarko Petroleum Corp 1.27 1.05 21% 24/10/2014 Colgate-Palmolive Co 0.76 2.61 0.70 273% 22/10/2014 At&TRobinson Inc 0.64 1.42 0.67 112% 28/10/2014 C.H. Worldwide Inc 0.80 0.70 15% 24/10/2014 Ford Motor Co 0.19 1.58 0.45 251% 22/10/2014 Biogen Idec Inc 3.46 0.65 2.30 -72% Utilidad por Acción Fecha Reporte Empresa 28/10/2014 E I Du Pont De Nemours And Co 0.53 1.28 -59% 24/10/2014 Procter & Gamble Co 1.07 12.51 0.79 1484% 3T14 (e/c) 22/10/2014 Boeing Co 1.97 0.62 1.67 -63% 28/10/2014 Express Scripts Holding Co 1.29 1.12 15% vs. 3T14e 3T14 3T13 3T13 24/10/2014 United Parcel Service Inc 1.28 0.61 1.13 -46% 22/10/2014 Ca Inc 0.62 3.68 0.78 372% 28/10/2014 Facebook Inc 0.40 0.19 113% 20/10/2014 Apple IncInc 1.31 1.07 1.07 0% 27/10/2014 Allergan 1.68 1.22 37% 22/10/2014 Citrix Systems Inc 0.73 0.75 0.66 14% 28/10/2014 Fiserv Inc 0.84 0.75 12% 20/10/2014 Halliburton 1.10 1.32 0.73 81% 27/10/2014 Amgen Inc Co 2.11 1.89 12% 22/10/2014 Dow Chemical Co 0.68 0.38 0.64 -41% 28/10/2014 Gilead Sciences Inc 1.92 0.50 283% 20/10/2014 Illumina 0.56 2.36 0.43 449% 27/10/2014 Merck &Inc Co Inc 0.88 0.84 5% 22/10/2014 Emc CorpInternational Inc 0.46 -0.95 0.42 -328% 28/10/2014 Marriott 0.62 0.57 8% 20/10/2014 International Business 0.81 3.22 -75% 27/10/2014 Seagate Technology PlcMachines Corp 4.32 1.25 1.20 4% 22/10/2014 Nxp Semiconductors Nv 1.30 2.47 0.71 248% 28/10/2014 Mckesson Corp 2.73 2.07 32% 20/10/2014 Texas Instruments IncCorp 0.71 0.99 0.58 71% 28/10/2014 Anadarko Petroleum 1.27 1.05 21% 22/10/2014 O'ReillyInc Automotive Inc 1.95 12.51 1.58 692% 28/10/2014 Paccar 0.96 0.82 17% 21/10/2014 Broadcom CorpWorldwide Inc 0.84 1.19 0.70 70% 28/10/2014 C.H. Robinson 0.80 0.70 15% 22/10/2014 Simon Property Group Inc 0.83 1.28 1.10 16% 28/10/2014 Pfizer Inc 0.55 0.56 -1% 21/10/2014 Intuitive Surgical Inc 3.80 0.90 3.90 -77% 28/10/2014 E I Du Pont De Nemours And Co 0.53 1.28 -59% 22/10/2014 Thermo Scientific 1.69 1.42 1.32 8% 28/10/2014 Sirius XmFisher Holdings Inc Inc 0.02 0.02 0% 21/10/2014 Lockheed MartinHolding Corp Co 2.71 0.63 2.64 -76% 28/10/2014 Express Scripts 1.29 1.12 15% 22/10/2014 TractorAnalytics Supply Co 0.50 0.93 0.88 6% 28/10/2014 Verisk Inc 0.64 0.55 17% 21/10/2014 Mcdonald'S 1.37 0.80 1.38 -42% 28/10/2014 Facebook IncCorp 0.40 0.19 113% 22/10/2014 U.S. Bancorp 0.78 1.14 0.76 50% 28/10/2014 Vertex Pharmaceuticals Inc -0.62 -0.26 -138% 21/10/2014 The Coca-Cola Co 0.53 0.90 0.63 43% 28/10/2014 Fiserv Inc 0.84 0.75 12% 23/10/2014 3M Co 1.96 2.11 1.71 23% 28/10/2014 Western Digital Corp 2.03 1.96 4% 21/10/2014 Travelers Companies 