2. Mexico`s Natural Gas Transportation System (Plan 2028)

Cadwalader, Wickersham & Taft LLP www.cadwalader.com 2014 Energy & Commodities Conference October 8, 2014 Electric Market Update: FERC and CFE Panelists • Moderators: Ken Irvin and Terence Healey, Cadwalader • Jette Gebhart, Senior Policy Advisor to FERC Chair Cheryl LaFleur, FERC • Eugenio Herrera, Comisión Federal de Electricidad (CFE) Cadwalader, Wickersham & Taft LLP 3 Introducing Jette Gebhart, Senior Policy Advisor to Chairman Cheryl LaFleur Cove Point LNG Export Authorization • Fourth LNG Export Approval Granted by FERC. • Permits export from Cove Point terminal in Maryland of up to 5.75 metric tons of LNG/year. • Targeted completion of Maryland Liquefaction facilities: June 2017. • Construction of related Virginia facilities targeted to begin in 2016 and enter service by March 2017. Cadwalader, Wickersham & Taft LLP 5 Contention Over Cove Point • During 2-year approval process, FERC heard from 140 speakers at 3 public meetings related to Environmental Assessment. • Received > 650 comments from the public and federal and state local agencies on the application. • July 14, 2014 protesters hauled off in handcuffs. • Balance of Environmental and Economic. • LNG price in Japan 3-4x U.S. Price Cadwalader, Wickersham & Taft LLP 6 Evolving Capacity Markets • “LaFleur said capacity markets also need to evolve and suggested that need has become more apparent given the changes occurring in the power industry, including in the generation resource mix in response to the growth of natural gas and renewable generation, new environmental regulations and other factors.” • Boshart, Glen, FERC’s LaFleur details possible need for capacity markets, enforcement process to evolve (SNL, Aug. 12, 2014) (paraphrasing Chairman LaFleur) Cadwalader, Wickersham & Taft LLP 7 New England Capacity Markets • “The ISO-New England (ISO-NE) Forward Capacity Market (FCM) plays a vital role in ensuring reliability in New England. The FCM auction (the Forward Capacity Auction or FCA) is the mechanism that ensures future system reliability by procuring capacity resources sufficient to meet New England’s resource adequacy needs. . . . This is especially important in light of the current capacity situation in New England, where for the first time the region is facing an overall capacity shortage and the FCM must procure new resources in order to satisfy New England’s reliability needs.” • Statement of Chairman Cheryl A. LaFleur, ER14-1409 (Sept. 16, 2014). Cadwalader, Wickersham & Taft LLP 8 Coordination Between Gas and Electric • “Questions related to gas/electric interdependency highlight one of the central issues we face as federal regulators—whether to encourage regional solutions, or act to promote national solutions. We learned in the comments and in the technical conferences that certain gas/electric issues varied sharply by region, while others were more national. Thus, both regional and national actions are called for.” • Statement of Commissioner Cheryl A. LaFleur, AD12-12 (Nov. 15, 2012) Cadwalader, Wickersham & Taft LLP 9 Heavy Investment in Natural Gas • “Half of power plant capacity additions in 2013 came from natural gas,” U.S. Energy Information System (April 8, 2014), available at http://www.eia.gov/todayinenergy/detail.cfm?id=15751 Cadwalader, Wickersham & Taft LLP 10 Changes to Enforcement Policy? • “LaFleur said she is open to considering possible reforms to the agency's enforcement processes. . . .” • “LaFleur also acknowledged that enforcement is a relatively new area of FERC's work. As such, ‘a lot of things are cases of first impression, things are happening for the first time, and it's normal that there would be debate about it.’” • Boshart, Glen, FERC’s LaFleur details possible need for capacity markets, enforcement process to evolve (SNL, Aug. 12, 2014) (paraphrasing Chairman LaFleur) Cadwalader, Wickersham & Taft LLP 11 CFE’s Natural Gas Transportation Strategy & the Energy Reform October 8th, 2014. Table of Contents 1. Mexico’s Energy Reform and the CFE 2. Mexico’s Natural Gas Transportation System (Plan 2028) 3. Pipeline Biddings in the U.S. (Waha, TX.) 1. Mexico’s Energy Reform and the CFE The new law forces the monopoly to reorganize itself horizontally and not vertically. Private firms will be able to participate in the power generation strengthening the competitiveness of the market. An independent power system operator is created (CENACE) and placed outside of CFE. An independent natural gas pipeline system operator is created (CENAGAS) and placed outside of CFE. A new power and fuel market will flourish upon the mid-term. 14 2. Mexico’s Natural Gas Transportation System (Plan 2028) All natural gas projects of CFE are designed as long-term transportation projects: • To expand and reinforce Mexico’s natural gas pipeline network utilized for generation of electric power and industrial usage. • To improve Mexico’s natural gas supply chain. • To offer all Mexican end users a wider range of opportunities to meet their natural gas consumption needs at competitive prices. 15 2. Mexico’s Natural Gas Transportation System (Plan 2028) In construction In construction Pemex National Pipeline System Sásabe (±6,751 mi.) Puerto Libertad Nueces Guaymas El Encino Aguadulce LNG Terminals Compression Stations Reynosa Topolobampo Mazatlán Pipeline Diameter Sásabe - Guaymas Guaymas – El Oro El Oro - Mazatlán El Encino - Topolobampo Tlaxcala - Cuautla Aguadulce - Reynosa 36” 30” 24” 30” 24” 42” Capacity Distance (MMCFD) ( ± mi. ) 770 322 510 215 202 273 670 340 320 102 1,330 118 TOTAL: 1,370 Tlaxcala Cuautla 2. Mexico’s Natural Gas Transportation System (Plan 2028) Announcements 2014 Announcements CFE Pemex National Pipeline System Sásabe San Elizario/ San Isidro Samalayuca (±6,751 mi.) Waha Presidio / Ojinaga El Encino Colombia Escobedo La Laguna Pipeline Waha – San Elizario San Isidro - Samalayuca Samalayuca - Sásabe Waha - Presidio Ojinaga – El Encino El Encino – La Laguna Colombia - Escobedo Diameter 42” 42”/30” 30” 42” 42” 42” 42” Capacity Distance (MMCFD) ( ± mi. ) 1,475 178 1,450/600 14 550 330 1,350 136 1,350 150 1,500 250 1,500 150 1,208 TOTAL: LNG Terminals Compression Stations 2. Mexico’s Natural Gas Transportation System (Plan 2028) Pipeline scenario assumed 2014 Naco Sásabe Aguaprieta In operation CFE pipelines In construction Announcement 2014 Pemex National Pipeline System San Elizario/ San Isidro Samalayuca Waha Presidio / Ojinaga Puerto Libertad Nueces Guaymas El Encino Aguadulce Colombia Topolobampo LNG Terminals Compression Stations Reynosa Escobedo La Laguna Mazatlán Tamazunchale Guadalajara Pipeline System shift by 2028 El Sauz Distance ( ± mi. ) Tlaxcala Manzanillo PEMEX (actual) 6,751 Additional to existing system 6,805 TOTAL: 13,556 Distances include not only announcements due 2014 but also future announcements by 2018 Naranjos Cuautla 2. Mexico’s Natural Gas Transportation System (Plan 2028) Pipeline scenario with conversion of power plants Conversion of Thermal Power Plants Naco Sásabe Aguaprieta Puerto Libertad Conversions according to CFE’s strategy San Elizario/ San Isidro Samalayuca TOTAL Repowered MW: Waha Presidio / Ojinaga Puerto Libertad Nueces El Encino Guaymas Aguadulce Colombia Francisco Villa Topolobampo Topolobampo II Power Plants for Conversion Puerto Libertad Río Bravo Tula Villa de Reyes Mazatlán II Topolobampo II Francisco Villa Manzanillo II Cap. (MW) 632 300 1,606 700 300 320 300 700 Reynosa Escobedo Río Bravo La Laguna Est. COD Apr 2015 Apr 2015 Oct 2015 Dic 2015 Feb 2016 Apr 2016 Apr 2016 Nov 2016 Mazatlán Villa de Reyes Mazatlàn II Tamazunchale Guadalajara El Sauz Naranjos Tula Tlaxcala Manzanillo Manzanillo II Cuautla 4,858 2. Mexico’s Natural Gas Transportation System (Plan 2028) Pipeline scenario with new power plants due 2028 New Combined Cycle Power Plants Baja California II & BajaCalifornia V Naco Sásabe Aguaprieta New Power Plants at Baja California & Yucatán Clusters and Repowering are not included San Elizario/ San Isidro Samalayuca TOTAL Additional CC MW: Waha Norte III Presidio / Ojinaga Puerto Aguaprieta II Libertad Nueces Guaymas II & Guaymas III El Encino Guaymas Aguadulce Colombia Norte VI & Norte VII Francisco Villa Noreste & Monterrey IV Noroeste & Topolobampo III Topolobampo Escobedo Reynosa La Laguna New Power Plants Non Central México Norte III Guaymas II Guaymas III Baja California II (SLRC) Noreste (Escobedo) Lerdo (Norte IV) Noroeste (Topolobampo II) Topolobampo III Guadalajara I San Luis Potosí Mazatlán Baja California V (SLRC) Aguascalientes Francisco Villa (Norte V) Monterrey IV Salamanca Salamanca II Chihuahua Sur (Norte VI) San Luis Potosí II Tamazunchale II Tamazunchale III Aguascalientes II Norte VII TOTAL MW: Cap. (MW) 954 735 735 276 1,034 990 847 700 908 862 867 522 872 958 1,088 680 680 958 862 1,121 1,121 872 867 19,509 23,695 COD Jul 2017 Apr 2017 Jul 2017 Jul 2017 Dec 2017 Apr 2018 Apr 2018 May 2018 Apr 2019 Apr 2019 