2.27 0.93 2.13 -56% 28/10/2014 Gilead Sciences Inc Inc 1.92 0.50 283% 23/10/2014 Alexion Pharmaceuticals Inc 1.16 0.90 0.73 23% 28/10/2014 Wynn Resorts Ltd 1.84 1.51 22% 21/10/2014 United Technologies Corp 1.81 1.14 1.70 -33% 28/10/2014 Marriott International Inc 0.62 0.57 8% 23/10/2014 Altera Corp 0.37 1.86 0.31 500% 29/10/2014 Akamai Technologies Inc 0.57 0.46 23% 21/10/2014 Verizon Communications Inc 0.90 0.47 0.73 -36% 28/10/2014 Mckesson Corp 2.73 2.07 32% 23/10/2014 Amazon.Com IncProcessing Inc -0.74 6.35 -0.02 31850% 29/10/2014 Automatic Data 0.60 0.55 9% 22/10/2014 Abbott 0.59 1.50 0.46 226% 28/10/2014 Paccar Laboratories Inc 0.96 0.82 17% 23/10/2014 Caterpillar Inc 1.36 0.76 1.45 -48% 29/10/2014 Baidu Inc 9.76 7.52 30% 22/10/2014 At&T 0.64 1.42 0.67 112% 28/10/2014 PfizerInc Inc 0.55 0.56 -1% 23/10/2014 CelgeneInc Corp 0.95 0.91 0.76 20% 29/10/2014 Equinix 0.89 -0.58 253% 22/10/2014 Biogen Idec Inc 3.46 0.65 2.30 -72% 28/10/2014 Sirius Xm Holdings Inc 0.02 0.02 0% 23/10/2014 Cerner Corp 0.42 3.92 0.34 1053% 29/10/2014 F5 Networks Inc 1.48 1.12 32% 22/10/2014 Boeing Co 1.97 0.62 1.67 -63% 28/10/2014 Verisk Analytics Inc 0.64 0.55 17% 23/10/2014 Check Point 0.91 2.76 0.83 233% 29/10/2014 Garmin Ltd Software Technologies Ltd 0.71 0.76 -7% 22/10/2014 Ca Inc Pharmaceuticals Inc 0.62 3.68 0.78 372% 28/10/2014 Vertex -0.62 -0.26 -138% 23/10/2014 Comcast Corp 0.71 2.04 0.65 214% 29/10/2014 Kraft Foods Group Inc 0.74 0.76 -2% 22/10/2014 Citrix Systems IncCorp 0.73 0.75 0.66 14% 28/10/2014 Western Digital 2.03 1.96 4% 23/10/2014 Eli Lilly And 0.67 0.22 1.16 -81% 29/10/2014 Metlife Inc Co 1.38 1.44 -4% 22/10/2014 Dow Chemical 0.68 0.38 0.64 -41% 28/10/2014 Wynn Resorts Co Ltd 1.84 1.51 22% 23/10/2014 Kla-Tencor Corp 0.46 2.49 0.82 204% 29/10/2014 Phillips 66 1.75 1.50 17% 22/10/2014 Emc CorpTechnologies Inc 0.46 -0.95 0.42 -328% 29/10/2014 Akamai 0.57 0.46 23% 23/10/2014 Maxim 0.37 2.05 0.44 366% 29/10/2014 Visa IncIntegrated Products Inc 2.10 1.88 12% 22/10/2014 Nxp Semiconductors Nv 1.30 2.47 0.71 248% 29/10/2014 Automatic Data Processing Inc 0.60 0.55 9% 23/10/2014 Microsoft Corp 0.49 -0.42 0.66 -164% 30/10/2014 Altria Group Inc 0.68 0.62 10% 22/10/2014 O'Reilly Automotive Inc 1.95 12.51 1.58 692% 29/10/2014 Baidu Inc 9.76 7.52 30% 23/10/2014 Occidental Corp Petroleum Corp 1.57 2.47 1.58 56% 30/10/2014 Catamaran 0.56 0.49 15% 22/10/2014 Simon Group Inc 0.83 1.28 1.10 16% 29/10/2014 EquinixProperty Inc 0.89 -0.58 253% 23/10/2014 Sigma-Aldrich Corp 1.06 1.59 1.05 51% 30/10/2014 Conocophillips 1.20 1.41 -15% 22/10/2014 