Apr 2020 Apr 2020 Apr 2020 Apr 2021 Apr 2022 Apr 2022 Apr 2023 Apr 2024 Jun 2024 Jul 2025 Apr 2026 Jul 2027 Jun 2028 New Power Plants Central México Valle de México II Centro II Central (Tula) Valle de México III Central II (Tula) Lerdo Mazatlán San Luis Potosí & San Luis Potosí II Mazatlàn Aguascalientes Guadalajara Manzanillo Tamazunchale II & Tamazunchale III Tamazunchale El Sauz Guadalajara I Salamanca & Salamanca II Cuautla Naranjos Tlaxcala TOTAL MW: Cap. (MW) 601 660 1,162 601 1,162 4,186 COD May 2017 Sep 2019 Apr 2021 Apr 2023 Apr 2024 3. Pipeline Biddings in the U.S. (Waha, TX.) As a result of the Energy Reform, and the competitiveness that the market will require for power generation, CFE requires natural gas transportation systems with reliable and diversified sources of supply. Today, Mexico’s natural gas supply is concentrated in the Northeastern-Gulf side of the country, which brings limited flexibility and supply options. The development of alternate routes along the border between the U.S. and Mexico will strengthen market capabilities and will help to improve operational margins. 21 3. Pipeline Biddings in the U.S. (Waha, TX.) Waha – San Elizario (November 2014) • Development, construction and operation of a Header “CFE Waha Header” for 2.825 Bcf/d, with at least 10 interconnects to existing pipelines near the Waha Hub area that supply at least 130% of the maximum aggregated capacity of these pipelines (130%*2.825 Bcf/d). • Development, construction and operation of a pipeline with capacity of 1.475 Bcf/d from CFE Waha Header to United States Border with Mexico near San Elizario, Texas. C.O.D. : January 2017 Diameter: 42” Capacity (MMCFD): 1,475 Length (approx) : 225 Miles MAOP (psig): 1,440 • Border crossing and permits to interconnect with a future pipeline that runs from San Isidro to Samalayuca, both located in the State of Chihuahua, Mexico. • Minimum pressure of delivery at the international border at 1,145 psig. • 25-year Transportation Service Agreement (“TSA”). At the end of the agreement, CFE and the Transporter will enter into a Joint Venture agreement and CFE shall own 49% of the equity. Fiber optic lines that will service the telecommunication needs of the pipeline, which will run parallel to it. Design, development, construction and operation of the Fiber Optic Lines must be included in the tariff of the TSA. RFP final stage schedule Due Submission of final proposals (Houston, Texas, exact location TBD) November 14, 2014 Announcement of winning bidder (Houston, Texas, exact location TBD) December 5, 2014 Execution of TSA (Mexico City, Mexico, exact location TBD) January 16, 2015 (All dates and requirements may change subject to the final specifications of the corresponding RFP.) 22 3. Pipeline Biddings in the U.S. (Waha, TX.) Waha – Presidio (November 2014) • Development, construction and operation of a pipeline with capacity of 1.350 Bcf/d from CFE Waha Header to United States Border with Mexico near Presidio, Texas. • Border crossing and permits to interconnect with a future pipeline that runs from Ojinaga to El Encino both located in the State of Chihuahua, Mexico. • Minimum pressure of delivery at the international border at 1,160 psig. C.O.D. : March 2017 Diameter: 42” Capacity (MMCFD): 1,350 Length (approx) : 145 Miles MAOP (psig): 1,440 • 25-year TSA. At the end of the agreement, CFE and the Transporter will enter into a Joint Venture agreement and CFE shall own 49% of the equity. • Fiber optic lines that will service the telecommunication needs of the pipeline, which will run parallel to it. Design, development, construction and operation of the Fiber Optic Lines must be included in the tariff of the TSA. RFP final stage schedule Due Submission of final proposals (Houston, Texas, exact location TBD) November 14, 2014 Announcement of winning bidder (Houston, Texas, exact location TBD) December 5, 2014 Execution of TSA (Mexico City, Mexico, exact location TBD) January 16, 2015 (All dates and requirements may change subject to the final specifications of the corresponding RFP.) 23 3. Pipeline Biddings in the U.S. (Waha, TX.) Bidding essentials • Commitment Bond and Performance • Specific experience criteria to be met by the Bidders on development, construction, operation, permitting, routing (ROW’s) and financing for similar natural gas transportation projects in the US • Governing Law: State of Texas • Language: English 24

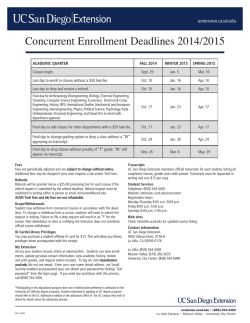

© Copyright 2026