Thermo FisherInc Scientific Inc 1.69 1.42 1.32 8% 29/10/2014 F5 Networks 1.48 1.12 32% 23/10/2014 Stericycle 1.06 0.46 0.93 -51% 30/10/2014 Expedia IncInc 1.74 0.64 172% 22/10/2014 Tractor 0.50 0.93 0.88 6% 29/10/2014 GarminSupply Ltd Co 0.71 0.76 -7% 23/10/2014 Union Pacific Corp 1.52 0.12 1.19 -90% 30/10/2014 Mastercard Inc 0.78 0.70 12% 22/10/2014 U.S. 0.78 1.14 0.76 50% 29/10/2014 KraftBancorp Foods Group Inc 0.74 0.76 -2% 24/10/2014 Bristol-Myers Squibb Co 0.42 1.42 0.44 223% 30/10/2014 Mylan Inc 1.14 0.68 68% 23/10/2014 3M Co Inc 1.96 2.11 1.71 23% 29/10/2014 Metlife 1.38 1.44 -4% 24/10/2014 Colgate-Palmolive Co 0.76 2.61 0.70 273% 30/10/2014 Starbucks Corp 0.74 0.55 35% 23/10/2014 Alexion Pharmaceuticals Inc 1.16 0.90 0.73 23% 29/10/2014 Phillips 66 1.75 1.50 17% 24/10/2014 Ford Motor 0.19 1.58 0.45 251% 31/10/2014 Abbvie Inc Co 0.77 0.82 -6% 23/10/2014 Altera Corp 0.37 1.86 0.31 500% 29/10/2014 Visa Inc 2.10 1.88 12% 24/10/2014 Procter Communications & Gamble Co Inc 1.07 12.51 0.79 1484% 31/10/2014 Charter 0.07 -0.96 107% 23/10/2014 Amazon.Com Inc -0.74 6.35 -0.02 31850% 30/10/2014 Altria Group Inc 0.68 0.62 10% 24/10/2014 United Parcel 1.28 0.61 1.13 -46% 31/10/2014 Chevron Corp Service Inc 2.56 2.77 -8% 23/10/2014 Caterpillar 1.36 0.76 1.45 -48% 30/10/2014 CatamaranInc Corp 0.56 0.49 15% 27/10/2014 Allergan Inc 1.68 1.22 37% 31/10/2014 Exxon Mobil Corp 1.73 1.55 11% 23/10/2014 Celgene Corp 0.95 0.91 0.76 20% 30/10/2014 Conocophillips 1.20 1.41 -15% 27/10/2014 Amgen Inc 2.11 1.89 12% 23/10/2014 Cerner 0.42 3.92 0.34 1053% 30/10/2014 ExpediaCorp Inc 1.74 0.64 172% 27/10/2014 Merck & Co Inc 0.88 0.84 5% 23/10/2014 Check Point Software Technologies Ltd 0.91 2.76 0.83 233% 30/10/2014 Mastercard Inc 0.78 0.70 12% 27/10/2014 Seagate Technology Plc 1.25 1.20 4% 23/10/2014 Comcast 0.71 2.04 0.65 214% 30/10/2014 Mylan IncCorp 1.14 0.68 68% 28/10/2014 Anadarko Petroleum Corp 1.27 1.05 21% 23/10/2014 Eli Lilly AndCorp Co 0.67 0.22 1.16 -81% 30/10/2014 Starbucks 0.74 0.55 35% 28/10/2014 C.H. Robinson Worldwide Inc 0.80 0.70 15% 23/10/2014 Kla-Tencor 0.46 2.49 0.82 204% 31/10/2014 Abbvie Inc Corp 0.77 0.82 -6% 28/10/2014 E I Du Pont De Nemours And Co 0.53 1.28 -59% 23/10/2014 Maxim Products 0.37 2.05 0.44 366% 31/10/2014 CharterIntegrated Communications IncInc 0.07 -0.96 107% 28/10/2014 Express Scripts Holding Co 1.29 1.12 15% 23/10/2014 Microsoft Corp 0.49 -0.42 0.66 -164% 31/10/2014 Chevron Corp 2.56 2.77 -8% 28/10/2014 Facebook Inc 0.40 0.19 113% 23/10/2014 Occidental Petroleum Corp 1.57 2.47 1.58 56% 31/10/2014 Exxon Mobil Corp 1.73 1.55 11% 28/10/2014 Fiserv Inc 0.84 0.75 12% Sigma-Aldrich Corp 1.06 1.59 ha presentado 1.05 51% (e/c)23/10/2014 Dato estimado cuando la empresa no ha reportado. Dato conocido cuando la empresa su reporte 28/10/2014 Gilead Sciences Inc 1.92 0.50 283% Fuente: Monex con base en Thomson 23/10/2014 Stericycle IncReuters y Bloomberg 1.06 0.46 0.93 -51% 28/10/2014 Marriott International Inc 0.62 0.57 8% 23/10/2014 Union Pacific Corp 1.52 0.12 1.19 -90% 28/10/2014 Mckesson Corp 2.73 2.07 32% 24/10/2014 Bristol-Myers Squibb Co 0.42 1.42 0.44 223% 28/10/2014 Paccar Inc 0.96 0.82 17% 24/10/2014 Colgate-Palmolive Co 0.76 2.61 0.70 273% 28/10/2014 Pfizer Inc 0.55 0.56 -1% 24/10/2014 Ford Motor Co 0.19 1.58 0.45 251% 28/10/2014 Sirius Xm Holdings Inc 0.02 0.02 0% 85% 491% 46% 3% 7% -44% -22% -305% 399% 89% 964% 541% -44% 54% -4% -16% 831% 85% 205% 46% 189% 7% -67% -22% 438% 399% 460%vs. 3T14 964% 3T14E -186% -44% -18% 57% -4% 20% 50% 831% 323% -57% 205% -81% -92% 189% 39% 240% -67% 42% 246% 438% -76% 727% 460% -77% 1067% -186% -42% -52% 57% 71% 50% -59% -57% -37% -92% -48% 240% 153% 246% 123% 727% -81% 1067% 3T14 vs. -69% 3T14E -52% 491% -18% 3% 20% -44% 323% -305% -81% 89% 39% 541% 42% 54% -76% -16% -77% 85% -42% 46% 71% 7% -59% -22% -37% 399% -48% 964% 153% -44% 123% -4% -81% 831% -69% 205% 491% 189% 3% -67% -44% 438% -305% 460% 89% -186% 541% 57% 54% 50% -16% -57% 85% -92% 46% 240% 7% 246% -22% 727% 399% 1067% 964% -52% -44% -4% 831% 205% 189% -67% 438% 460% -186% 57% 50% -57% -92% 240% 246% 727% 5.3% 3.6% 0.0% 0.0% 0.4% 0.1% 0.5% 0.3% 0.2% 0.3% 0.1% 0.7% 0.1% 0.3% 0.3% 0.4% 0.3% 0.1% 0.0% 0.1% 0.2% 0.2% 0.5% 0.1% 0.2% 2.2% 0.2% 1.1% 0.3% 0.1% 0.2% 0.4% 0.8% 1.7% 5.3% 0.5% 0.4% 0.2% 0.5% 0.1% 0.2% Influencia en el Índice 0.1% 0.1% 0.1% Dow Jones 0.7% S&P Nasdaq 2.2% 1.8% 2.1% 5.7% 3.6% 0.3% 3.6% 9.2% 0.4% 0.4% 1.1% 0.3% 0.1% 0.2% 0.1% 0.3% 0.3% 0.1% 0.1% 0.2% 7.2% 1.0% 0.5% 0.8% 1.7% 0.3% 0.7% 0.5% 0.4% 0.1% 0.3% 0.3% 0.1% 0.2% 0.1% 0.3% 0.3% 0.1% 0.3% 3.2% 1.4% 1.8% 2.1% 5.7% 3.6% 0.5% 0.4% 0.4% 1.7% 1.0% 0.3% 0.1% 0.2% 3.6% 0.2% 0.6% 1.6% 0.1% 0.1% 3.9% 0.5% 2.3% 1.0% 0.5% 1.9% 1.2% 0.1% 0.3% 0.5% 0.4% 0.3% 0.3% 1.3% 1.0% 0.1% 0.1% 0.3% 0.4% 1.1% Influencia en el Índice 2.6% 0.4% 3.2% 1.4% 0.5% 0.3% 0.8% Dow4.7% Jones S&P Nasdaq 0.4% 0.0% 0.2% 0.8% 2.3% 3.6% 9.2% 0.3% 0.1% 0.2% 0.1% 0.2% 0.3% 0.6% 1.6% 0.3% 0.9% 2.4% 0.3% 2.3% 1.0% 0.3% 0.1% 0.3% 7.2% 1.0% 0.1% 0.3% 0.2% 0.3% 0.3% 0.7% 0.3% 0.1% 0.2% 0.1% 0.3% 0.1% 0.3% 0.1% 0.1% 0.3% 1.1% 1.1% 0.1% 0.3% 2.6% 0.4% 0.3% 0.3% 0.3% 0.3% 0.8% 0.0% 0.1% 0.1% 3.6% 0.5% 0.8% 2.3% 0.4% 0.1% 0.4% 1.7% 1.0% 0.1% 0.2% 5.3% 0.5% 0.1% 0.3% 3.6% 0.2% 0.9% 2.4% 0.2% 0.5% 0.1% 0.3% 3.9% 0.5% 0.1% 0.3% 0.1% 0.1% 0.1% 0.2% 1.9% 1.2% 0.3% 0.7% 2.2% 0.2% 0.5% 0.4% 0.1% 0.3% 3.6% 0.3% 0.9% 1.3% 1.0% 1.1% 1.1% 0.4% 1.1% 0.2% 0.4% 1.1% 0.3% 0.1% 0.3% 0.0% 0.1% 4.7% 0.5% 0.1% 0.2% 0.0% 0.1% 0.0% 0.2% 0.1% 0.4% 0.8% 1.7% 0.2% 0.5% 0.1% 0.2% 0.1% 0.3% 0.4% 0.3% 0.3% 0.1% 0.3% 0.1% 0.2% 0.3% 0.3% 0.1% 0.2% 0.1% 8.0% 0.6% 0.2% 0.2% 0.5% 1.8% 2.1% 5.7% 0.5% 0.1% 0.2% 0.9% 0.4% 0.1% 0.3% 0.2% 0.1% 0.2% 0.5% 0.3% 0.0% 0.1% 0.1% 0.1% 0.0% 0.1% 0.0% 0.1% 0.0% 0.1% 0.5% 0.4% 0.4% 0.2% 0.5% 0.5% 0.1% 0.3% 5.3% 0.5% 0.3% 0.3% 0.3% 0.9% 0.2% 0.5% 0.3% 0.3% 0.5% 0.1% 0.1% 8.0% 0.6% 3.2% 1.4% 0.2% 0.7% 2.2% 0.5% 0.4% 4.4% 1.3% 3.6% 0.3% 0.1% 0.3% 3.5% 2.3% 0.4% 1.1% 0.5% 0.6% 1.6% 0.1% 0.3% 0.0% 0.1% 2.3% 1.0% 0.2% 0.4% 0.1% 0.3% 0.8% 1.7% 0.1% 0.3% 0.3% 0.4% 0.3% 0.9% 0.1% 0.1% 0.1% 0.2% 0.5% 2.6% 0.4% 0.1% 0.2% 0.3% 0.8% 1.8% 2.1% 5.7% 4.4% 1.3% 0.8% 2.3% 0.4% 3.5% 2.3% 0.1% 0.2% 0.1% 0.2% 0.9% 2.4% 0.1% 0.1% 0.1% 0.3% 0.5% 0.3% 0.5% 0.1% 0.3% 0.3% 1.1% 1.1% 0.3% 0.3% MONEX Grupo Financiero / Mercado Accionario 2 Mercado Accionario Directorio Dirección de Análisis y Estrategia Bursátil Carlos A. González Tabares Director de Análisis y Estrategia Bursátil T. 5231-4521 [email protected] Eduardo Ávila Vargas Subdirector de Análisis Económico T. 5231-0489 [email protected] Daniela Ruíz Zárate Analista Económico T. 5231-0489 [email protected] Fernando E. Bolaños S. Analista Bursátil / Industrial, Minero y Petroquímico T. 5230-0200 Ext. 0720 [email protected] J. Roberto Solano Pérez Analista Bursátil / Construcción, Vivienda y Fibras T. 5230-0200 Ext. 4451 [email protected] Verónica Uribe Boyzo Analista Bursátil T. 5230-0200 Ext. 4782 [email protected] Stephany Ramírez Rojas Analista Bursátil T. 5230-0200 Ext. 4262 [email protected] J. Francisco Caudillo Lira Analista Técnico Sr. T. 5231-0016 [email protected] Astianax Cuanalo Dorantes Analista Sr. de Sistemas de Información T. 5230-0200 Ext. 4790 [email protected] Política de Recomendaciones Compra Aquellas emisoras cuyo rendimiento esperado supere en más del 5% el rendimiento esperado para el IPyC. Mantener Aquellas emisoras cuyo rendimiento esperado se ubique +/-5% respecto al rendimiento esperado para el IPyC. Venta Aquellas emisoras cuyo rendimiento sea inferior en más del 5% el rendimiento esperado para el IPyC. MONEX Grupo Financiero / Mercado Accionario 3 Mercado Accionario Disclaimer MONEX Grupo Financiero / Mercado Accionario 4

© Copyright 2026